Key Insights

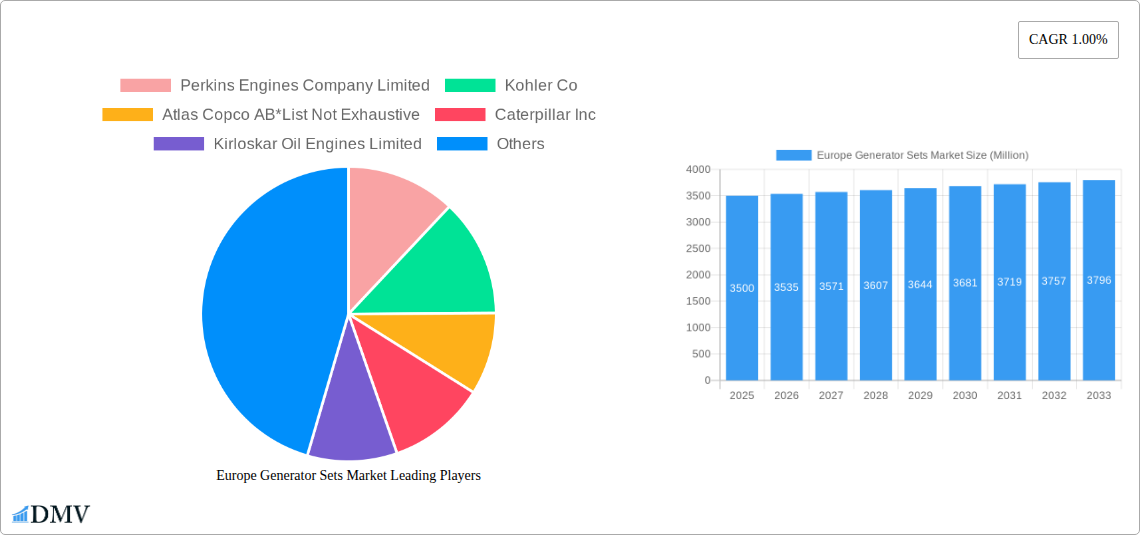

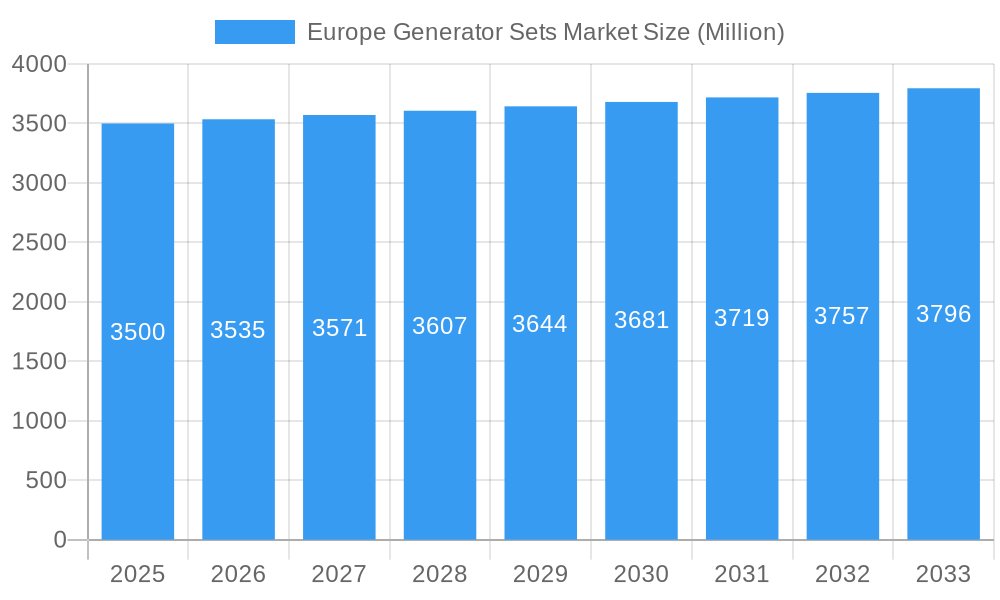

The European generator sets market is projected for robust expansion, forecast to reach €3.5 billion by 2025. This growth is fueled by escalating power outage frequency, increasing demand for dependable backup power in commercial and industrial settings, and the expanding renewable energy sector's need for grid stabilization. The market's Compound Annual Growth Rate (CAGR) is estimated at 1.00%, indicating a mature landscape with established participants, yet presenting opportunities across various segments. The diesel fuel segment is anticipated to maintain dominance owing to its established infrastructure and proven reliability. However, the gas fuel segment is expected to witness growth, driven by environmental considerations and potential regulatory shifts favoring cleaner energy alternatives. The 75-350 kVA rating segment is predicted to be the largest, addressing the power requirements of Small and Medium-sized Enterprises (SMEs) and smaller industrial facilities. Key growth regions include Germany, France, and the UK, attributed to higher industrial activity and stringent regulations mandating reliable backup power solutions. Market challenges encompass fluctuating fuel prices, stringent emission standards, and the increasing integration of grid-tied renewable energy systems, which may reduce reliance on standalone generators in certain applications. Nevertheless, the demand for portable and temporary power solutions in construction, events, and emergency services is expected to partially offset these constraints.

Europe Generator Sets Market Market Size (In Billion)

The competitive environment comprises global leaders such as Cummins, Caterpillar, and Kohler, alongside specialized regional manufacturers. To succeed, companies must prioritize innovative solutions, including intelligent generator management systems and remote monitoring capabilities. Enhancing fuel efficiency will be crucial to address rising fuel costs, and adaptation to stricter environmental regulations through the provision of low-emission generator models is imperative. The market's moderate growth trajectory emphasizes the necessity for companies to differentiate through superior technology, service excellence, and strategic alliances to secure market share in this established yet dynamic sector. Government initiatives promoting energy security and resilience, particularly in regions vulnerable to natural disasters or grid instability, could further stimulate market expansion.

Europe Generator Sets Market Company Market Share

Europe Generator Sets Market: A Comprehensive Market Report (2019-2033)

This insightful report provides a comprehensive analysis of the Europe Generator Sets market, offering a detailed overview of its current state, future trajectory, and key players. Covering the period from 2019 to 2033, with a focus on the 2025-2033 forecast, this report is an indispensable resource for stakeholders seeking to understand and capitalize on the opportunities within this dynamic market. The market size is estimated at xx Million in 2025 and is projected to reach xx Million by 2033.

Europe Generator Sets Market Composition & Trends

This section delves into the intricate landscape of the European generator sets market, examining its competitive dynamics, driving forces, and regulatory environment. We analyze market concentration, identifying key players and their respective market shares, with a particular focus on mergers and acquisitions (M&A) activities and their impact. The report also explores the influence of technological innovations, substitute products, and evolving end-user preferences.

- Market Concentration: The European generator sets market exhibits a moderately concentrated structure, with a few major players holding significant market share. The top five players collectively account for approximately xx% of the market. However, several smaller, specialized companies also contribute significantly to niche segments.

- Innovation Catalysts: Stringent emission regulations, coupled with the increasing demand for reliable power solutions, are driving innovation in generator set technology, particularly in areas like fuel efficiency and noise reduction.

- Regulatory Landscape: EU directives on emissions and energy efficiency significantly influence the market, promoting the adoption of cleaner and more efficient technologies. These regulations are creating opportunities for manufacturers offering compliant products.

- Substitute Products: Renewable energy sources, such as solar and wind power, are emerging as substitutes for generator sets in some applications. However, generator sets continue to hold a significant position due to their reliability and flexibility.

- End-User Profiles: The market is diversified across residential, commercial, and industrial end-users, with industrial applications currently dominating market demand. Growth in the renewable energy sector will drive industrial growth.

- M&A Activities: Consolidation within the market has been modest in recent years. While several M&A deals have been recorded in the value of xx Million over the past five years, these transactions primarily focused on strengthening regional presence and product portfolios rather than creating market dominance. The average deal size has been approximately xx Million.

Europe Generator Sets Market Industry Evolution

This section provides a detailed analysis of the evolution of the European generator sets market, charting its growth trajectory, examining the impact of technological advancements, and exploring how changing consumer demands have shaped the industry. We present detailed data points on market growth rates, adoption metrics, and technological shifts. The market witnessed significant growth during the historical period (2019-2024), with a Compound Annual Growth Rate (CAGR) of approximately xx%. This growth is expected to continue during the forecast period (2025-2033), albeit at a slightly moderated pace due to market saturation and increased competition. Factors like growing investments in renewable energy and increasing energy efficiency standards influence growth trajectory. The adoption of advanced technologies like digital control systems and remote monitoring capabilities has increased the efficiency and reliability of generator sets which also influences consumer demands.

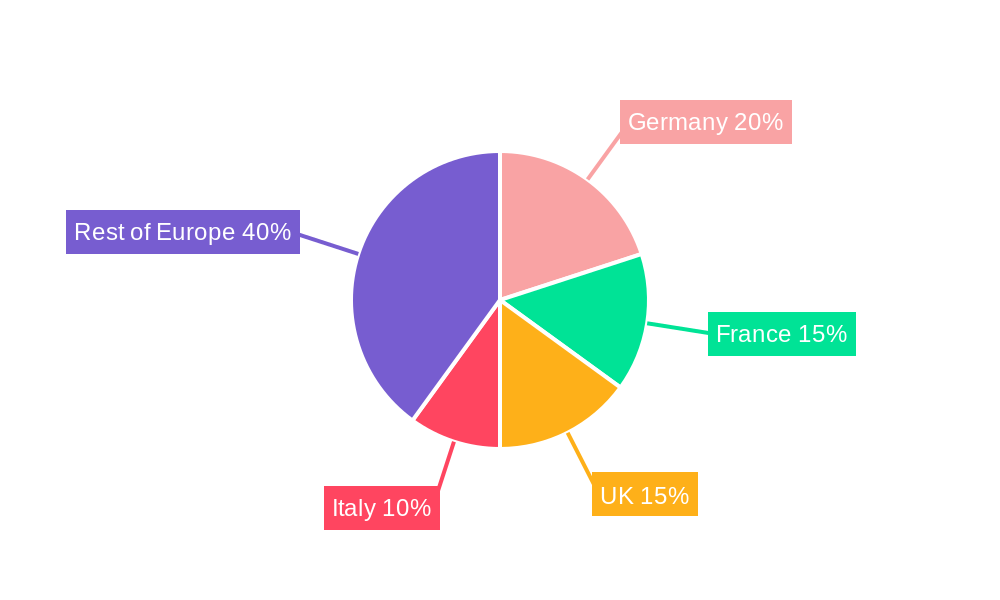

Leading Regions, Countries, or Segments in Europe Generator Sets Market

This section identifies the dominant regions, countries, and market segments within the European generator sets market. We explore the factors contributing to this dominance. The analysis is broken down by fuel type (Diesel, Gas, Others), power rating (Below 75 kVA, 75-350 kVA, Above 350 kVA), and end-user segment (Residential, Commercial, Industrial).

- Dominant Region: Germany holds the largest market share in Europe, driven by strong industrial activity and substantial investments in infrastructure projects.

- Dominant Fuel Type: Diesel generator sets continue to dominate the market owing to their established reliability, widespread availability, and cost-effectiveness.

- Dominant Power Rating: The 75-350 kVA segment holds the largest market share, driven by the demand from commercial and industrial applications.

- Dominant End-User: The Industrial sector remains the most significant end-user segment, owing to the growing need for backup power in manufacturing, data centers, and other critical operations.

Key Drivers:

- Germany: High industrial concentration, robust infrastructure development, and government support for energy security initiatives.

- Diesel Fuel: Established technology, cost-effectiveness, and readily available fuel infrastructure.

- 75-350 kVA Rating: Suitability for a wide range of applications, from commercial buildings to small-scale industrial facilities.

- Industrial End-User: High demand for reliable backup power in manufacturing, data centers, and other critical industrial applications.

Europe Generator Sets Market Product Innovations

Recent years have witnessed significant product innovations in the European generator sets market. Manufacturers are focusing on developing more fuel-efficient, quieter, and technologically advanced generator sets. Key innovations include advanced control systems, improved emission control technologies, and integrated monitoring capabilities. These innovations enhance efficiency, reliability, and environmental performance. The integration of smart technologies and remote monitoring capabilities allows for better performance management and predictive maintenance, reducing downtime and optimizing operational costs.

Propelling Factors for Europe Generator Sets Market Growth

Several factors are driving the growth of the European generator sets market. Stringent emission regulations are pushing the adoption of cleaner technologies, while increasing urbanization and industrialization are fuelling the demand for reliable power solutions. Furthermore, growing investments in renewable energy projects, which often require backup power during periods of low generation, are also contributing to market expansion. Government initiatives promoting energy security are additional catalysts.

Obstacles in the Europe Generator Sets Market

Despite the growth potential, the European generator sets market faces several challenges. Fluctuating fuel prices impact operating costs, while supply chain disruptions can affect production and availability. Intense competition among manufacturers also pressures profit margins. Stringent environmental regulations necessitate significant investments in research and development to meet compliance standards, further impacting profitability.

Future Opportunities in Europe Generator Sets Market

Future opportunities lie in the development of hybrid and renewable energy integrated generator sets, catering to the rising demand for sustainable power solutions. Expansion into emerging markets and providing advanced maintenance and service packages can also drive significant growth. The increasing adoption of smart technologies and data analytics for predictive maintenance also presents significant opportunities.

Major Players in the Europe Generator Sets Market Ecosystem

- Perkins Engines Company Limited

- Kohler Co

- Atlas Copco AB

- Caterpillar Inc

- Kirloskar Oil Engines Limited

- Honda Siel Power Products Limited

- Cummins Inc

- Yanmar Holdings co Ltd

- Aggreko plc

- Mitsubishi Heavy Industries Ltd

Key Developments in Europe Generator Sets Market Industry

- February 2023: Volvo Penta launched a new 200 kVA D8 Stage II engine, expanding its industrial genset product line. This launch enhances the company’s competitiveness in the high-efficiency, low-noise generator segment.

- October 2022: Himoinsa showcased its Mobile Power product line at Bauma 2022, including battery power storage systems and gas/diesel generator sets with Stage V engines. This highlights the increasing integration of battery technology with conventional generator sets.

Strategic Europe Generator Sets Market Forecast

The European generator sets market is poised for continued growth, driven by increasing demand for reliable power solutions across various sectors. Technological advancements in fuel efficiency, emissions control, and smart technologies will shape the market's evolution. The integration of renewable energy sources and the development of hybrid systems will be key factors driving future market expansion. The market’s growth will be significantly influenced by the adoption of greener technologies and government initiatives to improve energy security.

Europe Generator Sets Market Segmentation

-

1. Fuel

- 1.1. Diesel

- 1.2. Gas

- 1.3. Others

-

2. Ratings

- 2.1. Below 75 kVA

- 2.2. 75 - 350 kVA

- 2.3. Above 350 kVA

-

3. End-User

- 3.1. Residential

- 3.2. Commercial

- 3.3. Industrial

Europe Generator Sets Market Segmentation By Geography

- 1. Germany

- 2. Russia

- 3. United Kingdom

- 4. Rest of Europe

Europe Generator Sets Market Regional Market Share

Geographic Coverage of Europe Generator Sets Market

Europe Generator Sets Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 1% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Demand for Uninterrupted and Reliable Power Supply4.; The Longer Timeframe Required to Set Up the Transmission and Distribution Infrastructure

- 3.3. Market Restrains

- 3.3.1. 4.; The Higher Cost of Electricity Produced By the Generator Sets

- 3.4. Market Trends

- 3.4.1. Industrial Sector is Expected to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Generator Sets Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Fuel

- 5.1.1. Diesel

- 5.1.2. Gas

- 5.1.3. Others

- 5.2. Market Analysis, Insights and Forecast - by Ratings

- 5.2.1. Below 75 kVA

- 5.2.2. 75 - 350 kVA

- 5.2.3. Above 350 kVA

- 5.3. Market Analysis, Insights and Forecast - by End-User

- 5.3.1. Residential

- 5.3.2. Commercial

- 5.3.3. Industrial

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Germany

- 5.4.2. Russia

- 5.4.3. United Kingdom

- 5.4.4. Rest of Europe

- 5.1. Market Analysis, Insights and Forecast - by Fuel

- 6. Germany Europe Generator Sets Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Fuel

- 6.1.1. Diesel

- 6.1.2. Gas

- 6.1.3. Others

- 6.2. Market Analysis, Insights and Forecast - by Ratings

- 6.2.1. Below 75 kVA

- 6.2.2. 75 - 350 kVA

- 6.2.3. Above 350 kVA

- 6.3. Market Analysis, Insights and Forecast - by End-User

- 6.3.1. Residential

- 6.3.2. Commercial

- 6.3.3. Industrial

- 6.1. Market Analysis, Insights and Forecast - by Fuel

- 7. Russia Europe Generator Sets Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Fuel

- 7.1.1. Diesel

- 7.1.2. Gas

- 7.1.3. Others

- 7.2. Market Analysis, Insights and Forecast - by Ratings

- 7.2.1. Below 75 kVA

- 7.2.2. 75 - 350 kVA

- 7.2.3. Above 350 kVA

- 7.3. Market Analysis, Insights and Forecast - by End-User

- 7.3.1. Residential

- 7.3.2. Commercial

- 7.3.3. Industrial

- 7.1. Market Analysis, Insights and Forecast - by Fuel

- 8. United Kingdom Europe Generator Sets Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Fuel

- 8.1.1. Diesel

- 8.1.2. Gas

- 8.1.3. Others

- 8.2. Market Analysis, Insights and Forecast - by Ratings

- 8.2.1. Below 75 kVA

- 8.2.2. 75 - 350 kVA

- 8.2.3. Above 350 kVA

- 8.3. Market Analysis, Insights and Forecast - by End-User

- 8.3.1. Residential

- 8.3.2. Commercial

- 8.3.3. Industrial

- 8.1. Market Analysis, Insights and Forecast - by Fuel

- 9. Rest of Europe Europe Generator Sets Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Fuel

- 9.1.1. Diesel

- 9.1.2. Gas

- 9.1.3. Others

- 9.2. Market Analysis, Insights and Forecast - by Ratings

- 9.2.1. Below 75 kVA

- 9.2.2. 75 - 350 kVA

- 9.2.3. Above 350 kVA

- 9.3. Market Analysis, Insights and Forecast - by End-User

- 9.3.1. Residential

- 9.3.2. Commercial

- 9.3.3. Industrial

- 9.1. Market Analysis, Insights and Forecast - by Fuel

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Perkins Engines Company Limited

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Kohler Co

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Atlas Copco AB*List Not Exhaustive

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Caterpillar Inc

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Kirloskar Oil Engines Limited

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Honda Siel Power Products Limited

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Cummins Inc

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Yanmar Holdings co Ltd

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Aggreko plc

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Mitsubishi Heavy Industries Ltd

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.1 Perkins Engines Company Limited

List of Figures

- Figure 1: Europe Generator Sets Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Europe Generator Sets Market Share (%) by Company 2025

List of Tables

- Table 1: Europe Generator Sets Market Revenue billion Forecast, by Fuel 2020 & 2033

- Table 2: Europe Generator Sets Market Volume Gigawatt Forecast, by Fuel 2020 & 2033

- Table 3: Europe Generator Sets Market Revenue billion Forecast, by Ratings 2020 & 2033

- Table 4: Europe Generator Sets Market Volume Gigawatt Forecast, by Ratings 2020 & 2033

- Table 5: Europe Generator Sets Market Revenue billion Forecast, by End-User 2020 & 2033

- Table 6: Europe Generator Sets Market Volume Gigawatt Forecast, by End-User 2020 & 2033

- Table 7: Europe Generator Sets Market Revenue billion Forecast, by Region 2020 & 2033

- Table 8: Europe Generator Sets Market Volume Gigawatt Forecast, by Region 2020 & 2033

- Table 9: Europe Generator Sets Market Revenue billion Forecast, by Fuel 2020 & 2033

- Table 10: Europe Generator Sets Market Volume Gigawatt Forecast, by Fuel 2020 & 2033

- Table 11: Europe Generator Sets Market Revenue billion Forecast, by Ratings 2020 & 2033

- Table 12: Europe Generator Sets Market Volume Gigawatt Forecast, by Ratings 2020 & 2033

- Table 13: Europe Generator Sets Market Revenue billion Forecast, by End-User 2020 & 2033

- Table 14: Europe Generator Sets Market Volume Gigawatt Forecast, by End-User 2020 & 2033

- Table 15: Europe Generator Sets Market Revenue billion Forecast, by Country 2020 & 2033

- Table 16: Europe Generator Sets Market Volume Gigawatt Forecast, by Country 2020 & 2033

- Table 17: Europe Generator Sets Market Revenue billion Forecast, by Fuel 2020 & 2033

- Table 18: Europe Generator Sets Market Volume Gigawatt Forecast, by Fuel 2020 & 2033

- Table 19: Europe Generator Sets Market Revenue billion Forecast, by Ratings 2020 & 2033

- Table 20: Europe Generator Sets Market Volume Gigawatt Forecast, by Ratings 2020 & 2033

- Table 21: Europe Generator Sets Market Revenue billion Forecast, by End-User 2020 & 2033

- Table 22: Europe Generator Sets Market Volume Gigawatt Forecast, by End-User 2020 & 2033

- Table 23: Europe Generator Sets Market Revenue billion Forecast, by Country 2020 & 2033

- Table 24: Europe Generator Sets Market Volume Gigawatt Forecast, by Country 2020 & 2033

- Table 25: Europe Generator Sets Market Revenue billion Forecast, by Fuel 2020 & 2033

- Table 26: Europe Generator Sets Market Volume Gigawatt Forecast, by Fuel 2020 & 2033

- Table 27: Europe Generator Sets Market Revenue billion Forecast, by Ratings 2020 & 2033

- Table 28: Europe Generator Sets Market Volume Gigawatt Forecast, by Ratings 2020 & 2033

- Table 29: Europe Generator Sets Market Revenue billion Forecast, by End-User 2020 & 2033

- Table 30: Europe Generator Sets Market Volume Gigawatt Forecast, by End-User 2020 & 2033

- Table 31: Europe Generator Sets Market Revenue billion Forecast, by Country 2020 & 2033

- Table 32: Europe Generator Sets Market Volume Gigawatt Forecast, by Country 2020 & 2033

- Table 33: Europe Generator Sets Market Revenue billion Forecast, by Fuel 2020 & 2033

- Table 34: Europe Generator Sets Market Volume Gigawatt Forecast, by Fuel 2020 & 2033

- Table 35: Europe Generator Sets Market Revenue billion Forecast, by Ratings 2020 & 2033

- Table 36: Europe Generator Sets Market Volume Gigawatt Forecast, by Ratings 2020 & 2033

- Table 37: Europe Generator Sets Market Revenue billion Forecast, by End-User 2020 & 2033

- Table 38: Europe Generator Sets Market Volume Gigawatt Forecast, by End-User 2020 & 2033

- Table 39: Europe Generator Sets Market Revenue billion Forecast, by Country 2020 & 2033

- Table 40: Europe Generator Sets Market Volume Gigawatt Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Generator Sets Market?

The projected CAGR is approximately 1%.

2. Which companies are prominent players in the Europe Generator Sets Market?

Key companies in the market include Perkins Engines Company Limited, Kohler Co, Atlas Copco AB*List Not Exhaustive, Caterpillar Inc, Kirloskar Oil Engines Limited, Honda Siel Power Products Limited, Cummins Inc, Yanmar Holdings co Ltd, Aggreko plc, Mitsubishi Heavy Industries Ltd.

3. What are the main segments of the Europe Generator Sets Market?

The market segments include Fuel, Ratings, End-User.

4. Can you provide details about the market size?

The market size is estimated to be USD 3.5 billion as of 2022.

5. What are some drivers contributing to market growth?

4.; Demand for Uninterrupted and Reliable Power Supply4.; The Longer Timeframe Required to Set Up the Transmission and Distribution Infrastructure.

6. What are the notable trends driving market growth?

Industrial Sector is Expected to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; The Higher Cost of Electricity Produced By the Generator Sets.

8. Can you provide examples of recent developments in the market?

In February 2023, Volvo Penta expanded its industrial genset product line with a new 200 kVA D8 Stage II engine. The 8-liter power-generating engine provides excellent fuel efficiency, a compact size, and low noise levels.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion and volume, measured in Gigawatt.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Generator Sets Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Generator Sets Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Generator Sets Market?

To stay informed about further developments, trends, and reports in the Europe Generator Sets Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence