Key Insights

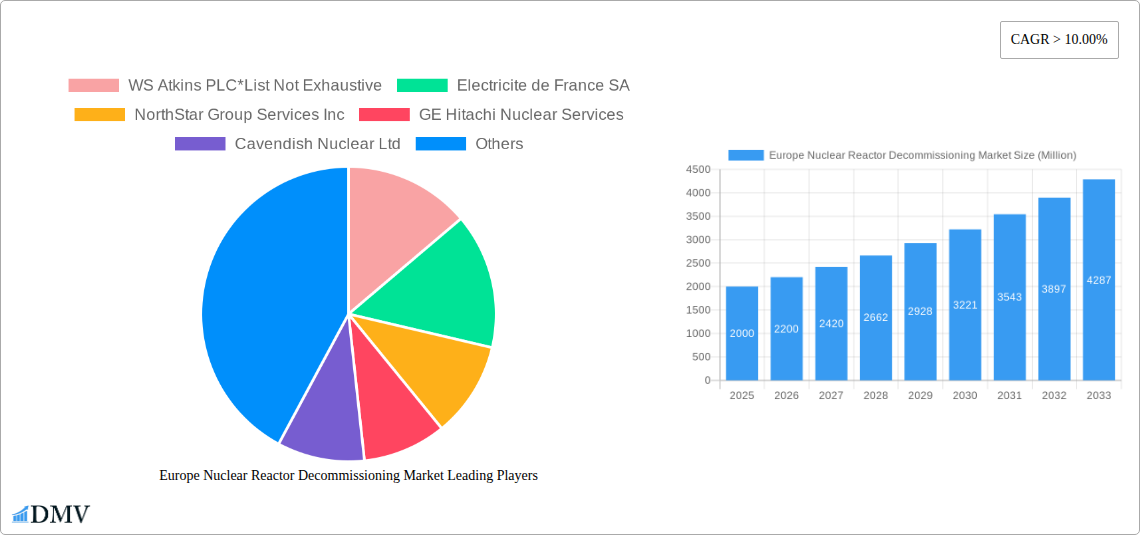

The European nuclear reactor decommissioning market is driven by aging nuclear power infrastructure and increasing regulatory mandates for safe and timely dismantling. The market, currently valued at 9.84 billion, is projected to grow at a Compound Annual Growth Rate (CAGR) of 18.5% from the base year 2025, reaching a substantial valuation by 2033. Key growth factors include stringent safety regulations, responsible management of radioactive waste, and a strong emphasis on environmental sustainability. Commercial Power Reactors represent the largest segment, followed by Prototype and Research Reactors. The high capacity segment (Above 1000 MW) dominates due to the scale and complexity of these projects. Pressurized Water Reactors (PWRs) are a significant focus for decommissioning activities, mirroring their widespread adoption in Europe. Leading market participants are leveraging specialized dismantling techniques, waste management expertise, and project management capabilities to capitalize on this expanding sector. However, high initial investment costs and extended project timelines present significant challenges, alongside potential restraints from skilled labor shortages and technological hurdles.

Europe Nuclear Reactor Decommissioning Market Market Size (In Billion)

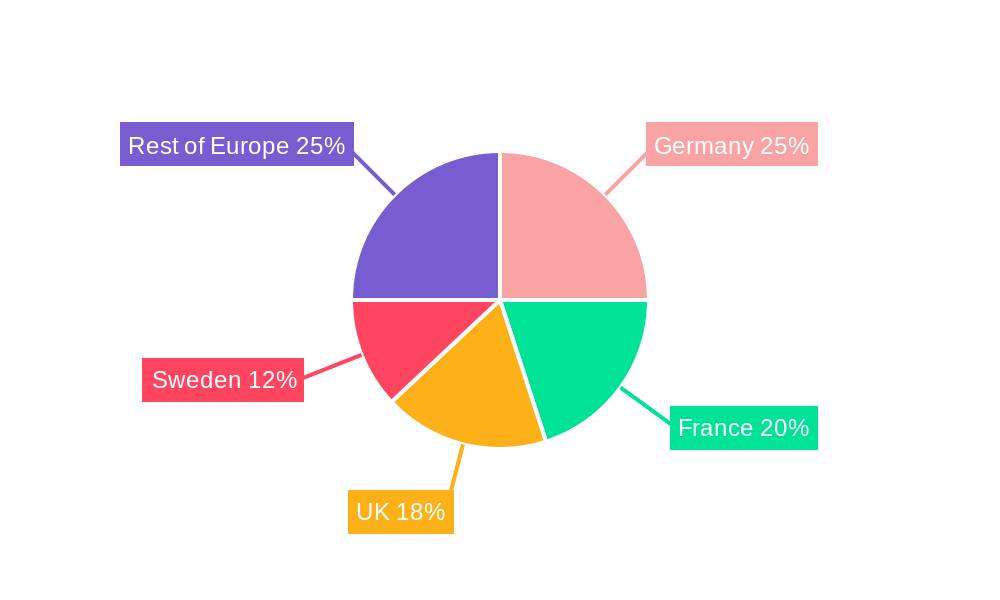

Geographically, market concentration is observed in countries with established nuclear power programs, including Germany, France, the United Kingdom, and Sweden, driven by their significant aging reactor fleets and proactive decommissioning policies. The "Rest of Europe" segment will also contribute to growth, albeit potentially at a slower pace due to varied regulatory frameworks. The forecast period of 2025-2033 offers substantial opportunities for companies specializing in decommissioning, waste management, and related services. Strategic partnerships, technological innovation, and efficient project management are critical for success in this specialized market.

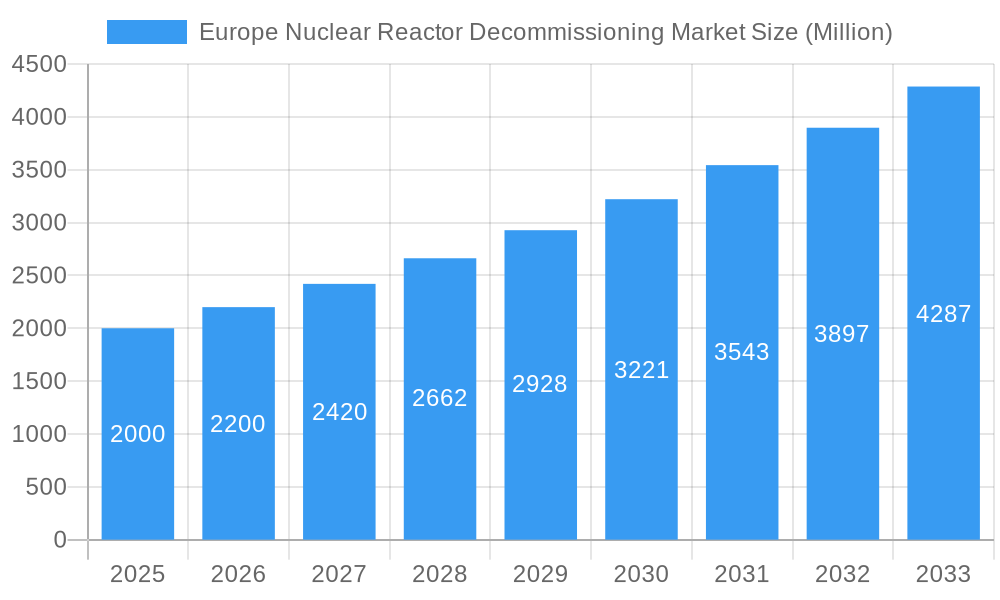

Europe Nuclear Reactor Decommissioning Market Company Market Share

Europe Nuclear Reactor Decommissioning Market Analysis: 2025-2033 Forecast

This report offers a comprehensive analysis of the European Nuclear Reactor Decommissioning Market, detailing its current status, future projections, and key stakeholders. The study period encompasses 2025-2033, with 2025 as the base year. The market is segmented by application (Commercial Power Reactor, Prototype Power Reactor, Research Reactor), capacity (Below 100 MW, 100-1000 MW, Above 1000 MW), and reactor type (Pressurized Water Reactor, Boiling Water Reactor, Gas Cooled Reactor, Other Reactor Types). With a projected market size of 9.84 billion, this report is an essential resource for stakeholders seeking to understand and leverage opportunities within this dynamic market.

Europe Nuclear Reactor Decommissioning Market Composition & Trends

The Europe Nuclear Reactor Decommissioning Market exhibits a moderately concentrated landscape, with several major players vying for market share. Market concentration is estimated at xx%, with the top five players holding a combined share of approximately xx%. Innovation is driven by the need for safer, more efficient, and cost-effective decommissioning techniques, spurred by increasingly stringent regulatory frameworks across Europe. The market is characterized by a significant number of M&A activities, reflecting the consolidation trend among players seeking to expand their capabilities and geographical reach. Recent M&A deals, though varying significantly in value, have collectively contributed to increased market concentration. For instance, the deal values ranged from xx Million to xx Million in recent years. Substitute products are limited, given the specialized nature of nuclear decommissioning. End-users primarily comprise nuclear power plant operators, government agencies, and specialized decommissioning companies.

- Market Share Distribution: Top 5 players hold approximately xx% of the market.

- M&A Activity: Significant consolidation through mergers and acquisitions, with deal values ranging from xx Million to xx Million.

- Regulatory Landscape: Stringent regulations drive innovation and necessitate specialized expertise.

- End-User Profile: Primarily nuclear power plant operators and government agencies.

Europe Nuclear Reactor Decommissioning Market Industry Evolution

The Europe Nuclear Reactor Decommissioning Market has witnessed substantial growth during the historical period (2019-2024), driven by the aging nuclear power plant infrastructure across Europe and growing regulatory pressures for timely decommissioning. The market is expected to maintain a steady Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). Technological advancements, such as the development of robotic systems and advanced waste management techniques, are significantly improving efficiency and safety. Furthermore, a shift towards more sustainable decommissioning practices, emphasizing waste minimization and environmental protection, is gaining momentum. Growing public awareness of nuclear safety and environmental concerns is also influencing consumer demand for responsible decommissioning solutions. The increased focus on digitalization in the sector facilitates enhanced monitoring, data analysis, and decision-making during the decommissioning process.

Leading Regions, Countries, or Segments in Europe Nuclear Reactor Decommissioning Market

The Commercial Power Reactor segment dominates the market, owing to the large number of aging commercial reactors nearing the end of their operational life. France and Germany emerge as leading countries, driven by their significant nuclear power generation capacity and the resulting need for large-scale decommissioning projects.

- By Application: Commercial Power Reactor segment leads due to the large number of aging plants.

- By Capacity: The Between 100-1000 MW capacity segment holds a significant share.

- By Reactor Type: Pressurized Water Reactors (PWRs) constitute the largest share given their prevalence in Europe.

- Key Drivers: Significant government investments in decommissioning projects and strong regulatory support are major growth drivers.

- Dominance Factors: High concentration of aging nuclear power plants and proactive regulatory frameworks contribute to the dominance of specific regions and countries.

Europe Nuclear Reactor Decommissioning Market Product Innovations

Recent innovations focus on robotic systems for enhanced safety and efficiency in dismantling tasks, advanced waste management technologies to minimize environmental impact, and the implementation of digital tools for improved project management and data analysis. These innovations offer unique selling propositions focused on improved safety, reduced costs, and minimized environmental impact, thereby shaping the market competitiveness and driving demand.

Propelling Factors for Europe Nuclear Reactor Decommissioning Market Growth

The market is propelled by several factors, including stringent regulatory requirements mandating timely decommissioning, increasing numbers of aging nuclear power plants approaching end-of-life, and substantial government investments in decommissioning projects. Technological advancements in robotics, waste management, and digitalization further accelerate growth.

Obstacles in the Europe Nuclear Reactor Decommissioning Market

Significant challenges include the high cost associated with decommissioning, the complexity of handling radioactive materials, and the potential for regulatory delays and uncertainties. Supply chain disruptions for specialized equipment and skilled labor shortages also pose significant constraints. The environmental and public perception of nuclear waste remains a critical concern. These obstacles cumulatively impact the market's overall growth trajectory and require proactive mitigation strategies.

Future Opportunities in Europe Nuclear Reactor Decommissioning Market

Emerging opportunities lie in developing advanced robotics and automation technologies, enhancing waste recycling and reuse methods, expanding into new geographical markets with aging nuclear infrastructure, and providing comprehensive decommissioning services encompassing the entire project lifecycle. The focus on sustainability and the development of circular economy models offers significant growth prospects.

Major Players in the Europe Nuclear Reactor Decommissioning Market Ecosystem

- WS Atkins PLC

- Electricite de France SA

- NorthStar Group Services Inc

- GE Hitachi Nuclear Services

- Cavendish Nuclear Ltd

- James Fisher & Sons PLC

- Fluor Corporation

- Babcock International Group PLC

- Studsvik AB

Key Developments in Europe Nuclear Reactor Decommissioning Market Industry

- June 2022: Enresa completed demolition works at the Jose Cabrera nuclear power plant in Spain, converting the turbine building into an auxiliary decommissioning building.

- December 2021: Westinghouse Electric Company signed a contract with RWE Nuclear GmbH to dismantle two reactors in the Gundremmingen nuclear facility in Germany.

Strategic Europe Nuclear Reactor Decommissioning Market Forecast

The Europe Nuclear Reactor Decommissioning Market is poised for continued growth, driven by a confluence of factors. The aging nuclear infrastructure, stringent regulations, and technological advancements will create significant demand for efficient and safe decommissioning services. The focus on sustainable practices and the emergence of innovative technologies will further propel market expansion and offer considerable potential for market participants.

Europe Nuclear Reactor Decommissioning Market Segmentation

-

1. Reactor Type

- 1.1. Pressurized Water Reactor

- 1.2. Boiling Water Reactor

- 1.3. Gas Cooled Reactor

- 1.4. Other Reactor Types

-

2. Application

- 2.1. Commercial Power Reactor

- 2.2. Prototype Power Reactor

- 2.3. Research Reactor

-

3. Capacity

- 3.1. Below 100 MW

- 3.2. Between 100 - 1000 MW

- 3.3. Above 1000 MW

Europe Nuclear Reactor Decommissioning Market Segmentation By Geography

- 1. France

- 2. Germany

- 3. United Kingdom

- 4. Ukraine

- 5. Rest of Europe

Europe Nuclear Reactor Decommissioning Market Regional Market Share

Geographic Coverage of Europe Nuclear Reactor Decommissioning Market

Europe Nuclear Reactor Decommissioning Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 18.5% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Presence of Strict Government Regulations to Control Air Pollution

- 3.3. Market Restrains

- 3.3.1. 4.; Increasing Adoption of Renewable Energy

- 3.4. Market Trends

- 3.4.1. Research Reactors to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Nuclear Reactor Decommissioning Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Reactor Type

- 5.1.1. Pressurized Water Reactor

- 5.1.2. Boiling Water Reactor

- 5.1.3. Gas Cooled Reactor

- 5.1.4. Other Reactor Types

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Commercial Power Reactor

- 5.2.2. Prototype Power Reactor

- 5.2.3. Research Reactor

- 5.3. Market Analysis, Insights and Forecast - by Capacity

- 5.3.1. Below 100 MW

- 5.3.2. Between 100 - 1000 MW

- 5.3.3. Above 1000 MW

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. France

- 5.4.2. Germany

- 5.4.3. United Kingdom

- 5.4.4. Ukraine

- 5.4.5. Rest of Europe

- 5.1. Market Analysis, Insights and Forecast - by Reactor Type

- 6. France Europe Nuclear Reactor Decommissioning Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Reactor Type

- 6.1.1. Pressurized Water Reactor

- 6.1.2. Boiling Water Reactor

- 6.1.3. Gas Cooled Reactor

- 6.1.4. Other Reactor Types

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Commercial Power Reactor

- 6.2.2. Prototype Power Reactor

- 6.2.3. Research Reactor

- 6.3. Market Analysis, Insights and Forecast - by Capacity

- 6.3.1. Below 100 MW

- 6.3.2. Between 100 - 1000 MW

- 6.3.3. Above 1000 MW

- 6.1. Market Analysis, Insights and Forecast - by Reactor Type

- 7. Germany Europe Nuclear Reactor Decommissioning Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Reactor Type

- 7.1.1. Pressurized Water Reactor

- 7.1.2. Boiling Water Reactor

- 7.1.3. Gas Cooled Reactor

- 7.1.4. Other Reactor Types

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Commercial Power Reactor

- 7.2.2. Prototype Power Reactor

- 7.2.3. Research Reactor

- 7.3. Market Analysis, Insights and Forecast - by Capacity

- 7.3.1. Below 100 MW

- 7.3.2. Between 100 - 1000 MW

- 7.3.3. Above 1000 MW

- 7.1. Market Analysis, Insights and Forecast - by Reactor Type

- 8. United Kingdom Europe Nuclear Reactor Decommissioning Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Reactor Type

- 8.1.1. Pressurized Water Reactor

- 8.1.2. Boiling Water Reactor

- 8.1.3. Gas Cooled Reactor

- 8.1.4. Other Reactor Types

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Commercial Power Reactor

- 8.2.2. Prototype Power Reactor

- 8.2.3. Research Reactor

- 8.3. Market Analysis, Insights and Forecast - by Capacity

- 8.3.1. Below 100 MW

- 8.3.2. Between 100 - 1000 MW

- 8.3.3. Above 1000 MW

- 8.1. Market Analysis, Insights and Forecast - by Reactor Type

- 9. Ukraine Europe Nuclear Reactor Decommissioning Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Reactor Type

- 9.1.1. Pressurized Water Reactor

- 9.1.2. Boiling Water Reactor

- 9.1.3. Gas Cooled Reactor

- 9.1.4. Other Reactor Types

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Commercial Power Reactor

- 9.2.2. Prototype Power Reactor

- 9.2.3. Research Reactor

- 9.3. Market Analysis, Insights and Forecast - by Capacity

- 9.3.1. Below 100 MW

- 9.3.2. Between 100 - 1000 MW

- 9.3.3. Above 1000 MW

- 9.1. Market Analysis, Insights and Forecast - by Reactor Type

- 10. Rest of Europe Europe Nuclear Reactor Decommissioning Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Reactor Type

- 10.1.1. Pressurized Water Reactor

- 10.1.2. Boiling Water Reactor

- 10.1.3. Gas Cooled Reactor

- 10.1.4. Other Reactor Types

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Commercial Power Reactor

- 10.2.2. Prototype Power Reactor

- 10.2.3. Research Reactor

- 10.3. Market Analysis, Insights and Forecast - by Capacity

- 10.3.1. Below 100 MW

- 10.3.2. Between 100 - 1000 MW

- 10.3.3. Above 1000 MW

- 10.1. Market Analysis, Insights and Forecast - by Reactor Type

- 11. Competitive Analysis

- 11.1. Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 WS Atkins PLC*List Not Exhaustive

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Electricite de France SA

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 NorthStar Group Services Inc

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 GE Hitachi Nuclear Services

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Cavendish Nuclear Ltd

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 James Fisher & Sons PLC

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Fluor Corporation

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Babcock International Group PLC

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Studsvik AB

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.1 WS Atkins PLC*List Not Exhaustive

List of Figures

- Figure 1: Europe Nuclear Reactor Decommissioning Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Europe Nuclear Reactor Decommissioning Market Share (%) by Company 2025

List of Tables

- Table 1: Europe Nuclear Reactor Decommissioning Market Revenue billion Forecast, by Reactor Type 2020 & 2033

- Table 2: Europe Nuclear Reactor Decommissioning Market Revenue billion Forecast, by Application 2020 & 2033

- Table 3: Europe Nuclear Reactor Decommissioning Market Revenue billion Forecast, by Capacity 2020 & 2033

- Table 4: Europe Nuclear Reactor Decommissioning Market Revenue billion Forecast, by Region 2020 & 2033

- Table 5: Europe Nuclear Reactor Decommissioning Market Revenue billion Forecast, by Reactor Type 2020 & 2033

- Table 6: Europe Nuclear Reactor Decommissioning Market Revenue billion Forecast, by Application 2020 & 2033

- Table 7: Europe Nuclear Reactor Decommissioning Market Revenue billion Forecast, by Capacity 2020 & 2033

- Table 8: Europe Nuclear Reactor Decommissioning Market Revenue billion Forecast, by Country 2020 & 2033

- Table 9: Europe Nuclear Reactor Decommissioning Market Revenue billion Forecast, by Reactor Type 2020 & 2033

- Table 10: Europe Nuclear Reactor Decommissioning Market Revenue billion Forecast, by Application 2020 & 2033

- Table 11: Europe Nuclear Reactor Decommissioning Market Revenue billion Forecast, by Capacity 2020 & 2033

- Table 12: Europe Nuclear Reactor Decommissioning Market Revenue billion Forecast, by Country 2020 & 2033

- Table 13: Europe Nuclear Reactor Decommissioning Market Revenue billion Forecast, by Reactor Type 2020 & 2033

- Table 14: Europe Nuclear Reactor Decommissioning Market Revenue billion Forecast, by Application 2020 & 2033

- Table 15: Europe Nuclear Reactor Decommissioning Market Revenue billion Forecast, by Capacity 2020 & 2033

- Table 16: Europe Nuclear Reactor Decommissioning Market Revenue billion Forecast, by Country 2020 & 2033

- Table 17: Europe Nuclear Reactor Decommissioning Market Revenue billion Forecast, by Reactor Type 2020 & 2033

- Table 18: Europe Nuclear Reactor Decommissioning Market Revenue billion Forecast, by Application 2020 & 2033

- Table 19: Europe Nuclear Reactor Decommissioning Market Revenue billion Forecast, by Capacity 2020 & 2033

- Table 20: Europe Nuclear Reactor Decommissioning Market Revenue billion Forecast, by Country 2020 & 2033

- Table 21: Europe Nuclear Reactor Decommissioning Market Revenue billion Forecast, by Reactor Type 2020 & 2033

- Table 22: Europe Nuclear Reactor Decommissioning Market Revenue billion Forecast, by Application 2020 & 2033

- Table 23: Europe Nuclear Reactor Decommissioning Market Revenue billion Forecast, by Capacity 2020 & 2033

- Table 24: Europe Nuclear Reactor Decommissioning Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Nuclear Reactor Decommissioning Market?

The projected CAGR is approximately 18.5%.

2. Which companies are prominent players in the Europe Nuclear Reactor Decommissioning Market?

Key companies in the market include WS Atkins PLC*List Not Exhaustive, Electricite de France SA, NorthStar Group Services Inc, GE Hitachi Nuclear Services, Cavendish Nuclear Ltd, James Fisher & Sons PLC, Fluor Corporation, Babcock International Group PLC, Studsvik AB.

3. What are the main segments of the Europe Nuclear Reactor Decommissioning Market?

The market segments include Reactor Type, Application, Capacity.

4. Can you provide details about the market size?

The market size is estimated to be USD 9.84 billion as of 2022.

5. What are some drivers contributing to market growth?

4.; Presence of Strict Government Regulations to Control Air Pollution.

6. What are the notable trends driving market growth?

Research Reactors to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; Increasing Adoption of Renewable Energy.

8. Can you provide examples of recent developments in the market?

June 2022- The Spanish decommissioning and waste management firm Enresa announced the completion of the demolition works on the last remaining large building, the turbine building, at the Jose Cabrera (Zorita) nuclear power plant in Spain. The 30 meters high structure made of reinforced concrete was converted to the Auxiliary Decommissioning Building, where radioactive waste from dismantling the plant's active parts was conditioned.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Nuclear Reactor Decommissioning Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Nuclear Reactor Decommissioning Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Nuclear Reactor Decommissioning Market?

To stay informed about further developments, trends, and reports in the Europe Nuclear Reactor Decommissioning Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence