Key Insights

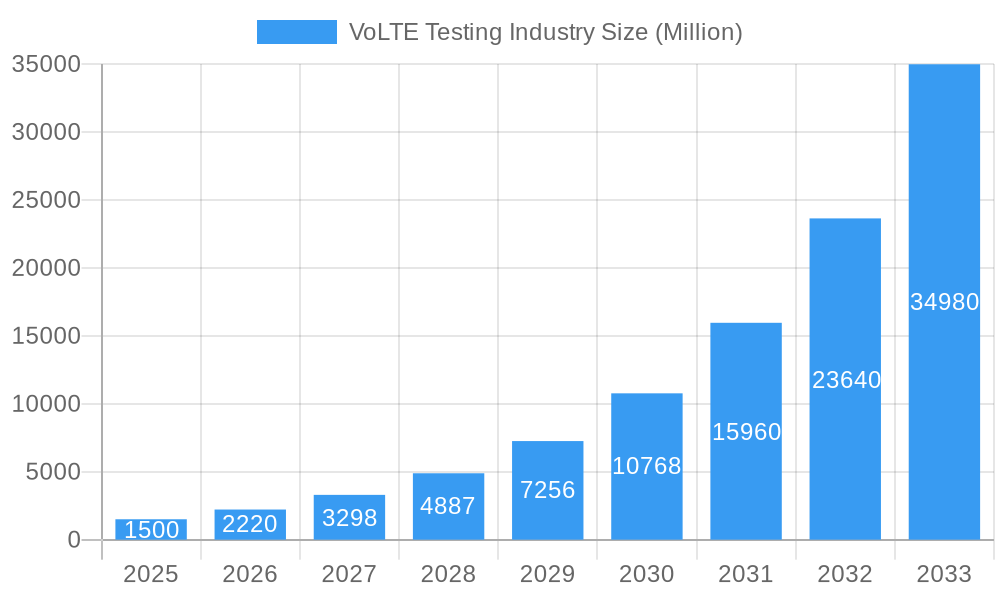

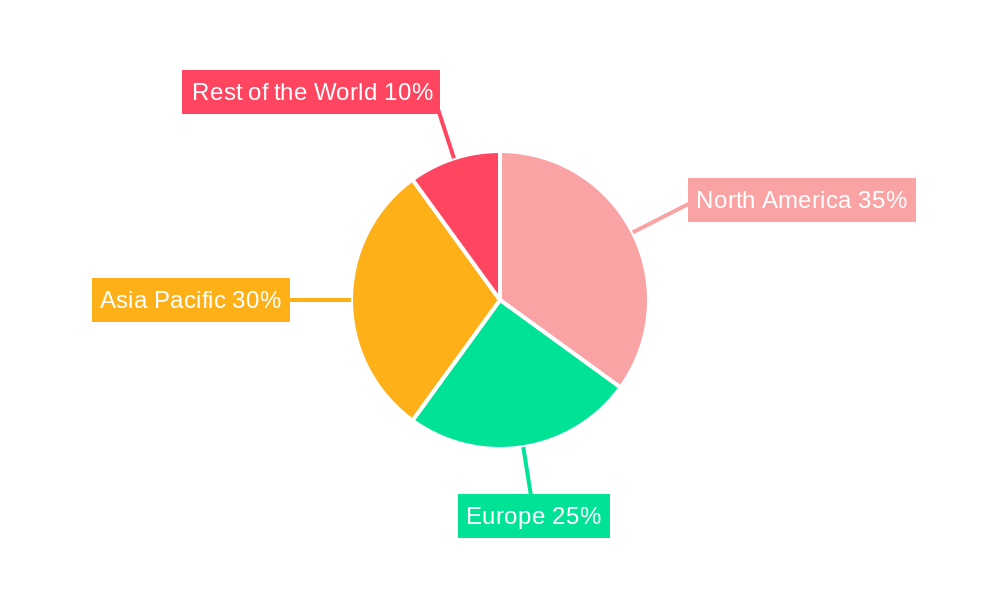

The VoLTE testing market is experiencing explosive growth, driven by the global proliferation of 5G networks and the increasing demand for high-quality voice and data services. A CAGR of 48% from 2019-2033 indicates a significant expansion, with the market projected to reach substantial value within the next decade. Key drivers include the rising adoption of smartphones with VoLTE capabilities, the need for rigorous testing to ensure network performance and reliability, and the increasing pressure on telecommunication companies to deliver seamless user experiences. The market is segmented by testing type (functional, performance, compliance, and others) and end-user industry (telecommunication, IT & ITeS, consumer electronics, and others). The telecommunication sector is currently the dominant end-user, given the direct reliance on VoLTE infrastructure. However, growth in other sectors like consumer electronics, driven by smart devices and IoT integration, will contribute significantly to overall market expansion. Geographic distribution is likely uneven, with North America and Asia Pacific regions expected to show robust growth due to strong technological advancements and significant investments in 5G infrastructure. Competitive forces include established players like Ericsson, and emerging companies focusing on specialized testing solutions.

VoLTE Testing Industry Market Size (In Billion)

The competitive landscape is characterized by a mix of established telecom equipment vendors offering comprehensive testing solutions and specialized companies focusing on niche areas within VoLTE testing. The ongoing expansion of 5G networks is a major catalyst for market growth, necessitating extensive testing to ensure optimal performance and compatibility across diverse devices and network configurations. While the high initial investment in testing infrastructure might pose a restraint for some smaller players, the long-term returns are expected to be substantial given the market's projected trajectory. Furthermore, emerging trends like the increasing adoption of cloud-based testing solutions and AI-powered automation will further shape the market's future, fostering efficiency and reducing testing costs. The continuous evolution of VoLTE technology and the introduction of new features will necessitate constant testing and optimization efforts, sustaining the growth of this dynamic market for the foreseeable future.

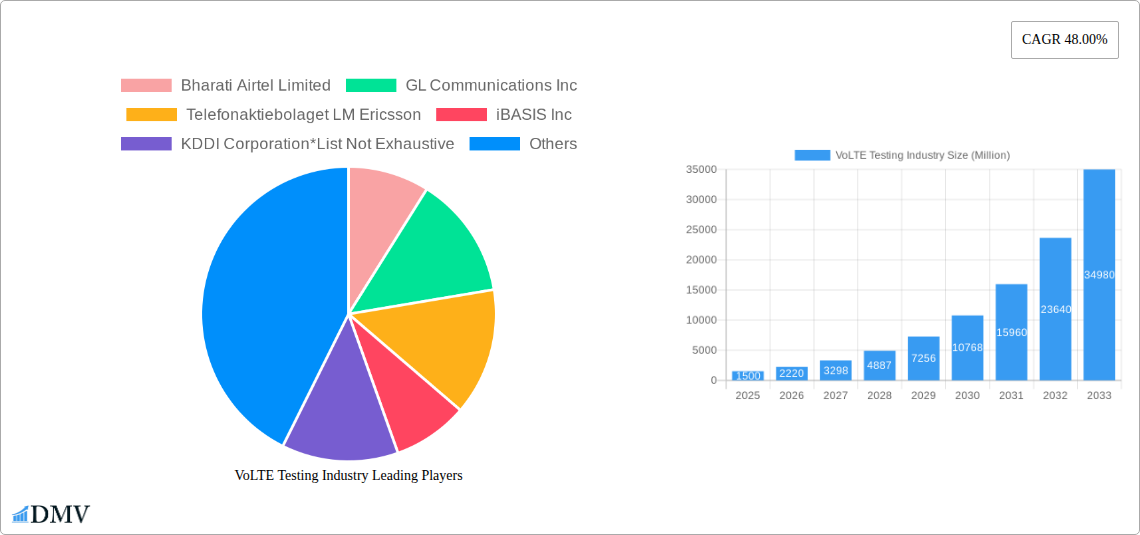

VoLTE Testing Industry Company Market Share

VoLTE Testing Industry: A Comprehensive Market Report (2019-2033)

This insightful report provides a comprehensive analysis of the VoLTE Testing industry, offering invaluable data and forecasts for stakeholders. The study period spans from 2019 to 2033, with 2025 serving as the base and estimated year. The report meticulously examines market trends, technological advancements, leading players, and future growth potential, providing a 360-degree view of this dynamic sector. The global VoLTE Testing market is projected to reach $XX Million by 2033, showcasing significant growth opportunities.

VoLTE Testing Industry Market Composition & Trends

This section delves into the competitive landscape of the VoLTE Testing market, analyzing market concentration, innovation drivers, regulatory frameworks, substitute products, and end-user profiles. The report assesses the market share distribution among key players, including Bharati Airtel Limited, GL Communications Inc, Telefonaktiebolaget LM Ericsson, iBASIS Inc, KDDI Corporation, Verizon Communications Inc, LG Uplus Corp, Rohde & Schwarz GmbH & Co KG, Reliance Jio Infocomm Limited, AT&T Inc, SK Telecom Co Ltd, and KT Corporation (list not exhaustive). Mergers and acquisitions (M&A) activities within the industry are also examined, with an estimated total M&A deal value of $XX Million during the historical period.

- Market Concentration: The market exhibits a [Describe Market Concentration - e.g., moderately concentrated] structure with [Number] major players holding approximately [Percentage]% of the market share in 2024.

- Innovation Catalysts: The ongoing development of 5G and the increasing demand for high-quality voice services are major catalysts for innovation in VoLTE testing.

- Regulatory Landscape: Government regulations concerning network quality and security significantly impact the VoLTE testing market.

- Substitute Products: While VoLTE testing is currently the primary method, [Mention potential substitute technologies or methods, if any and their impact].

- End-User Profiles: The report profiles key end-user industries, including telecommunications, IT & ITeS, and consumer electronics, highlighting their specific testing needs and market contribution.

VoLTE Testing Industry Industry Evolution

This section provides a detailed analysis of the VoLTE Testing industry's evolution from 2019 to 2033. We examine market growth trajectories, technological advancements (such as the integration of AI and automation in testing processes), and the impact of shifting consumer demands for improved voice quality and reliability. The market experienced a Compound Annual Growth Rate (CAGR) of XX% during the historical period (2019-2024) and is projected to grow at a CAGR of XX% during the forecast period (2025-2033). Adoption rates for VoLTE testing are steadily increasing, driven by the widespread deployment of 4G and the transition to 5G networks. Specific data points on growth rates and adoption metrics across different regions and segments are included.

Leading Regions, Countries, or Segments in VoLTE Testing Industry

This section identifies the dominant regions, countries, and market segments within the VoLTE Testing industry.

By Type:

- Functional Testing: This segment dominates the market due to its crucial role in ensuring basic functionality. Key drivers include the rising demand for high-quality voice calls and the increasing complexity of VoLTE networks.

- Performance Testing: This segment is experiencing robust growth driven by the need to optimize network performance and user experience. Investment in advanced testing tools and methodologies is fueling this segment's expansion.

- Compliance Testing: Stringent regulatory requirements regarding network compliance are driving growth in this segment. Government mandates and industry standards are key factors.

- Other Types: This includes specialized testing services catering to niche requirements, which show a moderate growth rate.

By End-user Industry:

- Telecommunication: The telecommunications sector accounts for the largest market share, owing to the direct reliance on VoLTE technology and stringent quality assurance needs. Significant investments in network infrastructure development are further driving demand.

- IT & ITeS: This segment's contribution is substantial, fueled by the need for robust testing solutions to ensure reliable communication within IT infrastructure.

- Consumer Electronics: With the increasing integration of VoLTE capabilities into smartphones and other devices, this segment is experiencing moderate but steady growth.

- Other End-user Industries: This encompasses various sectors adopting VoLTE technology, contributing to overall market expansion.

VoLTE Testing Industry Product Innovations

The VoLTE testing landscape is constantly evolving, with innovations focused on enhancing testing speed, accuracy, and efficiency. New products incorporate advanced automation, AI-driven analytics, and cloud-based solutions. These innovations reduce testing time, minimize costs, and deliver comprehensive test coverage. Unique selling propositions include improved reporting capabilities, streamlined workflows, and support for diverse network configurations.

Propelling Factors for VoLTE Testing Industry Growth

The VoLTE Testing industry's growth is fueled by several factors: the expansion of 4G and 5G networks globally; increasing demand for higher-quality voice services; stringent regulatory requirements mandating network testing; and the rising adoption of VoLTE technology in various industries. Technological advancements such as AI and automation further boost market expansion. Government initiatives supporting digital infrastructure development also contribute significantly.

Obstacles in the VoLTE Testing Industry Market

The VoLTE Testing market faces challenges including the high cost of advanced testing equipment, the complexity of testing procedures for advanced VoLTE features, and competition from established and emerging players. Supply chain disruptions may lead to delays and increased costs, particularly in procuring specialized testing equipment. Furthermore, keeping pace with rapidly evolving technology standards presents an ongoing hurdle.

Future Opportunities in VoLTE Testing Industry

Future opportunities lie in emerging markets, especially in developing economies undergoing rapid network expansion. The integration of 5G and the growing adoption of IoT devices will drive demand for advanced VoLTE testing solutions. Furthermore, opportunities exist in developing specialized testing services to address niche market needs and incorporate new testing methodologies such as AI-driven predictive analytics.

Major Players in the VoLTE Testing Industry Ecosystem

Key Developments in VoLTE Testing Industry Industry

- [Month, Year]: [Company Name] launched a new VoLTE testing platform with advanced AI capabilities.

- [Month, Year]: [Company Name] and [Company Name] announced a strategic partnership to expand their VoLTE testing services globally.

- [Month, Year]: New regulations regarding VoLTE network security were implemented in [Region/Country], impacting testing requirements.

- [Month, Year]: [Technological Advancements] are expected to disrupt the market, opening new opportunities for innovation. (Add more bullet points as needed with specific details)

Strategic VoLTE Testing Industry Market Forecast

The VoLTE Testing market is poised for continued growth, driven by technological advancements, increasing demand for enhanced voice services, and expanding 5G networks. The forecast period (2025-2033) anticipates a significant market expansion, with considerable opportunities for both established players and new entrants. The integration of AI and automation in testing processes is expected to drive efficiency gains and reduce costs, further enhancing market potential. Emerging markets present substantial untapped growth potential, while innovation in testing methodologies will shape future market dynamics.

VoLTE Testing Industry Segmentation

-

1. Type

- 1.1. Functional Testing

- 1.2. Performance Testing

- 1.3. Compliance Testing

- 1.4. Other Types

-

2. End-user Industry

- 2.1. Telecommunication

- 2.2. IT & ITes

- 2.3. Consumer Electronics

- 2.4. Other End-user Industries

VoLTE Testing Industry Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Rest of the World

VoLTE Testing Industry Regional Market Share

Geographic Coverage of VoLTE Testing Industry

VoLTE Testing Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 11.31% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Growing Demand of VoLTE Devices Due to Emergence of 4G Services; Rising Adoption of VoLTE Enabled Networking Applications in Telecom Sector

- 3.3. Market Restrains

- 3.3.1. ; Low Coverage of VoLTE Network Across the Remote Locations; High Initial Investment Cost

- 3.4. Market Trends

- 3.4.1. Telecommunication Sector is Gaining Traction Due to Emergence of IMS (IP Multimedia Subsystem) Services

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global VoLTE Testing Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Functional Testing

- 5.1.2. Performance Testing

- 5.1.3. Compliance Testing

- 5.1.4. Other Types

- 5.2. Market Analysis, Insights and Forecast - by End-user Industry

- 5.2.1. Telecommunication

- 5.2.2. IT & ITes

- 5.2.3. Consumer Electronics

- 5.2.4. Other End-user Industries

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America VoLTE Testing Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Functional Testing

- 6.1.2. Performance Testing

- 6.1.3. Compliance Testing

- 6.1.4. Other Types

- 6.2. Market Analysis, Insights and Forecast - by End-user Industry

- 6.2.1. Telecommunication

- 6.2.2. IT & ITes

- 6.2.3. Consumer Electronics

- 6.2.4. Other End-user Industries

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Europe VoLTE Testing Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Functional Testing

- 7.1.2. Performance Testing

- 7.1.3. Compliance Testing

- 7.1.4. Other Types

- 7.2. Market Analysis, Insights and Forecast - by End-user Industry

- 7.2.1. Telecommunication

- 7.2.2. IT & ITes

- 7.2.3. Consumer Electronics

- 7.2.4. Other End-user Industries

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Asia Pacific VoLTE Testing Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Functional Testing

- 8.1.2. Performance Testing

- 8.1.3. Compliance Testing

- 8.1.4. Other Types

- 8.2. Market Analysis, Insights and Forecast - by End-user Industry

- 8.2.1. Telecommunication

- 8.2.2. IT & ITes

- 8.2.3. Consumer Electronics

- 8.2.4. Other End-user Industries

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Rest of the World VoLTE Testing Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Functional Testing

- 9.1.2. Performance Testing

- 9.1.3. Compliance Testing

- 9.1.4. Other Types

- 9.2. Market Analysis, Insights and Forecast - by End-user Industry

- 9.2.1. Telecommunication

- 9.2.2. IT & ITes

- 9.2.3. Consumer Electronics

- 9.2.4. Other End-user Industries

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Bharati Airtel Limited

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 GL Communications Inc

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Telefonaktiebolaget LM Ericsson

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 iBASIS Inc

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 KDDI Corporation*List Not Exhaustive

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Verizon Communications Inc

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 LG Uplus Corp

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Rohde & Schwarz GmbH & Co KG

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Reliance Jio Infocomm Limited

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 AT&T Inc

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 SK Telecom Co Ltd

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.12 KT Corporation

- 10.2.12.1. Overview

- 10.2.12.2. Products

- 10.2.12.3. SWOT Analysis

- 10.2.12.4. Recent Developments

- 10.2.12.5. Financials (Based on Availability)

- 10.2.1 Bharati Airtel Limited

List of Figures

- Figure 1: Global VoLTE Testing Industry Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: North America VoLTE Testing Industry Revenue (undefined), by Type 2025 & 2033

- Figure 3: North America VoLTE Testing Industry Revenue Share (%), by Type 2025 & 2033

- Figure 4: North America VoLTE Testing Industry Revenue (undefined), by End-user Industry 2025 & 2033

- Figure 5: North America VoLTE Testing Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 6: North America VoLTE Testing Industry Revenue (undefined), by Country 2025 & 2033

- Figure 7: North America VoLTE Testing Industry Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe VoLTE Testing Industry Revenue (undefined), by Type 2025 & 2033

- Figure 9: Europe VoLTE Testing Industry Revenue Share (%), by Type 2025 & 2033

- Figure 10: Europe VoLTE Testing Industry Revenue (undefined), by End-user Industry 2025 & 2033

- Figure 11: Europe VoLTE Testing Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 12: Europe VoLTE Testing Industry Revenue (undefined), by Country 2025 & 2033

- Figure 13: Europe VoLTE Testing Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific VoLTE Testing Industry Revenue (undefined), by Type 2025 & 2033

- Figure 15: Asia Pacific VoLTE Testing Industry Revenue Share (%), by Type 2025 & 2033

- Figure 16: Asia Pacific VoLTE Testing Industry Revenue (undefined), by End-user Industry 2025 & 2033

- Figure 17: Asia Pacific VoLTE Testing Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 18: Asia Pacific VoLTE Testing Industry Revenue (undefined), by Country 2025 & 2033

- Figure 19: Asia Pacific VoLTE Testing Industry Revenue Share (%), by Country 2025 & 2033

- Figure 20: Rest of the World VoLTE Testing Industry Revenue (undefined), by Type 2025 & 2033

- Figure 21: Rest of the World VoLTE Testing Industry Revenue Share (%), by Type 2025 & 2033

- Figure 22: Rest of the World VoLTE Testing Industry Revenue (undefined), by End-user Industry 2025 & 2033

- Figure 23: Rest of the World VoLTE Testing Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 24: Rest of the World VoLTE Testing Industry Revenue (undefined), by Country 2025 & 2033

- Figure 25: Rest of the World VoLTE Testing Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global VoLTE Testing Industry Revenue undefined Forecast, by Type 2020 & 2033

- Table 2: Global VoLTE Testing Industry Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 3: Global VoLTE Testing Industry Revenue undefined Forecast, by Region 2020 & 2033

- Table 4: Global VoLTE Testing Industry Revenue undefined Forecast, by Type 2020 & 2033

- Table 5: Global VoLTE Testing Industry Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 6: Global VoLTE Testing Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 7: Global VoLTE Testing Industry Revenue undefined Forecast, by Type 2020 & 2033

- Table 8: Global VoLTE Testing Industry Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 9: Global VoLTE Testing Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 10: Global VoLTE Testing Industry Revenue undefined Forecast, by Type 2020 & 2033

- Table 11: Global VoLTE Testing Industry Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 12: Global VoLTE Testing Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 13: Global VoLTE Testing Industry Revenue undefined Forecast, by Type 2020 & 2033

- Table 14: Global VoLTE Testing Industry Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 15: Global VoLTE Testing Industry Revenue undefined Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the VoLTE Testing Industry?

The projected CAGR is approximately 11.31%.

2. Which companies are prominent players in the VoLTE Testing Industry?

Key companies in the market include Bharati Airtel Limited, GL Communications Inc, Telefonaktiebolaget LM Ericsson, iBASIS Inc, KDDI Corporation*List Not Exhaustive, Verizon Communications Inc, LG Uplus Corp, Rohde & Schwarz GmbH & Co KG, Reliance Jio Infocomm Limited, AT&T Inc, SK Telecom Co Ltd, KT Corporation.

3. What are the main segments of the VoLTE Testing Industry?

The market segments include Type, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

; Growing Demand of VoLTE Devices Due to Emergence of 4G Services; Rising Adoption of VoLTE Enabled Networking Applications in Telecom Sector.

6. What are the notable trends driving market growth?

Telecommunication Sector is Gaining Traction Due to Emergence of IMS (IP Multimedia Subsystem) Services.

7. Are there any restraints impacting market growth?

; Low Coverage of VoLTE Network Across the Remote Locations; High Initial Investment Cost.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "VoLTE Testing Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the VoLTE Testing Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the VoLTE Testing Industry?

To stay informed about further developments, trends, and reports in the VoLTE Testing Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence