Key Insights

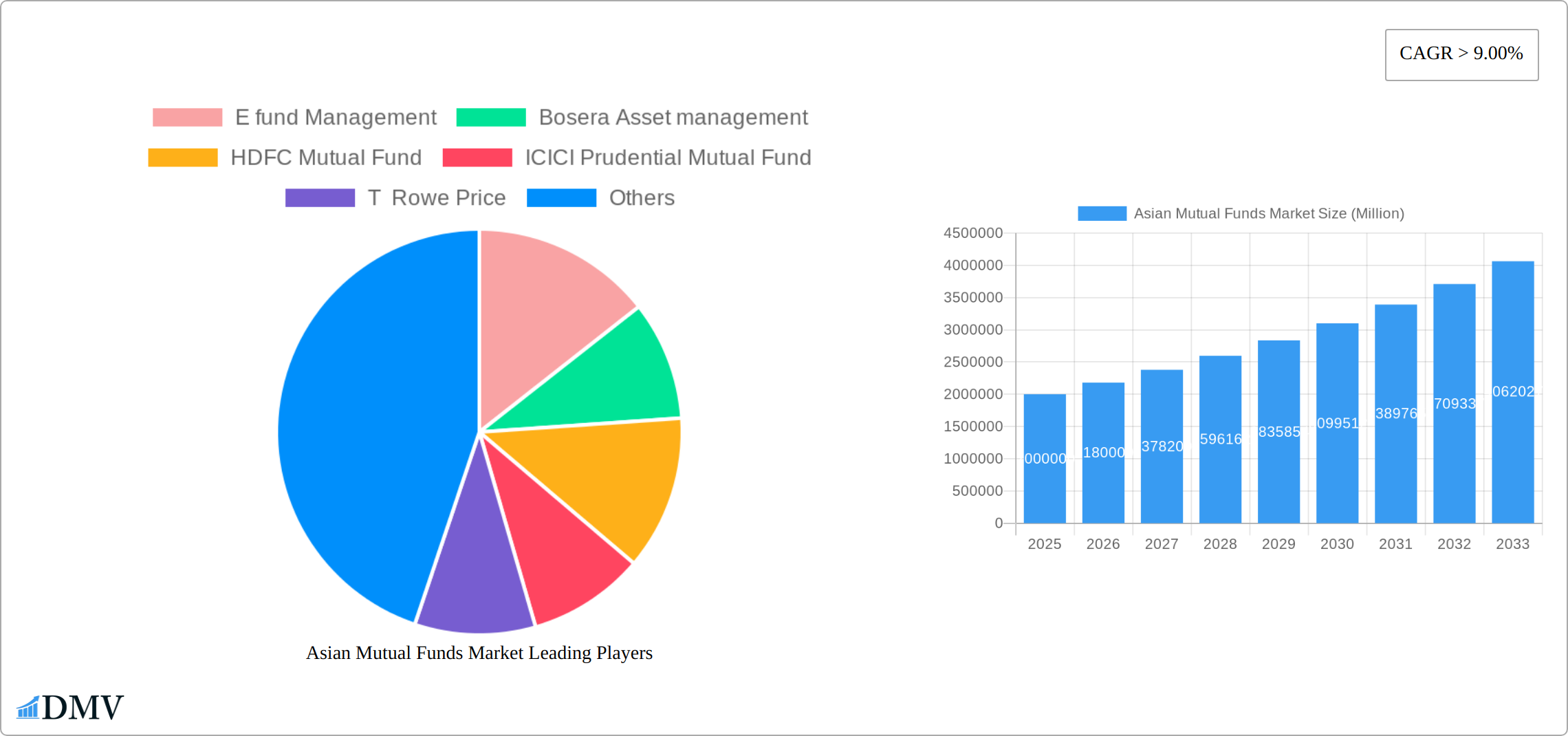

The Asian mutual funds market is poised for significant expansion, projected to achieve a Compound Annual Growth Rate (CAGR) of 12.1%. This robust growth, with a current market size of $614 billion in the base year of 2025, is propelled by rising disposable incomes, enhanced financial literacy, and a growing appetite for investment opportunities across the region. Supportive government initiatives promoting financial inclusion and the widespread adoption of digital platforms for seamless investment access further bolster market dynamics.

Asian Mutual Funds Market Market Size (In Billion)

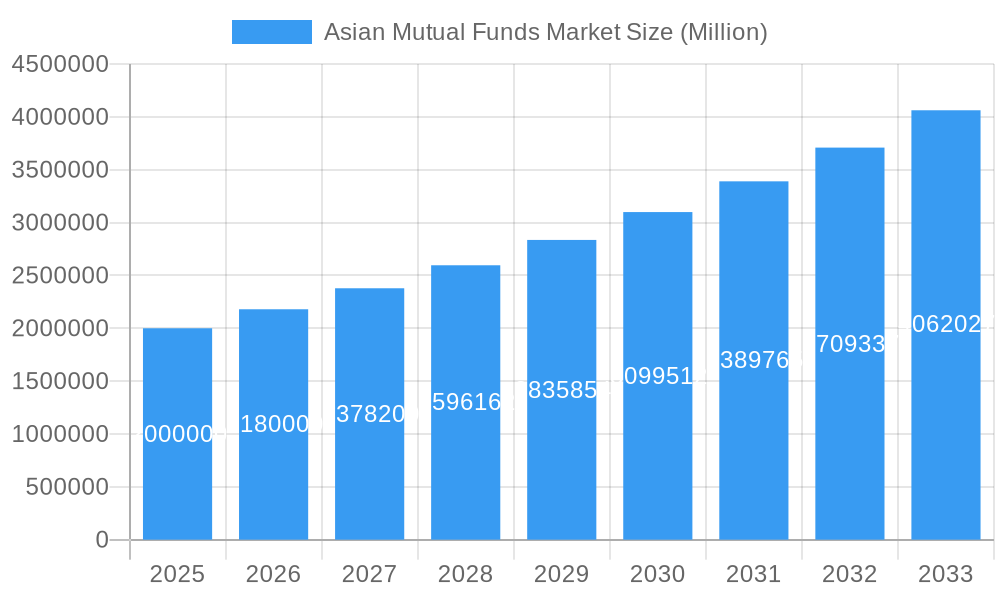

The market is strategically segmented by fund type (equity, debt, balanced), investment strategy (growth, value), and investor profile (retail, institutional). Key industry leaders, including E Fund Management, Bosera Asset Management, HDFC Mutual Fund, and ICICI Prudential Mutual Fund, are engaged in intense competition, focusing on cost-effectiveness, performance, and superior service delivery. Emerging global players such as BlackRock, Goldman Sachs, and Fidelity Investments are intensifying competition and vying for greater market share.

Asian Mutual Funds Market Company Market Share

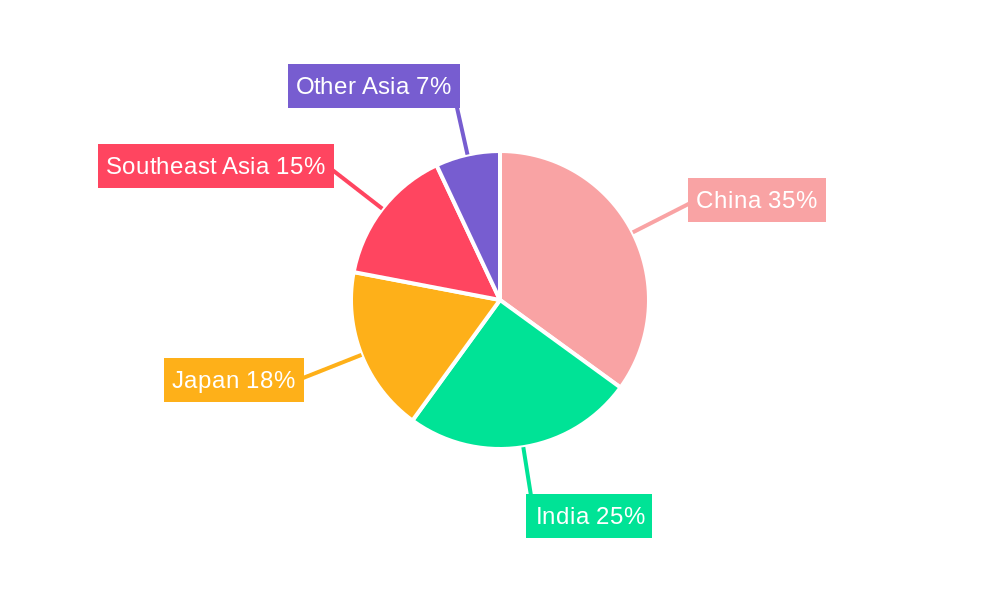

Challenges to sustained growth include evolving regulatory frameworks, macroeconomic volatility, and potential geopolitical risks. However, the market's substantial size in 2025, estimated at $614 billion, highlights its considerable potential. While precise regional data varies, it is anticipated that China, India, Japan, and Southeast Asia will represent significant market shares, reflecting their diverse economic landscapes and investor maturity.

Future success will be driven by continuous product innovation, leveraging technology for improved customer engagement, and a commitment to responsible investing. The long-term outlook remains optimistic, underpinned by favorable demographic trends and expanding financial markets in Asia. Agile adaptation to market shifts and evolving investor preferences will be critical for sustained growth in this dynamic sector.

Asian Mutual Funds Market: A Comprehensive Report (2019-2033)

This insightful report provides a detailed analysis of the Asian Mutual Funds Market, encompassing historical performance (2019-2024), current state (2025), and future projections (2025-2033). We delve into market composition, key players, industry trends, and growth opportunities, offering invaluable insights for stakeholders across the investment landscape. The report incorporates rigorous data analysis and forecasts, offering a 360-degree view of this dynamic market. The total market size in 2025 is estimated at xx Million.

Asian Mutual Funds Market Composition & Trends

This section evaluates the competitive landscape, innovative drivers, regulatory frameworks, substitute investment options, investor demographics, and mergers & acquisitions (M&A) within the Asian Mutual Funds Market. The analysis covers the period from 2019 to 2024, providing a robust understanding of market evolution.

Market Concentration & Share Distribution:

- The market demonstrates a moderately concentrated structure, with the top 5 players commanding approximately xx% of the market share in 2024. Specific market share for each player will vary depending on the region and fund type.

- Smaller players focus on niche segments or regional expertise.

Innovation Catalysts:

- Technological advancements such as robo-advisors and AI-driven portfolio management are transforming the industry.

- The increasing demand for ESG (Environmental, Social, and Governance) investing fuels innovation in sustainable fund offerings.

Regulatory Landscape:

- Regulatory changes across Asian nations significantly impact fund operations and product offerings. Varying regulations across countries affect cross-border investments.

- The influence of regulatory bodies like SEBI (Securities and Exchange Board of India) is analyzed.

Substitute Products:

- The report examines the competition from alternative investment vehicles, such as ETFs and direct stock investments.

- Competitive pressures from these alternatives are analyzed and quantified.

End-User Profiles:

- The report segments investors by demographics, risk appetite, investment goals, and financial knowledge, providing a clearer picture of target audiences.

- This granular level of analysis will help stakeholders tailor their strategies.

M&A Activities:

- The analysis includes a detailed overview of significant M&A deals within the Asian Mutual Funds Market during 2019-2024, examining transaction values and their impact on market dynamics.

- Total M&A deal value during this period was estimated at xx Million.

Asian Mutual Funds Market Industry Evolution

The Asian Mutual Funds Market has undergone a dynamic transformation, evolving from its nascent stages to a significant financial sector. From 2019 to 2033, this evolution is characterized by a confluence of accelerating technological advancements and a notable shift in consumer preferences. This analysis delves into the growth trajectory, exploring the key drivers and transformations that have reshaped the market landscape.

The market's substantial growth is underpinned by a combination of favorable economic and demographic trends. Rising disposable incomes, coupled with a burgeoning middle class across key Asian economies, have significantly boosted investment capacity. Simultaneously, an increase in financial literacy has empowered more individuals to participate in the capital markets. Technological innovation has been a pivotal force, leading to the development of sophisticated and accessible investment products. This innovation, in turn, has been shaped by evolving consumer demands, which now place a strong emphasis on Environmental, Social, and Governance (ESG) investing principles and the desire for bespoke portfolio management solutions. The projected Compound Annual Growth Rate (CAGR) from 2019 to 2024 is estimated to be approximately XX%, with strong indications of sustained expansion throughout the forecast period (2025-2033). The adoption of digital investment channels has been nothing short of revolutionary. In 2024, approximately XX% of investors utilized online platforms, marking a significant XX% increase since 2019. This digital acceleration is anticipated to further propel market growth. Moreover, the evolving preference for actively managed funds over passively managed funds highlights a growing demand for sophisticated and personalized investment strategies, contributing to the industry's ongoing maturation.

Leading Regions, Countries, or Segments in Asian Mutual Funds Market

This section identifies the dominant regions, countries, or segments within the Asian Mutual Funds Market.

- Dominant Region/Country: India consistently demonstrates strong growth, driven by a large and expanding investor base, coupled with supportive government initiatives. China also represents a large and significant market with considerable potential for growth.

Key Drivers:

- India: Robust economic growth, increasing financial inclusion, and a young population eager to invest contribute to market expansion. Government initiatives to promote financial literacy further bolster the market's growth trajectory.

- China: Although experiencing periods of volatility, China’s vast population and expanding middle class present significant growth potential. Increasing regulatory clarity and further financial market reforms will be crucial.

- Other Key Markets: While India and China hold significant shares, other countries like Singapore, Hong Kong, and South Korea also represent important segments, each with their unique drivers and market dynamics.

The dominance of India and China is primarily attributed to their large populations, rising middle classes, and supportive government policies. However, other markets in the region have the potential for growth fueled by specific local factors, including increasing wealth and access to investment products.

Asian Mutual Funds Market Product Innovations

In recent years, the Asian Mutual Funds Market has been a hotbed of product innovation. A prominent trend is the emergence of thematic funds, strategically targeting high-growth sectors such as technology, healthcare, and renewable energy. These funds are designed to capture investor interest by aligning with specific megatrends and forward-looking economic developments. Furthermore, the escalating global focus on sustainability and ethical investing has catalyzed the creation of a diverse array of ESG-focused funds. These sustainable and responsible investment vehicles are not only meeting investor demand for ethical alignment but are also often integrated with advanced analytical tools for sophisticated portfolio optimization and robust risk management, thereby enhancing their overall attractiveness. The pervasive influence of technology continues to enable the development of more personalized investment solutions and highly tailored strategies, meeting the unique financial objectives of individual investors.

Propelling Factors for Asian Mutual Funds Market Growth

The robust growth trajectory of the Asian Mutual Funds Market is propelled by a synergistic interplay of several key factors. Foremost among these are the rising disposable incomes observed across the region, which provide individuals with greater capacity for investment. Concurrently, there's an increasing awareness and understanding of diverse investment options, demystifying the capital markets for a broader audience. Supportive government policies, actively promoting financial inclusion and encouraging domestic savings, also play a crucial role. Technological advancements, exemplified by the proliferation of user-friendly online investment platforms and sophisticated robo-advisors, have dramatically enhanced the accessibility of investing for a wider demographic. Furthermore, the growing investor appetite for diversified investment portfolios, coupled with a demand for personalized financial solutions, directly fuels market expansion. The strategic launch of innovative products, including specialized thematic funds and impactful ESG funds, adeptly caters to the evolving preferences and values of modern investors, further solidifying the market's growth momentum.

Obstacles in the Asian Mutual Funds Market

Despite significant growth, the Asian Mutual Funds Market faces challenges such as regulatory uncertainties across different jurisdictions, geopolitical risks, and competitive pressures from alternative investment products. Fluctuations in global financial markets can impact investor sentiment and market performance. Moreover, maintaining trust and managing investor expectations in a volatile environment is also crucial for the industry's sustainable growth. The varying levels of financial literacy among investors also pose a challenge for expanding market access.

Future Opportunities in Asian Mutual Funds Market

The Asian Mutual Funds Market presents numerous opportunities for growth. The expansion of the middle class and increasing financial literacy across various Asian economies creates a larger pool of potential investors. Furthermore, the increasing adoption of fintech solutions and the development of innovative investment products will further stimulate market growth. The rising interest in ESG investing presents lucrative opportunities for sustainable fund managers, while focusing on niche sectors such as fintech and healthcare can lead to higher returns. There is also considerable potential in expanding into less-developed markets within Asia.

Major Players in the Asian Mutual Funds Market Ecosystem

- E fund Management

- Bosera Asset management

- HDFC Mutual Fund

- ICICI Prudential Mutual Fund

- T Rowe Price

- BlackRock

- Goldman Sachs

- Matthews Asia Funds

- Fidelity Investments

- Invesco

- List Not Exhaustive

Key Developments in Asian Mutual Funds Market Industry

- 2022: HDFC Mutual Fund's pioneering initiative to file a scheme information document (SID) with SEBI for India's first Defence Fund underscores a significant trend towards diversification into highly niche and specialized sectors, reflecting an innovative approach to market offerings.

- 2021: Fidelity International's strategic decision to merge six of its funds demonstrates a proactive approach to streamlining its product suite and ensuring better alignment with the evolving needs and expectations of its client base, showcasing adaptability to dynamic market conditions.

Strategic Asian Mutual Funds Market Forecast

The Asian Mutual Funds Market is poised for continued expansion in the coming years, driven by favorable demographic trends, technological advancements, and the increasing demand for sophisticated investment solutions. Opportunities exist in expanding into underserved markets, developing innovative products tailored to evolving investor preferences, and leveraging technology to enhance efficiency and accessibility. The market's robust growth trajectory is expected to continue, with a projected CAGR of xx% from 2025 to 2033, resulting in a market size of xx Million by 2033. The focus on personalized investment strategies and increasing adoption of sustainable investment practices will be key factors driving this growth.

Asian Mutual Funds Market Segmentation

-

1. Fund Type

- 1.1. Equity

- 1.2. Bond

- 1.3. Hybrid

- 1.4. Money Market

- 1.5. Others

-

2. Geography

- 2.1. China

- 2.2. India

- 2.3. Singapore

- 2.4. Taiwan

- 2.5. Hong Kong

- 2.6. Korea

- 2.7. Rest of Asia-Pacific

Asian Mutual Funds Market Segmentation By Geography

- 1. China

- 2. India

- 3. Singapore

- 4. Taiwan

- 5. Hong Kong

- 6. Korea

- 7. Rest of Asia Pacific

Asian Mutual Funds Market Regional Market Share

Geographic Coverage of Asian Mutual Funds Market

Asian Mutual Funds Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 12.1% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Rising inflation will create opportunities

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Asian Mutual Funds Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Fund Type

- 5.1.1. Equity

- 5.1.2. Bond

- 5.1.3. Hybrid

- 5.1.4. Money Market

- 5.1.5. Others

- 5.2. Market Analysis, Insights and Forecast - by Geography

- 5.2.1. China

- 5.2.2. India

- 5.2.3. Singapore

- 5.2.4. Taiwan

- 5.2.5. Hong Kong

- 5.2.6. Korea

- 5.2.7. Rest of Asia-Pacific

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. China

- 5.3.2. India

- 5.3.3. Singapore

- 5.3.4. Taiwan

- 5.3.5. Hong Kong

- 5.3.6. Korea

- 5.3.7. Rest of Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Fund Type

- 6. China Asian Mutual Funds Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Fund Type

- 6.1.1. Equity

- 6.1.2. Bond

- 6.1.3. Hybrid

- 6.1.4. Money Market

- 6.1.5. Others

- 6.2. Market Analysis, Insights and Forecast - by Geography

- 6.2.1. China

- 6.2.2. India

- 6.2.3. Singapore

- 6.2.4. Taiwan

- 6.2.5. Hong Kong

- 6.2.6. Korea

- 6.2.7. Rest of Asia-Pacific

- 6.1. Market Analysis, Insights and Forecast - by Fund Type

- 7. India Asian Mutual Funds Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Fund Type

- 7.1.1. Equity

- 7.1.2. Bond

- 7.1.3. Hybrid

- 7.1.4. Money Market

- 7.1.5. Others

- 7.2. Market Analysis, Insights and Forecast - by Geography

- 7.2.1. China

- 7.2.2. India

- 7.2.3. Singapore

- 7.2.4. Taiwan

- 7.2.5. Hong Kong

- 7.2.6. Korea

- 7.2.7. Rest of Asia-Pacific

- 7.1. Market Analysis, Insights and Forecast - by Fund Type

- 8. Singapore Asian Mutual Funds Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Fund Type

- 8.1.1. Equity

- 8.1.2. Bond

- 8.1.3. Hybrid

- 8.1.4. Money Market

- 8.1.5. Others

- 8.2. Market Analysis, Insights and Forecast - by Geography

- 8.2.1. China

- 8.2.2. India

- 8.2.3. Singapore

- 8.2.4. Taiwan

- 8.2.5. Hong Kong

- 8.2.6. Korea

- 8.2.7. Rest of Asia-Pacific

- 8.1. Market Analysis, Insights and Forecast - by Fund Type

- 9. Taiwan Asian Mutual Funds Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Fund Type

- 9.1.1. Equity

- 9.1.2. Bond

- 9.1.3. Hybrid

- 9.1.4. Money Market

- 9.1.5. Others

- 9.2. Market Analysis, Insights and Forecast - by Geography

- 9.2.1. China

- 9.2.2. India

- 9.2.3. Singapore

- 9.2.4. Taiwan

- 9.2.5. Hong Kong

- 9.2.6. Korea

- 9.2.7. Rest of Asia-Pacific

- 9.1. Market Analysis, Insights and Forecast - by Fund Type

- 10. Hong Kong Asian Mutual Funds Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Fund Type

- 10.1.1. Equity

- 10.1.2. Bond

- 10.1.3. Hybrid

- 10.1.4. Money Market

- 10.1.5. Others

- 10.2. Market Analysis, Insights and Forecast - by Geography

- 10.2.1. China

- 10.2.2. India

- 10.2.3. Singapore

- 10.2.4. Taiwan

- 10.2.5. Hong Kong

- 10.2.6. Korea

- 10.2.7. Rest of Asia-Pacific

- 10.1. Market Analysis, Insights and Forecast - by Fund Type

- 11. Korea Asian Mutual Funds Market Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Fund Type

- 11.1.1. Equity

- 11.1.2. Bond

- 11.1.3. Hybrid

- 11.1.4. Money Market

- 11.1.5. Others

- 11.2. Market Analysis, Insights and Forecast - by Geography

- 11.2.1. China

- 11.2.2. India

- 11.2.3. Singapore

- 11.2.4. Taiwan

- 11.2.5. Hong Kong

- 11.2.6. Korea

- 11.2.7. Rest of Asia-Pacific

- 11.1. Market Analysis, Insights and Forecast - by Fund Type

- 12. Rest of Asia Pacific Asian Mutual Funds Market Analysis, Insights and Forecast, 2020-2032

- 12.1. Market Analysis, Insights and Forecast - by Fund Type

- 12.1.1. Equity

- 12.1.2. Bond

- 12.1.3. Hybrid

- 12.1.4. Money Market

- 12.1.5. Others

- 12.2. Market Analysis, Insights and Forecast - by Geography

- 12.2.1. China

- 12.2.2. India

- 12.2.3. Singapore

- 12.2.4. Taiwan

- 12.2.5. Hong Kong

- 12.2.6. Korea

- 12.2.7. Rest of Asia-Pacific

- 12.1. Market Analysis, Insights and Forecast - by Fund Type

- 13. Competitive Analysis

- 13.1. Global Market Share Analysis 2025

- 13.2. Company Profiles

- 13.2.1 E fund Management

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 Bosera Asset management

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 HDFC Mutual Fund

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 ICICI Prudential Mutual Fund

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 T Rowe Price

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 BlackRock

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 Goldman Sachs

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 Matthews Asia Funds

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 Fidelity Investments

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.10 Invesco**List Not Exhaustive

- 13.2.10.1. Overview

- 13.2.10.2. Products

- 13.2.10.3. SWOT Analysis

- 13.2.10.4. Recent Developments

- 13.2.10.5. Financials (Based on Availability)

- 13.2.1 E fund Management

List of Figures

- Figure 1: Global Asian Mutual Funds Market Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: China Asian Mutual Funds Market Revenue (billion), by Fund Type 2025 & 2033

- Figure 3: China Asian Mutual Funds Market Revenue Share (%), by Fund Type 2025 & 2033

- Figure 4: China Asian Mutual Funds Market Revenue (billion), by Geography 2025 & 2033

- Figure 5: China Asian Mutual Funds Market Revenue Share (%), by Geography 2025 & 2033

- Figure 6: China Asian Mutual Funds Market Revenue (billion), by Country 2025 & 2033

- Figure 7: China Asian Mutual Funds Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: India Asian Mutual Funds Market Revenue (billion), by Fund Type 2025 & 2033

- Figure 9: India Asian Mutual Funds Market Revenue Share (%), by Fund Type 2025 & 2033

- Figure 10: India Asian Mutual Funds Market Revenue (billion), by Geography 2025 & 2033

- Figure 11: India Asian Mutual Funds Market Revenue Share (%), by Geography 2025 & 2033

- Figure 12: India Asian Mutual Funds Market Revenue (billion), by Country 2025 & 2033

- Figure 13: India Asian Mutual Funds Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Singapore Asian Mutual Funds Market Revenue (billion), by Fund Type 2025 & 2033

- Figure 15: Singapore Asian Mutual Funds Market Revenue Share (%), by Fund Type 2025 & 2033

- Figure 16: Singapore Asian Mutual Funds Market Revenue (billion), by Geography 2025 & 2033

- Figure 17: Singapore Asian Mutual Funds Market Revenue Share (%), by Geography 2025 & 2033

- Figure 18: Singapore Asian Mutual Funds Market Revenue (billion), by Country 2025 & 2033

- Figure 19: Singapore Asian Mutual Funds Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: Taiwan Asian Mutual Funds Market Revenue (billion), by Fund Type 2025 & 2033

- Figure 21: Taiwan Asian Mutual Funds Market Revenue Share (%), by Fund Type 2025 & 2033

- Figure 22: Taiwan Asian Mutual Funds Market Revenue (billion), by Geography 2025 & 2033

- Figure 23: Taiwan Asian Mutual Funds Market Revenue Share (%), by Geography 2025 & 2033

- Figure 24: Taiwan Asian Mutual Funds Market Revenue (billion), by Country 2025 & 2033

- Figure 25: Taiwan Asian Mutual Funds Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Hong Kong Asian Mutual Funds Market Revenue (billion), by Fund Type 2025 & 2033

- Figure 27: Hong Kong Asian Mutual Funds Market Revenue Share (%), by Fund Type 2025 & 2033

- Figure 28: Hong Kong Asian Mutual Funds Market Revenue (billion), by Geography 2025 & 2033

- Figure 29: Hong Kong Asian Mutual Funds Market Revenue Share (%), by Geography 2025 & 2033

- Figure 30: Hong Kong Asian Mutual Funds Market Revenue (billion), by Country 2025 & 2033

- Figure 31: Hong Kong Asian Mutual Funds Market Revenue Share (%), by Country 2025 & 2033

- Figure 32: Korea Asian Mutual Funds Market Revenue (billion), by Fund Type 2025 & 2033

- Figure 33: Korea Asian Mutual Funds Market Revenue Share (%), by Fund Type 2025 & 2033

- Figure 34: Korea Asian Mutual Funds Market Revenue (billion), by Geography 2025 & 2033

- Figure 35: Korea Asian Mutual Funds Market Revenue Share (%), by Geography 2025 & 2033

- Figure 36: Korea Asian Mutual Funds Market Revenue (billion), by Country 2025 & 2033

- Figure 37: Korea Asian Mutual Funds Market Revenue Share (%), by Country 2025 & 2033

- Figure 38: Rest of Asia Pacific Asian Mutual Funds Market Revenue (billion), by Fund Type 2025 & 2033

- Figure 39: Rest of Asia Pacific Asian Mutual Funds Market Revenue Share (%), by Fund Type 2025 & 2033

- Figure 40: Rest of Asia Pacific Asian Mutual Funds Market Revenue (billion), by Geography 2025 & 2033

- Figure 41: Rest of Asia Pacific Asian Mutual Funds Market Revenue Share (%), by Geography 2025 & 2033

- Figure 42: Rest of Asia Pacific Asian Mutual Funds Market Revenue (billion), by Country 2025 & 2033

- Figure 43: Rest of Asia Pacific Asian Mutual Funds Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Asian Mutual Funds Market Revenue billion Forecast, by Fund Type 2020 & 2033

- Table 2: Global Asian Mutual Funds Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 3: Global Asian Mutual Funds Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Global Asian Mutual Funds Market Revenue billion Forecast, by Fund Type 2020 & 2033

- Table 5: Global Asian Mutual Funds Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 6: Global Asian Mutual Funds Market Revenue billion Forecast, by Country 2020 & 2033

- Table 7: Global Asian Mutual Funds Market Revenue billion Forecast, by Fund Type 2020 & 2033

- Table 8: Global Asian Mutual Funds Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 9: Global Asian Mutual Funds Market Revenue billion Forecast, by Country 2020 & 2033

- Table 10: Global Asian Mutual Funds Market Revenue billion Forecast, by Fund Type 2020 & 2033

- Table 11: Global Asian Mutual Funds Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 12: Global Asian Mutual Funds Market Revenue billion Forecast, by Country 2020 & 2033

- Table 13: Global Asian Mutual Funds Market Revenue billion Forecast, by Fund Type 2020 & 2033

- Table 14: Global Asian Mutual Funds Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 15: Global Asian Mutual Funds Market Revenue billion Forecast, by Country 2020 & 2033

- Table 16: Global Asian Mutual Funds Market Revenue billion Forecast, by Fund Type 2020 & 2033

- Table 17: Global Asian Mutual Funds Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 18: Global Asian Mutual Funds Market Revenue billion Forecast, by Country 2020 & 2033

- Table 19: Global Asian Mutual Funds Market Revenue billion Forecast, by Fund Type 2020 & 2033

- Table 20: Global Asian Mutual Funds Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 21: Global Asian Mutual Funds Market Revenue billion Forecast, by Country 2020 & 2033

- Table 22: Global Asian Mutual Funds Market Revenue billion Forecast, by Fund Type 2020 & 2033

- Table 23: Global Asian Mutual Funds Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 24: Global Asian Mutual Funds Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asian Mutual Funds Market?

The projected CAGR is approximately 12.1%.

2. Which companies are prominent players in the Asian Mutual Funds Market?

Key companies in the market include E fund Management, Bosera Asset management, HDFC Mutual Fund, ICICI Prudential Mutual Fund, T Rowe Price, BlackRock, Goldman Sachs, Matthews Asia Funds, Fidelity Investments, Invesco**List Not Exhaustive.

3. What are the main segments of the Asian Mutual Funds Market?

The market segments include Fund Type, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 614 billion as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Rising inflation will create opportunities.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

In 2022, HDFC Mutual Fund has filed a scheme information document (SID) with SEBI to come up with India's first Defence Fund. Called the HDFC Defence Fund, it will be an open-ended equity scheme that will be investing in defence & allied sector companies.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asian Mutual Funds Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asian Mutual Funds Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asian Mutual Funds Market?

To stay informed about further developments, trends, and reports in the Asian Mutual Funds Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence