Key Insights

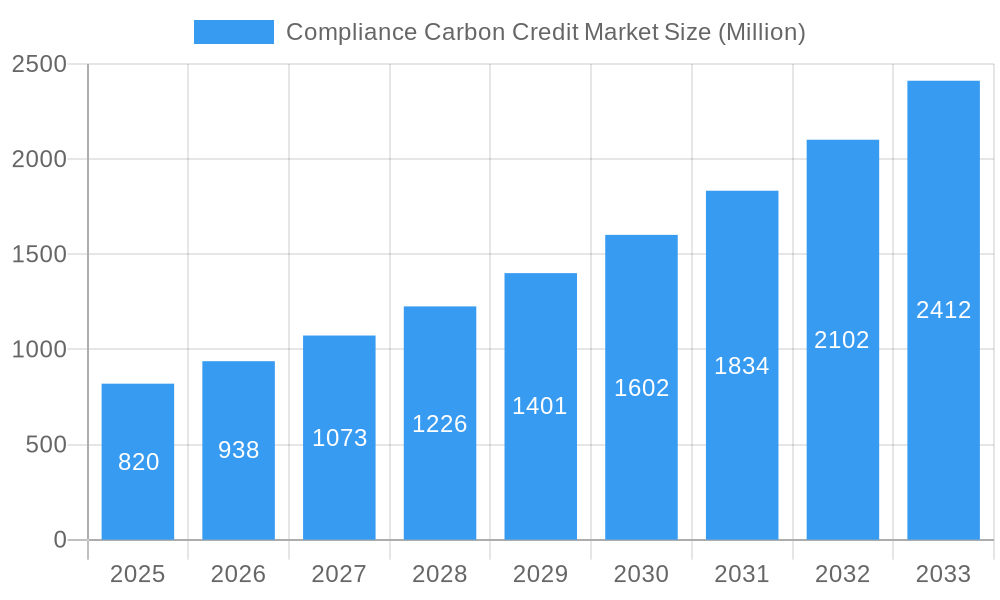

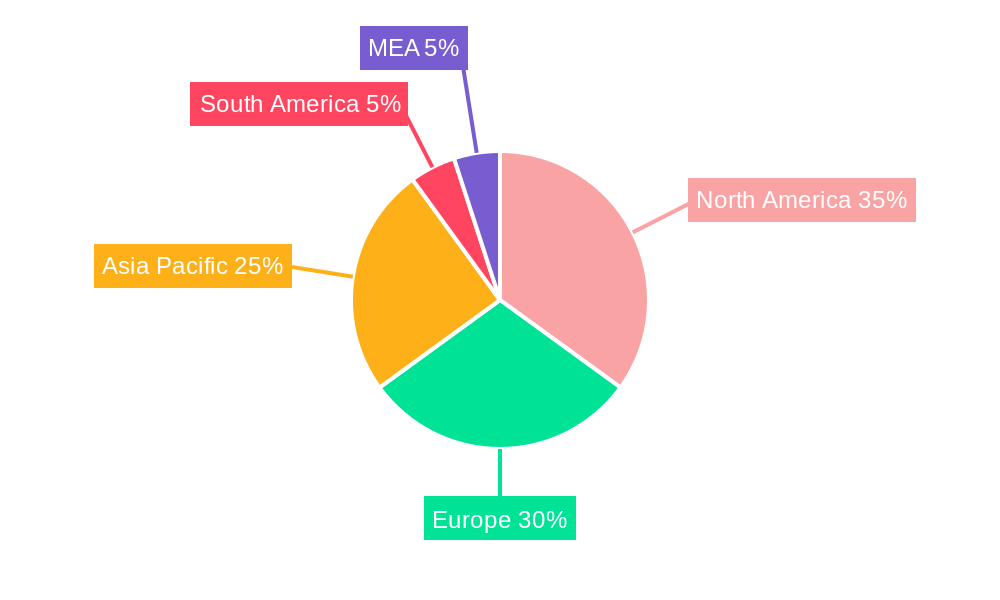

The Compliance Carbon Credit Market is experiencing robust growth, projected to reach \$0.82 billion in 2025 and maintain a Compound Annual Growth Rate (CAGR) of 14.81% from 2025 to 2033. This expansion is driven by increasing regulatory pressure on businesses to reduce their carbon footprint, coupled with a rising awareness of environmental, social, and governance (ESG) factors among investors and consumers. The market's segmentation reveals strong demand across various credit types, with renewable energy projects, forestry and land use, and energy efficiency initiatives leading the way. Key sectors driving market growth include energy, transportation, and industry, reflecting the significant carbon emissions associated with these areas. Furthermore, geographical diversification is evident, with North America and Europe currently representing substantial market shares, though the Asia-Pacific region is expected to witness significant growth driven by increasing industrialization and government initiatives promoting carbon reduction. The presence of established players like Shell New Energies, ClimateCare, and Natural Capital Partners indicates a mature but rapidly evolving market landscape.

Compliance Carbon Credit Market Market Size (In Million)

Continued growth will be fueled by evolving compliance regulations, expanding carbon offsetting schemes, and the increasing availability of high-quality carbon credits. However, challenges remain, including the potential for market volatility related to credit pricing and verification processes, as well as concerns surrounding the additionality and permanence of certain carbon reduction projects. The market's future success hinges on addressing these challenges through improved methodologies for credit verification, increased transparency, and the development of robust, internationally recognized standards for carbon accounting and trading. The consistent expansion of the market across multiple sectors and regions suggests that compliance carbon credits will continue to play a crucial role in the global transition to a low-carbon economy.

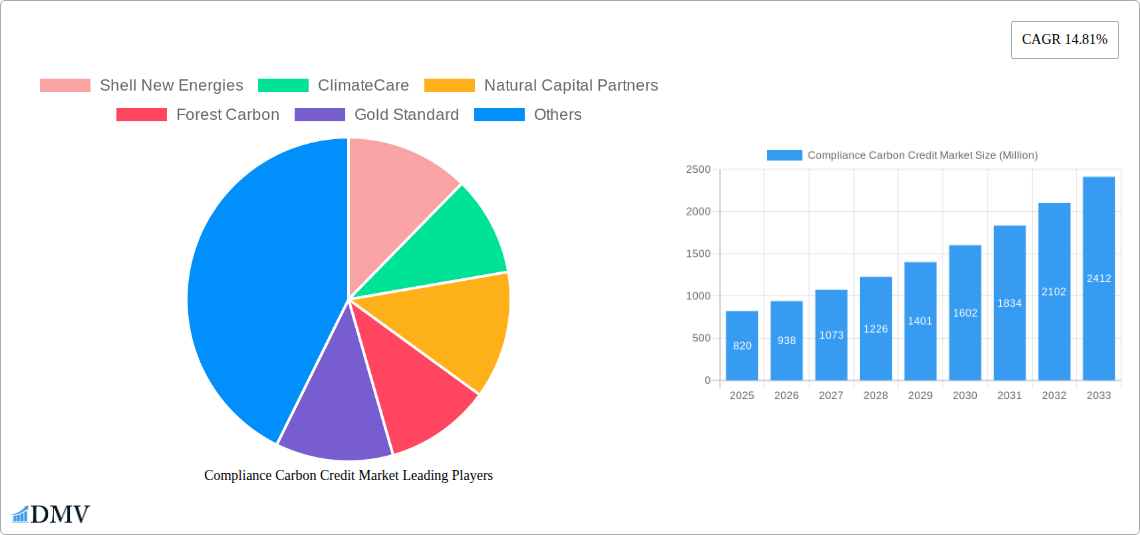

Compliance Carbon Credit Market Company Market Share

Compliance Carbon Credit Market: A Comprehensive Report (2019-2033)

This insightful report provides a detailed analysis of the Compliance Carbon Credit Market, offering a comprehensive overview of its current state and future trajectory. With a study period spanning 2019-2033, a base year of 2025, and a forecast period from 2025-2033, this report is an invaluable resource for stakeholders seeking to navigate this rapidly evolving market. The report examines market dynamics, leading players, innovative technologies, and future growth opportunities, incorporating data from the historical period (2019-2024) and projecting trends through 2033. The market is valued at xx Million in 2025 and projected to reach xx Million by 2033.

Compliance Carbon Credit Market Composition & Trends

This section delves into the competitive landscape of the compliance carbon credit market, analyzing market concentration, innovation drivers, regulatory frameworks, substitute products, end-user profiles, and merger & acquisition (M&A) activity. The report reveals market share distribution among key players and provides insights into the financial aspects of M&A deals.

Market Concentration: The market exhibits a moderately concentrated structure, with a few major players holding significant shares. Shell New Energies, ClimateCare, Natural Capital Partners, Forest Carbon, and Gold Standard are among the leading firms, together accounting for an estimated xx% of the market share in 2025. Smaller players and new entrants compete in niche segments.

Innovation Catalysts: Technological advancements, particularly in monitoring, verification, and trading platforms, are driving market innovation. The development of blockchain-based solutions for improved transparency and traceability is a significant trend.

Regulatory Landscape: Stringent environmental regulations and carbon pricing mechanisms across various jurisdictions are key drivers of market growth. However, inconsistencies in regulatory frameworks across different regions pose a challenge.

Substitute Products: While compliance carbon credits are currently the primary mechanism for emission reduction compliance, alternative technologies and strategies are emerging, potentially affecting market growth.

End-User Profiles: The primary end-users include energy companies, industrial manufacturers, transportation firms, and governmental agencies striving to meet regulatory emission reduction targets.

M&A Activity: The report analyzes past M&A activity, identifying key deals and their financial implications. The total value of M&A transactions within the compliance carbon credit market during the historical period (2019-2024) is estimated at xx Million.

Compliance Carbon Credit Market Industry Evolution

This section analyzes the evolutionary trajectory of the compliance carbon credit market, examining growth patterns, technological advancements, and evolving consumer demands. Detailed data points, such as growth rates and adoption metrics, are provided to illustrate these trends. The market has demonstrated a Compound Annual Growth Rate (CAGR) of xx% during the historical period (2019-2024), driven primarily by increasing regulatory pressure and growing corporate sustainability initiatives. The adoption rate of compliance carbon credits has risen significantly across various sectors. Technological advancements such as remote sensing, data analytics, and improved methodologies for project verification have improved the market’s efficiency and transparency. The emergence of innovative carbon credit types linked to nature-based solutions and technological advancements further fuels market expansion. Shifting consumer preferences towards environmentally friendly products and services also influence corporate demand for compliance carbon credits.

Leading Regions, Countries, or Segments in Compliance Carbon Credit Market

This section identifies the dominant regions, countries, and market segments within the compliance carbon credit market. Both "By Type of Credits" and "By Sector" are analyzed.

By Type of Credits:

- Renewable Energy Projects: This segment exhibits strong growth, driven by increasing investments in renewable energy infrastructure and supportive government policies.

- Forestry and Land Use: This sector demonstrates significant potential, with various initiatives focused on carbon sequestration and forest conservation.

- Energy Efficiency: This segment shows steady growth, driven by technological advancements and corporate sustainability efforts aimed at optimizing energy consumption.

- Industrial Process Improvements: This segment demonstrates moderate growth, influenced by government regulations and the adoption of clean technologies.

By Sector:

- Energy Sector: This is the largest segment, with substantial demand driven by regulatory requirements and a need for emission reduction.

- Transportation: The transportation sector demonstrates rising demand for carbon credits, reflecting the growing focus on reducing emissions from vehicles.

- Industrial Sector: The industrial sector shows a significant and growing demand for compliance carbon credits, stemming from stringent emissions regulations imposed on various industrial processes.

- Agriculture and Forestry: This sector exhibits rising demand for carbon credits, with increased initiatives focused on sustainable land management practices.

Key drivers for the dominance of specific regions and segments, including investment trends and regulatory support, are elaborated upon throughout the report.

Compliance Carbon Credit Market Product Innovations

Recent product innovations focus on enhanced methodologies for carbon credit verification, improved tracking systems utilizing blockchain technology, and the development of new carbon credit types linked to innovative emission reduction technologies. This enhances transparency, simplifies trading, and adds value through improved tracking and verification mechanisms. These advancements are improving data quality, increasing investor confidence, and driving market expansion. Unique selling propositions center around superior traceability, robust verification, and the development of new product types to meet evolving market needs.

Propelling Factors for Compliance Carbon Credit Market Growth

Several factors drive the growth of the compliance carbon credit market. Firstly, stringent government regulations, such as carbon pricing mechanisms and emissions trading schemes, compel companies to acquire carbon credits to meet their compliance obligations. Secondly, growing corporate social responsibility (CSR) initiatives are motivating companies to voluntarily reduce their environmental impact, increasing the demand for compliance carbon credits. Finally, technological advancements like improved monitoring and verification techniques are enhancing market efficiency and transparency.

Obstacles in the Compliance Carbon Credit Market

The compliance carbon credit market faces challenges, including the complexity of carbon credit verification and standardization, leading to inconsistencies and potential for fraud. Supply chain disruptions in the procurement of carbon credits can affect market stability and price volatility. Moreover, the market's competitiveness and the presence of various substitute products create pressure for price adjustments.

Future Opportunities in Compliance Carbon Credit Market

Future opportunities lie in the expansion of carbon credit markets into emerging economies, with developing nations experiencing increased regulatory pressure to adopt carbon reduction measures. Furthermore, the development and implementation of innovative technologies such as carbon capture and storage (CCS) can generate new types of high-quality carbon credits. Finally, the integration of carbon credit markets with other sustainability initiatives and the growing emphasis on nature-based solutions present substantial opportunities.

Major Players in the Compliance Carbon Credit Market Ecosystem

- Shell New Energies

- ClimateCare

- Natural Capital Partners

- Forest Carbon

- Gold Standard

- 3Degrees

- Carbon Trust

- South Pole

- Atmosfair

- 7 3 Other Companies

- Sustainable Travel International

Key Developments in Compliance Carbon Credit Market Industry

- April 2024: Regional efforts in the Western United States and Canada are gaining momentum, with plans to link carbon markets in California, Quebec, and Washington. This initiative aims to create a larger, more integrated carbon market.

- January 2024: The Commodity Futures Trading Commission (CFTC) proposed guidance on the listing of voluntary carbon credit (VCC) derivatives contracts, potentially increasing market liquidity and transparency.

Strategic Compliance Carbon Credit Market Market Forecast

The compliance carbon credit market is poised for significant growth, driven by strengthened environmental regulations, increasing corporate sustainability initiatives, and technological innovations. Expanding into new geographical regions and the development of new credit types will contribute significantly to market expansion, unlocking immense potential in the coming years. The market's trajectory suggests a robust and sustainable growth path, making it an attractive sector for investment and innovation.

Compliance Carbon Credit Market Segmentation

-

1. Type of Credits

- 1.1. Renewable Energy Projects

- 1.2. Forestry and Land Use

- 1.3. Energy Efficiency

- 1.4. Industrial Process Improvements

-

2. Sector

- 2.1. Energy Sector

- 2.2. Transportation

- 2.3. Industrial Sector

- 2.4. Agriculture and Forestry

Compliance Carbon Credit Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

-

2. Europe

- 2.1. United Kingdom

- 2.2. Germany

- 2.3. France

- 2.4. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. South Korea

- 3.5. Rest of Asia Pacific

- 4. Middle East and Africa

- 5. Latin America

Compliance Carbon Credit Market Regional Market Share

Geographic Coverage of Compliance Carbon Credit Market

Compliance Carbon Credit Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 14.81% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Regulatory Mandates and Policies; Growing Corporate Sustainability Initiatives

- 3.3. Market Restrains

- 3.3.1. Market Complexity and Uncertainty

- 3.4. Market Trends

- 3.4.1. Charting the Course of Carbon Pricing

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Compliance Carbon Credit Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type of Credits

- 5.1.1. Renewable Energy Projects

- 5.1.2. Forestry and Land Use

- 5.1.3. Energy Efficiency

- 5.1.4. Industrial Process Improvements

- 5.2. Market Analysis, Insights and Forecast - by Sector

- 5.2.1. Energy Sector

- 5.2.2. Transportation

- 5.2.3. Industrial Sector

- 5.2.4. Agriculture and Forestry

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Middle East and Africa

- 5.3.5. Latin America

- 5.1. Market Analysis, Insights and Forecast - by Type of Credits

- 6. North America Compliance Carbon Credit Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type of Credits

- 6.1.1. Renewable Energy Projects

- 6.1.2. Forestry and Land Use

- 6.1.3. Energy Efficiency

- 6.1.4. Industrial Process Improvements

- 6.2. Market Analysis, Insights and Forecast - by Sector

- 6.2.1. Energy Sector

- 6.2.2. Transportation

- 6.2.3. Industrial Sector

- 6.2.4. Agriculture and Forestry

- 6.1. Market Analysis, Insights and Forecast - by Type of Credits

- 7. Europe Compliance Carbon Credit Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type of Credits

- 7.1.1. Renewable Energy Projects

- 7.1.2. Forestry and Land Use

- 7.1.3. Energy Efficiency

- 7.1.4. Industrial Process Improvements

- 7.2. Market Analysis, Insights and Forecast - by Sector

- 7.2.1. Energy Sector

- 7.2.2. Transportation

- 7.2.3. Industrial Sector

- 7.2.4. Agriculture and Forestry

- 7.1. Market Analysis, Insights and Forecast - by Type of Credits

- 8. Asia Pacific Compliance Carbon Credit Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type of Credits

- 8.1.1. Renewable Energy Projects

- 8.1.2. Forestry and Land Use

- 8.1.3. Energy Efficiency

- 8.1.4. Industrial Process Improvements

- 8.2. Market Analysis, Insights and Forecast - by Sector

- 8.2.1. Energy Sector

- 8.2.2. Transportation

- 8.2.3. Industrial Sector

- 8.2.4. Agriculture and Forestry

- 8.1. Market Analysis, Insights and Forecast - by Type of Credits

- 9. Middle East and Africa Compliance Carbon Credit Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type of Credits

- 9.1.1. Renewable Energy Projects

- 9.1.2. Forestry and Land Use

- 9.1.3. Energy Efficiency

- 9.1.4. Industrial Process Improvements

- 9.2. Market Analysis, Insights and Forecast - by Sector

- 9.2.1. Energy Sector

- 9.2.2. Transportation

- 9.2.3. Industrial Sector

- 9.2.4. Agriculture and Forestry

- 9.1. Market Analysis, Insights and Forecast - by Type of Credits

- 10. Latin America Compliance Carbon Credit Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type of Credits

- 10.1.1. Renewable Energy Projects

- 10.1.2. Forestry and Land Use

- 10.1.3. Energy Efficiency

- 10.1.4. Industrial Process Improvements

- 10.2. Market Analysis, Insights and Forecast - by Sector

- 10.2.1. Energy Sector

- 10.2.2. Transportation

- 10.2.3. Industrial Sector

- 10.2.4. Agriculture and Forestry

- 10.1. Market Analysis, Insights and Forecast - by Type of Credits

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Shell New Energies

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 ClimateCare

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Natural Capital Partners

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Forest Carbon

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Gold Standard

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 3Degrees

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Carbon Trust

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 South Pole

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Atmosfair**List Not Exhaustive 7 3 Other Companie

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Sustainable Travel International

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Shell New Energies

List of Figures

- Figure 1: Global Compliance Carbon Credit Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Compliance Carbon Credit Market Revenue (Million), by Type of Credits 2025 & 2033

- Figure 3: North America Compliance Carbon Credit Market Revenue Share (%), by Type of Credits 2025 & 2033

- Figure 4: North America Compliance Carbon Credit Market Revenue (Million), by Sector 2025 & 2033

- Figure 5: North America Compliance Carbon Credit Market Revenue Share (%), by Sector 2025 & 2033

- Figure 6: North America Compliance Carbon Credit Market Revenue (Million), by Country 2025 & 2033

- Figure 7: North America Compliance Carbon Credit Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Compliance Carbon Credit Market Revenue (Million), by Type of Credits 2025 & 2033

- Figure 9: Europe Compliance Carbon Credit Market Revenue Share (%), by Type of Credits 2025 & 2033

- Figure 10: Europe Compliance Carbon Credit Market Revenue (Million), by Sector 2025 & 2033

- Figure 11: Europe Compliance Carbon Credit Market Revenue Share (%), by Sector 2025 & 2033

- Figure 12: Europe Compliance Carbon Credit Market Revenue (Million), by Country 2025 & 2033

- Figure 13: Europe Compliance Carbon Credit Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Compliance Carbon Credit Market Revenue (Million), by Type of Credits 2025 & 2033

- Figure 15: Asia Pacific Compliance Carbon Credit Market Revenue Share (%), by Type of Credits 2025 & 2033

- Figure 16: Asia Pacific Compliance Carbon Credit Market Revenue (Million), by Sector 2025 & 2033

- Figure 17: Asia Pacific Compliance Carbon Credit Market Revenue Share (%), by Sector 2025 & 2033

- Figure 18: Asia Pacific Compliance Carbon Credit Market Revenue (Million), by Country 2025 & 2033

- Figure 19: Asia Pacific Compliance Carbon Credit Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: Middle East and Africa Compliance Carbon Credit Market Revenue (Million), by Type of Credits 2025 & 2033

- Figure 21: Middle East and Africa Compliance Carbon Credit Market Revenue Share (%), by Type of Credits 2025 & 2033

- Figure 22: Middle East and Africa Compliance Carbon Credit Market Revenue (Million), by Sector 2025 & 2033

- Figure 23: Middle East and Africa Compliance Carbon Credit Market Revenue Share (%), by Sector 2025 & 2033

- Figure 24: Middle East and Africa Compliance Carbon Credit Market Revenue (Million), by Country 2025 & 2033

- Figure 25: Middle East and Africa Compliance Carbon Credit Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Latin America Compliance Carbon Credit Market Revenue (Million), by Type of Credits 2025 & 2033

- Figure 27: Latin America Compliance Carbon Credit Market Revenue Share (%), by Type of Credits 2025 & 2033

- Figure 28: Latin America Compliance Carbon Credit Market Revenue (Million), by Sector 2025 & 2033

- Figure 29: Latin America Compliance Carbon Credit Market Revenue Share (%), by Sector 2025 & 2033

- Figure 30: Latin America Compliance Carbon Credit Market Revenue (Million), by Country 2025 & 2033

- Figure 31: Latin America Compliance Carbon Credit Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Compliance Carbon Credit Market Revenue Million Forecast, by Type of Credits 2020 & 2033

- Table 2: Global Compliance Carbon Credit Market Revenue Million Forecast, by Sector 2020 & 2033

- Table 3: Global Compliance Carbon Credit Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global Compliance Carbon Credit Market Revenue Million Forecast, by Type of Credits 2020 & 2033

- Table 5: Global Compliance Carbon Credit Market Revenue Million Forecast, by Sector 2020 & 2033

- Table 6: Global Compliance Carbon Credit Market Revenue Million Forecast, by Country 2020 & 2033

- Table 7: United States Compliance Carbon Credit Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Canada Compliance Carbon Credit Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Global Compliance Carbon Credit Market Revenue Million Forecast, by Type of Credits 2020 & 2033

- Table 10: Global Compliance Carbon Credit Market Revenue Million Forecast, by Sector 2020 & 2033

- Table 11: Global Compliance Carbon Credit Market Revenue Million Forecast, by Country 2020 & 2033

- Table 12: United Kingdom Compliance Carbon Credit Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Germany Compliance Carbon Credit Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: France Compliance Carbon Credit Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Rest of Europe Compliance Carbon Credit Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Global Compliance Carbon Credit Market Revenue Million Forecast, by Type of Credits 2020 & 2033

- Table 17: Global Compliance Carbon Credit Market Revenue Million Forecast, by Sector 2020 & 2033

- Table 18: Global Compliance Carbon Credit Market Revenue Million Forecast, by Country 2020 & 2033

- Table 19: China Compliance Carbon Credit Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Japan Compliance Carbon Credit Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: India Compliance Carbon Credit Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: South Korea Compliance Carbon Credit Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: Rest of Asia Pacific Compliance Carbon Credit Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Global Compliance Carbon Credit Market Revenue Million Forecast, by Type of Credits 2020 & 2033

- Table 25: Global Compliance Carbon Credit Market Revenue Million Forecast, by Sector 2020 & 2033

- Table 26: Global Compliance Carbon Credit Market Revenue Million Forecast, by Country 2020 & 2033

- Table 27: Global Compliance Carbon Credit Market Revenue Million Forecast, by Type of Credits 2020 & 2033

- Table 28: Global Compliance Carbon Credit Market Revenue Million Forecast, by Sector 2020 & 2033

- Table 29: Global Compliance Carbon Credit Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Compliance Carbon Credit Market?

The projected CAGR is approximately 14.81%.

2. Which companies are prominent players in the Compliance Carbon Credit Market?

Key companies in the market include Shell New Energies, ClimateCare, Natural Capital Partners, Forest Carbon, Gold Standard, 3Degrees, Carbon Trust, South Pole, Atmosfair**List Not Exhaustive 7 3 Other Companie, Sustainable Travel International.

3. What are the main segments of the Compliance Carbon Credit Market?

The market segments include Type of Credits, Sector.

4. Can you provide details about the market size?

The market size is estimated to be USD 0.82 Million as of 2022.

5. What are some drivers contributing to market growth?

Regulatory Mandates and Policies; Growing Corporate Sustainability Initiatives.

6. What are the notable trends driving market growth?

Charting the Course of Carbon Pricing: UK-ETS Post-Brexit.

7. Are there any restraints impacting market growth?

Market Complexity and Uncertainty.

8. Can you provide examples of recent developments in the market?

April 2024: Regional efforts in the Western United States and Canada are gaining momentum as the urgency of combating climate change increases. Plans to link their carbon markets are being drawn up in California, Quebec, and Washington, which could significantly affect trading dynamics. The three authorities intend to work together to create a more extensive carbon credit market as soon as their proposed alliance takes effect.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Compliance Carbon Credit Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Compliance Carbon Credit Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Compliance Carbon Credit Market?

To stay informed about further developments, trends, and reports in the Compliance Carbon Credit Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence