Key Insights

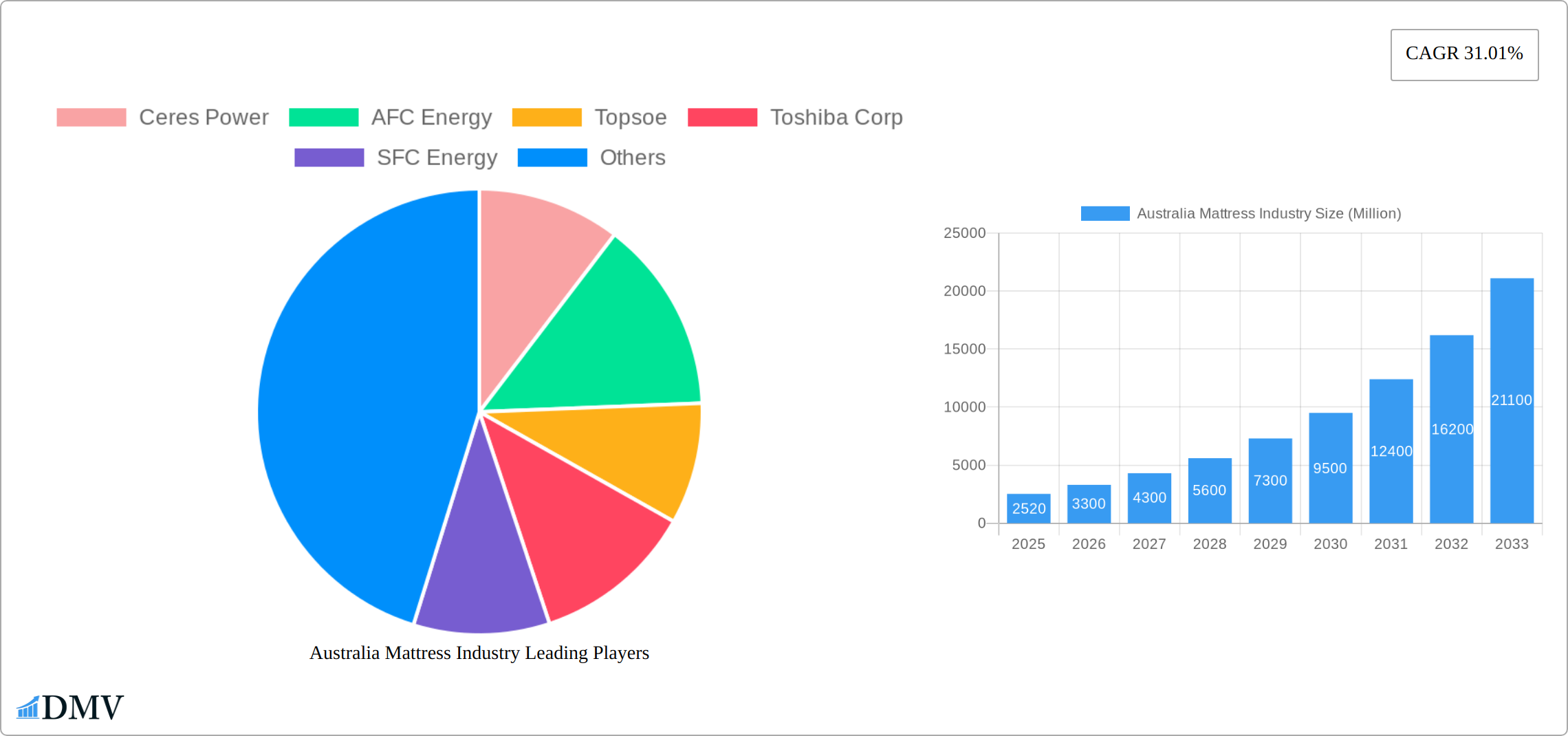

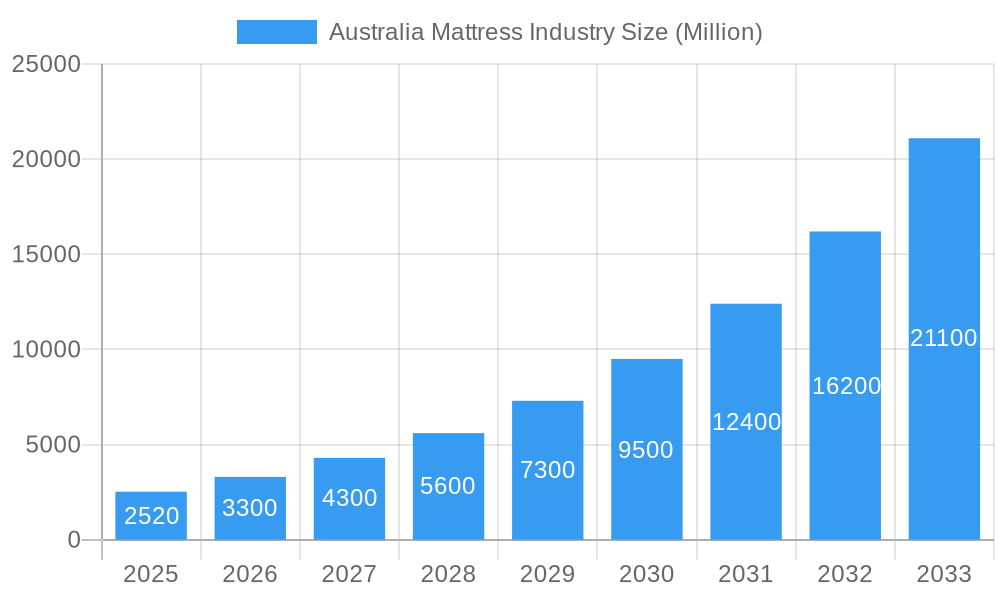

The global fuel cell market, valued at $2.52 billion in 2025, is projected to experience robust growth, with a compound annual growth rate (CAGR) of 31.01% from 2025 to 2033. This expansion is driven by increasing demand for clean energy solutions across various sectors, including portable power devices, stationary power generation, and transportation. The rising adoption of fuel cell electric vehicles (FCEVs) and the growing focus on reducing carbon emissions are significant catalysts. Technological advancements, particularly in Polymer Electrolyte Membrane Fuel Cells (PEMFCs) and Solid Oxide Fuel Cells (SOFCs), are enhancing efficiency and reducing costs, further fueling market growth. However, high initial investment costs and the limited availability of hydrogen refueling infrastructure remain key restraints. The market is segmented by application (portable, stationary, transportation) and fuel cell technology (PEMFC, SOFC, other). Key players include Ceres Power, AFC Energy, Topsoe, Toshiba Corp, SFC Energy, Cummins Inc, Ballard Power Systems Inc, Plug Power Inc, Fuelcell Energy Inc, and Nuvera Fuel Cells LLC. Geographic analysis focuses primarily on European markets, including Germany, France, Italy, the United Kingdom, Netherlands, and Sweden, reflecting significant early adoption and government support for fuel cell technologies in these regions. The forecast period of 2025-2033 indicates continued strong growth, driven by ongoing technological improvements, supportive government policies, and increasing environmental awareness.

Australia Mattress Industry Market Size (In Billion)

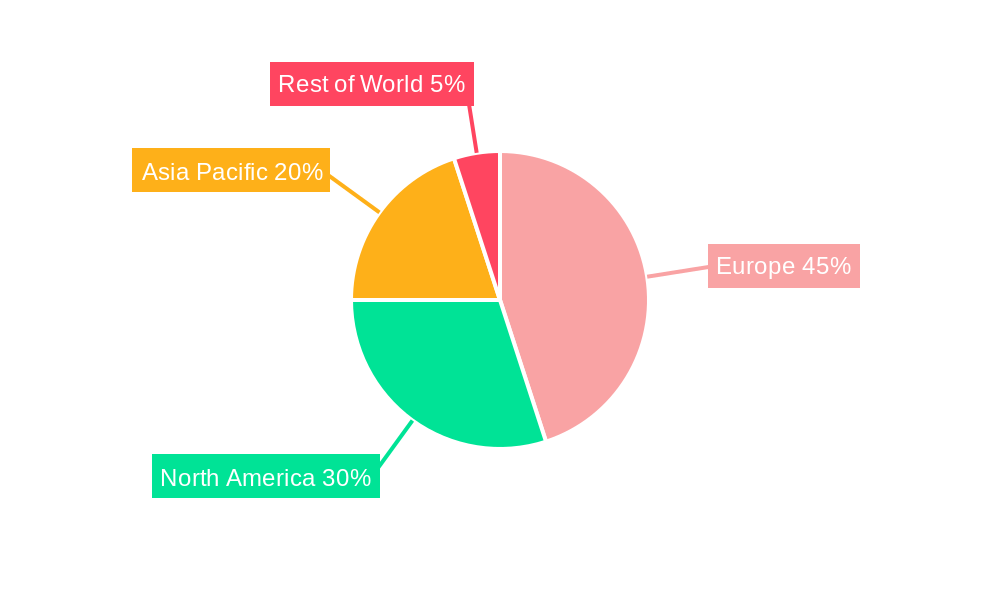

The European market holds a significant share of the global fuel cell market due to strong government policies promoting renewable energy adoption and a well-established automotive industry. Germany, with its advanced automotive sector and investment in renewable energy infrastructure, is a key contributor to this regional market dominance. However, the market’s expansion will depend on overcoming challenges such as the high cost of fuel cell technology, improving hydrogen infrastructure, and addressing technological limitations. The ongoing research and development efforts focused on enhancing fuel cell efficiency, durability, and reducing production costs are expected to drive market expansion across all applications. The increasing demand for clean and efficient energy solutions in sectors such as transportation and power generation will be the key factors driving the market's future growth. The competition among key players is driving innovation and resulting in better cost-effectiveness and performance of fuel cell technologies.

Australia Mattress Industry Company Market Share

Australia Mattress Industry Market Composition & Trends

The Australia Mattress Industry is characterized by a dynamic interplay of market concentration, innovation, and regulatory frameworks. The market is moderately concentrated, with the top five players controlling approximately 45% of the market share. This concentration is driven by the presence of established companies like Ceres Power and AFC Energy, which continue to innovate and expand their product lines.

Innovation catalysts in the industry include significant R&D investments, with companies like Topsoe and Toshiba Corp leading the charge. The regulatory landscape is supportive, with government initiatives aimed at promoting sustainable energy solutions, which directly benefits the fuel cell sector. Substitute products, such as traditional batteries, pose a challenge, but fuel cells are gaining traction due to their efficiency and environmental benefits.

End-user profiles are diverse, ranging from portable applications in consumer electronics to stationary uses in power generation and transportation. M&A activities have been robust, with deal values reaching up to $100 Million in the past year, reflecting the industry's consolidation and growth ambitions.

- Market Share Distribution: Top 5 players hold 45% of the market.

- R&D Investment: Significant investments by Topsoe and Toshiba Corp.

- Regulatory Support: Government initiatives promoting sustainable energy.

- M&A Deal Values: Up to $100 Million in the past year.

Australia Mattress Industry Industry Evolution

The Australia Mattress Industry has undergone significant evolution over the study period from 2019 to 2033, with a base year of 2025. The industry has seen a compound annual growth rate (CAGR) of 8.5% during the forecast period of 2025-2033, driven by technological advancements and shifting consumer demands.

Technological advancements have been pivotal, particularly in the development of fuel cell technologies such as Polymer Electrolyte Membrane Fuel Cells (PEMFC) and Solid Oxide Fuel Cells (SOFC). These technologies have seen adoption rates increase by 12% annually, as they offer higher efficiency and lower emissions compared to traditional energy sources.

Consumer demands have shifted towards more sustainable and efficient energy solutions, which has propelled the growth of the fuel cell market. The transportation segment, for instance, has witnessed a 15% increase in demand for fuel cell systems in electric vehicles, reflecting a broader trend towards eco-friendly transportation options.

The industry's growth trajectory is also influenced by global trends, such as the increasing focus on hydrogen as a clean energy source. This trend is expected to further drive the market, as hydrogen fuel cells become more integrated into various applications.

Leading Regions, Countries, or Segments in Australia Mattress Industry

The Australia Mattress Industry is dominated by the transportation segment, which is poised to lead the market due to its significant growth potential and increasing adoption of fuel cell technology in electric vehicles.

- Key Drivers for Transportation Segment:

- Investment Trends: Increased investments in R&D for fuel cell systems in electric vehicles.

- Regulatory Support: Government incentives and policies promoting clean transportation solutions.

- Consumer Demand: Rising demand for eco-friendly and efficient transportation options.

The transportation segment's dominance can be attributed to several factors. Firstly, the global push towards reducing carbon emissions has led to increased investments in electric vehicles, with fuel cells offering a promising solution. Secondly, regulatory support in Australia and other countries has incentivized the adoption of fuel cell technology in transportation. For example, Australia's government has introduced tax incentives for companies investing in clean energy solutions, which directly benefits the fuel cell market.

Moreover, consumer demand for sustainable transportation options has surged, driven by heightened environmental awareness. The adoption of fuel cells in the transportation sector is expected to grow at a CAGR of 18% over the forecast period, making it the leading segment in the Australia Mattress Industry.

Australia Mattress Industry Product Innovations

The Australian mattress industry is experiencing a surge in innovation, focusing on enhanced comfort, durability, and sustainability. New materials like advanced foams (e.g., graphene-infused foam, memory foam with cooling gels), innovative spring systems (e.g., pocket coil designs with zoned support), and smart-bed technologies (e.g., adjustable bases with sleep-tracking capabilities) are transforming the market. Manufacturers are increasingly emphasizing natural and organic materials, such as latex and wool, catering to growing consumer demand for eco-friendly and hypoallergenic products. Furthermore, there's a significant focus on personalized sleep solutions, with mattresses designed to cater to individual body types and sleep preferences. This includes adjustable firmness levels and customizable support features.

Propelling Factors for Australia Mattress Industry Growth

Several factors are driving growth in the Australian mattress industry. Firstly, the increasing awareness of the importance of sleep health and its impact on overall well-being is boosting demand for higher-quality mattresses. Economically, a rising disposable income and improved living standards are allowing consumers to invest more in premium sleep solutions. Changes in demographics, including an aging population with specific sleep needs, also contribute to market expansion. Finally, effective marketing strategies highlighting the benefits of quality sleep and innovative mattress technologies are influencing purchasing decisions.

Obstacles in the Australia Mattress Industry Market

Despite positive growth trends, the Australian mattress industry faces challenges. Intense competition from both established brands and emerging online retailers puts pressure on pricing and profit margins. Consumer perception and brand trust can be significantly influenced by reviews and online reputation, demanding robust quality control and customer service. Fluctuations in raw material costs and supply chain disruptions, particularly with global sourcing of specialized components, impact production efficiency and pricing. Finally, the prevalence of counterfeit products undermines market integrity and consumer confidence.

Future Opportunities in Australia Mattress Industry

Future opportunities in the Australia Mattress Industry are abundant, driven by new markets and technologies. The integration of fuel cells in emerging markets, such as Asia-Pacific, presents significant growth potential. Technological advancements, like the development of more affordable and efficient fuel cell systems, are poised to expand the market. Additionally, consumer trends towards sustainability and energy efficiency are expected to further drive demand for fuel cell solutions in various applications.

Major Players in the Australia Mattress Industry Ecosystem

- Koala Mattress

- Emma Sleep

- Ecosa

- Sleepmaker

- Rest Assured

- A.H. Beard

Key Developments in Australia Mattress Industry Industry

July 2022: The European Commission approved USD 5.47 billion in public funding for the IPCEI Hy2Tech project, jointly prepared and notified by fifteen Member States. This project supports research, innovation, and the first industrial development in the hydrogen technology value chain. Hydrogen is expected to become one of the leading options for power generation, further driving the fuel cell market.

February 2022: Ballard Power Systems and MAHLE group announced a collaboration to develop a new fuel cell system for long-haul trucks. MAHLE Group, an automotive supplier, was contracted to take the first delivery of a 120kW fuel cell module at Ballard's hydrogen test center in Stuttgart, Germany. The company is expected to reach power outputs up to 360kW, with the multi-year development program anticipated to be completed within one to two years. These developments are poised to enhance the market dynamics by introducing advanced fuel cell solutions for transportation.

Strategic Australia Mattress Industry Market Forecast

The Australian mattress industry is projected to experience continued growth, driven by increasing consumer spending on health and wellness, coupled with ongoing innovation in mattress technology. The market is expected to see a rise in demand for personalized and technologically advanced sleep solutions. Online sales are likely to remain a significant growth channel, while a focus on building strong brand reputations and addressing supply chain vulnerabilities will be crucial for sustained success. The forecast anticipates a steady increase in market share for brands that effectively cater to evolving consumer preferences and deliver exceptional customer experiences.

Australia Mattress Industry Segmentation

-

1. Application

- 1.1. Portable

- 1.2. Stationary

- 1.3. Transportation

-

2. Fuel Cell Technology

- 2.1. Polymer Electrolyte Membrane Fuel Cell (PEMFC)

- 2.2. Solid Oxide Fuel Cell (SOFC)

- 2.3. Other Fuel Cell Technologies

Australia Mattress Industry Segmentation By Geography

- 1. Germany

- 2. France

- 3. Italy

- 4. United Kingdom

- 5. Russia

- 6. NORDIC

- 7. Spain

- 8. Rest of Europe

Australia Mattress Industry Regional Market Share

Geographic Coverage of Australia Mattress Industry

Australia Mattress Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 31.01% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Government Supportive Policies and Incentives4.; Renewable Energy Integration

- 3.3. Market Restrains

- 3.3.1. 4.; High Initial Costs

- 3.4. Market Trends

- 3.4.1. Transportation Sector Expected to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Australia Mattress Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Portable

- 5.1.2. Stationary

- 5.1.3. Transportation

- 5.2. Market Analysis, Insights and Forecast - by Fuel Cell Technology

- 5.2.1. Polymer Electrolyte Membrane Fuel Cell (PEMFC)

- 5.2.2. Solid Oxide Fuel Cell (SOFC)

- 5.2.3. Other Fuel Cell Technologies

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Germany

- 5.3.2. France

- 5.3.3. Italy

- 5.3.4. United Kingdom

- 5.3.5. Russia

- 5.3.6. NORDIC

- 5.3.7. Spain

- 5.3.8. Rest of Europe

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. Germany Australia Mattress Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Portable

- 6.1.2. Stationary

- 6.1.3. Transportation

- 6.2. Market Analysis, Insights and Forecast - by Fuel Cell Technology

- 6.2.1. Polymer Electrolyte Membrane Fuel Cell (PEMFC)

- 6.2.2. Solid Oxide Fuel Cell (SOFC)

- 6.2.3. Other Fuel Cell Technologies

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. France Australia Mattress Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Portable

- 7.1.2. Stationary

- 7.1.3. Transportation

- 7.2. Market Analysis, Insights and Forecast - by Fuel Cell Technology

- 7.2.1. Polymer Electrolyte Membrane Fuel Cell (PEMFC)

- 7.2.2. Solid Oxide Fuel Cell (SOFC)

- 7.2.3. Other Fuel Cell Technologies

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Italy Australia Mattress Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Portable

- 8.1.2. Stationary

- 8.1.3. Transportation

- 8.2. Market Analysis, Insights and Forecast - by Fuel Cell Technology

- 8.2.1. Polymer Electrolyte Membrane Fuel Cell (PEMFC)

- 8.2.2. Solid Oxide Fuel Cell (SOFC)

- 8.2.3. Other Fuel Cell Technologies

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. United Kingdom Australia Mattress Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Portable

- 9.1.2. Stationary

- 9.1.3. Transportation

- 9.2. Market Analysis, Insights and Forecast - by Fuel Cell Technology

- 9.2.1. Polymer Electrolyte Membrane Fuel Cell (PEMFC)

- 9.2.2. Solid Oxide Fuel Cell (SOFC)

- 9.2.3. Other Fuel Cell Technologies

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Russia Australia Mattress Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Portable

- 10.1.2. Stationary

- 10.1.3. Transportation

- 10.2. Market Analysis, Insights and Forecast - by Fuel Cell Technology

- 10.2.1. Polymer Electrolyte Membrane Fuel Cell (PEMFC)

- 10.2.2. Solid Oxide Fuel Cell (SOFC)

- 10.2.3. Other Fuel Cell Technologies

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. NORDIC Australia Mattress Industry Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Application

- 11.1.1. Portable

- 11.1.2. Stationary

- 11.1.3. Transportation

- 11.2. Market Analysis, Insights and Forecast - by Fuel Cell Technology

- 11.2.1. Polymer Electrolyte Membrane Fuel Cell (PEMFC)

- 11.2.2. Solid Oxide Fuel Cell (SOFC)

- 11.2.3. Other Fuel Cell Technologies

- 11.1. Market Analysis, Insights and Forecast - by Application

- 12. Spain Australia Mattress Industry Analysis, Insights and Forecast, 2020-2032

- 12.1. Market Analysis, Insights and Forecast - by Application

- 12.1.1. Portable

- 12.1.2. Stationary

- 12.1.3. Transportation

- 12.2. Market Analysis, Insights and Forecast - by Fuel Cell Technology

- 12.2.1. Polymer Electrolyte Membrane Fuel Cell (PEMFC)

- 12.2.2. Solid Oxide Fuel Cell (SOFC)

- 12.2.3. Other Fuel Cell Technologies

- 12.1. Market Analysis, Insights and Forecast - by Application

- 13. Rest of Europe Australia Mattress Industry Analysis, Insights and Forecast, 2020-2032

- 13.1. Market Analysis, Insights and Forecast - by Application

- 13.1.1. Portable

- 13.1.2. Stationary

- 13.1.3. Transportation

- 13.2. Market Analysis, Insights and Forecast - by Fuel Cell Technology

- 13.2.1. Polymer Electrolyte Membrane Fuel Cell (PEMFC)

- 13.2.2. Solid Oxide Fuel Cell (SOFC)

- 13.2.3. Other Fuel Cell Technologies

- 13.1. Market Analysis, Insights and Forecast - by Application

- 14. Competitive Analysis

- 14.1. Market Share Analysis 2025

- 14.2. Company Profiles

- 14.2.1 Ceres Power

- 14.2.1.1. Overview

- 14.2.1.2. Products

- 14.2.1.3. SWOT Analysis

- 14.2.1.4. Recent Developments

- 14.2.1.5. Financials (Based on Availability)

- 14.2.2 AFC Energy

- 14.2.2.1. Overview

- 14.2.2.2. Products

- 14.2.2.3. SWOT Analysis

- 14.2.2.4. Recent Developments

- 14.2.2.5. Financials (Based on Availability)

- 14.2.3 Topsoe

- 14.2.3.1. Overview

- 14.2.3.2. Products

- 14.2.3.3. SWOT Analysis

- 14.2.3.4. Recent Developments

- 14.2.3.5. Financials (Based on Availability)

- 14.2.4 Toshiba Corp

- 14.2.4.1. Overview

- 14.2.4.2. Products

- 14.2.4.3. SWOT Analysis

- 14.2.4.4. Recent Developments

- 14.2.4.5. Financials (Based on Availability)

- 14.2.5 SFC Energy

- 14.2.5.1. Overview

- 14.2.5.2. Products

- 14.2.5.3. SWOT Analysis

- 14.2.5.4. Recent Developments

- 14.2.5.5. Financials (Based on Availability)

- 14.2.6 Cummins Inc

- 14.2.6.1. Overview

- 14.2.6.2. Products

- 14.2.6.3. SWOT Analysis

- 14.2.6.4. Recent Developments

- 14.2.6.5. Financials (Based on Availability)

- 14.2.7 Ballard Power System Inc

- 14.2.7.1. Overview

- 14.2.7.2. Products

- 14.2.7.3. SWOT Analysis

- 14.2.7.4. Recent Developments

- 14.2.7.5. Financials (Based on Availability)

- 14.2.8 Plug Power Inc

- 14.2.8.1. Overview

- 14.2.8.2. Products

- 14.2.8.3. SWOT Analysis

- 14.2.8.4. Recent Developments

- 14.2.8.5. Financials (Based on Availability)

- 14.2.9 Fuelcell Energy Inc

- 14.2.9.1. Overview

- 14.2.9.2. Products

- 14.2.9.3. SWOT Analysis

- 14.2.9.4. Recent Developments

- 14.2.9.5. Financials (Based on Availability)

- 14.2.10 Nuvera Fuel Cells LLC

- 14.2.10.1. Overview

- 14.2.10.2. Products

- 14.2.10.3. SWOT Analysis

- 14.2.10.4. Recent Developments

- 14.2.10.5. Financials (Based on Availability)

- 14.2.1 Ceres Power

List of Figures

- Figure 1: Australia Mattress Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Australia Mattress Industry Share (%) by Company 2025

List of Tables

- Table 1: Australia Mattress Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 2: Australia Mattress Industry Volume K Unit Forecast, by Application 2020 & 2033

- Table 3: Australia Mattress Industry Revenue Million Forecast, by Fuel Cell Technology 2020 & 2033

- Table 4: Australia Mattress Industry Volume K Unit Forecast, by Fuel Cell Technology 2020 & 2033

- Table 5: Australia Mattress Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Australia Mattress Industry Volume K Unit Forecast, by Region 2020 & 2033

- Table 7: Australia Mattress Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 8: Australia Mattress Industry Volume K Unit Forecast, by Application 2020 & 2033

- Table 9: Australia Mattress Industry Revenue Million Forecast, by Fuel Cell Technology 2020 & 2033

- Table 10: Australia Mattress Industry Volume K Unit Forecast, by Fuel Cell Technology 2020 & 2033

- Table 11: Australia Mattress Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 12: Australia Mattress Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 13: Australia Mattress Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 14: Australia Mattress Industry Volume K Unit Forecast, by Application 2020 & 2033

- Table 15: Australia Mattress Industry Revenue Million Forecast, by Fuel Cell Technology 2020 & 2033

- Table 16: Australia Mattress Industry Volume K Unit Forecast, by Fuel Cell Technology 2020 & 2033

- Table 17: Australia Mattress Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 18: Australia Mattress Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 19: Australia Mattress Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 20: Australia Mattress Industry Volume K Unit Forecast, by Application 2020 & 2033

- Table 21: Australia Mattress Industry Revenue Million Forecast, by Fuel Cell Technology 2020 & 2033

- Table 22: Australia Mattress Industry Volume K Unit Forecast, by Fuel Cell Technology 2020 & 2033

- Table 23: Australia Mattress Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 24: Australia Mattress Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 25: Australia Mattress Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 26: Australia Mattress Industry Volume K Unit Forecast, by Application 2020 & 2033

- Table 27: Australia Mattress Industry Revenue Million Forecast, by Fuel Cell Technology 2020 & 2033

- Table 28: Australia Mattress Industry Volume K Unit Forecast, by Fuel Cell Technology 2020 & 2033

- Table 29: Australia Mattress Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 30: Australia Mattress Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 31: Australia Mattress Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 32: Australia Mattress Industry Volume K Unit Forecast, by Application 2020 & 2033

- Table 33: Australia Mattress Industry Revenue Million Forecast, by Fuel Cell Technology 2020 & 2033

- Table 34: Australia Mattress Industry Volume K Unit Forecast, by Fuel Cell Technology 2020 & 2033

- Table 35: Australia Mattress Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 36: Australia Mattress Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 37: Australia Mattress Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 38: Australia Mattress Industry Volume K Unit Forecast, by Application 2020 & 2033

- Table 39: Australia Mattress Industry Revenue Million Forecast, by Fuel Cell Technology 2020 & 2033

- Table 40: Australia Mattress Industry Volume K Unit Forecast, by Fuel Cell Technology 2020 & 2033

- Table 41: Australia Mattress Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 42: Australia Mattress Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 43: Australia Mattress Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 44: Australia Mattress Industry Volume K Unit Forecast, by Application 2020 & 2033

- Table 45: Australia Mattress Industry Revenue Million Forecast, by Fuel Cell Technology 2020 & 2033

- Table 46: Australia Mattress Industry Volume K Unit Forecast, by Fuel Cell Technology 2020 & 2033

- Table 47: Australia Mattress Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 48: Australia Mattress Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 49: Australia Mattress Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 50: Australia Mattress Industry Volume K Unit Forecast, by Application 2020 & 2033

- Table 51: Australia Mattress Industry Revenue Million Forecast, by Fuel Cell Technology 2020 & 2033

- Table 52: Australia Mattress Industry Volume K Unit Forecast, by Fuel Cell Technology 2020 & 2033

- Table 53: Australia Mattress Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 54: Australia Mattress Industry Volume K Unit Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Australia Mattress Industry?

The projected CAGR is approximately 31.01%.

2. Which companies are prominent players in the Australia Mattress Industry?

Key companies in the market include Ceres Power, AFC Energy, Topsoe, Toshiba Corp, SFC Energy, Cummins Inc , Ballard Power System Inc, Plug Power Inc, Fuelcell Energy Inc, Nuvera Fuel Cells LLC.

3. What are the main segments of the Australia Mattress Industry?

The market segments include Application, Fuel Cell Technology.

4. Can you provide details about the market size?

The market size is estimated to be USD 2.52 Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Government Supportive Policies and Incentives4.; Renewable Energy Integration.

6. What are the notable trends driving market growth?

Transportation Sector Expected to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; High Initial Costs.

8. Can you provide examples of recent developments in the market?

July 2022: the European Commission approved USD 5.47 billion in public funding for the IPCEI Hy2Tech project was jointly prepared and notified by fifteen Member States to support research, innovation, and the first industrial development in the hydrogen technology value chain. Hydrogen was expected to become one of the leading options for power generation, further expected to drive the fuel cell market.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Australia Mattress Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Australia Mattress Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Australia Mattress Industry?

To stay informed about further developments, trends, and reports in the Australia Mattress Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence