Key Insights

The global X-ray film market, while influenced by digital imaging advancements, maintains relevance in specialized applications. The market size in 2025 is estimated at 908 million, with a Compound Annual Growth Rate (CAGR) of 2.7% projected from 2025 to 2033. Growth drivers include demand in emerging economies with developing digital infrastructure and specialized sectors requiring high-resolution imaging or archival capabilities, such as medical archiving and industrial radiography. Key factors supporting this include cost-effective imaging solutions in resource-limited environments, consistent image quality, and sustained demand for accessible film processing in select medical and industrial settings. However, the market faces challenges from the widespread adoption of digital X-ray technologies, which offer advantages in speed, image manipulation, and reduced storage. Segmentation by end-user shows medical applications leading, followed by research/education and industrial sectors. Leading companies like Konica Minolta, Fujifilm, and Agfa-Gevaert are adapting by offering specialized films and services. Regional growth patterns indicate slower expansion in North America and Europe due to high digital system adoption, while Asia-Pacific and other developing regions are expected to drive expansion through increased healthcare investment and industrial growth.

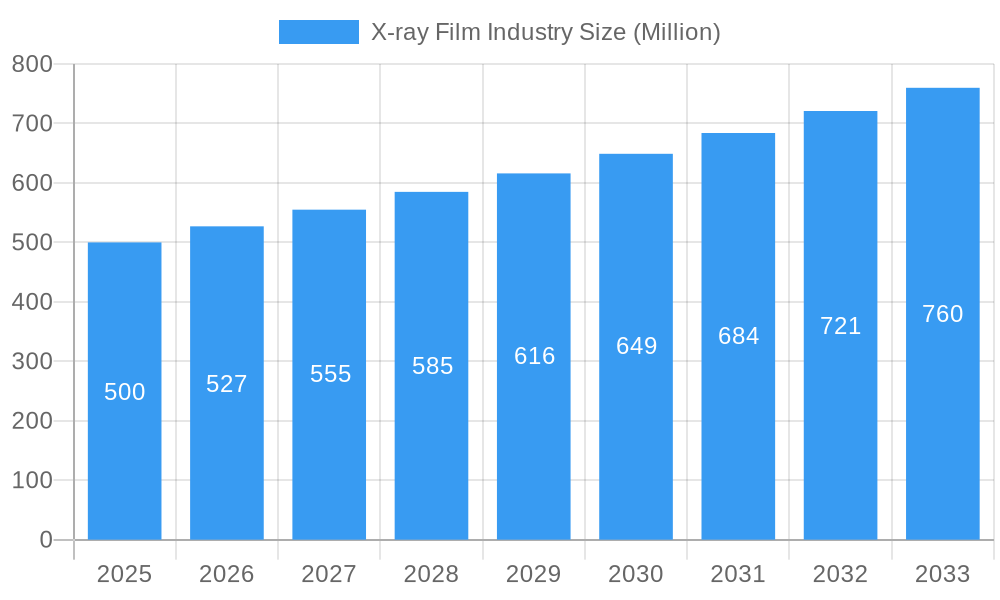

X-ray Film Industry Market Size (In Million)

The future trajectory of the X-ray film market relies on serving specific niche requirements. Industry players are expected to concentrate on specialized film types offering superior image quality or unique advantages. Strategic collaborations with digital imaging providers, introducing hybrid solutions, may unlock growth opportunities. Sustainable business models will likely prioritize high-value, specialized markets and cost optimization. The long-term outlook suggests a focused, stable market driven by enduring demand in particular segments, rather than broad expansion. While the transition to digital imaging is ongoing, X-ray film is anticipated to retain its position in specific market niches.

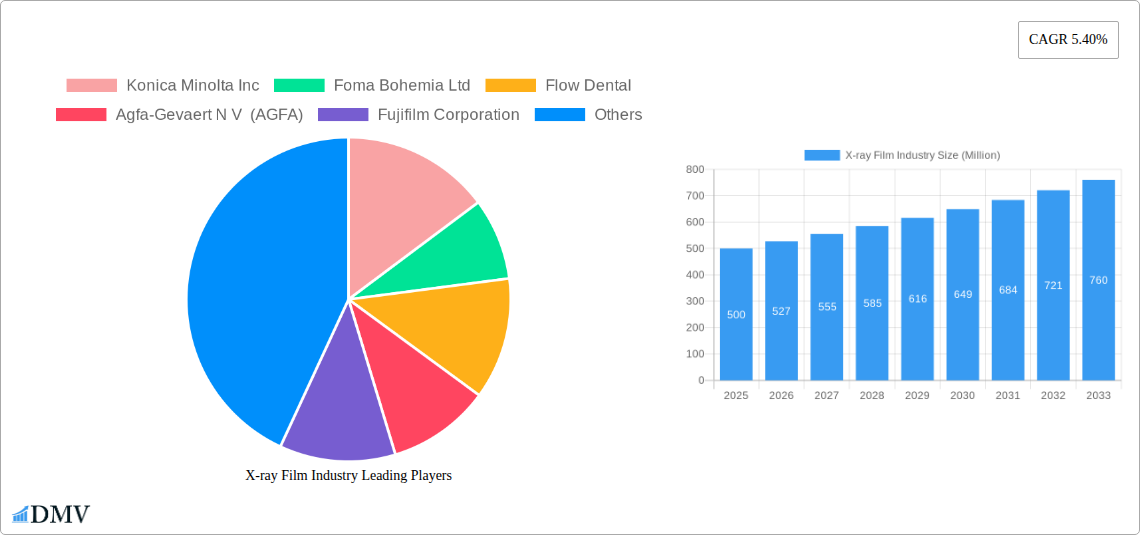

X-ray Film Industry Company Market Share

X-ray Film Industry Market Report: 2019-2033 Forecast

This comprehensive report provides an in-depth analysis of the global X-ray film industry, offering critical insights for stakeholders seeking to understand market trends, competitive dynamics, and future growth opportunities. The report covers the period 2019-2033, with a focus on the 2025-2033 forecast period and a base year of 2025. The market is segmented by end-user (Medical, Research and Educational Institutions, Industrial, and Other End Users), providing a granular view of market performance across key sectors. The total market size is projected to reach xx Million by 2033, presenting significant opportunities for investment and growth.

X-ray Film Industry Market Composition & Trends

This section delves into the intricate composition and evolving trends within the X-ray film market. We analyze market concentration, revealing the market share distribution amongst key players like Konica Minolta Inc, Fujifilm Corporation, Agfa-Gevaert N V (AGFA), and Carestream Health Inc. The report quantifies the level of market concentration using metrics like the Herfindahl-Hirschman Index (HHI) and identifies any potential monopolies or oligopolies. Furthermore, we explore innovation drivers, such as advancements in film emulsion technology and digital imaging alternatives, alongside regulatory landscapes impacting the industry globally. The influence of substitute products, primarily digital imaging technologies, is also examined, coupled with an analysis of M&A activities within the industry, including the value of completed deals and their impact on market structure during the historical period (2019-2024). End-user profiles are analyzed to determine market demand from each segment.

- Market Concentration: xx% controlled by top 5 players in 2024.

- M&A Deal Value (2019-2024): Estimated at xx Million.

- Key Innovation Drivers: Improved film sensitivity, enhanced image clarity, eco-friendly processing techniques.

- Major Regulatory Impacts: Varying regulations across different countries concerning medical waste disposal.

X-ray Film Industry Industry Evolution

This section provides a comprehensive analysis of the X-ray film industry's evolution from 2019 to 2033. We examine market growth trajectories, pinpointing key periods of expansion and contraction. Technological advancements, such as improvements in film sensitivity and resolution, are analyzed alongside their impact on market dynamics. The report details the shift in consumer demands, moving from traditional X-ray film towards digital imaging solutions and factors driving this change. Growth rates are presented for each segment and the overall market, comparing historical performance (2019-2024) with the projected forecast (2025-2033). Adoption metrics, including market penetration rates for different X-ray film types, are also included. The report also analyzes the impact of the COVID-19 pandemic on the industry's growth trajectory.

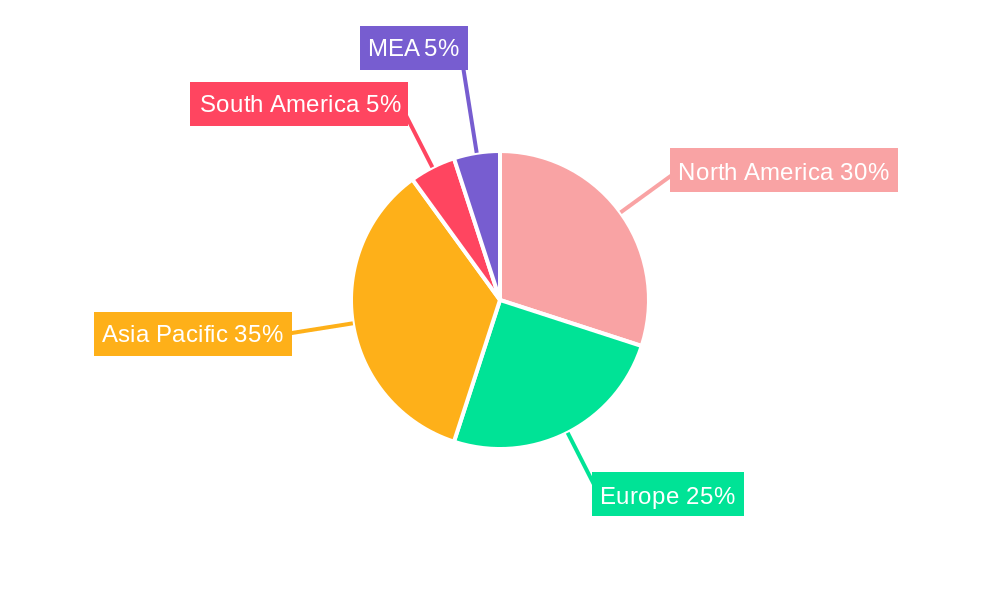

Leading Regions, Countries, or Segments in X-ray Film Industry

This section identifies the dominant regions, countries, or segments within the X-ray film market. We analyze market leadership based on revenue generation and market share across the key segments: Medical, Research and Educational Institutions, Industrial, and Other End Users. The factors contributing to the dominance of the leading segment(s) are explored in detail.

Medical Segment Dominance: The Medical segment is projected to remain the largest, driven by the continuous need for diagnostic imaging in healthcare.

- Key Drivers: High demand for medical diagnostics, growing global population, increasing prevalence of chronic diseases.

- Dominance Factors: Large patient base, crucial role in disease diagnosis and treatment, continuous investment in healthcare infrastructure.

Geographic Dominance: North America or [Insert predicted dominant region based on research] is likely to maintain its leading position due to [Insert reasons, e.g., advanced healthcare infrastructure, high disposable incomes, etc.]

X-ray Film Industry Product Innovations

Recent innovations in X-ray film technology focus on improving image quality, reducing radiation exposure, and streamlining workflow. New emulsion formulations offer increased sensitivity, resulting in clearer images with reduced exposure times. Advancements in film processing techniques have minimized processing time and chemical waste, aligning with environmental sustainability goals. These innovations enhance the unique selling propositions of X-ray film, particularly in niche applications requiring high-resolution images or where access to digital imaging is limited.

Propelling Factors for X-ray Film Industry Growth

Several factors contribute to the continued growth of the X-ray film industry. Technological advancements leading to enhanced image quality and reduced radiation exposure are key drivers. Furthermore, economic factors such as increasing healthcare expenditure globally, particularly in developing economies, contribute significantly to demand. Favorable regulatory environments in some regions supporting medical imaging procedures also play a vital role.

Obstacles in the X-ray Film Industry Market

The X-ray film market faces significant challenges. The rise of digital imaging technologies presents a major competitive pressure, eroding market share. Stricter environmental regulations concerning chemical waste disposal increase operational costs. Supply chain disruptions can impact the availability of raw materials, affecting production and market stability.

Future Opportunities in X-ray Film Industry

The X-ray film industry can capitalize on several emerging opportunities. Niche applications in specialized medical imaging and industrial settings continue to offer growth potential. Technological advancements in film materials and processing can improve performance and sustainability, creating new market segments. Focusing on developing economies with limited access to digital imaging can also create new avenues for growth.

Major Players in the X-ray Film Industry Ecosystem

- Konica Minolta Inc

- Foma Bohemia Ltd

- Flow Dental

- Agfa-Gevaert N V (AGFA)

- Fujifilm Corporation

- Codonics Inc

- Carestream Health Inc

- Sony Corporation

Key Developments in X-ray Film Industry Industry

- 2022: Fujifilm announces a new, more sustainable X-ray film processing solution.

- 2023: Agfa-Gevaert launches a high-resolution X-ray film for specialized medical applications.

- [Insert year]: [Insert relevant development with impact and details]

Strategic X-ray Film Industry Market Forecast

The X-ray film market is projected to experience moderate growth over the forecast period (2025-2033), driven by continued demand in niche applications and regions with limited access to digital imaging. While the overall market may shrink compared to digital alternatives, innovation in film technology and targeted marketing strategies can help sustain growth. The market is expected to maintain a relatively stable yet competitive landscape with significant opportunities for companies focused on specific end-user segments and specialized applications.

X-ray Film Industry Segmentation

-

1. End User

-

1.1. Medical

- 1.1.1. Diagnostic Centers

- 1.1.2. Hospitals

- 1.1.3. Research and Educational Institutions

- 1.2. Industrial

- 1.3. Other End Users

-

1.1. Medical

X-ray Film Industry Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Latin America

- 5. Middle East

X-ray Film Industry Regional Market Share

Geographic Coverage of X-ray Film Industry

X-ray Film Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 2.7% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Continued Adoption of Traditional X-ray Equipment in Developing Economies

- 3.3. Market Restrains

- 3.3.1. ; Emergence of Digital Radiography and Flat Panel Detector Technology

- 3.4. Market Trends

- 3.4.1. Diagnostic Centers Segment is Expected to Register a Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global X-ray Film Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by End User

- 5.1.1. Medical

- 5.1.1.1. Diagnostic Centers

- 5.1.1.2. Hospitals

- 5.1.1.3. Research and Educational Institutions

- 5.1.2. Industrial

- 5.1.3. Other End Users

- 5.1.1. Medical

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. Europe

- 5.2.3. Asia Pacific

- 5.2.4. Latin America

- 5.2.5. Middle East

- 5.1. Market Analysis, Insights and Forecast - by End User

- 6. North America X-ray Film Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by End User

- 6.1.1. Medical

- 6.1.1.1. Diagnostic Centers

- 6.1.1.2. Hospitals

- 6.1.1.3. Research and Educational Institutions

- 6.1.2. Industrial

- 6.1.3. Other End Users

- 6.1.1. Medical

- 6.1. Market Analysis, Insights and Forecast - by End User

- 7. Europe X-ray Film Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by End User

- 7.1.1. Medical

- 7.1.1.1. Diagnostic Centers

- 7.1.1.2. Hospitals

- 7.1.1.3. Research and Educational Institutions

- 7.1.2. Industrial

- 7.1.3. Other End Users

- 7.1.1. Medical

- 7.1. Market Analysis, Insights and Forecast - by End User

- 8. Asia Pacific X-ray Film Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by End User

- 8.1.1. Medical

- 8.1.1.1. Diagnostic Centers

- 8.1.1.2. Hospitals

- 8.1.1.3. Research and Educational Institutions

- 8.1.2. Industrial

- 8.1.3. Other End Users

- 8.1.1. Medical

- 8.1. Market Analysis, Insights and Forecast - by End User

- 9. Latin America X-ray Film Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by End User

- 9.1.1. Medical

- 9.1.1.1. Diagnostic Centers

- 9.1.1.2. Hospitals

- 9.1.1.3. Research and Educational Institutions

- 9.1.2. Industrial

- 9.1.3. Other End Users

- 9.1.1. Medical

- 9.1. Market Analysis, Insights and Forecast - by End User

- 10. Middle East X-ray Film Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by End User

- 10.1.1. Medical

- 10.1.1.1. Diagnostic Centers

- 10.1.1.2. Hospitals

- 10.1.1.3. Research and Educational Institutions

- 10.1.2. Industrial

- 10.1.3. Other End Users

- 10.1.1. Medical

- 10.1. Market Analysis, Insights and Forecast - by End User

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Konica Minolta Inc

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Foma Bohemia Ltd

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Flow Dental

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Agfa-Gevaert N V (AGFA)

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Fujifilm Corporation

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Codonics Inc

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Carestream Health Inc

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Sony Corporation

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.1 Konica Minolta Inc

List of Figures

- Figure 1: Global X-ray Film Industry Revenue Breakdown (million, %) by Region 2025 & 2033

- Figure 2: Global X-ray Film Industry Volume Breakdown (K Unit, %) by Region 2025 & 2033

- Figure 3: North America X-ray Film Industry Revenue (million), by End User 2025 & 2033

- Figure 4: North America X-ray Film Industry Volume (K Unit), by End User 2025 & 2033

- Figure 5: North America X-ray Film Industry Revenue Share (%), by End User 2025 & 2033

- Figure 6: North America X-ray Film Industry Volume Share (%), by End User 2025 & 2033

- Figure 7: North America X-ray Film Industry Revenue (million), by Country 2025 & 2033

- Figure 8: North America X-ray Film Industry Volume (K Unit), by Country 2025 & 2033

- Figure 9: North America X-ray Film Industry Revenue Share (%), by Country 2025 & 2033

- Figure 10: North America X-ray Film Industry Volume Share (%), by Country 2025 & 2033

- Figure 11: Europe X-ray Film Industry Revenue (million), by End User 2025 & 2033

- Figure 12: Europe X-ray Film Industry Volume (K Unit), by End User 2025 & 2033

- Figure 13: Europe X-ray Film Industry Revenue Share (%), by End User 2025 & 2033

- Figure 14: Europe X-ray Film Industry Volume Share (%), by End User 2025 & 2033

- Figure 15: Europe X-ray Film Industry Revenue (million), by Country 2025 & 2033

- Figure 16: Europe X-ray Film Industry Volume (K Unit), by Country 2025 & 2033

- Figure 17: Europe X-ray Film Industry Revenue Share (%), by Country 2025 & 2033

- Figure 18: Europe X-ray Film Industry Volume Share (%), by Country 2025 & 2033

- Figure 19: Asia Pacific X-ray Film Industry Revenue (million), by End User 2025 & 2033

- Figure 20: Asia Pacific X-ray Film Industry Volume (K Unit), by End User 2025 & 2033

- Figure 21: Asia Pacific X-ray Film Industry Revenue Share (%), by End User 2025 & 2033

- Figure 22: Asia Pacific X-ray Film Industry Volume Share (%), by End User 2025 & 2033

- Figure 23: Asia Pacific X-ray Film Industry Revenue (million), by Country 2025 & 2033

- Figure 24: Asia Pacific X-ray Film Industry Volume (K Unit), by Country 2025 & 2033

- Figure 25: Asia Pacific X-ray Film Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Asia Pacific X-ray Film Industry Volume Share (%), by Country 2025 & 2033

- Figure 27: Latin America X-ray Film Industry Revenue (million), by End User 2025 & 2033

- Figure 28: Latin America X-ray Film Industry Volume (K Unit), by End User 2025 & 2033

- Figure 29: Latin America X-ray Film Industry Revenue Share (%), by End User 2025 & 2033

- Figure 30: Latin America X-ray Film Industry Volume Share (%), by End User 2025 & 2033

- Figure 31: Latin America X-ray Film Industry Revenue (million), by Country 2025 & 2033

- Figure 32: Latin America X-ray Film Industry Volume (K Unit), by Country 2025 & 2033

- Figure 33: Latin America X-ray Film Industry Revenue Share (%), by Country 2025 & 2033

- Figure 34: Latin America X-ray Film Industry Volume Share (%), by Country 2025 & 2033

- Figure 35: Middle East X-ray Film Industry Revenue (million), by End User 2025 & 2033

- Figure 36: Middle East X-ray Film Industry Volume (K Unit), by End User 2025 & 2033

- Figure 37: Middle East X-ray Film Industry Revenue Share (%), by End User 2025 & 2033

- Figure 38: Middle East X-ray Film Industry Volume Share (%), by End User 2025 & 2033

- Figure 39: Middle East X-ray Film Industry Revenue (million), by Country 2025 & 2033

- Figure 40: Middle East X-ray Film Industry Volume (K Unit), by Country 2025 & 2033

- Figure 41: Middle East X-ray Film Industry Revenue Share (%), by Country 2025 & 2033

- Figure 42: Middle East X-ray Film Industry Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global X-ray Film Industry Revenue million Forecast, by End User 2020 & 2033

- Table 2: Global X-ray Film Industry Volume K Unit Forecast, by End User 2020 & 2033

- Table 3: Global X-ray Film Industry Revenue million Forecast, by Region 2020 & 2033

- Table 4: Global X-ray Film Industry Volume K Unit Forecast, by Region 2020 & 2033

- Table 5: Global X-ray Film Industry Revenue million Forecast, by End User 2020 & 2033

- Table 6: Global X-ray Film Industry Volume K Unit Forecast, by End User 2020 & 2033

- Table 7: Global X-ray Film Industry Revenue million Forecast, by Country 2020 & 2033

- Table 8: Global X-ray Film Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 9: Global X-ray Film Industry Revenue million Forecast, by End User 2020 & 2033

- Table 10: Global X-ray Film Industry Volume K Unit Forecast, by End User 2020 & 2033

- Table 11: Global X-ray Film Industry Revenue million Forecast, by Country 2020 & 2033

- Table 12: Global X-ray Film Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 13: Global X-ray Film Industry Revenue million Forecast, by End User 2020 & 2033

- Table 14: Global X-ray Film Industry Volume K Unit Forecast, by End User 2020 & 2033

- Table 15: Global X-ray Film Industry Revenue million Forecast, by Country 2020 & 2033

- Table 16: Global X-ray Film Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 17: Global X-ray Film Industry Revenue million Forecast, by End User 2020 & 2033

- Table 18: Global X-ray Film Industry Volume K Unit Forecast, by End User 2020 & 2033

- Table 19: Global X-ray Film Industry Revenue million Forecast, by Country 2020 & 2033

- Table 20: Global X-ray Film Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 21: Global X-ray Film Industry Revenue million Forecast, by End User 2020 & 2033

- Table 22: Global X-ray Film Industry Volume K Unit Forecast, by End User 2020 & 2033

- Table 23: Global X-ray Film Industry Revenue million Forecast, by Country 2020 & 2033

- Table 24: Global X-ray Film Industry Volume K Unit Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the X-ray Film Industry?

The projected CAGR is approximately 2.7%.

2. Which companies are prominent players in the X-ray Film Industry?

Key companies in the market include Konica Minolta Inc, Foma Bohemia Ltd, Flow Dental, Agfa-Gevaert N V (AGFA), Fujifilm Corporation, Codonics Inc, Carestream Health Inc, Sony Corporation.

3. What are the main segments of the X-ray Film Industry?

The market segments include End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 908 million as of 2022.

5. What are some drivers contributing to market growth?

; Continued Adoption of Traditional X-ray Equipment in Developing Economies.

6. What are the notable trends driving market growth?

Diagnostic Centers Segment is Expected to Register a Significant Growth.

7. Are there any restraints impacting market growth?

; Emergence of Digital Radiography and Flat Panel Detector Technology.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "X-ray Film Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the X-ray Film Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the X-ray Film Industry?

To stay informed about further developments, trends, and reports in the X-ray Film Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence