Key Insights

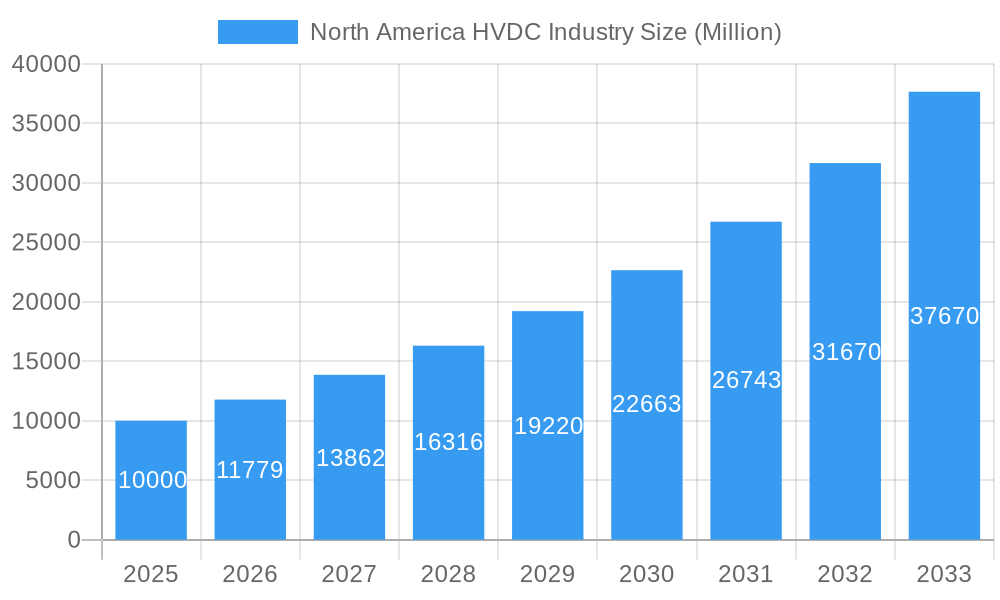

The North American High-Voltage Direct Current (HVDC) transmission market is poised for significant expansion. This growth is primarily driven by the escalating need for efficient, long-distance power transmission solutions. The integration of renewable energy sources, such as solar and wind power, often situated remotely from consumption centers, along with the modernization of aging grid infrastructure, underscores the imperative for HVDC technology. Government initiatives promoting clean energy and energy security are catalyzing substantial investments in grid upgrades, further accelerating market development. Submarine HVDC transmission systems are experiencing particularly robust demand, fueled by offshore wind projects and the necessity to connect dispersed energy resources. Converter stations, essential for HVDC operations, constitute a major market segment due to their crucial role in AC/DC conversion. While underground HVDC systems offer environmental and land-use benefits, their higher initial costs may present a near-term constraint compared to overhead alternatives. Leading industry players are strategically enhancing their market positions through innovation and partnerships. The forecast period (2025-2033) indicates a sustained upward trend, supported by ongoing investments in grid modernization and renewable energy integration.

North America HVDC Industry Market Size (In Billion)

Projected to reach $12.69 billion by 2025 with a Compound Annual Growth Rate (CAGR) of 4.2%, the North American HVDC market is set for substantial value appreciation. Growth is anticipated to be consistent across segments, with submarine and overhead transmission systems expected to outpace underground systems due to their cost-effectiveness and application versatility. The strong emphasis on research and development by established market participants contributes to this optimistic outlook. Potential challenges, including regulatory complexities, permitting delays, and raw material price volatility, may influence the growth trajectory. Nevertheless, the overarching trend points to a significant and positive expansion of the North American HVDC market.

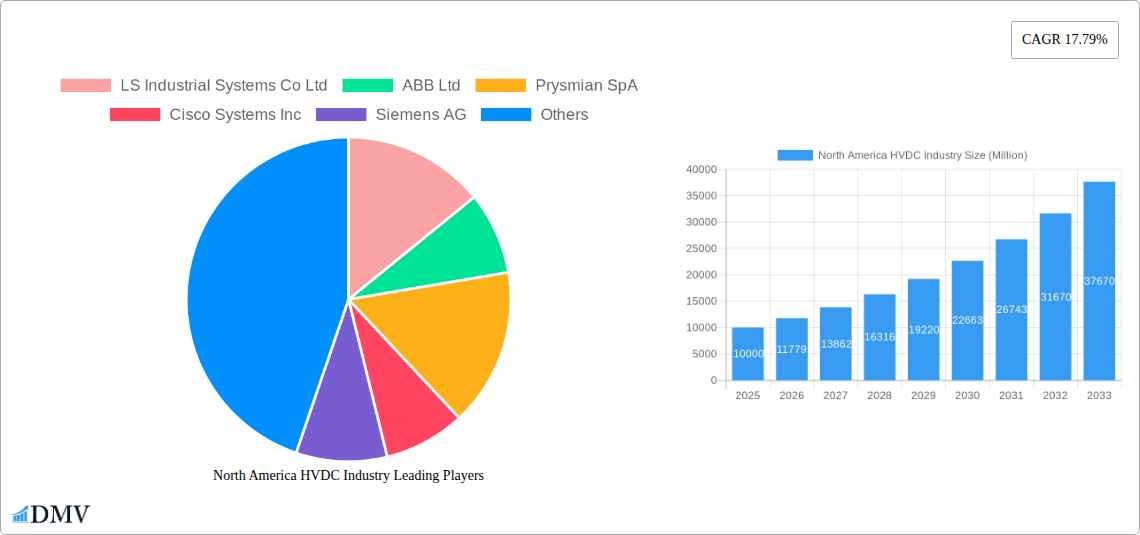

North America HVDC Industry Company Market Share

North America HVDC Industry Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the North America High-Voltage Direct Current (HVDC) industry, offering valuable insights for stakeholders seeking to understand market trends, technological advancements, and future growth opportunities. The report covers the period 2019-2033, with a focus on the 2025-2033 forecast period. The total market value in 2025 is estimated at $xx Million.

North America HVDC Industry Market Composition & Trends

This section evaluates the competitive landscape, innovation drivers, regulatory environment, and market dynamics of the North American HVDC industry. The market is characterized by a moderate level of concentration, with key players such as ABB Ltd, Siemens AG, and General Electric Company holding significant market share. However, emerging players and technological advancements are fostering increased competition.

- Market Share Distribution (2025): ABB Ltd (25%), Siemens AG (20%), General Electric Company (15%), Others (40%). These figures are estimations based on available data and expert analysis.

- M&A Activity: The HVDC sector has witnessed significant M&A activity in recent years, with deal values exceeding $xx Million in the past five years. These activities are primarily driven by companies seeking to expand their geographical reach and enhance their technological capabilities.

- Innovation Catalysts: The increasing demand for renewable energy integration and grid modernization is driving innovation in HVDC technologies, including advancements in converter stations, cable technology, and control systems.

- Regulatory Landscape: Government regulations and policies promoting renewable energy integration and grid modernization are crucial factors influencing market growth. Stringent environmental regulations also play a significant role.

- Substitute Products: While HVDC technology remains the most efficient solution for long-distance power transmission, alternative technologies such as high-voltage alternating current (HVAC) systems still compete in specific applications.

- End-User Profiles: Key end-users include utility companies, independent power producers (IPPs), and government agencies involved in grid infrastructure development and expansion.

North America HVDC Industry Evolution

The North American HVDC market has experienced substantial growth over the past five years, driven primarily by increasing demand for efficient long-distance power transmission and integration of renewable energy sources. The historical period (2019-2024) saw a Compound Annual Growth Rate (CAGR) of xx%, while the forecast period (2025-2033) is projected to witness a CAGR of xx%. This growth is fueled by several key factors, including:

- Technological Advancements: The development of more efficient and cost-effective HVDC technologies, such as Voltage Source Converters (VSC), is significantly impacting the market.

- Renewable Energy Integration: The increasing adoption of renewable energy sources, such as solar and wind power, requires efficient long-distance transmission solutions, creating strong demand for HVDC systems.

- Grid Modernization: Aging power grids in North America necessitate upgrades and expansion, further driving the adoption of advanced HVDC technologies.

- Consumer Demands: Growing awareness of environmental concerns and the need for sustainable energy solutions is encouraging utilities and governments to invest in HVDC infrastructure.

- Policy Support: Government policies promoting renewable energy and grid modernization, including investment incentives and regulatory frameworks, provide a positive impetus for market growth.

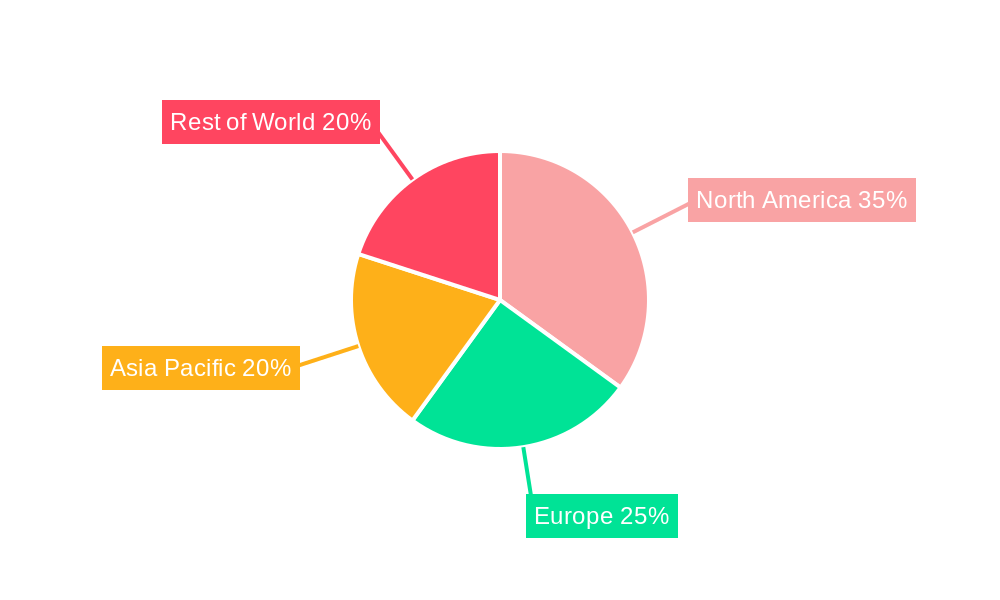

Leading Regions, Countries, or Segments in North America HVDC Industry

The North American HVDC market is geographically diverse, with varying levels of growth and development across different regions and countries. Specific segments also exhibit varying market dynamics.

Transmission Type: The submarine HVDC transmission system segment is experiencing significant growth due to the increasing need for offshore wind power integration. The HVDC overhead transmission system holds the largest market share due to its established presence and cost-effectiveness for long distances. The HVDC underground transmission system is experiencing moderate growth, primarily driven by urban electrification needs.

Component: Converter stations are the largest component segment, representing over 50% of the market share due to their essential role in HVDC system operation. The Transmission Medium (Cables) segment is growing rapidly, with significant investment in advanced cable technologies.

Key Drivers:

- Investment Trends: Significant investments in renewable energy projects, including offshore wind farms and large-scale solar farms, are driving demand for HVDC transmission infrastructure.

- Regulatory Support: Supportive government policies and regulations promoting renewable energy integration and grid modernization are facilitating market expansion.

- Technological Advancements: Innovations in HVDC technology, such as VSC technology and advanced cable materials, are enhancing the efficiency and reliability of HVDC systems.

North America HVDC Industry Product Innovations

Recent innovations in the HVDC industry include advanced modular converter stations, which offer greater flexibility and scalability. Improved cable designs using high-temperature superconducting (HTS) materials are enhancing power transmission capacity and efficiency. These advancements reduce costs, increase efficiency, and improve system reliability, providing unique selling propositions for manufacturers.

Propelling Factors for North America HVDC Industry Growth

Several factors are propelling the growth of the North American HVDC industry. These include increasing investments in renewable energy projects to meet climate goals, the need for grid modernization and expansion to accommodate growing energy demand, technological advancements leading to more efficient and cost-effective HVDC systems, and supportive government policies and regulations. The continued shift towards a decarbonized energy sector will further fuel demand.

Obstacles in the North America HVDC Industry Market

Key obstacles hindering market growth include the high upfront capital costs associated with HVDC projects, potential supply chain disruptions affecting the availability of critical components, and the competitive pressure from existing HVAC technologies in certain applications. Furthermore, securing regulatory approvals and navigating complex permitting processes can create delays and increase project costs. These issues can potentially reduce the rate of market growth by xx% in the coming years.

Future Opportunities in North America HVDC Industry

Future opportunities for growth include expanding into new markets, such as microgrids and distributed energy resources (DER) integration, developing more efficient and sustainable HVDC technologies, leveraging digital technologies for improved grid management and control, and exploring the potential of HVDC systems in supporting emerging technologies such as electric vehicle charging infrastructure and hydrogen production.

Major Players in the North America HVDC Industry Ecosystem

- ABB Ltd

- Prysmian SpA

- Cisco Systems Inc

- Siemens AG

- Alstom SA

- Schneider Electric SE

- Toshiba Corporation

- NKT A/S

- General Electric Company

- LS Industrial Systems Co Ltd

Key Developments in North America HVDC Industry Industry

- December 2022: Siemens Energy Inc. secured a contract to supply HVDC technology for the TransWest Express Transmission Project, showcasing significant investment in HVDC infrastructure. This project demonstrates the increasing scale of HVDC projects and the technological capabilities of key players.

Strategic North America HVDC Industry Market Forecast

The North America HVDC market is poised for robust growth over the forecast period, driven by continued investment in renewable energy, grid modernization, and technological advancements. The increasing demand for efficient long-distance power transmission and the supportive regulatory environment will further contribute to market expansion. New opportunities, such as microgrid integration and advanced cable technologies, are anticipated to create significant growth potential in the coming years.

North America HVDC Industry Segmentation

-

1. Transmission Type

- 1.1. Submarine HVDC Transmission System

- 1.2. HVDC Overhead Transmission System

- 1.3. HVDC Underground Transmission System

-

2. Component

- 2.1. Converter Stations

- 2.2. Transmission Medium (Cables)

-

3. Geography

- 3.1. United States

- 3.2. Canada

- 3.3. Rest of North America

North America HVDC Industry Segmentation By Geography

- 1. United States

- 2. Canada

- 3. Rest of North America

North America HVDC Industry Regional Market Share

Geographic Coverage of North America HVDC Industry

North America HVDC Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.2% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 HVDC systems facilitate efficient cross-border energy trading

- 3.2.2 allowing for the exchange of electricity between regions with varying energy demands and supply conditions. This capability is particularly beneficial in North America

- 3.2.3 where interconnected grids can optimize energy distribution and enhance grid resilience.

- 3.3. Market Restrains

- 3.3.1 The initial investment required for HVDC systems is substantial

- 3.3.2 which can be a barrier for utilities and energy providers. While HVDC systems offer long-term operational benefits

- 3.3.3 the upfront costs may deter some stakeholders from adopting the technology

- 3.4. Market Trends

- 3.4.1 The expansion of offshore wind power technology is creating significant opportunities for the HVDC market. HVDC systems are ideal for transmitting power from offshore wind farms to onshore grids

- 3.4.2 supporting the growth of renewable energy infrastructure.

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America HVDC Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Transmission Type

- 5.1.1. Submarine HVDC Transmission System

- 5.1.2. HVDC Overhead Transmission System

- 5.1.3. HVDC Underground Transmission System

- 5.2. Market Analysis, Insights and Forecast - by Component

- 5.2.1. Converter Stations

- 5.2.2. Transmission Medium (Cables)

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. United States

- 5.3.2. Canada

- 5.3.3. Rest of North America

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. United States

- 5.4.2. Canada

- 5.4.3. Rest of North America

- 5.1. Market Analysis, Insights and Forecast - by Transmission Type

- 6. United States North America HVDC Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Transmission Type

- 6.1.1. Submarine HVDC Transmission System

- 6.1.2. HVDC Overhead Transmission System

- 6.1.3. HVDC Underground Transmission System

- 6.2. Market Analysis, Insights and Forecast - by Component

- 6.2.1. Converter Stations

- 6.2.2. Transmission Medium (Cables)

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. United States

- 6.3.2. Canada

- 6.3.3. Rest of North America

- 6.1. Market Analysis, Insights and Forecast - by Transmission Type

- 7. Canada North America HVDC Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Transmission Type

- 7.1.1. Submarine HVDC Transmission System

- 7.1.2. HVDC Overhead Transmission System

- 7.1.3. HVDC Underground Transmission System

- 7.2. Market Analysis, Insights and Forecast - by Component

- 7.2.1. Converter Stations

- 7.2.2. Transmission Medium (Cables)

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. United States

- 7.3.2. Canada

- 7.3.3. Rest of North America

- 7.1. Market Analysis, Insights and Forecast - by Transmission Type

- 8. Rest of North America North America HVDC Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Transmission Type

- 8.1.1. Submarine HVDC Transmission System

- 8.1.2. HVDC Overhead Transmission System

- 8.1.3. HVDC Underground Transmission System

- 8.2. Market Analysis, Insights and Forecast - by Component

- 8.2.1. Converter Stations

- 8.2.2. Transmission Medium (Cables)

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. United States

- 8.3.2. Canada

- 8.3.3. Rest of North America

- 8.1. Market Analysis, Insights and Forecast - by Transmission Type

- 9. Competitive Analysis

- 9.1. Market Share Analysis 2025

- 9.2. Company Profiles

- 9.2.1 LS Industrial Systems Co Ltd

- 9.2.1.1. Overview

- 9.2.1.2. Products

- 9.2.1.3. SWOT Analysis

- 9.2.1.4. Recent Developments

- 9.2.1.5. Financials (Based on Availability)

- 9.2.2 ABB Ltd

- 9.2.2.1. Overview

- 9.2.2.2. Products

- 9.2.2.3. SWOT Analysis

- 9.2.2.4. Recent Developments

- 9.2.2.5. Financials (Based on Availability)

- 9.2.3 Prysmian SpA

- 9.2.3.1. Overview

- 9.2.3.2. Products

- 9.2.3.3. SWOT Analysis

- 9.2.3.4. Recent Developments

- 9.2.3.5. Financials (Based on Availability)

- 9.2.4 Cisco Systems Inc

- 9.2.4.1. Overview

- 9.2.4.2. Products

- 9.2.4.3. SWOT Analysis

- 9.2.4.4. Recent Developments

- 9.2.4.5. Financials (Based on Availability)

- 9.2.5 Siemens AG

- 9.2.5.1. Overview

- 9.2.5.2. Products

- 9.2.5.3. SWOT Analysis

- 9.2.5.4. Recent Developments

- 9.2.5.5. Financials (Based on Availability)

- 9.2.6 Alstom SA

- 9.2.6.1. Overview

- 9.2.6.2. Products

- 9.2.6.3. SWOT Analysis

- 9.2.6.4. Recent Developments

- 9.2.6.5. Financials (Based on Availability)

- 9.2.7 Schneider Electric SE

- 9.2.7.1. Overview

- 9.2.7.2. Products

- 9.2.7.3. SWOT Analysis

- 9.2.7.4. Recent Developments

- 9.2.7.5. Financials (Based on Availability)

- 9.2.8 Toshiba Corporation

- 9.2.8.1. Overview

- 9.2.8.2. Products

- 9.2.8.3. SWOT Analysis

- 9.2.8.4. Recent Developments

- 9.2.8.5. Financials (Based on Availability)

- 9.2.9 NKT A/S

- 9.2.9.1. Overview

- 9.2.9.2. Products

- 9.2.9.3. SWOT Analysis

- 9.2.9.4. Recent Developments

- 9.2.9.5. Financials (Based on Availability)

- 9.2.10 General Electric Company

- 9.2.10.1. Overview

- 9.2.10.2. Products

- 9.2.10.3. SWOT Analysis

- 9.2.10.4. Recent Developments

- 9.2.10.5. Financials (Based on Availability)

- 9.2.1 LS Industrial Systems Co Ltd

List of Figures

- Figure 1: North America HVDC Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: North America HVDC Industry Share (%) by Company 2025

List of Tables

- Table 1: North America HVDC Industry Revenue billion Forecast, by Transmission Type 2020 & 2033

- Table 2: North America HVDC Industry Revenue billion Forecast, by Component 2020 & 2033

- Table 3: North America HVDC Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 4: North America HVDC Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 5: North America HVDC Industry Revenue billion Forecast, by Transmission Type 2020 & 2033

- Table 6: North America HVDC Industry Revenue billion Forecast, by Component 2020 & 2033

- Table 7: North America HVDC Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 8: North America HVDC Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 9: North America HVDC Industry Revenue billion Forecast, by Transmission Type 2020 & 2033

- Table 10: North America HVDC Industry Revenue billion Forecast, by Component 2020 & 2033

- Table 11: North America HVDC Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 12: North America HVDC Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 13: North America HVDC Industry Revenue billion Forecast, by Transmission Type 2020 & 2033

- Table 14: North America HVDC Industry Revenue billion Forecast, by Component 2020 & 2033

- Table 15: North America HVDC Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 16: North America HVDC Industry Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America HVDC Industry?

The projected CAGR is approximately 4.2%.

2. Which companies are prominent players in the North America HVDC Industry?

Key companies in the market include LS Industrial Systems Co Ltd, ABB Ltd, Prysmian SpA, Cisco Systems Inc, Siemens AG, Alstom SA, Schneider Electric SE, Toshiba Corporation, NKT A/S, General Electric Company.

3. What are the main segments of the North America HVDC Industry?

The market segments include Transmission Type, Component, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 12.69 billion as of 2022.

5. What are some drivers contributing to market growth?

HVDC systems facilitate efficient cross-border energy trading. allowing for the exchange of electricity between regions with varying energy demands and supply conditions. This capability is particularly beneficial in North America. where interconnected grids can optimize energy distribution and enhance grid resilience..

6. What are the notable trends driving market growth?

The expansion of offshore wind power technology is creating significant opportunities for the HVDC market. HVDC systems are ideal for transmitting power from offshore wind farms to onshore grids. supporting the growth of renewable energy infrastructure..

7. Are there any restraints impacting market growth?

The initial investment required for HVDC systems is substantial. which can be a barrier for utilities and energy providers. While HVDC systems offer long-term operational benefits. the upfront costs may deter some stakeholders from adopting the technology.

8. Can you provide examples of recent developments in the market?

In December 2022, TransWest Express LLC selected Siemens Energy Inc. to supply the high-voltage direct current transmission technology for the TransWest Express Transmission Project. Under the contract, Siemens Energy will engineer, procure, and construct the HVDC converter stations, ancillary equipment, and systems. The project is a 732-mile high-voltage interregional transmission system with HVDC and HVAC segments that will connect to the existing grid in Wyoming and Utah and directly to the ISO Controlled Grid in southern Nevada.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America HVDC Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America HVDC Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America HVDC Industry?

To stay informed about further developments, trends, and reports in the North America HVDC Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence