Key Insights

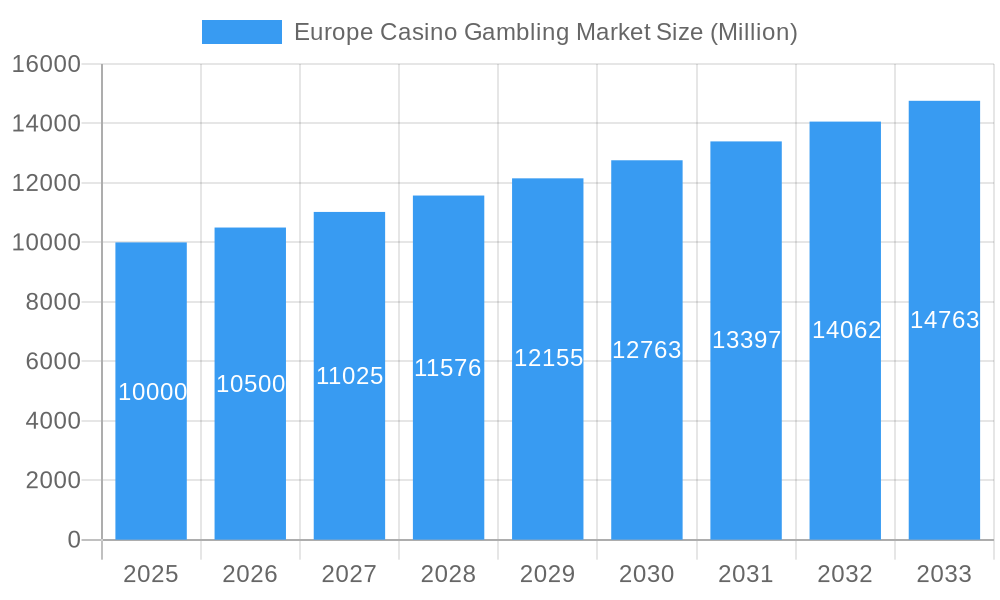

The European casino gambling market is projected for significant expansion, forecasting a Compound Annual Growth Rate (CAGR) of 14.18% from 2025 to 2033. The market size is estimated at $80.13 billion in the base year of 2025. Key growth drivers include the escalating adoption of online casino platforms, propelled by mobile technology advancements and widespread high-speed internet access. Evolving regulatory frameworks across European nations, while demanding, are fostering opportunities for compliant operators. The growing appeal of immersive live casino experiences, coupled with innovative game development and varied betting options, further fuels this upward trend. Strategic marketing initiatives and responsible gambling programs are also contributing to player acquisition and industry sustainability.

Europe Casino Gambling Market Market Size (In Billion)

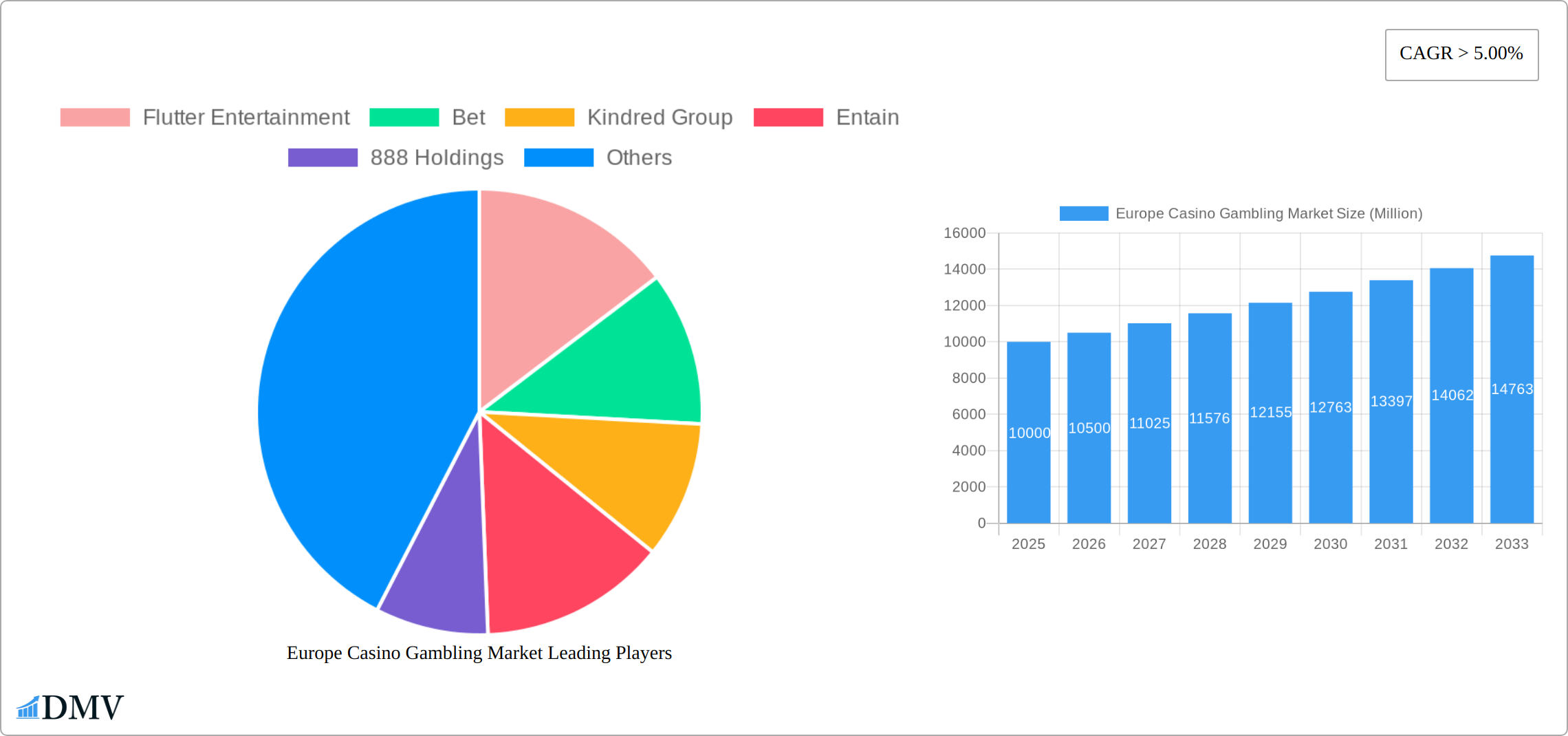

Despite positive outlooks, the market navigates challenges including stringent regulations designed to mitigate problem gambling and safeguard vulnerable populations. Intense competition among existing operators and new market entrants necessitates ongoing innovation and strategic adaptation. Geopolitical and economic volatilities within certain European regions may also affect consumer discretionary spending, impacting overall market performance. Nevertheless, the European casino gambling sector presents a compelling investment landscape with substantial growth potential. Continuous technological evolution and responsible business strategies are paramount for achieving sustained success in this dynamic industry. Leading entities such as Flutter Entertainment, Bet365, Kindred Group, and Entain are strategically positioned to leverage these market dynamics.

Europe Casino Gambling Market Company Market Share

Europe Casino Gambling Market: A Comprehensive Report (2019-2033)

This insightful report provides a detailed analysis of the Europe Casino Gambling Market, offering a comprehensive overview of its current state, future trajectory, and key players. The study period spans 2019-2033, with 2025 serving as the base and estimated year, and a forecast period of 2025-2033. The report leverages extensive market research and data analysis to provide valuable insights for stakeholders seeking to understand this dynamic and rapidly evolving market. The market is expected to reach xx Million by 2033.

Europe Casino Gambling Market Composition & Trends

This section delves into the intricate landscape of the European casino gambling market, analyzing market concentration, innovation drivers, regulatory frameworks, substitute products, end-user profiles, and the significant impact of mergers and acquisitions (M&A) activities. The market exhibits a moderately concentrated structure with key players commanding significant market share. The distribution is as follows: Flutter Entertainment (xx%), Bet (xx%), Kindred Group (xx%), Entain (xx%), and 888 Holdings (xx%). Smaller operators and niche players together account for the remaining market share.

- Market Concentration: Moderately concentrated, with top 5 players holding xx% of the market share.

- Innovation Catalysts: Technological advancements (e.g., mobile gaming, VR/AR integration, AI-powered personalization) are driving significant innovation.

- Regulatory Landscape: Differing regulations across European countries significantly impact market growth and operations; a detailed overview by country is provided.

- Substitute Products: The emergence of alternative forms of entertainment poses a degree of substitution but the overall appeal of casino games remains substantial.

- End-User Profiles: The report profiles various end-user segments, including demographics, preferences, and spending patterns, with detailed segmentation by age, income level, and location.

- M&A Activities: The market has witnessed notable M&A activity, with deals valued at xx Million in the past five years. Key examples include Flutter Entertainment's acquisition of a 51% stake in MaxBet for €141 Million in September 2023. This strategic move highlights the increasing consolidation within the sector.

Europe Casino Gambling Market Industry Evolution

This section provides a comprehensive analysis of the Europe Casino Gambling Market's evolution. It charts the market's growth trajectory, examining technological advancements that are reshaping the industry, and detailing shifting consumer demands. The market experienced a Compound Annual Growth Rate (CAGR) of xx% during the historical period (2019-2024). This growth is primarily driven by increased internet and mobile penetration across Europe, coupled with the rising popularity of online casino games and sports betting.

The integration of innovative technologies such as mobile gaming, virtual reality (VR), augmented reality (AR), and artificial intelligence (AI) has greatly enhanced the user experience and further propelled market expansion. Changing consumer preferences are leaning towards immersive and personalized gaming experiences, fueling demand for advanced gaming platforms and personalized offers. The market is projected to maintain a strong growth trajectory, with a projected CAGR of xx% during the forecast period (2025-2033), driven by increased adoption of mobile gaming and consistent technological innovation.

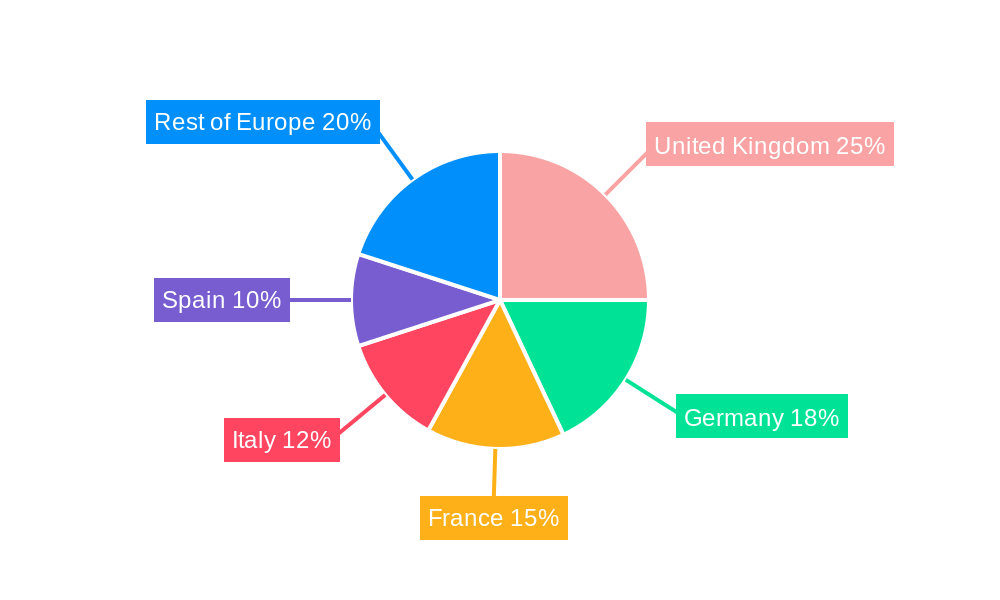

Leading Regions, Countries, or Segments in Europe Casino Gambling Market

The European casino gambling market is a dynamic and diverse landscape, with several key regions and countries leading the charge. The United Kingdom consistently stands out as a dominant force. This is largely attributed to its mature and well-regulated environment, which fosters trust and encourages player participation. High levels of internet and mobile penetration are crucial enablers, coupled with a significant and actively engaged player base drawn to both online casino offerings and sports betting. Operators in the UK have also made substantial investments in cutting-edge infrastructure and technology, further solidifying its leading position.

- Key Drivers for UK Dominance:

- Ubiquitous internet and high mobile adoption rates.

- A robust and evolving regulatory framework emphasizing responsible gambling practices.

- Deep-seated consumer interest in a wide spectrum of online casino games and sports wagering.

- Substantial capital investment by operators in advanced infrastructure and technological innovation.

- Other Significant Markets: Beyond the UK, countries like Germany, France, and Italy represent substantial and growing markets. While their growth trajectories may vary, these nations are characterized by distinct regulatory environments, unique consumer preferences, and developing market potentials that present attractive opportunities for industry players. Emerging markets within Eastern Europe are also showing promising signs of expansion as regulatory frameworks mature.

Europe Casino Gambling Market Product Innovations

The Europe casino gambling market is characterized by continuous product innovation. Operators are constantly introducing new game formats, features, and technologies to enhance user experience and engagement. Notable innovations include the rise of live dealer games, mobile-first game design, and the integration of virtual and augmented reality technologies. These advancements cater to the evolving preferences of players, who increasingly demand interactive and immersive gaming experiences. The use of AI and machine learning is also driving personalization efforts, resulting in more tailored gaming experiences.

Propelling Factors for Europe Casino Gambling Market Growth

Several key factors are driving the expansion of the European casino gambling market. Firstly, the ever-increasing popularity of online and mobile gaming provides unparalleled convenience and accessibility for players. Secondly, technological advancements, such as the development of immersive VR/AR technologies and AI-powered personalized experiences, are greatly enhancing user engagement. Finally, relaxed regulatory frameworks in certain European countries are creating favorable conditions for market expansion.

Obstacles in the Europe Casino Gambling Market

Despite its considerable growth trajectory, the European casino gambling market navigates a complex terrain of challenges. The increasing stringency of regulations concerning responsible gambling and advertising, alongside the fragmented nature of regulatory frameworks across various European nations, presents significant operational hurdles for market participants. Competition from an ever-expanding array of alternative entertainment options also demands constant innovation and strategic positioning. Furthermore, the imperative to implement and maintain sophisticated cybersecurity measures to safeguard sensitive player data adds a layer of complexity and considerable expense to operational overhead.

Future Opportunities in Europe Casino Gambling Market

The outlook for the European casino gambling market is exceptionally promising, brimming with untapped potential. The strategic expansion into emerging markets within Europe, particularly those with less saturated sectors and evolving regulatory landscapes, offers substantial avenues for growth and market penetration. The continuous integration of disruptive and innovative technologies, such as the exploration of blockchain for secure transactions and the burgeoning metaverse for novel, immersive experiences, promises to redefine player engagement. Moreover, the escalating demand for highly personalized gaming experiences, empowered by advancements in Artificial Intelligence (AI) and machine learning, will undoubtedly create dynamic new opportunities for astute market players seeking to cater to individual player preferences.

Major Players in the Europe Casino Gambling Market Ecosystem

- Flutter Entertainment

- Betsson Group (Note: The original "Bet" link was ambiguous, assuming Betsson Group as a major player)

- Kindred Group

- Entain plc

- 888 Holdings plc

- MyStake Casino

- PlayOJO (part of SkillOnNet)

- Spin Casino (part of the Palace Group)

- Evolution Gaming (Now Evolution AB - leading live casino provider)

- International Game Technology (IGT)

- Aristocrat Technologies

- DraftKings (with increasing European presence)

This list represents prominent entities and is not exhaustive. The market is constantly evolving with new entrants and consolidations.

Key Developments in Europe Casino Gambling Market Industry

- September 2023: Flutter Entertainment acquired a 51% stake in MaxBet, a Serbian omni-channel sports betting and gaming operator, for €141 Million. This acquisition expands Flutter's reach into new and rapidly growing markets.

- July 2023: The Ultimate Fighting Championship (UFC) extended its sponsorship agreement with Bet365, solidifying Bet365's position as a leading sports betting partner across multiple European countries. This partnership enhances brand visibility and strengthens Bet365's market standing.

Strategic Europe Casino Gambling Market Forecast

The future of the European casino gambling market appears promising, driven by consistent technological advancements, evolving consumer preferences, and the expansion into new markets. The increasing adoption of mobile gaming, coupled with the integration of immersive technologies like VR and AR, will continue to drive market growth. The strategic acquisitions and partnerships witnessed recently signify the ongoing consolidation and maturity of the market, which is likely to maintain a steady and sustainable growth trajectory over the forecast period.

Europe Casino Gambling Market Segmentation

-

1. Type

- 1.1. Live Casino

- 1.2. Baccarat

- 1.3. Blackjack

- 1.4. Poker

- 1.5. Slots

- 1.6. Other Types

-

2. Application

- 2.1. Online

- 2.2. Offline

Europe Casino Gambling Market Segmentation By Geography

- 1. Germany

- 2. United Kingdom

- 3. France

- 4. Italy

- 5. Rest of Europe

Europe Casino Gambling Market Regional Market Share

Geographic Coverage of Europe Casino Gambling Market

Europe Casino Gambling Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 14.18% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Internet Penetration is Driving the Market

- 3.3. Market Restrains

- 3.3.1. Internet Penetration is Driving the Market

- 3.4. Market Trends

- 3.4.1. Online Casino Gambling is Driving the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Europe Casino Gambling Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Live Casino

- 5.1.2. Baccarat

- 5.1.3. Blackjack

- 5.1.4. Poker

- 5.1.5. Slots

- 5.1.6. Other Types

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Online

- 5.2.2. Offline

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Germany

- 5.3.2. United Kingdom

- 5.3.3. France

- 5.3.4. Italy

- 5.3.5. Rest of Europe

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Germany Europe Casino Gambling Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Live Casino

- 6.1.2. Baccarat

- 6.1.3. Blackjack

- 6.1.4. Poker

- 6.1.5. Slots

- 6.1.6. Other Types

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Online

- 6.2.2. Offline

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. United Kingdom Europe Casino Gambling Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Live Casino

- 7.1.2. Baccarat

- 7.1.3. Blackjack

- 7.1.4. Poker

- 7.1.5. Slots

- 7.1.6. Other Types

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Online

- 7.2.2. Offline

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. France Europe Casino Gambling Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Live Casino

- 8.1.2. Baccarat

- 8.1.3. Blackjack

- 8.1.4. Poker

- 8.1.5. Slots

- 8.1.6. Other Types

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Online

- 8.2.2. Offline

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Italy Europe Casino Gambling Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Live Casino

- 9.1.2. Baccarat

- 9.1.3. Blackjack

- 9.1.4. Poker

- 9.1.5. Slots

- 9.1.6. Other Types

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Online

- 9.2.2. Offline

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Rest of Europe Europe Casino Gambling Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Live Casino

- 10.1.2. Baccarat

- 10.1.3. Blackjack

- 10.1.4. Poker

- 10.1.5. Slots

- 10.1.6. Other Types

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Online

- 10.2.2. Offline

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Flutter Entertainment

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Bet

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Kindred Group

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Entain

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 888 Holdings

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 MyStake

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 PlayOJO

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Spin Casino

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Evolution Gaming

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 International Game Technology

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Aristocrat

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Draft Kings**List Not Exhaustive

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.1 Flutter Entertainment

List of Figures

- Figure 1: Global Europe Casino Gambling Market Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: Germany Europe Casino Gambling Market Revenue (billion), by Type 2025 & 2033

- Figure 3: Germany Europe Casino Gambling Market Revenue Share (%), by Type 2025 & 2033

- Figure 4: Germany Europe Casino Gambling Market Revenue (billion), by Application 2025 & 2033

- Figure 5: Germany Europe Casino Gambling Market Revenue Share (%), by Application 2025 & 2033

- Figure 6: Germany Europe Casino Gambling Market Revenue (billion), by Country 2025 & 2033

- Figure 7: Germany Europe Casino Gambling Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: United Kingdom Europe Casino Gambling Market Revenue (billion), by Type 2025 & 2033

- Figure 9: United Kingdom Europe Casino Gambling Market Revenue Share (%), by Type 2025 & 2033

- Figure 10: United Kingdom Europe Casino Gambling Market Revenue (billion), by Application 2025 & 2033

- Figure 11: United Kingdom Europe Casino Gambling Market Revenue Share (%), by Application 2025 & 2033

- Figure 12: United Kingdom Europe Casino Gambling Market Revenue (billion), by Country 2025 & 2033

- Figure 13: United Kingdom Europe Casino Gambling Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: France Europe Casino Gambling Market Revenue (billion), by Type 2025 & 2033

- Figure 15: France Europe Casino Gambling Market Revenue Share (%), by Type 2025 & 2033

- Figure 16: France Europe Casino Gambling Market Revenue (billion), by Application 2025 & 2033

- Figure 17: France Europe Casino Gambling Market Revenue Share (%), by Application 2025 & 2033

- Figure 18: France Europe Casino Gambling Market Revenue (billion), by Country 2025 & 2033

- Figure 19: France Europe Casino Gambling Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: Italy Europe Casino Gambling Market Revenue (billion), by Type 2025 & 2033

- Figure 21: Italy Europe Casino Gambling Market Revenue Share (%), by Type 2025 & 2033

- Figure 22: Italy Europe Casino Gambling Market Revenue (billion), by Application 2025 & 2033

- Figure 23: Italy Europe Casino Gambling Market Revenue Share (%), by Application 2025 & 2033

- Figure 24: Italy Europe Casino Gambling Market Revenue (billion), by Country 2025 & 2033

- Figure 25: Italy Europe Casino Gambling Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Rest of Europe Europe Casino Gambling Market Revenue (billion), by Type 2025 & 2033

- Figure 27: Rest of Europe Europe Casino Gambling Market Revenue Share (%), by Type 2025 & 2033

- Figure 28: Rest of Europe Europe Casino Gambling Market Revenue (billion), by Application 2025 & 2033

- Figure 29: Rest of Europe Europe Casino Gambling Market Revenue Share (%), by Application 2025 & 2033

- Figure 30: Rest of Europe Europe Casino Gambling Market Revenue (billion), by Country 2025 & 2033

- Figure 31: Rest of Europe Europe Casino Gambling Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Europe Casino Gambling Market Revenue billion Forecast, by Type 2020 & 2033

- Table 2: Global Europe Casino Gambling Market Revenue billion Forecast, by Application 2020 & 2033

- Table 3: Global Europe Casino Gambling Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Global Europe Casino Gambling Market Revenue billion Forecast, by Type 2020 & 2033

- Table 5: Global Europe Casino Gambling Market Revenue billion Forecast, by Application 2020 & 2033

- Table 6: Global Europe Casino Gambling Market Revenue billion Forecast, by Country 2020 & 2033

- Table 7: Global Europe Casino Gambling Market Revenue billion Forecast, by Type 2020 & 2033

- Table 8: Global Europe Casino Gambling Market Revenue billion Forecast, by Application 2020 & 2033

- Table 9: Global Europe Casino Gambling Market Revenue billion Forecast, by Country 2020 & 2033

- Table 10: Global Europe Casino Gambling Market Revenue billion Forecast, by Type 2020 & 2033

- Table 11: Global Europe Casino Gambling Market Revenue billion Forecast, by Application 2020 & 2033

- Table 12: Global Europe Casino Gambling Market Revenue billion Forecast, by Country 2020 & 2033

- Table 13: Global Europe Casino Gambling Market Revenue billion Forecast, by Type 2020 & 2033

- Table 14: Global Europe Casino Gambling Market Revenue billion Forecast, by Application 2020 & 2033

- Table 15: Global Europe Casino Gambling Market Revenue billion Forecast, by Country 2020 & 2033

- Table 16: Global Europe Casino Gambling Market Revenue billion Forecast, by Type 2020 & 2033

- Table 17: Global Europe Casino Gambling Market Revenue billion Forecast, by Application 2020 & 2033

- Table 18: Global Europe Casino Gambling Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Casino Gambling Market?

The projected CAGR is approximately 14.18%.

2. Which companies are prominent players in the Europe Casino Gambling Market?

Key companies in the market include Flutter Entertainment, Bet, Kindred Group, Entain, 888 Holdings, MyStake, PlayOJO, Spin Casino, Evolution Gaming, International Game Technology, Aristocrat, Draft Kings**List Not Exhaustive.

3. What are the main segments of the Europe Casino Gambling Market?

The market segments include Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 80.13 billion as of 2022.

5. What are some drivers contributing to market growth?

Internet Penetration is Driving the Market.

6. What are the notable trends driving market growth?

Online Casino Gambling is Driving the Market.

7. Are there any restraints impacting market growth?

Internet Penetration is Driving the Market.

8. Can you provide examples of recent developments in the market?

September 2023: Flutter made the acquisition of an initial 51% stake in MaxBet, Serbia's omni-channel sports betting and gaming operator, for a cash consideration of euros 141 million. MaxBet will likely provide Flutter with the platform to access fast-growing markets via a podium brand.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Casino Gambling Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Casino Gambling Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Casino Gambling Market?

To stay informed about further developments, trends, and reports in the Europe Casino Gambling Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence