Key Insights

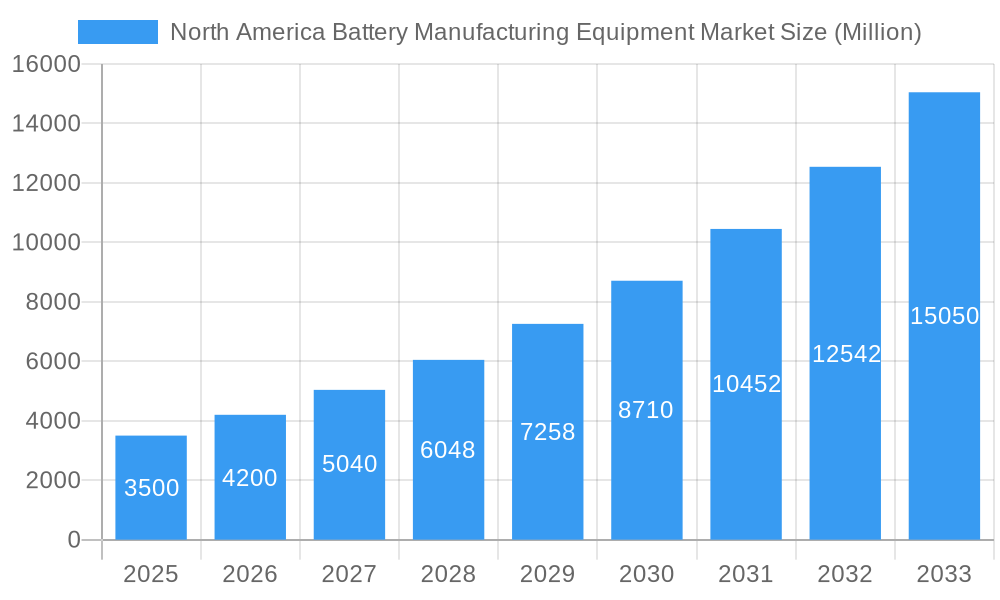

The North American battery manufacturing equipment market is poised for substantial growth, propelled by the surging electric vehicle (EV) sector and expanding energy storage demands. The market is projected to achieve a Compound Annual Growth Rate (CAGR) of 27.61%. With an estimated market size of $9.77 billion in the base year of 2025, significant opportunities await equipment manufacturers and suppliers.

North America Battery Manufacturing Equipment Market Market Size (In Billion)

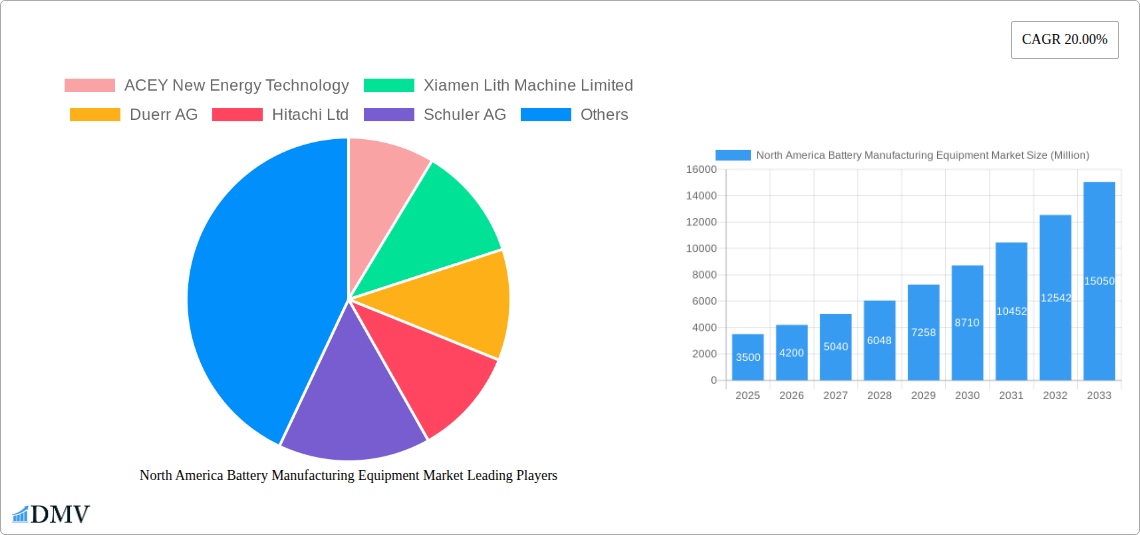

Key growth drivers include demand for advanced machinery such as coating & dryer, calendaring, and slitting machines, crucial for high-performance battery cell production. The automotive sector remains the dominant end-user, with the industrial sector, encompassing energy storage and grid applications, showing accelerated adoption. Leading companies such as ACEY New Energy Technology, Dürr AG, and Hitachi Ltd. are at the forefront, capitalizing on innovation and strategic alliances.

North America Battery Manufacturing Equipment Market Company Market Share

While the market presents immense potential, challenges such as high initial capital expenditure for cutting-edge equipment and the requirement for specialized technical expertise may pose barriers to entry for smaller enterprises. However, supportive government incentives and policies aimed at fostering EV adoption and domestic battery production are anticipated to offset these challenges, ensuring continued market expansion through 2033. The market is segmented by machine type (Coating & Dryer, Calendaring, Slitting, Mixing, Electrode Stacking, Assembly & Handling Machines, Formation & Testing Machines) and end-user (Automotive, Industrial, Other End Users). North America's robust automotive industry and favorable policy landscape position it as a major contributor to the global market.

North America Battery Manufacturing Equipment Market: A Comprehensive Report (2019-2033)

This insightful report provides a detailed analysis of the North America Battery Manufacturing Equipment market, offering a comprehensive overview of its current state, future trends, and key players. With a study period spanning 2019-2033, a base year of 2025, and a forecast period from 2025-2033, this report is an invaluable resource for stakeholders seeking to understand and capitalize on this rapidly evolving market. The market is projected to reach xx Million by 2033, showcasing significant growth potential.

North America Battery Manufacturing Equipment Market Composition & Trends

The North America Battery Manufacturing Equipment market is experiencing dynamic growth fueled by the surging demand for electric vehicles (EVs) and energy storage systems. Market concentration is currently [Insert Market Concentration Metric, e.g., moderately fragmented], with several key players vying for market share. Innovation is a significant catalyst, with continuous advancements in battery technologies driving the need for sophisticated manufacturing equipment. The regulatory landscape, including government incentives and environmental regulations, plays a crucial role in shaping market dynamics. Substitute products are limited, further solidifying the market's growth trajectory. The end-user profile is largely dominated by the automotive sector, but industrial and other applications are also contributing to market expansion. M&A activities are frequent, indicating significant investment and consolidation within the industry. Deal values have ranged from xx Million to xx Million in recent years.

- Market Share Distribution (2024): [Insert estimated market share for top 3-5 players]

- M&A Deal Values (2022-2024): Average deal value: xx Million; Total deal value: xx Million.

- Key Market Segments: Automotive, Industrial, Other.

- Technological Advancements: Focus on automation, high-throughput capabilities, and advanced process control.

North America Battery Manufacturing Equipment Market Industry Evolution

The North America Battery Manufacturing Equipment market has witnessed substantial growth over the historical period (2019-2024), exhibiting a [Insert CAGR] Compound Annual Growth Rate. This robust growth is primarily driven by the increasing adoption of electric vehicles and the expansion of renewable energy infrastructure. Technological advancements, including automation and improved process efficiency, have further propelled market expansion. Shifting consumer preferences towards sustainable and eco-friendly solutions have created a favorable environment for battery manufacturing equipment suppliers. The market is expected to maintain a strong growth trajectory throughout the forecast period (2025-2033), with adoption rates accelerating as government initiatives and investments in battery production continue to grow. The development of next-generation battery technologies (e.g., solid-state batteries) will unlock further opportunities. By 2033, the market is estimated to reach xx Million, a significant increase from the xx Million valuation in 2024. Specific growth segments include [Mention Specific High-Growth Segments, e.g., Electrode Stacking, Assembly & Handling Machines].

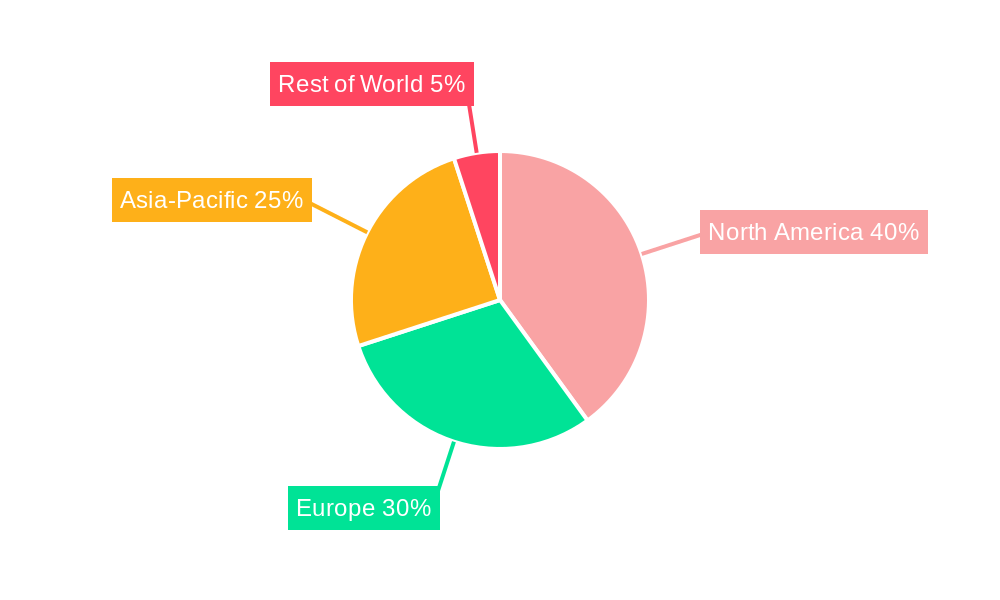

Leading Regions, Countries, or Segments in North America Battery Manufacturing Equipment Market

The [Insert Dominant Region, e.g., US] is currently the leading region in the North America Battery Manufacturing Equipment market, owing to its robust automotive industry and substantial investments in renewable energy infrastructure.

Key Drivers:

- Significant Investments: Massive investments by both OEMs and government agencies are boosting manufacturing capacity.

- Favorable Regulatory Environment: Incentives for EV adoption and manufacturing are driving equipment demand.

- Presence of Key Players: Many leading manufacturers of battery equipment have established a strong presence in the region.

Dominance Factors:

The US's dominance stems from the concentration of major automotive manufacturers and battery production facilities within its borders, creating a high demand for advanced equipment. Additionally, government policies favoring domestic manufacturing and renewable energy sources further enhance this market leadership. Canada is also rapidly emerging as a key player.

Segment Analysis:

- Machine Type: The demand for electrode stacking, assembly & handling machines, and formation & testing machines is particularly strong due to their critical role in battery production. Coating & Dryer equipment also shows significant growth potential.

- End User: The automotive sector is the largest consumer of battery manufacturing equipment, driven by the rising popularity of electric vehicles and plug-in hybrids.

North America Battery Manufacturing Equipment Market Product Innovations

Recent innovations in battery manufacturing equipment focus on enhancing efficiency, precision, and automation. This includes the development of advanced coating and drying systems, high-speed assembly lines, and automated quality control mechanisms. These advancements significantly improve productivity while reducing manufacturing costs and optimizing battery performance. Unique selling propositions frequently involve proprietary technologies and optimized process control systems, boosting production efficiency and lowering operational expenses. The implementation of AI and machine learning in equipment operations allows for predictive maintenance and reduced downtime.

Propelling Factors for North America Battery Manufacturing Equipment Market Growth

The North America Battery Manufacturing Equipment market is experiencing robust growth, fueled by a confluence of dynamic forces. Foremost among these is the **explosive demand for electric vehicles (EVs)**, necessitating a significant expansion in battery production capacity. This surge in EV adoption is further bolstered by **supportive government incentives and policies** aimed at accelerating the transition to electric mobility and renewable energy sources. Crucially, continuous **technological advancements** are yielding batteries with enhanced efficiency, longer lifespans, and improved safety profiles, directly driving the need for sophisticated manufacturing equipment. Moreover, the global imperative to **promote sustainability and drastically reduce carbon emissions** is creating a highly favorable ecosystem for battery technologies and, consequently, the equipment required to produce them.

Obstacles in the North America Battery Manufacturing Equipment Market

Despite its promising trajectory, the North America Battery Manufacturing Equipment market is not without its hurdles. **Vulnerability to supply chain disruptions** remains a persistent concern, capable of inflicting production delays and escalating operational costs. The recent global semiconductor shortage served as a stark reminder of this risk. Furthermore, **intense competitive pressures from established and emerging international manufacturers** demand continuous innovation and cost optimization. Navigating a complex and evolving regulatory landscape, coupled with the inherent volatility of raw material costs, also presents significant challenges that can impact market expansion and profitability.

Future Opportunities in North America Battery Manufacturing Equipment Market

The horizon for the North America Battery Manufacturing Equipment market is brimming with promising opportunities. A key area of growth lies in the development and deployment of specialized equipment for **next-generation battery technologies**, with a particular focus on the promising realm of solid-state batteries. Beyond the automotive sector, significant growth potential exists in catering to the burgeoning demand for battery manufacturing equipment for stationary energy storage solutions, powering grids and homes, as well as for diverse industrial applications. The increasing consumer and industrial demand for sustainable and environmentally conscious manufacturing processes presents fertile ground for the introduction of innovative, green equipment solutions. Finally, strategic partnerships and collaborations between leading equipment manufacturers and battery producers are poised to unlock synergistic innovations, drive technological advancements, and pave the way for substantial market expansion.

Major Players in the North America Battery Manufacturing Equipment Ecosystem

- ACEY New Energy Technology

- Xiamen Lith Machine Limited

- Duerr AG

- Hitachi Ltd

- Schuler AG

- InoBat

- IPG Photonics Corporation

- Andritz AG

- Xiamen Tmax Battery Equipments Limited

- Wuxi Lead Intelligent Equipment Co Ltd

Key Developments in North America Battery Manufacturing Equipment Industry

- December 2022: General Motors and LG Energy Solution invest an additional USD 275 Million in their Tennessee battery plant, increasing production by over 40%.

- December 2022: Hyundai Motor Group and SK On sign an MOU for a new EV battery manufacturing facility in Georgia, with a USD 4-5 Billion investment.

- March 2022: LG Energy Solution and Stellantis N.V. announce a USD 4.1 Billion joint venture in Canada to manufacture EV batteries.

Strategic North America Battery Manufacturing Equipment Market Forecast

The North America Battery Manufacturing Equipment market is poised for continued robust growth, driven by the accelerating adoption of electric vehicles and renewable energy technologies. The market's future is bright, with opportunities in next-generation battery technologies and expanding applications creating significant market potential. Continued government support and technological advancements will further fuel this expansion, solidifying the market’s position as a key driver of the clean energy transition.

North America Battery Manufacturing Equipment Market Segmentation

-

1. Machine Type

- 1.1. Coating & Dryer

- 1.2. Calendaring

- 1.3. Slitting

- 1.4. Mixing

- 1.5. Electrode Stacking

- 1.6. Assembly & Handling Machines

- 1.7. Formation & Testing Machines

-

2. End User

- 2.1. Automotive

- 2.2. Industrial

- 2.3. Other End Users

-

3. Geograph

- 3.1. United States

- 3.2. Canada

- 3.3. Mexico

- 3.4. Rest of North America

North America Battery Manufacturing Equipment Market Segmentation By Geography

- 1. United States

- 2. Canada

- 3. Mexico

- 4. Rest of North America

North America Battery Manufacturing Equipment Market Regional Market Share

Geographic Coverage of North America Battery Manufacturing Equipment Market

North America Battery Manufacturing Equipment Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 27.61% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increasing Investments in Water Treatment by Developing Countries4.; Growing Demand for the Various End-Use Sectors

- 3.3. Market Restrains

- 3.3.1. 4.; Availability of Cheap and Alternative Pumps

- 3.4. Market Trends

- 3.4.1. Automotive Segment to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Battery Manufacturing Equipment Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Machine Type

- 5.1.1. Coating & Dryer

- 5.1.2. Calendaring

- 5.1.3. Slitting

- 5.1.4. Mixing

- 5.1.5. Electrode Stacking

- 5.1.6. Assembly & Handling Machines

- 5.1.7. Formation & Testing Machines

- 5.2. Market Analysis, Insights and Forecast - by End User

- 5.2.1. Automotive

- 5.2.2. Industrial

- 5.2.3. Other End Users

- 5.3. Market Analysis, Insights and Forecast - by Geograph

- 5.3.1. United States

- 5.3.2. Canada

- 5.3.3. Mexico

- 5.3.4. Rest of North America

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. United States

- 5.4.2. Canada

- 5.4.3. Mexico

- 5.4.4. Rest of North America

- 5.1. Market Analysis, Insights and Forecast - by Machine Type

- 6. United States North America Battery Manufacturing Equipment Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Machine Type

- 6.1.1. Coating & Dryer

- 6.1.2. Calendaring

- 6.1.3. Slitting

- 6.1.4. Mixing

- 6.1.5. Electrode Stacking

- 6.1.6. Assembly & Handling Machines

- 6.1.7. Formation & Testing Machines

- 6.2. Market Analysis, Insights and Forecast - by End User

- 6.2.1. Automotive

- 6.2.2. Industrial

- 6.2.3. Other End Users

- 6.3. Market Analysis, Insights and Forecast - by Geograph

- 6.3.1. United States

- 6.3.2. Canada

- 6.3.3. Mexico

- 6.3.4. Rest of North America

- 6.1. Market Analysis, Insights and Forecast - by Machine Type

- 7. Canada North America Battery Manufacturing Equipment Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Machine Type

- 7.1.1. Coating & Dryer

- 7.1.2. Calendaring

- 7.1.3. Slitting

- 7.1.4. Mixing

- 7.1.5. Electrode Stacking

- 7.1.6. Assembly & Handling Machines

- 7.1.7. Formation & Testing Machines

- 7.2. Market Analysis, Insights and Forecast - by End User

- 7.2.1. Automotive

- 7.2.2. Industrial

- 7.2.3. Other End Users

- 7.3. Market Analysis, Insights and Forecast - by Geograph

- 7.3.1. United States

- 7.3.2. Canada

- 7.3.3. Mexico

- 7.3.4. Rest of North America

- 7.1. Market Analysis, Insights and Forecast - by Machine Type

- 8. Mexico North America Battery Manufacturing Equipment Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Machine Type

- 8.1.1. Coating & Dryer

- 8.1.2. Calendaring

- 8.1.3. Slitting

- 8.1.4. Mixing

- 8.1.5. Electrode Stacking

- 8.1.6. Assembly & Handling Machines

- 8.1.7. Formation & Testing Machines

- 8.2. Market Analysis, Insights and Forecast - by End User

- 8.2.1. Automotive

- 8.2.2. Industrial

- 8.2.3. Other End Users

- 8.3. Market Analysis, Insights and Forecast - by Geograph

- 8.3.1. United States

- 8.3.2. Canada

- 8.3.3. Mexico

- 8.3.4. Rest of North America

- 8.1. Market Analysis, Insights and Forecast - by Machine Type

- 9. Rest of North America North America Battery Manufacturing Equipment Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Machine Type

- 9.1.1. Coating & Dryer

- 9.1.2. Calendaring

- 9.1.3. Slitting

- 9.1.4. Mixing

- 9.1.5. Electrode Stacking

- 9.1.6. Assembly & Handling Machines

- 9.1.7. Formation & Testing Machines

- 9.2. Market Analysis, Insights and Forecast - by End User

- 9.2.1. Automotive

- 9.2.2. Industrial

- 9.2.3. Other End Users

- 9.3. Market Analysis, Insights and Forecast - by Geograph

- 9.3.1. United States

- 9.3.2. Canada

- 9.3.3. Mexico

- 9.3.4. Rest of North America

- 9.1. Market Analysis, Insights and Forecast - by Machine Type

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 ACEY New Energy Technology

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Xiamen Lith Machine Limited

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Duerr AG

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Hitachi Ltd

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Schuler AG

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 InoBat

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 IPG Photonics Corporation

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Andritz AG*List Not Exhaustive

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Xiamen Tmax Battery Equipments Limited

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Wuxi Lead Intelligent Equipment Co Ltd

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.1 ACEY New Energy Technology

List of Figures

- Figure 1: North America Battery Manufacturing Equipment Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: North America Battery Manufacturing Equipment Market Share (%) by Company 2025

List of Tables

- Table 1: North America Battery Manufacturing Equipment Market Revenue billion Forecast, by Machine Type 2020 & 2033

- Table 2: North America Battery Manufacturing Equipment Market Volume Gigawatt Forecast, by Machine Type 2020 & 2033

- Table 3: North America Battery Manufacturing Equipment Market Revenue billion Forecast, by End User 2020 & 2033

- Table 4: North America Battery Manufacturing Equipment Market Volume Gigawatt Forecast, by End User 2020 & 2033

- Table 5: North America Battery Manufacturing Equipment Market Revenue billion Forecast, by Geograph 2020 & 2033

- Table 6: North America Battery Manufacturing Equipment Market Volume Gigawatt Forecast, by Geograph 2020 & 2033

- Table 7: North America Battery Manufacturing Equipment Market Revenue billion Forecast, by Region 2020 & 2033

- Table 8: North America Battery Manufacturing Equipment Market Volume Gigawatt Forecast, by Region 2020 & 2033

- Table 9: North America Battery Manufacturing Equipment Market Revenue billion Forecast, by Machine Type 2020 & 2033

- Table 10: North America Battery Manufacturing Equipment Market Volume Gigawatt Forecast, by Machine Type 2020 & 2033

- Table 11: North America Battery Manufacturing Equipment Market Revenue billion Forecast, by End User 2020 & 2033

- Table 12: North America Battery Manufacturing Equipment Market Volume Gigawatt Forecast, by End User 2020 & 2033

- Table 13: North America Battery Manufacturing Equipment Market Revenue billion Forecast, by Geograph 2020 & 2033

- Table 14: North America Battery Manufacturing Equipment Market Volume Gigawatt Forecast, by Geograph 2020 & 2033

- Table 15: North America Battery Manufacturing Equipment Market Revenue billion Forecast, by Country 2020 & 2033

- Table 16: North America Battery Manufacturing Equipment Market Volume Gigawatt Forecast, by Country 2020 & 2033

- Table 17: North America Battery Manufacturing Equipment Market Revenue billion Forecast, by Machine Type 2020 & 2033

- Table 18: North America Battery Manufacturing Equipment Market Volume Gigawatt Forecast, by Machine Type 2020 & 2033

- Table 19: North America Battery Manufacturing Equipment Market Revenue billion Forecast, by End User 2020 & 2033

- Table 20: North America Battery Manufacturing Equipment Market Volume Gigawatt Forecast, by End User 2020 & 2033

- Table 21: North America Battery Manufacturing Equipment Market Revenue billion Forecast, by Geograph 2020 & 2033

- Table 22: North America Battery Manufacturing Equipment Market Volume Gigawatt Forecast, by Geograph 2020 & 2033

- Table 23: North America Battery Manufacturing Equipment Market Revenue billion Forecast, by Country 2020 & 2033

- Table 24: North America Battery Manufacturing Equipment Market Volume Gigawatt Forecast, by Country 2020 & 2033

- Table 25: North America Battery Manufacturing Equipment Market Revenue billion Forecast, by Machine Type 2020 & 2033

- Table 26: North America Battery Manufacturing Equipment Market Volume Gigawatt Forecast, by Machine Type 2020 & 2033

- Table 27: North America Battery Manufacturing Equipment Market Revenue billion Forecast, by End User 2020 & 2033

- Table 28: North America Battery Manufacturing Equipment Market Volume Gigawatt Forecast, by End User 2020 & 2033

- Table 29: North America Battery Manufacturing Equipment Market Revenue billion Forecast, by Geograph 2020 & 2033

- Table 30: North America Battery Manufacturing Equipment Market Volume Gigawatt Forecast, by Geograph 2020 & 2033

- Table 31: North America Battery Manufacturing Equipment Market Revenue billion Forecast, by Country 2020 & 2033

- Table 32: North America Battery Manufacturing Equipment Market Volume Gigawatt Forecast, by Country 2020 & 2033

- Table 33: North America Battery Manufacturing Equipment Market Revenue billion Forecast, by Machine Type 2020 & 2033

- Table 34: North America Battery Manufacturing Equipment Market Volume Gigawatt Forecast, by Machine Type 2020 & 2033

- Table 35: North America Battery Manufacturing Equipment Market Revenue billion Forecast, by End User 2020 & 2033

- Table 36: North America Battery Manufacturing Equipment Market Volume Gigawatt Forecast, by End User 2020 & 2033

- Table 37: North America Battery Manufacturing Equipment Market Revenue billion Forecast, by Geograph 2020 & 2033

- Table 38: North America Battery Manufacturing Equipment Market Volume Gigawatt Forecast, by Geograph 2020 & 2033

- Table 39: North America Battery Manufacturing Equipment Market Revenue billion Forecast, by Country 2020 & 2033

- Table 40: North America Battery Manufacturing Equipment Market Volume Gigawatt Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Battery Manufacturing Equipment Market?

The projected CAGR is approximately 27.61%.

2. Which companies are prominent players in the North America Battery Manufacturing Equipment Market?

Key companies in the market include ACEY New Energy Technology, Xiamen Lith Machine Limited, Duerr AG, Hitachi Ltd, Schuler AG, InoBat, IPG Photonics Corporation, Andritz AG*List Not Exhaustive, Xiamen Tmax Battery Equipments Limited, Wuxi Lead Intelligent Equipment Co Ltd .

3. What are the main segments of the North America Battery Manufacturing Equipment Market?

The market segments include Machine Type, End User, Geograph.

4. Can you provide details about the market size?

The market size is estimated to be USD 9.77 billion as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing Investments in Water Treatment by Developing Countries4.; Growing Demand for the Various End-Use Sectors.

6. What are the notable trends driving market growth?

Automotive Segment to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; Availability of Cheap and Alternative Pumps.

8. Can you provide examples of recent developments in the market?

In December 2022, General Motors and LG Energy Solution will spend an additional USD 275 million in their joint venture battery plant in Tennessee to increase production by more than 40%. The joint venture, Ultium Cells LLC, announced that the new investment is in addition to the USD 2.3 billion announced in April 2021 to build the 2.8 million-square-foot facility. Production at the plant is expected to begin in late 2023.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion and volume, measured in Gigawatt.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Battery Manufacturing Equipment Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Battery Manufacturing Equipment Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Battery Manufacturing Equipment Market?

To stay informed about further developments, trends, and reports in the North America Battery Manufacturing Equipment Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence