Key Insights

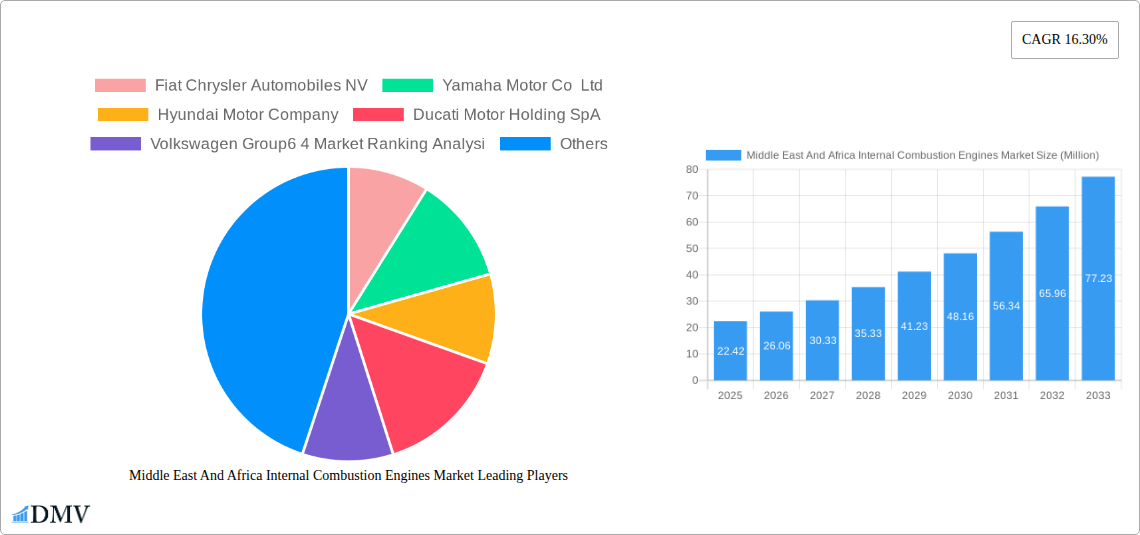

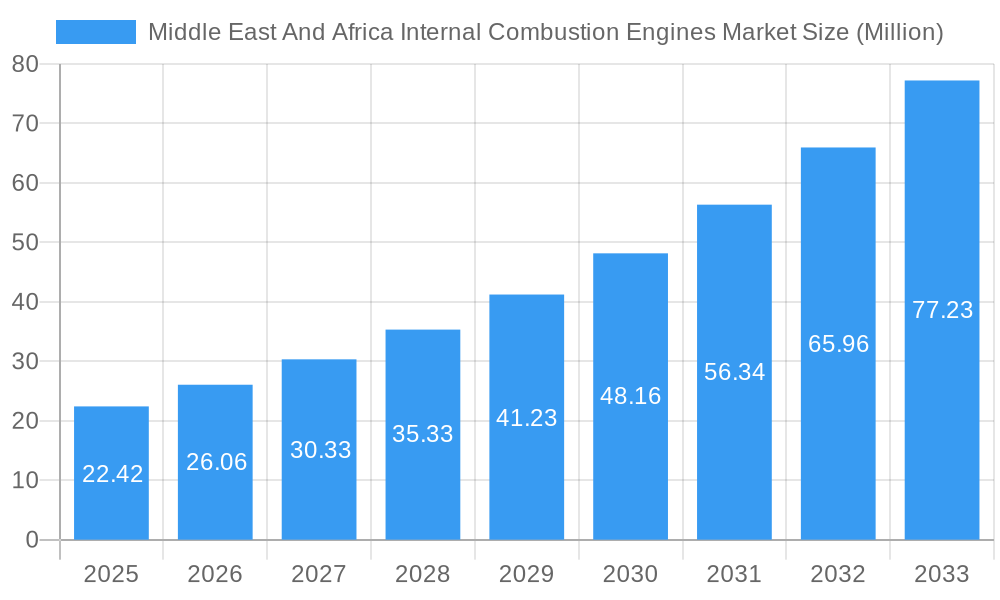

The Middle East and Africa Internal Combustion Engine (ICE) market, valued at $22.42 million in 2025, is projected to experience robust growth, driven by increasing vehicle production and infrastructure development across the region. A Compound Annual Growth Rate (CAGR) of 16.30% is anticipated from 2025 to 2033, indicating significant market expansion. Key drivers include rising urbanization, growing disposable incomes leading to increased vehicle ownership, and the expanding transportation and construction sectors. However, the market faces constraints such as fluctuating oil prices, government regulations promoting electric vehicles (EVs), and the intermittent availability of quality maintenance services in certain regions. Segmentation reveals strong demand across various engine capacities, with the 201-800 cm³ segment potentially dominating due to its suitability for a wide range of vehicles popular in the region. Gasoline engines currently hold the largest market share within the fuel type segment, though the "Others" category (potentially encompassing alternative fuels like LPG or biofuels) may see increased adoption driven by environmental concerns and government incentives. Major players like Fiat Chrysler Automobiles, Yamaha Motor Co Ltd, and Hyundai Motor Company are actively competing in this dynamic market, focusing on technological advancements and localized production to capture market share. Regional variations are expected, with countries like South Africa, Kenya, and others in North Africa experiencing higher growth rates due to their relatively larger economies and higher vehicle penetration.

Middle East And Africa Internal Combustion Engines Market Market Size (In Million)

The forecast period (2025-2033) presents considerable opportunities for ICE manufacturers, particularly those focusing on fuel efficiency and incorporating advanced emission control technologies. However, the long-term outlook suggests a gradual shift towards alternative fuel vehicles, making it crucial for manufacturers to adapt strategies and invest in research and development to ensure sustained growth in the face of evolving regulatory landscapes and consumer preferences. While the immediate future remains dominated by ICE technology, the long-term viability relies on adaptation and diversification within the market. Companies will need to carefully balance immediate market demands with long-term sustainability considerations. Specific regional focus within Africa, targeting infrastructure development and addressing the maintenance gap, will be paramount for sustained success.

Middle East And Africa Internal Combustion Engines Market Company Market Share

Middle East & Africa Internal Combustion Engines Market: A Comprehensive Report (2019-2033)

This insightful report provides a detailed analysis of the Middle East and Africa Internal Combustion Engines market, offering a comprehensive overview of its current state, future trajectory, and key players. Spanning the period from 2019 to 2033, with a base year of 2025 and a forecast period from 2025 to 2033, this report is essential for stakeholders seeking to understand and navigate this dynamic market. The market is segmented by capacity (50 cm3 to 200 cm3, 201 cm3 to 800 cm3, 801 cm3 to 1500 cm3, 1501 cm3 to 3000 cm3) and fuel type (Gasoline, Diesel, Others). Expect robust data analysis and actionable insights to help inform your strategic decisions. The report's total market value in 2025 is estimated at xx Million USD.

Middle East And Africa Internal Combustion Engines Market Market Composition & Trends

This section delves into the intricate structure of the Middle East and Africa Internal Combustion Engines market. We analyze market concentration, revealing the dominance of key players and their respective market share distribution. Innovation catalysts, such as technological advancements and evolving consumer preferences, are thoroughly examined. The regulatory landscape, including government policies and emission standards, is discussed, along with an assessment of substitute products, such as electric and hybrid vehicles, and their potential impact. End-user profiles across various sectors—automotive, industrial, and others—are profiled, providing a comprehensive understanding of demand dynamics. Finally, a detailed analysis of recent M&A activities, including deal values (estimated at xx Million USD in 2024), shapes a clear picture of the competitive dynamics and strategic shifts within the market.

- Market Concentration: Analysis of market share distribution amongst top players (e.g., top 5 players hold xx% of market share).

- Innovation Catalysts: Detailed examination of technological advancements, focusing on engine efficiency and emission reduction technologies.

- Regulatory Landscape: In-depth study of emission norms and government regulations impacting market growth.

- Substitute Products: Assessment of the market share and potential growth of electric and hybrid vehicles.

- End-User Profiles: Profiling of key end-use sectors and their respective consumption patterns.

- M&A Activities: Review of major mergers and acquisitions, including transaction values and strategic implications.

Middle East And Africa Internal Combustion Engines Market Industry Evolution

This section presents a detailed analysis of the evolutionary path of the Middle East and Africa Internal Combustion Engines market. We trace the market's growth trajectory from 2019 to 2024, highlighting significant milestones and identifying key factors driving its expansion. The report analyzes technological advancements, including the adoption of fuel-efficient and emission-control technologies, and how these innovations have shaped market trends. Furthermore, the evolving consumer demands, particularly the increasing preference for fuel-efficient and environmentally friendly vehicles, are scrutinized. The report quantifies this evolution with specific growth rates (e.g., a CAGR of xx% from 2019-2024 and a projected CAGR of xx% from 2025-2033) and adoption metrics for key technologies, providing a clear picture of the market's dynamic transformation. Analysis of factors such as increasing urbanization, infrastructure development, and economic growth impacting market growth are also included.

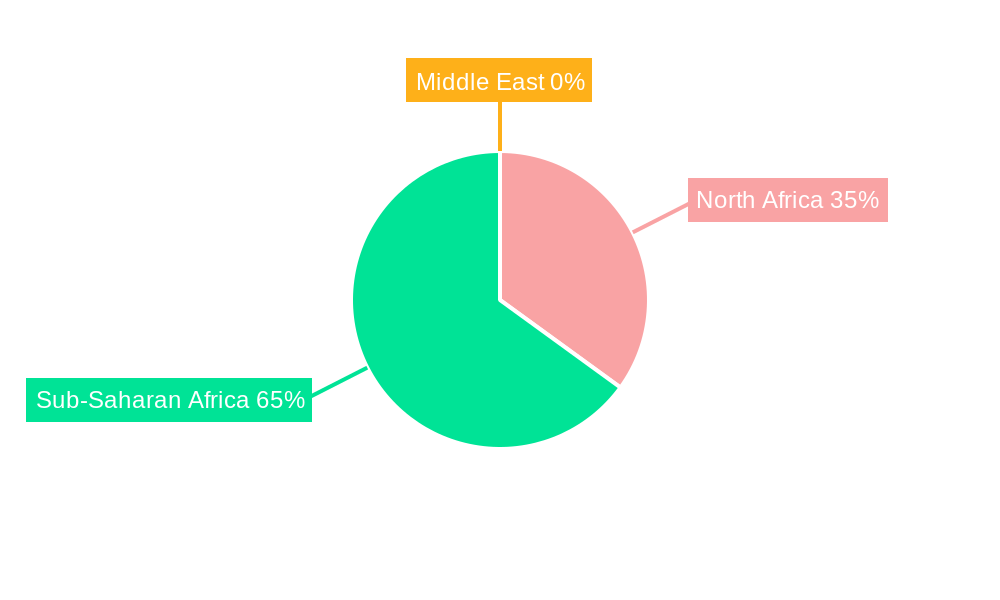

Leading Regions, Countries, or Segments in Middle East And Africa Internal Combustion Engines Market

This section identifies the dominant regions, countries, and segments within the Middle East and Africa Internal Combustion Engines market. We analyze performance across different capacity segments (50 cm3 to 200 cm3, 201 cm3 to 800 cm3, 801 cm3 to 1500 cm3, 1501 cm3 to 3000 cm3) and fuel types (Gasoline, Diesel, Others). The analysis will detail the factors contributing to the dominance of specific segments and regions.

Key Drivers (By Capacity & Fuel Type):

- Investment trends in specific engine capacity segments.

- Government regulations and policies favoring specific fuel types.

- Infrastructure development supporting specific engine applications.

- Consumer preferences across different regions.

Dominance Factors: Paragraphs explaining the factors behind the leading segments' strong performance, including market size, growth potential, and key applications. For example, the strong performance of the gasoline engine segment in a specific region might be attributed to existing infrastructure, affordability, or consumer preference. Similar analysis will be performed for other segments and regions.

Middle East And Africa Internal Combustion Engines Market Product Innovations

This section showcases recent product innovations, highlighting their applications and performance metrics. We detail unique selling propositions (USPs) of new engines, focusing on improvements in fuel efficiency, emission control, and durability. Technological advancements such as the integration of advanced materials and manufacturing processes are examined, with an emphasis on how these innovations enhance engine performance and meet evolving market demands. Examples of specific innovative features, such as variable valve timing or advanced combustion technologies, and their market impact will be highlighted.

Propelling Factors for Middle East And Africa Internal Combustion Engines Market Growth

Several factors are driving the growth of the Middle East and Africa Internal Combustion Engines market. Economic expansion in several regions fuels demand for vehicles and industrial machinery. Technological advancements, such as improvements in fuel efficiency and emission control, are leading to a more sustainable and cost-effective market. Favorable government policies and regulations supporting the automotive industry create an environment conducive to growth. The continued demand for affordable transportation solutions in developing countries is also a key factor.

Obstacles in the Middle East And Africa Internal Combustion Engines Market Market

Despite the market's potential, several obstacles hinder its growth. Stringent emission regulations, increasing pressure for greener transportation solutions, and the growing popularity of electric vehicles pose challenges. Supply chain disruptions caused by global events can impact production and availability of parts. Intense competition from established and new entrants in the market creates pressure on pricing and profitability. These factors can negatively impact market growth and the profitability of companies operating within the market. Quantifiable impacts will be provided where possible.

Future Opportunities in Middle East And Africa Internal Combustion Engines Market

Despite the challenges, significant opportunities exist for growth. The increasing demand for light commercial vehicles and agricultural machinery in the Middle East and Africa creates potential. The development of advanced internal combustion engines that meet stricter emission norms opens new avenues. Focus on improving engine efficiency and integrating advanced technologies like hybrid powertrains can attract consumers seeking greener options. Expansion into underserved markets, technological advancements, and adaptation to evolving consumer trends present considerable growth opportunities.

Major Players in the Middle East And Africa Internal Combustion Engines Market Ecosystem

- Fiat Chrysler Automobiles NV

- Yamaha Motor Co Ltd

- Hyundai Motor Company

- Ducati Motor Holding SpA

- Volkswagen Group

- Toyota Motor Corporation

- Volvo AB

- Suzuki Motor Corp

- Ford Motor Company

- Man SE

Key Developments in Middle East And Africa Internal Combustion Engines Market Industry

- November 2023: Ford Motor Company's South African subsidiary announced a ZAR 5.2 billion (USD 281 Million) investment in hybrid vehicle production, highlighting the shift towards greener technologies and the need for supportive government policies.

- May 2023: Inter Emirates Motors (IEM) launched a hybrid MG HS PHEV in the UAE, showcasing the growing adoption of hybrid technology within the region, driven by fuel efficiency and environmental concerns.

Strategic Middle East And Africa Internal Combustion Engines Market Market Forecast

The Middle East and Africa Internal Combustion Engines market is poised for significant growth, driven by factors discussed earlier. While the transition to electric vehicles presents a challenge, the continuing demand for affordable and reliable transportation, especially in developing economies, ensures a substantial market for internal combustion engines in the foreseeable future. Continued innovation in engine technology, focusing on fuel efficiency and emission reduction, will be critical for sustained market success. The report offers detailed market forecasts for the period 2025-2033, providing insights into future market potential and growth catalysts.

Middle East And Africa Internal Combustion Engines Market Segmentation

-

1. Capacity

- 1.1. 50 cm3 to 200 cm3

- 1.2. 201 cm3 to 800 cm3

- 1.3. 801 cm3 to 1500 cm3

- 1.4. 1501 cm3 to 3000 cm3

-

2. Fuel Type

- 2.1. Gasoline

- 2.2. Diesel

- 2.3. Others

-

3. Geogr

- 3.1. United Arab Emirates

- 3.2. Kuwait

- 3.3. Qatar

- 3.4. Nigeria

- 3.5. Egypt

- 3.6. Saudi Arabia

- 3.7. Rest of the Middle East and Africa

Middle East And Africa Internal Combustion Engines Market Segmentation By Geography

- 1. United Arab Emirates

- 2. Kuwait

- 3. Qatar

- 4. Nigeria

- 5. Egypt

- 6. Saudi Arabia

- 7. Rest of the Middle East and Africa

Middle East And Africa Internal Combustion Engines Market Regional Market Share

Geographic Coverage of Middle East And Africa Internal Combustion Engines Market

Middle East And Africa Internal Combustion Engines Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 16.30% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Growing Demand for for Two-wheelers4.; Rising Demand for Power Production

- 3.3. Market Restrains

- 3.3.1. 4.; Rising Demand for Non-GHG

- 3.4. Market Trends

- 3.4.1. The Diesel Fuel Type Segment to Witness Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Middle East And Africa Internal Combustion Engines Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Capacity

- 5.1.1. 50 cm3 to 200 cm3

- 5.1.2. 201 cm3 to 800 cm3

- 5.1.3. 801 cm3 to 1500 cm3

- 5.1.4. 1501 cm3 to 3000 cm3

- 5.2. Market Analysis, Insights and Forecast - by Fuel Type

- 5.2.1. Gasoline

- 5.2.2. Diesel

- 5.2.3. Others

- 5.3. Market Analysis, Insights and Forecast - by Geogr

- 5.3.1. United Arab Emirates

- 5.3.2. Kuwait

- 5.3.3. Qatar

- 5.3.4. Nigeria

- 5.3.5. Egypt

- 5.3.6. Saudi Arabia

- 5.3.7. Rest of the Middle East and Africa

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. United Arab Emirates

- 5.4.2. Kuwait

- 5.4.3. Qatar

- 5.4.4. Nigeria

- 5.4.5. Egypt

- 5.4.6. Saudi Arabia

- 5.4.7. Rest of the Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Capacity

- 6. United Arab Emirates Middle East And Africa Internal Combustion Engines Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Capacity

- 6.1.1. 50 cm3 to 200 cm3

- 6.1.2. 201 cm3 to 800 cm3

- 6.1.3. 801 cm3 to 1500 cm3

- 6.1.4. 1501 cm3 to 3000 cm3

- 6.2. Market Analysis, Insights and Forecast - by Fuel Type

- 6.2.1. Gasoline

- 6.2.2. Diesel

- 6.2.3. Others

- 6.3. Market Analysis, Insights and Forecast - by Geogr

- 6.3.1. United Arab Emirates

- 6.3.2. Kuwait

- 6.3.3. Qatar

- 6.3.4. Nigeria

- 6.3.5. Egypt

- 6.3.6. Saudi Arabia

- 6.3.7. Rest of the Middle East and Africa

- 6.1. Market Analysis, Insights and Forecast - by Capacity

- 7. Kuwait Middle East And Africa Internal Combustion Engines Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Capacity

- 7.1.1. 50 cm3 to 200 cm3

- 7.1.2. 201 cm3 to 800 cm3

- 7.1.3. 801 cm3 to 1500 cm3

- 7.1.4. 1501 cm3 to 3000 cm3

- 7.2. Market Analysis, Insights and Forecast - by Fuel Type

- 7.2.1. Gasoline

- 7.2.2. Diesel

- 7.2.3. Others

- 7.3. Market Analysis, Insights and Forecast - by Geogr

- 7.3.1. United Arab Emirates

- 7.3.2. Kuwait

- 7.3.3. Qatar

- 7.3.4. Nigeria

- 7.3.5. Egypt

- 7.3.6. Saudi Arabia

- 7.3.7. Rest of the Middle East and Africa

- 7.1. Market Analysis, Insights and Forecast - by Capacity

- 8. Qatar Middle East And Africa Internal Combustion Engines Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Capacity

- 8.1.1. 50 cm3 to 200 cm3

- 8.1.2. 201 cm3 to 800 cm3

- 8.1.3. 801 cm3 to 1500 cm3

- 8.1.4. 1501 cm3 to 3000 cm3

- 8.2. Market Analysis, Insights and Forecast - by Fuel Type

- 8.2.1. Gasoline

- 8.2.2. Diesel

- 8.2.3. Others

- 8.3. Market Analysis, Insights and Forecast - by Geogr

- 8.3.1. United Arab Emirates

- 8.3.2. Kuwait

- 8.3.3. Qatar

- 8.3.4. Nigeria

- 8.3.5. Egypt

- 8.3.6. Saudi Arabia

- 8.3.7. Rest of the Middle East and Africa

- 8.1. Market Analysis, Insights and Forecast - by Capacity

- 9. Nigeria Middle East And Africa Internal Combustion Engines Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Capacity

- 9.1.1. 50 cm3 to 200 cm3

- 9.1.2. 201 cm3 to 800 cm3

- 9.1.3. 801 cm3 to 1500 cm3

- 9.1.4. 1501 cm3 to 3000 cm3

- 9.2. Market Analysis, Insights and Forecast - by Fuel Type

- 9.2.1. Gasoline

- 9.2.2. Diesel

- 9.2.3. Others

- 9.3. Market Analysis, Insights and Forecast - by Geogr

- 9.3.1. United Arab Emirates

- 9.3.2. Kuwait

- 9.3.3. Qatar

- 9.3.4. Nigeria

- 9.3.5. Egypt

- 9.3.6. Saudi Arabia

- 9.3.7. Rest of the Middle East and Africa

- 9.1. Market Analysis, Insights and Forecast - by Capacity

- 10. Egypt Middle East And Africa Internal Combustion Engines Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Capacity

- 10.1.1. 50 cm3 to 200 cm3

- 10.1.2. 201 cm3 to 800 cm3

- 10.1.3. 801 cm3 to 1500 cm3

- 10.1.4. 1501 cm3 to 3000 cm3

- 10.2. Market Analysis, Insights and Forecast - by Fuel Type

- 10.2.1. Gasoline

- 10.2.2. Diesel

- 10.2.3. Others

- 10.3. Market Analysis, Insights and Forecast - by Geogr

- 10.3.1. United Arab Emirates

- 10.3.2. Kuwait

- 10.3.3. Qatar

- 10.3.4. Nigeria

- 10.3.5. Egypt

- 10.3.6. Saudi Arabia

- 10.3.7. Rest of the Middle East and Africa

- 10.1. Market Analysis, Insights and Forecast - by Capacity

- 11. Saudi Arabia Middle East And Africa Internal Combustion Engines Market Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Capacity

- 11.1.1. 50 cm3 to 200 cm3

- 11.1.2. 201 cm3 to 800 cm3

- 11.1.3. 801 cm3 to 1500 cm3

- 11.1.4. 1501 cm3 to 3000 cm3

- 11.2. Market Analysis, Insights and Forecast - by Fuel Type

- 11.2.1. Gasoline

- 11.2.2. Diesel

- 11.2.3. Others

- 11.3. Market Analysis, Insights and Forecast - by Geogr

- 11.3.1. United Arab Emirates

- 11.3.2. Kuwait

- 11.3.3. Qatar

- 11.3.4. Nigeria

- 11.3.5. Egypt

- 11.3.6. Saudi Arabia

- 11.3.7. Rest of the Middle East and Africa

- 11.1. Market Analysis, Insights and Forecast - by Capacity

- 12. Rest of the Middle East and Africa Middle East And Africa Internal Combustion Engines Market Analysis, Insights and Forecast, 2020-2032

- 12.1. Market Analysis, Insights and Forecast - by Capacity

- 12.1.1. 50 cm3 to 200 cm3

- 12.1.2. 201 cm3 to 800 cm3

- 12.1.3. 801 cm3 to 1500 cm3

- 12.1.4. 1501 cm3 to 3000 cm3

- 12.2. Market Analysis, Insights and Forecast - by Fuel Type

- 12.2.1. Gasoline

- 12.2.2. Diesel

- 12.2.3. Others

- 12.3. Market Analysis, Insights and Forecast - by Geogr

- 12.3.1. United Arab Emirates

- 12.3.2. Kuwait

- 12.3.3. Qatar

- 12.3.4. Nigeria

- 12.3.5. Egypt

- 12.3.6. Saudi Arabia

- 12.3.7. Rest of the Middle East and Africa

- 12.1. Market Analysis, Insights and Forecast - by Capacity

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2025

- 13.2. Company Profiles

- 13.2.1 Fiat Chrysler Automobiles NV

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 Yamaha Motor Co Ltd

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 Hyundai Motor Company

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 Ducati Motor Holding SpA

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 Volkswagen Group6 4 Market Ranking Analysi

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 Toyota Motor Corporation

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 Volvo AB

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 Suzuki Motor Corp

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 Ford Motor Company

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.10 Man SE

- 13.2.10.1. Overview

- 13.2.10.2. Products

- 13.2.10.3. SWOT Analysis

- 13.2.10.4. Recent Developments

- 13.2.10.5. Financials (Based on Availability)

- 13.2.1 Fiat Chrysler Automobiles NV

List of Figures

- Figure 1: Middle East And Africa Internal Combustion Engines Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Middle East And Africa Internal Combustion Engines Market Share (%) by Company 2025

List of Tables

- Table 1: Middle East And Africa Internal Combustion Engines Market Revenue Million Forecast, by Capacity 2020 & 2033

- Table 2: Middle East And Africa Internal Combustion Engines Market Volume K Units Forecast, by Capacity 2020 & 2033

- Table 3: Middle East And Africa Internal Combustion Engines Market Revenue Million Forecast, by Fuel Type 2020 & 2033

- Table 4: Middle East And Africa Internal Combustion Engines Market Volume K Units Forecast, by Fuel Type 2020 & 2033

- Table 5: Middle East And Africa Internal Combustion Engines Market Revenue Million Forecast, by Geogr 2020 & 2033

- Table 6: Middle East And Africa Internal Combustion Engines Market Volume K Units Forecast, by Geogr 2020 & 2033

- Table 7: Middle East And Africa Internal Combustion Engines Market Revenue Million Forecast, by Region 2020 & 2033

- Table 8: Middle East And Africa Internal Combustion Engines Market Volume K Units Forecast, by Region 2020 & 2033

- Table 9: Middle East And Africa Internal Combustion Engines Market Revenue Million Forecast, by Capacity 2020 & 2033

- Table 10: Middle East And Africa Internal Combustion Engines Market Volume K Units Forecast, by Capacity 2020 & 2033

- Table 11: Middle East And Africa Internal Combustion Engines Market Revenue Million Forecast, by Fuel Type 2020 & 2033

- Table 12: Middle East And Africa Internal Combustion Engines Market Volume K Units Forecast, by Fuel Type 2020 & 2033

- Table 13: Middle East And Africa Internal Combustion Engines Market Revenue Million Forecast, by Geogr 2020 & 2033

- Table 14: Middle East And Africa Internal Combustion Engines Market Volume K Units Forecast, by Geogr 2020 & 2033

- Table 15: Middle East And Africa Internal Combustion Engines Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Middle East And Africa Internal Combustion Engines Market Volume K Units Forecast, by Country 2020 & 2033

- Table 17: Middle East And Africa Internal Combustion Engines Market Revenue Million Forecast, by Capacity 2020 & 2033

- Table 18: Middle East And Africa Internal Combustion Engines Market Volume K Units Forecast, by Capacity 2020 & 2033

- Table 19: Middle East And Africa Internal Combustion Engines Market Revenue Million Forecast, by Fuel Type 2020 & 2033

- Table 20: Middle East And Africa Internal Combustion Engines Market Volume K Units Forecast, by Fuel Type 2020 & 2033

- Table 21: Middle East And Africa Internal Combustion Engines Market Revenue Million Forecast, by Geogr 2020 & 2033

- Table 22: Middle East And Africa Internal Combustion Engines Market Volume K Units Forecast, by Geogr 2020 & 2033

- Table 23: Middle East And Africa Internal Combustion Engines Market Revenue Million Forecast, by Country 2020 & 2033

- Table 24: Middle East And Africa Internal Combustion Engines Market Volume K Units Forecast, by Country 2020 & 2033

- Table 25: Middle East And Africa Internal Combustion Engines Market Revenue Million Forecast, by Capacity 2020 & 2033

- Table 26: Middle East And Africa Internal Combustion Engines Market Volume K Units Forecast, by Capacity 2020 & 2033

- Table 27: Middle East And Africa Internal Combustion Engines Market Revenue Million Forecast, by Fuel Type 2020 & 2033

- Table 28: Middle East And Africa Internal Combustion Engines Market Volume K Units Forecast, by Fuel Type 2020 & 2033

- Table 29: Middle East And Africa Internal Combustion Engines Market Revenue Million Forecast, by Geogr 2020 & 2033

- Table 30: Middle East And Africa Internal Combustion Engines Market Volume K Units Forecast, by Geogr 2020 & 2033

- Table 31: Middle East And Africa Internal Combustion Engines Market Revenue Million Forecast, by Country 2020 & 2033

- Table 32: Middle East And Africa Internal Combustion Engines Market Volume K Units Forecast, by Country 2020 & 2033

- Table 33: Middle East And Africa Internal Combustion Engines Market Revenue Million Forecast, by Capacity 2020 & 2033

- Table 34: Middle East And Africa Internal Combustion Engines Market Volume K Units Forecast, by Capacity 2020 & 2033

- Table 35: Middle East And Africa Internal Combustion Engines Market Revenue Million Forecast, by Fuel Type 2020 & 2033

- Table 36: Middle East And Africa Internal Combustion Engines Market Volume K Units Forecast, by Fuel Type 2020 & 2033

- Table 37: Middle East And Africa Internal Combustion Engines Market Revenue Million Forecast, by Geogr 2020 & 2033

- Table 38: Middle East And Africa Internal Combustion Engines Market Volume K Units Forecast, by Geogr 2020 & 2033

- Table 39: Middle East And Africa Internal Combustion Engines Market Revenue Million Forecast, by Country 2020 & 2033

- Table 40: Middle East And Africa Internal Combustion Engines Market Volume K Units Forecast, by Country 2020 & 2033

- Table 41: Middle East And Africa Internal Combustion Engines Market Revenue Million Forecast, by Capacity 2020 & 2033

- Table 42: Middle East And Africa Internal Combustion Engines Market Volume K Units Forecast, by Capacity 2020 & 2033

- Table 43: Middle East And Africa Internal Combustion Engines Market Revenue Million Forecast, by Fuel Type 2020 & 2033

- Table 44: Middle East And Africa Internal Combustion Engines Market Volume K Units Forecast, by Fuel Type 2020 & 2033

- Table 45: Middle East And Africa Internal Combustion Engines Market Revenue Million Forecast, by Geogr 2020 & 2033

- Table 46: Middle East And Africa Internal Combustion Engines Market Volume K Units Forecast, by Geogr 2020 & 2033

- Table 47: Middle East And Africa Internal Combustion Engines Market Revenue Million Forecast, by Country 2020 & 2033

- Table 48: Middle East And Africa Internal Combustion Engines Market Volume K Units Forecast, by Country 2020 & 2033

- Table 49: Middle East And Africa Internal Combustion Engines Market Revenue Million Forecast, by Capacity 2020 & 2033

- Table 50: Middle East And Africa Internal Combustion Engines Market Volume K Units Forecast, by Capacity 2020 & 2033

- Table 51: Middle East And Africa Internal Combustion Engines Market Revenue Million Forecast, by Fuel Type 2020 & 2033

- Table 52: Middle East And Africa Internal Combustion Engines Market Volume K Units Forecast, by Fuel Type 2020 & 2033

- Table 53: Middle East And Africa Internal Combustion Engines Market Revenue Million Forecast, by Geogr 2020 & 2033

- Table 54: Middle East And Africa Internal Combustion Engines Market Volume K Units Forecast, by Geogr 2020 & 2033

- Table 55: Middle East And Africa Internal Combustion Engines Market Revenue Million Forecast, by Country 2020 & 2033

- Table 56: Middle East And Africa Internal Combustion Engines Market Volume K Units Forecast, by Country 2020 & 2033

- Table 57: Middle East And Africa Internal Combustion Engines Market Revenue Million Forecast, by Capacity 2020 & 2033

- Table 58: Middle East And Africa Internal Combustion Engines Market Volume K Units Forecast, by Capacity 2020 & 2033

- Table 59: Middle East And Africa Internal Combustion Engines Market Revenue Million Forecast, by Fuel Type 2020 & 2033

- Table 60: Middle East And Africa Internal Combustion Engines Market Volume K Units Forecast, by Fuel Type 2020 & 2033

- Table 61: Middle East And Africa Internal Combustion Engines Market Revenue Million Forecast, by Geogr 2020 & 2033

- Table 62: Middle East And Africa Internal Combustion Engines Market Volume K Units Forecast, by Geogr 2020 & 2033

- Table 63: Middle East And Africa Internal Combustion Engines Market Revenue Million Forecast, by Country 2020 & 2033

- Table 64: Middle East And Africa Internal Combustion Engines Market Volume K Units Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Middle East And Africa Internal Combustion Engines Market?

The projected CAGR is approximately 16.30%.

2. Which companies are prominent players in the Middle East And Africa Internal Combustion Engines Market?

Key companies in the market include Fiat Chrysler Automobiles NV, Yamaha Motor Co Ltd, Hyundai Motor Company, Ducati Motor Holding SpA, Volkswagen Group6 4 Market Ranking Analysi, Toyota Motor Corporation, Volvo AB, Suzuki Motor Corp, Ford Motor Company, Man SE.

3. What are the main segments of the Middle East And Africa Internal Combustion Engines Market?

The market segments include Capacity, Fuel Type, Geogr.

4. Can you provide details about the market size?

The market size is estimated to be USD 22.42 Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Growing Demand for for Two-wheelers4.; Rising Demand for Power Production.

6. What are the notable trends driving market growth?

The Diesel Fuel Type Segment to Witness Significant Growth.

7. Are there any restraints impacting market growth?

4.; Rising Demand for Non-GHG.

8. Can you provide examples of recent developments in the market?

November 2023: The South African subsidiary of Ford Motor Company announced that it would invest ZAR 5.2 billion, or roughly USD 281 million, to produce a hybrid vehicle there. This substantial investment emphasizes the need for the South African government to create an effective vehicle policy in light of the world's swift transition to advanced car technology.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Units.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Middle East And Africa Internal Combustion Engines Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Middle East And Africa Internal Combustion Engines Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Middle East And Africa Internal Combustion Engines Market?

To stay informed about further developments, trends, and reports in the Middle East And Africa Internal Combustion Engines Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence