Key Insights

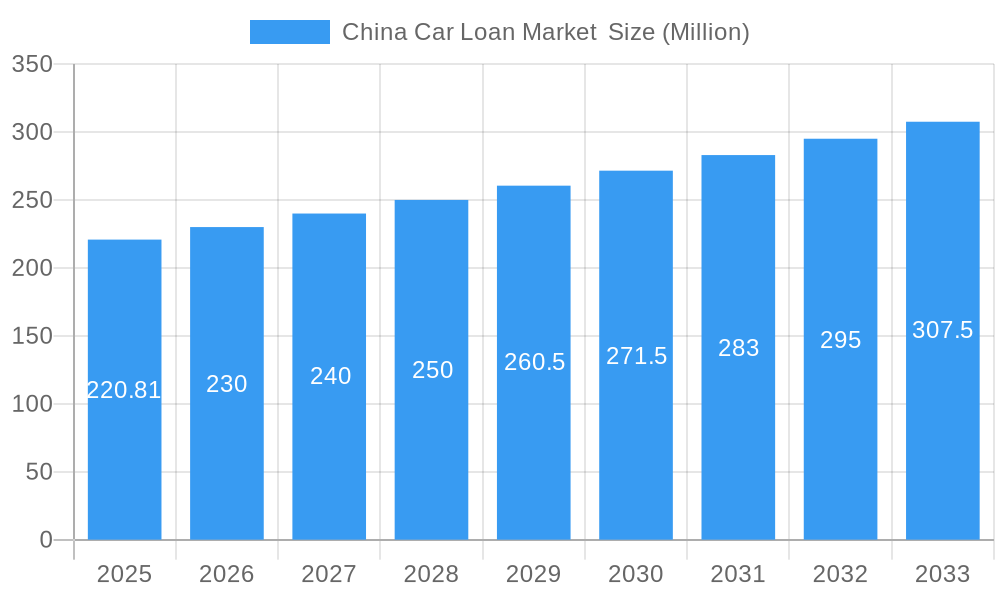

The China car loan market, valued at $220.81 million in 2025, is projected to experience robust growth, driven by a rising middle class with increased disposable income and a burgeoning automotive industry. The Compound Annual Growth Rate (CAGR) of 4.16% from 2025 to 2033 indicates a steady expansion, fueled by government initiatives promoting vehicle ownership and favorable financing options. Key players like Industrial and Commercial Bank of China (ICBC), China Construction Bank (CCB), and Bank of China (BOC) dominate the market, leveraging their extensive branch networks and established customer bases. However, competition is intensifying with the emergence of fintech companies offering innovative and convenient digital lending solutions. Growth will be influenced by factors such as macroeconomic conditions, interest rate fluctuations, and government regulations impacting the automotive sector. Furthermore, evolving consumer preferences towards electric vehicles (EVs) and the development of associated financing products will shape market dynamics. The market's expansion is also supported by improving infrastructure and increasing urbanization across the country. This expansion presents substantial opportunities for lenders to capitalize on this growing segment of the financial market.

China Car Loan Market Market Size (In Million)

The forecast period (2025-2033) anticipates a consistent increase in market value, reflecting the sustained demand for automobiles and accessible financing options. Factors such as government policies aimed at boosting domestic automotive production and encouraging car ownership, particularly in rural areas, will play a significant role. Challenges remain, including the potential for fluctuations in economic growth and increasing competition from both established banks and new entrants. Successfully navigating these complexities will require lenders to offer competitive interest rates, innovative lending products tailored to the evolving needs of Chinese consumers, and robust risk management strategies. A proactive approach to technological advancements, including leveraging data analytics and AI-powered credit scoring, will also be crucial to securing a strong market position.

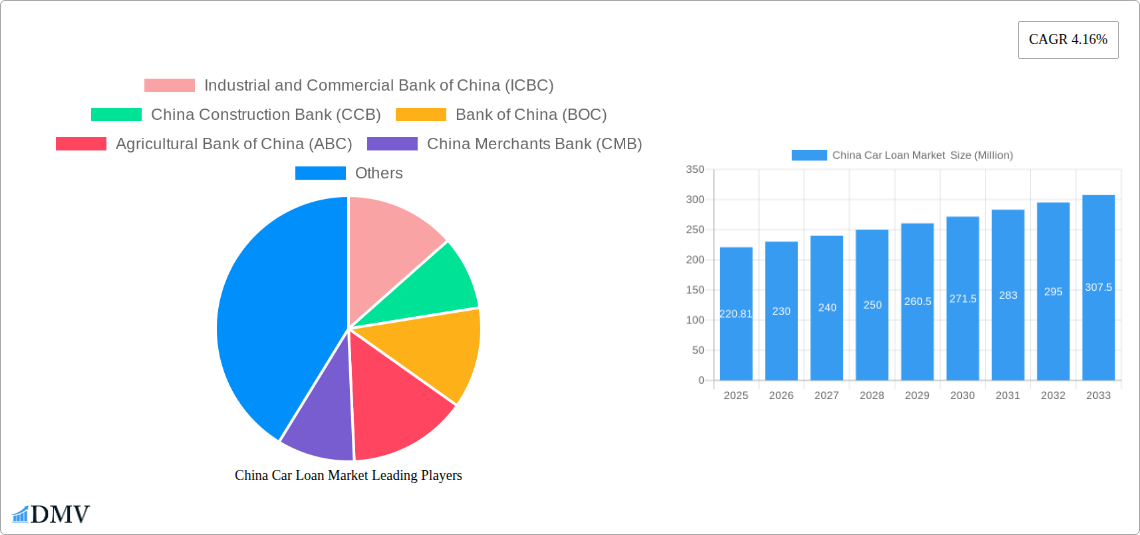

China Car Loan Market Company Market Share

China Car Loan Market: A Comprehensive Report (2019-2033)

This insightful report provides a detailed analysis of the dynamic China car loan market, offering a comprehensive overview of its current state, future trajectory, and key players. With a study period spanning 2019-2033, a base year of 2025, and an estimated year of 2025, this report is an indispensable resource for stakeholders seeking to navigate this rapidly evolving landscape. The forecast period covers 2025-2033, while the historical period analyzed is 2019-2024. The total market size is predicted to reach xx Million by 2033.

China Car Loan Market Market Composition & Trends

This section delves into the intricate composition of the China car loan market, examining market concentration, innovation drivers, regulatory frameworks, substitute products, end-user profiles, and mergers and acquisitions (M&A) activities. We analyze the market share distribution amongst key players, revealing the competitive dynamics at play. The report also quantifies M&A deal values, providing a clear picture of investment trends and strategic partnerships within the sector. The market is characterized by a high degree of competition, with several major players vying for market share. Innovation in financing options and technological integration are key catalysts driving market growth. Stringent regulatory oversight significantly influences market operations. The rising popularity of electric vehicles and alternative financing solutions presents challenges and opportunities alike. The report estimates that the top five players collectively held approximately xx% of the market share in 2024. Significant M&A activity, totaling approximately xx Million in 2024, reshaped the market landscape.

- Market Concentration: High, with top 5 players controlling xx% of market share (2024).

- Innovation Catalysts: Fintech integration, personalized loan offerings, EV financing schemes.

- Regulatory Landscape: Stringent regulations concerning lending practices and consumer protection.

- Substitute Products: Peer-to-peer lending platforms, leasing options.

- End-User Profiles: Individuals, dealerships, fleet operators, leasing companies.

- M&A Activities: Significant consolidation in recent years, with total deal values reaching xx Million in 2024.

China Car Loan Market Industry Evolution

This section traces the evolution of the China car loan market, analyzing its growth trajectory, technological advancements, and evolving consumer preferences. We examine growth rates, adoption rates of new technologies, and shifting consumer demands for diverse financing options, particularly in the booming electric vehicle segment. The market has experienced substantial growth driven by increasing car ownership, favorable government policies, and expanding financial services. Technological advancements, such as online lending platforms and digital credit scoring, have significantly enhanced efficiency and access to credit. Furthermore, shifting consumer preferences towards electric vehicles and personalized financing solutions are reshaping the market dynamics. The market is projected to grow at a Compound Annual Growth Rate (CAGR) of xx% from 2025 to 2033. The adoption rate of online car loan platforms increased by xx% between 2021 and 2024.

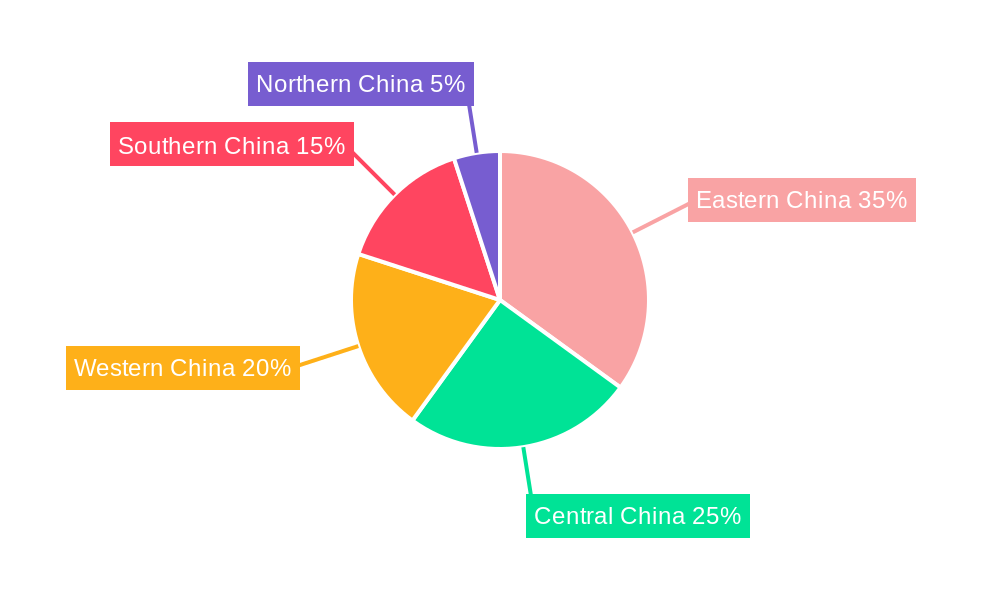

Leading Regions, Countries, or Segments in China Car Loan Market

This section pinpoints the dominant regions, countries, or segments within the China car loan market, providing a granular analysis of the factors contributing to their prominence. The analysis considers economic factors, government incentives, and infrastructure development. Coastal provinces such as Guangdong and Jiangsu, known for their robust automotive industries and high disposable incomes, consistently lead the market.

- Key Drivers (Guangdong Province):

- High concentration of automotive manufacturing plants.

- Strong economic growth and high disposable incomes.

- Supportive government policies promoting automotive sales.

- Key Drivers (Jiangsu Province):

- Developed financial infrastructure and access to capital.

- Large consumer base with increasing car ownership rates.

- Government initiatives to stimulate car loan uptake.

Guangdong and Jiangsu’s dominance stems from their combination of strong automotive manufacturing sectors, high levels of disposable income, and proactive government support, creating a fertile ground for car loan growth.

China Car Loan Market Product Innovations

Recent innovations include the rise of online lending platforms that streamline the application process, personalized loan products tailored to specific consumer needs (e.g., EV financing), and the integration of AI-powered credit scoring systems that improve risk assessment and lending decisions. These advancements enhance efficiency, reduce costs, and broaden access to credit. The introduction of bundled financing packages combining insurance and maintenance agreements adds further value to consumers. The adoption of blockchain technology to enhance security and transparency is also gaining traction.

Propelling Factors for China Car Loan Market Growth

Several factors contribute to the robust growth of the China car loan market. Government incentives, such as subsidies and tax breaks for EV purchases, stimulate demand. Expanding middle-class purchasing power fuels demand for vehicles and associated financing options. Technological advancements, such as online platforms and AI-powered risk assessment tools, enhance efficiency and affordability. Moreover, favorable regulatory environments and increased access to credit further bolster market expansion.

Obstacles in the China Car Loan Market Market

The market faces challenges such as stringent regulatory compliance requirements, which can increase operational costs and complexity. Economic downturns or fluctuations in consumer confidence can impact lending volumes. Intense competition among lenders necessitates continuous innovation and strategic adjustments. Furthermore, potential supply chain disruptions and geopolitical risks can affect car production and consequently impact the car loan market.

Future Opportunities in China Car Loan Market

Emerging opportunities reside in the expanding EV market, demanding specialized financing solutions. The potential of fintech integration to enhance efficiency and personalization presents significant possibilities. Untapped rural markets with increasing car ownership represent considerable growth potential. Focus on sustainable and green financing options will be crucial for long-term market sustainability.

Major Players in the China Car Loan Market Ecosystem

- Industrial and Commercial Bank of China (ICBC)

- China Construction Bank (CCB)

- Bank of China (BOC)

- Agricultural Bank of China (ABC)

- China Merchants Bank (CMB)

- China Minsheng Banking Corp Ltd

- Ping An Bank

- Bank of Communications (BOCOM)

- China Everbright Bank

- China CITIC Bank

Key Developments in China Car Loan Market Industry

- July 2023: Volkswagen partnered with Chinese EV startup Xpeng and joint venture partner SAIC to develop new models and potentially co-create platforms, leveraging local expertise to maintain market share. This signals a significant shift towards collaboration and localization in the Chinese automotive market.

- October 2022: Santander's Brazilian subsidiary reached an agreement with BYD, a prominent Chinese electric vehicle manufacturer, to finance BYD's car sales and dealerships in Brazil. This indicates expanding international financing partnerships for Chinese automakers.

Strategic China Car Loan Market Market Forecast

The China car loan market is poised for continued expansion, driven by strong economic growth, rising car ownership, and government support for the automotive industry, particularly in the electric vehicle sector. Strategic partnerships and technological innovation will shape future market dynamics. The market's robust growth potential positions it as an attractive investment destination for both domestic and international players. Expanding into rural markets and developing innovative financing solutions tailored to the unique needs of the burgeoning EV market offer lucrative opportunities for growth.

China Car Loan Market Segmentation

-

1. Product Type

- 1.1. Passenger Vehicle

- 1.2. Commercial Vehicle

-

2. Provider Type

- 2.1. Banks

- 2.2. Non-Banking Financial Services

- 2.3. Original Equipment Manufacturers

- 2.4. Other Provider Types (Fintech Companies)

-

3. Ownership

- 3.1. Used Vehicle

- 3.2. New Vehicle

-

4. Tenure

- 4.1. Less Than Three Years

- 4.2. 3-5 Years

- 4.3. More Than 5 Years

China Car Loan Market Segmentation By Geography

- 1. China

China Car Loan Market Regional Market Share

Geographic Coverage of China Car Loan Market

China Car Loan Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.16% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rise in Demand for Luxury Cars Fueling the Market Growth

- 3.3. Market Restrains

- 3.3.1. Rise in Demand for Luxury Cars Fueling the Market Growth

- 3.4. Market Trends

- 3.4.1. Increase in Electric Vehicle Sales

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. China Car Loan Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Passenger Vehicle

- 5.1.2. Commercial Vehicle

- 5.2. Market Analysis, Insights and Forecast - by Provider Type

- 5.2.1. Banks

- 5.2.2. Non-Banking Financial Services

- 5.2.3. Original Equipment Manufacturers

- 5.2.4. Other Provider Types (Fintech Companies)

- 5.3. Market Analysis, Insights and Forecast - by Ownership

- 5.3.1. Used Vehicle

- 5.3.2. New Vehicle

- 5.4. Market Analysis, Insights and Forecast - by Tenure

- 5.4.1. Less Than Three Years

- 5.4.2. 3-5 Years

- 5.4.3. More Than 5 Years

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. China

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Industrial and Commercial Bank of China (ICBC)

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 China Construction Bank (CCB)

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Bank of China (BOC)

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Agricultural Bank of China (ABC)

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 China Merchants Bank (CMB)

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 China Minsheng Banking Corp Ltd

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Ping An Bank

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Bank of Communications (BOCOM)

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 China Everbright Bank

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 China CITIC Bank**List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Industrial and Commercial Bank of China (ICBC)

List of Figures

- Figure 1: China Car Loan Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: China Car Loan Market Share (%) by Company 2025

List of Tables

- Table 1: China Car Loan Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 2: China Car Loan Market Volume Billion Forecast, by Product Type 2020 & 2033

- Table 3: China Car Loan Market Revenue Million Forecast, by Provider Type 2020 & 2033

- Table 4: China Car Loan Market Volume Billion Forecast, by Provider Type 2020 & 2033

- Table 5: China Car Loan Market Revenue Million Forecast, by Ownership 2020 & 2033

- Table 6: China Car Loan Market Volume Billion Forecast, by Ownership 2020 & 2033

- Table 7: China Car Loan Market Revenue Million Forecast, by Tenure 2020 & 2033

- Table 8: China Car Loan Market Volume Billion Forecast, by Tenure 2020 & 2033

- Table 9: China Car Loan Market Revenue Million Forecast, by Region 2020 & 2033

- Table 10: China Car Loan Market Volume Billion Forecast, by Region 2020 & 2033

- Table 11: China Car Loan Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 12: China Car Loan Market Volume Billion Forecast, by Product Type 2020 & 2033

- Table 13: China Car Loan Market Revenue Million Forecast, by Provider Type 2020 & 2033

- Table 14: China Car Loan Market Volume Billion Forecast, by Provider Type 2020 & 2033

- Table 15: China Car Loan Market Revenue Million Forecast, by Ownership 2020 & 2033

- Table 16: China Car Loan Market Volume Billion Forecast, by Ownership 2020 & 2033

- Table 17: China Car Loan Market Revenue Million Forecast, by Tenure 2020 & 2033

- Table 18: China Car Loan Market Volume Billion Forecast, by Tenure 2020 & 2033

- Table 19: China Car Loan Market Revenue Million Forecast, by Country 2020 & 2033

- Table 20: China Car Loan Market Volume Billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the China Car Loan Market ?

The projected CAGR is approximately 4.16%.

2. Which companies are prominent players in the China Car Loan Market ?

Key companies in the market include Industrial and Commercial Bank of China (ICBC), China Construction Bank (CCB), Bank of China (BOC), Agricultural Bank of China (ABC), China Merchants Bank (CMB), China Minsheng Banking Corp Ltd, Ping An Bank, Bank of Communications (BOCOM), China Everbright Bank, China CITIC Bank**List Not Exhaustive.

3. What are the main segments of the China Car Loan Market ?

The market segments include Product Type, Provider Type, Ownership, Tenure .

4. Can you provide details about the market size?

The market size is estimated to be USD 220.81 Million as of 2022.

5. What are some drivers contributing to market growth?

Rise in Demand for Luxury Cars Fueling the Market Growth.

6. What are the notable trends driving market growth?

Increase in Electric Vehicle Sales.

7. Are there any restraints impacting market growth?

Rise in Demand for Luxury Cars Fueling the Market Growth.

8. Can you provide examples of recent developments in the market?

July 2023: Volkswagen and Chinese EV startup Xpeng announced a partnership and joint venture partner SAIC to build new models and potentially co-create platforms as it attempts to use local expertise to protect market share.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "China Car Loan Market ," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the China Car Loan Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the China Car Loan Market ?

To stay informed about further developments, trends, and reports in the China Car Loan Market , consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence