Key Insights

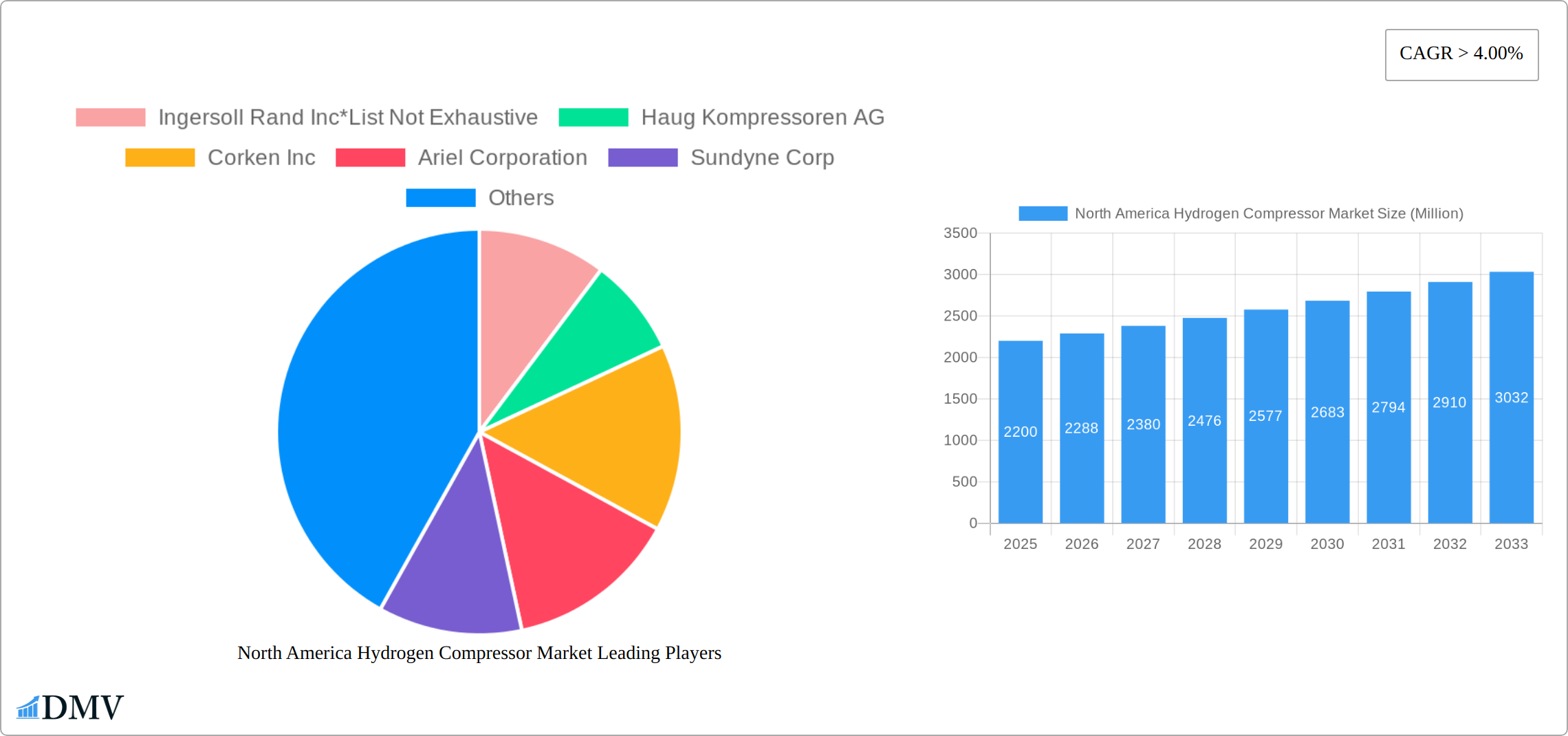

The North American hydrogen compressor market, valued at $2200 million in 2025, is projected to experience robust growth, driven by the burgeoning renewable energy sector and increasing demand for hydrogen as a clean fuel source. The market's Compound Annual Growth Rate (CAGR) exceeding 4% through 2033 reflects a significant expansion fueled by government incentives promoting green hydrogen production and large-scale investments in hydrogen infrastructure. Key growth drivers include the rising adoption of fuel cell electric vehicles (FCEVs), the expansion of hydrogen refueling stations, and the increasing use of hydrogen in industrial processes such as ammonia production and refinery operations. Technological advancements in compressor design, particularly in multi-stage and oil-free compressors, are further enhancing efficiency and reliability, stimulating market expansion. The chemical and oil & gas sectors represent significant end-use industries, with increasing demand for efficient and reliable hydrogen compression solutions for various applications within these sectors. While challenges exist, such as the high initial investment costs associated with hydrogen infrastructure and the need for specialized expertise in hydrogen handling, the long-term growth potential remains exceptionally promising.

North America Hydrogen Compressor Market Market Size (In Billion)

Segmentation reveals a dynamic market landscape. The multi-stage compressor technology segment holds a larger market share due to its suitability for high-pressure applications. Oil-free compressors are gaining traction due to environmental concerns and stricter regulations, indicating a shift towards sustainable practices. Within end-use industries, the chemical sector leads in adoption, followed by the oil and gas industry. Geographic analysis points to the United States as the dominant market within North America, benefiting from significant government support for clean energy initiatives. Canada and Mexico are also experiencing growth, albeit at a comparatively slower pace. The continued expansion of renewable energy sources, coupled with technological advancements and supportive government policies, firmly positions the North American hydrogen compressor market for sustained growth over the forecast period. Major players like Ingersoll Rand, Haug Kompressoren, and Atlas Copco are actively participating in this expanding market, driving innovation and competition.

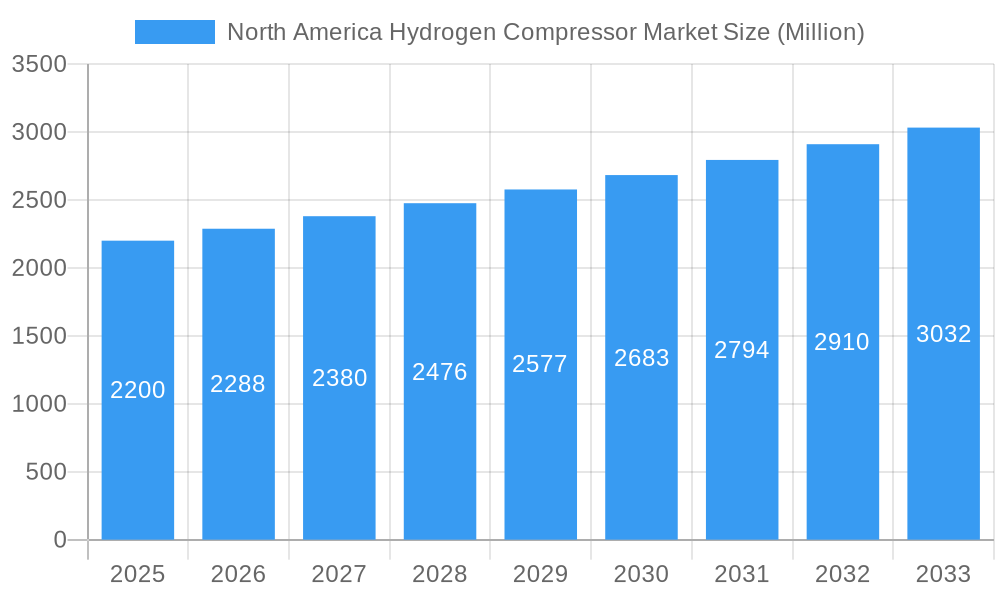

North America Hydrogen Compressor Market Company Market Share

North America Hydrogen Compressor Market: A Comprehensive Report (2019-2033)

This insightful report provides a detailed analysis of the North America hydrogen compressor market, offering a comprehensive overview of market dynamics, competitive landscape, and future growth prospects. Covering the period from 2019 to 2033, with a focus on 2025, this study is an essential resource for stakeholders seeking to understand and capitalize on the burgeoning opportunities within this vital sector. The market is projected to reach xx Million by 2033, exhibiting a CAGR of xx% during the forecast period (2025-2033).

North America Hydrogen Compressor Market Composition & Trends

This section delves into the intricate structure of the North America hydrogen compressor market, examining its concentration levels, innovative drivers, regulatory frameworks, substitute products, and end-user profiles. We analyze mergers and acquisitions (M&A) activities, quantifying deal values and their impact on market share distribution. The highly competitive landscape features both established players and emerging entrants, vying for market share in a rapidly evolving sector.

- Market Concentration: The market exhibits a moderately concentrated structure, with the top five players holding an estimated xx% market share in 2024. This is influenced by the capital-intensive nature of the industry and the technological expertise required.

- Innovation Catalysts: Stringent emission regulations and growing demand for clean energy are primary drivers of innovation, pushing manufacturers to develop more efficient and environmentally friendly hydrogen compressor technologies.

- Regulatory Landscape: Government policies promoting hydrogen as a clean energy source significantly influence market growth. Incentives and subsidies accelerate adoption and drive investment.

- Substitute Products: While no direct substitutes exist, alternative compression technologies influence market dynamics.

- End-User Profiles: The chemical, oil & gas, and other end-use industries are key consumers of hydrogen compressors, each exhibiting distinct needs and investment patterns.

- M&A Activities: Several significant M&A deals have reshaped the competitive landscape, with total deal values exceeding xx Million in the last five years. This activity highlights the strategic importance of this market segment.

North America Hydrogen Compressor Market Industry Evolution

This section provides a detailed analysis of the North America hydrogen compressor market's growth trajectory, technological advancements, and shifting consumer demands from 2019 to 2024 and projected to 2033. We examine the factors driving market expansion, including the increasing adoption of hydrogen in various sectors, advancements in compressor technology, and evolving regulatory frameworks. The market witnessed significant growth during the historical period (2019-2024), with a CAGR of xx%, driven primarily by increasing demand from the oil and gas sector and government initiatives to support the hydrogen economy. Technological advancements, specifically in oil-free and multistage compressors, are significantly improving efficiency and reducing operational costs, accelerating market growth. The forecast period (2025-2033) anticipates continued growth, fueled by expanding applications in the transportation and energy storage sectors. Adoption rates of oil-free technologies are expected to increase by xx% annually during the forecast period, reflecting a growing preference for environmentally friendly solutions.

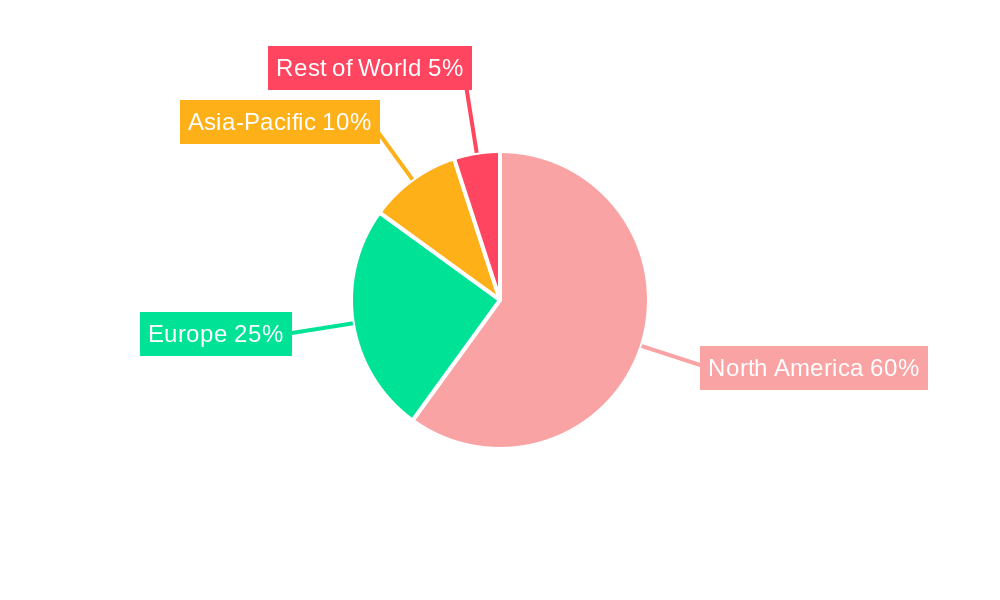

Leading Regions, Countries, or Segments in North America Hydrogen Compressor Market

This section identifies the dominant regions, countries, and market segments within North America, highlighting key drivers and influential factors shaping the market landscape.

-

Dominant Region: The Western United States, particularly states like California, is currently at the forefront of hydrogen compressor adoption. This leadership is primarily attributed to a robust and expanding renewable energy infrastructure, coupled with proactive and supportive government policies and initiatives aimed at decarbonization and the promotion of hydrogen as a clean energy carrier.

-

Key Drivers (By Segment):

- Technology (Multistage): Multistage compressors are experiencing significant growth due to their superior efficiency and capability to handle high-pressure applications, which are crucial for various hydrogen storage and distribution systems. Their ability to compress hydrogen in multiple stages minimizes energy loss and enhances overall system performance.

- Type (Oil-free): The demand for oil-free compressors is rapidly increasing, driven by growing environmental consciousness and increasingly stringent emission regulations. These compressors prevent oil contamination of hydrogen, ensuring higher purity levels and reducing maintenance needs, making them ideal for sensitive applications like fuel cell vehicles and industrial hydrogen.

- End-Use Industry (Oil and Gas): The established infrastructure and substantial investments being channeled into hydrogen-related projects within the oil and gas sector are a significant catalyst for demand. Companies in this industry are leveraging their existing expertise and facilities to transition towards hydrogen production, storage, and distribution, creating a substantial market for compressors.

- End-Use Industry (Transportation): The burgeoning hydrogen fuel cell electric vehicle (FCEV) market is a major growth area, necessitating the development of extensive hydrogen refueling infrastructure. This directly translates to increased demand for high-performance hydrogen compressors for refueling stations.

- End-Use Industry (Industrial Applications): A wide array of industrial processes, including chemical manufacturing, refining, and metal fabrication, are increasingly exploring hydrogen as a cleaner alternative. This diversification of end-use industries is contributing to sustained market expansion.

A detailed analysis of dominance factors underscores the pivotal influence of government support, significant investments in renewable energy infrastructure for green hydrogen production, and the strategic presence and active involvement of major industry players in driving market penetration and technological advancement.

North America Hydrogen Compressor Market Product Innovations

Recent innovations focus on increasing efficiency, reducing operational costs, and minimizing environmental impact. Oil-free compressor technologies are gaining traction, driven by environmental concerns. Advancements in materials science and design are resulting in compressors with improved longevity and reliability. Unique selling propositions include enhanced energy efficiency, reduced maintenance requirements, and improved safety features.

Propelling Factors for North America Hydrogen Compressor Market Growth

The North America hydrogen compressor market is experiencing robust growth, propelled by a confluence of powerful factors. Foremost among these are supportive government policies and substantial financial incentives from federal, state, and provincial governments, which are actively promoting the adoption and development of hydrogen technologies and infrastructure. This is complemented by a surging demand from diverse and rapidly evolving sectors, including the transportation industry's embrace of fuel cell electric vehicles and the critical need for efficient energy storage solutions. Furthermore, continuous technological advancements are leading to the development of more efficient, reliable, and cost-effective hydrogen compressors. Innovations in materials science, compression technologies, and control systems are enhancing performance and reducing operational costs. Adding to this positive trajectory, the decreasing cost of renewable energy sources, such as solar and wind power, which are essential for producing green hydrogen, further enhances the economic viability and attractiveness of hydrogen as a clean energy solution, thereby fueling market growth.

Obstacles in the North America Hydrogen Compressor Market

Challenges include the high initial investment costs associated with hydrogen compressor technology, potential supply chain disruptions affecting component availability, and ongoing competition from other energy sources. Regulatory uncertainty and lack of standardized infrastructure in some regions also pose significant barriers. These factors can collectively impact market expansion, potentially slowing growth by an estimated xx% in specific years.

Future Opportunities in North America Hydrogen Compressor Market

Emerging opportunities lie in the expanding transportation sector, particularly in fuel cell electric vehicles (FCEVs), and in large-scale hydrogen storage projects. Advancements in compressor technology, including the development of smaller, lighter, and more efficient units, will unlock new applications. Growing interest in green hydrogen production and the development of associated infrastructure will further expand market potential.

Major Players in the North America Hydrogen Compressor Market Ecosystem

- Ingersoll Rand Inc.

- Haug Kompressoren AG

- Corken Inc. (a subsidiary of IDEX Corporation)

- Ariel Corporation (a subsidiary of General Electric)

- Sundyne Corp.

- Hydro-Pac Inc.

- Burckhardt Compression AG

- Howden Group Ltd.

- Atlas Copco Group

- NEUMAN & ESSER Group

- Tuthill Corporation

- Dover Corporation

Key Developments in North America Hydrogen Compressor Market Industry

- July 2022: LIFTE H2 and Burckhardt Compression AG solidified their commitment to global hydrogen solutions by signing a Memorandum of Understanding (MOU). This strategic partnership is designed to jointly offer comprehensive hydrogen solutions worldwide, aiming to expand market reach and accelerate the adoption of hydrogen technologies across various applications.

- June 2022: Ariel Corporation, a leading compressor manufacturer, and Hoerbiger, a prominent player in fluid technology, announced a collaboration to provide advanced non-lube compressor solutions specifically tailored for the burgeoning hydrogen mobility market. This partnership addresses the critical need for reliable and efficient compression in hydrogen refueling infrastructure, driving innovation in a key growth sector.

- October 2023: Atlas Copco announced the launch of its new generation of hydrogen compressors designed for industrial applications, featuring enhanced energy efficiency and reduced footprint, catering to the growing demand for clean hydrogen in manufacturing processes.

- February 2024: Sundyne Corporation unveiled an expanded portfolio of hydrogen compression solutions, including API 618 compliant compressors, to support the increasing scale of green hydrogen production facilities and large-scale hydrogen storage projects in North America.

Strategic North America Hydrogen Compressor Market Forecast

The North America hydrogen compressor market is poised for significant growth, driven by increasing demand for clean energy and supportive government policies. Continued technological innovation, specifically in oil-free and high-efficiency compressors, will play a crucial role. The expanding use of hydrogen in various sectors creates substantial market potential, with significant opportunities for both established and emerging players.

North America Hydrogen Compressor Market Segmentation

-

1. Technology

- 1.1. Single-stage

- 1.2. Multistage

-

2. Type

- 2.1. Oil-based

- 2.2. Oil-free

-

3. End-Use Industries

- 3.1. Chemical

- 3.2. Oil and Gas

- 3.3. Other End-Use Industries

-

4. Geography

- 4.1. United States

- 4.2. Canada

- 4.3. Rest of North America

North America Hydrogen Compressor Market Segmentation By Geography

- 1. United States

- 2. Canada

- 3. Rest of North America

North America Hydrogen Compressor Market Regional Market Share

Geographic Coverage of North America Hydrogen Compressor Market

North America Hydrogen Compressor Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of > 4.00% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increasing Demand for Petroleum Products Due to the Growth of the Local Economy4.; Government Initiatives to Boost the Production of Crude Oil and Natural Gas

- 3.3. Market Restrains

- 3.3.1. 4.; Increasing Adoption of Renewable Energy

- 3.4. Market Trends

- 3.4.1. Single-stage Segment to Witness Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Hydrogen Compressor Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Technology

- 5.1.1. Single-stage

- 5.1.2. Multistage

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Oil-based

- 5.2.2. Oil-free

- 5.3. Market Analysis, Insights and Forecast - by End-Use Industries

- 5.3.1. Chemical

- 5.3.2. Oil and Gas

- 5.3.3. Other End-Use Industries

- 5.4. Market Analysis, Insights and Forecast - by Geography

- 5.4.1. United States

- 5.4.2. Canada

- 5.4.3. Rest of North America

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. United States

- 5.5.2. Canada

- 5.5.3. Rest of North America

- 5.1. Market Analysis, Insights and Forecast - by Technology

- 6. United States North America Hydrogen Compressor Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Technology

- 6.1.1. Single-stage

- 6.1.2. Multistage

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1. Oil-based

- 6.2.2. Oil-free

- 6.3. Market Analysis, Insights and Forecast - by End-Use Industries

- 6.3.1. Chemical

- 6.3.2. Oil and Gas

- 6.3.3. Other End-Use Industries

- 6.4. Market Analysis, Insights and Forecast - by Geography

- 6.4.1. United States

- 6.4.2. Canada

- 6.4.3. Rest of North America

- 6.1. Market Analysis, Insights and Forecast - by Technology

- 7. Canada North America Hydrogen Compressor Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Technology

- 7.1.1. Single-stage

- 7.1.2. Multistage

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1. Oil-based

- 7.2.2. Oil-free

- 7.3. Market Analysis, Insights and Forecast - by End-Use Industries

- 7.3.1. Chemical

- 7.3.2. Oil and Gas

- 7.3.3. Other End-Use Industries

- 7.4. Market Analysis, Insights and Forecast - by Geography

- 7.4.1. United States

- 7.4.2. Canada

- 7.4.3. Rest of North America

- 7.1. Market Analysis, Insights and Forecast - by Technology

- 8. Rest of North America North America Hydrogen Compressor Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Technology

- 8.1.1. Single-stage

- 8.1.2. Multistage

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1. Oil-based

- 8.2.2. Oil-free

- 8.3. Market Analysis, Insights and Forecast - by End-Use Industries

- 8.3.1. Chemical

- 8.3.2. Oil and Gas

- 8.3.3. Other End-Use Industries

- 8.4. Market Analysis, Insights and Forecast - by Geography

- 8.4.1. United States

- 8.4.2. Canada

- 8.4.3. Rest of North America

- 8.1. Market Analysis, Insights and Forecast - by Technology

- 9. Competitive Analysis

- 9.1. Market Share Analysis 2025

- 9.2. Company Profiles

- 9.2.1 Ingersoll Rand Inc*List Not Exhaustive

- 9.2.1.1. Overview

- 9.2.1.2. Products

- 9.2.1.3. SWOT Analysis

- 9.2.1.4. Recent Developments

- 9.2.1.5. Financials (Based on Availability)

- 9.2.2 Haug Kompressoren AG

- 9.2.2.1. Overview

- 9.2.2.2. Products

- 9.2.2.3. SWOT Analysis

- 9.2.2.4. Recent Developments

- 9.2.2.5. Financials (Based on Availability)

- 9.2.3 Corken Inc

- 9.2.3.1. Overview

- 9.2.3.2. Products

- 9.2.3.3. SWOT Analysis

- 9.2.3.4. Recent Developments

- 9.2.3.5. Financials (Based on Availability)

- 9.2.4 Ariel Corporation

- 9.2.4.1. Overview

- 9.2.4.2. Products

- 9.2.4.3. SWOT Analysis

- 9.2.4.4. Recent Developments

- 9.2.4.5. Financials (Based on Availability)

- 9.2.5 Sundyne Corp

- 9.2.5.1. Overview

- 9.2.5.2. Products

- 9.2.5.3. SWOT Analysis

- 9.2.5.4. Recent Developments

- 9.2.5.5. Financials (Based on Availability)

- 9.2.6 Hydro-Pac Inc

- 9.2.6.1. Overview

- 9.2.6.2. Products

- 9.2.6.3. SWOT Analysis

- 9.2.6.4. Recent Developments

- 9.2.6.5. Financials (Based on Availability)

- 9.2.7 Indian Compressors Ltd

- 9.2.7.1. Overview

- 9.2.7.2. Products

- 9.2.7.3. SWOT Analysis

- 9.2.7.4. Recent Developments

- 9.2.7.5. Financials (Based on Availability)

- 9.2.8 Burckhardt Compression AG

- 9.2.8.1. Overview

- 9.2.8.2. Products

- 9.2.8.3. SWOT Analysis

- 9.2.8.4. Recent Developments

- 9.2.8.5. Financials (Based on Availability)

- 9.2.9 Howden Group Ltd

- 9.2.9.1. Overview

- 9.2.9.2. Products

- 9.2.9.3. SWOT Analysis

- 9.2.9.4. Recent Developments

- 9.2.9.5. Financials (Based on Availability)

- 9.2.10 Atlas Copco Group

- 9.2.10.1. Overview

- 9.2.10.2. Products

- 9.2.10.3. SWOT Analysis

- 9.2.10.4. Recent Developments

- 9.2.10.5. Financials (Based on Availability)

- 9.2.1 Ingersoll Rand Inc*List Not Exhaustive

List of Figures

- Figure 1: North America Hydrogen Compressor Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: North America Hydrogen Compressor Market Share (%) by Company 2025

List of Tables

- Table 1: North America Hydrogen Compressor Market Revenue Million Forecast, by Technology 2020 & 2033

- Table 2: North America Hydrogen Compressor Market Volume K Tons Forecast, by Technology 2020 & 2033

- Table 3: North America Hydrogen Compressor Market Revenue Million Forecast, by Type 2020 & 2033

- Table 4: North America Hydrogen Compressor Market Volume K Tons Forecast, by Type 2020 & 2033

- Table 5: North America Hydrogen Compressor Market Revenue Million Forecast, by End-Use Industries 2020 & 2033

- Table 6: North America Hydrogen Compressor Market Volume K Tons Forecast, by End-Use Industries 2020 & 2033

- Table 7: North America Hydrogen Compressor Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 8: North America Hydrogen Compressor Market Volume K Tons Forecast, by Geography 2020 & 2033

- Table 9: North America Hydrogen Compressor Market Revenue Million Forecast, by Region 2020 & 2033

- Table 10: North America Hydrogen Compressor Market Volume K Tons Forecast, by Region 2020 & 2033

- Table 11: North America Hydrogen Compressor Market Revenue Million Forecast, by Technology 2020 & 2033

- Table 12: North America Hydrogen Compressor Market Volume K Tons Forecast, by Technology 2020 & 2033

- Table 13: North America Hydrogen Compressor Market Revenue Million Forecast, by Type 2020 & 2033

- Table 14: North America Hydrogen Compressor Market Volume K Tons Forecast, by Type 2020 & 2033

- Table 15: North America Hydrogen Compressor Market Revenue Million Forecast, by End-Use Industries 2020 & 2033

- Table 16: North America Hydrogen Compressor Market Volume K Tons Forecast, by End-Use Industries 2020 & 2033

- Table 17: North America Hydrogen Compressor Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 18: North America Hydrogen Compressor Market Volume K Tons Forecast, by Geography 2020 & 2033

- Table 19: North America Hydrogen Compressor Market Revenue Million Forecast, by Country 2020 & 2033

- Table 20: North America Hydrogen Compressor Market Volume K Tons Forecast, by Country 2020 & 2033

- Table 21: North America Hydrogen Compressor Market Revenue Million Forecast, by Technology 2020 & 2033

- Table 22: North America Hydrogen Compressor Market Volume K Tons Forecast, by Technology 2020 & 2033

- Table 23: North America Hydrogen Compressor Market Revenue Million Forecast, by Type 2020 & 2033

- Table 24: North America Hydrogen Compressor Market Volume K Tons Forecast, by Type 2020 & 2033

- Table 25: North America Hydrogen Compressor Market Revenue Million Forecast, by End-Use Industries 2020 & 2033

- Table 26: North America Hydrogen Compressor Market Volume K Tons Forecast, by End-Use Industries 2020 & 2033

- Table 27: North America Hydrogen Compressor Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 28: North America Hydrogen Compressor Market Volume K Tons Forecast, by Geography 2020 & 2033

- Table 29: North America Hydrogen Compressor Market Revenue Million Forecast, by Country 2020 & 2033

- Table 30: North America Hydrogen Compressor Market Volume K Tons Forecast, by Country 2020 & 2033

- Table 31: North America Hydrogen Compressor Market Revenue Million Forecast, by Technology 2020 & 2033

- Table 32: North America Hydrogen Compressor Market Volume K Tons Forecast, by Technology 2020 & 2033

- Table 33: North America Hydrogen Compressor Market Revenue Million Forecast, by Type 2020 & 2033

- Table 34: North America Hydrogen Compressor Market Volume K Tons Forecast, by Type 2020 & 2033

- Table 35: North America Hydrogen Compressor Market Revenue Million Forecast, by End-Use Industries 2020 & 2033

- Table 36: North America Hydrogen Compressor Market Volume K Tons Forecast, by End-Use Industries 2020 & 2033

- Table 37: North America Hydrogen Compressor Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 38: North America Hydrogen Compressor Market Volume K Tons Forecast, by Geography 2020 & 2033

- Table 39: North America Hydrogen Compressor Market Revenue Million Forecast, by Country 2020 & 2033

- Table 40: North America Hydrogen Compressor Market Volume K Tons Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Hydrogen Compressor Market?

The projected CAGR is approximately > 4.00%.

2. Which companies are prominent players in the North America Hydrogen Compressor Market?

Key companies in the market include Ingersoll Rand Inc*List Not Exhaustive, Haug Kompressoren AG, Corken Inc, Ariel Corporation, Sundyne Corp, Hydro-Pac Inc, Indian Compressors Ltd, Burckhardt Compression AG, Howden Group Ltd, Atlas Copco Group.

3. What are the main segments of the North America Hydrogen Compressor Market?

The market segments include Technology, Type, End-Use Industries, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 2200 Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing Demand for Petroleum Products Due to the Growth of the Local Economy4.; Government Initiatives to Boost the Production of Crude Oil and Natural Gas.

6. What are the notable trends driving market growth?

Single-stage Segment to Witness Significant Growth.

7. Are there any restraints impacting market growth?

4.; Increasing Adoption of Renewable Energy.

8. Can you provide examples of recent developments in the market?

In July 2022, the hydrogen infrastructure development company LIFTE H2 and compressor manufacturer Burckhardt Compression signed a Memorandum of Understanding (MOU) to develop a joint offering of hydrogen solutions to the global market.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Tons.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Hydrogen Compressor Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Hydrogen Compressor Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Hydrogen Compressor Market?

To stay informed about further developments, trends, and reports in the North America Hydrogen Compressor Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence