Key Insights

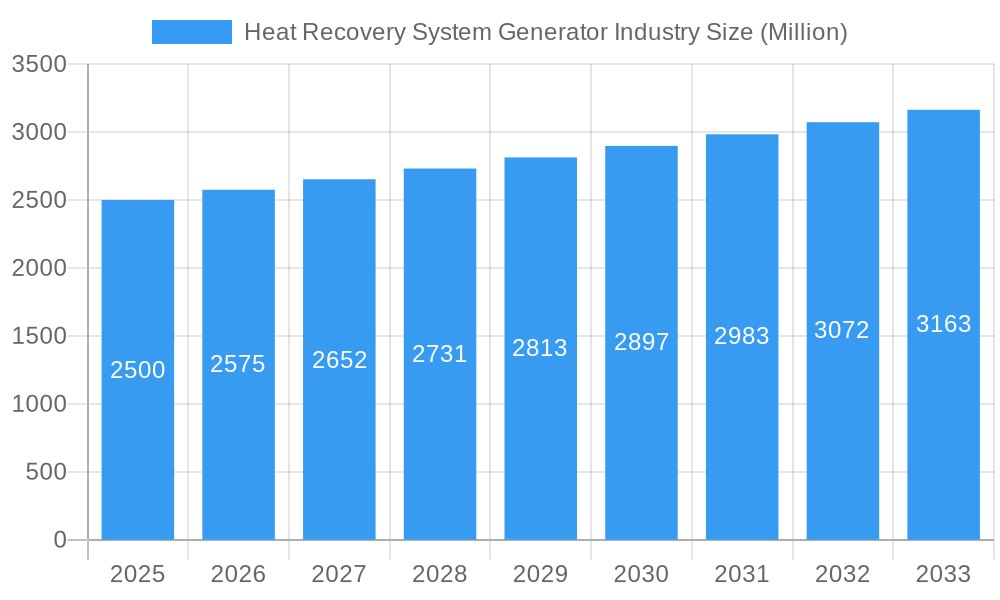

The Heat Recovery System Generator (HRSG) market, valued at $13.39 billion in the base year 2025, is projected to expand at a Compound Annual Growth Rate (CAGR) of 9.22% from 2025 to 2033. This significant growth is driven by escalating industrial energy requirements, stringent environmental mandates for enhanced energy efficiency, and the widespread adoption of Combined Heat and Power (CHP) systems across diverse sectors. Key market catalysts include the expansion of the power generation sector, especially in emerging economies undergoing rapid industrialization. Additionally, the manufacturing and chemical industries are substantial contributors due to their high energy consumption and the considerable cost savings achievable with HRSG implementation. Organic Rankine Cycle (ORC) generators are gaining prominence for their efficient utilization of low-grade heat, while steam turbine and combined cycle generators maintain dominance, particularly in large-scale power facilities. However, substantial initial capital outlay and technological intricacies for certain HRSG configurations may present barriers to market entry, particularly for smaller businesses.

Heat Recovery System Generator Industry Market Size (In Billion)

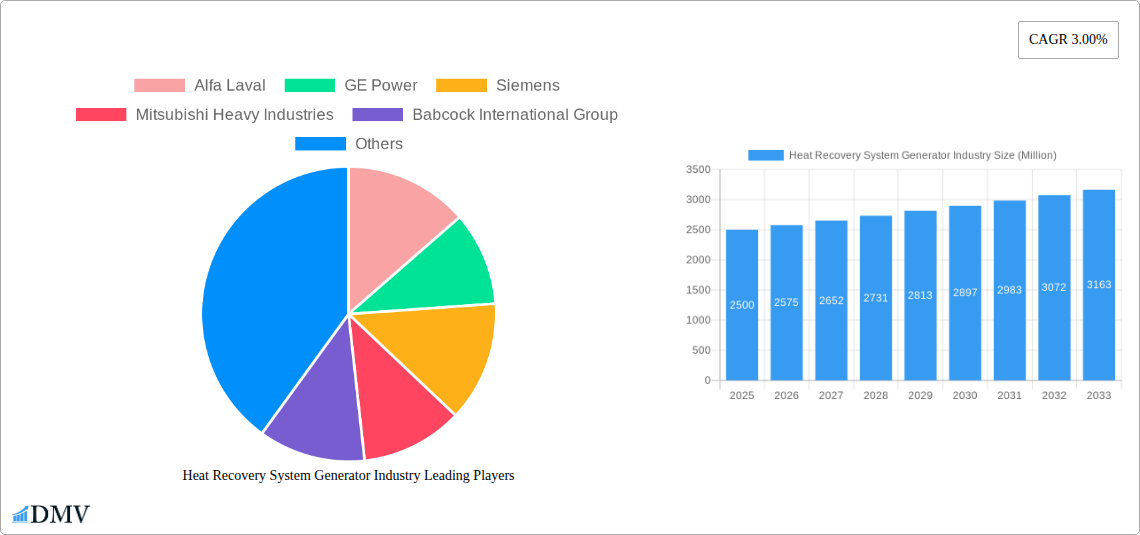

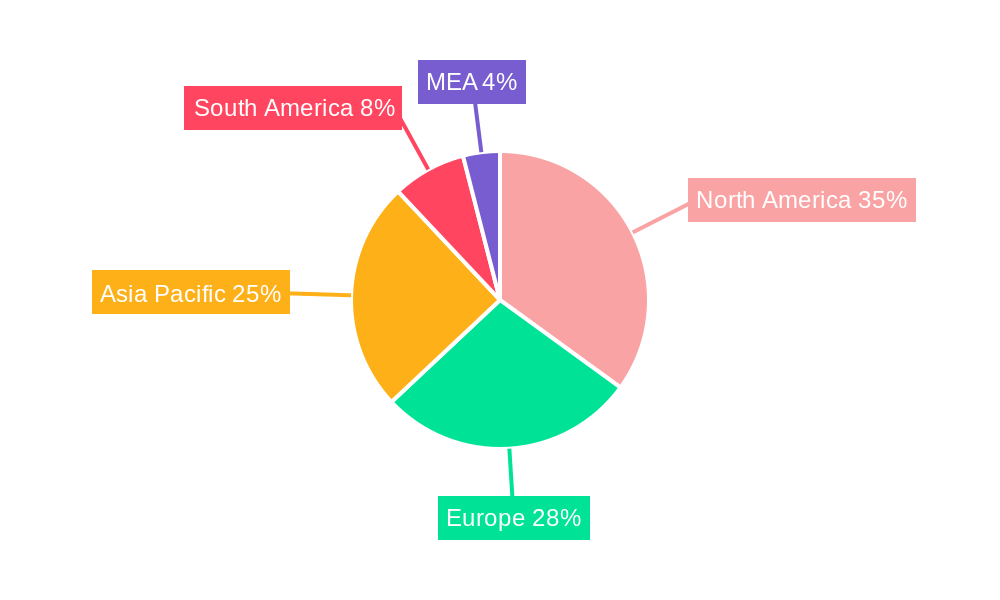

Market segmentation highlights robust opportunities across various end-use industries and applications. The power generation sector commands the largest market share, followed by manufacturing and chemical processing. Within applications, heat exchangers constitute a significant market segment, with increasing demand for thermal storage and humidity recovery systems augmenting overall market expansion. Regional analysis points to strong performance in North America and Asia-Pacific, propelled by vigorous industrial expansion and governmental support for renewable energy integration. Europe also demonstrates considerable potential, influenced by policies promoting energy efficiency. While the Middle East and Africa region offers emerging prospects, market growth may be moderated by economic development and infrastructure investment. Competitive landscapes are shaped by established industry leaders such as Alfa Laval, GE Power, Siemens, and Mitsubishi Heavy Industries, alongside specialized firms concentrating on specific HRSG technologies or niche markets. Continuous technological advancements, including improvements in efficiency and reductions in maintenance expenditures, will be pivotal in defining the future trajectory of the HRSG market.

Heat Recovery System Generator Industry Company Market Share

Heat Recovery System Generator Industry: Market Analysis & Forecast 2019-2033

This comprehensive report provides an in-depth analysis of the Heat Recovery System Generator industry, offering valuable insights into market dynamics, technological advancements, and future growth opportunities. The study covers the period 2019-2033, with 2025 as the base year and a forecast period spanning 2025-2033. The report is essential for stakeholders, investors, and industry professionals seeking to understand the current landscape and future trajectory of this rapidly evolving sector. The global market size reached xx Million in 2024 and is projected to reach xx Million by 2033, exhibiting a robust CAGR of xx% during the forecast period.

Heat Recovery System Generator Industry Market Composition & Trends

The Heat Recovery System Generator market is characterized by a moderately concentrated competitive landscape, with key players like Alfa Laval, GE Power, Siemens, Mitsubishi Heavy Industries, Babcock International Group, Kelvion Holding GmbH, ATEC, Thermotech, and Calnetix holding significant market share. Market share distribution among these players varies considerably, with Alfa Laval and Siemens estimated to hold approximately xx% and xx% respectively in 2025. Innovation is primarily driven by advancements in Organic Rankine Cycle (ORC) technology and the development of more efficient heat exchangers. Stringent environmental regulations globally are major catalysts, pushing for increased energy efficiency and reduced carbon emissions. Substitute products, such as direct combustion systems, present competitive pressure, although the efficiency advantages of heat recovery systems often outweigh the initial cost differences. The end-user profile is diverse, spanning power generation, manufacturing, chemical, and petrochemical industries, with power generation representing the largest segment. M&A activity in the industry has been relatively moderate in recent years, with deal values averaging around xx Million per transaction historically. However, a surge in activity is anticipated as companies seek to expand their technological capabilities and geographic reach.

- Market Concentration: Moderately concentrated, with a few dominant players.

- Innovation Catalysts: ORC technology advancements, efficient heat exchanger design, environmental regulations.

- Regulatory Landscape: Stringent emission standards drive adoption.

- Substitute Products: Direct combustion systems pose competitive pressure.

- End-User Profile: Diverse, including power generation (largest segment), manufacturing, chemical, and petrochemical industries.

- M&A Activity: Moderate historically, with an anticipated increase in the coming years.

Heat Recovery System Generator Industry Industry Evolution

The Heat Recovery System Generator market has witnessed significant growth over the historical period (2019-2024), driven by increasing industrial energy demands and growing awareness of energy efficiency. Technological advancements, such as the development of advanced materials and improved control systems, have enhanced the performance and reliability of heat recovery systems. Shifting consumer demands towards sustainability and reduced carbon footprint are further propelling market growth. The market experienced a xx% growth rate during 2019-2024, fueled by strong demand from the power generation sector and the increasing adoption of ORC technology in smaller-scale applications. The forecast period (2025-2033) anticipates sustained growth, driven by expansion in emerging economies and further technological improvements leading to increased efficiency and reduced costs. The adoption of heat recovery systems in various end-use industries is expected to increase by approximately xx% annually during the forecast period, mainly driven by stricter environmental regulations.

Leading Regions, Countries, or Segments in Heat Recovery System Generator Industry

The North American region currently holds a dominant position in the Heat Recovery System Generator market, driven by substantial investments in renewable energy infrastructure and stringent emission regulations. Europe follows closely, with a strong focus on energy efficiency and industrial modernization. Within the segment breakdown:

By Generator Type: The Steam Turbine segment currently holds the largest market share due to its established technology and wider applicability. However, the Organic Rankine Cycle (ORC) segment is experiencing the fastest growth rate due to its suitability for lower temperature heat sources and smaller scale applications.

By End-Use Industry: The Power Generation segment dominates the market due to the significant potential for energy savings in power plants.

By Application: Heat Exchangers represent the largest application segment due to their versatility and applicability across various industries.

Key Drivers for Dominance:

- North America: Stringent environmental regulations, substantial investments in renewable energy.

- Europe: Focus on industrial modernization and energy efficiency initiatives.

- Steam Turbine Segment: Established technology, wider applicability.

- ORC Segment: Fast growth due to suitability for diverse applications.

- Power Generation Segment: Significant energy saving potential.

- Heat Exchanger Application: Versatility and broad applicability across industries.

Heat Recovery System Generator Industry Product Innovations

Recent innovations in the heat recovery system generator market include advanced materials for improved heat transfer efficiency, enhanced control systems for optimized performance, and the integration of smart technologies for predictive maintenance. These advancements have resulted in increased system efficiency, reduced operating costs, and extended lifespan. Unique selling propositions often center around improved energy efficiency, reduced emissions, and enhanced system reliability. The development of compact and modular systems for easier installation and integration is also contributing to market growth.

Propelling Factors for Heat Recovery System Generator Industry Growth

Technological advancements, particularly in ORC technology and heat exchanger design, are key growth drivers. Stringent environmental regulations globally incentivize the adoption of energy-efficient technologies, boosting demand for heat recovery systems. Furthermore, the increasing focus on industrial energy efficiency and the rising cost of energy are driving the adoption of these systems across various end-use industries. Government incentives and subsidies for renewable energy projects further enhance market growth.

Obstacles in the Heat Recovery System Generator Industry Market

High initial investment costs can hinder adoption, particularly for smaller businesses. Supply chain disruptions and material price volatility can impact production and profitability. Intense competition among established players and the emergence of new entrants pose significant competitive pressures. Furthermore, regulatory uncertainties and complexities in different regions can create barriers to market entry and expansion. The overall impact of these obstacles on market growth is estimated to reduce the annual growth rate by approximately xx% during the forecast period.

Future Opportunities in Heat Recovery System Generator Industry

Significant opportunities lie in emerging economies with rapid industrialization and increasing energy demands. The integration of advanced technologies like artificial intelligence (AI) and machine learning (ML) for predictive maintenance and optimized performance represents a substantial growth area. Expansion into niche applications, such as waste heat recovery from data centers and transportation, presents further potential. Furthermore, the development of sustainable and eco-friendly materials for heat exchangers can provide a competitive advantage.

Major Players in the Heat Recovery System Generator Industry Ecosystem

- Alfa Laval

- GE Power

- Siemens

- Mitsubishi Heavy Industries

- Babcock International Group

- Kelvion Holding GmbH

- ATEC

- Thermotech

- Calnetix

Key Developments in Heat Recovery System Generator Industry Industry

- 2022 Q4: Alfa Laval launched a new line of high-efficiency heat exchangers, boosting market competitiveness.

- 2023 Q1: Siemens announced a strategic partnership to develop advanced ORC technology for industrial applications.

- 2023 Q3: Mitsubishi Heavy Industries acquired a smaller competitor, expanding its market share. (Further details on the acquired company and deal value are not available at this time.)

Strategic Heat Recovery System Generator Industry Market Forecast

The Heat Recovery System Generator market is poised for significant growth over the forecast period, driven by sustained demand from various end-use industries, technological advancements, and supportive government policies. The market's expansion will be particularly strong in emerging economies, coupled with the continued adoption of ORC technology and the development of innovative heat exchanger designs. This positive outlook, however, is tempered by potential supply chain challenges and intense competition. Overall, the market is expected to experience robust growth, with considerable opportunities for established players and new entrants alike.

Heat Recovery System Generator Industry Segmentation

-

1. Generator Type

- 1.1. Organic Rankine Cycle (ORC)

- 1.2. Steam Turbine

- 1.3. Combined Cycle

-

2. End-Use Industry

- 2.1. Power Generation

- 2.2. Manufacturing

- 2.3. Chemical

- 2.4. Petrochemical

-

3. Application

- 3.1. Heat Exchangers

- 3.2. Thermal Storage

- 3.3. Humidity Recovery

Heat Recovery System Generator Industry Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. South America

- 5. Middle East and Africa

Heat Recovery System Generator Industry Regional Market Share

Geographic Coverage of Heat Recovery System Generator Industry

Heat Recovery System Generator Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 9.22% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; The Growing Demand for Solar Energy-Based Power Generation4.; Declining Photovoltaic System Prices

- 3.3. Market Restrains

- 3.3.1. 4.; The Country's Inefficient Electricity Grid Infrastructure

- 3.4. Market Trends

- 3.4.1. Power Generation to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Heat Recovery System Generator Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Generator Type

- 5.1.1. Organic Rankine Cycle (ORC)

- 5.1.2. Steam Turbine

- 5.1.3. Combined Cycle

- 5.2. Market Analysis, Insights and Forecast - by End-Use Industry

- 5.2.1. Power Generation

- 5.2.2. Manufacturing

- 5.2.3. Chemical

- 5.2.4. Petrochemical

- 5.3. Market Analysis, Insights and Forecast - by Application

- 5.3.1. Heat Exchangers

- 5.3.2. Thermal Storage

- 5.3.3. Humidity Recovery

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. South America

- 5.4.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Generator Type

- 6. North America Heat Recovery System Generator Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Generator Type

- 6.1.1. Organic Rankine Cycle (ORC)

- 6.1.2. Steam Turbine

- 6.1.3. Combined Cycle

- 6.2. Market Analysis, Insights and Forecast - by End-Use Industry

- 6.2.1. Power Generation

- 6.2.2. Manufacturing

- 6.2.3. Chemical

- 6.2.4. Petrochemical

- 6.3. Market Analysis, Insights and Forecast - by Application

- 6.3.1. Heat Exchangers

- 6.3.2. Thermal Storage

- 6.3.3. Humidity Recovery

- 6.1. Market Analysis, Insights and Forecast - by Generator Type

- 7. Europe Heat Recovery System Generator Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Generator Type

- 7.1.1. Organic Rankine Cycle (ORC)

- 7.1.2. Steam Turbine

- 7.1.3. Combined Cycle

- 7.2. Market Analysis, Insights and Forecast - by End-Use Industry

- 7.2.1. Power Generation

- 7.2.2. Manufacturing

- 7.2.3. Chemical

- 7.2.4. Petrochemical

- 7.3. Market Analysis, Insights and Forecast - by Application

- 7.3.1. Heat Exchangers

- 7.3.2. Thermal Storage

- 7.3.3. Humidity Recovery

- 7.1. Market Analysis, Insights and Forecast - by Generator Type

- 8. Asia Pacific Heat Recovery System Generator Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Generator Type

- 8.1.1. Organic Rankine Cycle (ORC)

- 8.1.2. Steam Turbine

- 8.1.3. Combined Cycle

- 8.2. Market Analysis, Insights and Forecast - by End-Use Industry

- 8.2.1. Power Generation

- 8.2.2. Manufacturing

- 8.2.3. Chemical

- 8.2.4. Petrochemical

- 8.3. Market Analysis, Insights and Forecast - by Application

- 8.3.1. Heat Exchangers

- 8.3.2. Thermal Storage

- 8.3.3. Humidity Recovery

- 8.1. Market Analysis, Insights and Forecast - by Generator Type

- 9. South America Heat Recovery System Generator Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Generator Type

- 9.1.1. Organic Rankine Cycle (ORC)

- 9.1.2. Steam Turbine

- 9.1.3. Combined Cycle

- 9.2. Market Analysis, Insights and Forecast - by End-Use Industry

- 9.2.1. Power Generation

- 9.2.2. Manufacturing

- 9.2.3. Chemical

- 9.2.4. Petrochemical

- 9.3. Market Analysis, Insights and Forecast - by Application

- 9.3.1. Heat Exchangers

- 9.3.2. Thermal Storage

- 9.3.3. Humidity Recovery

- 9.1. Market Analysis, Insights and Forecast - by Generator Type

- 10. Middle East and Africa Heat Recovery System Generator Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Generator Type

- 10.1.1. Organic Rankine Cycle (ORC)

- 10.1.2. Steam Turbine

- 10.1.3. Combined Cycle

- 10.2. Market Analysis, Insights and Forecast - by End-Use Industry

- 10.2.1. Power Generation

- 10.2.2. Manufacturing

- 10.2.3. Chemical

- 10.2.4. Petrochemical

- 10.3. Market Analysis, Insights and Forecast - by Application

- 10.3.1. Heat Exchangers

- 10.3.2. Thermal Storage

- 10.3.3. Humidity Recovery

- 10.1. Market Analysis, Insights and Forecast - by Generator Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Alfa Laval

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 GE Power

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Siemens

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Mitsubishi Heavy Industries

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Babcock International Group

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Kelvion Holding GmbH

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 ATEC

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Thermotech

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Calnetix

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.1 Alfa Laval

List of Figures

- Figure 1: Global Heat Recovery System Generator Industry Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Heat Recovery System Generator Industry Revenue (billion), by Generator Type 2025 & 2033

- Figure 3: North America Heat Recovery System Generator Industry Revenue Share (%), by Generator Type 2025 & 2033

- Figure 4: North America Heat Recovery System Generator Industry Revenue (billion), by End-Use Industry 2025 & 2033

- Figure 5: North America Heat Recovery System Generator Industry Revenue Share (%), by End-Use Industry 2025 & 2033

- Figure 6: North America Heat Recovery System Generator Industry Revenue (billion), by Application 2025 & 2033

- Figure 7: North America Heat Recovery System Generator Industry Revenue Share (%), by Application 2025 & 2033

- Figure 8: North America Heat Recovery System Generator Industry Revenue (billion), by Country 2025 & 2033

- Figure 9: North America Heat Recovery System Generator Industry Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe Heat Recovery System Generator Industry Revenue (billion), by Generator Type 2025 & 2033

- Figure 11: Europe Heat Recovery System Generator Industry Revenue Share (%), by Generator Type 2025 & 2033

- Figure 12: Europe Heat Recovery System Generator Industry Revenue (billion), by End-Use Industry 2025 & 2033

- Figure 13: Europe Heat Recovery System Generator Industry Revenue Share (%), by End-Use Industry 2025 & 2033

- Figure 14: Europe Heat Recovery System Generator Industry Revenue (billion), by Application 2025 & 2033

- Figure 15: Europe Heat Recovery System Generator Industry Revenue Share (%), by Application 2025 & 2033

- Figure 16: Europe Heat Recovery System Generator Industry Revenue (billion), by Country 2025 & 2033

- Figure 17: Europe Heat Recovery System Generator Industry Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific Heat Recovery System Generator Industry Revenue (billion), by Generator Type 2025 & 2033

- Figure 19: Asia Pacific Heat Recovery System Generator Industry Revenue Share (%), by Generator Type 2025 & 2033

- Figure 20: Asia Pacific Heat Recovery System Generator Industry Revenue (billion), by End-Use Industry 2025 & 2033

- Figure 21: Asia Pacific Heat Recovery System Generator Industry Revenue Share (%), by End-Use Industry 2025 & 2033

- Figure 22: Asia Pacific Heat Recovery System Generator Industry Revenue (billion), by Application 2025 & 2033

- Figure 23: Asia Pacific Heat Recovery System Generator Industry Revenue Share (%), by Application 2025 & 2033

- Figure 24: Asia Pacific Heat Recovery System Generator Industry Revenue (billion), by Country 2025 & 2033

- Figure 25: Asia Pacific Heat Recovery System Generator Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: South America Heat Recovery System Generator Industry Revenue (billion), by Generator Type 2025 & 2033

- Figure 27: South America Heat Recovery System Generator Industry Revenue Share (%), by Generator Type 2025 & 2033

- Figure 28: South America Heat Recovery System Generator Industry Revenue (billion), by End-Use Industry 2025 & 2033

- Figure 29: South America Heat Recovery System Generator Industry Revenue Share (%), by End-Use Industry 2025 & 2033

- Figure 30: South America Heat Recovery System Generator Industry Revenue (billion), by Application 2025 & 2033

- Figure 31: South America Heat Recovery System Generator Industry Revenue Share (%), by Application 2025 & 2033

- Figure 32: South America Heat Recovery System Generator Industry Revenue (billion), by Country 2025 & 2033

- Figure 33: South America Heat Recovery System Generator Industry Revenue Share (%), by Country 2025 & 2033

- Figure 34: Middle East and Africa Heat Recovery System Generator Industry Revenue (billion), by Generator Type 2025 & 2033

- Figure 35: Middle East and Africa Heat Recovery System Generator Industry Revenue Share (%), by Generator Type 2025 & 2033

- Figure 36: Middle East and Africa Heat Recovery System Generator Industry Revenue (billion), by End-Use Industry 2025 & 2033

- Figure 37: Middle East and Africa Heat Recovery System Generator Industry Revenue Share (%), by End-Use Industry 2025 & 2033

- Figure 38: Middle East and Africa Heat Recovery System Generator Industry Revenue (billion), by Application 2025 & 2033

- Figure 39: Middle East and Africa Heat Recovery System Generator Industry Revenue Share (%), by Application 2025 & 2033

- Figure 40: Middle East and Africa Heat Recovery System Generator Industry Revenue (billion), by Country 2025 & 2033

- Figure 41: Middle East and Africa Heat Recovery System Generator Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Heat Recovery System Generator Industry Revenue billion Forecast, by Generator Type 2020 & 2033

- Table 2: Global Heat Recovery System Generator Industry Revenue billion Forecast, by End-Use Industry 2020 & 2033

- Table 3: Global Heat Recovery System Generator Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 4: Global Heat Recovery System Generator Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 5: Global Heat Recovery System Generator Industry Revenue billion Forecast, by Generator Type 2020 & 2033

- Table 6: Global Heat Recovery System Generator Industry Revenue billion Forecast, by End-Use Industry 2020 & 2033

- Table 7: Global Heat Recovery System Generator Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 8: Global Heat Recovery System Generator Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 9: Global Heat Recovery System Generator Industry Revenue billion Forecast, by Generator Type 2020 & 2033

- Table 10: Global Heat Recovery System Generator Industry Revenue billion Forecast, by End-Use Industry 2020 & 2033

- Table 11: Global Heat Recovery System Generator Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 12: Global Heat Recovery System Generator Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 13: Global Heat Recovery System Generator Industry Revenue billion Forecast, by Generator Type 2020 & 2033

- Table 14: Global Heat Recovery System Generator Industry Revenue billion Forecast, by End-Use Industry 2020 & 2033

- Table 15: Global Heat Recovery System Generator Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 16: Global Heat Recovery System Generator Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 17: Global Heat Recovery System Generator Industry Revenue billion Forecast, by Generator Type 2020 & 2033

- Table 18: Global Heat Recovery System Generator Industry Revenue billion Forecast, by End-Use Industry 2020 & 2033

- Table 19: Global Heat Recovery System Generator Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 20: Global Heat Recovery System Generator Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 21: Global Heat Recovery System Generator Industry Revenue billion Forecast, by Generator Type 2020 & 2033

- Table 22: Global Heat Recovery System Generator Industry Revenue billion Forecast, by End-Use Industry 2020 & 2033

- Table 23: Global Heat Recovery System Generator Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 24: Global Heat Recovery System Generator Industry Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Heat Recovery System Generator Industry?

The projected CAGR is approximately 9.22%.

2. Which companies are prominent players in the Heat Recovery System Generator Industry?

Key companies in the market include Alfa Laval , GE Power , Siemens , Mitsubishi Heavy Industries , Babcock International Group , Kelvion Holding GmbH , ATEC , Thermotech , Calnetix.

3. What are the main segments of the Heat Recovery System Generator Industry?

The market segments include Generator Type, End-Use Industry, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 13.39 billion as of 2022.

5. What are some drivers contributing to market growth?

4.; The Growing Demand for Solar Energy-Based Power Generation4.; Declining Photovoltaic System Prices.

6. What are the notable trends driving market growth?

Power Generation to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; The Country's Inefficient Electricity Grid Infrastructure.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Heat Recovery System Generator Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Heat Recovery System Generator Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Heat Recovery System Generator Industry?

To stay informed about further developments, trends, and reports in the Heat Recovery System Generator Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence