Key Insights

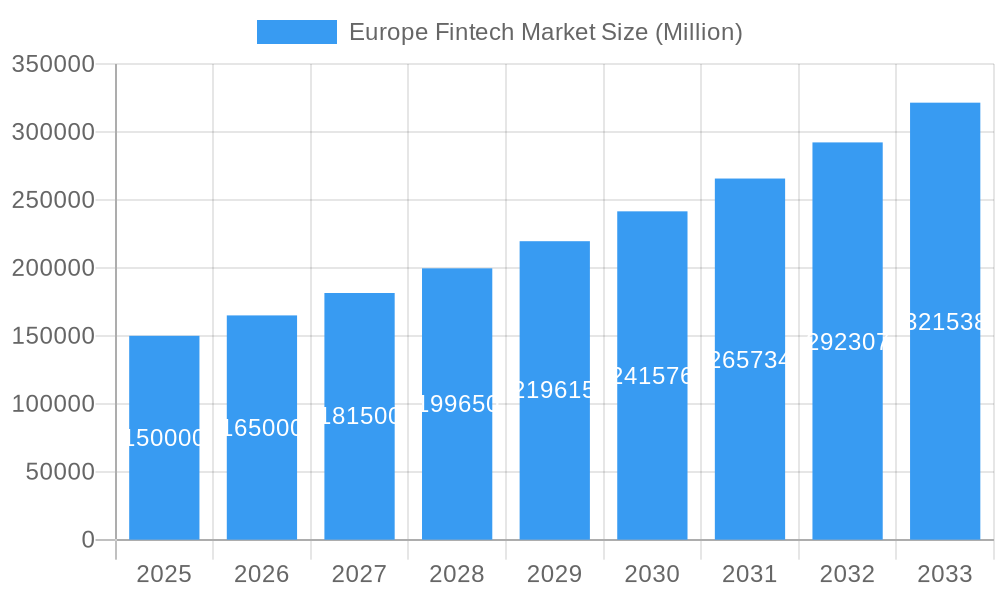

The European Fintech market, projected to reach €98.1 billion by 2025, is poised for substantial expansion with a projected Compound Annual Growth Rate (CAGR) of 24.22% through 2033. This growth is propelled by increasing smartphone penetration and internet access, expanding the digital financial services customer base. Shifting consumer preferences, particularly among younger demographics, favor the convenience and accessibility of Fintech solutions. Supportive regulatory frameworks fostering innovation and competition also contribute to market growth. Key performing segments include Money Transfer & Payments, Digital Lending, and Online Insurance. Leading players and emerging innovators are driving this evolution, yet data privacy regulations, cybersecurity threats, and building consumer trust present challenges. Intense competition necessitates continuous innovation and adaptation.

Europe Fintech Market Market Size (In Billion)

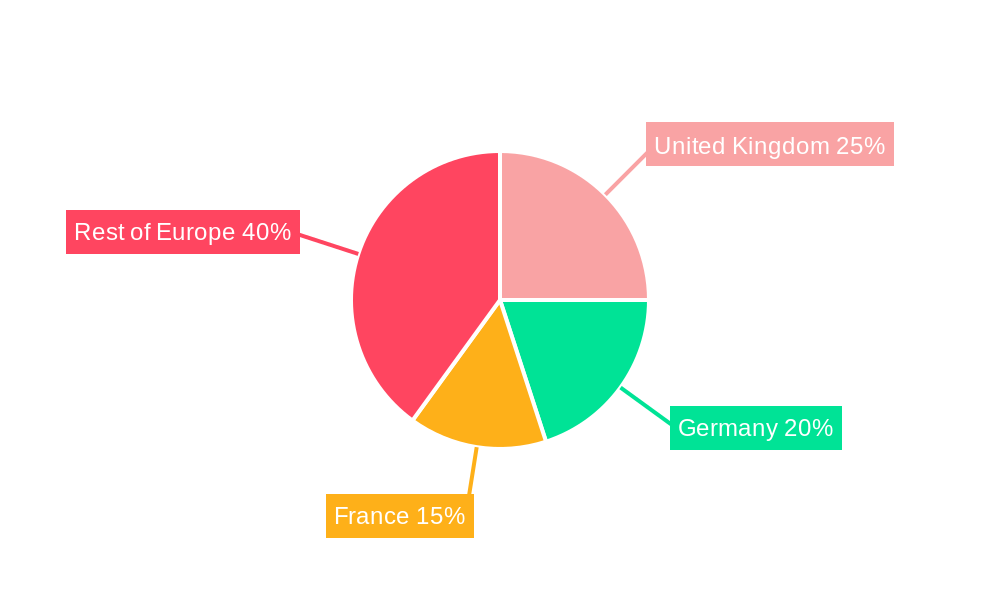

Significant market variations exist across Europe, with the UK, Germany, and France leading due to advanced digital infrastructures and high financial literacy. Emerging economies present substantial growth opportunities as Fintech adoption broadens. Targeted strategies focusing on specific niches and enhancing user experience, security, and financial inclusion will be critical for sustained growth. The integration of AI and machine learning will further accelerate this dynamic market's expansion.

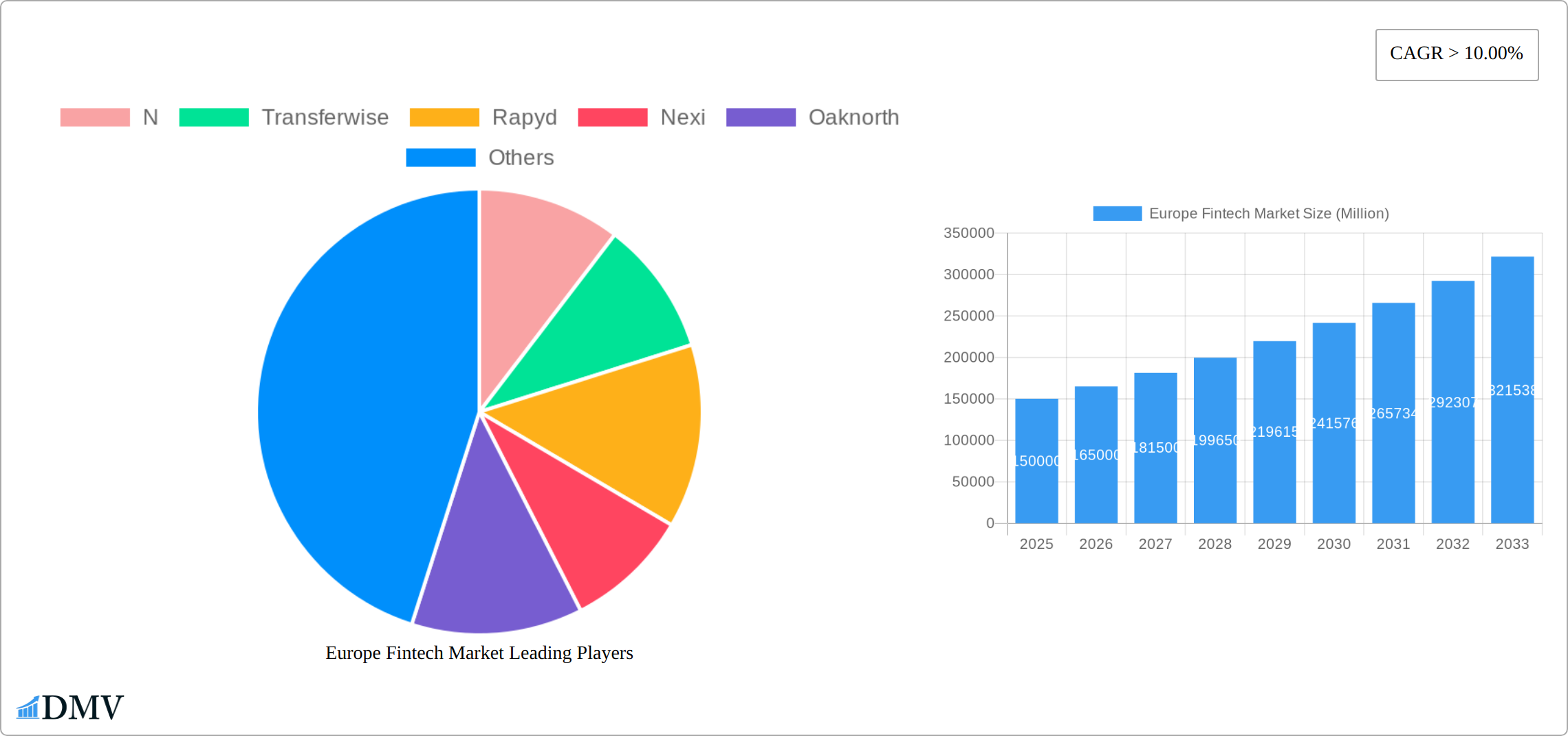

Europe Fintech Market Company Market Share

Europe Fintech Market Market Composition & Trends

The European Fintech market is a dynamic landscape characterized by both high concentration and remarkable diversity. While major players like Adyen, Revolut, and Klarna command substantial market share—with the top five companies controlling approximately 40%—a vibrant ecosystem of smaller, innovative firms also thrives. This competitive tension fuels innovation, significantly accelerated by technological advancements (AI, blockchain) and supportive regulatory environments, particularly in the UK and Germany. These catalysts are reshaping service offerings across key sectors including Money Transfer and Payments, Savings and Investments, and Digital Lending.

- Market Share Distribution: A highly concentrated market, with the top five companies holding approximately 40% of the market share, yet a significant long tail of smaller players.

- Innovation Catalysts: Widespread adoption of AI and Machine Learning for personalization and fraud detection, blockchain for secure transactions, and the establishment of regulatory sandboxes encouraging experimentation.

- Regulatory Landscapes: A complex but generally supportive environment, shaped by regulations like GDPR and MiFID II, demanding careful navigation across different European jurisdictions.

- Competitive Landscape: Intense competition exists not only between fintech firms but also from established traditional banking services, forcing continuous innovation and adaptation.

- End-User Profiles: The market caters to increasingly tech-savvy consumers and SMEs, demanding seamless, personalized, and efficient financial solutions.

- M&A Activities: The surge in mergers and acquisitions, with over 50 deals exceeding €10 million in 2023, reflects aggressive consolidation and a drive towards scale and technological integration.

While the regulatory environment fosters growth, navigating compliance across diverse European markets remains a significant challenge. Competition from traditional banks persists, yet the agility and customer-centric approaches of fintech companies are proving increasingly attractive, especially to SMEs and digitally native consumers. The wave of mergers and acquisitions underscores a strategic shift towards consolidation, leveraging combined resources and technological expertise to enhance offerings and expand market reach.

Europe Fintech Market Industry Evolution

The European Fintech market has experienced robust growth, fueled by technological breakthroughs and evolving consumer expectations. Between 2019 and 2024, the market expanded at a CAGR of 15%, driven primarily by the accelerating adoption of digital payment solutions and a rising demand for personalized financial services. The UK and Germany have spearheaded this evolution, with thriving fintech hubs in London and Berlin attracting significant investment and fostering a vibrant ecosystem of startups and established players.

Technological advancements have been pivotal. AI-driven fraud detection and personalized customer service, alongside blockchain's role in securing transactions, have fundamentally reshaped the industry. This shift away from traditional banking models towards more user-friendly and flexible fintech solutions is clearly evident. For example, the Money Transfer and Payments segment demonstrated impressive annual growth of 20%, reflecting a strong consumer preference for seamless and instant transactions. Similarly, the Digital Lending and Lending Marketplaces segment flourished, with platforms like Funding Circle and Oaknorth leading the way in providing SMEs with readily accessible financing options.

Consumer preferences for transparency, convenience, and personalization are reshaping the market landscape. This is visible in the increasing popularity of robo-advisors for Savings and Investments and the proliferation of online insurance marketplaces offering wider choices and competitive pricing. The market's positive trajectory is expected to continue, with forecasts projecting a CAGR of 18% from 2025 to 2033, driven by ongoing technological innovation and continued regulatory support for fintech initiatives.

Leading Regions, Countries, or Segments in Europe Fintech Market

The United Kingdom stands as the leading force in the European Fintech market, benefiting from a robust regulatory framework, a high density of fintech startups, and significant investment inflows. London, a global fintech hub, is home to companies like Revolut and Monzo, which have revolutionized personal banking.

- Key Drivers in the UK:

- Investment Trends: Over £200 Million invested in fintech startups in 2023 (Note: Currency updated for clarity).

- Regulatory Support: The FCA's regulatory sandbox fosters innovation and reduces risk for early-stage ventures.

- Consumer Demand: High adoption rates of digital banking solutions and a digitally-savvy population.

The UK's dominance stems from a confluence of factors: early adoption of fintech, a supportive regulatory landscape, and a talent pool specializing in financial technology. The Money Transfer and Payments segment is particularly strong, with companies like Wise (formerly TransferWise) leading the charge in providing cost-effective and efficient cross-border payment solutions.

Germany follows closely, with Berlin establishing itself as a prominent fintech hub. The nation's emphasis on savings and investments, coupled with its robust digital lending sector, positions it as a leader in these specific segments. The 2021 merger of Raisin and Deposit Solutions exemplifies Germany's commitment to innovation in the savings and investment space.

- Key Drivers in Germany:

- Investment Trends: Over €150 Million invested in fintech startups in 2023 (Note: Currency updated for clarity).

- Regulatory Support: BaFin's proactive approach to fintech regulation facilitates growth.

- Consumer Demand: Strong preference for digital lending and investment platforms among German consumers.

While not as dominant as the UK or Germany, France exhibits promising growth, particularly in the Online Insurance and Insurance Marketplaces segment, with innovative companies offering new solutions. The "Rest of Europe" also makes a substantial contribution, with countries like the Netherlands and Sweden nurturing diverse fintech ecosystems focusing on various service propositions.

Europe Fintech Market Product Innovations

Innovation is reshaping the European Fintech landscape, with companies leveraging AI and machine learning to enhance both customer experience and operational efficiency. Adyen's development of embedded financial products, for instance, allows platforms to seamlessly integrate tailored financial solutions, creating new revenue streams and fostering greater user loyalty. The integration of blockchain technology ensures secure and transparent transactions, particularly within the Digital Lending and Money Transfer segments. These innovations not only improve service delivery but also solidify the position of fintech firms at the forefront of technological advancement and customer-centricity.

Propelling Factors for Europe Fintech Market Growth

The Europe Fintech Market's growth is driven by several key factors:

- Technological Advancements: The integration of AI and blockchain technologies enhances service offerings and operational efficiency.

- Economic Factors: Increasing consumer demand for digital financial services and the rise of SMEs seeking flexible financing solutions.

- Regulatory Support: Initiatives like the UK's FCA regulatory sandbox and Germany's BaFin's progressive stance foster innovation and market entry.

These factors, coupled with a shift towards digitalization and personalized financial services, are propelling the market forward, with companies like Revolut and Klarna capitalizing on these trends.

Obstacles in the Europe Fintech Market Market

Despite its considerable growth, the European Fintech market faces significant challenges:

- Regulatory Fragmentation: Navigating the diverse regulatory frameworks across Europe presents a substantial hurdle, with compliance costs estimated at €5 million annually for large fintech firms (Note: Currency updated for clarity).

- Technological Dependence: Reliance on complex technology infrastructures makes the sector vulnerable to supply chain disruptions, potentially impacting customer trust and service availability.

- Intense Competition: The fierce competition from established banks and fellow fintechs can lead to price wars, potentially reducing profitability by as much as 10%.

Addressing these obstacles requires strategic planning, continuous innovation, and proactive adaptation to maintain sustainable market growth and profitability.

Future Opportunities in Europe Fintech Market

The Europe Fintech Market is poised for exciting opportunities:

- New Markets: Expansion into Eastern Europe, where fintech adoption is growing rapidly.

- Technologies: Continued advancements in AI and blockchain will drive new product development and service enhancements.

- Consumer Trends: Increasing demand for sustainable and ethical financial products offers new avenues for growth.

These opportunities, if leveraged effectively, can significantly expand the market's reach and impact.

Major Players in the Europe Fintech Market Ecosystem

Key Developments in Europe Fintech Market Industry

- March 2022: Adyen planned to expand beyond payments to build embedded financial products, enabling platforms to create tailored financial experiences. This move is expected to increase user loyalty and unlock new revenue streams, significantly impacting market dynamics.

- June 2021: Raisin and Deposit Solutions announced a merger to form a pan-European group offering innovative B2B and B2C products in savings and portfolio management. This strategic consolidation aims to combine best practices and enhance market presence, influencing the savings and investment landscape.

Strategic Europe Fintech Market Market Forecast

The future of the Europe Fintech Market looks promising, with growth catalysts including technological innovation, regulatory support, and evolving consumer demands. The market is expected to grow at a CAGR of 18% from 2025 to 2033, driven by the increasing adoption of digital financial services and the expansion into new markets. Opportunities in sustainable finance and the integration of advanced technologies will further propel the market, positioning Europe as a leader in the global fintech landscape.

Europe Fintech Market Segmentation

-

1. Service Proposition

- 1.1. Money Transfer and Payments

- 1.2. Savings and Investments

- 1.3. Digital Lending and Lending Marketplaces

- 1.4. Online Insurance and Insurance Marketplaces

- 1.5. Other Service Propositions

Europe Fintech Market Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

Europe Fintech Market Regional Market Share

Geographic Coverage of Europe Fintech Market

Europe Fintech Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 24.22% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Adoption of Innovative Tracking Technologies

- 3.3. Market Restrains

- 3.3.1. Rising Competition of Banks with Fintech and Financial Services

- 3.4. Market Trends

- 3.4.1. Favourable Regulatory Landscape is Driving the European Fintech Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Fintech Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Service Proposition

- 5.1.1. Money Transfer and Payments

- 5.1.2. Savings and Investments

- 5.1.3. Digital Lending and Lending Marketplaces

- 5.1.4. Online Insurance and Insurance Marketplaces

- 5.1.5. Other Service Propositions

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Service Proposition

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 N

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Transferwise

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Rapyd

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Nexi

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Oaknorth

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Funding Circle**List Not Exhaustive

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Revolut

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Klarna

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Adyen

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Monzo

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 N

List of Figures

- Figure 1: Europe Fintech Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Europe Fintech Market Share (%) by Company 2025

List of Tables

- Table 1: Europe Fintech Market Revenue billion Forecast, by Service Proposition 2020 & 2033

- Table 2: Europe Fintech Market Revenue billion Forecast, by Region 2020 & 2033

- Table 3: Europe Fintech Market Revenue billion Forecast, by Service Proposition 2020 & 2033

- Table 4: Europe Fintech Market Revenue billion Forecast, by Country 2020 & 2033

- Table 5: United Kingdom Europe Fintech Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 6: Germany Europe Fintech Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 7: France Europe Fintech Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: Italy Europe Fintech Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 9: Spain Europe Fintech Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Netherlands Europe Fintech Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: Belgium Europe Fintech Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: Sweden Europe Fintech Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 13: Norway Europe Fintech Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: Poland Europe Fintech Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: Denmark Europe Fintech Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Fintech Market?

The projected CAGR is approximately 24.22%.

2. Which companies are prominent players in the Europe Fintech Market?

Key companies in the market include N, Transferwise, Rapyd, Nexi, Oaknorth, Funding Circle**List Not Exhaustive, Revolut, Klarna, Adyen, Monzo.

3. What are the main segments of the Europe Fintech Market?

The market segments include Service Proposition.

4. Can you provide details about the market size?

The market size is estimated to be USD 98.1 billion as of 2022.

5. What are some drivers contributing to market growth?

Increasing Adoption of Innovative Tracking Technologies.

6. What are the notable trends driving market growth?

Favourable Regulatory Landscape is Driving the European Fintech Market.

7. Are there any restraints impacting market growth?

Rising Competition of Banks with Fintech and Financial Services.

8. Can you provide examples of recent developments in the market?

Mar 2022: Adyen, a global financial technology platform of choice for leading businesses, planned to expand beyond payments to build embedded financial products. These products will enable platforms and marketplaces to create tailored financial experiences for their users, such as small business owners or individual sellers. The suite of products will allow platforms to unlock new revenue streams and increase user loyalty.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Fintech Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Fintech Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Fintech Market?

To stay informed about further developments, trends, and reports in the Europe Fintech Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence