Key Insights

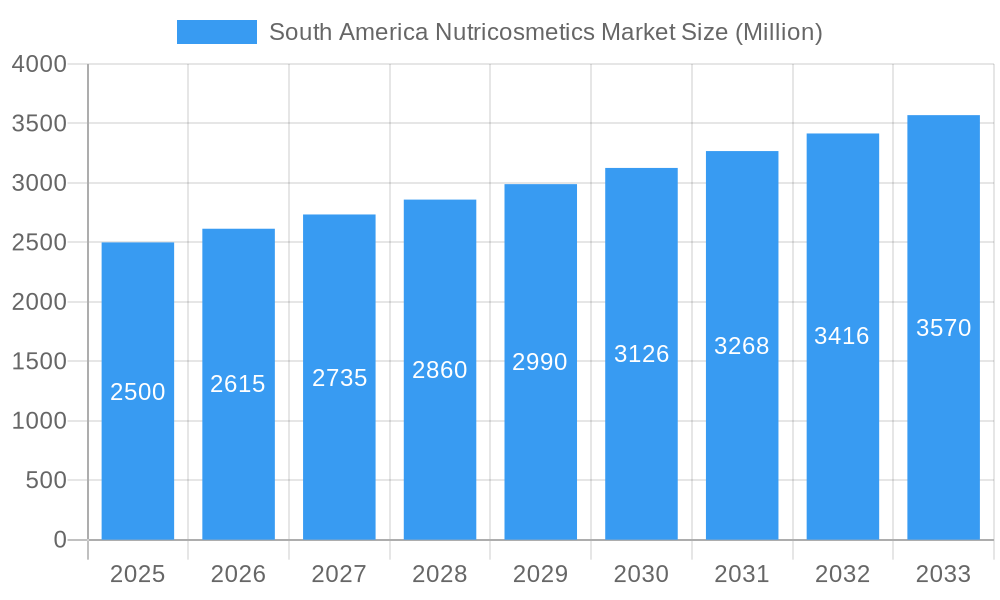

The South American nutricosmetics market, encompassing skincare, haircare, and nailcare products in diverse forms including tablets, capsules, powders, liquids, gummies, and chewables, is poised for significant expansion. Driven by heightened consumer awareness of the benefits of holistic beauty and a growing demand for convenient, effective solutions, the market is projected to achieve a CAGR of 8.2%. This growth trajectory is particularly pronounced in Brazil and Argentina, propelled by their robust economies, an expanding middle class with increased disposable income, and a strong preference for natural and organic formulations. The proliferation of online retail channels further enhances market accessibility and consumer convenience, complementing established distribution networks spanning supermarkets, drugstores, and specialist stores. The market size for 2025 is estimated at $7.5 billion, with the forecast period extending to 2033. Segmentation by product form, distribution channel, and type enables targeted market strategies.

South America Nutricosmetics Market Market Size (In Billion)

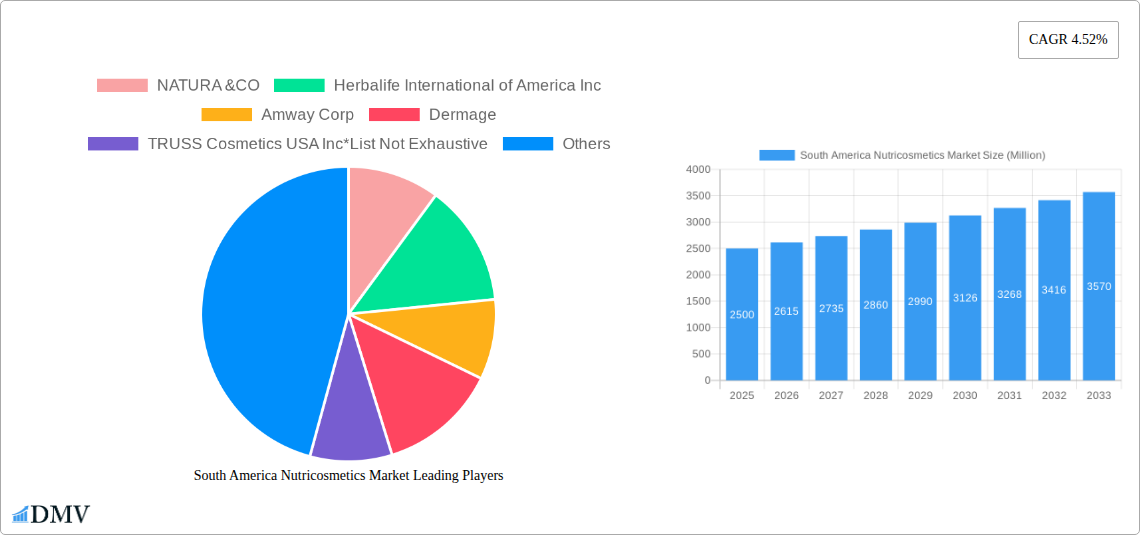

Evolving consumer preferences for personalized beauty routines and the increasing integration of functional foods and beverages that promote inner radiance are key growth catalysts. However, potential market expansion may be moderated by price sensitivity in specific segments and stringent regulatory landscapes concerning product claims and ingredient approvals. Intense competition from established global brands and emerging local players necessitates continuous innovation and strategic marketing. The future outlook remains highly positive, presenting substantial opportunities for companies willing to adapt to shifting consumer demands, capitalize on the growing health-conscious demographic, and develop innovative product offerings. Key industry players, including Natura &Co, Herbalife, and Amway, are strategically positioned to leverage these market dynamics, underscoring the importance of agile responses to evolving consumer needs and a deep understanding of the unique South American market landscape.

South America Nutricosmetics Market Company Market Share

South America Nutricosmetics Market: A Comprehensive Report (2019-2033)

This insightful report provides a detailed analysis of the South America nutricosmetics market, offering a comprehensive overview of its current state, future trajectory, and key players. The study period spans 2019-2033, with 2025 serving as the base and estimated year. The report delves into market segmentation, competitive landscape, growth drivers, challenges, and lucrative opportunities, providing stakeholders with actionable intelligence for informed decision-making. The market is projected to reach xx Million by 2033, showcasing significant growth potential.

South America Nutricosmetics Market Composition & Trends

This section evaluates the South American nutricosmetics market's competitive intensity, innovation drivers, regulatory environment, substitute products, end-user profiles, and mergers & acquisitions (M&A) activity. We analyze market share distribution amongst key players like NATURA & CO, Herbalife International of America Inc, Amway Corp, Dermage, TRUSS Cosmetics USA Inc, Earth Extracts Cosmetics Industry, Beiersdorf AG, and NutraHair (list not exhaustive). The report quantifies market concentration using metrics like the Herfindahl-Hirschman Index (HHI) and explores the impact of recent M&A deals, estimating their total value at xx Million. Further analysis covers consumer preferences across different age groups and income levels, identifying key trends influencing purchasing decisions. We examine the regulatory landscape’s impact on market entry and product approvals, alongside an assessment of substitute products and their market penetration.

- Market Concentration: xx% of the market is held by the top 5 players.

- M&A Activity (2019-2024): xx number of deals totaling xx Million in value.

- Innovation Catalysts: Growing demand for natural and organic ingredients, technological advancements in delivery systems.

- Regulatory Landscape: Analysis of key regulations affecting the industry in major South American countries.

South America Nutricosmetics Market Industry Evolution

This section provides a detailed analysis of the South American nutricosmetics market's growth trajectory from 2019 to 2033, examining technological advancements and shifting consumer demands. We present data points illustrating the market's Compound Annual Growth Rate (CAGR) during the historical period (2019-2024) at xx% and project the CAGR for the forecast period (2025-2033) at xx%. The analysis covers the rising popularity of specific product formats (like gummies and soft chews), the increasing adoption of personalized nutricosmetic solutions, and the impact of e-commerce on market distribution. The influence of technological advancements such as improved encapsulation techniques and targeted delivery systems is also assessed. The evolution of consumer awareness regarding the benefits of nutricosmetics and their increasing willingness to invest in preventative health and beauty solutions are key aspects of this analysis.

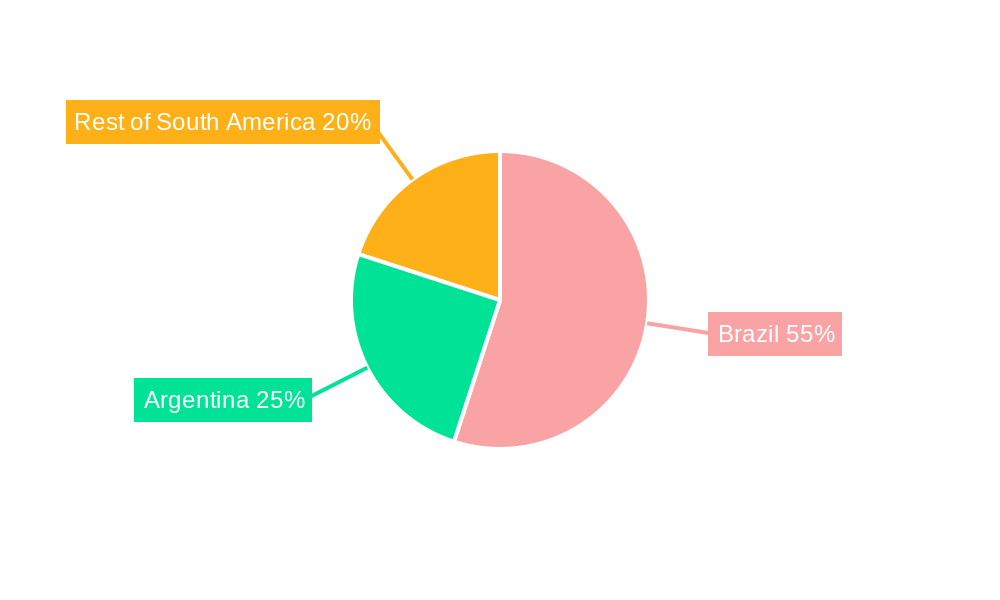

Leading Regions, Countries, or Segments in South America Nutricosmetics Market

This section identifies the leading regions, countries, and segments within the South American nutricosmetics market. We analyze performance across different product types (Skin Care, Hair Care, Nail Care), forms (Tablets and Capsules, Powder and Liquid, Gummies and Soft Chews), and distribution channels (Supermarkets/Hypermarkets, Drug Stores/Pharmacies, Specialist Stores, Online Retail Stores, Other Distribution Channels).

Key Drivers:

- Brazil: Strong economic growth, high consumer spending on beauty and personal care.

- Argentina: Growing awareness of health and wellness, increasing adoption of nutraceuticals.

- Colombia: Expanding middle class, rising disposable income fueling demand for premium products.

- Online Retail: Rapid growth in e-commerce penetration, increased convenience for consumers.

- Gummies and Soft Chews: High consumer preference driven by ease of consumption and appealing formats.

Dominance Factors: In-depth analysis of the factors driving the dominance of each leading segment. For example, the popularity of Gummies and Soft Chews is driven by their appealing form and ease of consumption, whereas the strong performance in Brazil is linked to its large population and significant spending on personal care.

South America Nutricosmetics Market Product Innovations

This section showcases recent product innovations in the South American nutricosmetics market, highlighting unique selling propositions (USPs) and technological advancements. Key trends include the development of targeted formulations for specific skin and hair concerns, the incorporation of novel bioactive ingredients, and the use of sustainable and ethically sourced materials. Examples include personalized nutricosmetic solutions tailored to individual genetic profiles and the incorporation of advanced delivery systems to enhance bioavailability and efficacy.

Propelling Factors for South America Nutricosmetics Market Growth

The South American nutricosmetics market is experiencing robust growth driven by several key factors. Rising disposable incomes in several key countries are empowering consumers to spend more on beauty and wellness products. The increasing awareness of the benefits of nutricosmetics for maintaining healthy skin, hair, and nails is another significant driver. Government initiatives promoting healthy lifestyles and supportive regulatory environments are also fostering market expansion. Technological advancements, such as improved encapsulation techniques and targeted delivery systems, further enhance product efficacy and appeal.

Obstacles in the South America Nutricosmetics Market

Despite the significant growth potential, the South American nutricosmetics market faces certain challenges. Regulatory complexities in some countries can hinder market entry and product approvals. Supply chain disruptions due to geopolitical factors or economic instability can impact product availability and pricing. Intense competition from both established and emerging players requires continuous innovation and strategic differentiation. Counterfeit products pose a significant threat, eroding consumer trust and brand loyalty.

Future Opportunities in South America Nutricosmetics Market

The South American nutricosmetics market presents several exciting opportunities for future growth. Expanding into untapped markets within the region, particularly in countries with emerging middle classes, holds significant potential. The increasing demand for personalized and customized products presents a lucrative opportunity for innovative companies. Leveraging digital marketing and e-commerce platforms to reach a wider consumer base is crucial. Focus on sustainable and ethical sourcing practices and environmentally friendly packaging will attract environmentally conscious consumers.

Major Players in the South America Nutricosmetics Market Ecosystem

- NATURA & CO

- Herbalife International of America Inc

- Amway Corp

- Dermage

- TRUSS Cosmetics USA Inc

- Earth Extracts Cosmetics Industry

- Beiersdorf AG

- NutraHair

Key Developments in South America Nutricosmetics Market Industry

- October 2022: Launch of a new line of collagen supplements by NATURA & CO.

- March 2023: Acquisition of a smaller nutricosmetics company by Amway Corp.

- June 2024: Introduction of a personalized nutricosmetics service by a leading online retailer. (Further developments to be added).

Strategic South America Nutricosmetics Market Forecast

The South American nutricosmetics market is poised for continued robust growth over the forecast period (2025-2033), driven by a confluence of factors, including rising consumer disposable incomes, increasing health and wellness awareness, technological innovation, and favorable regulatory developments. The market's expansion will be particularly pronounced in key segments, such as gummies and soft chews and online retail channels. The continued emergence of new and innovative products, along with strategic partnerships and acquisitions, will further accelerate market growth. We project significant market expansion, exceeding xx Million by 2033.

South America Nutricosmetics Market Segmentation

-

1. Product Type

- 1.1. Skin Care

- 1.2. Hair Care

- 1.3. Nail Care

-

2. Form

- 2.1. Tablets and Capsules

- 2.2. Powder and Liquid

- 2.3. Gummies and Soft Chews

-

3. Distribution Channel

- 3.1. Supermarkets/Hypermarkets

- 3.2. Drug Stores/Pharmacies

- 3.3. Specalist Stores

- 3.4. Online Retail Stores

- 3.5. Other Distribution Channel

-

4. Geography

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Colombia

- 4.4. Rest of South America

South America Nutricosmetics Market Segmentation By Geography

- 1. Brazil

- 2. Argentina

- 3. Colombia

- 4. Rest of South America

South America Nutricosmetics Market Regional Market Share

Geographic Coverage of South America Nutricosmetics Market

South America Nutricosmetics Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.2% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Emphasis on Gut Health; Innovation In Flavor and Supplement Delivery Format

- 3.3. Market Restrains

- 3.3.1. Escalating Functional Food Consumption and Other Substitutes; Side-effects Of Supplement Consumption

- 3.4. Market Trends

- 3.4.1 Indulgence Towards Natural

- 3.4.2 Fast and Effective Cosmetics Products

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. South America Nutricosmetics Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Skin Care

- 5.1.2. Hair Care

- 5.1.3. Nail Care

- 5.2. Market Analysis, Insights and Forecast - by Form

- 5.2.1. Tablets and Capsules

- 5.2.2. Powder and Liquid

- 5.2.3. Gummies and Soft Chews

- 5.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.3.1. Supermarkets/Hypermarkets

- 5.3.2. Drug Stores/Pharmacies

- 5.3.3. Specalist Stores

- 5.3.4. Online Retail Stores

- 5.3.5. Other Distribution Channel

- 5.4. Market Analysis, Insights and Forecast - by Geography

- 5.4.1. Brazil

- 5.4.2. Argentina

- 5.4.3. Colombia

- 5.4.4. Rest of South America

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. Brazil

- 5.5.2. Argentina

- 5.5.3. Colombia

- 5.5.4. Rest of South America

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Brazil South America Nutricosmetics Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Skin Care

- 6.1.2. Hair Care

- 6.1.3. Nail Care

- 6.2. Market Analysis, Insights and Forecast - by Form

- 6.2.1. Tablets and Capsules

- 6.2.2. Powder and Liquid

- 6.2.3. Gummies and Soft Chews

- 6.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.3.1. Supermarkets/Hypermarkets

- 6.3.2. Drug Stores/Pharmacies

- 6.3.3. Specalist Stores

- 6.3.4. Online Retail Stores

- 6.3.5. Other Distribution Channel

- 6.4. Market Analysis, Insights and Forecast - by Geography

- 6.4.1. Brazil

- 6.4.2. Argentina

- 6.4.3. Colombia

- 6.4.4. Rest of South America

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. Argentina South America Nutricosmetics Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Skin Care

- 7.1.2. Hair Care

- 7.1.3. Nail Care

- 7.2. Market Analysis, Insights and Forecast - by Form

- 7.2.1. Tablets and Capsules

- 7.2.2. Powder and Liquid

- 7.2.3. Gummies and Soft Chews

- 7.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.3.1. Supermarkets/Hypermarkets

- 7.3.2. Drug Stores/Pharmacies

- 7.3.3. Specalist Stores

- 7.3.4. Online Retail Stores

- 7.3.5. Other Distribution Channel

- 7.4. Market Analysis, Insights and Forecast - by Geography

- 7.4.1. Brazil

- 7.4.2. Argentina

- 7.4.3. Colombia

- 7.4.4. Rest of South America

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Colombia South America Nutricosmetics Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Skin Care

- 8.1.2. Hair Care

- 8.1.3. Nail Care

- 8.2. Market Analysis, Insights and Forecast - by Form

- 8.2.1. Tablets and Capsules

- 8.2.2. Powder and Liquid

- 8.2.3. Gummies and Soft Chews

- 8.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.3.1. Supermarkets/Hypermarkets

- 8.3.2. Drug Stores/Pharmacies

- 8.3.3. Specalist Stores

- 8.3.4. Online Retail Stores

- 8.3.5. Other Distribution Channel

- 8.4. Market Analysis, Insights and Forecast - by Geography

- 8.4.1. Brazil

- 8.4.2. Argentina

- 8.4.3. Colombia

- 8.4.4. Rest of South America

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. Rest of South America South America Nutricosmetics Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Skin Care

- 9.1.2. Hair Care

- 9.1.3. Nail Care

- 9.2. Market Analysis, Insights and Forecast - by Form

- 9.2.1. Tablets and Capsules

- 9.2.2. Powder and Liquid

- 9.2.3. Gummies and Soft Chews

- 9.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.3.1. Supermarkets/Hypermarkets

- 9.3.2. Drug Stores/Pharmacies

- 9.3.3. Specalist Stores

- 9.3.4. Online Retail Stores

- 9.3.5. Other Distribution Channel

- 9.4. Market Analysis, Insights and Forecast - by Geography

- 9.4.1. Brazil

- 9.4.2. Argentina

- 9.4.3. Colombia

- 9.4.4. Rest of South America

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 NATURA &CO

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Herbalife International of America Inc

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Amway Corp

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Dermage

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 TRUSS Cosmetics USA Inc*List Not Exhaustive

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Earth Extracts Cosmetics Industry

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Beiersdorf AG

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 NutraHair

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.1 NATURA &CO

List of Figures

- Figure 1: South America Nutricosmetics Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: South America Nutricosmetics Market Share (%) by Company 2025

List of Tables

- Table 1: South America Nutricosmetics Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 2: South America Nutricosmetics Market Revenue billion Forecast, by Form 2020 & 2033

- Table 3: South America Nutricosmetics Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 4: South America Nutricosmetics Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 5: South America Nutricosmetics Market Revenue billion Forecast, by Region 2020 & 2033

- Table 6: South America Nutricosmetics Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 7: South America Nutricosmetics Market Revenue billion Forecast, by Form 2020 & 2033

- Table 8: South America Nutricosmetics Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 9: South America Nutricosmetics Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 10: South America Nutricosmetics Market Revenue billion Forecast, by Country 2020 & 2033

- Table 11: South America Nutricosmetics Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 12: South America Nutricosmetics Market Revenue billion Forecast, by Form 2020 & 2033

- Table 13: South America Nutricosmetics Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 14: South America Nutricosmetics Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 15: South America Nutricosmetics Market Revenue billion Forecast, by Country 2020 & 2033

- Table 16: South America Nutricosmetics Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 17: South America Nutricosmetics Market Revenue billion Forecast, by Form 2020 & 2033

- Table 18: South America Nutricosmetics Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 19: South America Nutricosmetics Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 20: South America Nutricosmetics Market Revenue billion Forecast, by Country 2020 & 2033

- Table 21: South America Nutricosmetics Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 22: South America Nutricosmetics Market Revenue billion Forecast, by Form 2020 & 2033

- Table 23: South America Nutricosmetics Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 24: South America Nutricosmetics Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 25: South America Nutricosmetics Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the South America Nutricosmetics Market?

The projected CAGR is approximately 8.2%.

2. Which companies are prominent players in the South America Nutricosmetics Market?

Key companies in the market include NATURA &CO, Herbalife International of America Inc, Amway Corp, Dermage, TRUSS Cosmetics USA Inc*List Not Exhaustive, Earth Extracts Cosmetics Industry, Beiersdorf AG, NutraHair.

3. What are the main segments of the South America Nutricosmetics Market?

The market segments include Product Type, Form, Distribution Channel, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 7.5 billion as of 2022.

5. What are some drivers contributing to market growth?

Growing Emphasis on Gut Health; Innovation In Flavor and Supplement Delivery Format.

6. What are the notable trends driving market growth?

Indulgence Towards Natural. Fast and Effective Cosmetics Products.

7. Are there any restraints impacting market growth?

Escalating Functional Food Consumption and Other Substitutes; Side-effects Of Supplement Consumption.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "South America Nutricosmetics Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the South America Nutricosmetics Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the South America Nutricosmetics Market?

To stay informed about further developments, trends, and reports in the South America Nutricosmetics Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence