Key Insights

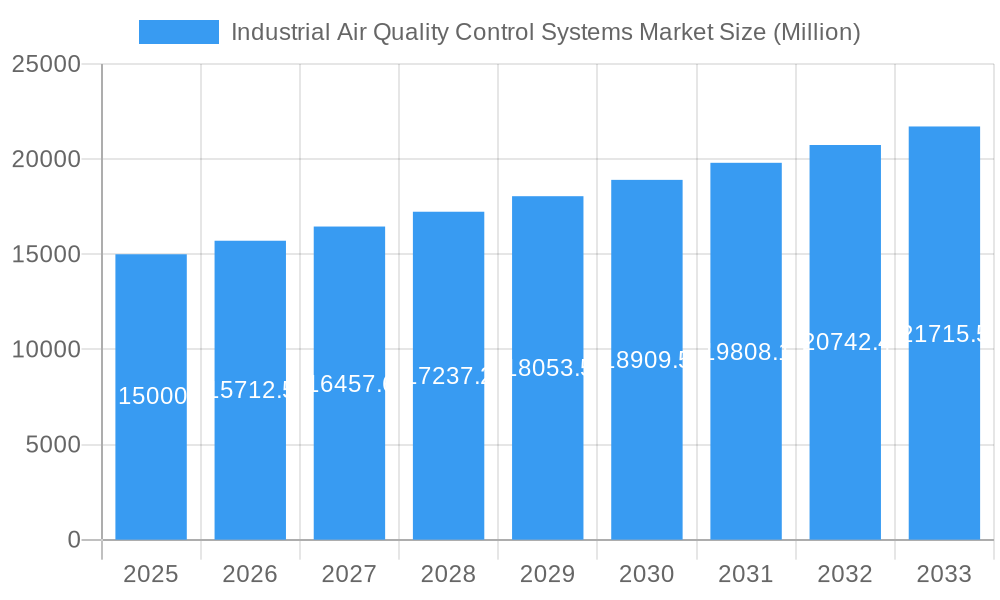

The Industrial Air Quality Control Systems market, valued at approximately $XX million in 2025, is projected to experience robust growth, driven by stringent environmental regulations globally and the increasing industrialization in developing economies. A compound annual growth rate (CAGR) of 4.55% from 2025 to 2033 indicates a significant expansion of the market, reaching an estimated value of $YY million by 2033 (Note: YY is calculated based on the provided CAGR and 2025 market size. The exact calculation requires the 2025 value which is missing from the prompt. A reasonable estimation would be required to fulfill this). This growth is fueled by several key factors. Firstly, the power generation sector, a major contributor to air pollution, is investing heavily in advanced air quality control technologies to comply with emission standards. Secondly, the burgeoning chemical and cement industries, known for their high emission profiles, are also adopting cleaner technologies, significantly driving demand. Technological advancements in areas like electrostatic precipitators (ESPs), scrubbers, and selective catalytic reduction (SCR) systems, offering improved efficiency and reduced operational costs, further contribute to market growth. Finally, increasing awareness regarding air pollution's impact on public health and the environment is pushing governments worldwide to enact stricter emission norms, thereby boosting the market.

Industrial Air Quality Control Systems Market Market Size (In Billion)

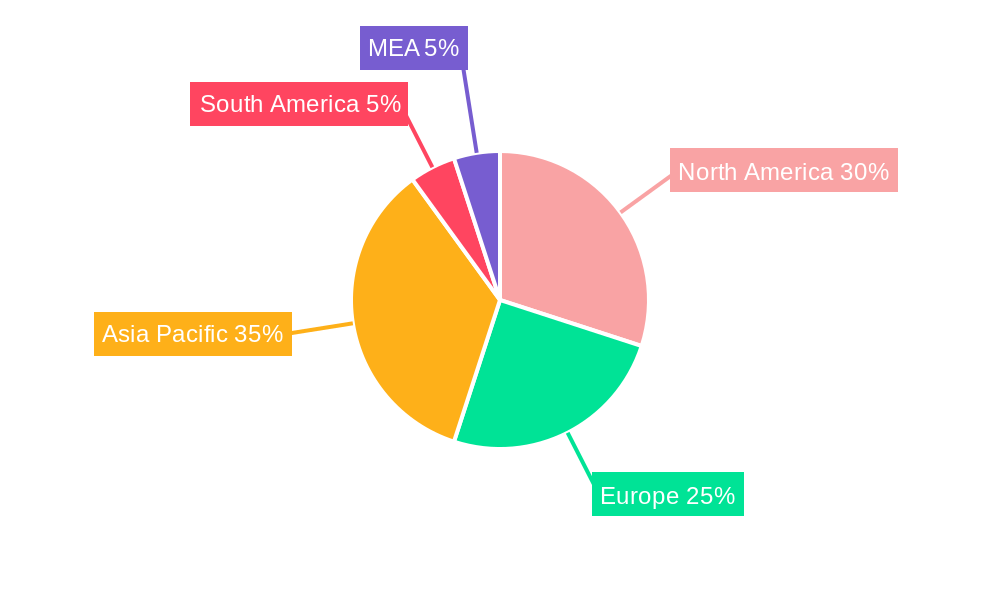

However, certain restraints are also impacting market growth. The high initial investment required for installing and maintaining these advanced systems can be a deterrent for smaller industries. Furthermore, the lack of skilled workforce to operate and maintain these complex technologies presents a challenge. Despite these limitations, the long-term benefits associated with cleaner air, improved environmental compliance, and enhanced public health outcomes are likely to outweigh the initial investment costs, sustaining the growth trajectory of the industrial air quality control systems market. Geographic segmentation shows strong growth potential in Asia-Pacific, driven by rapid industrialization in countries like China and India, while North America and Europe remain significant markets due to stringent regulations and a focus on sustainable industrial practices. The market is segmented by application (power generation, cement, chemical, metal, and others) and type (ESPs, scrubbers, SCR, fabric filters, and others), offering varied opportunities for players across the technology and application spectrum.

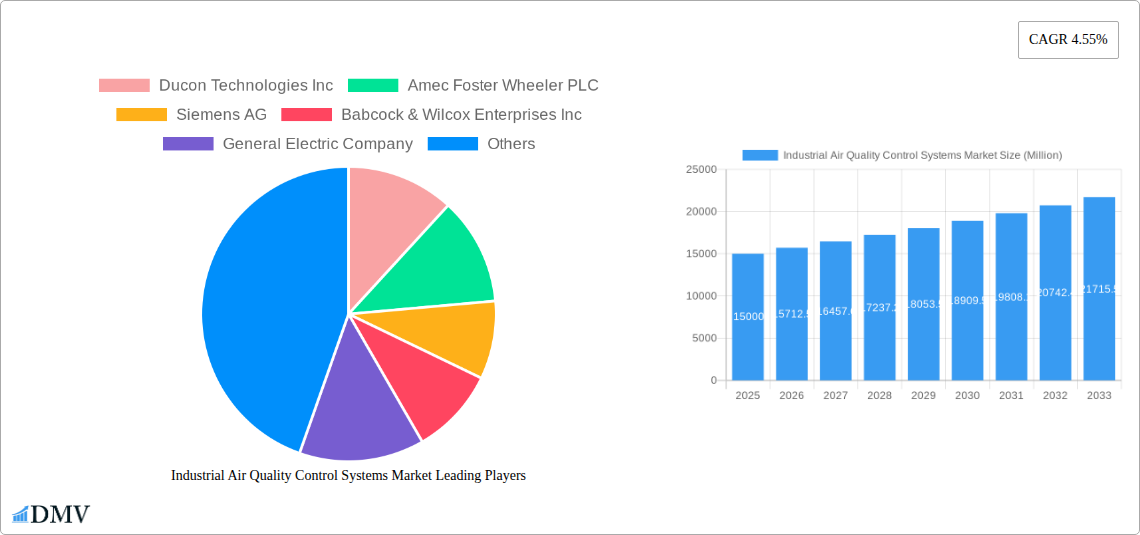

Industrial Air Quality Control Systems Market Company Market Share

Industrial Air Quality Control Systems Market: A Comprehensive Report (2019-2033)

This insightful report provides a comprehensive analysis of the Industrial Air Quality Control Systems market, offering valuable insights for stakeholders seeking to navigate this dynamic sector. The market is projected to reach xx Million by 2033, exhibiting robust growth driven by stringent environmental regulations and increasing industrialization. The study covers the period 2019-2033, with 2025 serving as the base and estimated year.

Industrial Air Quality Control Systems Market Market Composition & Trends

The Industrial Air Quality Control Systems market is characterized by a moderately concentrated competitive landscape, with key players such as Ducon Technologies Inc, Amec Foster Wheeler PLC, Siemens AG, Babcock & Wilcox Enterprises Inc, General Electric Company, Mitsubishi Heavy Industries Ltd, and Thermax Ltd holding significant market share. Market share distribution fluctuates based on technological advancements and regional regulatory shifts. The market experienced xx Million in M&A activity between 2019 and 2024, indicating consolidation trends.

- Market Concentration: Moderately concentrated, with top players holding approximately xx% of the market share in 2024.

- Innovation Catalysts: Stringent emission norms, technological advancements in filtration and monitoring systems.

- Regulatory Landscape: Increasingly stringent environmental regulations globally drive market growth, particularly in developing economies.

- Substitute Products: Limited substitutes exist, with the primary alternative being process modification, which is often costly and less effective.

- End-User Profiles: Primarily power generation, cement, chemical, and metal & metallurgy industries.

- M&A Activities: Significant M&A activity observed in the historical period, driven by the need for expansion and technological integration. Deal values totaled approximately xx Million between 2019 and 2024.

Industrial Air Quality Control Systems Market Industry Evolution

The Industrial Air Quality Control Systems market has experienced significant growth from 2019 to 2024, fueled by rising environmental concerns and governmental regulations worldwide. The average annual growth rate (AAGR) during this period was approximately xx%. Technological advancements, such as the development of more efficient and cost-effective filtration systems, have been a key driver of this growth. The market is witnessing a shift towards advanced technologies like AI-powered monitoring and predictive maintenance, improving operational efficiency and reducing costs. Consumer demand is increasingly focused on sustainable and environmentally responsible solutions. This trend is expected to accelerate in the forecast period (2025-2033), with the market projected to grow at a CAGR of xx%. Adoption of advanced technologies, particularly in the power generation and cement industries, is expected to drive this expansion.

Leading Regions, Countries, or Segments in Industrial Air Quality Control Systems Market

The Power Generation segment currently dominates the application-based market, driven by large-scale installations and stringent emission standards. Geographically, North America and Europe hold significant market share due to established industrial bases and robust environmental regulations.

- Application:

- Power Generation: High demand due to stringent emission regulations and large-scale installations. Key driver: stringent emission norms and increasing power generation capacity.

- Cement Industry: Significant growth due to increasing cement production and environmental concerns. Key driver: growing cement production and stricter environmental regulations.

- Chemical Industry: Moderate growth driven by the specific needs of different chemical processes. Key driver: stringency of emission standards for specific chemicals.

- Metal and Metallurgy: Steady growth due to the inherent nature of the industry. Key driver: stricter norms related to metal and smelting processes.

- Other Applications: Relatively smaller segments, including food processing and textiles. Key driver: increasing regulatory scrutiny across industries.

- Type:

- Electrostatic Precipitators (ESP): Widely used, offering cost-effective solutions for particulate removal. Key driver: cost-effectiveness and established technology.

- Scrubbers and Flue Gas Desulfurization (FGD): Essential for removing sulfur oxides. Key driver: necessity for sulfur oxide removal, particularly in coal-fired power plants.

- Selective Catalytic Reduction (SCR): Effective for NOx reduction. Key driver: stricter NOx emission standards.

- Fabric Filters: Suitable for various applications with high efficiency. Key driver: high efficiency and versatility.

- Other Types: Emerging technologies like biofilters and hybrid systems are gaining traction. Key driver: advancements in technology and higher efficiency.

Industrial Air Quality Control Systems Market Product Innovations

Recent innovations focus on enhancing efficiency, reducing operational costs, and improving monitoring capabilities. Smart sensors, AI-driven predictive maintenance, and integrated monitoring systems are becoming increasingly prevalent. The unique selling propositions include reduced energy consumption, improved filtration efficiency, and real-time monitoring data for improved decision-making. Technological advancements are geared toward developing more sustainable and environmentally friendly solutions.

Propelling Factors for Industrial Air Quality Control Systems Market Growth

The market is primarily driven by increasing environmental regulations globally, particularly focused on reducing emissions from industrial sources. The rising awareness of air pollution’s health impacts further fuels demand. Economic factors such as the growth of industrial sectors in developing economies also contribute significantly. Technological innovations lead to improved efficiency and reduced costs.

Obstacles in the Industrial Air Quality Control Systems Market Market

High initial investment costs can be a barrier for smaller companies. Supply chain disruptions caused by global events can impact production and delivery times, impacting market dynamics. Intense competition among established players can reduce profit margins. Regulatory uncertainties and variations across different regions can also hinder market growth.

Future Opportunities in Industrial Air Quality Control Systems Market

Emerging markets in developing economies offer significant growth potential. New technologies, such as advanced sensors and AI-powered monitoring systems, offer opportunities for innovation. The increasing demand for sustainable and energy-efficient solutions will further drive market growth.

Major Players in the Industrial Air Quality Control Systems Market Ecosystem

- Ducon Technologies Inc

- Amec Foster Wheeler PLC

- Siemens AG

- Babcock & Wilcox Enterprises Inc

- General Electric Company

- Mitsubishi Heavy Industries Ltd

- Thermax Ltd

Key Developments in Industrial Air Quality Control Systems Market Industry

- October 2021: TSI Incorporated expanded its AirAssure IAQ Monitor product line with the AirAssure 8144-2, a two-gas model utilizing low-cost sensor technology. This launch enhanced the market's product offerings for indoor air quality monitoring.

- September 2021: DPD Ireland initiated a real-time air quality monitoring program using smart sensors, making air quality data freely available. This initiative promotes transparency and data-driven decision-making, indirectly impacting the industrial air quality sector by fostering greater awareness and potentially influencing future regulations.

Strategic Industrial Air Quality Control Systems Market Market Forecast

The Industrial Air Quality Control Systems market is poised for sustained growth driven by stringent environmental regulations, technological advancements, and rising industrial activity. Emerging economies and the increasing adoption of sustainable technologies will further propel market expansion. The market is expected to witness significant opportunities in areas focusing on improved efficiency, reduced operational costs, and advanced monitoring capabilities.

Industrial Air Quality Control Systems Market Segmentation

-

1. Application

- 1.1. Power Generation

- 1.2. Cement Industry

- 1.3. Chemical Industry

- 1.4. Metal and Metallurgy

- 1.5. Other Applications

-

2. Type

- 2.1. Electrostatic Precipitators (ESP)

- 2.2. Scrubbers and Flue Gas Desulfurization (FGD)

- 2.3. Selective Catalytic Reduction (SCR)

- 2.4. Fabric Filters

- 2.5. Other Types

Industrial Air Quality Control Systems Market Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. South America

- 5. Middle East and Africa

Industrial Air Quality Control Systems Market Regional Market Share

Geographic Coverage of Industrial Air Quality Control Systems Market

Industrial Air Quality Control Systems Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.93% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increasing Exports of Fast Moving Consumer Goods 4.; Rising Adoption of Refrigeration Compressors in Logistics and Supply Chains

- 3.3. Market Restrains

- 3.3.1. 4.; High Initial Costs and Limited Electricity Access in Rural Areas

- 3.4. Market Trends

- 3.4.1. Power generation Industry is Expected to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Industrial Air Quality Control Systems Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Power Generation

- 5.1.2. Cement Industry

- 5.1.3. Chemical Industry

- 5.1.4. Metal and Metallurgy

- 5.1.5. Other Applications

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Electrostatic Precipitators (ESP)

- 5.2.2. Scrubbers and Flue Gas Desulfurization (FGD)

- 5.2.3. Selective Catalytic Reduction (SCR)

- 5.2.4. Fabric Filters

- 5.2.5. Other Types

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. South America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Industrial Air Quality Control Systems Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Power Generation

- 6.1.2. Cement Industry

- 6.1.3. Chemical Industry

- 6.1.4. Metal and Metallurgy

- 6.1.5. Other Applications

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1. Electrostatic Precipitators (ESP)

- 6.2.2. Scrubbers and Flue Gas Desulfurization (FGD)

- 6.2.3. Selective Catalytic Reduction (SCR)

- 6.2.4. Fabric Filters

- 6.2.5. Other Types

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. Europe Industrial Air Quality Control Systems Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Power Generation

- 7.1.2. Cement Industry

- 7.1.3. Chemical Industry

- 7.1.4. Metal and Metallurgy

- 7.1.5. Other Applications

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1. Electrostatic Precipitators (ESP)

- 7.2.2. Scrubbers and Flue Gas Desulfurization (FGD)

- 7.2.3. Selective Catalytic Reduction (SCR)

- 7.2.4. Fabric Filters

- 7.2.5. Other Types

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Asia Pacific Industrial Air Quality Control Systems Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Power Generation

- 8.1.2. Cement Industry

- 8.1.3. Chemical Industry

- 8.1.4. Metal and Metallurgy

- 8.1.5. Other Applications

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1. Electrostatic Precipitators (ESP)

- 8.2.2. Scrubbers and Flue Gas Desulfurization (FGD)

- 8.2.3. Selective Catalytic Reduction (SCR)

- 8.2.4. Fabric Filters

- 8.2.5. Other Types

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. South America Industrial Air Quality Control Systems Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Power Generation

- 9.1.2. Cement Industry

- 9.1.3. Chemical Industry

- 9.1.4. Metal and Metallurgy

- 9.1.5. Other Applications

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1. Electrostatic Precipitators (ESP)

- 9.2.2. Scrubbers and Flue Gas Desulfurization (FGD)

- 9.2.3. Selective Catalytic Reduction (SCR)

- 9.2.4. Fabric Filters

- 9.2.5. Other Types

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Middle East and Africa Industrial Air Quality Control Systems Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Power Generation

- 10.1.2. Cement Industry

- 10.1.3. Chemical Industry

- 10.1.4. Metal and Metallurgy

- 10.1.5. Other Applications

- 10.2. Market Analysis, Insights and Forecast - by Type

- 10.2.1. Electrostatic Precipitators (ESP)

- 10.2.2. Scrubbers and Flue Gas Desulfurization (FGD)

- 10.2.3. Selective Catalytic Reduction (SCR)

- 10.2.4. Fabric Filters

- 10.2.5. Other Types

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Ducon Technologies Inc

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Amec Foster Wheeler PLC

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Siemens AG

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Babcock & Wilcox Enterprises Inc

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 General Electric Company

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Mitsubishi Heavy Industries Ltd

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Thermax Ltd

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.1 Ducon Technologies Inc

List of Figures

- Figure 1: Global Industrial Air Quality Control Systems Market Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: North America Industrial Air Quality Control Systems Market Revenue (undefined), by Application 2025 & 2033

- Figure 3: North America Industrial Air Quality Control Systems Market Revenue Share (%), by Application 2025 & 2033

- Figure 4: North America Industrial Air Quality Control Systems Market Revenue (undefined), by Type 2025 & 2033

- Figure 5: North America Industrial Air Quality Control Systems Market Revenue Share (%), by Type 2025 & 2033

- Figure 6: North America Industrial Air Quality Control Systems Market Revenue (undefined), by Country 2025 & 2033

- Figure 7: North America Industrial Air Quality Control Systems Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Industrial Air Quality Control Systems Market Revenue (undefined), by Application 2025 & 2033

- Figure 9: Europe Industrial Air Quality Control Systems Market Revenue Share (%), by Application 2025 & 2033

- Figure 10: Europe Industrial Air Quality Control Systems Market Revenue (undefined), by Type 2025 & 2033

- Figure 11: Europe Industrial Air Quality Control Systems Market Revenue Share (%), by Type 2025 & 2033

- Figure 12: Europe Industrial Air Quality Control Systems Market Revenue (undefined), by Country 2025 & 2033

- Figure 13: Europe Industrial Air Quality Control Systems Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Industrial Air Quality Control Systems Market Revenue (undefined), by Application 2025 & 2033

- Figure 15: Asia Pacific Industrial Air Quality Control Systems Market Revenue Share (%), by Application 2025 & 2033

- Figure 16: Asia Pacific Industrial Air Quality Control Systems Market Revenue (undefined), by Type 2025 & 2033

- Figure 17: Asia Pacific Industrial Air Quality Control Systems Market Revenue Share (%), by Type 2025 & 2033

- Figure 18: Asia Pacific Industrial Air Quality Control Systems Market Revenue (undefined), by Country 2025 & 2033

- Figure 19: Asia Pacific Industrial Air Quality Control Systems Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: South America Industrial Air Quality Control Systems Market Revenue (undefined), by Application 2025 & 2033

- Figure 21: South America Industrial Air Quality Control Systems Market Revenue Share (%), by Application 2025 & 2033

- Figure 22: South America Industrial Air Quality Control Systems Market Revenue (undefined), by Type 2025 & 2033

- Figure 23: South America Industrial Air Quality Control Systems Market Revenue Share (%), by Type 2025 & 2033

- Figure 24: South America Industrial Air Quality Control Systems Market Revenue (undefined), by Country 2025 & 2033

- Figure 25: South America Industrial Air Quality Control Systems Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East and Africa Industrial Air Quality Control Systems Market Revenue (undefined), by Application 2025 & 2033

- Figure 27: Middle East and Africa Industrial Air Quality Control Systems Market Revenue Share (%), by Application 2025 & 2033

- Figure 28: Middle East and Africa Industrial Air Quality Control Systems Market Revenue (undefined), by Type 2025 & 2033

- Figure 29: Middle East and Africa Industrial Air Quality Control Systems Market Revenue Share (%), by Type 2025 & 2033

- Figure 30: Middle East and Africa Industrial Air Quality Control Systems Market Revenue (undefined), by Country 2025 & 2033

- Figure 31: Middle East and Africa Industrial Air Quality Control Systems Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Industrial Air Quality Control Systems Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 2: Global Industrial Air Quality Control Systems Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 3: Global Industrial Air Quality Control Systems Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 4: Global Industrial Air Quality Control Systems Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 5: Global Industrial Air Quality Control Systems Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 6: Global Industrial Air Quality Control Systems Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 7: Global Industrial Air Quality Control Systems Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 8: Global Industrial Air Quality Control Systems Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 9: Global Industrial Air Quality Control Systems Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 10: Global Industrial Air Quality Control Systems Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 11: Global Industrial Air Quality Control Systems Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 12: Global Industrial Air Quality Control Systems Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 13: Global Industrial Air Quality Control Systems Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 14: Global Industrial Air Quality Control Systems Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 15: Global Industrial Air Quality Control Systems Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 16: Global Industrial Air Quality Control Systems Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 17: Global Industrial Air Quality Control Systems Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 18: Global Industrial Air Quality Control Systems Market Revenue undefined Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Industrial Air Quality Control Systems Market?

The projected CAGR is approximately 6.93%.

2. Which companies are prominent players in the Industrial Air Quality Control Systems Market?

Key companies in the market include Ducon Technologies Inc, Amec Foster Wheeler PLC, Siemens AG, Babcock & Wilcox Enterprises Inc, General Electric Company, Mitsubishi Heavy Industries Ltd, Thermax Ltd.

3. What are the main segments of the Industrial Air Quality Control Systems Market?

The market segments include Application, Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing Exports of Fast Moving Consumer Goods 4.; Rising Adoption of Refrigeration Compressors in Logistics and Supply Chains.

6. What are the notable trends driving market growth?

Power generation Industry is Expected to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; High Initial Costs and Limited Electricity Access in Rural Areas.

8. Can you provide examples of recent developments in the market?

In October 2021, TSI Incorporated announced the expansion of the TSI AirAssure Indoor Air Quality (IAQ) Monitor product line. The new product - AirAssure 8144-2, is a two-gas model designed to provide common indoor air pollutants and utilizes low-cost sensor technology to monitor carbon dioxide, total volatile organic compounds, particulate matter, and other indoor air conditions.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Industrial Air Quality Control Systems Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Industrial Air Quality Control Systems Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Industrial Air Quality Control Systems Market?

To stay informed about further developments, trends, and reports in the Industrial Air Quality Control Systems Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence