Key Insights

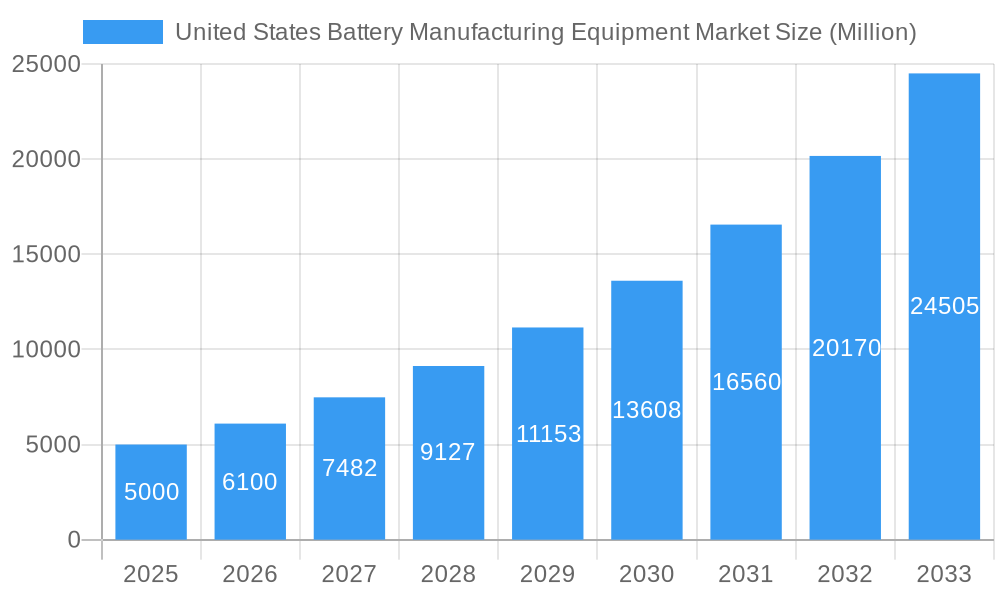

The United States battery manufacturing equipment market is poised for significant expansion, driven by the accelerating adoption of electric vehicles (EVs) and the critical need for advanced energy storage solutions. Projecting a substantial market size of 9.77 billion by 2025, the market is anticipated to experience a robust Compound Annual Growth Rate (CAGR) of 27.61%. Key growth catalysts include government incentives bolstering EV uptake, increasing reliance on renewable energy sources that necessitate efficient energy storage, and continuous technological innovation enhancing battery performance, longevity, and safety. The market is segmented by equipment type, encompassing coating & drying, calendaring, slitting, mixing, electrode stacking, assembly & handling, and formation & testing machines. The automotive sector currently leads demand, with substantial growth anticipated in energy storage for grid applications and broader industrial uses. Leading domestic and international manufacturers are strategically investing in research & development and capacity expansion to address escalating demand. Navigating supply chain complexities, skilled labor requirements, and evolving battery technologies will be paramount for sustained market expansion.

United States Battery Manufacturing Equipment Market Market Size (In Billion)

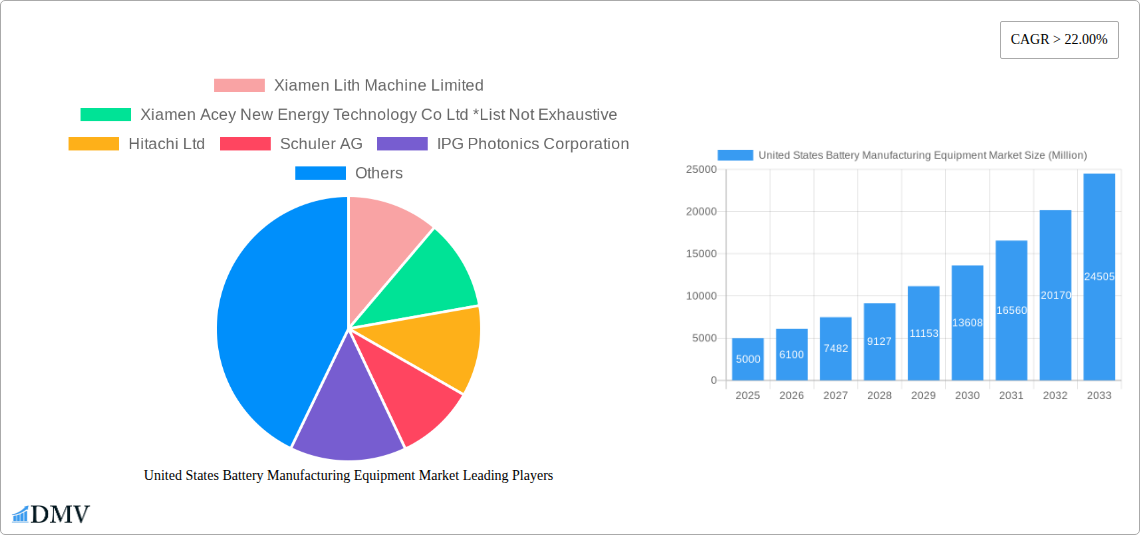

The competitive environment features a blend of global leaders and specialized providers. While precise US market share data is still emerging, established firms are expected to leverage economies of scale and extensive distribution channels. However, opportunities abound for agile, niche-focused companies offering tailored equipment solutions. Continuous innovation in battery chemistries and manufacturing processes presents avenues for new equipment development and market differentiation. Sustained government support, ongoing technological breakthroughs, and the successful integration of novel battery technologies are vital for realizing the market's considerable growth potential. Strategic adaptation will be essential for all market participants to capitalize on this dynamic landscape.

United States Battery Manufacturing Equipment Market Company Market Share

United States Battery Manufacturing Equipment Market: A Comprehensive Report (2019-2033)

This insightful report provides a detailed analysis of the United States battery manufacturing equipment market, offering a comprehensive overview of market trends, key players, and future growth prospects. Covering the period from 2019 to 2033, with a focus on 2025, this report is an essential resource for stakeholders seeking to understand and capitalize on this rapidly evolving sector. The market is projected to reach xx Million by 2033, showcasing significant growth potential.

United States Battery Manufacturing Equipment Market Composition & Trends

This section delves into the competitive landscape of the US battery manufacturing equipment market, evaluating market concentration, innovation drivers, regulatory frameworks, substitute products, and end-user profiles. We analyze mergers and acquisitions (M&A) activity, including deal values and their impact on market share distribution. The market is characterized by a mix of established players and emerging companies, with significant M&A activity reshaping the competitive dynamics.

- Market Concentration: The market exhibits a moderately concentrated structure, with a few major players holding significant market share. However, several smaller, specialized firms are also present. Precise market share distribution will be detailed in the full report.

- Innovation Catalysts: Government incentives, rising demand for electric vehicles (EVs), and technological advancements in battery production are major drivers of innovation.

- Regulatory Landscape: Federal and state regulations concerning environmental impact and safety standards influence equipment design and manufacturing processes. The impact of these regulations is assessed within the full report.

- Substitute Products: While the current technology landscape does not show strong substitute products for dedicated battery manufacturing equipment, evolving technologies may present challenges in the long term. This report evaluates these potential threats and opportunities.

- End-User Profiles: The report segments the market based on end-user industries, including automotive, industrial, and other end users, providing detailed insights into their specific needs and purchasing behaviors.

- M&A Activity: The report analyzes recent mergers and acquisitions, providing data on deal values and their influence on market consolidation. We have identified XX Million in M&A deals between 2022 and 2023.

United States Battery Manufacturing Equipment Market Industry Evolution

This section analyzes the evolutionary trajectory of the US battery manufacturing equipment market, focusing on market growth trajectories, technological advancements, and the shift in consumer demands. We provide specific data points on growth rates and adoption metrics for key technologies, mapping the evolution from traditional lead-acid battery production equipment towards the current dominance of lithium-ion battery production technologies. We will analyze the market's compound annual growth rate (CAGR) from 2019 to 2024, projected at XX%, and forecast the CAGR from 2025 to 2033 to be XX%. Technological advancements, such as automation and AI-driven processes, are dramatically improving production efficiency and lowering costs, driving market expansion. Shifting consumer preferences towards environmentally friendly energy solutions further fuels the market growth. The report also details the adoption rates of various machine types and the penetration of automation technologies.

Leading Regions, Countries, or Segments in United States Battery Manufacturing Equipment Market

This section identifies the dominant regions, countries, and segments within the US battery manufacturing equipment market. Specific analysis is provided for each of the following machine types: Coating & Dryer, Calendaring, Slitting, Mixing, Electrode Stacking, Assembly & Handling Machines, and Formation & Testing Machines; and end-user sectors: Automotive, Industrial, and Other End Users.

Key Drivers:

- Automotive Sector Dominance: The automotive industry, driven by the increasing adoption of electric vehicles, constitutes the largest segment, benefiting from significant investments in battery production facilities.

- Government Incentives and Policies: Federal and state-level incentives for the development of domestic battery manufacturing significantly contribute to the market expansion.

- Technological Advancements: The continuous development of advanced manufacturing technologies leads to higher efficiency and lower production costs.

Dominance Factors:

The automotive sector's dominance stems from massive investments in battery manufacturing plants across the United States. Government policies supporting domestic battery production further enhance this dominance. Technological improvements in automation and AI-driven processes are also driving significant growth across all segments.

United States Battery Manufacturing Equipment Market Product Innovations

The market is witnessing continuous product innovation, with manufacturers focusing on automation, increased efficiency, and improved precision. New technologies like AI-powered quality control systems and advanced materials handling solutions are enhancing production capabilities. These innovations deliver higher throughput, reduced defect rates, and lower overall production costs. Unique selling propositions often focus on customized solutions catering to specific customer needs and seamless integration into existing production lines.

Propelling Factors for United States Battery Manufacturing Equipment Market Growth

Several factors propel the growth of the US battery manufacturing equipment market. These include the increasing demand for electric vehicles (EVs), driven by environmental concerns and government regulations favoring electric mobility. Government subsidies and tax incentives aimed at promoting domestic battery production play a significant role. Technological advancements, such as automation and AI-driven manufacturing processes, are enhancing efficiency and productivity. Finally, growing investments from both established and new entrants in the battery industry further bolster market growth.

Obstacles in the United States Battery Manufacturing Equipment Market

Despite the significant growth potential, several challenges hinder the market's expansion. Supply chain disruptions, particularly regarding critical raw materials, can lead to production delays and increased costs. Intense competition from established international players and rising domestic competitors create pricing pressures. Moreover, stringent regulatory compliance requirements can increase the cost and complexity of equipment development and deployment.

Future Opportunities in United States Battery Manufacturing Equipment Market

Future opportunities lie in several key areas. The growing demand for energy storage solutions beyond the automotive sector, such as grid-scale energy storage and renewable energy integration, presents a significant market expansion opportunity. The development of next-generation battery technologies, such as solid-state batteries, will require new specialized equipment, creating further growth prospects. Finally, advancements in automation and AI will continue to drive efficiency improvements and cost reductions.

Major Players in the United States Battery Manufacturing Equipment Market Ecosystem

- Xiamen Lith Machine Limited

- Xiamen Acey New Energy Technology Co Ltd

- Hitachi Ltd

- Schuler AG

- IPG Photonics Corporation

- Dürr AG

- Xiamen Tmax Battery Equipments Limited

Key Developments in United States Battery Manufacturing Equipment Market Industry

- December 2022: General Motors and LG Energy Solution invest an additional USD 275 Million in their Tennessee battery plant, increasing production by over 40%.

- November 2022: Hyundai Motor Group and SK On announce a new EV battery manufacturing facility in Georgia, with an investment of approximately USD 4-5 Billion.

Strategic United States Battery Manufacturing Equipment Market Forecast

The US battery manufacturing equipment market is poised for significant growth, driven by strong demand for EVs and energy storage solutions. Continued technological advancements, supportive government policies, and substantial investments in domestic battery production will further fuel market expansion. The market is expected to witness robust growth throughout the forecast period (2025-2033), presenting lucrative opportunities for both established players and new entrants.

United States Battery Manufacturing Equipment Market Segmentation

-

1. Machine Type

- 1.1. Coating & Dryer

- 1.2. Calendaring

- 1.3. Slitting

- 1.4. Mixing

- 1.5. Electrode Stacking

- 1.6. Assembly & Handling Machines

- 1.7. Formation & Testing Machines

-

2. End User

- 2.1. Automotive

- 2.2. Industrial

- 2.3. Other End Users

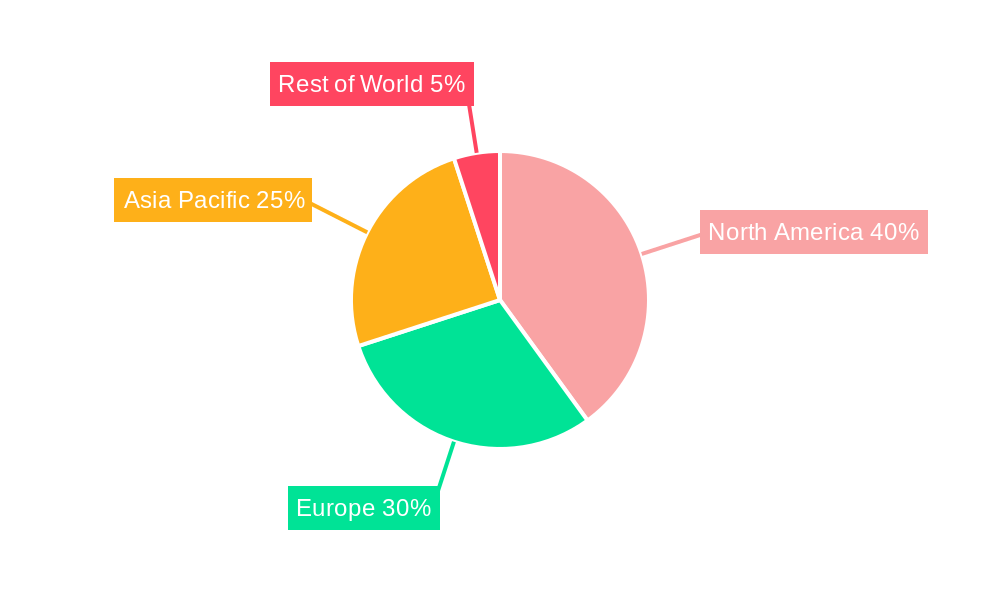

United States Battery Manufacturing Equipment Market Segmentation By Geography

- 1. United States

United States Battery Manufacturing Equipment Market Regional Market Share

Geographic Coverage of United States Battery Manufacturing Equipment Market

United States Battery Manufacturing Equipment Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 27.61% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increasing Investments in Offshore Wind Power Projects4.; Supportive Government Policies

- 3.3. Market Restrains

- 3.3.1. 4.; Increasing Adopting of Alternative Clean Energy Sources (Ex

- 3.4. Market Trends

- 3.4.1. Automotive Segment to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. United States Battery Manufacturing Equipment Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Machine Type

- 5.1.1. Coating & Dryer

- 5.1.2. Calendaring

- 5.1.3. Slitting

- 5.1.4. Mixing

- 5.1.5. Electrode Stacking

- 5.1.6. Assembly & Handling Machines

- 5.1.7. Formation & Testing Machines

- 5.2. Market Analysis, Insights and Forecast - by End User

- 5.2.1. Automotive

- 5.2.2. Industrial

- 5.2.3. Other End Users

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. United States

- 5.1. Market Analysis, Insights and Forecast - by Machine Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Xiamen Lith Machine Limited

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Xiamen Acey New Energy Technology Co Ltd *List Not Exhaustive

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Hitachi Ltd

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Schuler AG

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 IPG Photonics Corporation

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Durr AG

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Xiamen Tmax Battery Equipments Limited

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.1 Xiamen Lith Machine Limited

List of Figures

- Figure 1: United States Battery Manufacturing Equipment Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: United States Battery Manufacturing Equipment Market Share (%) by Company 2025

List of Tables

- Table 1: United States Battery Manufacturing Equipment Market Revenue billion Forecast, by Machine Type 2020 & 2033

- Table 2: United States Battery Manufacturing Equipment Market Volume K Units Forecast, by Machine Type 2020 & 2033

- Table 3: United States Battery Manufacturing Equipment Market Revenue billion Forecast, by End User 2020 & 2033

- Table 4: United States Battery Manufacturing Equipment Market Volume K Units Forecast, by End User 2020 & 2033

- Table 5: United States Battery Manufacturing Equipment Market Revenue billion Forecast, by Region 2020 & 2033

- Table 6: United States Battery Manufacturing Equipment Market Volume K Units Forecast, by Region 2020 & 2033

- Table 7: United States Battery Manufacturing Equipment Market Revenue billion Forecast, by Machine Type 2020 & 2033

- Table 8: United States Battery Manufacturing Equipment Market Volume K Units Forecast, by Machine Type 2020 & 2033

- Table 9: United States Battery Manufacturing Equipment Market Revenue billion Forecast, by End User 2020 & 2033

- Table 10: United States Battery Manufacturing Equipment Market Volume K Units Forecast, by End User 2020 & 2033

- Table 11: United States Battery Manufacturing Equipment Market Revenue billion Forecast, by Country 2020 & 2033

- Table 12: United States Battery Manufacturing Equipment Market Volume K Units Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the United States Battery Manufacturing Equipment Market?

The projected CAGR is approximately 27.61%.

2. Which companies are prominent players in the United States Battery Manufacturing Equipment Market?

Key companies in the market include Xiamen Lith Machine Limited, Xiamen Acey New Energy Technology Co Ltd *List Not Exhaustive, Hitachi Ltd, Schuler AG, IPG Photonics Corporation, Durr AG, Xiamen Tmax Battery Equipments Limited.

3. What are the main segments of the United States Battery Manufacturing Equipment Market?

The market segments include Machine Type, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 9.77 billion as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing Investments in Offshore Wind Power Projects4.; Supportive Government Policies.

6. What are the notable trends driving market growth?

Automotive Segment to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; Increasing Adopting of Alternative Clean Energy Sources (Ex: Solar. Hydro).

8. Can you provide examples of recent developments in the market?

In December 2022, General Motors and LG Energy Solution will spend an additional USD 275 million in their joint venture battery plant in Tennessee to increase production by more than 40%. The joint venture, Ultium Cells LLC, announced that the new investment is in addition to the USD 2.3 billion announced in April 2021 to build the 2.8 million-square-foot facility. Production at the plant is expected to begin in late 2023.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion and volume, measured in K Units.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "United States Battery Manufacturing Equipment Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the United States Battery Manufacturing Equipment Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the United States Battery Manufacturing Equipment Market?

To stay informed about further developments, trends, and reports in the United States Battery Manufacturing Equipment Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence