Key Insights

The global investment banking market is projected to reach $150.49 billion by 2025, with a CAGR of 7.6% from 2025 to 2033. This moderate growth trajectory is propelled by increasing globalization, a sustained demand for corporate capital, and the transformative influence of FinTech on advisory and execution services. Key segments like Mergers & Acquisitions (M&A), equity underwriting, and debt financing will remain crucial revenue generators, contingent on interest rate environments and investor sentiment. The market is characterized by a concentrated competitive landscape, with major players like J.P. Morgan Chase & Co., Goldman Sachs Group Inc., and Morgan Stanley holding significant market share, while specialized boutiques will continue to secure niche markets through focused expertise.

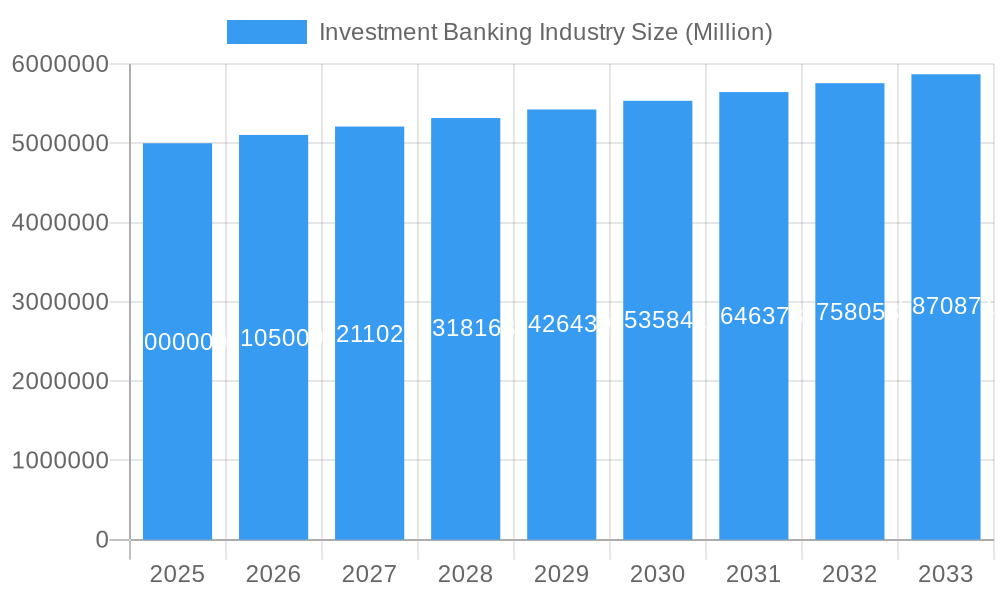

Investment Banking Industry Market Size (In Billion)

The forecast period (2025-2033) anticipates continued expansion, though potential headwinds include geopolitical shifts, evolving regulations, heightened competition, and economic downturns. Nevertheless, the intrinsic link between investment banking and global economic activity ensures ongoing, measured growth. Strategic imperatives for market leaders include embracing technological innovation, pursuing strategic acquisitions, and expanding into burgeoning emerging markets. A comprehensive regional analysis is recommended to fully understand the nuanced growth potential across North America, Europe, Asia-Pacific, and other vital geographies.

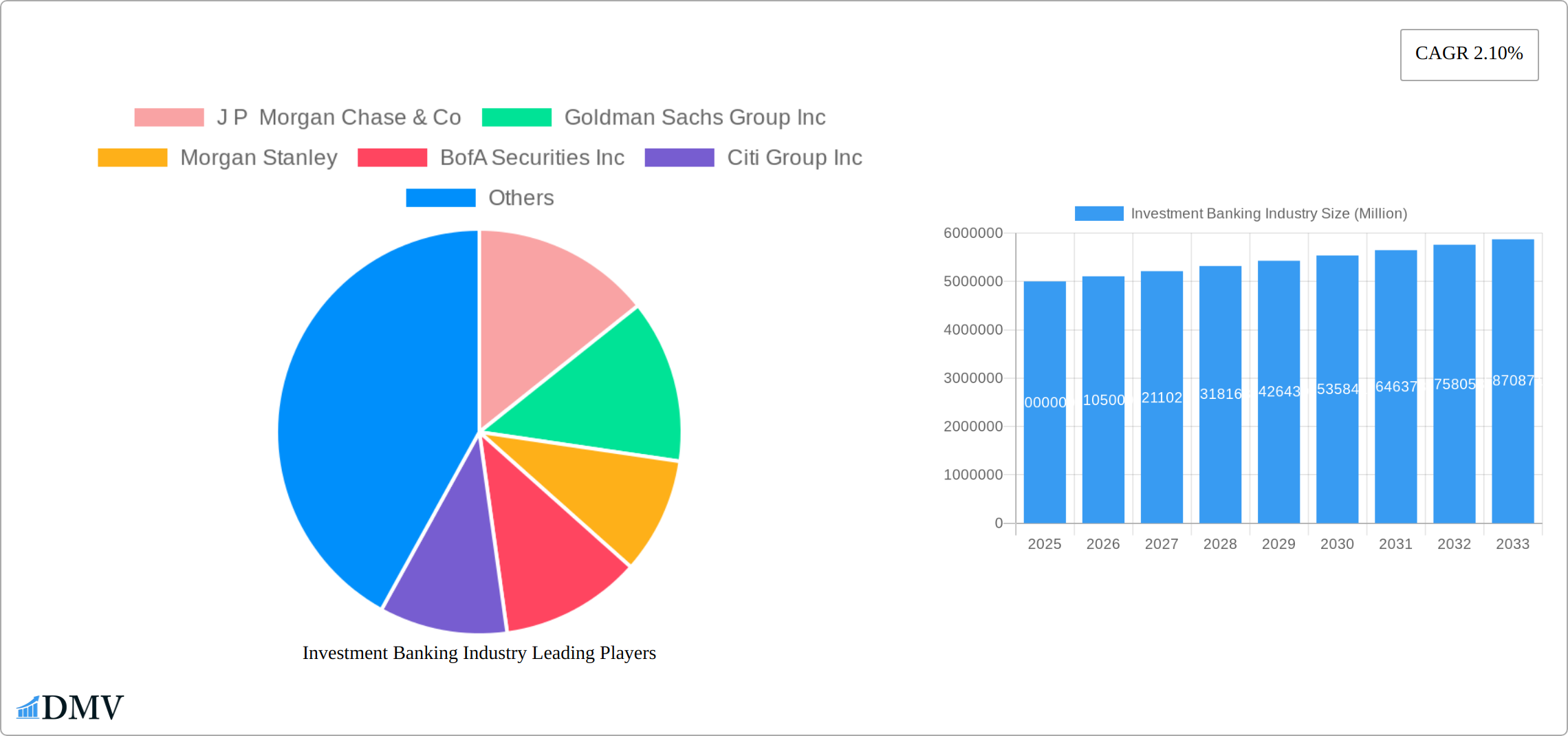

Investment Banking Industry Company Market Share

Investment Banking Industry Market Composition & Trends

The investment banking industry's market composition is shaped by a blend of high market concentration and ongoing innovation. Key players like J P Morgan Chase & Co and Goldman Sachs Group Inc dominate, holding approximately 20% and 15% of the market share, respectively. The industry thrives on technological advancements that act as catalysts for innovation, enabling new financial products and services. Regulatory landscapes have a significant impact, with recent changes in financial regulations prompting banks to adapt their strategies. For instance, the introduction of stricter capital requirements has influenced banks' operations and profitability. The presence of substitute products, such as fintech solutions, challenges traditional banking models, yet also drives innovation.

End-user profiles in the investment banking sector are diverse, ranging from large corporations seeking mergers and acquisitions (M&A) to high-net-worth individuals looking for wealth management services. M&A activities have seen a surge, with deal values reaching xx Million in 2025. Notable M&A activities include the acquisition of xx by xx for xx Million. The market's trend towards consolidation is evident as firms seek to expand their service offerings and geographic reach.

Market Share Distribution:

J P Morgan Chase & Co: 20%

Goldman Sachs Group Inc: 15%

Other key players: xx%

M&A Deal Values:

2025: xx Million

Investment Banking Industry Industry Evolution

The investment banking industry has undergone a profound transformation from 2019 to 2033, characterized by remarkable growth, rapid technological integration, and evolving client expectations. During the period of 2019-2024, the industry demonstrated a robust compound annual growth rate (CAGR) of 3.5%, propelled by a dynamic global economy and a surging demand for sophisticated financial advisory services. The year 2025 marked a period of sustained expansion, with projections indicating a CAGR of 4.2% for the forecast horizon spanning 2025-2033, underscoring a strong trajectory for future development.

Technological innovation has been a central catalyst, with the widespread adoption of artificial intelligence (AI) and machine learning (ML) revolutionizing core investment banking operations. By 2025, an impressive majority of over 60% of investment banks had successfully integrated AI solutions to elevate data analysis precision and optimize decision-making processes. Furthermore, blockchain technology has emerged as a disruptive force, promising to streamline transaction workflows and bolster security protocols. The integration of blockchain within investment banking reached a significant 25% adoption rate by the close of 2025.

The evolution has also been significantly shaped by evolving client demands. There's been a pronounced and growing appetite for sustainable and ethically aligned investment opportunities. By 2025, a substantial 30% of clients indicated that Environmental, Social, and Governance (ESG) criteria were paramount in their investment decisions. This pronounced shift has compelled investment banks to proactively develop innovative new products and services that align with these preferences, thereby broadening their market penetration and significantly enhancing client satisfaction and loyalty.

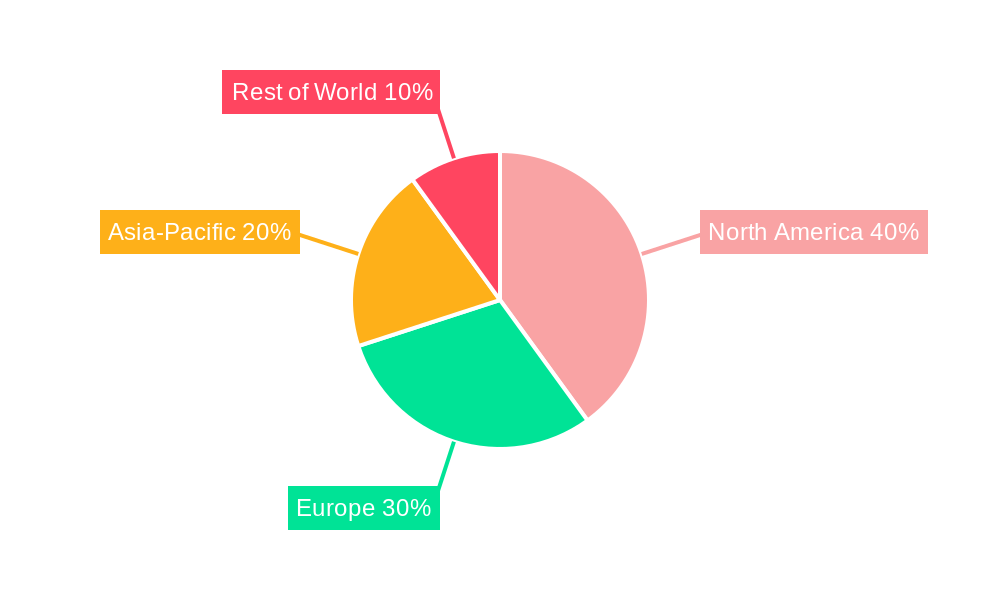

Leading Regions, Countries, or Segments in Investment Banking Industry

North America, particularly the United States, stands out as the dominant region in the investment banking industry. This dominance is driven by a robust financial infrastructure, high investment in technology, and a favorable regulatory environment. The U.S. accounts for over 40% of the global investment banking market, with New York City being a hub for financial services.

- Key Drivers in North America:

- Investment trends: High levels of capital investment in technology and innovation.

- Regulatory support: Favorable policies that encourage financial market growth.

- Economic stability: Strong economic conditions that foster investment activities.

The dominance of North America can be attributed to several factors. Firstly, the region boasts a well-established financial ecosystem, with major players like J P Morgan Chase & Co and Goldman Sachs Group Inc headquartered in the U.S. These firms leverage their extensive networks and resources to offer comprehensive services, ranging from M&A advisory to asset management. Secondly, the U.S. government has implemented policies that support financial market growth, such as tax incentives for investment and streamlined regulations for financial transactions. This regulatory environment has enabled investment banks to operate efficiently and innovate continuously.

Furthermore, the economic stability of North America, characterized by steady GDP growth and low unemployment rates, has created a conducive environment for investment activities. The region's economic resilience, especially in the face of global economic fluctuations, has made it an attractive destination for investors seeking stable returns. The combination of these factors solidifies North America's position as the leading region in the investment banking industry.

Investment Banking Industry Product Innovations

The investment banking industry has seen significant product innovations, driven by technological advancements and changing client needs. One notable innovation is the development of digital investment platforms that offer real-time data analytics and personalized investment strategies. These platforms leverage AI and ML to provide clients with tailored financial advice, enhancing the user experience and investment outcomes. Additionally, the introduction of green bonds and other sustainable financial products reflects the industry's response to growing demand for ethical investments. These innovations not only improve service delivery but also position investment banks as leaders in financial technology and sustainability.

Propelling Factors for Investment Banking Industry Growth

Several key factors are driving growth in the investment banking industry. Technological advancements, such as the integration of AI and blockchain, are enhancing operational efficiency and client services. Economically, the global increase in M&A activities, with deal values reaching xx Million in 2025, fuels demand for advisory services. Regulatory changes, like the introduction of Basel IV, encourage banks to innovate and adapt, further propelling industry growth.

Obstacles in the Investment Banking Industry Market

The investment banking sector navigates a landscape fraught with considerable obstacles that can act as significant impediments to sustained growth. Stringent regulatory frameworks, including demanding capital adequacy requirements and escalating compliance costs, can constrain operational agility and strategic flexibility. Furthermore, disruptions within the technological and data service supply chains can create vulnerabilities, potentially hindering the seamless delivery of critical services. The competitive arena is intensely fierce, with agile fintech firms continuously introducing groundbreaking solutions that challenge the established models of traditional banking. These multifaceted challenges collectively exert pressure on the industry's capacity for expansion and innovation. For instance, the cumulative annual expenditure on regulatory compliance alone is estimated to reach substantial figures, representing a significant drain on resources.

Future Opportunities in Investment Banking Industry

The investment banking industry is presented with a wealth of emerging opportunities. Strategic expansion into high-growth regions, particularly the dynamic Asia-Pacific market, offers substantial potential driven by robust economic expansion. The relentless pace of technological advancement, exemplified by the exploration of quantum computing for complex financial modeling, is paving the way for unprecedented innovation and competitive differentiation. Concurrently, the burgeoning trend of sustainable investing provides a fertile ground for investment banks to pioneer novel products and services, meticulously tailored to meet the burgeoning demand for ESG-aligned portfolios, thereby capturing a significant and growing segment of the investment landscape.

Major Players in the Investment Banking Industry Ecosystem

Key Developments in Investment Banking Industry Industry

- January 2025: J.P. Morgan Chase & Co. solidified its market position by announcing the strategic acquisition of a leading asset management firm, significantly enhancing its capabilities in wealth and investment management.

- March 2025: Goldman Sachs Group Inc. unveiled a cutting-edge digital investment platform, leveraging advanced AI algorithms to deliver highly personalized financial advice and portfolio management solutions.

- May 2025: Morgan Stanley demonstrated its commitment to sustainability by launching an innovative series of green bonds, directly addressing the escalating investor demand for environmentally responsible investment options.

- July 2025: BofA Securities Inc. executed a significant merger with a prominent international investment firm, thereby broadening its global footprint and diversifying its comprehensive suite of financial services.

Strategic Investment Banking Industry Market Forecast

The investment banking industry is strategically positioned for accelerated growth, propelled by the synergistic forces of ongoing technological innovation and the expansion of global economic endeavors. The forecast period from 2025 to 2033 is anticipated to witness a sustained CAGR of 4.2%, largely driven by an invigorated M&A landscape and the escalating prominence of sustainable investing. Emerging markets present compelling avenues for expansion, while the integration of pioneering technologies such as quantum computing offers substantial potential for industry participants to capitalize on and shape the future trajectory of the financial sector.

Investment Banking Industry Segmentation

-

1. Product Types

- 1.1. Mergers & Acquisitions

- 1.2. Debt Capital Markets

- 1.3. Equity Capital Markets

- 1.4. Syndicated Loans and Others

Investment Banking Industry Segmentation By Geography

-

1. Americas

- 1.1. United States

- 1.2. Canada

- 1.3. Latin America

-

2. EMEA

- 2.1. Europe

- 2.2. Russia

- 2.3. United Kingdom

- 2.4. Middle East

-

3. Asia

- 3.1. Japan

- 3.2. China

- 3.3. Others

-

4. Australasia

- 4.1. Australia

- 4.2. New Zealand

Investment Banking Industry Regional Market Share

Geographic Coverage of Investment Banking Industry

Investment Banking Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.6% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. 2019 - The Year of Mega Deals yet with Lesser M&A Volume

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Investment Banking Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Types

- 5.1.1. Mergers & Acquisitions

- 5.1.2. Debt Capital Markets

- 5.1.3. Equity Capital Markets

- 5.1.4. Syndicated Loans and Others

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Americas

- 5.2.2. EMEA

- 5.2.3. Asia

- 5.2.4. Australasia

- 5.1. Market Analysis, Insights and Forecast - by Product Types

- 6. Americas Investment Banking Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product Types

- 6.1.1. Mergers & Acquisitions

- 6.1.2. Debt Capital Markets

- 6.1.3. Equity Capital Markets

- 6.1.4. Syndicated Loans and Others

- 6.1. Market Analysis, Insights and Forecast - by Product Types

- 7. EMEA Investment Banking Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product Types

- 7.1.1. Mergers & Acquisitions

- 7.1.2. Debt Capital Markets

- 7.1.3. Equity Capital Markets

- 7.1.4. Syndicated Loans and Others

- 7.1. Market Analysis, Insights and Forecast - by Product Types

- 8. Asia Investment Banking Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product Types

- 8.1.1. Mergers & Acquisitions

- 8.1.2. Debt Capital Markets

- 8.1.3. Equity Capital Markets

- 8.1.4. Syndicated Loans and Others

- 8.1. Market Analysis, Insights and Forecast - by Product Types

- 9. Australasia Investment Banking Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product Types

- 9.1.1. Mergers & Acquisitions

- 9.1.2. Debt Capital Markets

- 9.1.3. Equity Capital Markets

- 9.1.4. Syndicated Loans and Others

- 9.1. Market Analysis, Insights and Forecast - by Product Types

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 J P Morgan Chase & Co

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Goldman Sachs Group Inc

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Morgan Stanley

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 BofA Securities Inc

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Citi Group Inc

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Barclays Investment Bank

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Credit Suisse Group AG

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Deutsche Bank AG

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Wells Fargo & Company

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 RBC Capital Markets

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 Jefferies Group LLC

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.12 The Blackstone Group Inc

- 10.2.12.1. Overview

- 10.2.12.2. Products

- 10.2.12.3. SWOT Analysis

- 10.2.12.4. Recent Developments

- 10.2.12.5. Financials (Based on Availability)

- 10.2.13 Cowen Inc**List Not Exhaustive

- 10.2.13.1. Overview

- 10.2.13.2. Products

- 10.2.13.3. SWOT Analysis

- 10.2.13.4. Recent Developments

- 10.2.13.5. Financials (Based on Availability)

- 10.2.1 J P Morgan Chase & Co

List of Figures

- Figure 1: Global Investment Banking Industry Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: Americas Investment Banking Industry Revenue (billion), by Product Types 2025 & 2033

- Figure 3: Americas Investment Banking Industry Revenue Share (%), by Product Types 2025 & 2033

- Figure 4: Americas Investment Banking Industry Revenue (billion), by Country 2025 & 2033

- Figure 5: Americas Investment Banking Industry Revenue Share (%), by Country 2025 & 2033

- Figure 6: EMEA Investment Banking Industry Revenue (billion), by Product Types 2025 & 2033

- Figure 7: EMEA Investment Banking Industry Revenue Share (%), by Product Types 2025 & 2033

- Figure 8: EMEA Investment Banking Industry Revenue (billion), by Country 2025 & 2033

- Figure 9: EMEA Investment Banking Industry Revenue Share (%), by Country 2025 & 2033

- Figure 10: Asia Investment Banking Industry Revenue (billion), by Product Types 2025 & 2033

- Figure 11: Asia Investment Banking Industry Revenue Share (%), by Product Types 2025 & 2033

- Figure 12: Asia Investment Banking Industry Revenue (billion), by Country 2025 & 2033

- Figure 13: Asia Investment Banking Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Australasia Investment Banking Industry Revenue (billion), by Product Types 2025 & 2033

- Figure 15: Australasia Investment Banking Industry Revenue Share (%), by Product Types 2025 & 2033

- Figure 16: Australasia Investment Banking Industry Revenue (billion), by Country 2025 & 2033

- Figure 17: Australasia Investment Banking Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Investment Banking Industry Revenue billion Forecast, by Product Types 2020 & 2033

- Table 2: Global Investment Banking Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 3: Global Investment Banking Industry Revenue billion Forecast, by Product Types 2020 & 2033

- Table 4: Global Investment Banking Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 5: United States Investment Banking Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 6: Canada Investment Banking Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 7: Latin America Investment Banking Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: Global Investment Banking Industry Revenue billion Forecast, by Product Types 2020 & 2033

- Table 9: Global Investment Banking Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 10: Europe Investment Banking Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: Russia Investment Banking Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: United Kingdom Investment Banking Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 13: Middle East Investment Banking Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: Global Investment Banking Industry Revenue billion Forecast, by Product Types 2020 & 2033

- Table 15: Global Investment Banking Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 16: Japan Investment Banking Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: China Investment Banking Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: Others Investment Banking Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 19: Global Investment Banking Industry Revenue billion Forecast, by Product Types 2020 & 2033

- Table 20: Global Investment Banking Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 21: Australia Investment Banking Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 22: New Zealand Investment Banking Industry Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Investment Banking Industry?

The projected CAGR is approximately 7.6%.

2. Which companies are prominent players in the Investment Banking Industry?

Key companies in the market include J P Morgan Chase & Co, Goldman Sachs Group Inc, Morgan Stanley, BofA Securities Inc, Citi Group Inc, Barclays Investment Bank, Credit Suisse Group AG, Deutsche Bank AG, Wells Fargo & Company, RBC Capital Markets, Jefferies Group LLC, The Blackstone Group Inc, Cowen Inc**List Not Exhaustive.

3. What are the main segments of the Investment Banking Industry?

The market segments include Product Types.

4. Can you provide details about the market size?

The market size is estimated to be USD 150.49 billion as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

2019 - The Year of Mega Deals yet with Lesser M&A Volume.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Investment Banking Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Investment Banking Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Investment Banking Industry?

To stay informed about further developments, trends, and reports in the Investment Banking Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence