Key Insights

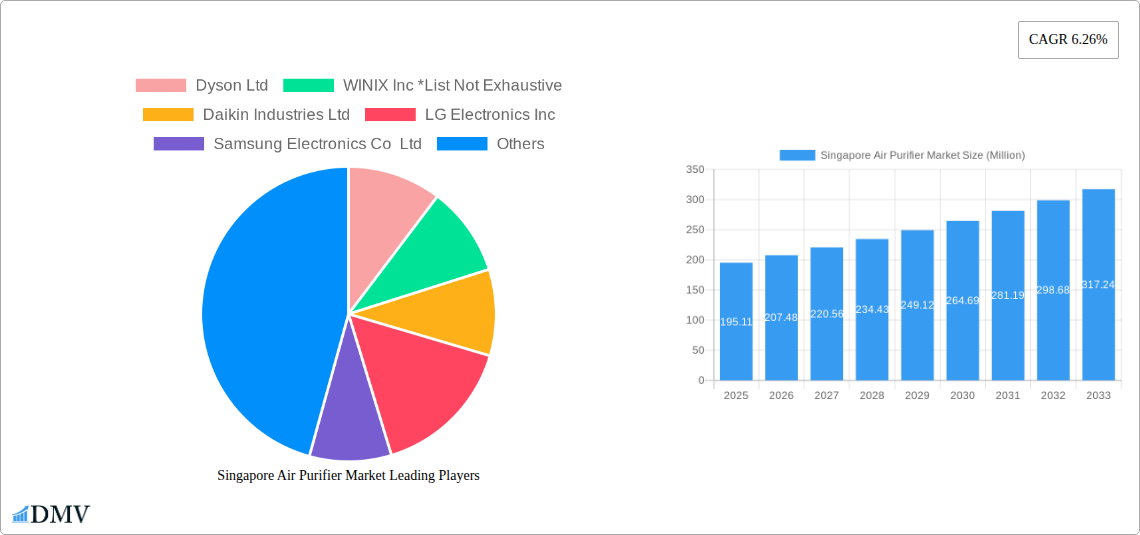

The Singapore air purifier market, valued at $195.11 million in 2025, is projected to experience robust growth, driven by increasing air pollution concerns and rising health consciousness among Singaporeans. The compound annual growth rate (CAGR) of 6.26% from 2025 to 2033 indicates a significant expansion of this market over the forecast period. Key drivers include government initiatives promoting cleaner air, a growing elderly population more susceptible to respiratory illnesses, and increased awareness of the health benefits of air purification. The market segmentation reveals a strong demand across residential, commercial, and industrial sectors, with HEPA filtration technology leading the preference due to its effectiveness in removing fine particulate matter. The stand-alone segment is likely dominant, reflecting consumer preference for portability and ease of use, although in-duct systems are gaining traction in commercial and industrial settings. Competition is fierce, with established international brands like Dyson, Daikin, and Samsung alongside local players vying for market share. The increasing adoption of smart home technology is also anticipated to influence market growth, with consumers seeking integrated and app-controlled air purification solutions.

Singapore Air Purifier Market Market Size (In Million)

The continued growth of the Singapore air purifier market is expected to be fueled by several factors. Firstly, rising disposable incomes and a focus on improved quality of life will boost consumer spending on premium air purifiers with advanced features. Secondly, the increasing prevalence of respiratory diseases will further encourage the adoption of these devices, creating a strong demand for both residential and commercial applications. Thirdly, stringent environmental regulations and government-led awareness campaigns will contribute to sustained market expansion. While the market faces some restraints, such as price sensitivity among certain consumer segments and the potential for market saturation in the long term, the overall outlook remains positive, reflecting a clear and growing demand for clean air in Singapore.

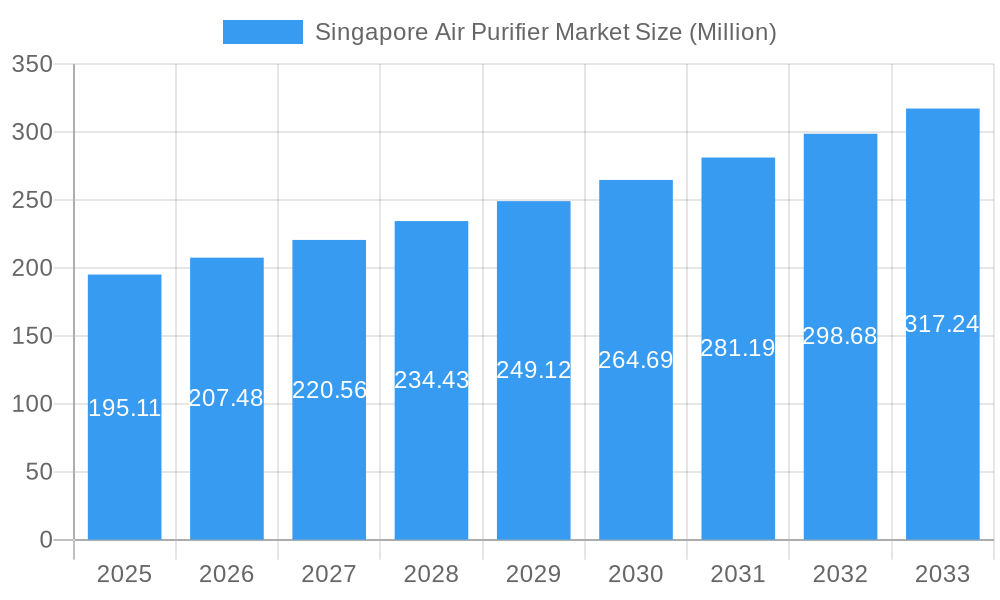

Singapore Air Purifier Market Company Market Share

Singapore Air Purifier Market: A Comprehensive Report (2019-2033)

This insightful report provides a detailed analysis of the Singapore air purifier market, offering valuable insights for stakeholders seeking to understand market dynamics, growth opportunities, and competitive landscapes. The study period covers 2019-2033, with a base year of 2025 and a forecast period of 2025-2033. The report is meticulously crafted to offer a clear and concise understanding of this crucial market segment, utilizing precise data and compelling analysis. The market is expected to reach xx Million by 2033.

Singapore Air Purifier Market Composition & Trends

This section delves into the competitive landscape of the Singapore air purifier market, analyzing market concentration, innovation drivers, regulatory frameworks, substitute products, end-user profiles, and mergers and acquisitions (M&A) activity. The market is characterized by a moderately concentrated structure, with key players such as Dyson Ltd, WINIX Inc, Daikin Industries Ltd, LG Electronics Inc, Samsung Electronics Co Ltd, Amway (Malaysia) Holdings Berhad, Koninklijke Philips NV, Sharp Corporation, Panasonic Corporation, and IQAir competing for market share. Market share distribution among these players is currently estimated at xx%, with Dyson and LG leading the pack in 2024.

- Market Concentration: Moderately concentrated, with top 5 players holding approximately xx% market share in 2024.

- Innovation Catalysts: Stringent air quality regulations and rising consumer awareness of air pollution are driving innovation in filtration technologies.

- Regulatory Landscape: Government initiatives promoting cleaner air and building standards contribute to market growth.

- Substitute Products: Limited direct substitutes exist, though natural ventilation strategies may be considered an indirect alternative.

- End-User Profiles: Residential users dominate, followed by commercial and industrial segments.

- M&A Activity: Moderate M&A activity observed between 2019-2024, with a total deal value estimated at xx Million.

Singapore Air Purifier Market Industry Evolution

The Singapore air purifier market has witnessed significant growth driven by factors such as increasing urbanization, rising disposable incomes, and heightened awareness of air pollution's health impacts. From 2019 to 2024, the market experienced a Compound Annual Growth Rate (CAGR) of xx%, reaching a market value of xx Million in 2024. Technological advancements, particularly in HEPA filtration and smart features, have fueled this growth, appealing to consumer preferences for efficient and convenient air purification solutions. The market is further segmented by filtration technology (HEPA, electrostatic precipitators, ionizers), product type (stand-alone, in-duct), and end-user (residential, commercial, industrial). The residential segment is the largest contributor to market revenue. We project a CAGR of xx% during the forecast period (2025-2033), reaching an estimated xx Million by 2033.

Leading Regions, Countries, or Segments in Singapore Air Purifier Market

The residential segment is currently the dominant end-user segment, driven by increasing concerns about indoor air quality and rising disposable incomes. The High-efficiency Particulate Air (HEPA) filtration technology holds the largest market share, due to its effectiveness in removing particulate matter. Stand-alone air purifiers are the preferred product type due to their flexibility and ease of use.

- Key Drivers for Residential Segment Dominance:

- Rising awareness of indoor air pollution and its health effects.

- Increasing disposable incomes among households.

- Government initiatives promoting better indoor air quality.

- Key Drivers for HEPA Filtration Technology Dominance:

- Proven effectiveness in removing fine particulate matter.

- Widely accepted and trusted technology.

- Relatively affordable compared to other technologies.

- Key Drivers for Stand-alone Air Purifier Dominance:

- Ease of installation and portability.

- Versatility in placement and usage.

- Competitive pricing compared to in-duct systems.

The dominance of these segments is expected to continue during the forecast period, although growth in commercial and industrial segments will gain momentum due to increasing awareness and stricter regulations.

Singapore Air Purifier Market Product Innovations

Recent innovations in the Singapore air purifier market focus on enhancing filtration efficiency, integrating smart features, and improving aesthetics. Manufacturers are incorporating advanced sensors for real-time air quality monitoring, intelligent control systems for automated operation, and sleek designs to seamlessly integrate with modern homes and offices. Key features include multi-stage filtration systems, improved allergen removal capabilities, quiet operation, and smart home integration. Companies like LG are introducing products like the LG PuriCare AeroFurniture, showcasing the trend of blending functionality with design.

Propelling Factors for Singapore Air Purifier Market Growth

Several factors are driving the growth of the Singapore air purifier market. Firstly, escalating air pollution levels, both indoor and outdoor, are increasing consumer demand for effective air purification solutions. Secondly, rising disposable incomes enable consumers to invest in premium air purifiers with advanced features. Finally, stringent government regulations regarding air quality standards are further stimulating market expansion.

Obstacles in the Singapore Air Purifier Market

The Singapore air purifier market faces challenges like the high initial cost of advanced air purifiers, which might hinder wider adoption among budget-conscious consumers. Supply chain disruptions due to global events can also impact the availability and pricing of air purifiers. Furthermore, intense competition among established and emerging players creates pressure on profit margins.

Future Opportunities in Singapore Air Purifier Market

Future opportunities lie in developing innovative air purification technologies that address specific pollutants, improving energy efficiency, and creating smart, connected devices that integrate seamlessly with smart home ecosystems. There's also potential for expansion in the commercial and industrial sectors, where demand for large-scale air purification systems is expected to grow.

Major Players in the Singapore Air Purifier Market Ecosystem

- Dyson Ltd

- WINIX Inc

- Daikin Industries Ltd

- LG Electronics Inc

- Samsung Electronics Co Ltd

- Amway (Malaysia) Holdings Berhad

- Koninklijke Philips NV

- Sharp Corporation

- Panasonic Corporation

- IQAir

Key Developments in Singapore Air Purifier Market Industry

- May 2023: LG Electronics Singapore launched the LG PuriCare AeroFurniture, a stylish air purifier designed to blend into modern homes.

- May 2023: Dyson Limited revamped its air purifiers and vacuum systems, incorporating advanced HEPA H13 filtration and intelligent sensing technology.

Strategic Singapore Air Purifier Market Forecast

The Singapore air purifier market is poised for continued growth, driven by sustained consumer demand, technological advancements, and supportive government regulations. The focus on smart features, energy efficiency, and innovative filtration technologies will shape future market dynamics. New product introductions and market expansion into commercial and industrial sectors will further contribute to the market's expansion over the forecast period.

Singapore Air Purifier Market Segmentation

-

1. Filtration Technology

- 1.1. High-efficiency Particulate Air (HEPA)

- 1.2. Other Fi

-

2. Type

- 2.1. Stand-alone

- 2.2. In-duct

-

3. End User

- 3.1. Residential

- 3.2. Commercial

- 3.3. Industrial

Singapore Air Purifier Market Segmentation By Geography

- 1. Singapore

Singapore Air Purifier Market Regional Market Share

Geographic Coverage of Singapore Air Purifier Market

Singapore Air Purifier Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.26% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increasing Airborne Diseases and Growing Health Consciousness4.; Increasing awareness among consumers about the importance of indoor air quality

- 3.3. Market Restrains

- 3.3.1. 4.; High Installation and Maintenance Costs

- 3.4. Market Trends

- 3.4.1. Increasing Airborne Diseases and Growing Health Consciousness Among Consumers are Expected to Drive the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Singapore Air Purifier Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Filtration Technology

- 5.1.1. High-efficiency Particulate Air (HEPA)

- 5.1.2. Other Fi

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Stand-alone

- 5.2.2. In-duct

- 5.3. Market Analysis, Insights and Forecast - by End User

- 5.3.1. Residential

- 5.3.2. Commercial

- 5.3.3. Industrial

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Singapore

- 5.1. Market Analysis, Insights and Forecast - by Filtration Technology

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Dyson Ltd

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 WINIX Inc *List Not Exhaustive

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Daikin Industries Ltd

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 LG Electronics Inc

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Samsung Electronics Co Ltd

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Amway (Malaysia) Holdings Berhad

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Koninklijke Philips NV

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Sharp Corporation

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Panasonic Corporation

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 IQAir

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Dyson Ltd

List of Figures

- Figure 1: Singapore Air Purifier Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Singapore Air Purifier Market Share (%) by Company 2025

List of Tables

- Table 1: Singapore Air Purifier Market Revenue Million Forecast, by Filtration Technology 2020 & 2033

- Table 2: Singapore Air Purifier Market Volume K Unit Forecast, by Filtration Technology 2020 & 2033

- Table 3: Singapore Air Purifier Market Revenue Million Forecast, by Type 2020 & 2033

- Table 4: Singapore Air Purifier Market Volume K Unit Forecast, by Type 2020 & 2033

- Table 5: Singapore Air Purifier Market Revenue Million Forecast, by End User 2020 & 2033

- Table 6: Singapore Air Purifier Market Volume K Unit Forecast, by End User 2020 & 2033

- Table 7: Singapore Air Purifier Market Revenue Million Forecast, by Region 2020 & 2033

- Table 8: Singapore Air Purifier Market Volume K Unit Forecast, by Region 2020 & 2033

- Table 9: Singapore Air Purifier Market Revenue Million Forecast, by Filtration Technology 2020 & 2033

- Table 10: Singapore Air Purifier Market Volume K Unit Forecast, by Filtration Technology 2020 & 2033

- Table 11: Singapore Air Purifier Market Revenue Million Forecast, by Type 2020 & 2033

- Table 12: Singapore Air Purifier Market Volume K Unit Forecast, by Type 2020 & 2033

- Table 13: Singapore Air Purifier Market Revenue Million Forecast, by End User 2020 & 2033

- Table 14: Singapore Air Purifier Market Volume K Unit Forecast, by End User 2020 & 2033

- Table 15: Singapore Air Purifier Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Singapore Air Purifier Market Volume K Unit Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Singapore Air Purifier Market?

The projected CAGR is approximately 6.26%.

2. Which companies are prominent players in the Singapore Air Purifier Market?

Key companies in the market include Dyson Ltd, WINIX Inc *List Not Exhaustive, Daikin Industries Ltd, LG Electronics Inc, Samsung Electronics Co Ltd, Amway (Malaysia) Holdings Berhad, Koninklijke Philips NV, Sharp Corporation, Panasonic Corporation, IQAir.

3. What are the main segments of the Singapore Air Purifier Market?

The market segments include Filtration Technology, Type, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 195.11 Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing Airborne Diseases and Growing Health Consciousness4.; Increasing awareness among consumers about the importance of indoor air quality.

6. What are the notable trends driving market growth?

Increasing Airborne Diseases and Growing Health Consciousness Among Consumers are Expected to Drive the Market.

7. Are there any restraints impacting market growth?

4.; High Installation and Maintenance Costs.

8. Can you provide examples of recent developments in the market?

May 2023: LG Electronics Singapore announced the launch of the LG PuriCare AeroFurniture. The LG PuriCare AeroFurniture sets to revolutionize how people view home appliances, especially air purifiers, and provide a sophisticated and effective solution for modern living. Featuring a chic design, it combines both style and functionality to bring fresh, clean air to users with its advanced air purification technology.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Singapore Air Purifier Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Singapore Air Purifier Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Singapore Air Purifier Market?

To stay informed about further developments, trends, and reports in the Singapore Air Purifier Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence