Key Insights

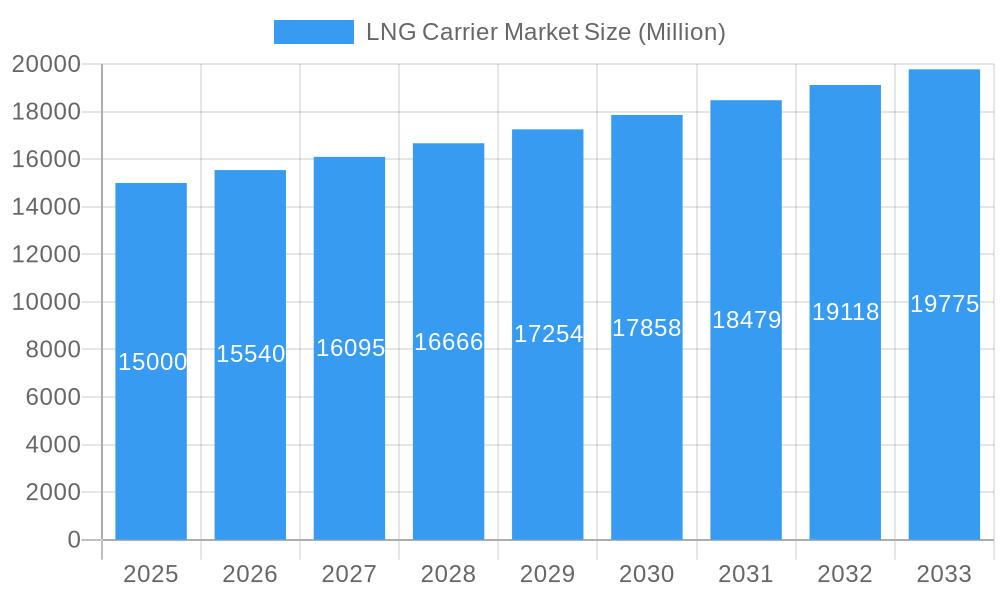

The LNG carrier market, currently valued at approximately $XX million (estimated based on the provided CAGR and market size), is experiencing robust growth, projected to maintain a Compound Annual Growth Rate (CAGR) exceeding 3.60% from 2025 to 2033. This expansion is driven by several factors, including the increasing global demand for liquefied natural gas (LNG) as a cleaner-burning alternative to traditional fossil fuels, coupled with significant investments in LNG infrastructure development, particularly in Asia-Pacific regions like China and India. The rising adoption of LNG as a marine fuel is further stimulating market growth, pushing demand for specialized LNG carriers equipped with advanced propulsion systems like ME-GI engines and dual-fuel options. However, market restraints include fluctuating LNG prices, geopolitical instability impacting trade routes, and the potential environmental concerns associated with LNG production and transportation, although these are being mitigated by technological advancements in containment and propulsion systems. Segment analysis reveals that the Moss and Membrane containment types dominate the market, while propulsion systems show a dynamic shift towards more efficient and environmentally friendly options. Major players, including shipbuilders like Samsung Heavy Industries, Daewoo Shipbuilding, and Kawasaki Heavy Industries, as well as LNG operators like Golar LNG and Mitsui OSK Lines, are heavily involved in shaping market dynamics through innovation and fleet expansion.

LNG Carrier Market Market Size (In Billion)

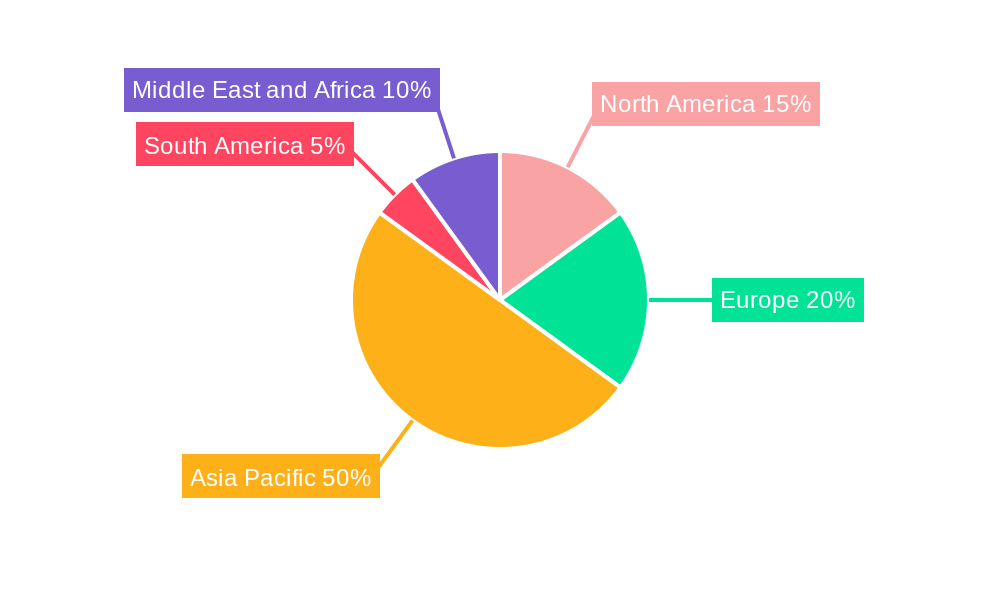

The regional breakdown indicates substantial growth opportunities in the Asia-Pacific region, driven by the strong demand from energy-hungry economies. Europe and North America also contribute significantly, though their market shares might be relatively more stable compared to the rapidly expanding Asian markets. The forecast period from 2025 to 2033 suggests a continuously expanding market, with further diversification in propulsion systems, containment technologies, and increased competition among major players. The overall outlook for the LNG carrier market remains positive, underpinned by the growing global reliance on natural gas and advancements in LNG carrier technology designed for enhanced efficiency and environmental sustainability. Further research into specific market segment growth rates and regional variations would provide a more detailed understanding of the nuances within this dynamic sector.

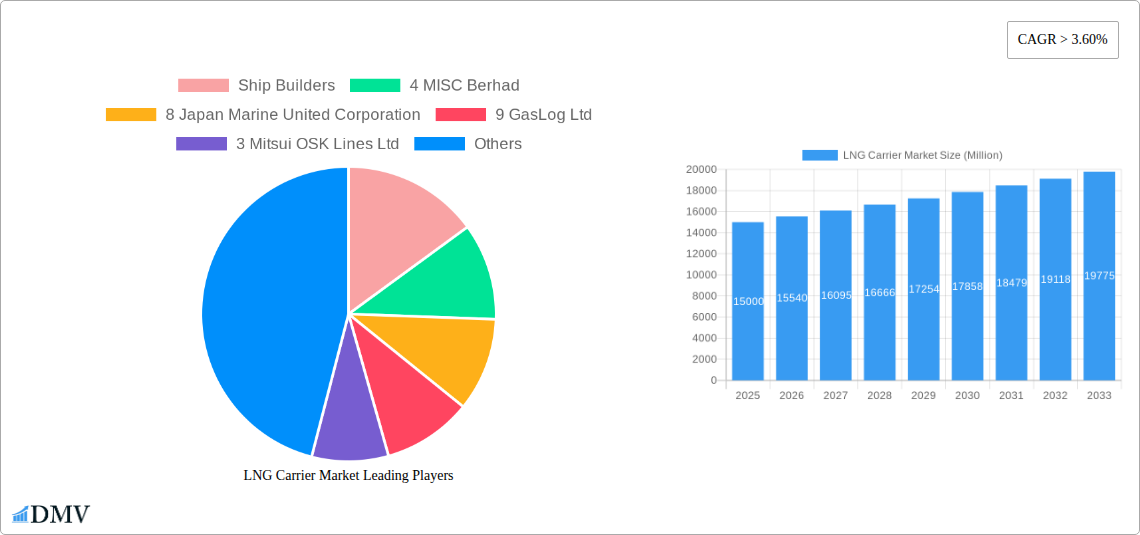

LNG Carrier Market Company Market Share

LNG Carrier Market: A Comprehensive Report (2019-2033)

This insightful report provides a detailed analysis of the LNG Carrier Market, covering the period from 2019 to 2033, with a focus on the year 2025. It examines market dynamics, technological advancements, key players, and future growth potential, equipping stakeholders with the knowledge needed to navigate this evolving sector. The report incorporates extensive market data and forecasts, providing valuable insights for strategic decision-making.

LNG Carrier Market Market Composition & Trends

The LNG carrier market is characterized by moderate concentration, with several major players dominating the shipbuilding and operation segments. Market share distribution among the top players fluctuates, influenced by new vessel orders, M&A activity, and technological innovation. Innovation in propulsion systems (such as ME-GI and TFDE) and containment technologies (Moss and Membrane) are key drivers. Stringent environmental regulations are reshaping the market, favoring fuel-efficient and environmentally friendly designs. Substitute products are limited, with LNG remaining the dominant fuel for long-haul transportation. End-users primarily include energy companies, with a growing emphasis on long-term contracts and strategic partnerships. The market witnessed significant M&A activity in recent years, with deal values reaching into the billions of dollars.

- Market Concentration: Moderately concentrated, with top 10 players holding approximately xx% of market share.

- Innovation Catalysts: Development of fuel-efficient propulsion systems (ME-GI, TFDE, SSD) and advanced containment technologies (Moss, Membrane).

- Regulatory Landscape: Stringent environmental regulations driving demand for greener technologies.

- Substitute Products: Limited substitutes for LNG transport, reinforcing market demand.

- End-User Profile: Primarily energy companies and LNG importers/exporters.

- M&A Activities: Significant M&A activity in recent years, with total deal values exceeding xx Million in the last 5 years.

LNG Carrier Market Industry Evolution

The LNG carrier market has experienced significant growth driven by the increasing global demand for natural gas and the ongoing expansion of LNG infrastructure. The market exhibited a CAGR of xx% during the historical period (2019-2024) and is projected to maintain a CAGR of xx% during the forecast period (2025-2033). This growth is primarily attributed to rising energy demand, particularly in Asia, coupled with the increasing adoption of LNG as a cleaner fuel source. Technological advancements, such as the development of larger and more efficient vessels, have played a crucial role in reducing transportation costs. Shifting consumer demands toward cleaner energy are also influencing the adoption of LNG as a fuel for power generation and transportation. The market is also witnessing increased focus on digitalization, enabling enhanced vessel management and optimized operations.

Leading Regions, Countries, or Segments in LNG Carrier Market

The Asia-Pacific region currently dominates the LNG carrier market, driven by high demand for natural gas and significant investments in LNG infrastructure. Several factors contribute to this dominance:

- Key Drivers:

- High natural gas demand from rapidly developing economies in Asia.

- Massive investment in LNG import terminals and infrastructure across the region.

- Supportive government policies promoting LNG as a cleaner energy source.

- Dominance Factors:

- Significant growth in LNG imports and exports.

- Strong presence of major LNG importers and exporters in the region.

- Development of specialized LNG carrier infrastructure and maintenance facilities.

Among the propulsion types, the Slow-Speed Diesel (SSD) and Dual Fuel Diesel Engine/Tri-Fuel Diesel Engine (DFDE/TFDE) segments currently hold the largest market share, due to their proven reliability and relatively lower initial cost. However, the M-type Electronically Controlled Gas Injection (ME-GI) segment is experiencing significant growth, driven by its superior fuel efficiency and lower emissions. For containment type, Moss and Membrane systems remain dominant owing to their established track record and proven efficacy.

LNG Carrier Market Product Innovations

Recent innovations in the LNG carrier market focus on improving fuel efficiency, reducing emissions, and enhancing operational safety. This includes advancements in propulsion systems, such as ME-GI engines, and improved containment technologies like the three-tank design announced by GTT in 2022. These innovations are resulting in significant improvements in vessel efficiency, leading to cost savings and reduced environmental impact. The industry is also embracing digitalization with smart vessel technologies improving route optimization, predictive maintenance, and real-time monitoring.

Propelling Factors for LNG Carrier Market Growth

Several factors are driving the growth of the LNG carrier market. The increasing global demand for natural gas, fuelled by the energy transition and growing industrialization, is a major catalyst. Government support for cleaner energy sources and investment in LNG infrastructure play a crucial role. Technological advancements leading to more efficient and environmentally friendly vessels further boost market growth.

Obstacles in the LNG Carrier Market Market

The LNG carrier market faces challenges, including volatile LNG prices impacting demand and potentially impacting profitability. Supply chain disruptions impacting the construction and maintenance of vessels can also lead to delays and cost overruns. Furthermore, intense competition among shipbuilders and operators necessitates continuous innovation and cost optimization. Finally, stricter environmental regulations could require substantial investments in emission reduction technologies.

Future Opportunities in LNG Carrier Market

Future opportunities lie in the expansion of LNG infrastructure in emerging markets, particularly in Africa and South America. Advancements in technologies like fuel cell propulsion and the development of smaller, more agile LNG carriers for shorter routes present exciting prospects. The increasing demand for LNG-powered vessels in shipping and bunkering presents another avenue for growth.

Major Players in the LNG Carrier Market Ecosystem

- MISC Berhad

- Japan Marine United Corporation

- GasLog Ltd

- Mitsui OSK Lines Ltd

- BW LPG

- STX Offshore and Shipbuilding CO LTD

- Daewoo Shipbuilding and Marine Engineering Co Ltd

- Kawasaki Heavy Industries Ltd

- Royal Dutch Shell PLC

- Nippon Yusen Kabushiki Kaisha

- Maran Gas Maritime Inc

- Seapeak

- Samsung Heavy Industries Co Ltd

- China Shipbuilding Trading Co Ltd

- Mitsubishi Heavy Industries Ltd

- Golar LNG

- Kawasaki Kisen Kaisha Ltd

- Hyundai Samho Heavy Industries Co Ltd

- HJ Shipbuilding & Construction Company Ltd

Key Developments in LNG Carrier Market Industry

- December 2022: GAIL (India) Ltd chartered a new LNG carrier from Mitsui O.S.K. Lines Ltd, built by Daewoo Shipbuilding & Marine Engineering Co Ltd, significantly increasing GAIL's LNG transportation capacity.

- October 2022: GTT's three-tank LNG carrier design received AiPs, promising cost reductions and improved efficiency in vessel construction.

Strategic LNG Carrier Market Market Forecast

The LNG carrier market is poised for continued growth, driven by increasing global LNG trade and the adoption of cleaner fuels. Future opportunities in emerging markets, technological innovation, and evolving regulations will shape the market landscape. Continued investment in new vessel construction and fleet modernization will be crucial for meeting future demand.

LNG Carrier Market Segmentation

-

1. Containment Type

- 1.1. Moss

- 1.2. Membrane

-

2. Propulsion Type

- 2.1. Steam Turbines

- 2.2. Dual Fue

- 2.3. Slow-Speed Diesel (SSD)

- 2.4. M-type E

- 2.5. XDF Two-stroke Engine

- 2.6. Steam Re-heat and Stage

LNG Carrier Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Rest of the North America

-

2. Asia Pacific

- 2.1. China

- 2.2. India

- 2.3. Japan

- 2.4. South Korea

- 2.5. Rest of the Asia Pacific

-

3. Europe

- 3.1. Germany

- 3.2. France

- 3.3. Spain

- 3.4. United Kingdom

- 3.5. Rest of the Europe

-

4. South America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Rest of the South America

-

5. Middle East and Africa

- 5.1. United Arab Emirates

- 5.2. Nigeria

- 5.3. Saudi Arabia

- 5.4. Rest of the Middle East and Africa

LNG Carrier Market Regional Market Share

Geographic Coverage of LNG Carrier Market

LNG Carrier Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.56% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increasing Natural Gas Demand4.; Rising Pipeline Network and Associated Infrastructure Development

- 3.3. Market Restrains

- 3.3.1. 4.; Rising Shift toward Renewable Energy

- 3.4. Market Trends

- 3.4.1. Membrane-Type Containment to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global LNG Carrier Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Containment Type

- 5.1.1. Moss

- 5.1.2. Membrane

- 5.2. Market Analysis, Insights and Forecast - by Propulsion Type

- 5.2.1. Steam Turbines

- 5.2.2. Dual Fue

- 5.2.3. Slow-Speed Diesel (SSD)

- 5.2.4. M-type E

- 5.2.5. XDF Two-stroke Engine

- 5.2.6. Steam Re-heat and Stage

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Asia Pacific

- 5.3.3. Europe

- 5.3.4. South America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Containment Type

- 6. North America LNG Carrier Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Containment Type

- 6.1.1. Moss

- 6.1.2. Membrane

- 6.2. Market Analysis, Insights and Forecast - by Propulsion Type

- 6.2.1. Steam Turbines

- 6.2.2. Dual Fue

- 6.2.3. Slow-Speed Diesel (SSD)

- 6.2.4. M-type E

- 6.2.5. XDF Two-stroke Engine

- 6.2.6. Steam Re-heat and Stage

- 6.1. Market Analysis, Insights and Forecast - by Containment Type

- 7. Asia Pacific LNG Carrier Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Containment Type

- 7.1.1. Moss

- 7.1.2. Membrane

- 7.2. Market Analysis, Insights and Forecast - by Propulsion Type

- 7.2.1. Steam Turbines

- 7.2.2. Dual Fue

- 7.2.3. Slow-Speed Diesel (SSD)

- 7.2.4. M-type E

- 7.2.5. XDF Two-stroke Engine

- 7.2.6. Steam Re-heat and Stage

- 7.1. Market Analysis, Insights and Forecast - by Containment Type

- 8. Europe LNG Carrier Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Containment Type

- 8.1.1. Moss

- 8.1.2. Membrane

- 8.2. Market Analysis, Insights and Forecast - by Propulsion Type

- 8.2.1. Steam Turbines

- 8.2.2. Dual Fue

- 8.2.3. Slow-Speed Diesel (SSD)

- 8.2.4. M-type E

- 8.2.5. XDF Two-stroke Engine

- 8.2.6. Steam Re-heat and Stage

- 8.1. Market Analysis, Insights and Forecast - by Containment Type

- 9. South America LNG Carrier Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Containment Type

- 9.1.1. Moss

- 9.1.2. Membrane

- 9.2. Market Analysis, Insights and Forecast - by Propulsion Type

- 9.2.1. Steam Turbines

- 9.2.2. Dual Fue

- 9.2.3. Slow-Speed Diesel (SSD)

- 9.2.4. M-type E

- 9.2.5. XDF Two-stroke Engine

- 9.2.6. Steam Re-heat and Stage

- 9.1. Market Analysis, Insights and Forecast - by Containment Type

- 10. Middle East and Africa LNG Carrier Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Containment Type

- 10.1.1. Moss

- 10.1.2. Membrane

- 10.2. Market Analysis, Insights and Forecast - by Propulsion Type

- 10.2.1. Steam Turbines

- 10.2.2. Dual Fue

- 10.2.3. Slow-Speed Diesel (SSD)

- 10.2.4. M-type E

- 10.2.5. XDF Two-stroke Engine

- 10.2.6. Steam Re-heat and Stage

- 10.1. Market Analysis, Insights and Forecast - by Containment Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Ship Builders

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 4 MISC Berhad

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 8 Japan Marine United Corporation

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 9 GasLog Ltd

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 3 Mitsui OSK Lines Ltd

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 8 BW LPG

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Ship Operators

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 4 STX Offshore and Shipbuilding CO LTD

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 3 Daewoo Shipbuilding and Marine Engineering Co Ltd

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 6 Kawasaki Heavy Industries Ltd

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 1 Royal Dutch Shell PLC

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 2 Nippon Yusen Kabushiki Kaisha

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 6 Maran Gas Maritime Inc

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 5 Seapeak

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 1 Samsung Heavy Industries Co Ltd

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 7 China Shipbuilding Trading Co Ltd

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.17 5 Mitsubishi Heavy Industries Ltd

- 11.2.17.1. Overview

- 11.2.17.2. Products

- 11.2.17.3. SWOT Analysis

- 11.2.17.4. Recent Developments

- 11.2.17.5. Financials (Based on Availability)

- 11.2.18 7 Golar LNG

- 11.2.18.1. Overview

- 11.2.18.2. Products

- 11.2.18.3. SWOT Analysis

- 11.2.18.4. Recent Developments

- 11.2.18.5. Financials (Based on Availability)

- 11.2.19 10 Kawasaki Kisen Kaisha Ltd *List Not Exhaustive

- 11.2.19.1. Overview

- 11.2.19.2. Products

- 11.2.19.3. SWOT Analysis

- 11.2.19.4. Recent Developments

- 11.2.19.5. Financials (Based on Availability)

- 11.2.20 2 Hyundai Samho Heavy Industries Co Ltd

- 11.2.20.1. Overview

- 11.2.20.2. Products

- 11.2.20.3. SWOT Analysis

- 11.2.20.4. Recent Developments

- 11.2.20.5. Financials (Based on Availability)

- 11.2.21 9 HJ Shipbuilding & Construction Company Ltd

- 11.2.21.1. Overview

- 11.2.21.2. Products

- 11.2.21.3. SWOT Analysis

- 11.2.21.4. Recent Developments

- 11.2.21.5. Financials (Based on Availability)

- 11.2.1 Ship Builders

List of Figures

- Figure 1: Global LNG Carrier Market Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: North America LNG Carrier Market Revenue (undefined), by Containment Type 2025 & 2033

- Figure 3: North America LNG Carrier Market Revenue Share (%), by Containment Type 2025 & 2033

- Figure 4: North America LNG Carrier Market Revenue (undefined), by Propulsion Type 2025 & 2033

- Figure 5: North America LNG Carrier Market Revenue Share (%), by Propulsion Type 2025 & 2033

- Figure 6: North America LNG Carrier Market Revenue (undefined), by Country 2025 & 2033

- Figure 7: North America LNG Carrier Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: Asia Pacific LNG Carrier Market Revenue (undefined), by Containment Type 2025 & 2033

- Figure 9: Asia Pacific LNG Carrier Market Revenue Share (%), by Containment Type 2025 & 2033

- Figure 10: Asia Pacific LNG Carrier Market Revenue (undefined), by Propulsion Type 2025 & 2033

- Figure 11: Asia Pacific LNG Carrier Market Revenue Share (%), by Propulsion Type 2025 & 2033

- Figure 12: Asia Pacific LNG Carrier Market Revenue (undefined), by Country 2025 & 2033

- Figure 13: Asia Pacific LNG Carrier Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe LNG Carrier Market Revenue (undefined), by Containment Type 2025 & 2033

- Figure 15: Europe LNG Carrier Market Revenue Share (%), by Containment Type 2025 & 2033

- Figure 16: Europe LNG Carrier Market Revenue (undefined), by Propulsion Type 2025 & 2033

- Figure 17: Europe LNG Carrier Market Revenue Share (%), by Propulsion Type 2025 & 2033

- Figure 18: Europe LNG Carrier Market Revenue (undefined), by Country 2025 & 2033

- Figure 19: Europe LNG Carrier Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: South America LNG Carrier Market Revenue (undefined), by Containment Type 2025 & 2033

- Figure 21: South America LNG Carrier Market Revenue Share (%), by Containment Type 2025 & 2033

- Figure 22: South America LNG Carrier Market Revenue (undefined), by Propulsion Type 2025 & 2033

- Figure 23: South America LNG Carrier Market Revenue Share (%), by Propulsion Type 2025 & 2033

- Figure 24: South America LNG Carrier Market Revenue (undefined), by Country 2025 & 2033

- Figure 25: South America LNG Carrier Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East and Africa LNG Carrier Market Revenue (undefined), by Containment Type 2025 & 2033

- Figure 27: Middle East and Africa LNG Carrier Market Revenue Share (%), by Containment Type 2025 & 2033

- Figure 28: Middle East and Africa LNG Carrier Market Revenue (undefined), by Propulsion Type 2025 & 2033

- Figure 29: Middle East and Africa LNG Carrier Market Revenue Share (%), by Propulsion Type 2025 & 2033

- Figure 30: Middle East and Africa LNG Carrier Market Revenue (undefined), by Country 2025 & 2033

- Figure 31: Middle East and Africa LNG Carrier Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global LNG Carrier Market Revenue undefined Forecast, by Containment Type 2020 & 2033

- Table 2: Global LNG Carrier Market Revenue undefined Forecast, by Propulsion Type 2020 & 2033

- Table 3: Global LNG Carrier Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 4: Global LNG Carrier Market Revenue undefined Forecast, by Containment Type 2020 & 2033

- Table 5: Global LNG Carrier Market Revenue undefined Forecast, by Propulsion Type 2020 & 2033

- Table 6: Global LNG Carrier Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 7: United States LNG Carrier Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 8: Canada LNG Carrier Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 9: Rest of the North America LNG Carrier Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 10: Global LNG Carrier Market Revenue undefined Forecast, by Containment Type 2020 & 2033

- Table 11: Global LNG Carrier Market Revenue undefined Forecast, by Propulsion Type 2020 & 2033

- Table 12: Global LNG Carrier Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 13: China LNG Carrier Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 14: India LNG Carrier Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 15: Japan LNG Carrier Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 16: South Korea LNG Carrier Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 17: Rest of the Asia Pacific LNG Carrier Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 18: Global LNG Carrier Market Revenue undefined Forecast, by Containment Type 2020 & 2033

- Table 19: Global LNG Carrier Market Revenue undefined Forecast, by Propulsion Type 2020 & 2033

- Table 20: Global LNG Carrier Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 21: Germany LNG Carrier Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 22: France LNG Carrier Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 23: Spain LNG Carrier Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 24: United Kingdom LNG Carrier Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 25: Rest of the Europe LNG Carrier Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 26: Global LNG Carrier Market Revenue undefined Forecast, by Containment Type 2020 & 2033

- Table 27: Global LNG Carrier Market Revenue undefined Forecast, by Propulsion Type 2020 & 2033

- Table 28: Global LNG Carrier Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 29: Brazil LNG Carrier Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 30: Argentina LNG Carrier Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 31: Rest of the South America LNG Carrier Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 32: Global LNG Carrier Market Revenue undefined Forecast, by Containment Type 2020 & 2033

- Table 33: Global LNG Carrier Market Revenue undefined Forecast, by Propulsion Type 2020 & 2033

- Table 34: Global LNG Carrier Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 35: United Arab Emirates LNG Carrier Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 36: Nigeria LNG Carrier Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 37: Saudi Arabia LNG Carrier Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 38: Rest of the Middle East and Africa LNG Carrier Market Revenue (undefined) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the LNG Carrier Market?

The projected CAGR is approximately 6.56%.

2. Which companies are prominent players in the LNG Carrier Market?

Key companies in the market include Ship Builders, 4 MISC Berhad, 8 Japan Marine United Corporation, 9 GasLog Ltd, 3 Mitsui OSK Lines Ltd, 8 BW LPG, Ship Operators, 4 STX Offshore and Shipbuilding CO LTD, 3 Daewoo Shipbuilding and Marine Engineering Co Ltd, 6 Kawasaki Heavy Industries Ltd, 1 Royal Dutch Shell PLC, 2 Nippon Yusen Kabushiki Kaisha, 6 Maran Gas Maritime Inc, 5 Seapeak, 1 Samsung Heavy Industries Co Ltd, 7 China Shipbuilding Trading Co Ltd, 5 Mitsubishi Heavy Industries Ltd, 7 Golar LNG, 10 Kawasaki Kisen Kaisha Ltd *List Not Exhaustive, 2 Hyundai Samho Heavy Industries Co Ltd, 9 HJ Shipbuilding & Construction Company Ltd.

3. What are the main segments of the LNG Carrier Market?

The market segments include Containment Type, Propulsion Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing Natural Gas Demand4.; Rising Pipeline Network and Associated Infrastructure Development.

6. What are the notable trends driving market growth?

Membrane-Type Containment to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; Rising Shift toward Renewable Energy.

8. Can you provide examples of recent developments in the market?

December 2022: GAIL (India) Ltd agreed to time charter a new liquefied natural gas (LNG) carrier with Japan's Mitsui O. S. K. Lines Ltd (MOL) and acquired a stake in an existing LNG carrier. The new LNG carrier, built by South Korea's Daewoo Shipbuilding & Marine Engineering Co Ltd, will be the second MOL Group LNG ship to serve GAIL and will commence time chartering in 2023.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "LNG Carrier Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the LNG Carrier Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the LNG Carrier Market?

To stay informed about further developments, trends, and reports in the LNG Carrier Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence