Key Insights

The South American probiotic market, projected to reach $3.49 billion by 2025, is poised for substantial expansion. This growth is primarily driven by heightened health consciousness, rising disposable incomes, and a deepening understanding of the gut microbiome's crucial role in overall wellness. Key growth drivers include the increasing incidence of digestive ailments and the growing preference for functional foods and beverages. The expanding dietary supplement sector, alongside broader distribution networks encompassing supermarkets, pharmacies, and health stores, presents significant opportunities for probiotic manufacturers. Brazil and Argentina currently dominate the regional market due to higher per capita consumption and established healthcare systems. However, the "Rest of South America" segment offers considerable future growth potential as awareness and accessibility of probiotic products rise. The competitive landscape features major players such as Nestle, Danone, and Yakult, fostering innovation and product diversification across food and beverage, dietary supplements, and animal feed. Nevertheless, potential regulatory complexities and varying consumer awareness levels across South American nations represent ongoing challenges. Sustained market growth will necessitate effective marketing strategies emphasizing probiotic health benefits and addressing consumer concerns regarding safety and efficacy.

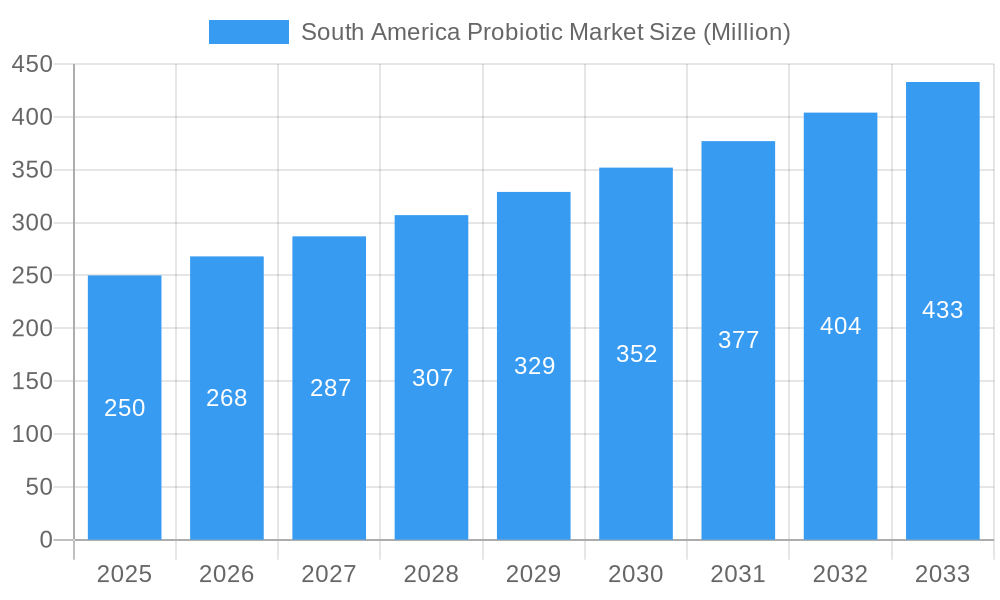

South America Probiotic Market Market Size (In Billion)

The forecast period (2025-2033) anticipates a compound annual growth rate (CAGR) of 9.1%, signifying robust market expansion. This trajectory will be supported by consistent demand for probiotic-enriched food and beverages, alongside increased adoption of probiotics in dietary supplements and animal feed. Continuous innovation from key manufacturers developing specialized health solutions will further propel growth. Market segmentation by product type and distribution channel highlights the varied pathways through which probiotics reach South American consumers. Strategic network expansions by leading companies will enhance market penetration. Potential headwinds include economic volatility in specific South American economies and fluctuations in raw material costs. Therefore, sustained growth requires agile adaptation to market dynamics and a focus on cost-efficient production.

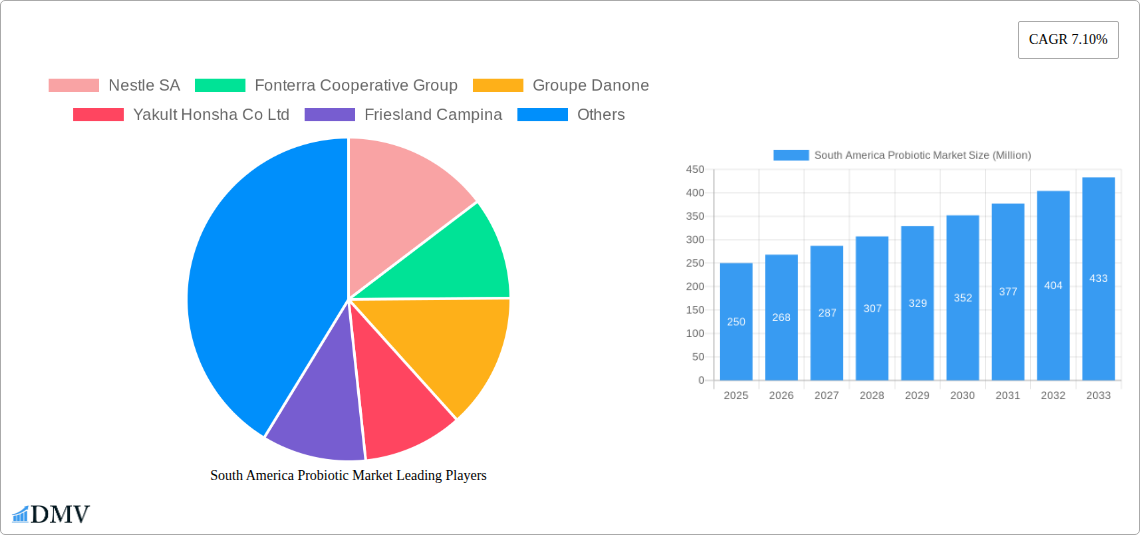

South America Probiotic Market Company Market Share

South America Probiotic Market: A Comprehensive Report (2019-2033)

This insightful report provides a detailed analysis of the South America probiotic market, offering valuable insights for stakeholders seeking to navigate this dynamic landscape. Covering the period from 2019 to 2033, with a focus on 2025, this study unveils key trends, growth drivers, challenges, and future opportunities within the South American probiotic industry. The report segments the market by product type (Food and Beverage, Dietary Supplements, Animal Feed) and distribution channel (Supermarkets/Hypermarkets, Pharmacies/Health Stores, Convenience Stores, Others), featuring prominent players like Nestle SA, Fonterra Cooperative Group, Groupe Danone, Yakult Honsha Co Ltd, Friesland Campina, PepsiCo Inc (Kevita), and Chr Hansen. The market size is projected to reach xx Million by 2033.

South America Probiotic Market Composition & Trends

This section delves into the competitive dynamics of the South American probiotic market, evaluating market concentration, innovation drivers, regulatory frameworks, substitute products, end-user profiles, and merger & acquisition (M&A) activities. The report analyzes market share distribution among key players, revealing the dominance of established multinational corporations and the emergence of regional players. M&A activities are examined, assessing deal values and their impact on market consolidation. The report also considers the influence of evolving regulatory landscapes on market growth and the impact of substitute products on market share. End-user profiles provide insights into consumer preferences and purchasing behaviors across different segments.

- Market Concentration: A detailed analysis of market share distribution among key players, including Nestle SA, Fonterra Cooperative Group, and Groupe Danone. The report will quantify the market share held by the top 5 players in 2025 (e.g., Top 5 players hold xx% of the market).

- Innovation Catalysts: Identification of key technological advancements driving innovation in probiotic product development, including advancements in strain identification and delivery systems.

- Regulatory Landscape: Assessment of the regulatory environment in key South American countries, outlining the impact of regulations on market entry and product development.

- Substitute Products: Analysis of substitute products and their influence on the market share of probiotic products.

- End-User Profiles: Profiling of key end-user segments, including consumers and businesses (e.g., the report will reveal that xx% of consumers are seeking probiotics for gut health).

- M&A Activities: Review of significant M&A activities in the South American probiotic market during the historical period, highlighting deal values and their implications for market consolidation (e.g., XX Million in M&A deals were recorded between 2019-2024).

South America Probiotic Market Industry Evolution

This section provides a comprehensive analysis of the South America probiotic market’s evolution from 2019 to 2033. It traces the market's growth trajectory, highlighting periods of expansion and contraction. Technological advancements impacting product development, manufacturing, and delivery are examined, including advancements in fermentation technology and microencapsulation. Shifting consumer demands and preferences, influenced by factors like health awareness and lifestyle changes, are also analyzed. The report includes specific data points such as compound annual growth rates (CAGR) and adoption rates of new probiotic technologies. The impact of health and wellness trends, consumer preferences for natural and organic products, and the rising awareness of gut health are incorporated into the analysis.

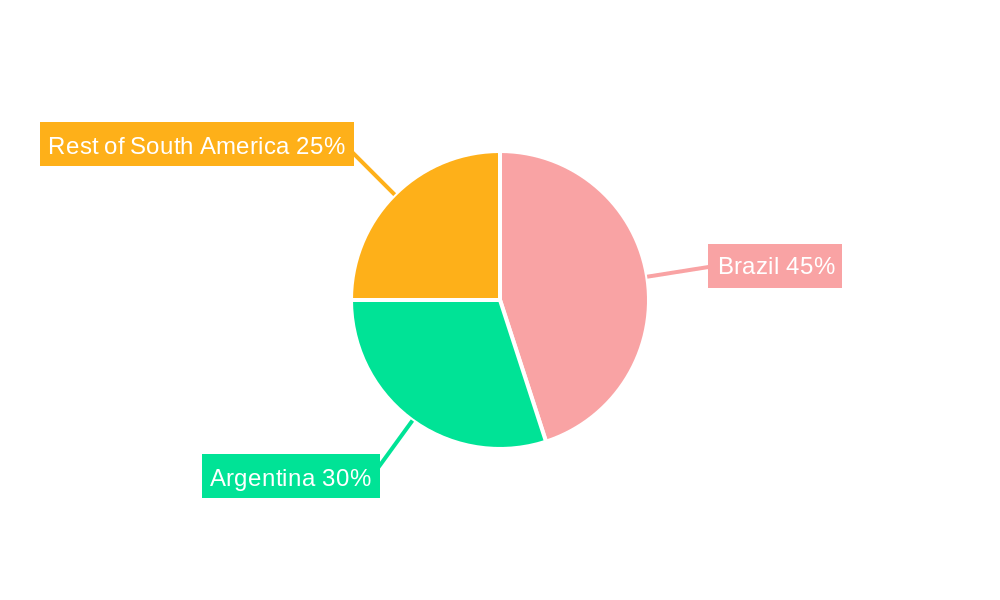

Leading Regions, Countries, or Segments in South America Probiotic Market

This section identifies the leading regions, countries, and segments within the South American probiotic market. It will pinpoint the dominant region, country, and specific segments from the product type and distribution channel categories. The dominance factors are explored deeply, using both bullet points to highlight key drivers and paragraphs to analyze these factors in detail.

Dominant Regions/Countries: [Analysis of specific countries will be included, detailing their growth rates and market size.]

- Key Drivers (Brazil):

- High population density and rising disposable income.

- Increased awareness of health and wellness.

- Government support for the food and beverage industry.

- Key Drivers (Other Countries): [Similar bullet point lists will be provided for other leading countries]

Dominant Segments:

- Product Type: [Analysis of which product type (Food & Beverage, Dietary Supplements, Animal Feed) is dominant, and why. E.g., Food and Beverage dominates due to increased consumer preference for convenient, functional foods.]

- Distribution Channel: [Analysis of which distribution channel (Supermarkets/Hypermarkets, Pharmacies/Health Stores, Convenience Stores, Others) is dominant, and why. E.g., Supermarkets/Hypermarkets dominate due to high reach and established infrastructure.]

South America Probiotic Market Product Innovations

This section details the latest product innovations within the South American probiotic market. It examines the applications of these innovations, evaluating their performance metrics against conventional probiotic products. Key aspects such as improved shelf life, enhanced bioavailability, and targeted health benefits are discussed. The report will also highlight the unique selling propositions of these new products and the technological advancements driving their development. For example, the increased use of specific probiotic strains for targeted health benefits (e.g., gut health, immune support) and improved delivery systems (e.g., encapsulation, freeze-drying) will be noted.

Propelling Factors for South America Probiotic Market Growth

Several factors are driving growth in the South American probiotic market. Increased awareness of gut health and its correlation to overall wellness fuels demand for probiotic products. Growing disposable incomes and changing lifestyle trends within the region contribute to greater consumption of health-conscious food and beverages. Supportive government regulations and initiatives that promote health and wellness within the food industry also provide a favorable environment for market growth. Technological advancements in probiotic strains, development, and delivery mechanisms are continuously improving the efficacy and market appeal of these products.

Obstacles in the South America Probiotic Market

Despite substantial growth potential, the South America probiotic market faces certain obstacles. Stringent regulatory approvals and compliance requirements can impede the launch of new products, creating delays and increasing development costs. Supply chain disruptions, particularly concerning the sourcing of raw materials and efficient logistics, can limit production capacity and impact product availability. Intense competition from established players and the emergence of new entrants can create price pressures and limit profit margins for individual companies.

Future Opportunities in South America Probiotic Market

The South American probiotic market presents several promising opportunities. Expanding into untapped markets within the region, particularly in less-developed areas, offers substantial growth potential. Development of innovative probiotic products tailored to specific consumer needs, such as personalized nutrition and targeted health benefits, can capture significant market share. Investment in research and development to improve the effectiveness and stability of probiotic products will enhance their appeal and market position. Leveraging digital marketing and e-commerce channels to increase product awareness and accessibility will provide further growth opportunities.

Major Players in the South America Probiotic Market Ecosystem

Key Developments in South America Probiotic Market Industry

- 2022-Q4: Nestle SA launched a new line of probiotic yogurts targeting the health-conscious consumer segment in Brazil.

- 2023-Q1: Groupe Danone announced a strategic partnership with a local distributor to expand its probiotic product distribution network in Argentina.

- 2023-Q2: Fonterra Cooperative Group invested in a new manufacturing facility in Chile, boosting its probiotic production capacity in the region.

- [Further developments will be added here.]

Strategic South America Probiotic Market Forecast

The South American probiotic market is poised for significant growth over the forecast period (2025-2033). Continued growth in disposable incomes, increasing health awareness, and the introduction of innovative probiotic products will drive market expansion. Opportunities in emerging markets and within specific product segments, such as functional foods and animal feed probiotics, will contribute to this growth. The market is expected to experience a considerable CAGR, making it an attractive investment destination for both established players and new entrants. The report provides a detailed forecast outlining market size and segment-specific projections for the upcoming years.

South America Probiotic Market Segmentation

-

1. Product Type

-

1.1. Food and Beverage

- 1.1.1. Dairy Products

- 1.1.2. Fermented Food Products

- 1.1.3. Non-Alcoholic Beverages

- 1.1.4. Other Products

- 1.2. Dietary Supplements

- 1.3. Animal Feed

-

1.1. Food and Beverage

-

2. Distribution Channel

- 2.1. Supermarkets/ Hypermarkets

- 2.2. Pharmacies/Health Stores

- 2.3. Convenience Stores

- 2.4. Others

-

3. Geography

- 3.1. Brazil

- 3.2. Argentina

- 3.3. Rest of South America

South America Probiotic Market Segmentation By Geography

- 1. Brazil

- 2. Argentina

- 3. Rest of South America

South America Probiotic Market Regional Market Share

Geographic Coverage of South America Probiotic Market

South America Probiotic Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 9.1% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growth In Foodservice Expenditure and Tourism Sector; Premiumization with the Growth of Fortified and Flavored Water

- 3.3. Market Restrains

- 3.3.1. Concerns Regarding Plastic Waste and the Rising Inclination Toward Tap Water

- 3.4. Market Trends

- 3.4.1. Functional Food and Beverage Serve the Largest Probiotic Market in the region

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. South America Probiotic Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Food and Beverage

- 5.1.1.1. Dairy Products

- 5.1.1.2. Fermented Food Products

- 5.1.1.3. Non-Alcoholic Beverages

- 5.1.1.4. Other Products

- 5.1.2. Dietary Supplements

- 5.1.3. Animal Feed

- 5.1.1. Food and Beverage

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Supermarkets/ Hypermarkets

- 5.2.2. Pharmacies/Health Stores

- 5.2.3. Convenience Stores

- 5.2.4. Others

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. Brazil

- 5.3.2. Argentina

- 5.3.3. Rest of South America

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Brazil

- 5.4.2. Argentina

- 5.4.3. Rest of South America

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Brazil South America Probiotic Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Food and Beverage

- 6.1.1.1. Dairy Products

- 6.1.1.2. Fermented Food Products

- 6.1.1.3. Non-Alcoholic Beverages

- 6.1.1.4. Other Products

- 6.1.2. Dietary Supplements

- 6.1.3. Animal Feed

- 6.1.1. Food and Beverage

- 6.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.2.1. Supermarkets/ Hypermarkets

- 6.2.2. Pharmacies/Health Stores

- 6.2.3. Convenience Stores

- 6.2.4. Others

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. Brazil

- 6.3.2. Argentina

- 6.3.3. Rest of South America

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. Argentina South America Probiotic Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Food and Beverage

- 7.1.1.1. Dairy Products

- 7.1.1.2. Fermented Food Products

- 7.1.1.3. Non-Alcoholic Beverages

- 7.1.1.4. Other Products

- 7.1.2. Dietary Supplements

- 7.1.3. Animal Feed

- 7.1.1. Food and Beverage

- 7.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.2.1. Supermarkets/ Hypermarkets

- 7.2.2. Pharmacies/Health Stores

- 7.2.3. Convenience Stores

- 7.2.4. Others

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. Brazil

- 7.3.2. Argentina

- 7.3.3. Rest of South America

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Rest of South America South America Probiotic Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Food and Beverage

- 8.1.1.1. Dairy Products

- 8.1.1.2. Fermented Food Products

- 8.1.1.3. Non-Alcoholic Beverages

- 8.1.1.4. Other Products

- 8.1.2. Dietary Supplements

- 8.1.3. Animal Feed

- 8.1.1. Food and Beverage

- 8.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.2.1. Supermarkets/ Hypermarkets

- 8.2.2. Pharmacies/Health Stores

- 8.2.3. Convenience Stores

- 8.2.4. Others

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. Brazil

- 8.3.2. Argentina

- 8.3.3. Rest of South America

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. Competitive Analysis

- 9.1. Market Share Analysis 2025

- 9.2. Company Profiles

- 9.2.1 Nestle SA

- 9.2.1.1. Overview

- 9.2.1.2. Products

- 9.2.1.3. SWOT Analysis

- 9.2.1.4. Recent Developments

- 9.2.1.5. Financials (Based on Availability)

- 9.2.2 Fonterra Cooperative Group

- 9.2.2.1. Overview

- 9.2.2.2. Products

- 9.2.2.3. SWOT Analysis

- 9.2.2.4. Recent Developments

- 9.2.2.5. Financials (Based on Availability)

- 9.2.3 Groupe Danone

- 9.2.3.1. Overview

- 9.2.3.2. Products

- 9.2.3.3. SWOT Analysis

- 9.2.3.4. Recent Developments

- 9.2.3.5. Financials (Based on Availability)

- 9.2.4 Yakult Honsha Co Ltd

- 9.2.4.1. Overview

- 9.2.4.2. Products

- 9.2.4.3. SWOT Analysis

- 9.2.4.4. Recent Developments

- 9.2.4.5. Financials (Based on Availability)

- 9.2.5 Friesland Campina

- 9.2.5.1. Overview

- 9.2.5.2. Products

- 9.2.5.3. SWOT Analysis

- 9.2.5.4. Recent Developments

- 9.2.5.5. Financials (Based on Availability)

- 9.2.6 PepsiCo Inc (Kevita)

- 9.2.6.1. Overview

- 9.2.6.2. Products

- 9.2.6.3. SWOT Analysis

- 9.2.6.4. Recent Developments

- 9.2.6.5. Financials (Based on Availability)

- 9.2.7 Chr Hansen

- 9.2.7.1. Overview

- 9.2.7.2. Products

- 9.2.7.3. SWOT Analysis

- 9.2.7.4. Recent Developments

- 9.2.7.5. Financials (Based on Availability)

- 9.2.1 Nestle SA

List of Figures

- Figure 1: South America Probiotic Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: South America Probiotic Market Share (%) by Company 2025

List of Tables

- Table 1: South America Probiotic Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 2: South America Probiotic Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 3: South America Probiotic Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 4: South America Probiotic Market Revenue billion Forecast, by Region 2020 & 2033

- Table 5: South America Probiotic Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 6: South America Probiotic Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 7: South America Probiotic Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 8: South America Probiotic Market Revenue billion Forecast, by Country 2020 & 2033

- Table 9: South America Probiotic Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 10: South America Probiotic Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 11: South America Probiotic Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 12: South America Probiotic Market Revenue billion Forecast, by Country 2020 & 2033

- Table 13: South America Probiotic Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 14: South America Probiotic Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 15: South America Probiotic Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 16: South America Probiotic Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the South America Probiotic Market?

The projected CAGR is approximately 9.1%.

2. Which companies are prominent players in the South America Probiotic Market?

Key companies in the market include Nestle SA, Fonterra Cooperative Group, Groupe Danone, Yakult Honsha Co Ltd, Friesland Campina, PepsiCo Inc (Kevita), Chr Hansen.

3. What are the main segments of the South America Probiotic Market?

The market segments include Product Type, Distribution Channel, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 3.49 billion as of 2022.

5. What are some drivers contributing to market growth?

Growth In Foodservice Expenditure and Tourism Sector; Premiumization with the Growth of Fortified and Flavored Water.

6. What are the notable trends driving market growth?

Functional Food and Beverage Serve the Largest Probiotic Market in the region.

7. Are there any restraints impacting market growth?

Concerns Regarding Plastic Waste and the Rising Inclination Toward Tap Water.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "South America Probiotic Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the South America Probiotic Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the South America Probiotic Market?

To stay informed about further developments, trends, and reports in the South America Probiotic Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence