Key Insights

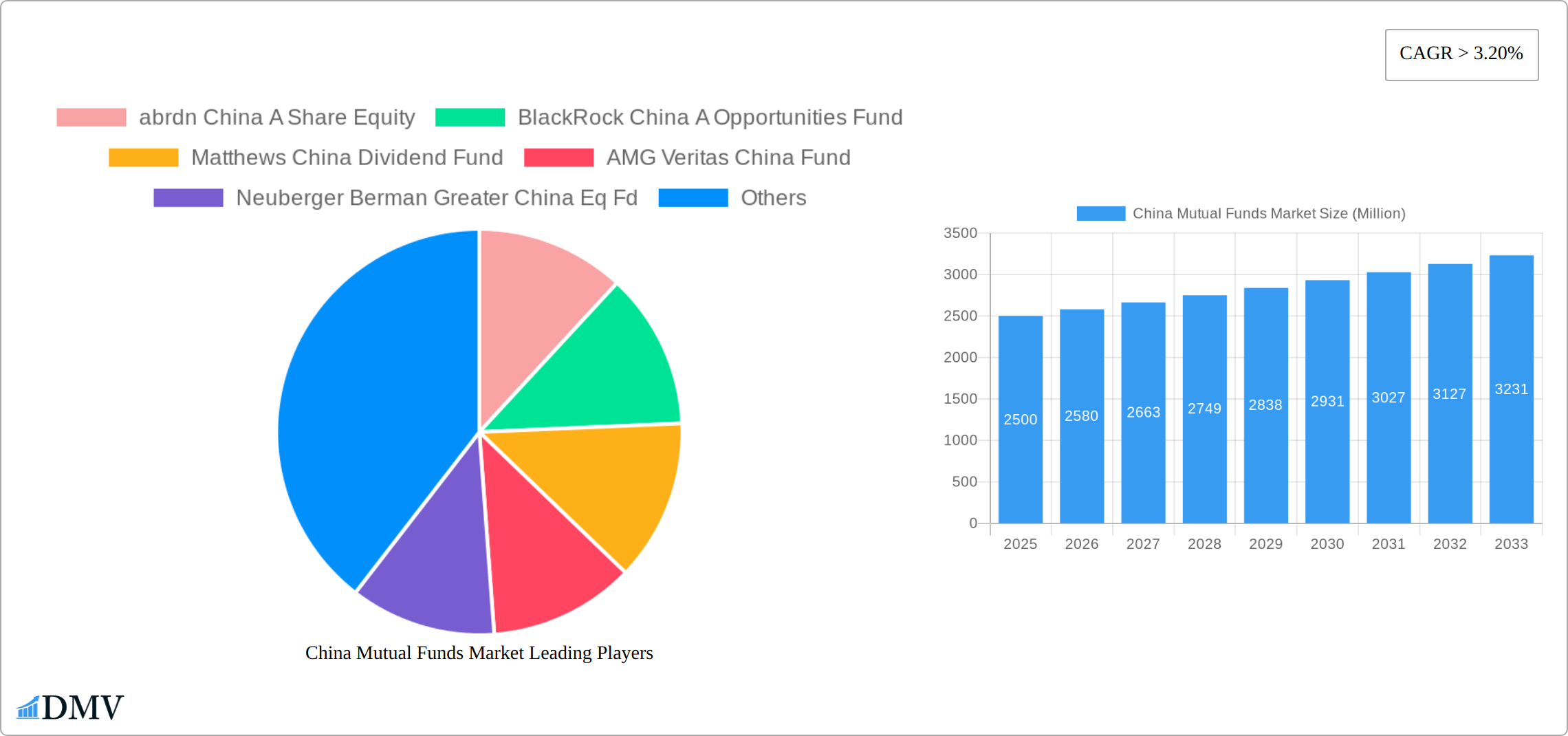

The China mutual funds market exhibits robust growth potential, fueled by a burgeoning middle class with increasing disposable income and a growing appetite for diversified investment options. A compound annual growth rate (CAGR) exceeding 3.20% since 2019 points to a consistently expanding market. This growth is driven by several factors, including China's ongoing economic development, supportive government policies encouraging domestic investment, and the increasing sophistication of Chinese investors seeking higher returns beyond traditional savings instruments. The market is segmented by fund type (e.g., equity, bond, balanced), investment strategy (e.g., growth, value, income), and investor profile (e.g., retail, institutional). Leading players like abrdn, BlackRock, Matthews, and others compete fiercely, offering a wide range of products to cater to diverse investor needs. While regulatory changes and macroeconomic uncertainties present potential headwinds, the long-term outlook remains positive, given China's considerable economic growth trajectory and expanding financial markets.

China Mutual Funds Market Market Size (In Billion)

The market's success hinges on continued investor education, the development of robust regulatory frameworks ensuring transparency and investor protection, and innovation in fund management strategies. The increasing integration of China's financial markets with the global economy also contributes to growth, attracting international investment and enhancing the competitiveness of Chinese mutual funds. While precise regional breakdowns are unavailable, the market's expansion is likely concentrated in major urban centers initially, with gradual penetration into less developed regions as financial literacy improves. The projected market size in 2033 will significantly exceed the 2025 estimate, reflecting sustained CAGR growth and increased investor participation. This continued growth will likely attract further competition and innovation within the industry, leading to more sophisticated products and services for investors.

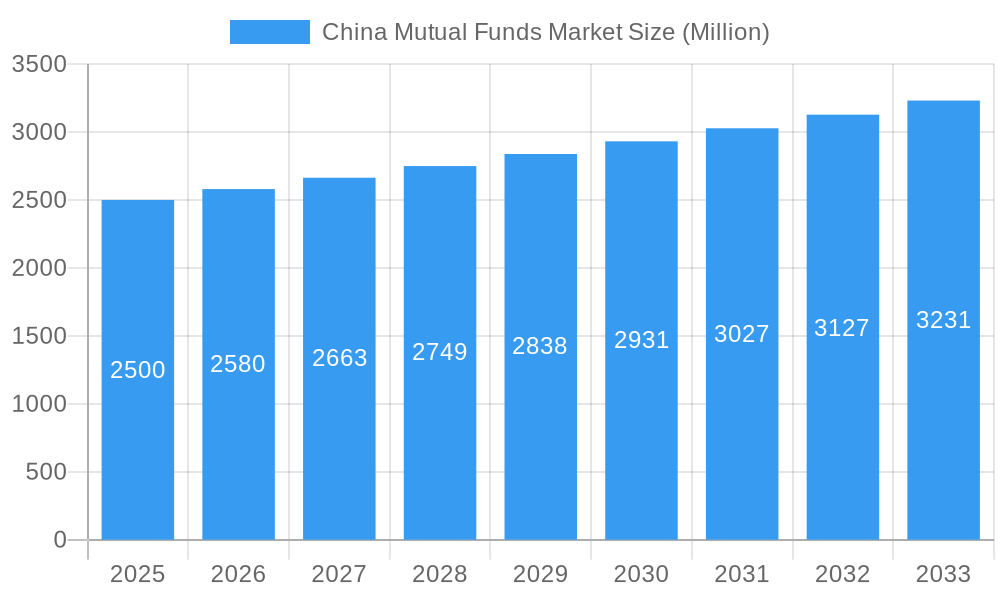

China Mutual Funds Market Company Market Share

China Mutual Funds Market Market Composition & Trends

The China Mutual Funds Market is a dynamic and evolving landscape, characterized by a strategic blend of market concentration, innovation, and a progressively liberalizing regulatory environment. While leading domestic asset managers hold a significant presence, controlling approximately 40% of the market share collectively among the top five, there is an increasing influence from international players due to recent policy shifts. Innovation is a key differentiator, with mutual fund companies actively developing sophisticated digital platforms and diverse product offerings. These innovations are often a direct response to regulatory encouragement for embracing financial technology (FinTech) and meeting the sophisticated demands of modern investors.

The regulatory framework is in a state of active development, with a notable trend towards greater market openness. Recent policies designed to attract foreign investment are intensifying competition and fostering a more innovative ecosystem. While alternative investment vehicles such as Exchange-Traded Funds (ETFs) and direct stock investments present a competitive challenge, mutual funds continue to maintain their appeal due to their inherent diversification benefits and the assurance of professional management. The investor base is broad, encompassing a wide spectrum from retail investors prioritizing long-term wealth accumulation to institutional investors seeking precise strategic asset allocation. The sector has witnessed substantial Mergers & Acquisitions (M&A) activity, with aggregate deal values reaching approximately [Insert Specific Figure] Million USD in the past year, underscoring a strategic push towards consolidation to achieve economies of scale and accelerate technological adoption.

- Market Concentration: The top five mutual fund companies collectively manage around 40% of the market, indicating a moderately concentrated structure with room for further competition.

- Innovation Catalysts: The adoption of advanced digital platforms and responsive regulatory changes are significant drivers of product and service innovation.

- Regulatory Landscape: A key trend is the ongoing liberalization of the market, with policies actively encouraging foreign investor participation.

- Substitute Products: ETFs and direct equity investments pose competitive threats, yet the diversified and professionally managed nature of mutual funds sustains their popularity.

- End-user Profiles: The market serves a diverse clientele, from retail investors focused on long-term growth to institutional investors requiring sophisticated asset allocation strategies.

- M&A Activities: Robust M&A trends are evident, with deal values reaching approximately [Insert Specific Figure] Million USD, reflecting a drive for consolidation and technological enhancement.

China Mutual Funds Market Industry Evolution

The China Mutual Funds Market has undergone significant evolution over the study period from 2019 to 2033. The market has seen a compound annual growth rate (CAGR) of approximately 15% from 2019 to 2024, driven by increasing financial literacy among the population and a burgeoning middle class seeking investment opportunities. Technological advancements have played a pivotal role, with the adoption of robo-advisors and online investment platforms reaching 30% by 2024. These platforms have democratized access to mutual funds, allowing a broader segment of the population to participate in the market.

Consumer demands have shifted towards more sustainable and socially responsible investment options, prompting mutual fund companies to launch ESG-focused funds. The growth trajectory is expected to continue, with the market projected to reach xx Million by 2033. The integration of artificial intelligence and big data analytics in fund management is anticipated to further enhance performance and attract tech-savvy investors. The market's evolution is also influenced by regulatory reforms aimed at enhancing transparency and investor protection, which have bolstered investor confidence and market stability.

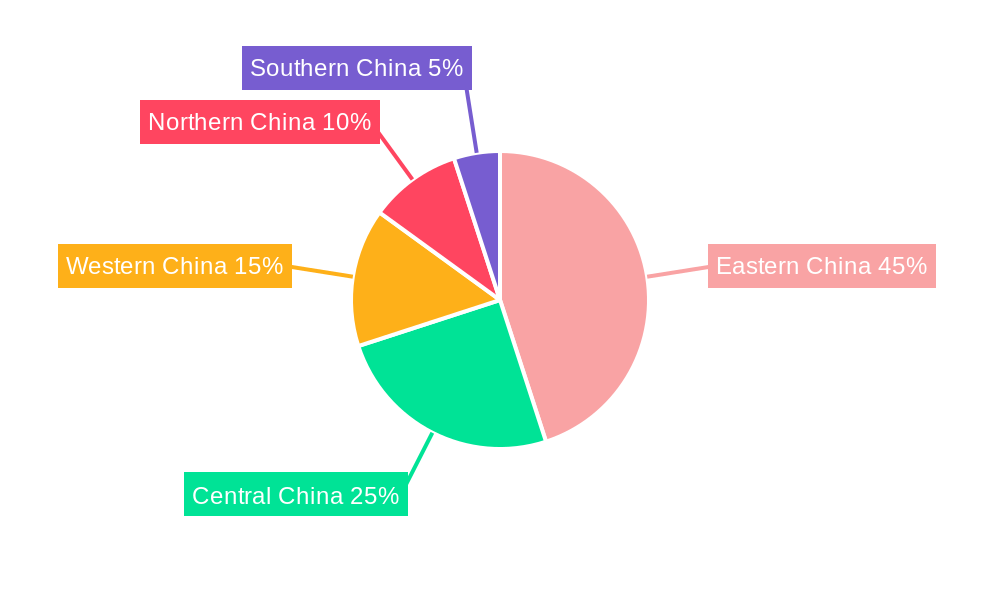

Leading Regions, Countries, or Segments in China Mutual Funds Market

The Shanghai region stands out as a dominant player in the China Mutual Funds Market, driven by its status as a financial hub and the presence of major financial institutions. The region's investment trends are characterized by a high concentration of wealth management services and a robust regulatory environment that supports market growth.

- Key Drivers:

- Investment Trends: High concentration of wealth management services.

- Regulatory Support: Robust regulatory environment fostering market growth.

- Technological Infrastructure: Advanced digital platforms facilitating investment.

Shanghai's dominance can be attributed to several factors. Firstly, the region benefits from a well-developed financial ecosystem that attracts both domestic and international investors. The Shanghai Stock Exchange (SSE) plays a crucial role in facilitating the trading of mutual funds, with trading volumes reaching xx Million daily. Secondly, the regulatory support in Shanghai has been instrumental in creating a conducive environment for mutual fund growth. The China Securities Regulatory Commission (CSRC) has implemented policies that encourage innovation and competition, leading to a proliferation of new fund products tailored to diverse investor needs.

Furthermore, the technological infrastructure in Shanghai is advanced, with digital platforms and fintech solutions enhancing the accessibility and efficiency of mutual fund investments. These platforms have not only attracted a younger demographic but also enabled more sophisticated investment strategies. The combination of these factors positions Shanghai as a leading region in the China Mutual Funds Market, with significant potential for future growth and development.

China Mutual Funds Market Product Innovations

Product innovations in the China Mutual Funds Market have focused on enhancing investor experience and returns. The introduction of thematic funds targeting sectors like technology, healthcare, and green energy has attracted investors interested in specific growth areas. Additionally, the use of AI and machine learning in fund management has improved decision-making processes, offering personalized investment strategies. These innovations have not only diversified the product offerings but also improved performance metrics, with some funds achieving above-average returns due to their unique selling propositions and technological advancements.

Propelling Factors for China Mutual Funds Market Growth

The China Mutual Funds Market is experiencing robust growth fueled by a confluence of powerful drivers. Technological advancements are at the forefront, with the integration of Artificial Intelligence (AI) in fund management not only optimizing decision-making processes but also attracting a new generation of tech-savvy investors. Economically, the sustained expansion of the middle class, coupled with a palpable increase in financial literacy across the population, is significantly boosting the demand for accessible and professionally managed investment products. Furthermore, progressive regulatory reforms, particularly the strategic opening of the market to foreign investors, are injecting a healthy dose of competition and stimulating a wave of innovation, thereby accelerating market expansion and enhancing the overall investment ecosystem.

Obstacles in the China Mutual Funds Market Market

Despite its promising trajectory, the China Mutual Funds Market navigates several significant obstacles. The regulatory environment, while evolving, presents challenges in the form of stringent compliance requirements that can complicate market entry and operational efficiency for both domestic and international firms. Global supply chain disruptions, a persistent concern in the broader economic landscape, can indirectly impact fund performance and investor confidence. The market is also characterized by intense competitive pressures, with a multitude of players vying for market share, which can sometimes lead to aggressive pricing strategies and pressure on profit margins. These barriers have tangible financial implications; for instance, the annual cost of regulatory compliance alone is estimated to be around [Insert Specific Figure] Million USD.

Future Opportunities in China Mutual Funds Market

The China Mutual Funds Market is replete with burgeoning opportunities for strategic growth and diversification. The escalating global focus on Environmental, Social, and Governance (ESG) investing is carving out a substantial new market segment. Projections indicate that the demand for sustainable and ethical funds is set to grow by an impressive 20% annually. Emerging technological innovations, such as blockchain and advanced AI applications, hold the potential to fundamentally transform fund management operations and deepen investor engagement through personalized experiences. Moreover, the increasing wealth accumulation and investment appetite among younger demographics present a particularly lucrative avenue for developing tailored investment products that resonate with their financial aspirations and risk profiles.

Major Players in the China Mutual Funds Market Ecosystem

- abrdn China A Share Equity

- BlackRock China A Opportunities Fund

- Matthews China Dividend Fund

- AMG Veritas China Fund

- Neuberger Berman Greater China Eq Fd

- Oberweis China Opportunities Fund

- Goldman Sachs China Equity Fund

- Eaton Vance Greater China Growth Fund

- AB All China Equity Portfolio

- Coloumbia Greater China Fund

**List Not Exhaustive

Key Developments in China Mutual Funds Market Industry

- September 2021: Neuberger Berman Group, an American asset manager, became the third foreign company to gain access to China's growing mutual fund market after receiving approval from the country's securities regulator to operate a wholly-owned mutual fund business on the Chinese mainland. This development has intensified competition and spurred innovation in the market.

- April 2021: The SME Board was merged with SZSE's Main Board, marking a significant step in deepening China's capital market reform. The merger aims to refine market functions, strengthen market foundations, improve market activity and resilience, facilitate market-oriented capital allocation, and better serve national strategic development, significantly impacting the mutual funds market dynamics.

Strategic China Mutual Funds Market Market Forecast

The strategic forecast for the China Mutual Funds Market paints a picture of sustained and robust growth, underpinned by a potent mix of propelling forces. The continued upward trajectory of the middle class and the deepening financial literacy across the populace will serve as a consistent engine for demand for a wide array of investment products. Technological advancements, especially in the realms of AI and blockchain, are anticipated to usher in a new era of fund management and investor interaction, enhancing efficiency and accessibility. The ongoing process of regulatory reform, which includes the progressive opening of the market to international participants, will further invigorate competition and spur innovation. Consequently, the market is strategically positioned to reach an estimated value of [Insert Specific Figure] Trillion USD by 2033, presenting substantial and exciting opportunities for all stakeholders involved.

China Mutual Funds Market Segmentation

-

1. Fund Type

- 1.1. Equity

- 1.2. Debt

- 1.3. Multi-Asset

- 1.4. Money Market

-

2. Investor Type

- 2.1. Households

- 2.2. Monetary Financial Institutions

- 2.3. General Government

- 2.4. Non-Financial Corporations

- 2.5. Insurers & Pension Funds

China Mutual Funds Market Segmentation By Geography

- 1. China

China Mutual Funds Market Regional Market Share

Geographic Coverage of China Mutual Funds Market

China Mutual Funds Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.8% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Growth of Stock or Equity Funds is Driving the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. China Mutual Funds Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Fund Type

- 5.1.1. Equity

- 5.1.2. Debt

- 5.1.3. Multi-Asset

- 5.1.4. Money Market

- 5.2. Market Analysis, Insights and Forecast - by Investor Type

- 5.2.1. Households

- 5.2.2. Monetary Financial Institutions

- 5.2.3. General Government

- 5.2.4. Non-Financial Corporations

- 5.2.5. Insurers & Pension Funds

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. China

- 5.1. Market Analysis, Insights and Forecast - by Fund Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 abrdn China A Share Equity

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 BlackRock China A Opportunities Fund

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Matthews China Dividend Fund

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 AMG Veritas China Fund

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Neuberger Berman Greater China Eq Fd

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Oberweis China Opportunities Fund

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Goldman Sachs China Equity Fund

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Eaton Vance Greater China Growth Fund

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 AB All China Equity Portfolio

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Coloumbia Greater China Fund**List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 abrdn China A Share Equity

List of Figures

- Figure 1: China Mutual Funds Market Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: China Mutual Funds Market Share (%) by Company 2025

List of Tables

- Table 1: China Mutual Funds Market Revenue undefined Forecast, by Fund Type 2020 & 2033

- Table 2: China Mutual Funds Market Revenue undefined Forecast, by Investor Type 2020 & 2033

- Table 3: China Mutual Funds Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 4: China Mutual Funds Market Revenue undefined Forecast, by Fund Type 2020 & 2033

- Table 5: China Mutual Funds Market Revenue undefined Forecast, by Investor Type 2020 & 2033

- Table 6: China Mutual Funds Market Revenue undefined Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the China Mutual Funds Market?

The projected CAGR is approximately 6.8%.

2. Which companies are prominent players in the China Mutual Funds Market?

Key companies in the market include abrdn China A Share Equity, BlackRock China A Opportunities Fund, Matthews China Dividend Fund, AMG Veritas China Fund, Neuberger Berman Greater China Eq Fd, Oberweis China Opportunities Fund, Goldman Sachs China Equity Fund, Eaton Vance Greater China Growth Fund, AB All China Equity Portfolio, Coloumbia Greater China Fund**List Not Exhaustive.

3. What are the main segments of the China Mutual Funds Market?

The market segments include Fund Type, Investor Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Growth of Stock or Equity Funds is Driving the Market.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

Sep 2021: Neuberger Berman Group, an American asset manager, is the third foreign company to gain access to China's growing mutual fund market after the country's securities regulator granted its application to operate a wholly-owned mutual fund business on the Chinese mainland,

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "China Mutual Funds Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the China Mutual Funds Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the China Mutual Funds Market?

To stay informed about further developments, trends, and reports in the China Mutual Funds Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence