Key Insights

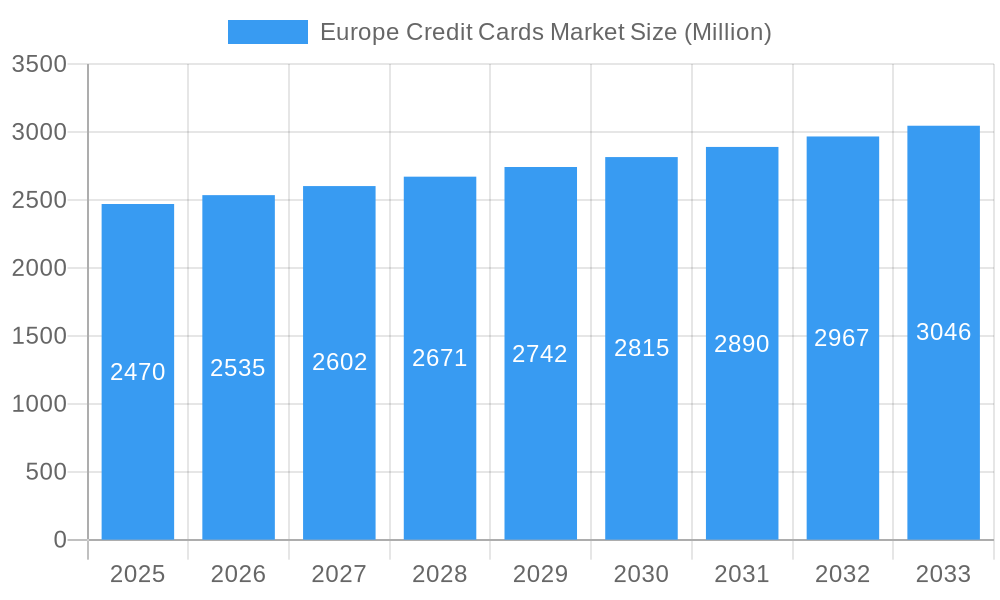

The European credit card market, valued at €2.47 billion in 2025, is projected to experience steady growth, exhibiting a compound annual growth rate (CAGR) of 2.83% from 2025 to 2033. This growth is fueled by several key factors. Increasing digitalization and the rising adoption of e-commerce are driving the demand for convenient and secure online payment solutions, significantly boosting credit card usage. Furthermore, the expansion of financial inclusion initiatives, particularly in underserved regions, is contributing to wider credit card penetration. Favorable regulatory environments in several European countries, coupled with innovative product offerings from major players like Capital One, Citi Bank, Chase, Bank of America, and others, are further stimulating market expansion. However, challenges remain. Concerns surrounding data security and fraud, coupled with the increasing popularity of alternative payment methods such as mobile wallets and Buy Now, Pay Later (BNPL) services, pose potential restraints to the market's growth trajectory.

Europe Credit Cards Market Market Size (In Billion)

The competitive landscape is characterized by a mix of established multinational banks and specialized credit card providers. Established players leverage their extensive branch networks and customer base to maintain market share, while smaller, specialized firms often focus on niche segments or innovative offerings to differentiate themselves. The market is geographically diverse, with significant variations in credit card adoption and usage patterns across different European nations. Future growth will likely be influenced by the evolving regulatory landscape, technological advancements, and consumer preference shifts towards contactless payments and digital financial solutions. A deeper understanding of these factors will be critical for market participants to strategically position themselves for success in the dynamic European credit card market.

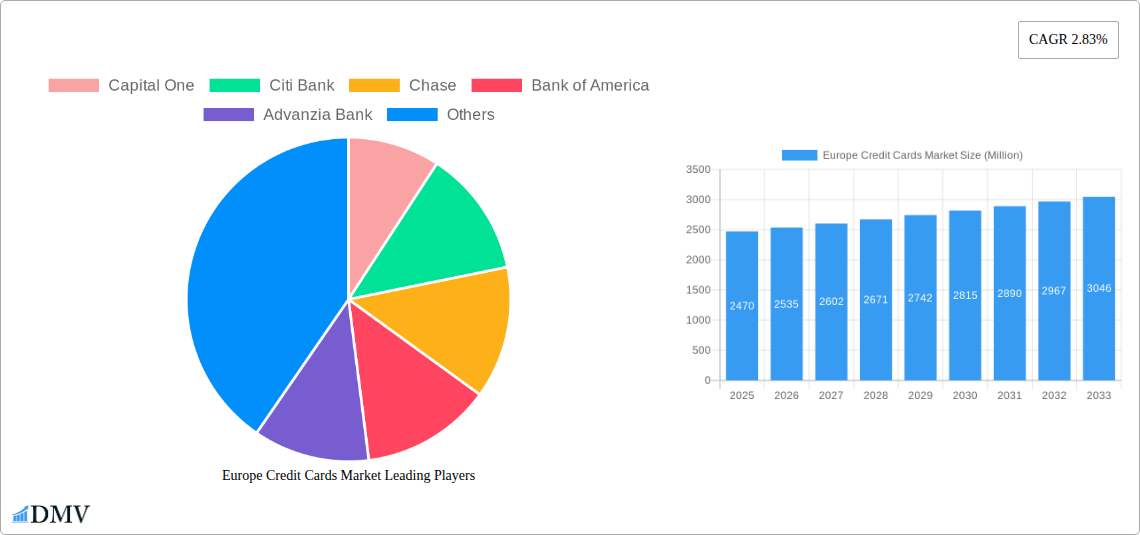

Europe Credit Cards Market Company Market Share

Europe Credit Cards Market: A Comprehensive Report (2019-2033)

This insightful report provides a detailed analysis of the Europe Credit Cards Market, encompassing market size, trends, competitive landscape, and future forecasts. The study period covers 2019-2033, with 2025 as the base and estimated year. The forecast period spans 2025-2033, and the historical period encompasses 2019-2024. This report is invaluable for stakeholders seeking to understand the dynamics of this evolving market and make informed strategic decisions. The total market value in 2025 is estimated at xx Million.

Europe Credit Cards Market Market Composition & Trends

This section delves into the intricate composition of the European credit card market, evaluating market concentration, innovative drivers, regulatory frameworks, substitute products, end-user profiles, and merger & acquisition (M&A) activities. The market exhibits a moderately consolidated structure, with a few major players holding significant market share. However, the emergence of fintech companies and niche players is gradually increasing competition.

- Market Share Distribution (2025): Capital One: xx%; Citi Bank: xx%; Chase: xx%; Bank of America: xx%; Others: xx% (These figures are estimates)

- Innovation Catalysts: Technological advancements such as contactless payments, mobile wallets, and embedded finance are reshaping the market. The increasing adoption of open banking APIs is also fostering innovation.

- Regulatory Landscape: PSD2 and other regulations are driving increased security and data privacy, influencing market practices and innovation.

- Substitute Products: Debit cards, mobile payment systems, and buy-now-pay-later (BNPL) services present competitive challenges.

- End-User Profiles: The market caters to a diverse range of individuals and businesses, with varying needs and preferences influencing product development.

- M&A Activities (2019-2024): A total of xx M&A deals were recorded, with a cumulative value of approximately xx Million. Key deals included [insert details of significant M&A transactions if available, otherwise state "Details unavailable"].

Europe Credit Cards Market Industry Evolution

This section examines the evolutionary trajectory of the European credit card market, focusing on growth trajectories, technological progress, and evolving consumer preferences. The market has witnessed significant growth over the past few years, driven by factors such as increasing digitalization, expanding e-commerce, and the growing adoption of credit cards among younger demographics. The annual growth rate (CAGR) from 2019 to 2024 is estimated to be xx%, and is projected to reach xx% during the forecast period (2025-2033). Technological advancements, including contactless payments and enhanced security features, have significantly impacted user adoption and market expansion. Shifting consumer demands towards greater convenience, personalization, and reward programs are also driving industry transformation. The increasing penetration of smartphones and the widespread adoption of mobile payment solutions are key factors in shaping the future of the European credit card market. Specific data points, including transaction volumes and market penetration rates, are discussed in detail within the full report.

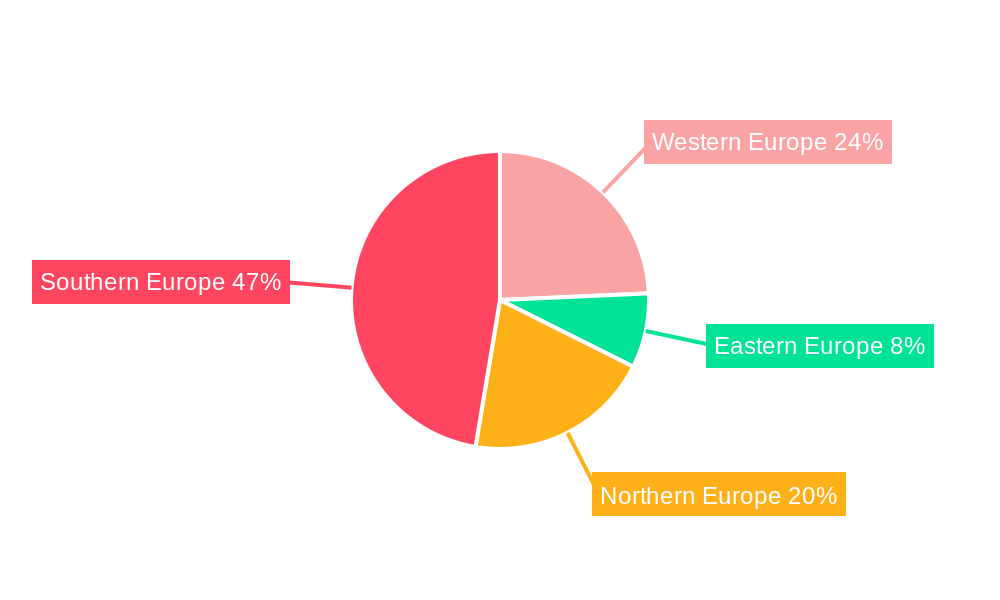

Leading Regions, Countries, or Segments in Europe Credit Cards Market

The United Kingdom and Germany currently hold the largest market shares within the European credit card market. These countries boast robust financial infrastructures, high credit card penetration rates, and a strong consumer base with a propensity to use credit for various purchases.

- Key Drivers for UK Dominance:

- High credit card penetration.

- Strong e-commerce sector.

- Well-developed financial infrastructure.

- Favorable regulatory environment.

- Key Drivers for German Dominance:

- Large and affluent consumer base.

- Robust financial institutions.

- Growing adoption of digital payments.

- Government initiatives promoting financial inclusion.

Further detailed analysis of other European countries' market shares and contributing factors is provided in the full report.

Europe Credit Cards Market Product Innovations

Recent innovations in the European credit card market include the integration of enhanced security features like biometric authentication, contactless payments, and virtual cards. These innovations improve user experience, transaction speed, and security. Furthermore, the rise of co-branded credit cards, tailored to specific customer preferences (such as the recent ASOS and Capital One partnership), offers unique selling propositions and increased customer loyalty. The integration of rewards programs and personalized offers also enhances the appeal of credit cards.

Propelling Factors for Europe Credit Cards Market Growth

Several key factors are driving the growth of the European credit cards market. Firstly, the expanding e-commerce sector fuels demand for convenient online payment options. Secondly, the increasing adoption of mobile payment technologies and digital wallets simplifies transactions and widens access to credit. Thirdly, favorable government policies and regulations encourage financial inclusion and the use of credit cards. Finally, the rise of innovative financial technology (fintech) companies further promotes competition and offers customized solutions to meet diverse consumer needs.

Obstacles in the Europe Credit Cards Market Market

Despite significant growth potential, the European credit cards market faces certain challenges. Stricter regulations on data privacy and security introduce operational costs and complexities. Fluctuating economic conditions and potential recessions can dampen consumer spending and credit card usage. Intense competition from alternative payment methods, such as mobile wallets and buy-now-pay-later schemes, also limits market expansion for traditional credit card providers.

Future Opportunities in Europe Credit Cards Market

The future of the European credit cards market holds substantial opportunities. The untapped potential in emerging markets within Europe presents significant growth prospects. The integration of advanced technologies such as artificial intelligence (AI) and machine learning (ML) offers opportunities for personalized credit scoring and fraud detection. Furthermore, the growing acceptance of sustainable and ethical banking practices provides avenues for innovative and responsible credit card offerings.

Major Players in the Europe Credit Cards Market Ecosystem

- Capital One

- Citi Bank

- Chase

- Bank of America

- Advanzia Bank

- AirPlus International

- Card Complete Group

- Cornèr Bank

- International Card Services BV

- RegioBank

- List Not Exhaustive

Key Developments in Europe Credit Cards Market Industry

- February 2023: ASOS and Capital One UK announced a new exclusive credit card partnership, expected to launch later in the year. This partnership will likely drive growth in the UK market and potentially influence the strategies of other companies.

- November 2022: CTS EVENTIM launched its branded credit card issued by Advanzia Bank, incorporating a loyalty program. This strategic partnership showcases the growing adoption of co-branded cards and highlights the benefits of integrating loyalty programs for enhanced customer engagement.

Strategic Europe Credit Cards Market Market Forecast

The European credit cards market is poised for continued expansion, driven by the sustained growth of e-commerce, increasing digitalization, and innovative product offerings. Emerging technologies and evolving consumer preferences will further shape the market dynamics. The forecast period presents significant opportunities for both established players and new entrants, particularly those focusing on digital solutions and personalized customer experiences. Strategic partnerships and collaborations will likely play a crucial role in shaping the future competitive landscape.

Europe Credit Cards Market Segmentation

-

1. Card Type

- 1.1. General Purpose Credit Cards

- 1.2. Specialty & Other Credit Cards

-

2. Application

- 2.1. Food & Groceries

- 2.2. Health & Pharmacy

- 2.3. Restaurants & Bars

- 2.4. Consumer Electronics

- 2.5. Media & Entertainment

- 2.6. Travel & Tourism

- 2.7. Other Applications

-

3. Provider

- 3.1. Visa

- 3.2. MasterCard

- 3.3. Other Providers

Europe Credit Cards Market Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

Europe Credit Cards Market Regional Market Share

Geographic Coverage of Europe Credit Cards Market

Europe Credit Cards Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 2.83% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Usage of Credit Card give the bonus and reward points

- 3.3. Market Restrains

- 3.3.1. Usage of Credit Card give the bonus and reward points

- 3.4. Market Trends

- 3.4.1. Increasing Card Transactions in Europe have a Major Impact on Credit Card

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Credit Cards Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Card Type

- 5.1.1. General Purpose Credit Cards

- 5.1.2. Specialty & Other Credit Cards

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Food & Groceries

- 5.2.2. Health & Pharmacy

- 5.2.3. Restaurants & Bars

- 5.2.4. Consumer Electronics

- 5.2.5. Media & Entertainment

- 5.2.6. Travel & Tourism

- 5.2.7. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by Provider

- 5.3.1. Visa

- 5.3.2. MasterCard

- 5.3.3. Other Providers

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Card Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Capital One

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Citi Bank

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Chase

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Bank of America

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Advanzia Bank

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 AirPlus International

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Card complete Group

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Cornèr Bank

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 International Card Services BV

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 RegioBank**List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Capital One

List of Figures

- Figure 1: Europe Credit Cards Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Europe Credit Cards Market Share (%) by Company 2025

List of Tables

- Table 1: Europe Credit Cards Market Revenue Million Forecast, by Card Type 2020 & 2033

- Table 2: Europe Credit Cards Market Volume Trillion Forecast, by Card Type 2020 & 2033

- Table 3: Europe Credit Cards Market Revenue Million Forecast, by Application 2020 & 2033

- Table 4: Europe Credit Cards Market Volume Trillion Forecast, by Application 2020 & 2033

- Table 5: Europe Credit Cards Market Revenue Million Forecast, by Provider 2020 & 2033

- Table 6: Europe Credit Cards Market Volume Trillion Forecast, by Provider 2020 & 2033

- Table 7: Europe Credit Cards Market Revenue Million Forecast, by Region 2020 & 2033

- Table 8: Europe Credit Cards Market Volume Trillion Forecast, by Region 2020 & 2033

- Table 9: Europe Credit Cards Market Revenue Million Forecast, by Card Type 2020 & 2033

- Table 10: Europe Credit Cards Market Volume Trillion Forecast, by Card Type 2020 & 2033

- Table 11: Europe Credit Cards Market Revenue Million Forecast, by Application 2020 & 2033

- Table 12: Europe Credit Cards Market Volume Trillion Forecast, by Application 2020 & 2033

- Table 13: Europe Credit Cards Market Revenue Million Forecast, by Provider 2020 & 2033

- Table 14: Europe Credit Cards Market Volume Trillion Forecast, by Provider 2020 & 2033

- Table 15: Europe Credit Cards Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Europe Credit Cards Market Volume Trillion Forecast, by Country 2020 & 2033

- Table 17: United Kingdom Europe Credit Cards Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: United Kingdom Europe Credit Cards Market Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 19: Germany Europe Credit Cards Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Germany Europe Credit Cards Market Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 21: France Europe Credit Cards Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: France Europe Credit Cards Market Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 23: Italy Europe Credit Cards Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Italy Europe Credit Cards Market Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 25: Spain Europe Credit Cards Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Spain Europe Credit Cards Market Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 27: Netherlands Europe Credit Cards Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Netherlands Europe Credit Cards Market Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 29: Belgium Europe Credit Cards Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Belgium Europe Credit Cards Market Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 31: Sweden Europe Credit Cards Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Sweden Europe Credit Cards Market Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 33: Norway Europe Credit Cards Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: Norway Europe Credit Cards Market Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 35: Poland Europe Credit Cards Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: Poland Europe Credit Cards Market Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 37: Denmark Europe Credit Cards Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 38: Denmark Europe Credit Cards Market Volume (Trillion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Credit Cards Market?

The projected CAGR is approximately 2.83%.

2. Which companies are prominent players in the Europe Credit Cards Market?

Key companies in the market include Capital One, Citi Bank, Chase, Bank of America, Advanzia Bank, AirPlus International, Card complete Group, Cornèr Bank, International Card Services BV, RegioBank**List Not Exhaustive.

3. What are the main segments of the Europe Credit Cards Market?

The market segments include Card Type, Application, Provider.

4. Can you provide details about the market size?

The market size is estimated to be USD 2.47 Million as of 2022.

5. What are some drivers contributing to market growth?

Usage of Credit Card give the bonus and reward points.

6. What are the notable trends driving market growth?

Increasing Card Transactions in Europe have a Major Impact on Credit Card.

7. Are there any restraints impacting market growth?

Usage of Credit Card give the bonus and reward points.

8. Can you provide examples of recent developments in the market?

February 2023: ASOS, the global online fashion destination, and Capital One UK announced a new and exclusive credit card partnership. The partnership will likely launch a new ASOS credit card for eligible shoppers, available later this year. It is projected to provide a range of features and benefits that only come with using a credit card when they shop at ASOS and elsewhere, such as Section 75 protection on purchases over EUR 100.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Trillion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Credit Cards Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Credit Cards Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Credit Cards Market?

To stay informed about further developments, trends, and reports in the Europe Credit Cards Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence