Key Insights

The South Asia battery market, encompassing India, Pakistan, Bangladesh, Sri Lanka, Nepal, Bhutan, and Maldives, is poised for substantial expansion. Fueled by the rapid growth of the automotive and energy storage sectors, the market is projected to reach a size of 259.21 billion by 2025. The compound annual growth rate (CAGR) is estimated at 6.8%. Lithium-ion batteries are leading this surge, attributed to their superior energy density and performance over traditional lead-acid alternatives. Key growth drivers include the escalating adoption of electric vehicles (EVs) across the region and government initiatives supporting renewable energy integration and grid stability via battery energy storage systems (BESS). India spearheads regional demand, followed by Pakistan and Bangladesh, driven by industrialization and urbanization. While infrastructure limitations for EV charging and the initial cost of lithium-ion batteries present challenges, technological advancements and supportive government policies are creating a positive market outlook.

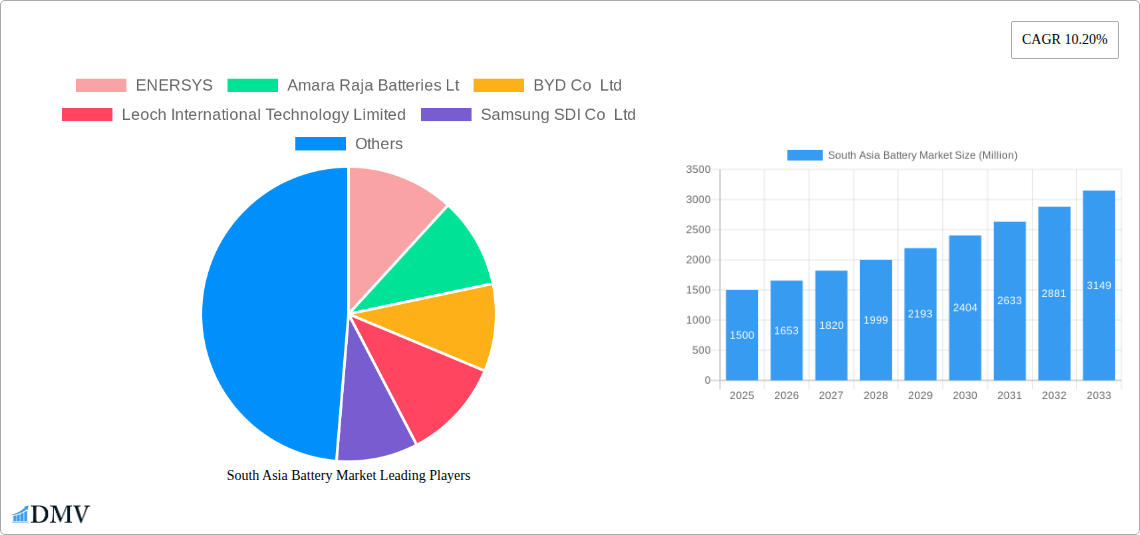

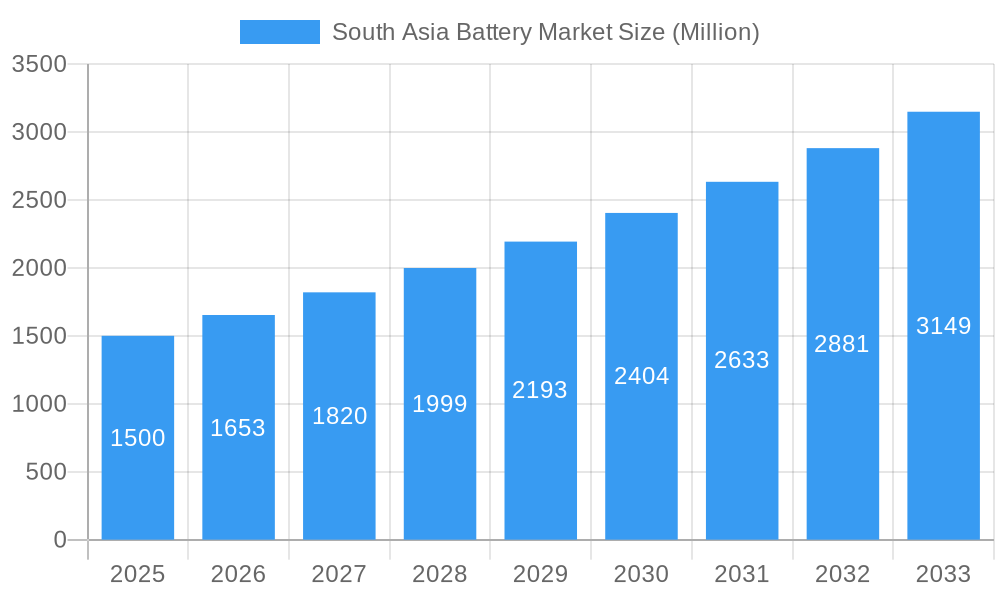

South Asia Battery Market Market Size (In Billion)

The competitive arena features both global leaders such as Samsung SDI, LG Chem, and Panasonic, and strong domestic contenders like Amara Raja Batteries (India). Future market dynamics are expected to be influenced by new entrants and strategic mergers and acquisitions, driven by the increasing demand for sustainable, high-performance battery solutions. Understanding country-specific regulations and incentives is vital for successful market entry. The market's trajectory will be closely tied to the pace of electrification, renewable energy infrastructure development, and ongoing battery technology improvements, indicating significant future potential.

South Asia Battery Market Company Market Share

South Asia Battery Market: A Comprehensive Report (2019-2033)

This insightful report provides a detailed analysis of the South Asia battery market, encompassing market size, trends, leading players, and future projections. The study period spans from 2019 to 2033, with 2025 serving as the base and estimated year. This comprehensive analysis will equip stakeholders with the necessary knowledge to navigate the dynamic landscape of this rapidly evolving sector. The market is valued at xx Million in 2025 and is projected to reach xx Million by 2033, exhibiting a robust CAGR of xx%.

South Asia Battery Market Composition & Trends

This section delves into the intricate structure and dynamics of the South Asia battery market. We examine market concentration, revealing the market share distribution among key players like Amara Raja Batteries Ltd, Exide Industries Ltd, and BYD Co Ltd. We analyze innovation catalysts, such as the increasing demand for electric vehicles and renewable energy storage, shaping technological advancements and influencing market growth. The regulatory landscape, including government incentives and environmental regulations, is meticulously scrutinized. We also assess the impact of substitute products and analyze the competitive intensity through an examination of M&A activities. Deal values for significant mergers and acquisitions are included, providing a comprehensive overview of market consolidation trends.

- Market Concentration: Amara Raja Batteries Ltd and Exide Industries Ltd hold a significant market share, with xx% and xx% respectively, while other players including BYD, Samsung SDI, and LG Chem compete for the remaining market.

- Innovation Catalysts: Government initiatives promoting electric mobility and renewable energy are driving innovation in lithium-ion battery technology.

- Regulatory Landscape: Stringent emission norms and government subsidies for electric vehicles are key regulatory drivers.

- Substitute Products: Alternative energy storage solutions, such as fuel cells, pose a competitive threat.

- M&A Activities: The market witnessed xx Million worth of M&A deals in the past five years, showcasing significant consolidation. This included the acquisitions of [mention specific M&A deals and values if available, otherwise use "xx" ].

- End-User Profiles: The automotive sector is a major end-user, followed by energy storage and telecommunication segments.

South Asia Battery Market Industry Evolution

This section presents a detailed analysis of the South Asia battery market's evolution. We trace the market's growth trajectory from 2019 to 2024, highlighting key milestones and inflection points. The analysis incorporates technological advancements, such as the shift from lead-acid to lithium-ion batteries, and explores their impact on market dynamics. The report meticulously analyzes shifting consumer demands, including preferences for high-performance, eco-friendly, and cost-effective battery solutions, and how manufacturers are responding to these trends. Growth rates and adoption metrics are provided for key battery types and end-user segments.

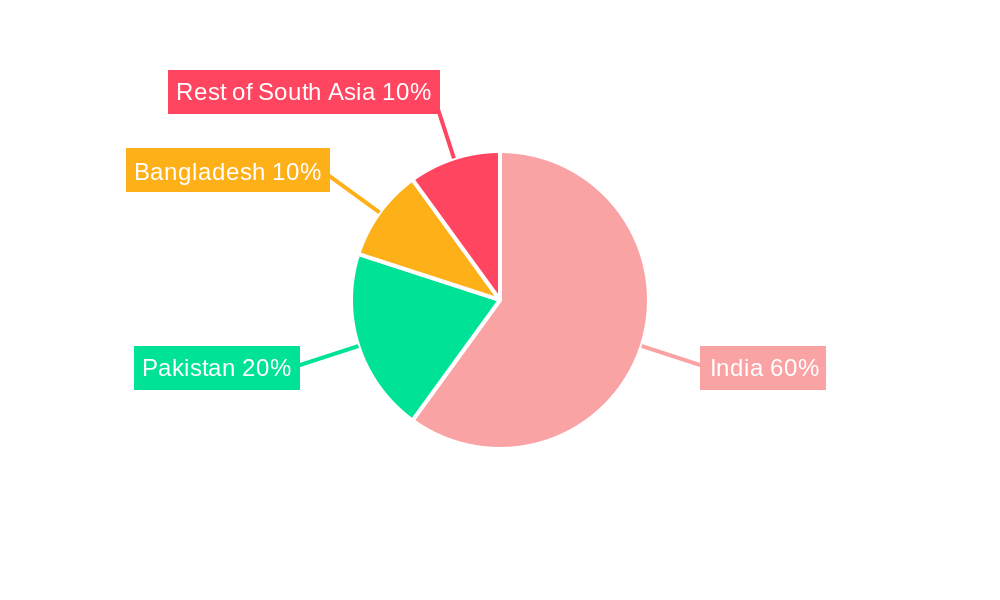

Leading Regions, Countries, or Segments in South Asia Battery Market

This section identifies the dominant regions, countries, and segments within the South Asia battery market. We analyze factors driving the dominance of specific segments (Lead Acid Battery, Lithium-ion Battery, Other Types) and end-users (Automotive, Data Centers, Telecommunication, Energy Storage, Other End Users). The analysis utilizes both bullet points and paragraphs to provide a comprehensive and nuanced understanding of the market's geographical and sectoral leadership.

- Dominant Region: India is the largest market in South Asia due to its growing automotive and renewable energy sectors.

- Dominant Segment (Type): The lead-acid battery segment currently holds a larger market share, although the lithium-ion battery segment is experiencing rapid growth.

- Dominant Segment (End-User): The automotive sector dominates the end-user segment, driven by increasing electric vehicle adoption.

Key Drivers:

- India: Government initiatives like the Production Linked Incentive (PLI) scheme significantly boost domestic manufacturing. Strong economic growth fuels demand for energy storage solutions across various sectors.

- Other South Asian Countries: Expanding infrastructure development and rising disposable incomes drive market growth. Governments are increasingly promoting renewable energy sources, leading to higher demand for energy storage solutions.

South Asia Battery Market Product Innovations

This section examines recent advancements in battery technology and their impact on the South Asia market. We showcase unique selling propositions (USPs) of innovative battery products, highlighting improvements in energy density, lifespan, safety, and charging speeds. Technological advancements, such as solid-state batteries and advanced materials, are discussed. Performance metrics, such as energy density (Wh/kg) and cycle life, are analyzed for different battery types.

Propelling Factors for South Asia Battery Market Growth

Several factors are driving the growth of the South Asia battery market. Technological advancements in battery technology, particularly in lithium-ion batteries, have led to increased energy density and performance, making them attractive for electric vehicles and renewable energy storage. The economic growth of the region is also a crucial driver, as rising disposable incomes and industrialization fuel demand for various battery applications. Furthermore, supportive government policies, including subsidies and incentives for electric vehicles and renewable energy, create a conducive environment for market expansion. The rising awareness of environmental concerns and the need for sustainable energy solutions further strengthens the growth trajectory.

Obstacles in the South Asia Battery Market

Despite its potential, the South Asia battery market faces several challenges. Regulatory hurdles, including complex import-export regulations and varying standards across countries, create obstacles for market expansion. Supply chain disruptions, particularly of raw materials like lithium and cobalt, pose a significant threat to manufacturers. Furthermore, intense competition among existing and emerging players can put downward pressure on prices, affecting profitability. These challenges can be quantified through lost revenue or production delays and detailed in specific case studies if available.

Future Opportunities in South Asia Battery Market

The South Asia battery market presents numerous future opportunities. The burgeoning electric vehicle sector offers significant growth potential, driving demand for high-performance batteries. The development of energy storage solutions for renewable energy integration is also expected to fuel market expansion. Emerging markets in rural areas and increasing adoption of battery-powered devices in diverse sectors present new avenues for growth. Advancements in battery technology, such as solid-state batteries and improved recycling technologies, offer additional opportunities.

Major Players in the South Asia Battery Market Ecosystem

- ENERSYS

- Amara Raja Batteries Ltd

- BYD Co Ltd

- Leoch International Technology Limited

- Samsung SDI Co Ltd

- LG Chem Ltd

- Exide Industries Ltd

- C&D Technologies Inc

- GS Yuasa Corporation

- Panasonic Corporation

Key Developments in South Asia Battery Market Industry

- July 2022: Ola Electric, Reliance New Energy, and Rajesh Export secured USD 2,187.7 Million under India's Production Linked Incentive (PLI) program to produce 95 GWh of batteries, signifying a major boost to domestic manufacturing.

- November 2022: Livent Corporation and Nanyang Technological University launched a research partnership to advance eco-friendly lithium battery technologies, showcasing a focus on sustainability within the industry.

Strategic South Asia Battery Market Forecast

The South Asia battery market is poised for significant growth driven by the increasing adoption of electric vehicles, government support for renewable energy, and technological innovations. The market's future potential is considerable, with strong prospects across various segments and geographical locations. The continued expansion of the electric vehicle market and growing demand for energy storage solutions are expected to fuel this growth. Technological advancements in battery technology, such as solid-state batteries, will further enhance the market's prospects. The supportive regulatory environment across several South Asian nations will also be a major catalyst for future growth.

South Asia Battery Market Segmentation

-

1. Type

- 1.1. Lead Acid Battery

- 1.2. Lithium-ion Battery

- 1.3. Other Types

-

2. End Users

- 2.1. Automotive

- 2.2. Data Centers

- 2.3. Telecommunication

- 2.4. Energy Storage

- 2.5. Other End Users

-

3. Geography

- 3.1. Singapore

- 3.2. Thailand

- 3.3. Indonesia

- 3.4. Rest of South Asia

South Asia Battery Market Segmentation By Geography

- 1. Singapore

- 2. Thailand

- 3. Indonesia

- 4. Rest of South Asia

South Asia Battery Market Regional Market Share

Geographic Coverage of South Asia Battery Market

South Asia Battery Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.8% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; The Increasing Demand for Cleaner Energy4.; Increasing Adoption of Sodium-Ion Batteries for Energy Storage Systems

- 3.3. Market Restrains

- 3.3.1. 4.; Availability of Technical Constraints

- 3.4. Market Trends

- 3.4.1. Data Centers Segment to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. South Asia Battery Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Lead Acid Battery

- 5.1.2. Lithium-ion Battery

- 5.1.3. Other Types

- 5.2. Market Analysis, Insights and Forecast - by End Users

- 5.2.1. Automotive

- 5.2.2. Data Centers

- 5.2.3. Telecommunication

- 5.2.4. Energy Storage

- 5.2.5. Other End Users

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. Singapore

- 5.3.2. Thailand

- 5.3.3. Indonesia

- 5.3.4. Rest of South Asia

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Singapore

- 5.4.2. Thailand

- 5.4.3. Indonesia

- 5.4.4. Rest of South Asia

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Singapore South Asia Battery Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Lead Acid Battery

- 6.1.2. Lithium-ion Battery

- 6.1.3. Other Types

- 6.2. Market Analysis, Insights and Forecast - by End Users

- 6.2.1. Automotive

- 6.2.2. Data Centers

- 6.2.3. Telecommunication

- 6.2.4. Energy Storage

- 6.2.5. Other End Users

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. Singapore

- 6.3.2. Thailand

- 6.3.3. Indonesia

- 6.3.4. Rest of South Asia

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Thailand South Asia Battery Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Lead Acid Battery

- 7.1.2. Lithium-ion Battery

- 7.1.3. Other Types

- 7.2. Market Analysis, Insights and Forecast - by End Users

- 7.2.1. Automotive

- 7.2.2. Data Centers

- 7.2.3. Telecommunication

- 7.2.4. Energy Storage

- 7.2.5. Other End Users

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. Singapore

- 7.3.2. Thailand

- 7.3.3. Indonesia

- 7.3.4. Rest of South Asia

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Indonesia South Asia Battery Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Lead Acid Battery

- 8.1.2. Lithium-ion Battery

- 8.1.3. Other Types

- 8.2. Market Analysis, Insights and Forecast - by End Users

- 8.2.1. Automotive

- 8.2.2. Data Centers

- 8.2.3. Telecommunication

- 8.2.4. Energy Storage

- 8.2.5. Other End Users

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. Singapore

- 8.3.2. Thailand

- 8.3.3. Indonesia

- 8.3.4. Rest of South Asia

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Rest of South Asia South Asia Battery Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Lead Acid Battery

- 9.1.2. Lithium-ion Battery

- 9.1.3. Other Types

- 9.2. Market Analysis, Insights and Forecast - by End Users

- 9.2.1. Automotive

- 9.2.2. Data Centers

- 9.2.3. Telecommunication

- 9.2.4. Energy Storage

- 9.2.5. Other End Users

- 9.3. Market Analysis, Insights and Forecast - by Geography

- 9.3.1. Singapore

- 9.3.2. Thailand

- 9.3.3. Indonesia

- 9.3.4. Rest of South Asia

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 ENERSYS

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Amara Raja Batteries Lt

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 BYD Co Ltd

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Leoch International Technology Limited

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Samsung SDI Co Ltd

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 LG Chem Ltd

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Exide Industries Ltd

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 C&D Technologies Inc

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 GS Yuasa Corporation

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Panasonic Corporation

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.1 ENERSYS

List of Figures

- Figure 1: South Asia Battery Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: South Asia Battery Market Share (%) by Company 2025

List of Tables

- Table 1: South Asia Battery Market Revenue billion Forecast, by Type 2020 & 2033

- Table 2: South Asia Battery Market Revenue billion Forecast, by End Users 2020 & 2033

- Table 3: South Asia Battery Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 4: South Asia Battery Market Revenue billion Forecast, by Region 2020 & 2033

- Table 5: South Asia Battery Market Revenue billion Forecast, by Type 2020 & 2033

- Table 6: South Asia Battery Market Revenue billion Forecast, by End Users 2020 & 2033

- Table 7: South Asia Battery Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 8: South Asia Battery Market Revenue billion Forecast, by Country 2020 & 2033

- Table 9: South Asia Battery Market Revenue billion Forecast, by Type 2020 & 2033

- Table 10: South Asia Battery Market Revenue billion Forecast, by End Users 2020 & 2033

- Table 11: South Asia Battery Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 12: South Asia Battery Market Revenue billion Forecast, by Country 2020 & 2033

- Table 13: South Asia Battery Market Revenue billion Forecast, by Type 2020 & 2033

- Table 14: South Asia Battery Market Revenue billion Forecast, by End Users 2020 & 2033

- Table 15: South Asia Battery Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 16: South Asia Battery Market Revenue billion Forecast, by Country 2020 & 2033

- Table 17: South Asia Battery Market Revenue billion Forecast, by Type 2020 & 2033

- Table 18: South Asia Battery Market Revenue billion Forecast, by End Users 2020 & 2033

- Table 19: South Asia Battery Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 20: South Asia Battery Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the South Asia Battery Market?

The projected CAGR is approximately 6.8%.

2. Which companies are prominent players in the South Asia Battery Market?

Key companies in the market include ENERSYS, Amara Raja Batteries Lt, BYD Co Ltd, Leoch International Technology Limited, Samsung SDI Co Ltd, LG Chem Ltd, Exide Industries Ltd, C&D Technologies Inc, GS Yuasa Corporation, Panasonic Corporation.

3. What are the main segments of the South Asia Battery Market?

The market segments include Type, End Users, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 259.21 billion as of 2022.

5. What are some drivers contributing to market growth?

4.; The Increasing Demand for Cleaner Energy4.; Increasing Adoption of Sodium-Ion Batteries for Energy Storage Systems.

6. What are the notable trends driving market growth?

Data Centers Segment to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; Availability of Technical Constraints.

8. Can you provide examples of recent developments in the market?

Jul 2022: Ola Electric, Reliance New Energy, and Rajesh Export all signed agreements for USD 2,187.7 million as part of the Center's Production Linked Incentive (PLI) program. The three businesses, which have been chosen as part of the PLI program of the Center, are anticipated to produce 95 GWh of batteries. Within two years, they will need to put up a manufacturing facility.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "South Asia Battery Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the South Asia Battery Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the South Asia Battery Market?

To stay informed about further developments, trends, and reports in the South Asia Battery Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence