Key Insights

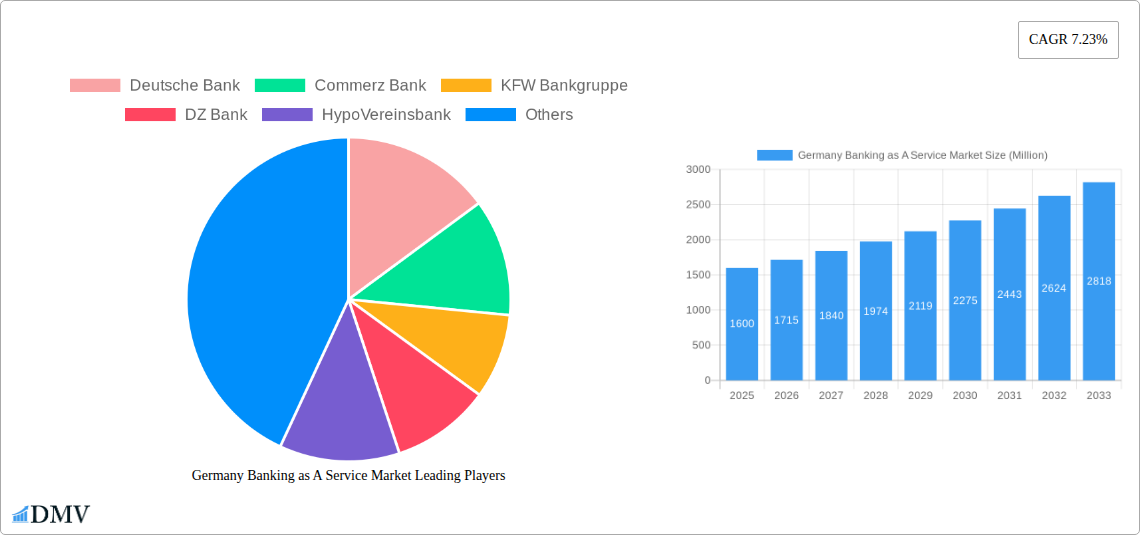

The German Banking-as-a-Service (BaaS) market, valued at €1.6 billion in 2025, is poised for significant growth, exhibiting a Compound Annual Growth Rate (CAGR) of 7.23% from 2025 to 2033. This expansion is driven by several key factors. Firstly, the increasing adoption of digital banking solutions by both established financial institutions and fintech startups is fueling demand for flexible and scalable BaaS offerings. Secondly, stringent regulatory requirements are encouraging banks to outsource non-core functions, leading them to leverage BaaS providers for enhanced efficiency and cost optimization. Finally, the rising demand for personalized financial products and services necessitates the agility and customization capabilities provided by BaaS platforms. The market's competitive landscape is shaped by a mix of established players like Deutsche Bank, Commerzbank, and KfW Bankgruppe, alongside innovative fintechs such as SolarisBank, Mambu, and Figo. This dynamic environment fosters innovation and accelerates the overall market growth.

Germany Banking as A Service Market Market Size (In Billion)

The projected growth trajectory suggests the market will continue its upward trend, exceeding €2.5 billion by 2030. However, challenges such as data security concerns and the need for robust regulatory compliance remain critical factors influencing market development. To maintain this momentum, BaaS providers must prioritize secure infrastructure, comply with evolving regulations, and offer innovative solutions addressing the evolving needs of both banks and consumers. Furthermore, strategic partnerships between traditional banks and fintechs are likely to play a vital role in shaping the future of the German BaaS market. The focus will increasingly shift towards providing tailored solutions catering to specific niches within the financial sector, such as embedded finance and open banking initiatives.

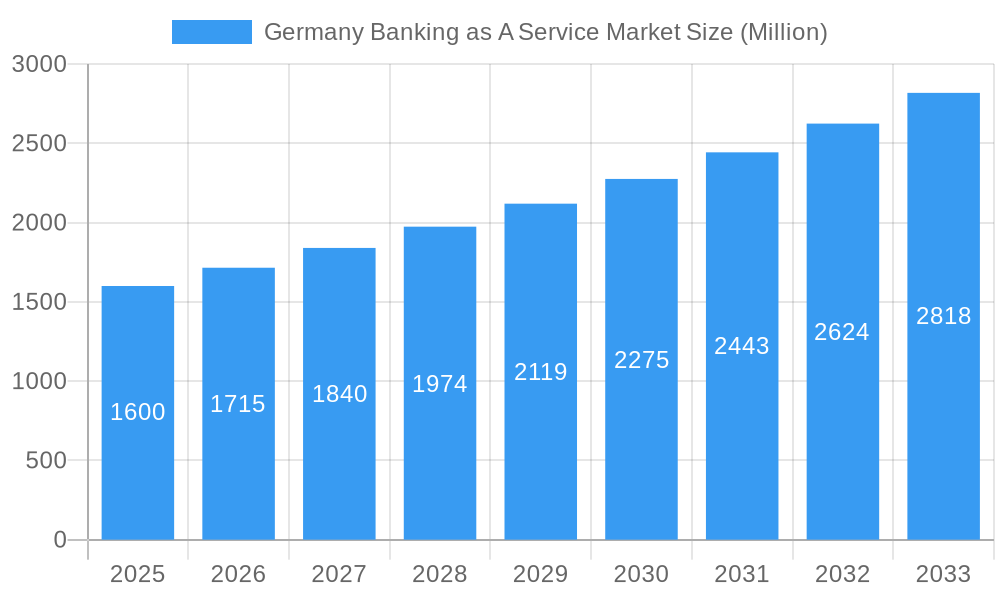

Germany Banking as A Service Market Company Market Share

Germany Banking as a Service (BaaS) Market: A Comprehensive Report (2019-2033)

This insightful report delivers a comprehensive analysis of the burgeoning Germany Banking as a Service (BaaS) market, projecting robust growth from €XX Million in 2025 to €XX Million by 2033. The study period covers 2019-2033, with 2025 serving as the base and estimated year. This detailed examination unravels market dynamics, competitive landscapes, and future opportunities, providing invaluable insights for stakeholders across the financial technology (FinTech) ecosystem.

Germany Banking as A Service Market Market Composition & Trends

This section offers a comprehensive analysis of the German Banking as a Service (BaaS) market, delving into its structural dynamics, competitive forces, key growth drivers, the influence of regulatory frameworks, the presence of alternative solutions, the characteristics of its diverse user base, and recent merger and acquisition (M&A) trends.

Market Structure & Competitive Dynamics: The German BaaS market is characterized by a dynamic competitive arena, balancing the presence of established financial institutions with the rapid innovation introduced by specialized FinTechs. Leading traditional banks such as Deutsche Bank and Commerzbank are actively engaging with BaaS offerings, while agile FinTech providers like SolarisBank and Mambu are carving out significant market positions. Projections for market share distribution in 2025 indicate a continued strong presence for Established Banks (estimated at 60%), with FinTechs capturing a substantial portion (approximately 30%), and other players filling the remaining 10%. This evolving distribution underscores the accelerated adoption of digital financial services and the increasing integration of BaaS solutions. Strategic M&A activities are proving instrumental in reshaping this competitive landscape, with a focus on expanding capabilities and market reach.

Innovation Drivers & Regulatory Environment: The proliferation of advanced technologies serves as a potent catalyst for innovation within the German BaaS ecosystem. Key among these are the widespread adoption of open banking APIs, which facilitate seamless integration and data exchange, and the scalability and flexibility offered by cloud computing infrastructure. The regulatory environment, while continuously adapting to the evolving FinTech sector, remains a critical factor influencing market development. Government initiatives aimed at nurturing FinTech innovation are creating a fertile ground for new BaaS solutions and partnerships. However, stringent regulations concerning data privacy (e.g., GDPR compliance) and cybersecurity present ongoing challenges that require meticulous attention and robust adherence from all market participants.

Substitute Offerings & End-User Segmentation: While traditional banking services represent the primary historical alternative to BaaS, the market is experiencing significant growth driven by the escalating demand for bespoke and embedded financial solutions. This demand is particularly pronounced among Small and Medium-sized Enterprises (SMEs) and large enterprises seeking to streamline their financial operations and enhance customer experiences. The end-user base for BaaS in Germany is broad and multifaceted, encompassing:

- Financial Institutions: Seeking to broaden their product portfolios, enhance customer engagement, and enter new market segments without the burden of building entirely new infrastructure.

- FinTech Companies: Leveraging BaaS providers to access regulated banking functionalities, enabling them to rapidly launch innovative financial products and services to their target audiences.

- Non-Financial Businesses: Requiring tailored financial solutions integrated directly into their existing platforms and workflows, such as payment processing, embedded lending, or account management capabilities, to improve operational efficiency and customer value.

Merger & Acquisition (M&A) Landscape: The past five years have been marked by a surge in M&A activity within the German BaaS sector, with reported deal values frequently exceeding €XX Million. These strategic consolidations are primarily fueled by a desire for accelerated expansion, the seamless integration of cutting-edge technologies and platforms, and the ambition to achieve broader market penetration and a more comprehensive service offering.

Germany Banking as a Service Market Industry Evolution

The German BaaS market is characterized by a dynamic interplay of technological advancements, shifting consumer demands, and evolving regulatory landscapes. The historical period (2019-2024) witnessed a Compound Annual Growth Rate (CAGR) of XX%, driven by the increasing adoption of digital banking solutions. This upward trajectory is expected to continue through the forecast period (2025-2033), with a projected CAGR of XX%. The growth is fueled by several key factors including:

- Increased Demand for Personalized Financial Services: Consumers and businesses increasingly seek customized and tailored financial solutions beyond the traditional banking offerings.

- Technological Advancements: Advancements in API technology, cloud computing, and AI are streamlining financial services and reducing operational costs.

- Open Banking Initiatives: The implementation of open banking frameworks is fostering interoperability and enabling seamless data exchange among financial institutions.

- Regulatory Support: Government support for FinTech development is creating a favorable environment for market expansion.

Leading Regions, Countries, or Segments in Germany Banking as a Service Market

The German BaaS market demonstrates a relatively even distribution across major metropolitan areas like Frankfurt, Munich, and Berlin. However, Frankfurt, being a major financial hub, holds a slight edge due to the concentration of traditional banks and FinTech startups. Key drivers for this dominance include:

- Established Financial Infrastructure: Frankfurt’s long-standing presence as a significant financial center provides a robust ecosystem supporting BaaS growth.

- High Concentration of Financial Institutions: A large number of traditional banks and FinTechs provide a fertile ground for innovation and collaboration within the BaaS space.

- Government Support for FinTech: Local and national policies promoting FinTech growth create a favorable business environment.

Germany Banking as a Service Market Product Innovations

Recent product innovations in the German BaaS market emphasize tailored solutions, enhanced security features, and streamlined integration capabilities. This includes the integration of AI for personalized services, improved risk management tools, and robust cybersecurity protocols. Unique selling propositions (USPs) focus on offering speed, flexibility, and cost-effectiveness compared to traditional banking solutions, while technological advancements leverage cloud-based architecture and open APIs to enhance scalability and accessibility.

Propelling Factors for Germany Banking as a Service Market Growth

The German BaaS market is propelled by several key factors:

- Technological advancements: Open banking APIs, cloud computing, and AI are driving efficiency and innovation.

- Economic growth: A stable economy increases demand for financial services and fuels investment in new technologies.

- Regulatory support: Favorable regulatory frameworks encourage FinTech development and competition.

Obstacles in the Germany Banking as a Service Market Market

Challenges facing the German BaaS market include:

- Regulatory complexities: Strict data privacy regulations can hinder innovation and market entry.

- Cybersecurity risks: The digital nature of BaaS increases vulnerability to cyberattacks.

- Competition: Intense competition from established banks and emerging FinTechs poses a challenge.

Future Opportunities in Germany Banking as a Service Market

Future opportunities include:

- Expansion into underserved markets, such as rural areas.

- Integration of new technologies, such as blockchain.

- Development of innovative products catering to evolving consumer needs.

Major Players in the Germany Banking as a Service Market Ecosystem

- Deutsche Bank

- Commerzbank

- KFW Bankgruppe

- DZ Bank

- HypoVereinsbank

- Solaris Bank

- Bankable

- Figo

- Mambu

- Crosscard

- Deposit Solutions

Key Developments in Germany Banking as a Service Market Industry

- September 2023: Deutsche Bank launched DB Investment Partners (DBIP), expanding into private credit opportunities.

- November 2023: Commerzbank received the first German Crypto Custody Licence, enabling the development of digital asset services.

Strategic Germany Banking as a Service Market Forecast

The German BaaS market is poised for continued growth, driven by technological innovation, evolving consumer preferences, and supportive regulatory frameworks. The market's future hinges on successful navigation of regulatory complexities and leveraging opportunities presented by emerging technologies. The forecast predicts sustained growth and market expansion, making it an attractive sector for both established players and new entrants.

Germany Banking as A Service Market Segmentation

-

1. Component

- 1.1. Platform

-

1.2. Service

- 1.2.1. Professional Service

- 1.2.2. Managed Service

-

2. Type

- 2.1. API-based Bank-as-a-service

- 2.2. Cloud-based Bank-as-a-service

-

3. Enterprise Size

- 3.1. Large Enterprise

- 3.2. Small & Medium Enterprise

-

4. End-User

- 4.1. Banks

- 4.2. FinTech Corporations/NBFC

- 4.3. Other End-Users

Germany Banking as A Service Market Segmentation By Geography

- 1. Germany

Germany Banking as A Service Market Regional Market Share

Geographic Coverage of Germany Banking as A Service Market

Germany Banking as A Service Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.23% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Digitization and Open Banking Initiatives are Driving the Market; Fintech Growth is Driving the Market

- 3.3. Market Restrains

- 3.3.1. Digitization and Open Banking Initiatives are Driving the Market; Fintech Growth is Driving the Market

- 3.4. Market Trends

- 3.4.1. Increase in Use of Digital Transformation Technology in Banks is Driving the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Germany Banking as A Service Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Component

- 5.1.1. Platform

- 5.1.2. Service

- 5.1.2.1. Professional Service

- 5.1.2.2. Managed Service

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. API-based Bank-as-a-service

- 5.2.2. Cloud-based Bank-as-a-service

- 5.3. Market Analysis, Insights and Forecast - by Enterprise Size

- 5.3.1. Large Enterprise

- 5.3.2. Small & Medium Enterprise

- 5.4. Market Analysis, Insights and Forecast - by End-User

- 5.4.1. Banks

- 5.4.2. FinTech Corporations/NBFC

- 5.4.3. Other End-Users

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. Germany

- 5.1. Market Analysis, Insights and Forecast - by Component

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Deutsche Bank

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Commerz Bank

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 KFW Bankgruppe

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 DZ Bank

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 HypoVereinsbank

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Solaris Bank

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Bankable

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Figo

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Mambu

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Crosscard

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Deposit Solutions**List Not Exhaustive

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 Deutsche Bank

List of Figures

- Figure 1: Germany Banking as A Service Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Germany Banking as A Service Market Share (%) by Company 2025

List of Tables

- Table 1: Germany Banking as A Service Market Revenue Million Forecast, by Component 2020 & 2033

- Table 2: Germany Banking as A Service Market Volume Billion Forecast, by Component 2020 & 2033

- Table 3: Germany Banking as A Service Market Revenue Million Forecast, by Type 2020 & 2033

- Table 4: Germany Banking as A Service Market Volume Billion Forecast, by Type 2020 & 2033

- Table 5: Germany Banking as A Service Market Revenue Million Forecast, by Enterprise Size 2020 & 2033

- Table 6: Germany Banking as A Service Market Volume Billion Forecast, by Enterprise Size 2020 & 2033

- Table 7: Germany Banking as A Service Market Revenue Million Forecast, by End-User 2020 & 2033

- Table 8: Germany Banking as A Service Market Volume Billion Forecast, by End-User 2020 & 2033

- Table 9: Germany Banking as A Service Market Revenue Million Forecast, by Region 2020 & 2033

- Table 10: Germany Banking as A Service Market Volume Billion Forecast, by Region 2020 & 2033

- Table 11: Germany Banking as A Service Market Revenue Million Forecast, by Component 2020 & 2033

- Table 12: Germany Banking as A Service Market Volume Billion Forecast, by Component 2020 & 2033

- Table 13: Germany Banking as A Service Market Revenue Million Forecast, by Type 2020 & 2033

- Table 14: Germany Banking as A Service Market Volume Billion Forecast, by Type 2020 & 2033

- Table 15: Germany Banking as A Service Market Revenue Million Forecast, by Enterprise Size 2020 & 2033

- Table 16: Germany Banking as A Service Market Volume Billion Forecast, by Enterprise Size 2020 & 2033

- Table 17: Germany Banking as A Service Market Revenue Million Forecast, by End-User 2020 & 2033

- Table 18: Germany Banking as A Service Market Volume Billion Forecast, by End-User 2020 & 2033

- Table 19: Germany Banking as A Service Market Revenue Million Forecast, by Country 2020 & 2033

- Table 20: Germany Banking as A Service Market Volume Billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Germany Banking as A Service Market?

The projected CAGR is approximately 7.23%.

2. Which companies are prominent players in the Germany Banking as A Service Market?

Key companies in the market include Deutsche Bank, Commerz Bank, KFW Bankgruppe, DZ Bank, HypoVereinsbank, Solaris Bank, Bankable, Figo, Mambu, Crosscard, Deposit Solutions**List Not Exhaustive.

3. What are the main segments of the Germany Banking as A Service Market?

The market segments include Component, Type, Enterprise Size, End-User.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.60 Million as of 2022.

5. What are some drivers contributing to market growth?

Digitization and Open Banking Initiatives are Driving the Market; Fintech Growth is Driving the Market.

6. What are the notable trends driving market growth?

Increase in Use of Digital Transformation Technology in Banks is Driving the Market.

7. Are there any restraints impacting market growth?

Digitization and Open Banking Initiatives are Driving the Market; Fintech Growth is Driving the Market.

8. Can you provide examples of recent developments in the market?

In September 2023, DEUTSCHE Bank announced the launch of DB Investment Partners (DBIP), a new investment manager focusing on private credit opportunities for institutional clients and high-net-worth investors. DBIP will target various private debt strategies, including corporate, real estate, asset-based, infrastructure, and renewable finance lending opportunities.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Germany Banking as A Service Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Germany Banking as A Service Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Germany Banking as A Service Market?

To stay informed about further developments, trends, and reports in the Germany Banking as A Service Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence