Key Insights

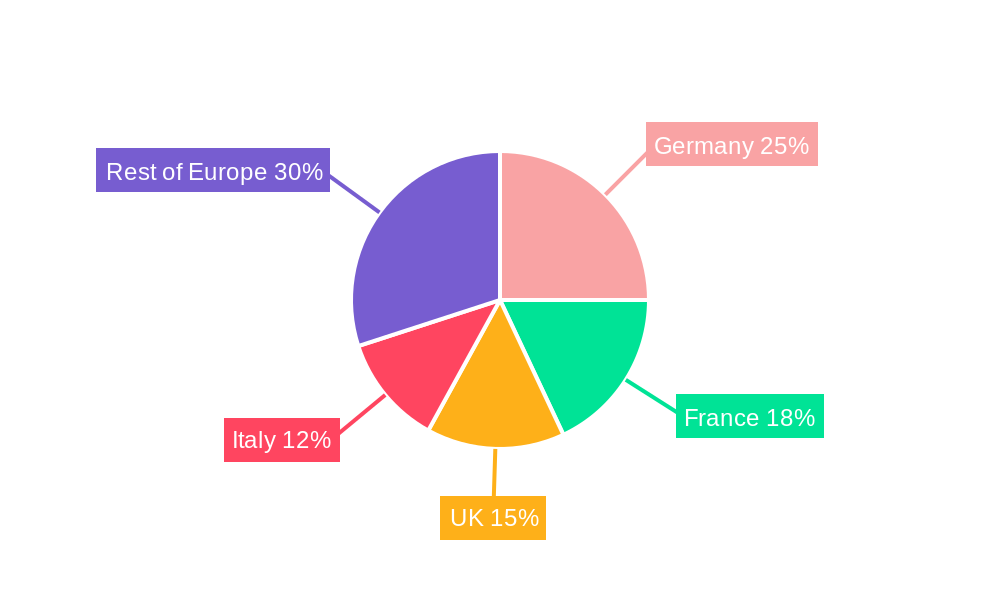

The European Air Separation Unit (ASU) market is poised for significant expansion, propelled by escalating demand from core industries including oil & gas, iron & steel, and chemicals. Key growth drivers encompass the increasing requirement for high-purity industrial gases, the expansion of energy-intensive sectors, and government mandates favoring sustainable energy solutions. Cryogenic distillation remains the dominant processing method, with nitrogen, oxygen, and argon representing the principal gases in demand. Germany, France, and the UK are identified as leading national markets, benefiting from robust industrial foundations and substantial infrastructure investments. The market is projected to achieve a Compound Annual Growth Rate (CAGR) of 4.3% from the base year 2025 through 2033. Challenges include volatile energy prices affecting operational costs and the imperative for ongoing technological innovation to enhance efficiency and minimize environmental impact. Intense competition among major players such as Linde PLC, Air Products & Chemicals Inc., and Air Liquide SA, alongside regional manufacturers, fosters continuous innovation and price competitiveness. The ongoing proliferation of renewable energy and stringent environmental regulations are anticipated to further shape the market, accelerating the adoption of sustainable ASU technologies.

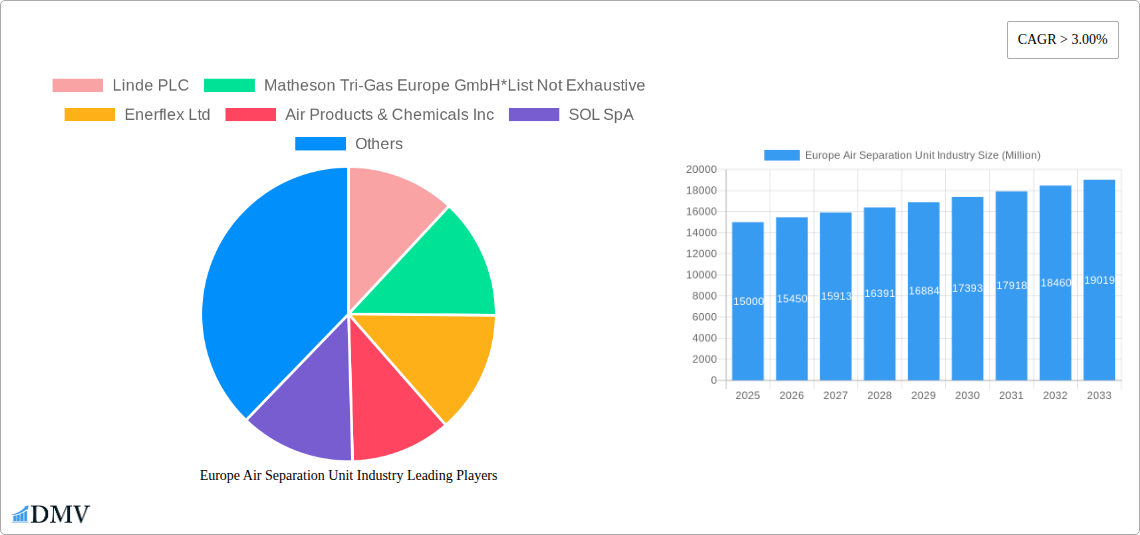

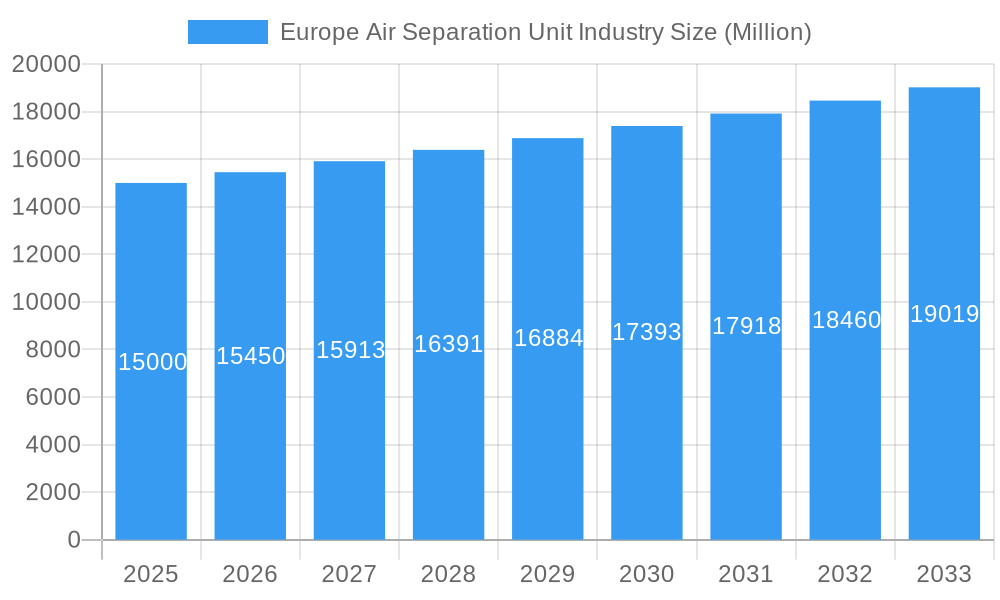

Europe Air Separation Unit Industry Market Size (In Billion)

This competitive environment spurs ongoing advancements in ASU technology, prioritizing enhanced efficiency and cost-effectiveness. Current research and development efforts are concentrated on reducing energy consumption and the environmental footprint, aligning with global sustainability objectives. Market segmentation by end-user underscores the critical function of ASUs across various industrial sectors; their future trajectory is intrinsically linked to the sustained growth and development of these industries, including potential diversification into emerging areas like hydrogen production. The forecast period anticipates increased market penetration in less developed European regions, though established economies will likely retain their industrial dominance. Consequently, strategic investments in technological innovation, geographical market expansion, and resilient supply chain management will be vital for success in this dynamic market.

Europe Air Separation Unit Industry Company Market Share

Europe Air Separation Unit (ASU) Industry Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the Europe Air Separation Unit (ASU) industry, offering invaluable insights for stakeholders seeking to navigate this dynamic market. The report covers the period 2019-2033, with a focus on the 2025-2033 forecast period and a base year of 2025. Expect detailed segmentation by process (cryogenic and non-cryogenic distillation), gas type (nitrogen, oxygen, argon, and other gases), and end-user industry (oil and gas, iron and steel, chemicals, and others). Discover key trends, growth drivers, and challenges impacting leading players such as Linde PLC, Air Liquide SA, and Air Products & Chemicals Inc., amongst others. The report leverages extensive market data to provide a clear picture of current market dynamics and future potential.

Europe Air Separation Unit Industry Market Composition & Trends

This section analyzes the competitive landscape of the European ASU market, examining market concentration, innovation drivers, regulatory factors, substitute products, end-user profiles, and mergers & acquisitions (M&A) activity. We explore the market share distribution among key players and delve into the financial details of significant M&A deals. The report quantifies the market size in Millions and examines the impact of evolving regulations on industry growth and investment. Specific examples of innovation driving market growth will be discussed alongside a detailed analysis of end-user industry trends. The analysis will also encompass an examination of substitute products and their impact on the market share of traditional ASU technologies. An assessment of the overall market concentration and the intensity of competition within the sector will be presented, including a discussion of the potential for future consolidation via mergers and acquisitions. The total market value in 2025 is estimated at xx Million, with a projected xx% CAGR from 2025 to 2033, reaching xx Million by 2033.

- Market Share Distribution (2025): Linde PLC (xx%), Air Liquide SA (xx%), Air Products & Chemicals Inc. (xx%), Others (xx%).

- M&A Deal Value (2019-2024): xx Million

- Key Regulatory Influences: Emission standards, energy efficiency regulations.

Europe Air Separation Unit Industry Evolution

This section provides a detailed historical analysis of the European ASU market from 2019 to 2024, followed by a forecast for 2025-2033. We analyze growth trajectories, technological advancements, and evolving consumer demands that have shaped the industry's evolution. Specific data points such as growth rates and technology adoption metrics will be presented to illustrate the pace of change. The analysis will cover the impact of macroeconomic factors, such as economic growth and industrial output, on the demand for ASU products. Technological advancements, including improvements in energy efficiency and the development of new ASU technologies, will be explored, along with shifts in consumer preferences towards more sustainable and environmentally friendly products. The role of innovation in driving market growth, as well as the impact of technological disruptions, will also be discussed. The report also investigates the impact of changing government policies and regulations. The market experienced a growth rate of xx% during the historical period (2019-2024) and is projected to grow at xx% during the forecast period (2025-2033).

Leading Regions, Countries, or Segments in Europe Air Separation Unit Industry

This section identifies the dominant regions, countries, and segments within the European ASU market. We analyze key drivers, such as investment trends and regulatory support, for each leading segment. In-depth analysis explains the reasons behind their dominance.

By Process:

- Cryogenic Distillation: Remains the dominant process due to its high purity output and established infrastructure. Key drivers include continued investment in large-scale ASU facilities and advancements in energy efficiency.

- Non-cryogenic Distillation: Shows moderate growth, driven by niche applications requiring smaller-scale units and lower capital expenditure.

By Gas:

- Nitrogen: Holds the largest market share due to its wide range of applications across various industries.

- Oxygen: Significant demand from the steel and chemical industries.

- Argon: Steady growth driven by increasing applications in welding and other specialized sectors.

By End User:

- Iron and Steel Industry: Largest end-user segment due to the high oxygen demand in steelmaking.

- Chemical Industry: Strong growth prospects due to the increasing use of oxygen and nitrogen in various chemical processes.

Europe Air Separation Unit Industry Product Innovations

Recent product innovations in the European ASU industry focus on improving energy efficiency, reducing operational costs, and enhancing the purity of the separated gases. New technologies are aimed at enabling modular designs for easier deployment and scaling, while advanced control systems optimize production processes and improve overall system reliability. These innovations offer unique selling propositions, such as reduced environmental impact and enhanced operational efficiency. The adoption of advanced materials and process optimization techniques contributes significantly to improved performance metrics.

Propelling Factors for Europe Air Separation Unit Industry Growth

Several factors drive the growth of the European ASU industry. Increased demand from key end-user sectors like steel and chemicals fuels market expansion. Stringent environmental regulations necessitate cleaner production methods, boosting demand for ASU technologies. Advancements in energy-efficient designs and modular ASU systems also contribute significantly to growth. Government incentives and investments in energy-efficient technologies further encourage industry expansion.

Obstacles in the Europe Air Separation Unit Industry Market

The European ASU market faces challenges such as volatile raw material prices impacting operational costs. Stringent environmental regulations can increase compliance costs. Intense competition among established players and potential new entrants creates pressure on profit margins. Supply chain disruptions can impact the availability of key components and materials. These factors can collectively restrain the market's growth potential.

Future Opportunities in Europe Air Separation Unit Industry

The future of the European ASU market holds exciting opportunities. Growing demand from emerging applications, particularly in advanced materials manufacturing and renewable energy, opens new avenues for growth. The development of smaller, more efficient, and modular ASU systems expands market reach to previously underserved segments. Focus on sustainable practices and energy efficiency will continue driving innovation and demand.

Major Players in the Europe Air Separation Unit Industry Ecosystem

- Linde PLC

- Matheson Tri-Gas Europe GmbH

- Enerflex Ltd

- Air Products & Chemicals Inc

- SOL SpA

- Air Liquide SA

- Messer Group GmbH

- Universal Industrial Plants Mfg Co Private Limited

- Taiyo Nippon Sanso Corporation

- SIAD Macchine Impianti SpA

Key Developments in Europe Air Separation Unit Industry Industry

- 2022 Q4: Linde PLC announces a major investment in a new ASU facility in Germany.

- 2023 Q1: Air Liquide SA launches a new line of energy-efficient ASU systems.

- 2023 Q3: Merger between two smaller ASU providers announced. (Further details within the report)

Strategic Europe Air Separation Unit Industry Market Forecast

The European ASU market is poised for continued growth, driven by increasing demand from various industrial sectors. Technological advancements, focusing on enhanced energy efficiency and sustainability, will shape future developments. Expansion into new applications and markets will further fuel market expansion in the coming years. The overall market outlook remains positive, with substantial opportunities for growth and innovation.

Europe Air Separation Unit Industry Segmentation

-

1. Process

- 1.1. Cryogenic Distillation

- 1.2. Non-cryogenic Distillation

-

2. Gas

- 2.1. Nitrogen

- 2.2. Oxygen

- 2.3. Argon

- 2.4. Other Gases

-

3. End User

- 3.1. Oil and Gas Industry

- 3.2. Iron and Steel Industry

- 3.3. Chemical Industry

- 3.4. Other End Users

Europe Air Separation Unit Industry Segmentation By Geography

- 1. United Kingdom

- 2. Germany

- 3. France

- 4. Italy

- 5. Rest of Europe

Europe Air Separation Unit Industry Regional Market Share

Geographic Coverage of Europe Air Separation Unit Industry

Europe Air Separation Unit Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.3% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increasing Focus on the Decarbonization of Global Energy4.; Expansion of Automobile Industry

- 3.3. Market Restrains

- 3.3.1. 4.; High Costs Associated with Transportation of Liquid Hydrogen

- 3.4. Market Trends

- 3.4.1. Cryogenic Distillation Segment is Expected to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Air Separation Unit Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Process

- 5.1.1. Cryogenic Distillation

- 5.1.2. Non-cryogenic Distillation

- 5.2. Market Analysis, Insights and Forecast - by Gas

- 5.2.1. Nitrogen

- 5.2.2. Oxygen

- 5.2.3. Argon

- 5.2.4. Other Gases

- 5.3. Market Analysis, Insights and Forecast - by End User

- 5.3.1. Oil and Gas Industry

- 5.3.2. Iron and Steel Industry

- 5.3.3. Chemical Industry

- 5.3.4. Other End Users

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. United Kingdom

- 5.4.2. Germany

- 5.4.3. France

- 5.4.4. Italy

- 5.4.5. Rest of Europe

- 5.1. Market Analysis, Insights and Forecast - by Process

- 6. United Kingdom Europe Air Separation Unit Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Process

- 6.1.1. Cryogenic Distillation

- 6.1.2. Non-cryogenic Distillation

- 6.2. Market Analysis, Insights and Forecast - by Gas

- 6.2.1. Nitrogen

- 6.2.2. Oxygen

- 6.2.3. Argon

- 6.2.4. Other Gases

- 6.3. Market Analysis, Insights and Forecast - by End User

- 6.3.1. Oil and Gas Industry

- 6.3.2. Iron and Steel Industry

- 6.3.3. Chemical Industry

- 6.3.4. Other End Users

- 6.1. Market Analysis, Insights and Forecast - by Process

- 7. Germany Europe Air Separation Unit Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Process

- 7.1.1. Cryogenic Distillation

- 7.1.2. Non-cryogenic Distillation

- 7.2. Market Analysis, Insights and Forecast - by Gas

- 7.2.1. Nitrogen

- 7.2.2. Oxygen

- 7.2.3. Argon

- 7.2.4. Other Gases

- 7.3. Market Analysis, Insights and Forecast - by End User

- 7.3.1. Oil and Gas Industry

- 7.3.2. Iron and Steel Industry

- 7.3.3. Chemical Industry

- 7.3.4. Other End Users

- 7.1. Market Analysis, Insights and Forecast - by Process

- 8. France Europe Air Separation Unit Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Process

- 8.1.1. Cryogenic Distillation

- 8.1.2. Non-cryogenic Distillation

- 8.2. Market Analysis, Insights and Forecast - by Gas

- 8.2.1. Nitrogen

- 8.2.2. Oxygen

- 8.2.3. Argon

- 8.2.4. Other Gases

- 8.3. Market Analysis, Insights and Forecast - by End User

- 8.3.1. Oil and Gas Industry

- 8.3.2. Iron and Steel Industry

- 8.3.3. Chemical Industry

- 8.3.4. Other End Users

- 8.1. Market Analysis, Insights and Forecast - by Process

- 9. Italy Europe Air Separation Unit Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Process

- 9.1.1. Cryogenic Distillation

- 9.1.2. Non-cryogenic Distillation

- 9.2. Market Analysis, Insights and Forecast - by Gas

- 9.2.1. Nitrogen

- 9.2.2. Oxygen

- 9.2.3. Argon

- 9.2.4. Other Gases

- 9.3. Market Analysis, Insights and Forecast - by End User

- 9.3.1. Oil and Gas Industry

- 9.3.2. Iron and Steel Industry

- 9.3.3. Chemical Industry

- 9.3.4. Other End Users

- 9.1. Market Analysis, Insights and Forecast - by Process

- 10. Rest of Europe Europe Air Separation Unit Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Process

- 10.1.1. Cryogenic Distillation

- 10.1.2. Non-cryogenic Distillation

- 10.2. Market Analysis, Insights and Forecast - by Gas

- 10.2.1. Nitrogen

- 10.2.2. Oxygen

- 10.2.3. Argon

- 10.2.4. Other Gases

- 10.3. Market Analysis, Insights and Forecast - by End User

- 10.3.1. Oil and Gas Industry

- 10.3.2. Iron and Steel Industry

- 10.3.3. Chemical Industry

- 10.3.4. Other End Users

- 10.1. Market Analysis, Insights and Forecast - by Process

- 11. Competitive Analysis

- 11.1. Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Linde PLC

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Matheson Tri-Gas Europe GmbH*List Not Exhaustive

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Enerflex Ltd

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Air Products & Chemicals Inc

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 SOL SpA

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Air Liquide SA

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Messer Group GmbH

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Universal Industrial Plants Mfg Co Private Limited

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Taiyo Nippon Sanso Corporation

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 SIAD Macchine Impianti SpA

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Linde PLC

List of Figures

- Figure 1: Europe Air Separation Unit Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Europe Air Separation Unit Industry Share (%) by Company 2025

List of Tables

- Table 1: Europe Air Separation Unit Industry Revenue billion Forecast, by Process 2020 & 2033

- Table 2: Europe Air Separation Unit Industry Revenue billion Forecast, by Gas 2020 & 2033

- Table 3: Europe Air Separation Unit Industry Revenue billion Forecast, by End User 2020 & 2033

- Table 4: Europe Air Separation Unit Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 5: Europe Air Separation Unit Industry Revenue billion Forecast, by Process 2020 & 2033

- Table 6: Europe Air Separation Unit Industry Revenue billion Forecast, by Gas 2020 & 2033

- Table 7: Europe Air Separation Unit Industry Revenue billion Forecast, by End User 2020 & 2033

- Table 8: Europe Air Separation Unit Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 9: Europe Air Separation Unit Industry Revenue billion Forecast, by Process 2020 & 2033

- Table 10: Europe Air Separation Unit Industry Revenue billion Forecast, by Gas 2020 & 2033

- Table 11: Europe Air Separation Unit Industry Revenue billion Forecast, by End User 2020 & 2033

- Table 12: Europe Air Separation Unit Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 13: Europe Air Separation Unit Industry Revenue billion Forecast, by Process 2020 & 2033

- Table 14: Europe Air Separation Unit Industry Revenue billion Forecast, by Gas 2020 & 2033

- Table 15: Europe Air Separation Unit Industry Revenue billion Forecast, by End User 2020 & 2033

- Table 16: Europe Air Separation Unit Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 17: Europe Air Separation Unit Industry Revenue billion Forecast, by Process 2020 & 2033

- Table 18: Europe Air Separation Unit Industry Revenue billion Forecast, by Gas 2020 & 2033

- Table 19: Europe Air Separation Unit Industry Revenue billion Forecast, by End User 2020 & 2033

- Table 20: Europe Air Separation Unit Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 21: Europe Air Separation Unit Industry Revenue billion Forecast, by Process 2020 & 2033

- Table 22: Europe Air Separation Unit Industry Revenue billion Forecast, by Gas 2020 & 2033

- Table 23: Europe Air Separation Unit Industry Revenue billion Forecast, by End User 2020 & 2033

- Table 24: Europe Air Separation Unit Industry Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Air Separation Unit Industry?

The projected CAGR is approximately 4.3%.

2. Which companies are prominent players in the Europe Air Separation Unit Industry?

Key companies in the market include Linde PLC, Matheson Tri-Gas Europe GmbH*List Not Exhaustive, Enerflex Ltd, Air Products & Chemicals Inc, SOL SpA, Air Liquide SA, Messer Group GmbH, Universal Industrial Plants Mfg Co Private Limited, Taiyo Nippon Sanso Corporation, SIAD Macchine Impianti SpA.

3. What are the main segments of the Europe Air Separation Unit Industry?

The market segments include Process, Gas, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 6.4 billion as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing Focus on the Decarbonization of Global Energy4.; Expansion of Automobile Industry.

6. What are the notable trends driving market growth?

Cryogenic Distillation Segment is Expected to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; High Costs Associated with Transportation of Liquid Hydrogen.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Air Separation Unit Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Air Separation Unit Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Air Separation Unit Industry?

To stay informed about further developments, trends, and reports in the Europe Air Separation Unit Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence