Key Insights

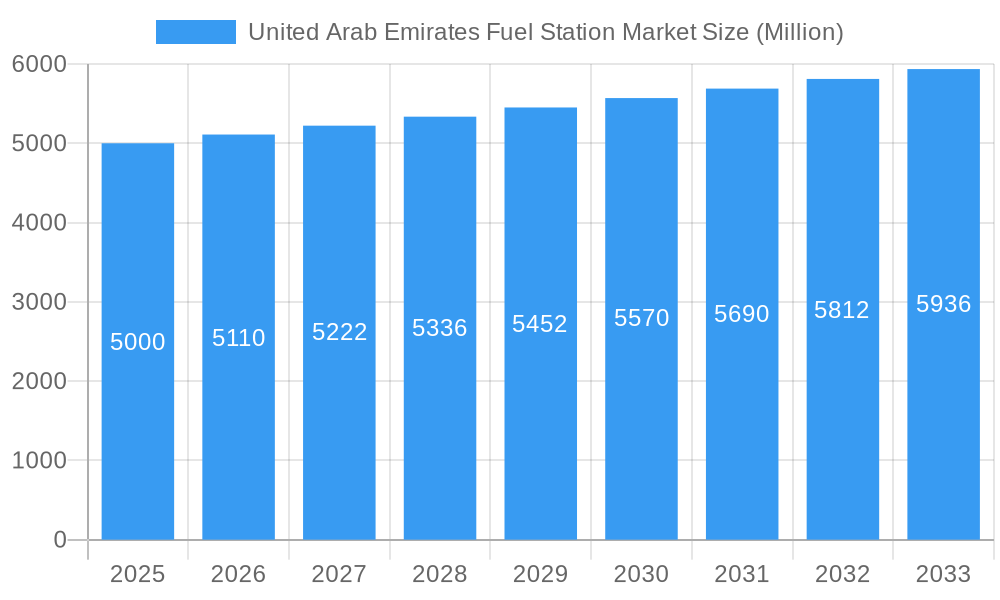

The United Arab Emirates (UAE) fuel station market demonstrates substantial growth potential, fueled by a strong economy, expanding transportation networks, and increasing tourism. While specific figures are pending, the market is poised for expansion. Projected to grow at a Compound Annual Growth Rate (CAGR) of 3.5%, the market is estimated to reach 453.8 million by the base year 2024. Factors such as government initiatives supporting sustainable transportation and the adoption of electric vehicles may influence long-term growth trajectories, but the overall market is expected to remain robust. Segmentation by fuel type (light, middle, and heavy distillates) presents opportunities for specialized fuel retailers. Key industry players including TotalEnergies, Emirates General Petroleum Corporation, ENOC, and ADNOC Distribution are pivotal in shaping market dynamics, pricing, and service innovation.

United Arab Emirates Fuel Station Market Market Size (In Million)

Geographic distribution within the UAE will likely concentrate in densely populated urban centers and along major transportation arteries. Based on regional trends and the UAE's economic indicators, the market size is significant. The forecast period (2025-2033) indicates continued expansion, likely surpassing the initial CAGR projections due to population growth, urbanization, and ongoing infrastructure development. This presents a favorable investment environment for existing and new market participants. Potential challenges include navigating fluctuating global oil prices and intensifying competition, necessitating strategic planning and innovative business models.

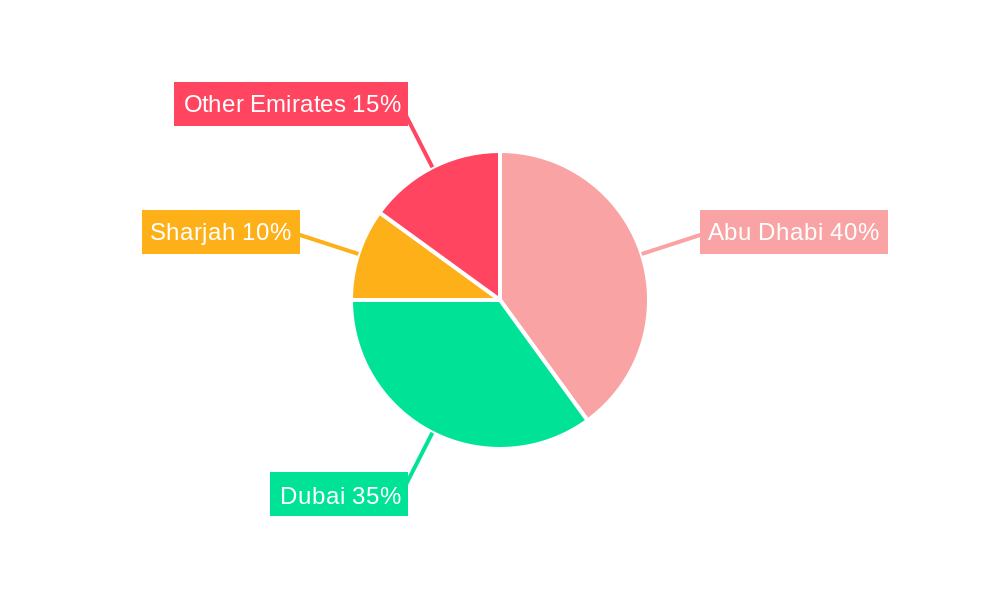

United Arab Emirates Fuel Station Market Company Market Share

United Arab Emirates Fuel Station Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the United Arab Emirates (UAE) fuel station market, offering valuable insights for stakeholders across the energy sector. Covering the period 2019-2033, with a focus on 2025, this report meticulously examines market trends, competitive landscapes, and future growth potential. The report leverages rigorous data analysis to provide a clear and actionable understanding of this dynamic market.

United Arab Emirates Fuel Station Market Composition & Trends

This section delves into the intricacies of the UAE fuel station market, analyzing its structure, dynamics, and future trajectory. We examine market concentration, assessing the market share held by key players like ADNOC Distribution PJSC, ENOC, Emirates General Petroleum Corporation, and TotalEnergies SE (a list not exhaustive). The report also explores the influence of innovation, regulatory changes, the presence of substitute products (e.g., electric vehicle charging stations), evolving end-user profiles (e.g., shift towards electric vehicles), and the impact of mergers and acquisitions (M&A) activity, including an estimated value of xx Million in M&A deals during the historical period. The competitive landscape is further dissected, revealing the strategic approaches adopted by major players. Specific metrics, including detailed market share distribution amongst the key players, are presented. The analysis incorporates a thorough evaluation of the regulatory framework governing the fuel station industry within the UAE, its influence on market operations, and potential future modifications.

United Arab Emirates Fuel Station Market Industry Evolution

This section charts the evolution of the UAE fuel station market from 2019 to 2033. The report analyzes market growth trajectories, documenting a compound annual growth rate (CAGR) of xx% during the historical period (2019-2024) and projecting a CAGR of xx% for the forecast period (2025-2033). Technological advancements such as the integration of AI and the emergence of hydrogen fueling stations are scrutinized for their impact on market dynamics. Furthermore, the report explores shifting consumer demands, noting the increasing preference for convenience and technologically advanced services at fuel stations, and analyzing their influence on the market's evolution. Specific data points detailing the adoption rate of new technologies and the growth rate in different segments are included.

Leading Regions, Countries, or Segments in United Arab Emirates Fuel Station Market

The UAE fuel station market is analyzed across key geographic segments and fuel types. While the report covers Morocco, Algeria, and Egypt for comparative purposes, the primary focus remains the UAE market. Within the UAE, the report pinpoints the dominant regions, focusing on factors contributing to their success. The analysis also delves into the fuel type segment (Light, Middle, and Heavy Distillates), identifying the leading segment and detailing the reasons for its dominance.

- Key Drivers for Dominant Segments (UAE):

- Strategic government investments in infrastructure development.

- Favorable regulatory policies promoting fuel distribution efficiency.

- High vehicle ownership rates driving fuel demand.

The dominant segment (e.g., Light Distillates in the UAE) is comprehensively analyzed, highlighting the factors responsible for its leading position within the UAE market.

United Arab Emirates Fuel Station Market Product Innovations

Recent innovations in the UAE fuel station market have focused on enhancing customer experience and operational efficiency. The introduction of AI-powered solutions at ADNOC Fill & Go stations, providing personalized fueling experiences, exemplifies this trend. The development of hydrogen fueling stations, as announced by DEWA and ENOC, signifies a significant move towards sustainable fuel options. These innovations are detailed with an emphasis on unique selling propositions and their impact on overall market performance.

Propelling Factors for United Arab Emirates Fuel Station Market Growth

Several factors are driving the growth of the UAE fuel station market. Government initiatives to improve infrastructure, coupled with consistent economic growth and a large vehicle population, fuel market expansion. Technological advancements, such as the adoption of AI and the exploration of alternative fuels, further contribute to market dynamism. A supportive regulatory environment also fosters innovation and investment in the sector.

Obstacles in the United Arab Emirates Fuel Station Market Market

Despite significant growth potential, the UAE fuel station market faces challenges. These include potential regulatory hurdles, disruptions to the global supply chain potentially impacting fuel availability and pricing, and intense competition among existing players which can exert downward pressure on profit margins. The report quantifies the impacts of these obstacles wherever possible.

Future Opportunities in United Arab Emirates Fuel Station Market

Future opportunities lie in expanding into new markets within the UAE, leveraging technological advancements such as hydrogen fuel cell technology, and catering to the evolving needs of a more environmentally conscious consumer base. The expansion of electric vehicle charging infrastructure presents both a challenge and an opportunity, requiring strategic adaptation by fuel station operators.

Major Players in the United Arab Emirates Fuel Station Market Ecosystem

- TotalEnergies SE

- Emirates General Petroleum Corporation

- Emirates National Oil Company (ENOC)

- Abu Dhabi National Oil Company (ADNOC) Distribution PJSC

Key Developments in United Arab Emirates Fuel Station Market Industry

- February 2023: DEWA and ENOC announced a joint venture to develop a hydrogen fueling station, signifying a move toward sustainable energy.

- February 2023: ADNOC Fill & Go launched AI-powered technology, enhancing customer experience and operational efficiency.

Strategic United Arab Emirates Fuel Station Market Forecast

The UAE fuel station market is poised for continued growth, driven by sustained economic activity and technological innovation. The adoption of sustainable fuel solutions and customer-centric technologies will be key factors shaping the market's future. This report provides a robust forecast for the coming years, identifying key opportunities and challenges for stakeholders. The market is expected to see substantial growth, particularly in the adoption of advanced technologies and expansion into new geographical areas within the UAE.

United Arab Emirates Fuel Station Market Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

United Arab Emirates Fuel Station Market Segmentation By Geography

- 1. United Arab Emirates

United Arab Emirates Fuel Station Market Regional Market Share

Geographic Coverage of United Arab Emirates Fuel Station Market

United Arab Emirates Fuel Station Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.5% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increasing Number of Vehicles4.; Increasing Adoption of Compact Fuel Station Concept

- 3.3. Market Restrains

- 3.3.1. 4.; Increasing Demand for Electric Vehicles in the Country

- 3.4. Market Trends

- 3.4.1. Increasing Number of Vehicles to Drive the Demand

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. United Arab Emirates Fuel Station Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. United Arab Emirates

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 TotalEnergies SE*List Not Exhaustive

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Emirates General Petroleum Corporation

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Emirates National Oil Company (ENOC)

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Abu Dhabi National Oil Company (ADNOC) Distribution PJSC

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.1 TotalEnergies SE*List Not Exhaustive

List of Figures

- Figure 1: United Arab Emirates Fuel Station Market Revenue Breakdown (million, %) by Product 2025 & 2033

- Figure 2: United Arab Emirates Fuel Station Market Share (%) by Company 2025

List of Tables

- Table 1: United Arab Emirates Fuel Station Market Revenue million Forecast, by Production Analysis 2020 & 2033

- Table 2: United Arab Emirates Fuel Station Market Volume Million Forecast, by Production Analysis 2020 & 2033

- Table 3: United Arab Emirates Fuel Station Market Revenue million Forecast, by Consumption Analysis 2020 & 2033

- Table 4: United Arab Emirates Fuel Station Market Volume Million Forecast, by Consumption Analysis 2020 & 2033

- Table 5: United Arab Emirates Fuel Station Market Revenue million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 6: United Arab Emirates Fuel Station Market Volume Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 7: United Arab Emirates Fuel Station Market Revenue million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 8: United Arab Emirates Fuel Station Market Volume Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 9: United Arab Emirates Fuel Station Market Revenue million Forecast, by Price Trend Analysis 2020 & 2033

- Table 10: United Arab Emirates Fuel Station Market Volume Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 11: United Arab Emirates Fuel Station Market Revenue million Forecast, by Region 2020 & 2033

- Table 12: United Arab Emirates Fuel Station Market Volume Million Forecast, by Region 2020 & 2033

- Table 13: United Arab Emirates Fuel Station Market Revenue million Forecast, by Production Analysis 2020 & 2033

- Table 14: United Arab Emirates Fuel Station Market Volume Million Forecast, by Production Analysis 2020 & 2033

- Table 15: United Arab Emirates Fuel Station Market Revenue million Forecast, by Consumption Analysis 2020 & 2033

- Table 16: United Arab Emirates Fuel Station Market Volume Million Forecast, by Consumption Analysis 2020 & 2033

- Table 17: United Arab Emirates Fuel Station Market Revenue million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 18: United Arab Emirates Fuel Station Market Volume Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 19: United Arab Emirates Fuel Station Market Revenue million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 20: United Arab Emirates Fuel Station Market Volume Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 21: United Arab Emirates Fuel Station Market Revenue million Forecast, by Price Trend Analysis 2020 & 2033

- Table 22: United Arab Emirates Fuel Station Market Volume Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 23: United Arab Emirates Fuel Station Market Revenue million Forecast, by Country 2020 & 2033

- Table 24: United Arab Emirates Fuel Station Market Volume Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the United Arab Emirates Fuel Station Market?

The projected CAGR is approximately 3.5%.

2. Which companies are prominent players in the United Arab Emirates Fuel Station Market?

Key companies in the market include TotalEnergies SE*List Not Exhaustive, Emirates General Petroleum Corporation, Emirates National Oil Company (ENOC), Abu Dhabi National Oil Company (ADNOC) Distribution PJSC.

3. What are the main segments of the United Arab Emirates Fuel Station Market?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD 453.8 million as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing Number of Vehicles4.; Increasing Adoption of Compact Fuel Station Concept.

6. What are the notable trends driving market growth?

Increasing Number of Vehicles to Drive the Demand.

7. Are there any restraints impacting market growth?

4.; Increasing Demand for Electric Vehicles in the Country.

8. Can you provide examples of recent developments in the market?

February 2023: DEWA and ENOC announced joining hands to develop a hydrogen fuelling station for vehicles in the United Arab Emirates. Both firms will conduct a joint feasibility study for establishing, developing, and operating pilot projects which will be utilized to provide hydrogen for vehicles.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million and volume, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "United Arab Emirates Fuel Station Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the United Arab Emirates Fuel Station Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the United Arab Emirates Fuel Station Market?

To stay informed about further developments, trends, and reports in the United Arab Emirates Fuel Station Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence