Key Insights

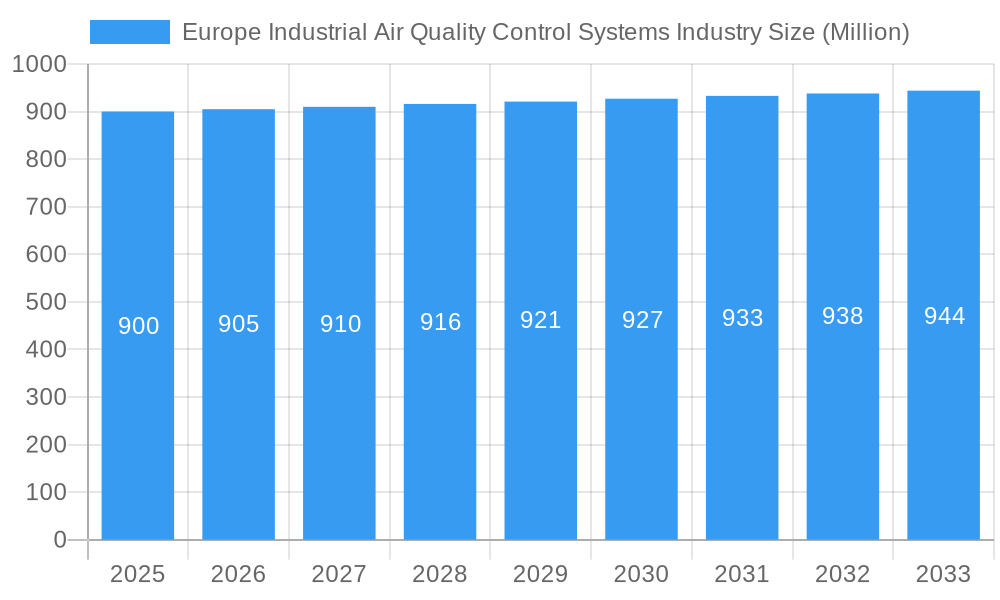

The European industrial air quality control systems market, valued at €97.9 billion in 2025, is poised for consistent expansion, driven by increasingly stringent environmental regulations across the region. This growth, projected at a Compound Annual Growth Rate (CAGR) of 0.6%, is primarily fueled by the expansion of energy-intensive industries such as power generation and cement manufacturing, alongside a heightened focus on reducing greenhouse gas emissions and enhancing overall air quality. Key technological advancements include improved electrostatic precipitators (ESPs), selective catalytic reduction (SCR) systems, and fabric filters, offering enhanced efficiency and reduced operational costs. While market restraints exist, including high initial investment and potential economic downturns impacting industry expansion, the long-term outlook remains positive, propelled by sustained regulatory pressure and growing public awareness of environmental issues. The power generation sector is expected to be the dominant application, followed by the cement and chemical industries. Germany, France, and the United Kingdom are anticipated to lead national markets due to their robust industrial bases and commitment to environmental sustainability.

Europe Industrial Air Quality Control Systems Industry Market Size (In Billion)

Within Europe, Electrostatic Precipitators (ESPs), Flue Gas Desulfurization (FGD) and Scrubbers, and Selective Catalytic Reduction (SCR) systems are the primary revenue contributors. The diverse applications across various industries ensure sustained demand. The competitive landscape is dynamic, with established and emerging companies vying for market share. Ongoing research and development efforts focused on enhancing system efficiency and sustainability, alongside innovative solutions for specific emission challenges, will shape the market's trajectory. Strategic adaptation to evolving regulations and collaborative supply chain partnerships are crucial for navigating market complexities and capitalizing on future growth opportunities.

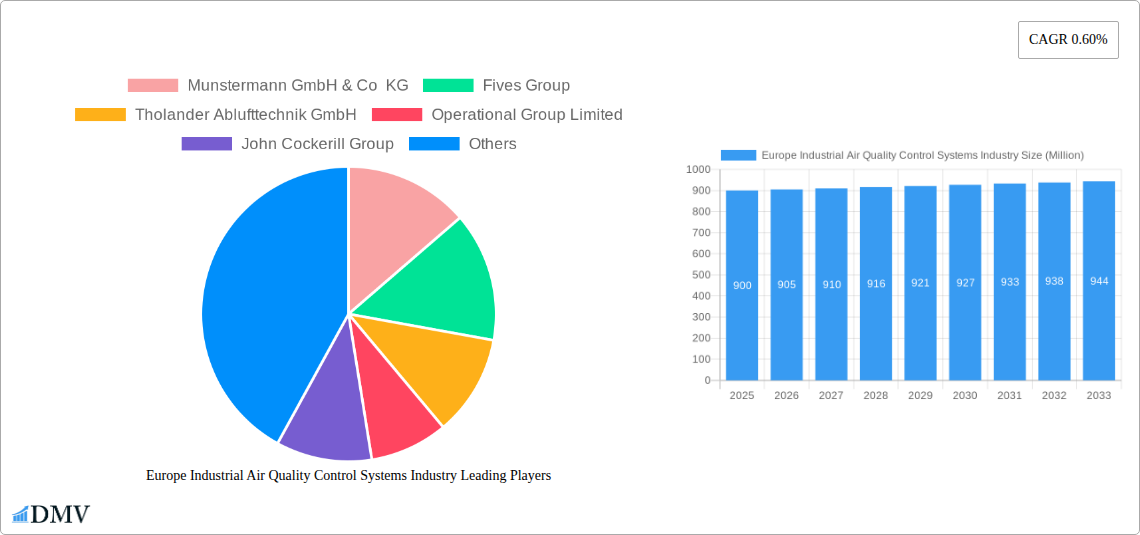

Europe Industrial Air Quality Control Systems Industry Company Market Share

Europe Industrial Air Quality Control Systems Market Report: 2019-2033

This report offers a detailed analysis of the European industrial air quality control systems market, providing insights for stakeholders. The study period spans 2019-2033, with 2025 as the base year. The market is segmented by system type (Electrostatic Precipitators (ESP), Flue Gas Desulfurization (FGD) and Scrubbers, Selective Catalytic Reduction (SCR), Fabric Filters, Others), application (Power Generation, Cement, Chemicals & Fertilizers, Iron & Steel, Automotive, Oil & Gas, Other), and key pollutants (Nitrogen Oxides (NOx), Sulphur Oxides (SO2), Particulate Matter (PM)). The market is projected to reach a significant value by 2033, driven by stringent environmental regulations and increasing industrialization.

Europe Industrial Air Quality Control Systems Industry Market Composition & Trends

The European industrial air quality control systems market exhibits a moderately concentrated structure, with leading players like Fives Group, John Cockerill Group, and Andritz AG holding significant market share. The overall market share distribution is estimated at approximately 40% for the top 5 players and 60% for the remaining players in 2025. Innovation is primarily driven by stricter emission regulations, particularly concerning PM2.5, NOx, and SO2, pushing for more efficient and effective control technologies. The regulatory landscape, influenced by the European Green Deal and national initiatives, is a crucial factor shaping market dynamics. Substitutes like advanced filtration technologies and process optimization strategies pose a degree of competitive pressure. End-users are predominantly large industrial players across various sectors, with a high focus on energy efficiency and compliance. M&A activity remains relatively moderate, with a total estimated deal value of xx Million in the historical period (2019-2024), largely driven by consolidation efforts among smaller players.

- Market concentration: Moderate, top 5 players holding ~40% market share (2025).

- Innovation catalysts: Stringent emission regulations (PM2.5, NOx, SO2).

- Regulatory landscape: Driven by the European Green Deal and national policies.

- Substitute products: Advanced filtration, process optimization.

- End-user profile: Large industrial companies across various sectors.

- M&A activity: Moderate, with total deal value of xx Million (2019-2024).

Europe Industrial Air Quality Control Systems Industry Industry Evolution

The European industrial air quality control systems market has witnessed consistent growth throughout the historical period (2019-2024), with a Compound Annual Growth Rate (CAGR) of approximately xx%. This growth is primarily attributed to the increasing awareness of air pollution's health and environmental impacts, leading to stricter regulations across numerous industrial sectors. Technological advancements, particularly in SCR, FGD, and ESP technologies, have enhanced efficiency and reduced operational costs, further stimulating market expansion. Consumer demand, driven by governmental policies and corporate social responsibility (CSR) initiatives, is shifting towards cleaner and more sustainable industrial practices, fostering the adoption of advanced air quality control systems. The forecast period (2025-2033) projects a CAGR of xx%, reflecting continued regulatory pressure, technological improvements in areas such as AI-driven optimization and the increasing adoption of digital technologies for improved monitoring and control. The rising demand for these systems from emerging sectors such as renewable energy and waste management will also support this growth trajectory.

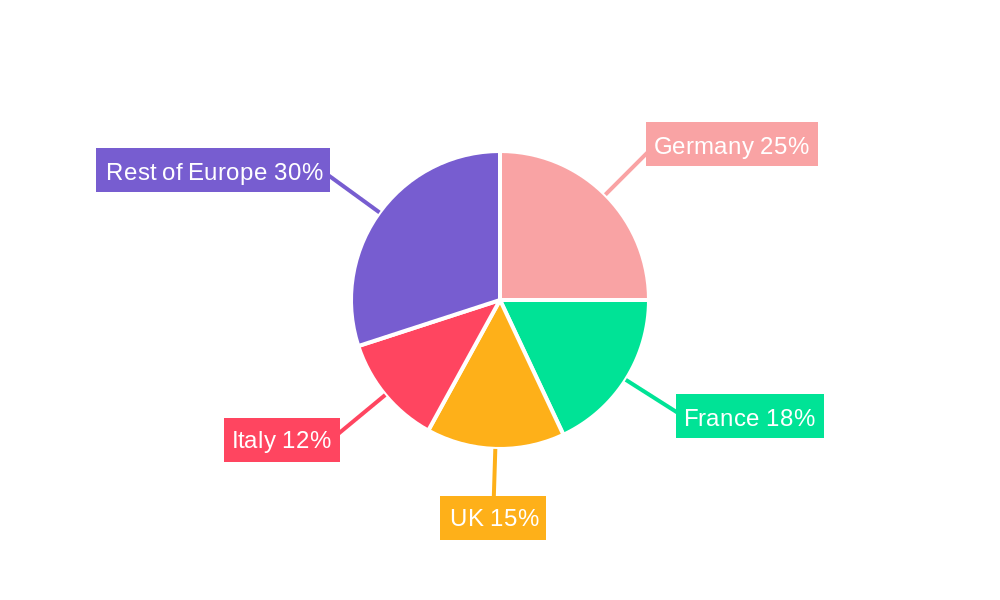

Leading Regions, Countries, or Segments in Europe Industrial Air Quality Control Systems Industry

Germany, followed by the United Kingdom and France, are currently leading the European market for industrial air quality control systems. The power generation industry remains the dominant application segment, driven by regulations aimed at reducing emissions from coal-fired power plants. Within system types, ESPs and fabric filters hold the largest market share owing to their widespread adoption and cost-effectiveness for various applications.

Key Drivers:

- Significant investments in upgrading existing infrastructure to meet stringent emission standards.

- Strong regulatory support and financial incentives for adopting cleaner technologies.

- Growing awareness of the health and environmental implications of air pollution.

Dominance Factors:

- Stringent emission regulations in Germany, the UK, and France.

- High concentration of industrial activity in these regions.

- Early adoption of advanced air pollution control technologies.

Europe Industrial Air Quality Control Systems Industry Product Innovations

Recent innovations focus on enhancing efficiency, reducing operational costs, and improving the overall performance of air quality control systems. These advancements include the integration of artificial intelligence (AI) for real-time monitoring and optimization, the development of more efficient and durable filter materials, and the use of advanced sensor technologies for precise pollutant detection. These improvements contribute to better emission control, minimized maintenance requirements, and improved overall system lifespan, leading to significant cost savings and improved environmental performance.

Propelling Factors for Europe Industrial Air Quality Control Systems Industry Growth

The European industrial air quality control systems market's growth is propelled by several key factors:

- Stringent Environmental Regulations: The European Green Deal and national policies are driving stricter emission standards, mandating the adoption of advanced air quality control systems.

- Technological Advancements: Continuous improvements in efficiency, performance, and cost-effectiveness are making these systems more attractive to industrial players.

- Economic Incentives: Governments are offering financial incentives and subsidies to encourage investment in cleaner technologies.

Obstacles in the Europe Industrial Air Quality Control Systems Industry Market

The market faces challenges including:

- High Initial Investment Costs: The cost of installing and maintaining these systems can be a significant barrier, especially for smaller companies.

- Supply Chain Disruptions: Global events impacting the supply of critical components can disrupt production and increase costs.

- Competitive Pressures: Intense competition among vendors can lead to price wars, impacting profitability.

Future Opportunities in Europe Industrial Air Quality Control Systems Industry

Future opportunities include:

- Expansion into Emerging Markets: Growth in developing economies will present new market entry points for advanced air quality control systems.

- Development of Innovative Technologies: The research and development of novel technologies such as carbon capture and utilization will create new market opportunities.

- Integration of Digital Technologies: The use of IoT sensors, AI and machine learning for improved system monitoring and optimization will drive market growth.

Major Players in the Europe Industrial Air Quality Control Systems Industry Ecosystem

- Munstermann GmbH & Co KG

- Fives Group

- Tholander Ablufttechnik GmbH

- Operational Group Limited

- John Cockerill Group

- John Wood Group PLC

- Exeon Ltd

- Chemisch Thermische Prozesstechnik GmbH

- Andritz AG

- Anguil Environmental Systems Inc

Key Developments in Europe Industrial Air Quality Control Systems Industry Industry

- October 2022: The European Green Deal's recommendation for stricter air quality regulations will significantly increase demand for advanced air quality control systems over the next decade, preventing more than 75% of deaths related to PM2.5 exceeding WHO guidelines.

- September 2022: Breathe Warsaw's initiative to create a comprehensive air quality database using a large sensor network will support better pollution source identification and inform future policy decisions regarding the adoption of cleaner technologies and low emission zones.

Strategic Europe Industrial Air Quality Control Systems Industry Market Forecast

The European industrial air quality control systems market is poised for significant growth in the forecast period (2025-2033), driven by the convergence of stricter environmental regulations, technological innovations, and increasing awareness of air pollution's health and environmental impacts. The continued adoption of advanced technologies, coupled with economic incentives and supportive policies, will create substantial opportunities for market players. The market's expansion will be particularly pronounced in sectors undergoing rapid industrialization and those facing heightened regulatory scrutiny.

Europe Industrial Air Quality Control Systems Industry Segmentation

-

1. Type

- 1.1. Electrostatic Precipitators (ESP)

- 1.2. Flue Gas Desulfurization (FGD) and Scrubbers

- 1.3. Selective Catalytic Reduction (SCR)

- 1.4. Fabric Filters

- 1.5. Others

-

2. Application

- 2.1. Power Generation Industry

- 2.2. Cement Industry

- 2.3. Chemicals and Fertilizers

- 2.4. Iron and Steel Industry

- 2.5. Automotive Industry

- 2.6. Oil & Gas Industry

- 2.7. Other Applications

-

3. Emissions (Qualitative Analysis only)

- 3.1. Nitrogen Oxides (NOx)

- 3.2. Sulphur Oxides (SO2)

- 3.3. Particulate Matter (PM)

Europe Industrial Air Quality Control Systems Industry Segmentation By Geography

- 1. Germany

- 2. France

- 3. United Kingdom

- 4. Rest of Europe

Europe Industrial Air Quality Control Systems Industry Regional Market Share

Geographic Coverage of Europe Industrial Air Quality Control Systems Industry

Europe Industrial Air Quality Control Systems Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 0.6% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Presence of Stringent Regulation for Air Quality Management

- 3.3. Market Restrains

- 3.3.1. 4.; High Capital is Required for the Installation of an Air Quality Control System

- 3.4. Market Trends

- 3.4.1. Power Generation Industry Segment to Witness Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Industrial Air Quality Control Systems Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Electrostatic Precipitators (ESP)

- 5.1.2. Flue Gas Desulfurization (FGD) and Scrubbers

- 5.1.3. Selective Catalytic Reduction (SCR)

- 5.1.4. Fabric Filters

- 5.1.5. Others

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Power Generation Industry

- 5.2.2. Cement Industry

- 5.2.3. Chemicals and Fertilizers

- 5.2.4. Iron and Steel Industry

- 5.2.5. Automotive Industry

- 5.2.6. Oil & Gas Industry

- 5.2.7. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by Emissions (Qualitative Analysis only)

- 5.3.1. Nitrogen Oxides (NOx)

- 5.3.2. Sulphur Oxides (SO2)

- 5.3.3. Particulate Matter (PM)

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Germany

- 5.4.2. France

- 5.4.3. United Kingdom

- 5.4.4. Rest of Europe

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Germany Europe Industrial Air Quality Control Systems Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Electrostatic Precipitators (ESP)

- 6.1.2. Flue Gas Desulfurization (FGD) and Scrubbers

- 6.1.3. Selective Catalytic Reduction (SCR)

- 6.1.4. Fabric Filters

- 6.1.5. Others

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Power Generation Industry

- 6.2.2. Cement Industry

- 6.2.3. Chemicals and Fertilizers

- 6.2.4. Iron and Steel Industry

- 6.2.5. Automotive Industry

- 6.2.6. Oil & Gas Industry

- 6.2.7. Other Applications

- 6.3. Market Analysis, Insights and Forecast - by Emissions (Qualitative Analysis only)

- 6.3.1. Nitrogen Oxides (NOx)

- 6.3.2. Sulphur Oxides (SO2)

- 6.3.3. Particulate Matter (PM)

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. France Europe Industrial Air Quality Control Systems Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Electrostatic Precipitators (ESP)

- 7.1.2. Flue Gas Desulfurization (FGD) and Scrubbers

- 7.1.3. Selective Catalytic Reduction (SCR)

- 7.1.4. Fabric Filters

- 7.1.5. Others

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Power Generation Industry

- 7.2.2. Cement Industry

- 7.2.3. Chemicals and Fertilizers

- 7.2.4. Iron and Steel Industry

- 7.2.5. Automotive Industry

- 7.2.6. Oil & Gas Industry

- 7.2.7. Other Applications

- 7.3. Market Analysis, Insights and Forecast - by Emissions (Qualitative Analysis only)

- 7.3.1. Nitrogen Oxides (NOx)

- 7.3.2. Sulphur Oxides (SO2)

- 7.3.3. Particulate Matter (PM)

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. United Kingdom Europe Industrial Air Quality Control Systems Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Electrostatic Precipitators (ESP)

- 8.1.2. Flue Gas Desulfurization (FGD) and Scrubbers

- 8.1.3. Selective Catalytic Reduction (SCR)

- 8.1.4. Fabric Filters

- 8.1.5. Others

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Power Generation Industry

- 8.2.2. Cement Industry

- 8.2.3. Chemicals and Fertilizers

- 8.2.4. Iron and Steel Industry

- 8.2.5. Automotive Industry

- 8.2.6. Oil & Gas Industry

- 8.2.7. Other Applications

- 8.3. Market Analysis, Insights and Forecast - by Emissions (Qualitative Analysis only)

- 8.3.1. Nitrogen Oxides (NOx)

- 8.3.2. Sulphur Oxides (SO2)

- 8.3.3. Particulate Matter (PM)

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Rest of Europe Europe Industrial Air Quality Control Systems Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Electrostatic Precipitators (ESP)

- 9.1.2. Flue Gas Desulfurization (FGD) and Scrubbers

- 9.1.3. Selective Catalytic Reduction (SCR)

- 9.1.4. Fabric Filters

- 9.1.5. Others

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Power Generation Industry

- 9.2.2. Cement Industry

- 9.2.3. Chemicals and Fertilizers

- 9.2.4. Iron and Steel Industry

- 9.2.5. Automotive Industry

- 9.2.6. Oil & Gas Industry

- 9.2.7. Other Applications

- 9.3. Market Analysis, Insights and Forecast - by Emissions (Qualitative Analysis only)

- 9.3.1. Nitrogen Oxides (NOx)

- 9.3.2. Sulphur Oxides (SO2)

- 9.3.3. Particulate Matter (PM)

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Munstermann GmbH & Co KG

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Fives Group

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Tholander Ablufttechnik GmbH

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Operational Group Limited

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 John Cockerill Group

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 John Wood Group PLC

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Exeon Ltd

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Chemisch Thermische Prozesstechnik GmbH

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Andritz AG

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Anguil Environmental Systems Inc

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.1 Munstermann GmbH & Co KG

List of Figures

- Figure 1: Europe Industrial Air Quality Control Systems Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Europe Industrial Air Quality Control Systems Industry Share (%) by Company 2025

List of Tables

- Table 1: Europe Industrial Air Quality Control Systems Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 2: Europe Industrial Air Quality Control Systems Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 3: Europe Industrial Air Quality Control Systems Industry Revenue billion Forecast, by Emissions (Qualitative Analysis only) 2020 & 2033

- Table 4: Europe Industrial Air Quality Control Systems Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 5: Europe Industrial Air Quality Control Systems Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 6: Europe Industrial Air Quality Control Systems Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 7: Europe Industrial Air Quality Control Systems Industry Revenue billion Forecast, by Emissions (Qualitative Analysis only) 2020 & 2033

- Table 8: Europe Industrial Air Quality Control Systems Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 9: Europe Industrial Air Quality Control Systems Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 10: Europe Industrial Air Quality Control Systems Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 11: Europe Industrial Air Quality Control Systems Industry Revenue billion Forecast, by Emissions (Qualitative Analysis only) 2020 & 2033

- Table 12: Europe Industrial Air Quality Control Systems Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 13: Europe Industrial Air Quality Control Systems Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 14: Europe Industrial Air Quality Control Systems Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 15: Europe Industrial Air Quality Control Systems Industry Revenue billion Forecast, by Emissions (Qualitative Analysis only) 2020 & 2033

- Table 16: Europe Industrial Air Quality Control Systems Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 17: Europe Industrial Air Quality Control Systems Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 18: Europe Industrial Air Quality Control Systems Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 19: Europe Industrial Air Quality Control Systems Industry Revenue billion Forecast, by Emissions (Qualitative Analysis only) 2020 & 2033

- Table 20: Europe Industrial Air Quality Control Systems Industry Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Industrial Air Quality Control Systems Industry?

The projected CAGR is approximately 0.6%.

2. Which companies are prominent players in the Europe Industrial Air Quality Control Systems Industry?

Key companies in the market include Munstermann GmbH & Co KG, Fives Group, Tholander Ablufttechnik GmbH, Operational Group Limited, John Cockerill Group, John Wood Group PLC, Exeon Ltd, Chemisch Thermische Prozesstechnik GmbH, Andritz AG, Anguil Environmental Systems Inc.

3. What are the main segments of the Europe Industrial Air Quality Control Systems Industry?

The market segments include Type, Application, Emissions (Qualitative Analysis only).

4. Can you provide details about the market size?

The market size is estimated to be USD 97.9 billion as of 2022.

5. What are some drivers contributing to market growth?

4.; Presence of Stringent Regulation for Air Quality Management.

6. What are the notable trends driving market growth?

Power Generation Industry Segment to Witness Significant Growth.

7. Are there any restraints impacting market growth?

4.; High Capital is Required for the Installation of an Air Quality Control System.

8. Can you provide examples of recent developments in the market?

October 2022: In the European Green Deal, the Commission recommended stricter regulations for sewage treatment from cities, surface and groundwater pollution, and ambient air quality. In ten years, the new regulations will prevent more than 75% of deaths brought on by levels of the major pollutant PM2.5 above WHO recommendations.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Industrial Air Quality Control Systems Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Industrial Air Quality Control Systems Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Industrial Air Quality Control Systems Industry?

To stay informed about further developments, trends, and reports in the Europe Industrial Air Quality Control Systems Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence