Key Insights

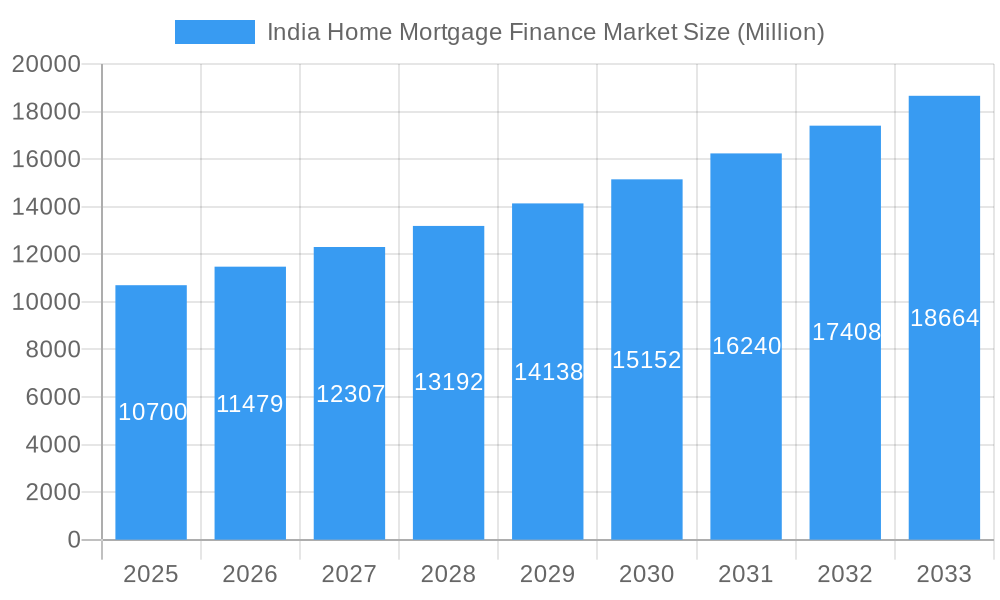

India's Home Mortgage Finance Market is demonstrating significant expansion, propelled by a growing middle class, rapid urbanization, supportive government housing initiatives, and attractive interest rates. The market is projected to achieve a Compound Annual Growth Rate (CAGR) of 4.9%. With a projected market size of $724.2 billion by 2025, this robust growth is attributed to increasing disposable incomes, enhanced credit accessibility, and a heightened desire for homeownership. The market is segmented by loan type, tenure, and geography, featuring intense competition among public and private sector entities such as HDFC, LIC Housing Finance, and Indiabulls Housing Finance. Potential challenges include regulatory shifts and economic volatility, such as interest rate adjustments and credit risk.

India Home Mortgage Finance Market Market Size (In Billion)

Future projections indicate sustained growth through 2033, with a potential moderation in CAGR as the market matures. Technological advancements, evolving demographics, and dynamic regulatory frameworks will significantly influence market trends. Opportunities for expansion are evident in underpenetrated segments, including rural housing and affordable housing projects. Companies are prioritizing product innovation, customer experience, and effective risk management to thrive in this competitive landscape. This ongoing expansion underscores the growing significance of homeownership in India and the persistent demand for mortgage financing solutions.

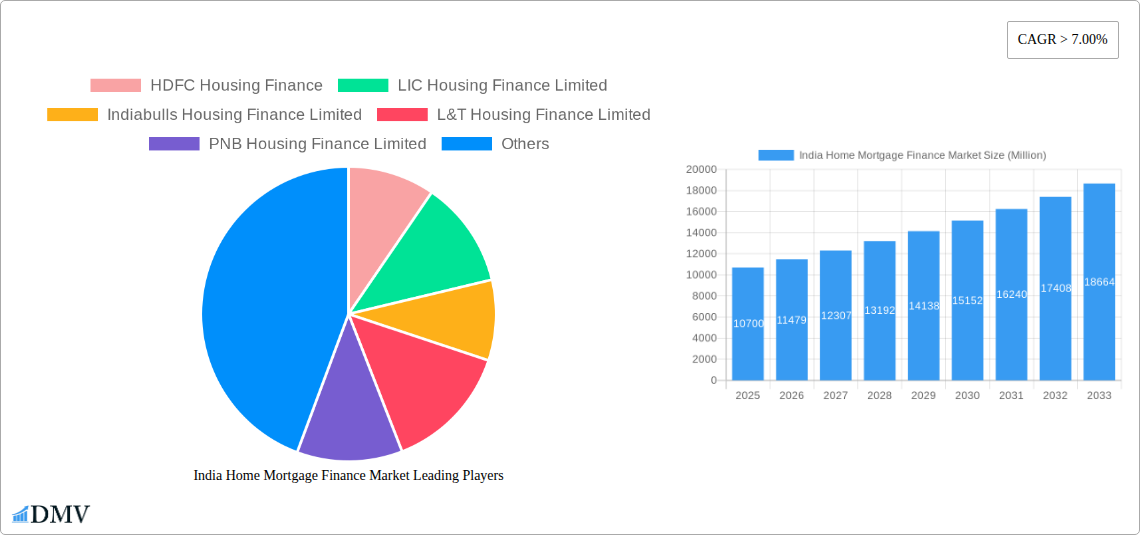

India Home Mortgage Finance Market Company Market Share

India Home Mortgage Finance Market: A Comprehensive Report (2019-2033)

This insightful report provides a detailed analysis of the India Home Mortgage Finance Market, offering a comprehensive overview of its current state, future trajectory, and key players. Covering the period from 2019 to 2033, with a base year of 2025 and a forecast period of 2025-2033, this report is an essential resource for stakeholders seeking to understand and capitalize on opportunities within this dynamic market. The total market size is predicted to reach xx Million by 2033.

India Home Mortgage Finance Market Composition & Trends

This section delves into the intricate structure of the Indian home mortgage finance market, examining market concentration, innovative drivers, regulatory frameworks, substitute products, end-user profiles, and mergers & acquisitions (M&A) activities. The market is characterized by a mix of established players and emerging fintech companies, leading to a moderately concentrated landscape. HDFC Ltd. historically holds a significant market share, although this is expected to shift following the merger with HDFC Bank.

- Market Share Distribution (2024): HDFC Ltd. (xx%), LIC Housing Finance (xx%), Indiabulls Housing Finance (xx%), Others (xx%). These figures are estimates based on available data and may vary slightly.

- Innovation Catalysts: Technological advancements like AI-powered loan applications and digital lending platforms are transforming the market. The increasing adoption of digital channels is accelerating this transformation.

- Regulatory Landscape: The Reserve Bank of India (RBI) plays a significant role in shaping market regulations, impacting lending practices and consumer protection.

- Substitute Products: While home loans remain dominant, alternative financing options like developer-sponsored schemes are gaining some traction.

- End-User Profiles: The market caters to a diverse range of borrowers, including first-time homebuyers, upgraders, and real estate developers.

- M&A Activities (2019-2024): Significant M&A activity, with deal values totaling approximately xx Million, reflects the industry's consolidation trends. The recent HDFC-HDFC Bank merger is a prime example.

India Home Mortgage Finance Market Industry Evolution

This section provides a detailed analysis of the evolutionary trajectory of the Indian home mortgage finance market, tracing its growth, technological integration, and shifts in consumer preferences across the historical period (2019-2024) and projecting its future course (2025-2033). The market has witnessed consistent growth, fueled by increasing urbanization, rising disposable incomes, and government initiatives promoting affordable housing. Technological innovations are driving efficiency and expanding accessibility, while evolving consumer preferences are shaping product offerings. Growth rates are expected to remain robust, although at a potentially slower pace than in the recent past, due to economic fluctuations and increased competition.

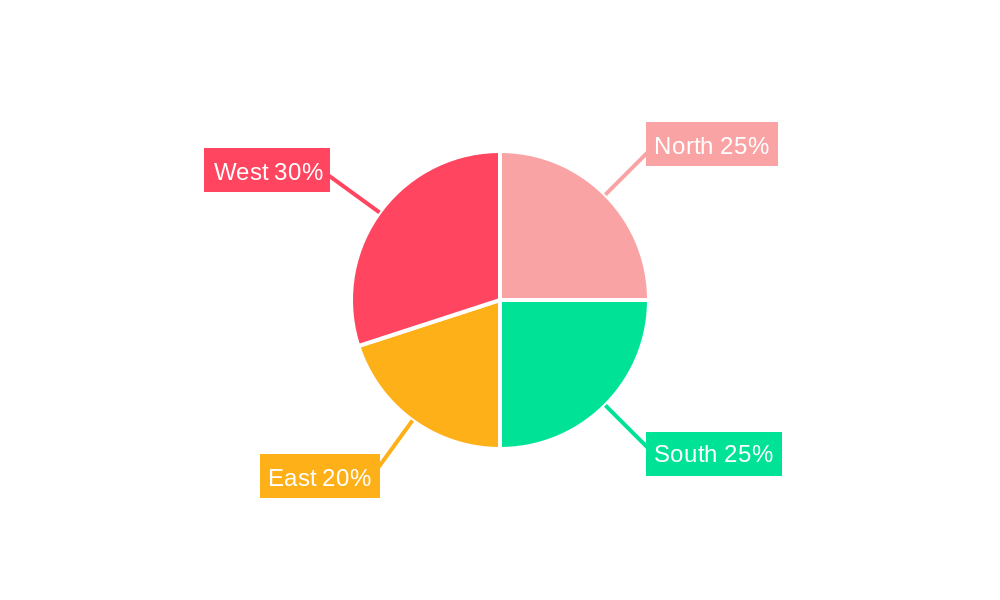

Leading Regions, Countries, or Segments in India Home Mortgage Finance Market

The Indian home mortgage finance market exhibits regional variations in growth and penetration. Metropolitan areas like Mumbai, Delhi-NCR, Bengaluru, and Chennai consistently demonstrate high demand, driven by robust real estate activity and higher disposable incomes.

- Key Drivers:

- High Urbanization Rates: A substantial portion of India's population is migrating to urban centers, boosting demand for housing.

- Government Initiatives: Government schemes supporting affordable housing have stimulated market growth.

- Favorable Interest Rates: Periods of lower interest rates have historically led to increased borrowing.

- Dominance Factors: The concentration of major players and significant real estate development in these metropolitan areas contributes to their dominance. Access to better infrastructure and higher employment opportunities also play crucial roles.

India Home Mortgage Finance Market Product Innovations

The market is witnessing a surge in innovative product offerings, including customized loan packages tailored to specific customer segments, flexible repayment options, and the integration of fintech solutions for streamlined processes. Digital platforms enhance accessibility, while AI-powered credit scoring and risk assessment tools enhance efficiency and reduce processing times. These innovations aim to enhance customer experience and improve overall market efficiency.

Propelling Factors for India Home Mortgage Finance Market Growth

Several factors are driving the growth of the India home mortgage finance market. These include:

- Government Initiatives: Government schemes like the Pradhan Mantri Awas Yojana (PMAY) have significantly boosted demand for affordable housing.

- Economic Growth: Rising disposable incomes and an expanding middle class are fueling demand for home ownership.

- Technological Advancements: Fintech solutions are streamlining lending processes and making home loans more accessible.

- Favorable Demographics: India's large and young population represents a considerable pool of potential homebuyers.

Obstacles in the India Home Mortgage Finance Market

The market faces some challenges, including:

- Regulatory Hurdles: Complex regulatory procedures can sometimes delay loan approvals.

- Economic Uncertainty: Fluctuations in economic conditions can impact consumer sentiment and borrowing activity.

- Competitive Pressures: Intense competition among lenders can lead to thin margins.

- Credit Risk: Assessing and managing credit risk remains crucial for lenders.

Future Opportunities in India Home Mortgage Finance Market

The future holds significant opportunities for growth, including:

- Expansion into Underserved Markets: Reaching potential borrowers in rural and semi-urban areas.

- Technological Advancements: Embracing innovative technologies like blockchain and AI for improved efficiency and security.

- Green Housing Finance: Promoting environmentally sustainable housing practices.

Major Players in the India Home Mortgage Finance Market Ecosystem

- HDFC Housing Finance

- LIC Housing Finance Limited

- Indiabulls Housing Finance Limited

- L&T Housing Finance Limited

- PNB Housing Finance Limited

- IIFL Housing Finance Limited

- GIC Housing Finance Limited

- Sundaram Home Finance

- Tata Capital Housing Finance Limited

- Can Fin Homes Limited

- Repco Home Finance

- Akme Star Housing Finance Limited

- Sahara Housing Finance

- India Home Loan Limited

Key Developments in India Home Mortgage Finance Market Industry

- November 2022: Tata Capital Housing Finance seeks INR 3,000 crore from the National Housing Bank and INR 1,000 crore via bonds to expand its home loan operations.

- October 2022: HDFC Bank and HDFC Ltd. merger to be completed by Q1 FY24.

Strategic India Home Mortgage Finance Market Forecast

The Indian home mortgage finance market is poised for sustained growth, driven by favorable demographics, economic expansion, and ongoing government support. Technological innovation will continue to shape the industry, leading to greater efficiency and accessibility. The market is expected to witness further consolidation, with larger players acquiring smaller ones. The rising adoption of digital platforms and the increasing demand for affordable housing will drive future growth and expansion.

India Home Mortgage Finance Market Segmentation

-

1. Source

- 1.1. Bank

- 1.2. Housing Finance Companies (HFC's)

-

2. Interest Rate

- 2.1. Fixed Rate

- 2.2. Floating Rate

-

3. Tenure

- 3.1. Upto 5 Years

- 3.2. 6 - 10 Years

- 3.3. 11 - 24 Years

- 3.4. 25 - 30 Years

India Home Mortgage Finance Market Segmentation By Geography

- 1. India

India Home Mortgage Finance Market Regional Market Share

Geographic Coverage of India Home Mortgage Finance Market

India Home Mortgage Finance Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.9% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Availability of Affordable Housing in India is Driving the Market Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India Home Mortgage Finance Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Source

- 5.1.1. Bank

- 5.1.2. Housing Finance Companies (HFC's)

- 5.2. Market Analysis, Insights and Forecast - by Interest Rate

- 5.2.1. Fixed Rate

- 5.2.2. Floating Rate

- 5.3. Market Analysis, Insights and Forecast - by Tenure

- 5.3.1. Upto 5 Years

- 5.3.2. 6 - 10 Years

- 5.3.3. 11 - 24 Years

- 5.3.4. 25 - 30 Years

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. India

- 5.1. Market Analysis, Insights and Forecast - by Source

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 HDFC Housing Finance

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 LIC Housing Finance Limited

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Indiabulls Housing Finance Limited

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 L&T Housing Finance Limited

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 PNB Housing Finance Limited

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 IIFL Housing Finance Limited

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 GIC Housing Finance Limited

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Sundaram Home Finance

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Tata Capital Housing Finance Limited

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Can Fin Homes Limited

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Repco Home Finance

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Akme Star Housing Finance Limited

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 Sahara Housing Finance

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.14 India Home Loan Limited**List Not Exhaustive

- 6.2.14.1. Overview

- 6.2.14.2. Products

- 6.2.14.3. SWOT Analysis

- 6.2.14.4. Recent Developments

- 6.2.14.5. Financials (Based on Availability)

- 6.2.1 HDFC Housing Finance

List of Figures

- Figure 1: India Home Mortgage Finance Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: India Home Mortgage Finance Market Share (%) by Company 2025

List of Tables

- Table 1: India Home Mortgage Finance Market Revenue billion Forecast, by Source 2020 & 2033

- Table 2: India Home Mortgage Finance Market Revenue billion Forecast, by Interest Rate 2020 & 2033

- Table 3: India Home Mortgage Finance Market Revenue billion Forecast, by Tenure 2020 & 2033

- Table 4: India Home Mortgage Finance Market Revenue billion Forecast, by Region 2020 & 2033

- Table 5: India Home Mortgage Finance Market Revenue billion Forecast, by Source 2020 & 2033

- Table 6: India Home Mortgage Finance Market Revenue billion Forecast, by Interest Rate 2020 & 2033

- Table 7: India Home Mortgage Finance Market Revenue billion Forecast, by Tenure 2020 & 2033

- Table 8: India Home Mortgage Finance Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India Home Mortgage Finance Market?

The projected CAGR is approximately 4.9%.

2. Which companies are prominent players in the India Home Mortgage Finance Market?

Key companies in the market include HDFC Housing Finance, LIC Housing Finance Limited, Indiabulls Housing Finance Limited, L&T Housing Finance Limited, PNB Housing Finance Limited, IIFL Housing Finance Limited, GIC Housing Finance Limited, Sundaram Home Finance, Tata Capital Housing Finance Limited, Can Fin Homes Limited, Repco Home Finance, Akme Star Housing Finance Limited, Sahara Housing Finance, India Home Loan Limited**List Not Exhaustive.

3. What are the main segments of the India Home Mortgage Finance Market?

The market segments include Source, Interest Rate, Tenure.

4. Can you provide details about the market size?

The market size is estimated to be USD 724.2 billion as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Availability of Affordable Housing in India is Driving the Market Growth.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

November 2022: Tata Capital Housing Finance, a Tata Capital subsidiary, intends to push into the home loan market significantly. To do so, it is looking for the capital of INR 3,000 crore from the National Housing Bank and intends to raise INR 1,000 crore through bonds. Both retail and real estate developers are expected to be eligible for financing from the organization.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India Home Mortgage Finance Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India Home Mortgage Finance Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India Home Mortgage Finance Market?

To stay informed about further developments, trends, and reports in the India Home Mortgage Finance Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence