Key Insights

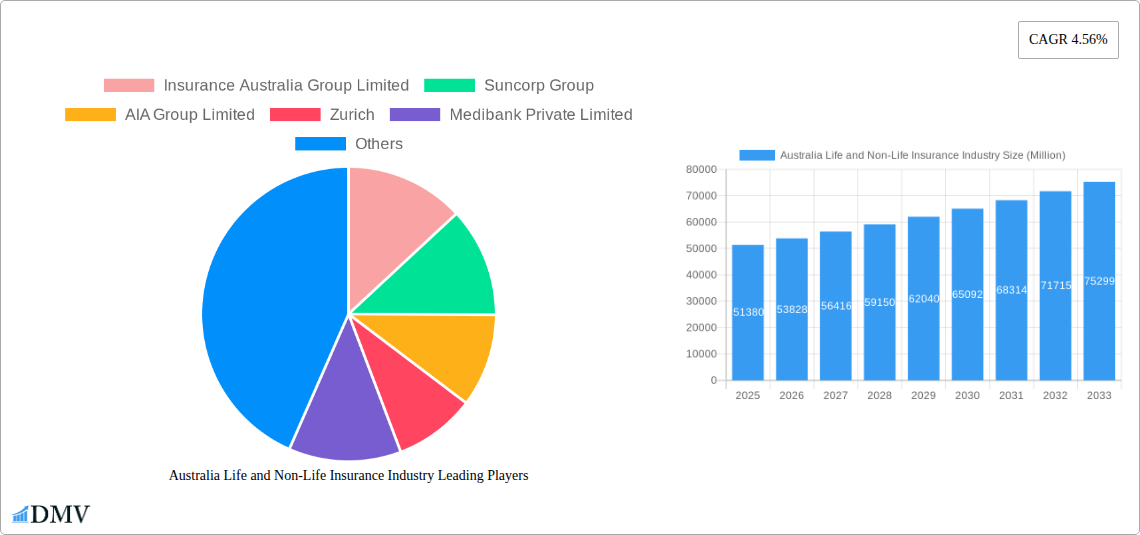

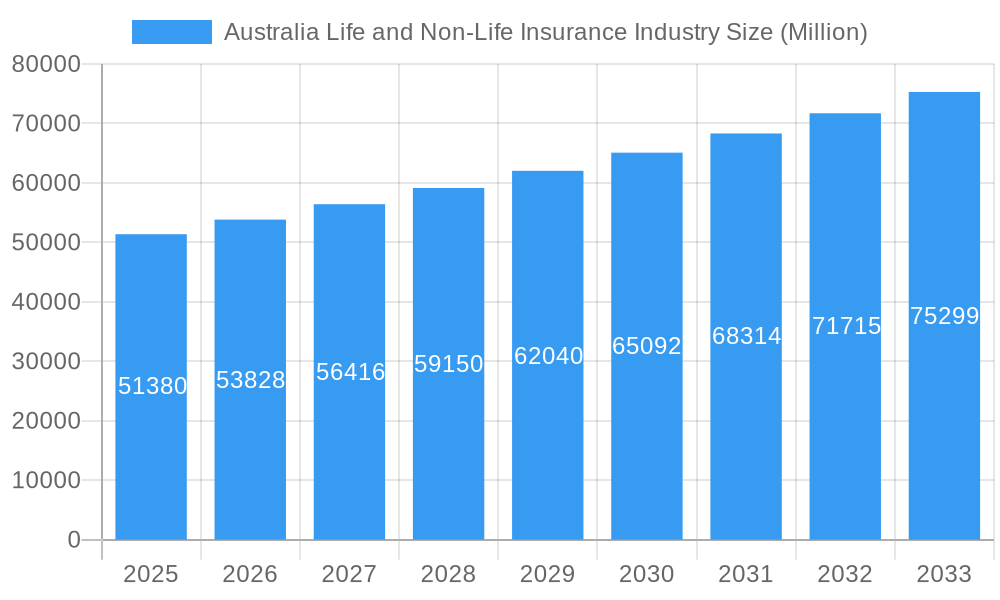

The Australian life and non-life insurance industry, valued at $51.38 billion in 2025, is projected to experience steady growth, exhibiting a compound annual growth rate (CAGR) of 4.56% from 2025 to 2033. This growth is driven by several factors. Firstly, an aging population necessitates increased demand for health and retirement insurance products. Secondly, rising awareness of financial protection needs, coupled with increasing disposable incomes, fuels demand for various insurance solutions. Thirdly, technological advancements, including improved data analytics and digital distribution channels, enhance efficiency and customer experience, further stimulating market expansion. However, regulatory changes, particularly those focused on consumer protection and affordability, present challenges to industry players. Intense competition amongst established players like Insurance Australia Group Limited, Suncorp Group, and AIA Group Limited, alongside emerging Insurtech companies, also influences market dynamics.

Australia Life and Non-Life Insurance Industry Market Size (In Billion)

The industry segmentation is likely diverse, encompassing life insurance (including term life, whole life, and annuities), health insurance, general insurance (motor, home, travel), and specialized insurance products catering to niche markets. Sustained economic growth and favorable government policies would further support the industry's expansion. Conversely, economic downturns or significant policy shifts could negatively impact growth trajectories. The forecast period (2025-2033) anticipates continued market consolidation, with larger players potentially acquiring smaller firms to expand their market share and product offerings. This continuous evolution presents both opportunities and challenges for insurers to adapt and innovate to remain competitive in the dynamic Australian insurance landscape.

Australia Life and Non-Life Insurance Industry Company Market Share

Australia Life and Non-Life Insurance Industry Market Report: 2019-2033

This comprehensive report provides a detailed analysis of the Australian life and non-life insurance industry, offering invaluable insights for stakeholders seeking to understand market dynamics, growth trajectories, and future opportunities. The report covers the period from 2019 to 2033, with a focus on the forecast period from 2025 to 2033 and a base year of 2025. Key players like Insurance Australia Group Limited, Suncorp Group, AIA Group Limited, and Zurich are analyzed, alongside numerous other significant contributors. This in-depth analysis will equip you with the knowledge to make informed strategic decisions within this dynamic market.

Australia Life and Non-Life Insurance Industry Market Composition & Trends

This section delves into the composition and trends shaping the Australian life and non-life insurance market from 2019-2024 and provides a forecast until 2033. We examine market concentration, revealing the market share distribution amongst key players like Insurance Australia Group Limited, Suncorp Group, and AIA Group Limited. We analyze the influence of innovation catalysts, such as the rise of Insurtech and the adoption of IoT technologies, on the industry's evolution. The regulatory landscape, including its impact on market competitiveness and product offerings, is also explored.

- Market Concentration: IAG holds an estimated xx% market share in 2024, followed by Suncorp Group with xx% and AIA Group Limited with xx%. The remaining market share is distributed among numerous smaller players, indicating a moderately concentrated market.

- Innovation Catalysts: The increasing adoption of Insurtech solutions and the integration of IoT devices are driving efficiency and creating new product opportunities.

- Regulatory Landscape: The Australian Prudential Regulation Authority (APRA) plays a significant role in shaping the regulatory environment, influencing solvency requirements and consumer protection measures.

- Substitute Products: Alternative risk management strategies, such as self-insurance and risk pooling, represent potential substitutes to traditional insurance.

- End-User Profiles: The report profiles key customer segments and their evolving needs, covering individual consumers, businesses (SMEs and corporates), and other entities.

- M&A Activities: The report analyzes significant M&A activity, noting deal values exceeding $xx Million in the period 2019-2024, with an anticipated increase to $xx Million during the forecast period (2025-2033).

Australia Life and Non-Life Insurance Industry Industry Evolution

This section provides a comprehensive analysis of the Australian life and non-life insurance industry’s evolution. It examines market growth trajectories, revealing a Compound Annual Growth Rate (CAGR) of xx% during the historical period (2019-2024) and projecting a CAGR of xx% for the forecast period (2025-2033). The impact of technological advancements, particularly in areas like AI, big data analytics, and blockchain technology, on market efficiency and customer engagement are thoroughly discussed. Furthermore, we analyze shifting consumer demands, exploring the growing preference for personalized and digitally enabled insurance solutions. The section also examines the implications of macroeconomic factors such as economic growth, interest rates, and inflation on insurance demand. The report showcases specific examples of how technological advancements and changing consumer demands have impacted various segments within the Australian insurance landscape, supported by quantifiable data on adoption rates and growth in specific product lines.

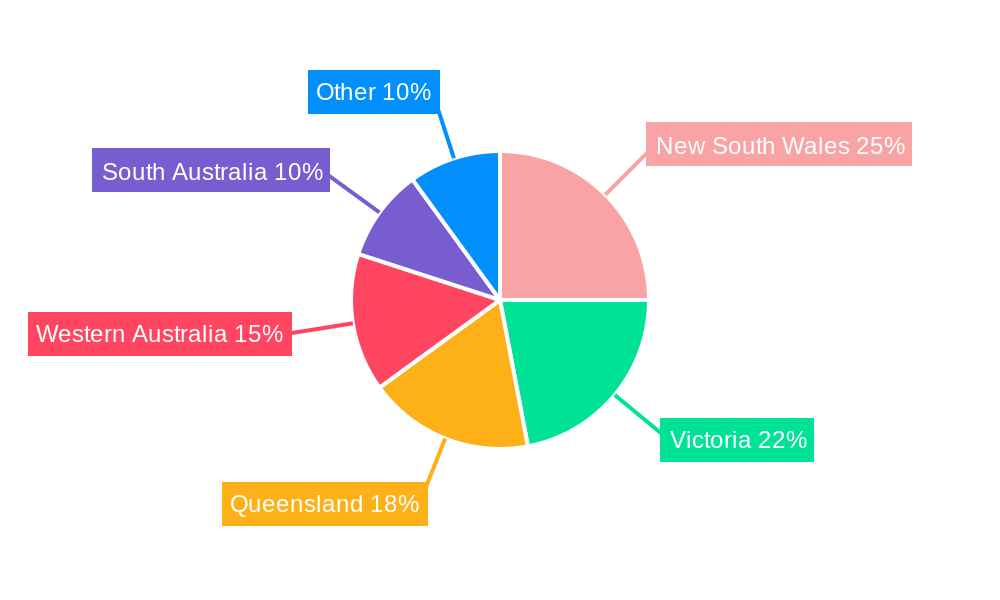

Leading Regions, Countries, or Segments in Australia Life and Non-Life Insurance Industry

This section identifies the dominant regions, countries, or segments within the Australian life and non-life insurance market. While the Australian market is predominantly national, the report details regional variations in market performance, focusing on key drivers of growth and dominance in specific areas. The influence of factors such as population density, economic activity, and regulatory frameworks on the geographic distribution of the insurance market are investigated.

- Key Drivers of Dominance:

- High Population Density in Major Cities: Sydney, Melbourne, and Brisbane exhibit higher insurance penetration due to concentrated populations.

- Strong Economic Growth: Periods of economic prosperity correlate with increased demand for insurance products.

- Supportive Regulatory Framework: A stable and transparent regulatory environment fosters investor confidence and encourages market growth.

Australia Life and Non-Life Insurance Industry Product Innovations

This section highlights recent product innovations, including the emergence of parametric insurance products and the increasing use of telematics in motor insurance. These innovations demonstrate a shift towards personalized and data-driven insurance solutions, leveraging technological advancements to improve risk assessment, pricing, and customer experience. Unique selling propositions (USPs) are identified and analyzed, demonstrating how companies are differentiating themselves in a competitive market.

Propelling Factors for Australia Life and Non-Life Insurance Industry Growth

Several key factors drive the growth of the Australian life and non-life insurance industry. Technological advancements, such as AI-powered risk assessment tools and blockchain technology for improved claims processing, enhance efficiency and reduce operational costs. Economic growth fuels increased demand for various insurance products, including health, motor, and property insurance. Furthermore, supportive regulatory policies, aimed at promoting financial stability and consumer protection, create a conducive environment for market expansion.

Obstacles in the Australia Life and Non-Life Insurance Industry Market

The Australian life and non-life insurance market faces several challenges. Stringent regulatory requirements, particularly concerning capital adequacy and solvency, can constrain market expansion and profitability. Supply chain disruptions, potentially impacting claims processing and service delivery, pose a significant risk. Intense competition amongst established players and the emergence of Insurtech disruptors create significant pressure on pricing and market share. These factors collectively create a complex environment for insurers operating in the Australian market.

Future Opportunities in Australia Life and Non-Life Insurance Industry

The Australian life and non-life insurance market presents numerous future opportunities. The expansion of Insurtech solutions creates space for innovative product offerings and improved customer experiences. The growing adoption of IoT devices opens avenues for risk management and personalized insurance products. Emerging consumer demands for sustainable and ethical insurance solutions present opportunities for insurers who embrace these trends. Furthermore, the expansion into under-penetrated segments like niche insurance solutions provides significant potential for growth.

Major Players in the Australia Life and Non-Life Insurance Industry Ecosystem

- Insurance Australia Group Limited

- Suncorp Group

- AIA Group Limited

- Zurich

- Medibank Private Limited

- Genworth Mortgage Insurance Australia Limited

- ClearView Wealth Limited

- Cover-More Limited

- AMP Limited

- NIB Holdings Limited

Key Developments in Australia Life and Non-Life Insurance Industry Industry

- September 2022: Launch of io.Insure, the world's first online marketplace for M&A insurance for SMEs, signifying a significant shift towards digitalization in the insurance sector.

- February 2023: IAG's investment in Myriota, showcasing the exploration of IoT applications to enhance risk management and customer value propositions.

Strategic Australia Life and Non-Life Insurance Industry Market Forecast

The Australian life and non-life insurance market is poised for continued growth, driven by technological advancements, economic expansion, and evolving consumer preferences. The increasing adoption of digital technologies, coupled with a focus on personalized and data-driven insurance solutions, will reshape the market landscape. Opportunities exist in areas such as Insurtech, IoT integration, and the expansion into underserved market segments. The projected CAGR suggests significant market potential and attractive opportunities for both established players and new entrants.

Australia Life and Non-Life Insurance Industry Segmentation

-

1. Insurance Type

-

1.1. Life insurance

- 1.1.1. Individual

- 1.1.2. Group

-

1.2. Non-Life Insurance

- 1.2.1. Fire

- 1.2.2. Motor

- 1.2.3. Marine

- 1.2.4. Health

- 1.2.5. Other Non-Life Insurance

-

1.1. Life insurance

-

2. Distribution Channel

- 2.1. Direct

- 2.2. Brokers

- 2.3. Banks

- 2.4. Other Distribution Channels

Australia Life and Non-Life Insurance Industry Segmentation By Geography

- 1. Australia

Australia Life and Non-Life Insurance Industry Regional Market Share

Geographic Coverage of Australia Life and Non-Life Insurance Industry

Australia Life and Non-Life Insurance Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.56% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Guaranteed Protection Drives The Market

- 3.3. Market Restrains

- 3.3.1. Guaranteed Protection Drives The Market

- 3.4. Market Trends

- 3.4.1. Motor Vehicle and Household Insurance has the Largest Shares

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Australia Life and Non-Life Insurance Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Insurance Type

- 5.1.1. Life insurance

- 5.1.1.1. Individual

- 5.1.1.2. Group

- 5.1.2. Non-Life Insurance

- 5.1.2.1. Fire

- 5.1.2.2. Motor

- 5.1.2.3. Marine

- 5.1.2.4. Health

- 5.1.2.5. Other Non-Life Insurance

- 5.1.1. Life insurance

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Direct

- 5.2.2. Brokers

- 5.2.3. Banks

- 5.2.4. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Australia

- 5.1. Market Analysis, Insights and Forecast - by Insurance Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Insurance Australia Group Limited

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Suncorp Group

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 AIA Group Limited

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Zurich

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Medibank Private Limited

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Genworth Mortgage Insurance Australia Limited

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 ClearView Wealth Limited

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Cover-More Limited

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 AMP Limited

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 NIB Holdings Limited**List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Insurance Australia Group Limited

List of Figures

- Figure 1: Australia Life and Non-Life Insurance Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Australia Life and Non-Life Insurance Industry Share (%) by Company 2025

List of Tables

- Table 1: Australia Life and Non-Life Insurance Industry Revenue Million Forecast, by Insurance Type 2020 & 2033

- Table 2: Australia Life and Non-Life Insurance Industry Volume Billion Forecast, by Insurance Type 2020 & 2033

- Table 3: Australia Life and Non-Life Insurance Industry Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 4: Australia Life and Non-Life Insurance Industry Volume Billion Forecast, by Distribution Channel 2020 & 2033

- Table 5: Australia Life and Non-Life Insurance Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Australia Life and Non-Life Insurance Industry Volume Billion Forecast, by Region 2020 & 2033

- Table 7: Australia Life and Non-Life Insurance Industry Revenue Million Forecast, by Insurance Type 2020 & 2033

- Table 8: Australia Life and Non-Life Insurance Industry Volume Billion Forecast, by Insurance Type 2020 & 2033

- Table 9: Australia Life and Non-Life Insurance Industry Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 10: Australia Life and Non-Life Insurance Industry Volume Billion Forecast, by Distribution Channel 2020 & 2033

- Table 11: Australia Life and Non-Life Insurance Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 12: Australia Life and Non-Life Insurance Industry Volume Billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Australia Life and Non-Life Insurance Industry?

The projected CAGR is approximately 4.56%.

2. Which companies are prominent players in the Australia Life and Non-Life Insurance Industry?

Key companies in the market include Insurance Australia Group Limited, Suncorp Group, AIA Group Limited, Zurich, Medibank Private Limited, Genworth Mortgage Insurance Australia Limited, ClearView Wealth Limited, Cover-More Limited, AMP Limited, NIB Holdings Limited**List Not Exhaustive.

3. What are the main segments of the Australia Life and Non-Life Insurance Industry?

The market segments include Insurance Type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 51.38 Million as of 2022.

5. What are some drivers contributing to market growth?

Guaranteed Protection Drives The Market.

6. What are the notable trends driving market growth?

Motor Vehicle and Household Insurance has the Largest Shares.

7. Are there any restraints impacting market growth?

Guaranteed Protection Drives The Market.

8. Can you provide examples of recent developments in the market?

February 2023: Insurance Australia Group Limited (IAG), Australia's largest general insurer, invested in Myriota, a global pioneer in low-cost and low-power satellite connectivity for the Internet of Things (IoT). This aim was to explore how IoT devices can help insurance customers manage risk and safeguard their assets.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Australia Life and Non-Life Insurance Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Australia Life and Non-Life Insurance Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Australia Life and Non-Life Insurance Industry?

To stay informed about further developments, trends, and reports in the Australia Life and Non-Life Insurance Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence