Key Insights

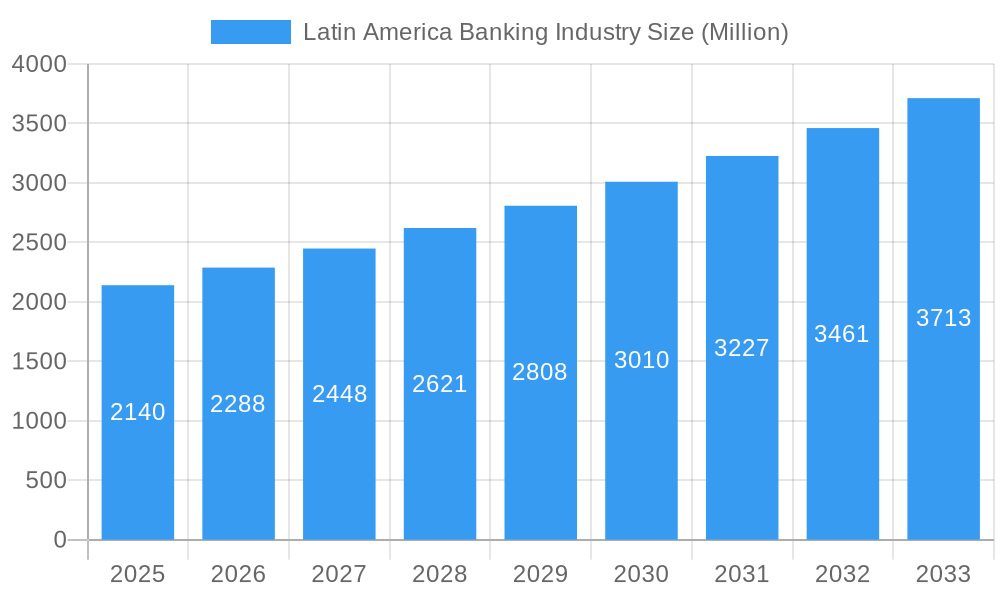

The Latin American banking industry, valued at $2.14 billion in 2025, is experiencing robust growth, projected to expand at a compound annual growth rate (CAGR) of 7% from 2025 to 2033. This expansion is fueled by several key drivers. The increasing adoption of digital banking and fintech solutions, particularly amongst younger demographics, is significantly accelerating financial inclusion across the region. Mobile penetration and improving internet infrastructure are creating fertile ground for innovative financial services like mobile banking, peer-to-peer payments, and digital lending platforms. Furthermore, the burgeoning entrepreneurial landscape and a growing middle class are driving demand for diverse financial products and services, bolstering the industry's overall growth. Government initiatives promoting financial literacy and access to credit also play a supportive role. However, challenges remain. Regulatory hurdles and varying levels of digital literacy across the region present obstacles to widespread adoption of new technologies. Competition from established players and emerging fintech companies is intensifying, creating a dynamic and ever-evolving market landscape.

Latin America Banking Industry Market Size (In Billion)

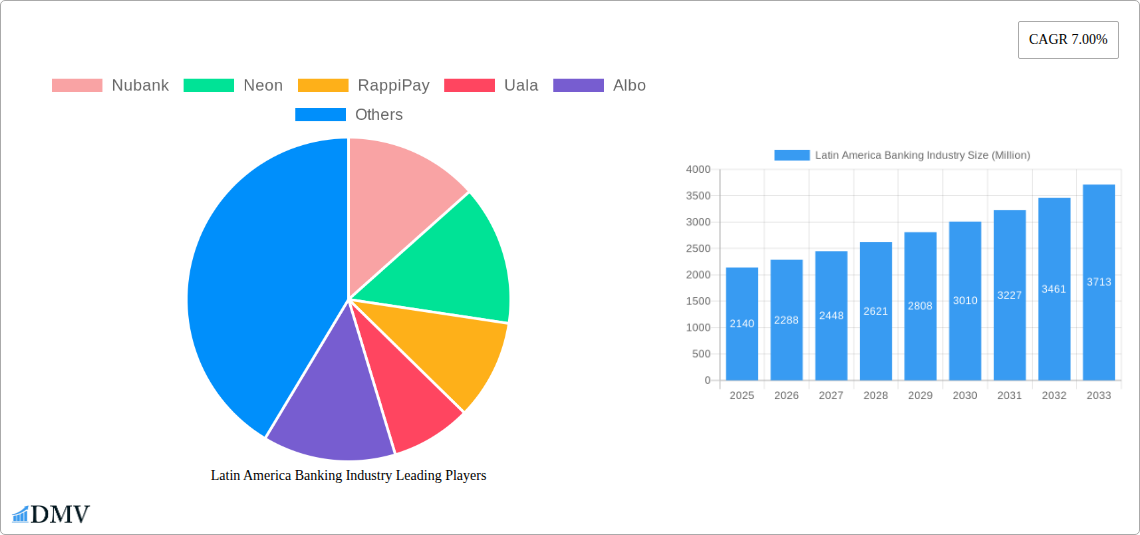

The competitive landscape is populated by a mix of established banks and innovative fintech disruptors. Traditional players like Banco Original SA are adapting to the digital revolution, while challenger banks such as Nubank, Neon, and RappiPay are rapidly gaining market share through user-friendly interfaces and tailored services. Companies like Uala, Albo, Broxel, Maximo, Cuenca, and Klar are further diversifying the offerings and strengthening the competitive intensity within the industry. While the precise regional market share for each player is not available, the data suggests a fragmented but rapidly consolidating market. The forecast period (2025-2033) will likely witness continued mergers and acquisitions as companies strive for scale and market dominance. Future success will hinge on the ability to adapt to evolving consumer preferences, effectively navigate regulatory complexities, and leverage technological advancements to drive innovation and financial inclusion across the diverse Latin American market.

Latin America Banking Industry Company Market Share

Latin America Banking Industry: A Comprehensive Market Report (2019-2033)

This insightful report provides a detailed analysis of the Latin America banking industry, encompassing market trends, competitive dynamics, technological advancements, and future growth prospects. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report offers critical insights for stakeholders, investors, and industry professionals seeking to navigate this dynamic market. The report analyzes key players such as Nubank, Neon, RappiPay, Uala, Albo, Broxel, Maximo, Cuenca, Klar, and Banco Original SA (list not exhaustive), providing a comprehensive understanding of the competitive landscape and emerging trends. The total market size is projected to reach xx Million by 2033.

Latin America Banking Industry Market Composition & Trends

This section delves into the intricate composition of the Latin American banking market, analyzing market concentration, innovation drivers, regulatory frameworks, substitute products, user demographics, and merger & acquisition (M&A) activity. The report examines the market share distribution among key players, revealing the dominance of certain players and the emergence of new competitors.

- Market Concentration: The market exhibits a mix of established players and rapidly growing fintech companies, leading to a moderately concentrated market. Traditional banks hold a significant share, but fintechs are rapidly gaining ground. We estimate that the top 5 players account for xx% of the market share in 2025.

- Innovation Catalysts: Open banking initiatives, mobile penetration, and growing demand for digital financial services are key catalysts driving innovation.

- Regulatory Landscape: Varying regulatory environments across different Latin American countries impact market dynamics. The report analyzes the specific regulatory landscape for each country, highlighting potential implications for businesses.

- Substitute Products: The rise of mobile payment platforms and alternative lending solutions present considerable challenges for traditional banking services.

- End-User Profiles: The report details the demographic and psychographic profile of end-users, identifying key customer segments and their evolving needs.

- M&A Activities: The report analyzes recent M&A activities, including deal values and their impact on market consolidation. Total M&A deal value for the period 2019-2024 is estimated at xx Million.

Latin America Banking Industry Industry Evolution

This section provides a comprehensive overview of the Latin American banking industry's evolution, examining market growth trajectories, technological advancements, and shifting consumer preferences. The report analyzes historical data (2019-2024) and forecasts future growth (2025-2033), providing insights into the industry's dynamic nature. It will discuss the impact of factors like increased smartphone penetration, the rise of digital banking, and regulatory changes on the overall growth trajectory. Growth rates are expected to average xx% annually during the forecast period, driven primarily by the expanding digital banking sector and increasing financial inclusion initiatives. Adoption rates for mobile banking and digital payments will be analyzed, highlighting the increasing reliance on digital channels for financial transactions.

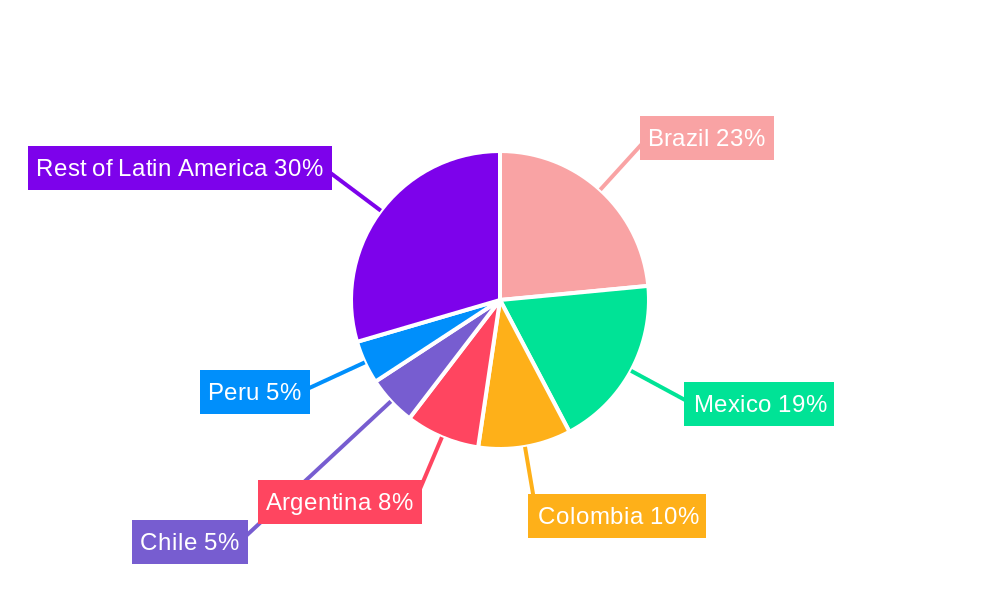

Leading Regions, Countries, or Segments in Latin America Banking Industry

This section identifies the leading regions, countries, or segments within the Latin American banking industry. The report pinpoints the dominant players and analyzes the factors contributing to their success.

- Key Drivers for Dominance:

- High mobile penetration rates

- Favorable regulatory environments

- Strong investment in Fintech infrastructure

- Growing demand for digital financial services

- Expanding middle class

- In-depth Analysis: The report will provide detailed explanations of the factors contributing to the dominance of specific regions or segments, examining economic indicators, regulatory support, and consumer behavior patterns. Brazil and Mexico are predicted to remain the leading markets, accounting for xx% of the total market value in 2025.

Latin America Banking Industry Product Innovations

The report highlights recent product innovations, including the expansion of digital banking platforms, the development of personalized financial solutions, and the integration of innovative technologies such as AI and blockchain. It analyzes the unique selling propositions of key products and assesses their performance metrics. The growing adoption of embedded finance, the integration of financial services into non-financial platforms like e-commerce and ride-hailing apps, is also considered. This is driving increased competition and product diversification within the industry.

Propelling Factors for Latin America Banking Industry Growth

Several factors are driving the growth of the Latin American banking industry. Technological advancements, such as the increasing adoption of mobile banking and digital payment solutions, are significantly impacting the sector. Furthermore, strong economic growth in certain regions is fostering demand for financial services, while supportive government regulations are promoting financial inclusion. The rise of fintech companies offering innovative solutions is another major driver.

Obstacles in the Latin America Banking Industry Market

Despite the considerable growth potential, the Latin American banking industry faces several challenges. Regulatory hurdles, including complex licensing procedures and compliance requirements, can hinder market entry and expansion. Supply chain disruptions can impact the availability of financial services, while intense competition among both traditional banks and fintech companies can create pressure on profitability. Cybersecurity threats also pose a significant risk to the sector.

Future Opportunities in Latin America Banking Industry

The Latin American banking industry presents significant opportunities for growth in the coming years. Untapped markets in underserved regions present a considerable potential for expansion. The adoption of new technologies, such as AI and blockchain, can lead to improved efficiency and service delivery. Evolving consumer trends, including a growing preference for digital banking services, present opportunities for innovation and market penetration.

Key Developments in Latin America Banking Industry Industry

- July 2023: Uala partnered with Western Union, enabling global money transfers via its app. This significantly expands its reach and service offerings.

- January 2023: Nubank secured a USD 150 Million loan from IFC, boosting its operational capacity and expansion into Colombia. This demonstrates investor confidence in the company's growth potential and strengthens its position in the market.

Strategic Latin America Banking Industry Market Forecast

The Latin American banking industry is poised for robust growth in the coming years, driven by technological innovation, increasing financial inclusion, and a burgeoning digital economy. The expansion of mobile banking, digital payments, and embedded finance will continue to shape the industry landscape. The forecast suggests a sustained upward trajectory, with market size expected to reach xx Million by 2033. Opportunities exist across various segments, particularly in underserved markets, making it an attractive sector for both established players and new entrants.

Latin America Banking Industry Segmentation

-

1. Component

- 1.1. Platform

-

1.2. Service

- 1.2.1. Professional Service

- 1.2.2. Managed Service

-

2. Type

- 2.1. API-Based BaaS

- 2.2. Cloud-Based BaaS

-

3. Enterprise

- 3.1. Large Enterprise

- 3.2. Small and Medium Enterprise

-

4. End User

- 4.1. Banks

- 4.2. Fintech Corporations/ NBFC

- 4.3. Others

Latin America Banking Industry Segmentation By Geography

-

1. Latin America

- 1.1. Brazil

- 1.2. Argentina

- 1.3. Chile

- 1.4. Colombia

- 1.5. Mexico

- 1.6. Peru

- 1.7. Venezuela

- 1.8. Ecuador

- 1.9. Bolivia

- 1.10. Paraguay

Latin America Banking Industry Regional Market Share

Geographic Coverage of Latin America Banking Industry

Latin America Banking Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.00% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rise of Internet of Things Devices is Driving The Market; Rise in Cloud Computing Technology is Driving The Market

- 3.3. Market Restrains

- 3.3.1. Rise of Internet of Things Devices is Driving The Market; Rise in Cloud Computing Technology is Driving The Market

- 3.4. Market Trends

- 3.4.1. Rise in Latin America Fintech Funding as a Driver

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Latin America Banking Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Component

- 5.1.1. Platform

- 5.1.2. Service

- 5.1.2.1. Professional Service

- 5.1.2.2. Managed Service

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. API-Based BaaS

- 5.2.2. Cloud-Based BaaS

- 5.3. Market Analysis, Insights and Forecast - by Enterprise

- 5.3.1. Large Enterprise

- 5.3.2. Small and Medium Enterprise

- 5.4. Market Analysis, Insights and Forecast - by End User

- 5.4.1. Banks

- 5.4.2. Fintech Corporations/ NBFC

- 5.4.3. Others

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. Latin America

- 5.1. Market Analysis, Insights and Forecast - by Component

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Nubank

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Neon

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 RappiPay

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Uala

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Albo

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Broxel

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Maximo

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Cuenca

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Klar

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Banco Original SA**List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Nubank

List of Figures

- Figure 1: Latin America Banking Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Latin America Banking Industry Share (%) by Company 2025

List of Tables

- Table 1: Latin America Banking Industry Revenue Million Forecast, by Component 2020 & 2033

- Table 2: Latin America Banking Industry Volume Billion Forecast, by Component 2020 & 2033

- Table 3: Latin America Banking Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 4: Latin America Banking Industry Volume Billion Forecast, by Type 2020 & 2033

- Table 5: Latin America Banking Industry Revenue Million Forecast, by Enterprise 2020 & 2033

- Table 6: Latin America Banking Industry Volume Billion Forecast, by Enterprise 2020 & 2033

- Table 7: Latin America Banking Industry Revenue Million Forecast, by End User 2020 & 2033

- Table 8: Latin America Banking Industry Volume Billion Forecast, by End User 2020 & 2033

- Table 9: Latin America Banking Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 10: Latin America Banking Industry Volume Billion Forecast, by Region 2020 & 2033

- Table 11: Latin America Banking Industry Revenue Million Forecast, by Component 2020 & 2033

- Table 12: Latin America Banking Industry Volume Billion Forecast, by Component 2020 & 2033

- Table 13: Latin America Banking Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 14: Latin America Banking Industry Volume Billion Forecast, by Type 2020 & 2033

- Table 15: Latin America Banking Industry Revenue Million Forecast, by Enterprise 2020 & 2033

- Table 16: Latin America Banking Industry Volume Billion Forecast, by Enterprise 2020 & 2033

- Table 17: Latin America Banking Industry Revenue Million Forecast, by End User 2020 & 2033

- Table 18: Latin America Banking Industry Volume Billion Forecast, by End User 2020 & 2033

- Table 19: Latin America Banking Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 20: Latin America Banking Industry Volume Billion Forecast, by Country 2020 & 2033

- Table 21: Brazil Latin America Banking Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Brazil Latin America Banking Industry Volume (Billion) Forecast, by Application 2020 & 2033

- Table 23: Argentina Latin America Banking Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Argentina Latin America Banking Industry Volume (Billion) Forecast, by Application 2020 & 2033

- Table 25: Chile Latin America Banking Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Chile Latin America Banking Industry Volume (Billion) Forecast, by Application 2020 & 2033

- Table 27: Colombia Latin America Banking Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Colombia Latin America Banking Industry Volume (Billion) Forecast, by Application 2020 & 2033

- Table 29: Mexico Latin America Banking Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Mexico Latin America Banking Industry Volume (Billion) Forecast, by Application 2020 & 2033

- Table 31: Peru Latin America Banking Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Peru Latin America Banking Industry Volume (Billion) Forecast, by Application 2020 & 2033

- Table 33: Venezuela Latin America Banking Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: Venezuela Latin America Banking Industry Volume (Billion) Forecast, by Application 2020 & 2033

- Table 35: Ecuador Latin America Banking Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: Ecuador Latin America Banking Industry Volume (Billion) Forecast, by Application 2020 & 2033

- Table 37: Bolivia Latin America Banking Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 38: Bolivia Latin America Banking Industry Volume (Billion) Forecast, by Application 2020 & 2033

- Table 39: Paraguay Latin America Banking Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 40: Paraguay Latin America Banking Industry Volume (Billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Latin America Banking Industry?

The projected CAGR is approximately 7.00%.

2. Which companies are prominent players in the Latin America Banking Industry?

Key companies in the market include Nubank, Neon, RappiPay, Uala, Albo, Broxel, Maximo, Cuenca, Klar, Banco Original SA**List Not Exhaustive.

3. What are the main segments of the Latin America Banking Industry?

The market segments include Component, Type, Enterprise, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 2.14 Million as of 2022.

5. What are some drivers contributing to market growth?

Rise of Internet of Things Devices is Driving The Market; Rise in Cloud Computing Technology is Driving The Market.

6. What are the notable trends driving market growth?

Rise in Latin America Fintech Funding as a Driver.

7. Are there any restraints impacting market growth?

Rise of Internet of Things Devices is Driving The Market; Rise in Cloud Computing Technology is Driving The Market.

8. Can you provide examples of recent developments in the market?

July 2023: Uala, the Latin American multi-banking fintech, announced a partnership with Western Union. This partnership will enable users of the application to receive money on their smartphones from other users across the globe.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Latin America Banking Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Latin America Banking Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Latin America Banking Industry?

To stay informed about further developments, trends, and reports in the Latin America Banking Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence