Key Insights

The North American Sports Team and Clubs Market is poised for substantial expansion, projected to reach $48.9 billion by 2025. Anticipated to grow at a Compound Annual Growth Rate (CAGR) of 8.6%, this dynamic sector is driven by escalating fan engagement, increased disposable income, and strategic infrastructure investments. Growing popularity of professional and collegiate sports, amplified by extensive media coverage and endorsements, attracts a dedicated fanbase. Rising consumer spending on live entertainment and experiences fuels demand for tickets, merchandise, and broadcast rights. Modern stadium development enhances spectator experiences and sponsor appeal, while innovative digital marketing strategies engage younger demographics.

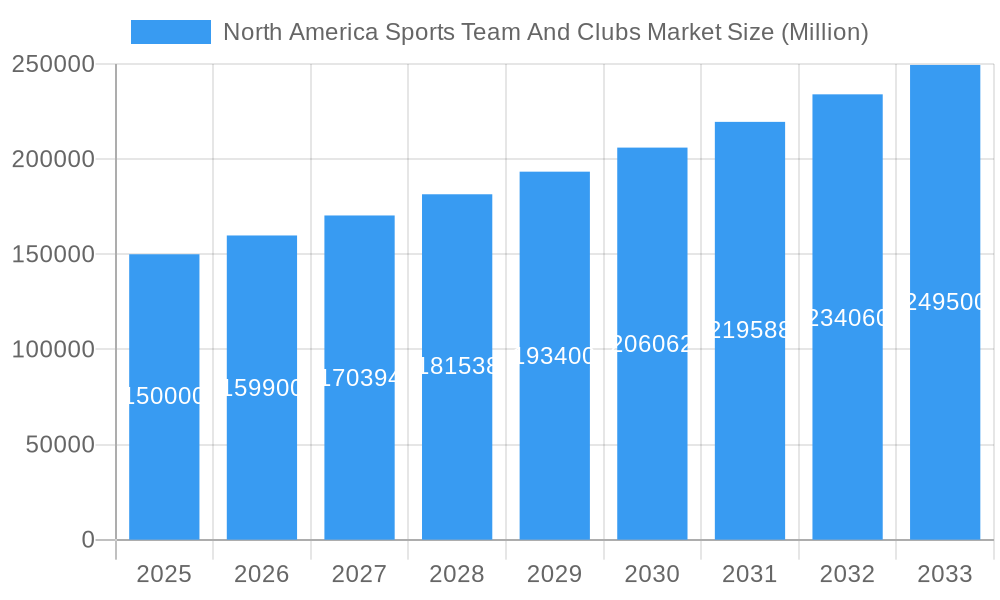

North America Sports Team And Clubs Market Market Size (In Billion)

Despite robust growth, the market faces potential headwinds. Economic downturns may impact consumer spending, affecting revenue streams. Intense competition, rising player salaries, and operational costs can challenge profitability. Evolving media consumption and alternative entertainment options also present competitive pressures. Major league sports dominate market share, followed by collegiate and niche leagues. While specific segment data is limited, the overarching dynamism and broad appeal of sports indicate significant future growth potential.

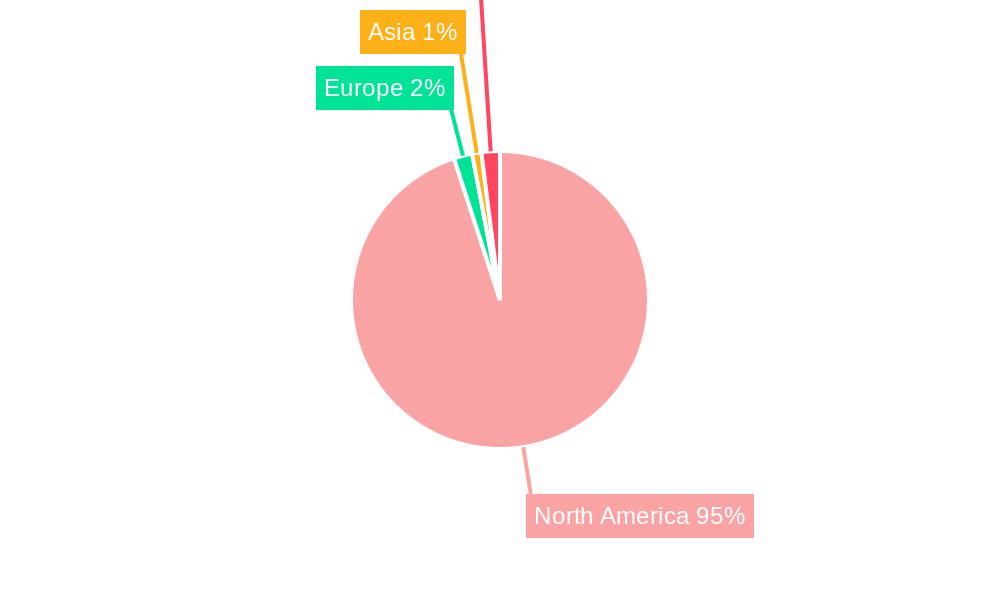

North America Sports Team And Clubs Market Company Market Share

North America Sports Team & Clubs Market: A Comprehensive Report (2019-2033)

This insightful report provides a detailed analysis of the North America Sports Team & Clubs Market, encompassing the historical period (2019-2024), base year (2025), and a comprehensive forecast (2025-2033). Valued at xx Million in 2025, the market is poised for significant growth, driven by technological advancements, evolving consumer preferences, and strategic partnerships. This report unravels the market's dynamics, identifying key players, lucrative segments, and potential obstacles for stakeholders seeking to navigate this dynamic landscape.

North America Sports Team And Clubs Market Market Composition & Trends

This section delves into the intricate structure of the North America Sports Team & Clubs Market, evaluating its concentration, innovative drivers, regulatory environment, substitute products, end-user profiles, and mergers & acquisitions (M&A) activities. The market exhibits a moderately concentrated structure, with a few dominant players commanding significant market share. However, the emergence of new teams and clubs, coupled with technological advancements, is fostering increased competition.

Market Concentration & M&A Activities:

- Market share distribution: Major leagues (NFL, MLB, NBA, NHL) hold the largest share, followed by smaller leagues and individual clubs. The exact distribution is complex and varies by league and sport, with an estimated xx% held by the top 5 leagues.

- M&A Deal Values: The value of M&A deals in the North American sports market has fluctuated between xx Million and xx Million annually in recent years, reflecting shifts in team valuations and investor interest. These transactions often involve strategic acquisitions aimed at expanding market reach or consolidating market power.

- Innovation Catalysts: Technological advancements such as fan engagement apps, data analytics for performance improvement, and virtual/augmented reality experiences are reshaping the industry.

- Regulatory Landscape: Federal and state regulations influence player contracts, broadcasting rights, and anti-trust issues, significantly shaping market operations.

- Substitute Products: The entertainment sector offers various substitutes, including video games, e-sports, and other live entertainment options. The intensity of substitution varies across different sports and demographics.

- End-User Profiles: The market caters to a diverse range of end-users, including fans (both live attendees and television viewers), sponsors, media companies, and government entities.

North America Sports Team And Clubs Market Industry Evolution

This section analyzes the evolutionary trajectory of the North American Sports Team & Clubs Market, focusing on market growth patterns, technological progress, and evolving consumer preferences. From 2019 to 2024, the market witnessed a Compound Annual Growth Rate (CAGR) of xx%, driven primarily by increasing media rights revenue, sponsorship deals, and a rising demand for live sporting events. The integration of technology is accelerating fan engagement, leading to increased viewership and revenue generation. The shift towards personalized fan experiences, data-driven decision-making, and digital platforms is further propelling market growth. The market is expected to maintain a strong CAGR of xx% from 2025-2033. Technological integration (e.g., advanced analytics, immersive fan experiences) is anticipated to remain a key growth driver.

Leading Regions, Countries, or Segments in North America Sports Team And Clubs Market

The United States dominates the North American Sports Team & Clubs Market, accounting for approximately xx% of the total market value in 2025. Canada represents a substantial portion of the remaining market share.

Key Drivers for U.S. Dominance:

- Larger population base and higher disposable income compared to Canada.

- Presence of major professional leagues with globally recognized teams.

- Strong media landscape and extensive broadcast rights deals.

- Significant investments in sports infrastructure and development.

Canada's Market Position:

- Growing participation in various sports, both professional and amateur.

- Increasing government support and investment in sports facilities.

- Strong international presence in certain sports like ice hockey.

North America Sports Team And Clubs Market Product Innovations

The market showcases continuous innovation, with improvements in athlete performance tracking technologies, enhanced fan engagement applications, and immersive experiences using AR/VR, improving the fan experience and enhancing data-driven decision-making for teams.

Propelling Factors for North America Sports Team And Clubs Market Growth

Several factors contribute to the market's expansion. The increasing popularity of sports, particularly among younger demographics, fuels demand. Rising disposable income and greater spending on entertainment, coupled with lucrative media rights and sponsorship deals, are significant growth enablers. Technological advancements, improving the fan experience and providing new revenue streams, also significantly contribute to growth.

Obstacles in the North America Sports Team And Clubs Market Market

The market faces challenges, including economic downturns that could reduce consumer spending on entertainment. The intense competition among leagues and teams, for both fans and sponsors, creates considerable pressure. Lastly, regulatory changes and potential broadcasting rights disputes can significantly impact profitability.

Future Opportunities in North America Sports Team And Clubs Market

Emerging opportunities exist in leveraging esports, expanding into new markets (e.g., through international partnerships), and capitalizing on the increasing demand for personalized fan experiences. Growth also lies in developing more sophisticated data analytics tools and enhancing the integration of technologies such as AR/VR.

Major Players in the North America Sports Team And Clubs Market Ecosystem

- Austin FC

- Westwood Motorcycle Racing Club

- Great Lake Canadians

- Club America (Global Link used as multiple websites are available)

- Tennis Club Of Canada

- ESPN

- Fox Sports

- Coca Cola

- Dallas Cowboys

- Toronto FC

- List Not Exhaustive

Key Developments in North America Sports Team And Clubs Market Industry

- July 2023: U.S. Soccer and Coca-Cola North America formed a long-term partnership, boosting U.S. soccer and expanding Coca-Cola's fan reach.

- June 2023: The PGA Tour and LIV Golf merged, creating a new entity and significantly altering golf governance.

Strategic North America Sports Team And Clubs Market Market Forecast

The North American Sports Team & Clubs Market exhibits strong growth potential. Continued technological advancements, expanding media rights deals, and a growing fan base will drive market expansion. The integration of data-driven strategies and innovative fan engagement will further enhance market dynamics, creating lucrative opportunities for existing and new market players.

North America Sports Team And Clubs Market Segmentation

-

1. Type

- 1.1. Football

- 1.2. Basketball

- 1.3. Baseball

- 1.4. Hockey

- 1.5. Other Types

-

2. Revenue Source

- 2.1. Media Rights

- 2.2. Merchandising

- 2.3. Tickets

- 2.4. Sponsorship

North America Sports Team And Clubs Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

North America Sports Team And Clubs Market Regional Market Share

Geographic Coverage of North America Sports Team And Clubs Market

North America Sports Team And Clubs Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.6% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. OTT and online streaming platforms driving the market; Rising Leisure time driving the sports entertainment market

- 3.3. Market Restrains

- 3.3.1. OTT and online streaming platforms driving the market; Rising Leisure time driving the sports entertainment market

- 3.4. Market Trends

- 3.4.1. Rising Digital Platforms Driving The Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Sports Team And Clubs Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Football

- 5.1.2. Basketball

- 5.1.3. Baseball

- 5.1.4. Hockey

- 5.1.5. Other Types

- 5.2. Market Analysis, Insights and Forecast - by Revenue Source

- 5.2.1. Media Rights

- 5.2.2. Merchandising

- 5.2.3. Tickets

- 5.2.4. Sponsorship

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Austin FC

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Westwood Motorcycle Racing Club

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Great Lake Canadians

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Club America

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Tennis Club Of Canada

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 ESPN

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Fox Sports

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Coca Cola

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Dallas Cowboys

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Toronto FC**List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Austin FC

List of Figures

- Figure 1: North America Sports Team And Clubs Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: North America Sports Team And Clubs Market Share (%) by Company 2025

List of Tables

- Table 1: North America Sports Team And Clubs Market Revenue billion Forecast, by Type 2020 & 2033

- Table 2: North America Sports Team And Clubs Market Revenue billion Forecast, by Revenue Source 2020 & 2033

- Table 3: North America Sports Team And Clubs Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: North America Sports Team And Clubs Market Revenue billion Forecast, by Type 2020 & 2033

- Table 5: North America Sports Team And Clubs Market Revenue billion Forecast, by Revenue Source 2020 & 2033

- Table 6: North America Sports Team And Clubs Market Revenue billion Forecast, by Country 2020 & 2033

- Table 7: United States North America Sports Team And Clubs Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: Canada North America Sports Team And Clubs Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 9: Mexico North America Sports Team And Clubs Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Sports Team And Clubs Market?

The projected CAGR is approximately 8.6%.

2. Which companies are prominent players in the North America Sports Team And Clubs Market?

Key companies in the market include Austin FC, Westwood Motorcycle Racing Club, Great Lake Canadians, Club America, Tennis Club Of Canada, ESPN, Fox Sports, Coca Cola, Dallas Cowboys, Toronto FC**List Not Exhaustive.

3. What are the main segments of the North America Sports Team And Clubs Market?

The market segments include Type, Revenue Source.

4. Can you provide details about the market size?

The market size is estimated to be USD 48.9 billion as of 2022.

5. What are some drivers contributing to market growth?

OTT and online streaming platforms driving the market; Rising Leisure time driving the sports entertainment market.

6. What are the notable trends driving market growth?

Rising Digital Platforms Driving The Market.

7. Are there any restraints impacting market growth?

OTT and online streaming platforms driving the market; Rising Leisure time driving the sports entertainment market.

8. Can you provide examples of recent developments in the market?

July 2023: U.S. Soccer and Coca-Cola North America entered into a long-term partnership, supporting the growth of the U.S. soccer ecosystem and leveraging Coca-Cola's iconic global reach to connect with fans around the world. The Coca-Cola Company exists as a beverage company with products sold in more than 200 countries and territories, and the U.S. Soccer Federation has been the official governing body of the sport in the United States for more than 100 years.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Sports Team And Clubs Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Sports Team And Clubs Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Sports Team And Clubs Market?

To stay informed about further developments, trends, and reports in the North America Sports Team And Clubs Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence