Key Insights

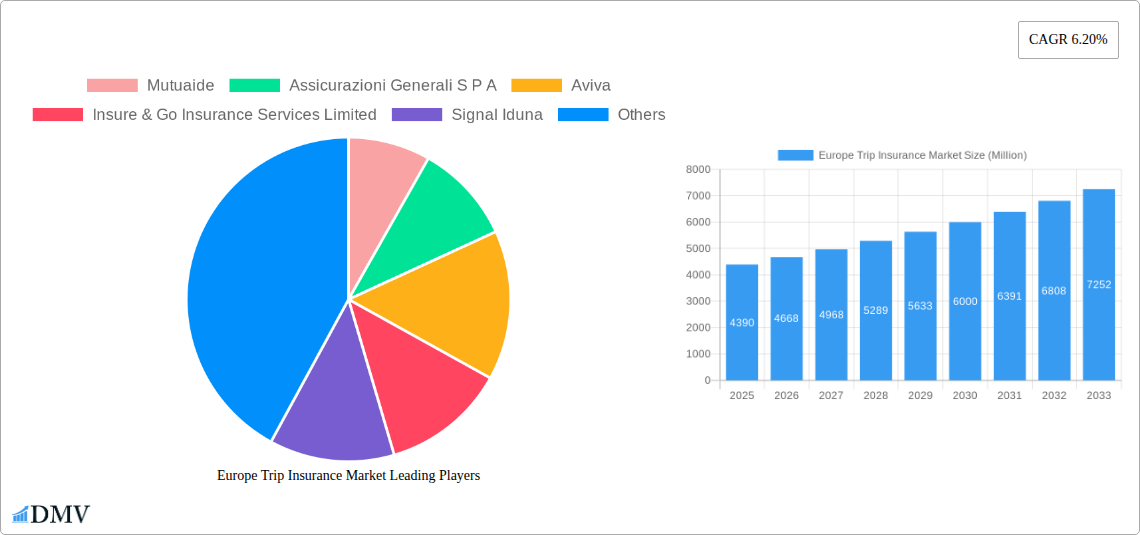

The European trip insurance market, valued at €4.39 billion in 2025, is projected to experience robust growth, exhibiting a Compound Annual Growth Rate (CAGR) of 6.20% from 2025 to 2033. This expansion is driven by several key factors. The increasing popularity of European travel among senior citizens, education travelers, families, and individuals fuels demand for comprehensive coverage. Furthermore, a rising awareness of potential travel disruptions, including medical emergencies, trip cancellations, and lost luggage, motivates travelers to secure insurance. The market is segmented by insurance coverage type (single-trip vs. annual multi-trip) and distribution channel (insurance companies, intermediaries, banks, brokers, and others). The dominance of established players like Allianz, AXA, and Zurich, alongside the presence of specialized insurers like Insure & Go, indicates a competitive landscape. Growth is expected to be particularly strong in countries with high outbound tourism rates such as Germany, France, the UK, and Italy. The continued expansion of online distribution channels will likely further facilitate market growth, as will the development of innovative insurance products catering to niche travel segments.

Europe Trip Insurance Market Market Size (In Billion)

The market's growth trajectory is expected to be influenced by macroeconomic factors, including economic growth across Europe and fluctuations in tourism spending. While potential restraints like economic downturns or changes in travel regulations could impact growth, the overall trend indicates a positive outlook for the European trip insurance market over the next decade. The market's strong growth prospects are likely to attract further investment and innovation in product offerings and distribution strategies, solidifying its position within the broader European travel and insurance sectors. The increasing use of technology and data analytics by insurance providers will lead to more personalized and affordable products, driving customer adoption and ultimately shaping the market's future.

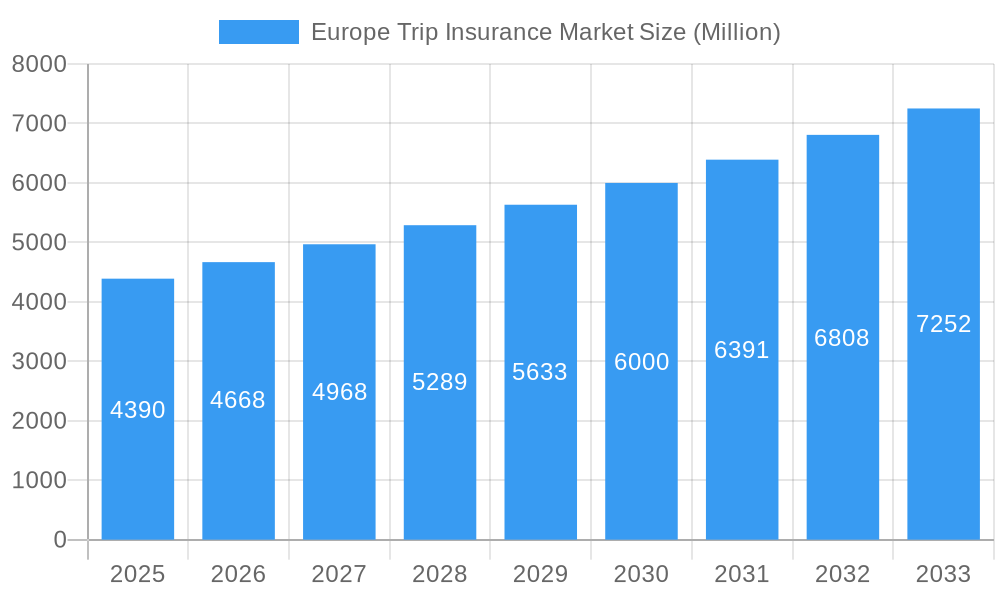

Europe Trip Insurance Market Company Market Share

Europe Trip Insurance Market: A Comprehensive Report (2019-2033)

This insightful report provides a detailed analysis of the Europe Trip Insurance Market, offering a comprehensive overview of market dynamics, key players, and future growth prospects. The study period covers 2019-2033, with 2025 serving as the base and estimated year. The report is crucial for stakeholders seeking to understand the market's intricacies and capitalize on emerging opportunities. The market is estimated to be worth xx Million in 2025 and is projected to reach xx Million by 2033.

Europe Trip Insurance Market Composition & Trends

This section delves into the competitive landscape of the European trip insurance market, analyzing market concentration, innovation drivers, regulatory frameworks, substitute products, end-user segmentation, and merger & acquisition (M&A) activities. The report examines the market share distribution among key players, including Mutuaide, Assicurazioni Generali S.p.A., Aviva, Insure & Go Insurance Services Limited, Signal Iduna, AXA, American International Group Inc., Zurich, The April Group, and Allianz (list not exhaustive). We analyze M&A activity, quantifying deal values where available, to understand market consolidation trends. The analysis considers the impact of various factors such as evolving consumer preferences, technological advancements, and regulatory changes on market concentration. The report also explores the availability of substitute products and their potential impact on market growth.

- Market Concentration: Analysis of market share held by top players, indicating a [describe concentration level: e.g., highly fragmented or concentrated] market.

- Innovation Catalysts: Discussion of technological advancements (e.g., AI-powered claims processing) driving innovation.

- Regulatory Landscape: Examination of key regulations influencing market operations across various European countries.

- Substitute Products: Evaluation of alternative solutions and their impact on market demand.

- End-User Profiles: Detailed segmentation of the market by end-users (Senior Citizens, Education Travelers, Family Travelers).

- M&A Activities: Review of significant mergers and acquisitions, including deal values (where available), and their impact on the market landscape. Example: [mention a specific M&A deal and its impact].

Europe Trip Insurance Market Industry Evolution

This section provides a comprehensive analysis of the Europe Trip Insurance Market’s historical and projected growth trajectories. It examines the influence of technological advancements, such as digital distribution channels and personalized insurance products, on market evolution. The report also explores shifting consumer demands and preferences, including the increasing demand for comprehensive coverage and bundled services. The analysis considers growth rates across different segments and identifies key factors contributing to market expansion.

- Market Growth Trajectories: Detailed analysis of historical (2019-2024) and forecast (2025-2033) market growth rates, segmented by insurance type and distribution channel. [Insert projected growth rates for key segments, e.g., "The annual multi-trip travel insurance segment is projected to experience a CAGR of X% during the forecast period."]

- Technological Advancements: Discussion of technological disruptions, such as mobile apps for claims processing and AI-driven risk assessment, and their impact on market dynamics.

- Shifting Consumer Demands: Examination of evolving customer preferences, such as the increasing demand for customized travel insurance plans and digital-first interactions.

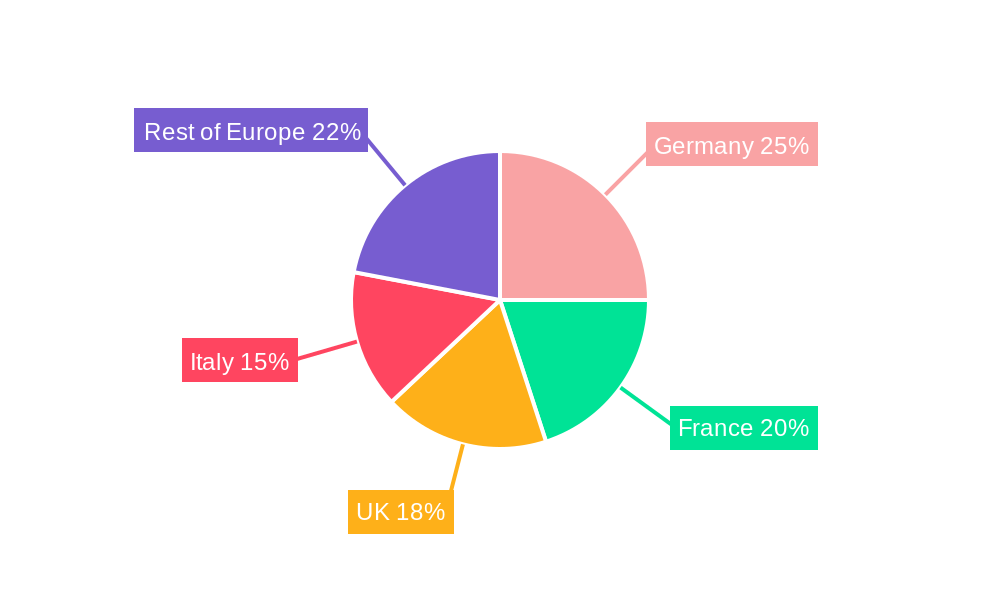

Leading Regions, Countries, or Segments in Europe Trip Insurance Market

This section identifies the dominant regions, countries, and segments within the Europe Trip Insurance Market. We analyze key drivers, including investment trends, regulatory support, and consumer behavior, which contribute to the dominance of specific regions or segments. The analysis encompasses end-user segments (Senior Citizens, Education Travelers, Family Travelers), insurance coverage types (Single-Trip, Annual Multi-trip), and distribution channels (Insurance Companies, Insurance Intermediaries, Banks, Insurance Brokers, Other Distribution Channels).

- Dominant Regions/Countries: [Identify leading regions/countries and explain reasons for dominance, e.g., "Western European countries like Germany and the UK hold a significant market share due to high tourist volume and strong insurance penetration."]

- Leading End-User Segments: [Analyze top-performing end-user segments and justify their leading position, e.g., "Family travelers represent a large share due to their increased travel frequency and need for comprehensive coverage."]

- Dominant Insurance Coverage Types: [Identify the most popular insurance coverage type and explain reasons, e.g., "Annual multi-trip policies are gaining popularity due to the increasing frequency of short trips by younger demographics."]

- Leading Distribution Channels: [Analyze leading distribution channels and rationalize their success, e.g., "Insurance companies directly selling policies maintain a large market share due to their brand recognition and established customer base."]

Europe Trip Insurance Market Product Innovations

Recent innovations in the Europe Trip Insurance Market focus on enhancing customer experience and offering more personalized and comprehensive coverage. This includes the development of mobile-first applications for streamlined claims processing and the integration of AI-powered risk assessment tools for more accurate pricing. Companies are also introducing innovative coverage options, such as specialized insurance for adventure travel or specific medical conditions, to cater to evolving customer needs. These innovations contribute to improved product offerings and increased market competitiveness.

Propelling Factors for Europe Trip Insurance Market Growth

Several factors contribute to the growth of the Europe Trip Insurance Market. Increased international travel, fueled by economic growth and rising disposable incomes across Europe, drives demand. The rising popularity of adventure tourism and extreme sports also necessitates more comprehensive coverage. Government regulations mandating minimum insurance levels for certain types of travel further contribute to market expansion. Finally, technological advancements, like digital platforms and AI-powered services, streamline operations and enhance customer experiences, thus supporting market growth.

Obstacles in the Europe Trip Insurance Market

The Europe Trip Insurance Market faces challenges such as increasing competition, particularly from online insurers offering lower prices. Regulatory changes in various European countries can impact operational costs and product offerings. Geopolitical uncertainty and global events, like the ongoing war in Ukraine (as exemplified by Axa's €300m loss), can significantly impact travel patterns and insurance claims. Moreover, economic downturns can decrease travel spending and reduce demand for insurance products.

Future Opportunities in Europe Trip Insurance Market

Future opportunities lie in expanding into underserved markets, developing specialized products for niche travel segments (e.g., eco-tourism), and leveraging technological advancements such as blockchain for secure and transparent claims processing. The growing demand for sustainable and responsible travel options presents opportunities for developing insurance products that align with these trends. Personalization of insurance policies based on individual travel profiles and risk assessment also presents a significant area for growth.

Major Players in the Europe Trip Insurance Market Ecosystem

Key Developments in Europe Trip Insurance Market Industry

- August 2022: Axa reports increased earnings offsetting a €300m (£251m) loss from the war in Ukraine, launching a €1bn share buyback scheme. This highlights the impact of geopolitical events on the insurance sector and the company's financial strength.

- April 2022: AXA Partners partners with Trip.com to expand travel insurance products in Europe, demonstrating strategic collaborations to increase market reach and product offerings.

Strategic Europe Trip Insurance Market Forecast

The Europe Trip Insurance Market is poised for significant growth, driven by increasing travel demand, technological advancements, and evolving consumer preferences. The focus on personalized products, digital distribution, and specialized coverage will shape future market dynamics. Opportunities exist in expanding into emerging markets, developing sustainable travel insurance solutions, and leveraging innovative technologies to improve customer experience and operational efficiency. The market is expected to maintain a healthy growth trajectory throughout the forecast period (2025-2033), driven by these key factors.

Europe Trip Insurance Market Segmentation

-

1. Insurance Coverage

- 1.1. Single-Trip Travel Insurance

- 1.2. Annual Multi-trip Travel Insurance

-

2. Distribution Channel

- 2.1. Insurance Companies

- 2.2. Insurance Intermediaries

- 2.3. Banks

- 2.4. Insurance Brokers

- 2.5. Other Distribution Channels

-

3. End-User

- 3.1. Senior Citizens

- 3.2. Education Travelers

- 3.3. Family Travelers

- 3.4. Other End Users

Europe Trip Insurance Market Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

Europe Trip Insurance Market Regional Market Share

Geographic Coverage of Europe Trip Insurance Market

Europe Trip Insurance Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.20% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Digitalization of the Insurance Industry; Surge in Regulatory Reforms and Mandates

- 3.3. Market Restrains

- 3.3.1. Data Privacy and Security Concerns; Rising Multiple Sizable Natural Catastrophes

- 3.4. Market Trends

- 3.4.1. Artificial Intelligence in Insurance

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Trip Insurance Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Insurance Coverage

- 5.1.1. Single-Trip Travel Insurance

- 5.1.2. Annual Multi-trip Travel Insurance

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Insurance Companies

- 5.2.2. Insurance Intermediaries

- 5.2.3. Banks

- 5.2.4. Insurance Brokers

- 5.2.5. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by End-User

- 5.3.1. Senior Citizens

- 5.3.2. Education Travelers

- 5.3.3. Family Travelers

- 5.3.4. Other End Users

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Insurance Coverage

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Mutuaide

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Assicurazioni Generali S P A

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Aviva

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Insure & Go Insurance Services Limited

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Signal Iduna

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 AXA

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 American International Group Inc

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Zurich**List Not Exhaustive

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 The April Group

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Allianz

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Mutuaide

List of Figures

- Figure 1: Europe Trip Insurance Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Europe Trip Insurance Market Share (%) by Company 2025

List of Tables

- Table 1: Europe Trip Insurance Market Revenue Million Forecast, by Insurance Coverage 2020 & 2033

- Table 2: Europe Trip Insurance Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 3: Europe Trip Insurance Market Revenue Million Forecast, by End-User 2020 & 2033

- Table 4: Europe Trip Insurance Market Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Europe Trip Insurance Market Revenue Million Forecast, by Insurance Coverage 2020 & 2033

- Table 6: Europe Trip Insurance Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 7: Europe Trip Insurance Market Revenue Million Forecast, by End-User 2020 & 2033

- Table 8: Europe Trip Insurance Market Revenue Million Forecast, by Country 2020 & 2033

- Table 9: United Kingdom Europe Trip Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Germany Europe Trip Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: France Europe Trip Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Italy Europe Trip Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Spain Europe Trip Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Netherlands Europe Trip Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Belgium Europe Trip Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Sweden Europe Trip Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Norway Europe Trip Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Poland Europe Trip Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Denmark Europe Trip Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Trip Insurance Market?

The projected CAGR is approximately 6.20%.

2. Which companies are prominent players in the Europe Trip Insurance Market?

Key companies in the market include Mutuaide, Assicurazioni Generali S P A, Aviva, Insure & Go Insurance Services Limited, Signal Iduna, AXA, American International Group Inc, Zurich**List Not Exhaustive, The April Group, Allianz.

3. What are the main segments of the Europe Trip Insurance Market?

The market segments include Insurance Coverage, Distribution Channel, End-User.

4. Can you provide details about the market size?

The market size is estimated to be USD 4.39 Million as of 2022.

5. What are some drivers contributing to market growth?

Digitalization of the Insurance Industry; Surge in Regulatory Reforms and Mandates.

6. What are the notable trends driving market growth?

Artificial Intelligence in Insurance.

7. Are there any restraints impacting market growth?

Data Privacy and Security Concerns; Rising Multiple Sizable Natural Catastrophes.

8. Can you provide examples of recent developments in the market?

In August 2022, French insurance giant Axa said an uptick in earnings, driven by higher incomes from its investment portfolio, offset the €300m (£251m) hit to its business arising from the war in Ukraine. Axa's decision to launch its €1bn share buyback scheme saw shares in the insurance giant surge by almost five percent in the early morning trading session, as the firm set out plans to complete its buyback by February 2023, subject matter to market conditions.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Trip Insurance Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Trip Insurance Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Trip Insurance Market?

To stay informed about further developments, trends, and reports in the Europe Trip Insurance Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence