Key Insights

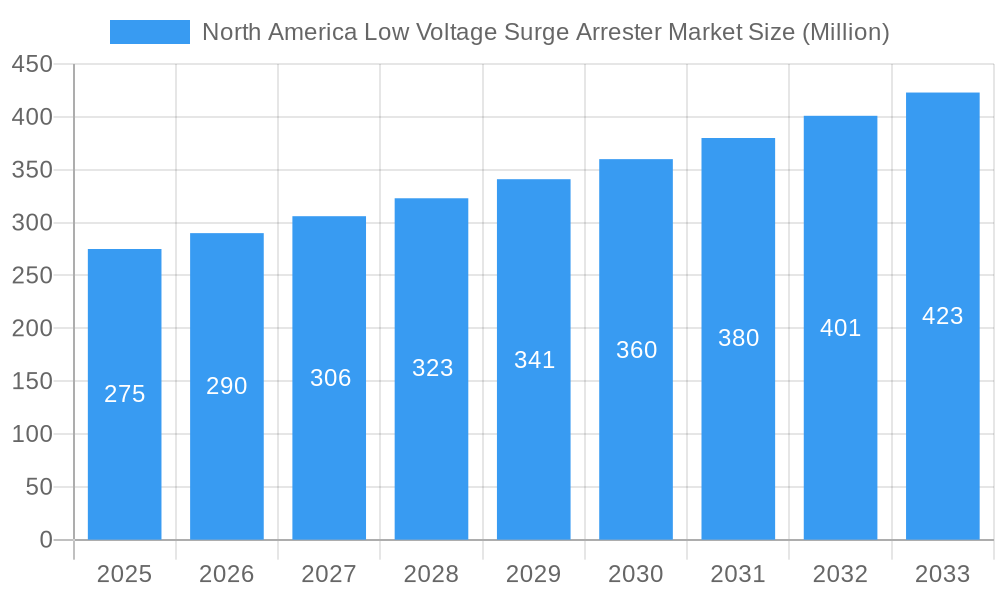

The North American low-voltage surge arrester market is experiencing robust growth, driven by increasing demand for reliable power protection across residential, commercial, and industrial sectors. The market's expansion is fueled by several factors, including the rising adoption of smart grids and renewable energy sources, which necessitate enhanced surge protection to mitigate the risks of voltage fluctuations and transients. Furthermore, stringent regulatory standards regarding electrical safety and the growing awareness of the potential damage caused by surges are bolstering market demand. The low-voltage segment, specifically, benefits from its widespread applicability in various settings, ranging from individual homes safeguarding sensitive electronics to large-scale industrial facilities protecting critical infrastructure. While precise market size figures for 2025 aren't explicitly provided, considering a global CAGR of >5.30% and a significant North American market share within the broader surge arrester landscape, a reasonable estimation places the 2025 North American low-voltage surge arrester market size in the range of $250-300 million USD. This projection anticipates continued growth throughout the forecast period (2025-2033), driven by ongoing technological advancements leading to more compact, efficient, and cost-effective surge arresters, coupled with increasing infrastructure investments. Competition among major players like ABB, Siemens, and Eaton fosters innovation and product diversification, ensuring a dynamic and expanding market.

North America Low Voltage Surge Arrester Market Market Size (In Million)

The residential segment is expected to witness substantial growth due to the increasing penetration of smart home devices and electronic appliances. The industrial segment will also experience significant growth due to the need for protection of critical equipment and processes from surge damage. However, factors such as the initial investment cost of surge protection systems and the cyclical nature of some end-use industries may pose challenges to growth. Despite these constraints, the long-term outlook for the North American low-voltage surge arrester market remains positive, supported by continuous technological advancements, increasing awareness of the importance of surge protection, and the rising demand for reliable power across diverse sectors.

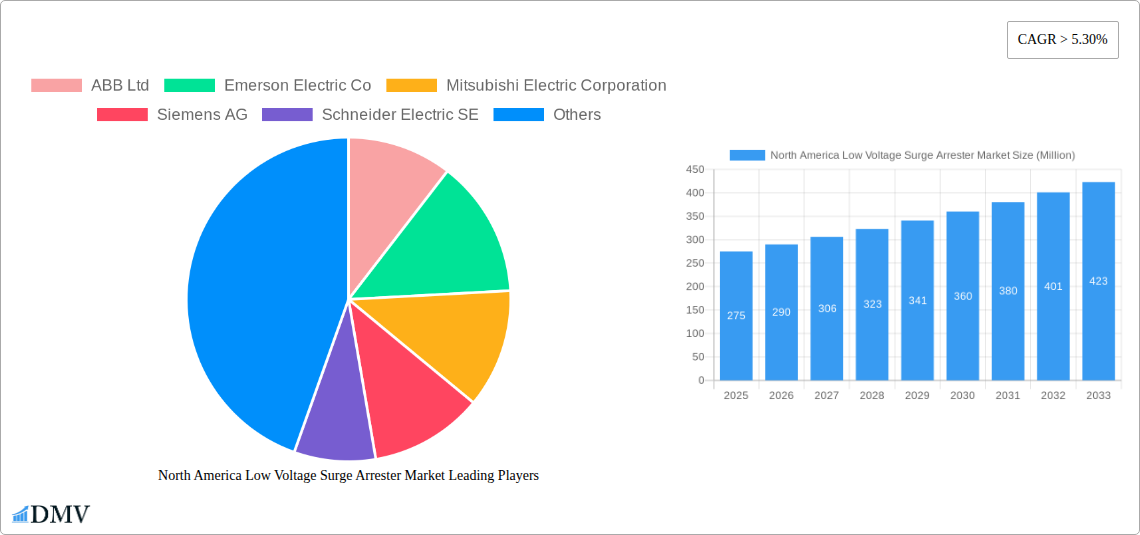

North America Low Voltage Surge Arrester Market Company Market Share

North America Low Voltage Surge Arrester Market: A Comprehensive Report (2019-2033)

This insightful report provides a detailed analysis of the North America Low Voltage Surge Arrester market, offering a comprehensive overview of its current state, future trends, and key players. Covering the period from 2019 to 2033, with 2025 as the base year and a forecast period from 2025 to 2033, this report is an invaluable resource for stakeholders seeking to understand and capitalize on the opportunities within this dynamic market. The market size is predicted to reach xx Million by 2033.

North America Low Voltage Surge Arrester Market Market Composition & Trends

This section delves into the competitive landscape of the North America Low Voltage Surge Arrester market, analyzing market concentration, innovation drivers, regulatory frameworks, substitute products, end-user profiles, and merger & acquisition (M&A) activities. We examine the market share distribution among key players, revealing the dominance of established companies like ABB Ltd, Emerson Electric Co, and Siemens AG. The report quantifies M&A activity with estimates of deal values and explores the impact of these transactions on market dynamics. Further, we analyze the influence of regulatory changes, such as updated safety standards, and the presence of substitute technologies on market growth. End-user profiles are detailed, highlighting the varying needs and purchasing behaviors across residential, commercial, and industrial sectors. The innovative landscape is assessed, focusing on the introduction of new materials and designs that improve performance and efficiency.

- Market Share Distribution: ABB Ltd holds an estimated xx% market share in 2025, followed by Emerson Electric Co. with xx% and Siemens AG with xx%.

- M&A Activity: A total estimated value of xx Million in M&A deals were recorded between 2019 and 2024.

- Regulatory Landscape: Analysis of key regulations impacting product safety and compliance in North America.

- Substitute Products: Evaluation of competing technologies and their market penetration.

North America Low Voltage Surge Arrester Market Industry Evolution

This section provides a detailed analysis of the North America Low Voltage Surge Arrester market's historical and projected growth trajectory. We examine technological advancements, such as the increasing adoption of polymer-based surge arresters, and their impact on market dynamics. The report explores shifting consumer demands, including a growing emphasis on energy efficiency and improved safety standards. Specific data points, including compound annual growth rates (CAGR) and adoption rates of new technologies, are presented to illustrate the market's evolution. We will also discuss the influence of macroeconomic factors and industry trends on the market's growth path. The market experienced a CAGR of xx% during the historical period (2019-2024), and it is projected to grow at a CAGR of xx% during the forecast period (2025-2033). The adoption rate of advanced surge arrester technologies is estimated to increase by xx% by 2033.

Leading Regions, Countries, or Segments in North America Low Voltage Surge Arrester Market

This section identifies the leading regions, countries, and market segments within the North America Low Voltage Surge Arrester market. We analyze the factors contributing to the dominance of specific segments, such as the high demand for low-voltage surge arresters in the residential sector, or the significant growth in the industrial sector driven by investment in renewable energy infrastructure. The report provides in-depth analysis, considering key drivers like investment trends, regulatory support, and technological advancements.

- Dominant Segment: The Low Voltage segment is the largest and fastest-growing segment, fueled by increasing residential and commercial construction.

- Key Drivers for the Low Voltage Segment:

- Increased demand for energy-efficient appliances and electronics.

- Stringent building codes and safety regulations mandating surge protection.

- Growth in renewable energy integration.

- Key Drivers for the Industrial Segment: Investment in robust power protection for critical infrastructure and manufacturing facilities.

North America Low Voltage Surge Arrester Market Product Innovations

This section highlights recent product innovations, encompassing new materials, designs, and features that enhance performance, reliability, and efficiency. The focus is on the unique selling propositions of these new products, including improved surge absorption capabilities, reduced size and weight, and enhanced environmental friendliness. Examples of technological advancements, such as the integration of smart sensors and remote monitoring capabilities, are discussed. The adoption of new materials like polymer composites in surge arrester manufacturing has significantly improved efficiency and durability.

Propelling Factors for North America Low Voltage Surge Arrester Market Growth

Several factors contribute to the growth of the North America Low Voltage Surge Arrester market. Stringent safety regulations mandating surge protection in buildings and infrastructure projects are a primary driver. The increasing adoption of renewable energy sources, such as solar and wind power, creates a significant demand for surge protection devices. Technological advancements, like the development of more efficient and reliable surge arresters, also contribute to market expansion. The rising demand for smart grid technologies further enhances the demand for surge protection.

Obstacles in the North America Low Voltage Surge Arrester Market Market

The North America Low Voltage Surge Arrester market faces challenges including supply chain disruptions impacting the availability of raw materials. Competition from lower-cost manufacturers, especially from Asia, puts pressure on pricing. The complexity of regulatory compliance across different jurisdictions in North America can also hinder market growth. These challenges are quantified using data on import/export volumes and price fluctuations.

Future Opportunities in North America Low Voltage Surge Arrester Market

Future opportunities lie in expanding into new market segments, such as electric vehicle charging infrastructure and data centers. The integration of advanced technologies, like IoT sensors for remote monitoring and predictive maintenance, presents significant growth potential. The increasing adoption of smart home technologies creates new demand for integrated surge protection solutions. The development of more sustainable and environmentally friendly surge arresters will further drive market expansion.

Major Players in the North America Low Voltage Surge Arrester Market Ecosystem

Key Developments in North America Low Voltage Surge Arrester Market Industry

- September 2021: Toshiba Energy Systems & Solutions Corporation announced plans to triple its production capacity of polymer house surge arresters by April 2022, indicating a significant investment in this technology.

- May 2021: DEHN launched DIN-rail mounted surge protection devices certified with UL 1449 4th Edition, expanding product options for US and Canadian markets.

Strategic North America Low Voltage Surge Arrester Market Market Forecast

The North America Low Voltage Surge Arrester market is poised for continued growth driven by increasing demand for reliable power protection across various sectors. Emerging trends such as the adoption of smart grid technologies and the expansion of renewable energy infrastructure will fuel market expansion. Continued innovation in surge arrester technology and the growing awareness of the importance of power protection will further drive market growth in the forecast period.

North America Low Voltage Surge Arrester Market Segmentation

-

1. Voltage

- 1.1. Low Voltage

- 1.2. Medium Voltage

- 1.3. High Voltage

-

2. Application

- 2.1. Industrial

- 2.2. Commercial

- 2.3. Residential

-

3. Geography

- 3.1. United States

- 3.2. Canada

- 3.3. Rest of North America

North America Low Voltage Surge Arrester Market Segmentation By Geography

- 1. United States

- 2. Canada

- 3. Rest of North America

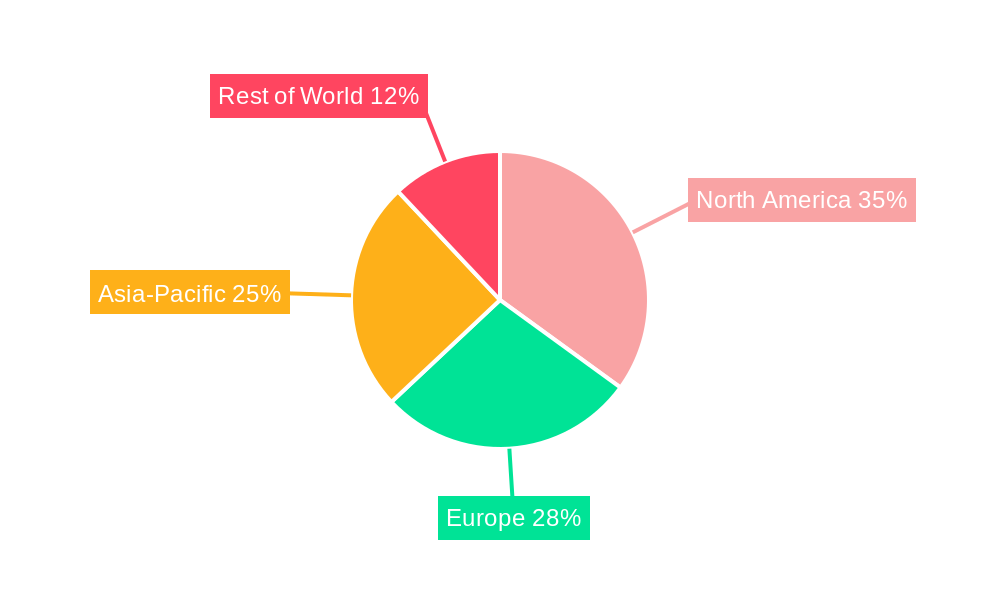

North America Low Voltage Surge Arrester Market Regional Market Share

Geographic Coverage of North America Low Voltage Surge Arrester Market

North America Low Voltage Surge Arrester Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 2.9% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Growing Power Demand from the Commercial and Industrial Sectors

- 3.3. Market Restrains

- 3.3.1. 4.; Stringent Environmental and Safety Regulations

- 3.4. Market Trends

- 3.4.1. Industrial Segment to Witness Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Low Voltage Surge Arrester Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Voltage

- 5.1.1. Low Voltage

- 5.1.2. Medium Voltage

- 5.1.3. High Voltage

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Industrial

- 5.2.2. Commercial

- 5.2.3. Residential

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. United States

- 5.3.2. Canada

- 5.3.3. Rest of North America

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. United States

- 5.4.2. Canada

- 5.4.3. Rest of North America

- 5.1. Market Analysis, Insights and Forecast - by Voltage

- 6. United States North America Low Voltage Surge Arrester Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Voltage

- 6.1.1. Low Voltage

- 6.1.2. Medium Voltage

- 6.1.3. High Voltage

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Industrial

- 6.2.2. Commercial

- 6.2.3. Residential

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. United States

- 6.3.2. Canada

- 6.3.3. Rest of North America

- 6.1. Market Analysis, Insights and Forecast - by Voltage

- 7. Canada North America Low Voltage Surge Arrester Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Voltage

- 7.1.1. Low Voltage

- 7.1.2. Medium Voltage

- 7.1.3. High Voltage

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Industrial

- 7.2.2. Commercial

- 7.2.3. Residential

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. United States

- 7.3.2. Canada

- 7.3.3. Rest of North America

- 7.1. Market Analysis, Insights and Forecast - by Voltage

- 8. Rest of North America North America Low Voltage Surge Arrester Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Voltage

- 8.1.1. Low Voltage

- 8.1.2. Medium Voltage

- 8.1.3. High Voltage

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Industrial

- 8.2.2. Commercial

- 8.2.3. Residential

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. United States

- 8.3.2. Canada

- 8.3.3. Rest of North America

- 8.1. Market Analysis, Insights and Forecast - by Voltage

- 9. Competitive Analysis

- 9.1. Market Share Analysis 2025

- 9.2. Company Profiles

- 9.2.1 ABB Ltd

- 9.2.1.1. Overview

- 9.2.1.2. Products

- 9.2.1.3. SWOT Analysis

- 9.2.1.4. Recent Developments

- 9.2.1.5. Financials (Based on Availability)

- 9.2.2 Emerson Electric Co

- 9.2.2.1. Overview

- 9.2.2.2. Products

- 9.2.2.3. SWOT Analysis

- 9.2.2.4. Recent Developments

- 9.2.2.5. Financials (Based on Availability)

- 9.2.3 Mitsubishi Electric Corporation

- 9.2.3.1. Overview

- 9.2.3.2. Products

- 9.2.3.3. SWOT Analysis

- 9.2.3.4. Recent Developments

- 9.2.3.5. Financials (Based on Availability)

- 9.2.4 Siemens AG

- 9.2.4.1. Overview

- 9.2.4.2. Products

- 9.2.4.3. SWOT Analysis

- 9.2.4.4. Recent Developments

- 9.2.4.5. Financials (Based on Availability)

- 9.2.5 Schneider Electric SE

- 9.2.5.1. Overview

- 9.2.5.2. Products

- 9.2.5.3. SWOT Analysis

- 9.2.5.4. Recent Developments

- 9.2.5.5. Financials (Based on Availability)

- 9.2.6 Eaton Corporation PLC

- 9.2.6.1. Overview

- 9.2.6.2. Products

- 9.2.6.3. SWOT Analysis

- 9.2.6.4. Recent Developments

- 9.2.6.5. Financials (Based on Availability)

- 9.2.7 Raycap Inc

- 9.2.7.1. Overview

- 9.2.7.2. Products

- 9.2.7.3. SWOT Analysis

- 9.2.7.4. Recent Developments

- 9.2.7.5. Financials (Based on Availability)

- 9.2.8 General Electric Company

- 9.2.8.1. Overview

- 9.2.8.2. Products

- 9.2.8.3. SWOT Analysis

- 9.2.8.4. Recent Developments

- 9.2.8.5. Financials (Based on Availability)

- 9.2.9 Hitachi Ltd*List Not Exhaustive 6 4 MARKET OPPORUNITIES AND FUTURE TREND

- 9.2.9.1. Overview

- 9.2.9.2. Products

- 9.2.9.3. SWOT Analysis

- 9.2.9.4. Recent Developments

- 9.2.9.5. Financials (Based on Availability)

- 9.2.1 ABB Ltd

List of Figures

- Figure 1: North America Low Voltage Surge Arrester Market Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: North America Low Voltage Surge Arrester Market Share (%) by Company 2025

List of Tables

- Table 1: North America Low Voltage Surge Arrester Market Revenue undefined Forecast, by Voltage 2020 & 2033

- Table 2: North America Low Voltage Surge Arrester Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 3: North America Low Voltage Surge Arrester Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 4: North America Low Voltage Surge Arrester Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 5: North America Low Voltage Surge Arrester Market Revenue undefined Forecast, by Voltage 2020 & 2033

- Table 6: North America Low Voltage Surge Arrester Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 7: North America Low Voltage Surge Arrester Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 8: North America Low Voltage Surge Arrester Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 9: North America Low Voltage Surge Arrester Market Revenue undefined Forecast, by Voltage 2020 & 2033

- Table 10: North America Low Voltage Surge Arrester Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 11: North America Low Voltage Surge Arrester Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 12: North America Low Voltage Surge Arrester Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 13: North America Low Voltage Surge Arrester Market Revenue undefined Forecast, by Voltage 2020 & 2033

- Table 14: North America Low Voltage Surge Arrester Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 15: North America Low Voltage Surge Arrester Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 16: North America Low Voltage Surge Arrester Market Revenue undefined Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Low Voltage Surge Arrester Market?

The projected CAGR is approximately 2.9%.

2. Which companies are prominent players in the North America Low Voltage Surge Arrester Market?

Key companies in the market include ABB Ltd, Emerson Electric Co, Mitsubishi Electric Corporation, Siemens AG, Schneider Electric SE, Eaton Corporation PLC, Raycap Inc, General Electric Company, Hitachi Ltd*List Not Exhaustive 6 4 MARKET OPPORUNITIES AND FUTURE TREND.

3. What are the main segments of the North America Low Voltage Surge Arrester Market?

The market segments include Voltage, Application, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

4.; Growing Power Demand from the Commercial and Industrial Sectors.

6. What are the notable trends driving market growth?

Industrial Segment to Witness Significant Growth.

7. Are there any restraints impacting market growth?

4.; Stringent Environmental and Safety Regulations.

8. Can you provide examples of recent developments in the market?

In September 2021, Toshiba Energy Systems & Solutions Corporation announced to triple its production capacity of polymer house surge arresters by April 2022.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Low Voltage Surge Arrester Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Low Voltage Surge Arrester Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Low Voltage Surge Arrester Market?

To stay informed about further developments, trends, and reports in the North America Low Voltage Surge Arrester Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence