Key Insights

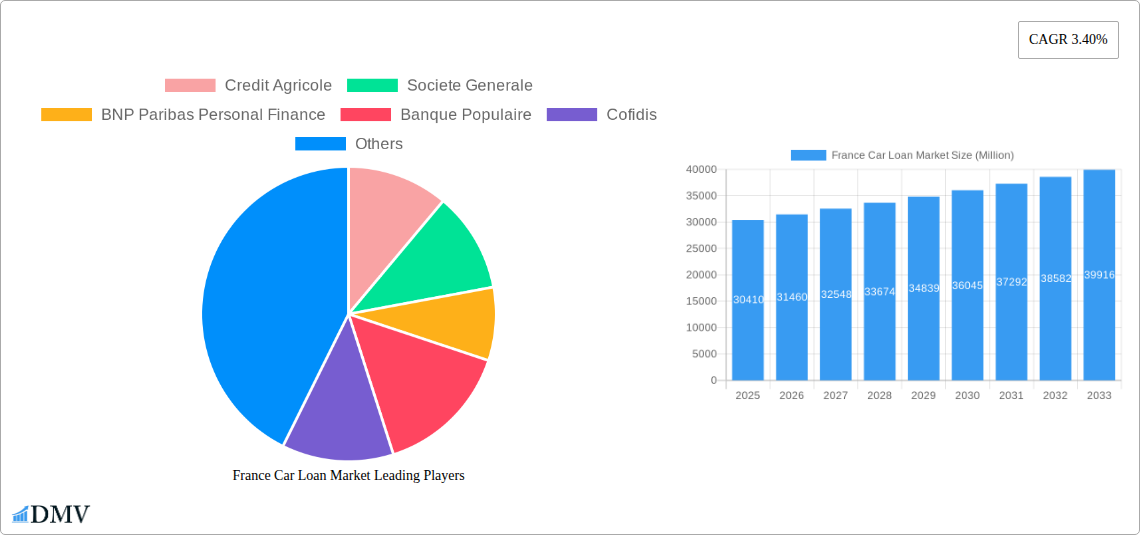

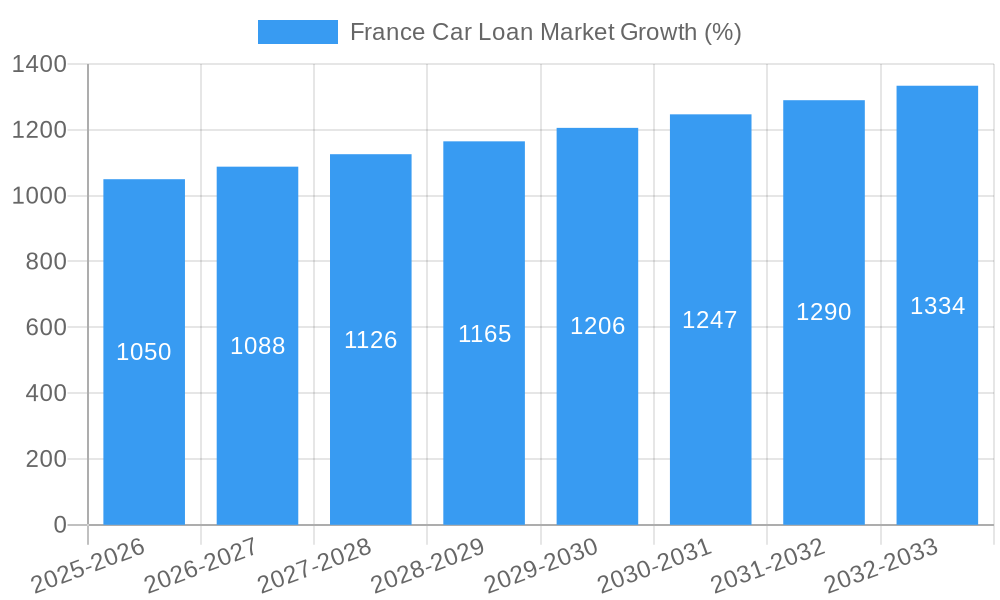

The France car loan market, valued at €30.41 billion in 2025, is projected to experience steady growth, exhibiting a Compound Annual Growth Rate (CAGR) of 3.40% from 2025 to 2033. This growth is fueled by several key factors. The increasing popularity of new vehicle purchases, driven by evolving consumer preferences and technological advancements in automotive engineering, is a significant driver. Furthermore, favorable financing options offered by banks and financial institutions, including competitive interest rates and flexible repayment schemes, incentivize consumers to opt for car loans. Government initiatives aimed at promoting sustainable transportation, such as incentives for electric vehicle purchases, indirectly contribute to the market's expansion. However, macroeconomic factors such as fluctuating interest rates and potential economic downturns pose potential restraints. The competitive landscape is dominated by major players like Credit Agricole, Societe Generale, BNP Paribas Personal Finance, and others, each vying for market share through innovative product offerings and improved customer service. The market is segmented based on loan type (e.g., new vs. used car loans), loan term, and borrower demographics, allowing lenders to tailor their strategies for specific customer segments.

Looking ahead, the market is expected to witness a continued, albeit moderate, expansion. The increasing penetration of online lending platforms is expected to further enhance accessibility and transparency for borrowers. Technological advancements in credit scoring and risk assessment will streamline the lending process. However, the market's growth trajectory will remain sensitive to broader economic conditions and shifts in consumer spending behavior. A focus on sustainable finance and environmentally friendly vehicle financing options will likely shape future market developments, attracting environmentally conscious borrowers and driving innovation in the sector. Continuous adaptation to evolving regulatory frameworks and robust risk management practices will be crucial for lenders to thrive in this dynamic market.

France Car Loan Market: A Comprehensive Report (2019-2033)

This insightful report provides a detailed analysis of the France car loan market, offering a comprehensive overview of its current state, future trajectory, and key players. Spanning the period from 2019 to 2033, with a base year of 2025 and a forecast period from 2025 to 2033, this study unravels the complexities of this dynamic market, equipping stakeholders with the knowledge needed to make informed decisions. The report encompasses market sizing in Millions, identifying key trends and offering strategic forecasts to navigate the evolving landscape.

France Car Loan Market Composition & Trends

This section delves into the intricate composition of the French car loan market, examining its competitive landscape, innovative drivers, regulatory framework, and evolving consumer preferences. The market is characterized by a high degree of concentration, with key players holding significant market shares. We analyze the market share distribution amongst major players such as Credit Agricole, Societe Generale, BNP Paribas Personal Finance, Banque Populaire, Cofidis, Banque Postale, Credit Mutuel, Sofinco, Franfinance, and AXA Banque (list not exhaustive). The report quantifies this distribution, highlighting the top three players’ combined share at approximately xx%.

- Market Concentration: High, with top 5 players controlling xx% of the market.

- Innovation Catalysts: Rise of online lending platforms, increasing adoption of fintech solutions, and government incentives for green vehicles.

- Regulatory Landscape: Analysis of existing and upcoming regulations impacting lending practices and consumer protection.

- Substitute Products: Exploring alternative financing options, such as leasing and vehicle subscription services.

- End-User Profiles: Segmentation of borrowers based on demographics, credit scores, and vehicle types.

- M&A Activities: Detailed examination of significant mergers and acquisitions in the period 2019-2024, with analysis of deal values totaling approximately xx Million. Key deals involved xx.

France Car Loan Market Industry Evolution

This section provides a detailed analysis of the France car loan market's evolutionary path, tracing its growth trajectory and highlighting the interplay of technological advancements and shifting consumer demands from 2019 to 2024. The market experienced a Compound Annual Growth Rate (CAGR) of xx% during the historical period (2019-2024), influenced by factors such as economic fluctuations, changes in consumer spending patterns, and the increasing popularity of new vehicle financing options. The report projects a CAGR of xx% for the forecast period (2025-2033), driven by factors like the growing adoption of electric vehicles (EVs) and the increasing penetration of digital lending platforms. Specific data points on growth rates and adoption metrics will be provided, showing a trend toward increased adoption of online platforms and innovative financing solutions. The impact of the COVID-19 pandemic on the market is also thoroughly assessed. The section also analyzes the evolving preference for longer loan terms and the consequent impact on the market dynamics.

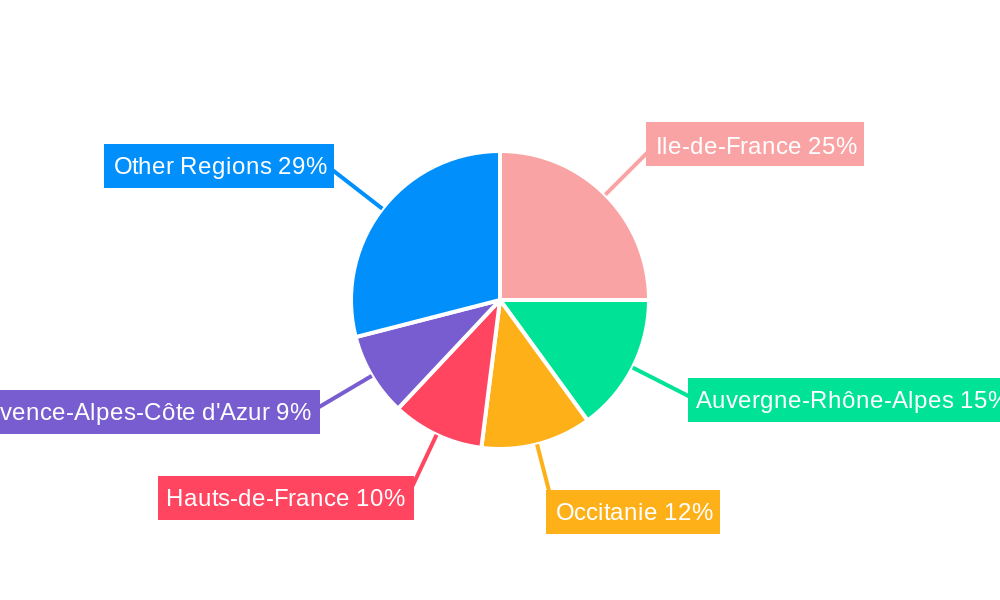

Leading Regions, Countries, or Segments in France Car Loan Market

This section identifies the dominant regions or segments within the French car loan market. While France is the singular focus, regional variations within the country are analyzed and compared. Île-de-France (Paris region) is expected to retain its leading position due to high population density and strong economic activity.

- Key Drivers for Île-de-France Dominance:

- Higher disposable incomes and spending power.

- Concentrated automotive dealerships and financial institutions.

- Robust infrastructure and convenient access to financial services.

- Significant investments in public transportation, impacting car ownership.

- Detailed Analysis: The report delves into a comprehensive analysis of the factors contributing to Île-de-France's leading role, comparing it to other regions and outlining growth prospects in other areas. This includes an examination of regional economic factors, car ownership trends, and the distribution of financial institutions.

France Car Loan Market Product Innovations

The French car loan market has seen notable innovations, particularly in digital lending platforms, personalized loan offerings catering to diverse borrower profiles, and bundled services integrating insurance and maintenance packages. These innovations enhance customer experience and efficiency, and offer competitive advantages. Technological advancements, such as AI-powered credit scoring and streamlined online application processes, have substantially improved the lending experience, leading to quicker approval times and a broader reach for financial institutions.

Propelling Factors for France Car Loan Market Growth

Several key factors propel the growth of the France car loan market. Government incentives for electric vehicle purchases stimulate demand, while low-interest rates create favorable borrowing conditions. The increasing adoption of online lending platforms expands accessibility, while innovative financing products (such as balloon payments and lease-to-own options) cater to evolving consumer needs. The growing popularity of subscription models for vehicles may also impact the market, but will require ongoing monitoring.

Obstacles in the France Car Loan Market

The France car loan market faces certain challenges. Stringent regulatory compliance requirements impose significant costs on lenders. Supply chain disruptions in the automotive sector can limit the availability of new vehicles, impacting loan demand. Furthermore, intense competition amongst established banks and the rise of fintech disruptors create pressure on profit margins. These obstacles affect market growth in quantifiable ways, impacting the overall market size and hindering expansion.

Future Opportunities in France Car Loan Market

The future holds considerable opportunities. The expanding EV market presents a significant growth avenue. The increasing adoption of digital lending technologies allows for more efficient and personalized loan offerings. Moreover, exploring new customer segments (e.g., younger borrowers, self-employed professionals) can significantly expand the market's reach. Expanding into related financial services (e.g., insurance, maintenance plans) may further enhance revenue generation.

Major Players in the France Car Loan Market Ecosystem

- Credit Agricole

- Societe Generale

- BNP Paribas Personal Finance

- Banque Populaire

- Cofidis

- Banque Postale

- Credit Mutuel

- Sofinco

- Franfinance

- AXA Banque (List Not Exhaustive)

Key Developments in France Car Loan Market Industry

- March 2023: M Motors Automobiles France (Mitsubishi Motors in France) and Mobilize Financial Services partnered to offer vehicle financing to Mitsubishi customers, signifying a growing trend of collaborations between automakers and financial service providers. This move is expected to increase market share for both companies.

- September 2022: DIF Capital Partners acquired a 55% stake in Bump SAS, a Paris-based EV charging infrastructure operator. This investment indicates growing confidence in the EV sector and suggests potential future implications for car loan markets as EV adoption increases.

Strategic France Car Loan Market Forecast

The France car loan market is poised for continued growth driven by several key factors: the increasing popularity of EVs, the persistent demand for personal transportation, and the continued evolution of innovative financial products. Despite challenges, the market's overall outlook remains positive, with projected growth fueled by technological advancements and shifting consumer preferences. The report provides specific forecasts for market size and growth rates for the forecast period, providing stakeholders with actionable insights for strategic planning.

France Car Loan Market Segmentation

-

1. Product Type

- 1.1. Used Cars (Consumer Use & Business Use)

- 1.2. New Cars (Consumer Use & Business Use)

-

2. Provider Type

- 2.1. Banks

- 2.2. Non-Banking Financial Services

- 2.3. Original Equipment Manufacturers

- 2.4. Other Provider Types (Fintech Companies)

France Car Loan Market Segmentation By Geography

- 1. France

France Car Loan Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 3.40% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Used Cars are Driving the Market; Increase in Vehicle Price is Driving the Market

- 3.3. Market Restrains

- 3.3.1. Used Cars are Driving the Market; Increase in Vehicle Price is Driving the Market

- 3.4. Market Trends

- 3.4.1. Growing Sales of Used Cars are Driving the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. France Car Loan Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Used Cars (Consumer Use & Business Use)

- 5.1.2. New Cars (Consumer Use & Business Use)

- 5.2. Market Analysis, Insights and Forecast - by Provider Type

- 5.2.1. Banks

- 5.2.2. Non-Banking Financial Services

- 5.2.3. Original Equipment Manufacturers

- 5.2.4. Other Provider Types (Fintech Companies)

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. France

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Credit Agricole

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Societe Generale

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 BNP Paribas Personal Finance

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Banque Populaire

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Cofidis

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Banque Postale

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Credit Mutuel

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Sofinco

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Franfinance

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 AXA Banque**List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Credit Agricole

List of Figures

- Figure 1: France Car Loan Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: France Car Loan Market Share (%) by Company 2024

List of Tables

- Table 1: France Car Loan Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: France Car Loan Market Volume Billion Forecast, by Region 2019 & 2032

- Table 3: France Car Loan Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 4: France Car Loan Market Volume Billion Forecast, by Product Type 2019 & 2032

- Table 5: France Car Loan Market Revenue Million Forecast, by Provider Type 2019 & 2032

- Table 6: France Car Loan Market Volume Billion Forecast, by Provider Type 2019 & 2032

- Table 7: France Car Loan Market Revenue Million Forecast, by Region 2019 & 2032

- Table 8: France Car Loan Market Volume Billion Forecast, by Region 2019 & 2032

- Table 9: France Car Loan Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 10: France Car Loan Market Volume Billion Forecast, by Product Type 2019 & 2032

- Table 11: France Car Loan Market Revenue Million Forecast, by Provider Type 2019 & 2032

- Table 12: France Car Loan Market Volume Billion Forecast, by Provider Type 2019 & 2032

- Table 13: France Car Loan Market Revenue Million Forecast, by Country 2019 & 2032

- Table 14: France Car Loan Market Volume Billion Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the France Car Loan Market?

The projected CAGR is approximately 3.40%.

2. Which companies are prominent players in the France Car Loan Market?

Key companies in the market include Credit Agricole, Societe Generale, BNP Paribas Personal Finance, Banque Populaire, Cofidis, Banque Postale, Credit Mutuel, Sofinco, Franfinance, AXA Banque**List Not Exhaustive.

3. What are the main segments of the France Car Loan Market?

The market segments include Product Type, Provider Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 30.41 Million as of 2022.

5. What are some drivers contributing to market growth?

Used Cars are Driving the Market; Increase in Vehicle Price is Driving the Market.

6. What are the notable trends driving market growth?

Growing Sales of Used Cars are Driving the Market.

7. Are there any restraints impacting market growth?

Used Cars are Driving the Market; Increase in Vehicle Price is Driving the Market.

8. Can you provide examples of recent developments in the market?

March 2023: M Motors Automobiles France (Mitsubishi Motors in France) and Mobilize Financial Services announced the creation of a partnership to offer vehicle financing and services to Mitsubishi Motors customers in France.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "France Car Loan Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the France Car Loan Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the France Car Loan Market?

To stay informed about further developments, trends, and reports in the France Car Loan Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence