Key Insights

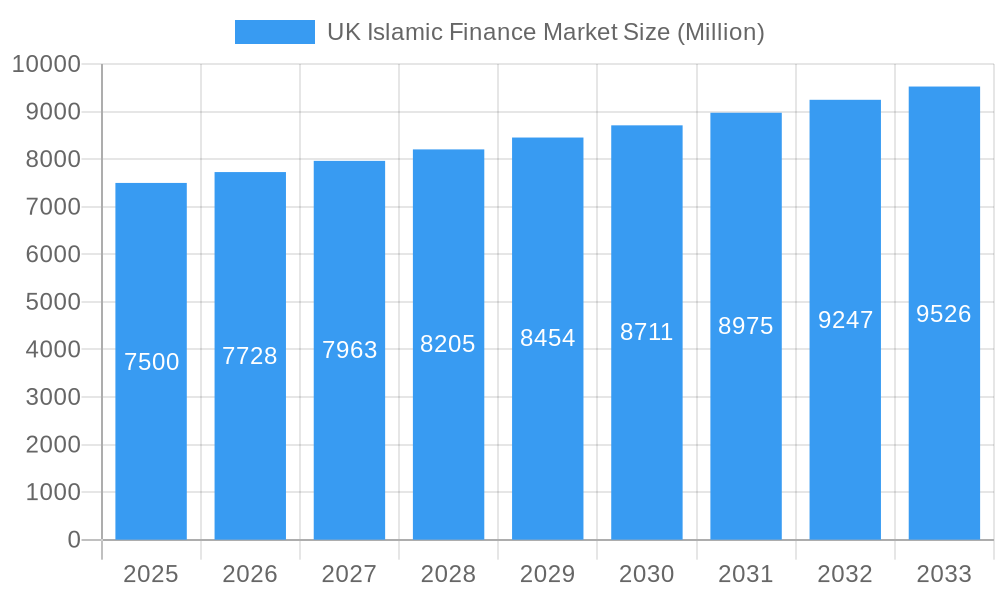

The UK Islamic finance market, valued at £7.5 billion in 2025, is projected to experience steady growth, driven by a rising Muslim population, increasing awareness of Sharia-compliant financial products, and supportive government initiatives. The 3.12% Compound Annual Growth Rate (CAGR) from 2025 to 2033 indicates a gradual but consistent expansion. Key growth drivers include the demand for ethical and responsible investments, the increasing sophistication of Islamic financial instruments catering to diverse needs (e.g., mortgages, investment funds), and a growing number of UK-based Islamic banks and financial institutions. This market segment is further strengthened by the UK's strategic location as a global financial hub, attracting both domestic and international investment. However, challenges remain, including the need for increased product innovation, enhanced regulatory clarity to address specific challenges within Islamic finance, and addressing potential knowledge gaps among consumers about Sharia-compliant products. The market's future growth depends on overcoming these hurdles and adapting to evolving consumer preferences and global economic trends. The presence of significant international players like Citigroup, Barclays, and BNP Paribas alongside established Islamic banks signifies a healthy level of competition and potential for further market expansion.

UK Islamic Finance Market Market Size (In Billion)

The segmentation of the UK Islamic finance market likely involves various product categories such as Islamic banking (deposit accounts, financing), Sukuk (Islamic bonds), Takaful (Islamic insurance), and ethical investments. A lack of detailed segment data prevents a precise breakdown, but growth is likely to be distributed across these sectors, with the banking segment probably maintaining a significant share given its established presence. Future growth will be influenced by the success of fintech companies in introducing innovative Sharia-compliant solutions, the development of a more robust regulatory framework, and successful campaigns to educate both Muslim and non-Muslim consumers about the benefits of Islamic finance.

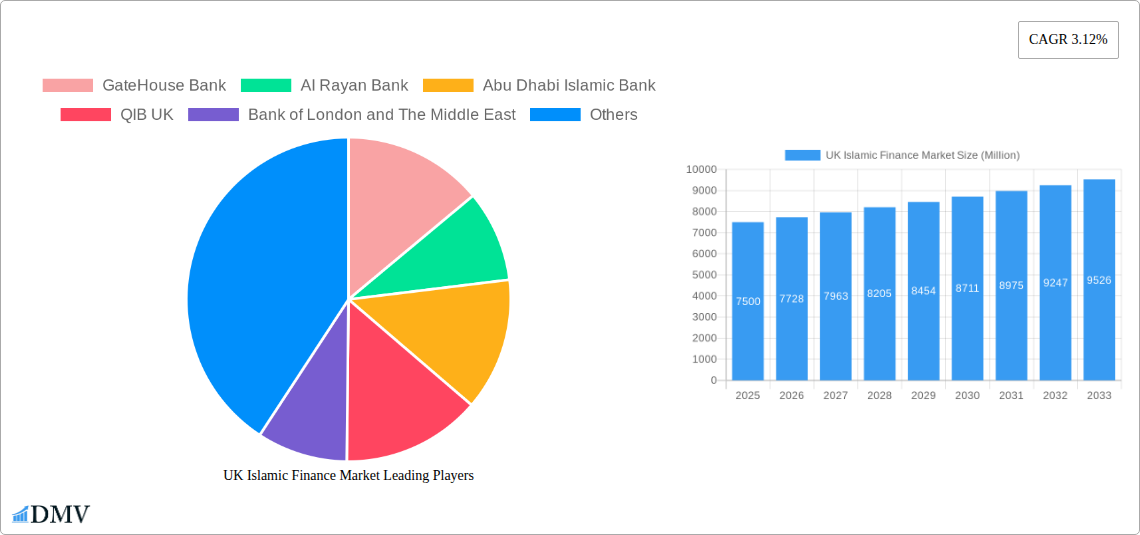

UK Islamic Finance Market Company Market Share

UK Islamic Finance Market: A Comprehensive Report (2019-2033)

This insightful report provides a detailed analysis of the UK Islamic finance market, offering a comprehensive overview of its current state, future trajectory, and key players. Covering the period from 2019 to 2033, with a base year of 2025 and a forecast period of 2025-2033, this report is essential for stakeholders seeking to understand and capitalize on the growth opportunities within this dynamic sector. The report uses Million for all values.

UK Islamic Finance Market Market Composition & Trends

This section delves into the intricate structure of the UK Islamic finance market, examining its concentration, innovation drivers, regulatory environment, substitute products, end-user profiles, and mergers and acquisitions (M&A) activity. We analyze market share distribution among key players and assess the financial implications of significant M&A deals. The market is characterized by a moderate level of concentration, with several major players and a growing number of niche participants. Innovation is driven by technological advancements, such as the rise of fintech and digital banking platforms catering to Islamic finance principles. The regulatory landscape, though evolving, plays a crucial role in shaping market growth and stability.

- Market Share Distribution (2024): AI Rayan Bank (xx%), GateHouse Bank (xx%), QIB UK (xx%), Others (xx%). These figures represent estimates based on available data.

- M&A Activity (2019-2024): Total deal value estimated at £xx Million, with an average deal size of £xx Million. Further detailed analysis of specific transactions is included in the full report.

- Key Regulatory Developments: The report will analyze significant regulatory changes affecting the market's operations and growth.

- Substitute Products and Services: Examination of alternative financial instruments and services that compete with Islamic finance products.

UK Islamic Finance Market Industry Evolution

This section provides a comprehensive analysis of the UK Islamic finance market's growth trajectory, technological advancements, and changing consumer demands from 2019 to 2024, and projects these trends through 2033. The market has demonstrated consistent growth, albeit at varying rates across different segments. Technological advancements, particularly in digital banking and fintech, are significantly impacting the industry, enhancing accessibility and efficiency. The increasing awareness and adoption of Sharia-compliant financial products among the Muslim population and beyond are driving market expansion.

- Compound Annual Growth Rate (CAGR) (2019-2024): xx%

- Projected CAGR (2025-2033): xx%

- Key Technological Advancements: Mobile banking, online platforms, blockchain technology integration, and AI-driven solutions.

- Shifting Consumer Demands: Increased demand for transparency, ethical investments, and personalized financial services.

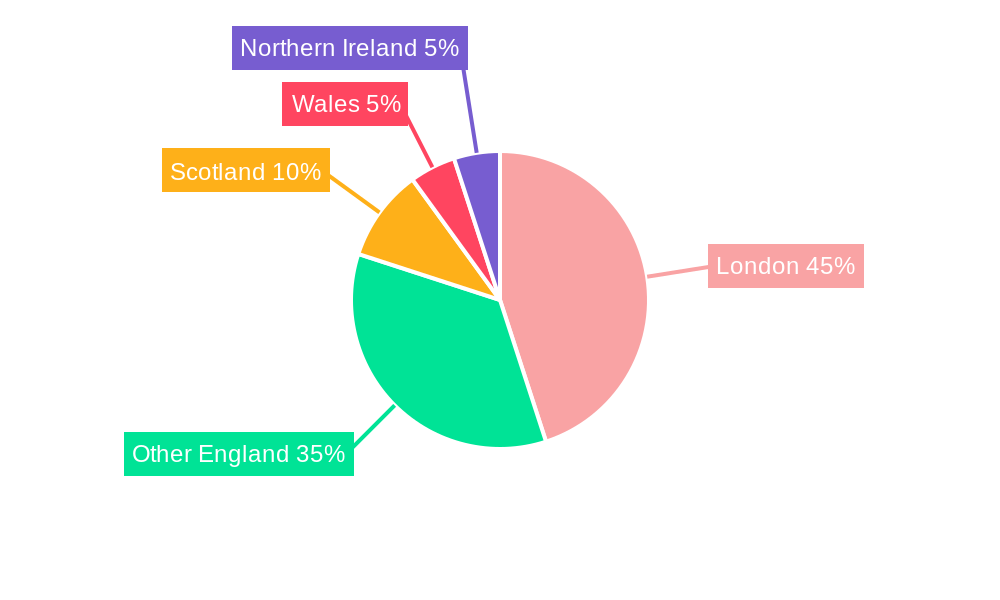

Leading Regions, Countries, or Segments in UK Islamic Finance Market

The report identifies London as the dominant hub for Islamic finance in the UK, driven by several key factors, including strong regulatory support, a concentration of financial institutions, and a significant Muslim population. However, the market’s growth is also observed in other regions of the UK, indicating a broad-based expansion.

Key Drivers for London's Dominance:

- Strong regulatory framework fostering a conducive environment for Islamic finance.

- Established presence of major Islamic banks and financial institutions.

- Large Muslim population base creating strong demand for Sharia-compliant products and services.

- Strategic location, acting as a gateway to European and global Islamic finance markets.

Other Significant Regions: Detailed analysis of other regions within the UK contributing to market growth, highlighting their growth potential.

UK Islamic Finance Market Product Innovations

Recent years have witnessed a surge in innovative Sharia-compliant financial products and services in the UK, including digital banking platforms, ethical investment funds, and specialized financing solutions for SMEs. These innovations are designed to meet diverse financial needs while adhering to Islamic principles. Technology plays a vital role, streamlining processes and expanding accessibility. Unique selling propositions often involve transparent fee structures and socially responsible investment options.

Propelling Factors for UK Islamic Finance Market Growth

The growth of the UK Islamic finance market is fueled by a confluence of factors including increasing awareness of Islamic finance principles, the rising Muslim population, supportive government policies, and ongoing technological advancements. The increasing demand for ethical and sustainable investment options further stimulates market expansion. Furthermore, favourable regulatory changes and international collaboration are contributing to overall growth.

Obstacles in the UK Islamic Finance Market Market

Despite significant potential, challenges hinder the UK Islamic finance market's full potential. Limited product standardization, a need for greater awareness among non-Muslim consumers, and competition from conventional financial services remain key obstacles. Regulatory complexities and the need for greater integration with the wider financial system also impact growth.

Future Opportunities in UK Islamic Finance Market

The UK Islamic finance market presents significant opportunities for expansion into underserved segments, such as SMEs and retail banking. The increasing adoption of fintech solutions and the potential for cross-border collaborations further enhance future prospects. The focus on sustainable finance and green Islamic finance offers additional avenues for market development.

Major Players in the UK Islamic Finance Market Ecosystem

- GateHouse Bank

- AI Rayan Bank

- Abu Dhabi Islamic Bank

- QIB UK

- Bank of London and The Middle East

- ABC International Bank

- Ahli United Bank

- Bank of Ireland

- Barclays

- BNP Paribas

- Bristol & West

- Citi Group

- IBJ International London

- J Aron & Co

Key Developments in UK Islamic Finance Market Industry

April 2023: London-based Nomo Bank partners with ADCB and Al Hilal Bank to offer digital banking services to UAE nationals and residents in the UK. This collaboration signifies the increasing convergence of Islamic finance and digital banking technologies.

January 2022: The UK's issuance of Sukuk bonds highlights growing participation in the global Islamic finance market. The increased volume and improved outlook of Fitch-rated sukuk (USD 132.4 Billion in 2021, with 80.1% investment-grade) demonstrate market confidence and potential for future growth.

Strategic UK Islamic Finance Market Market Forecast

The UK Islamic finance market is poised for substantial growth over the forecast period (2025-2033), driven by a confluence of factors including a growing Muslim population, increasing demand for Sharia-compliant products, technological advancements, and supportive regulatory frameworks. The market's potential is significant, offering substantial opportunities for investors and financial institutions. The projected CAGR underscores the market's dynamic nature and its capacity for continued expansion.

UK Islamic Finance Market Segmentation

-

1. Financial Sector

- 1.1. Islamic Banking

- 1.2. Islamic Insurance 'Takaful'

- 1.3. Islamic Bonds 'Sukuk'

- 1.4. Other Fi

UK Islamic Finance Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

UK Islamic Finance Market Regional Market Share

Geographic Coverage of UK Islamic Finance Market

UK Islamic Finance Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.12% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increase in International Business and Trade; Increase in Muslim Population

- 3.3. Market Restrains

- 3.3.1. Increase in International Business and Trade; Increase in Muslim Population

- 3.4. Market Trends

- 3.4.1. Digital Disruption of the Financial Services

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global UK Islamic Finance Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Financial Sector

- 5.1.1. Islamic Banking

- 5.1.2. Islamic Insurance 'Takaful'

- 5.1.3. Islamic Bonds 'Sukuk'

- 5.1.4. Other Fi

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. South America

- 5.2.3. Europe

- 5.2.4. Middle East & Africa

- 5.2.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Financial Sector

- 6. North America UK Islamic Finance Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Financial Sector

- 6.1.1. Islamic Banking

- 6.1.2. Islamic Insurance 'Takaful'

- 6.1.3. Islamic Bonds 'Sukuk'

- 6.1.4. Other Fi

- 6.1. Market Analysis, Insights and Forecast - by Financial Sector

- 7. South America UK Islamic Finance Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Financial Sector

- 7.1.1. Islamic Banking

- 7.1.2. Islamic Insurance 'Takaful'

- 7.1.3. Islamic Bonds 'Sukuk'

- 7.1.4. Other Fi

- 7.1. Market Analysis, Insights and Forecast - by Financial Sector

- 8. Europe UK Islamic Finance Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Financial Sector

- 8.1.1. Islamic Banking

- 8.1.2. Islamic Insurance 'Takaful'

- 8.1.3. Islamic Bonds 'Sukuk'

- 8.1.4. Other Fi

- 8.1. Market Analysis, Insights and Forecast - by Financial Sector

- 9. Middle East & Africa UK Islamic Finance Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Financial Sector

- 9.1.1. Islamic Banking

- 9.1.2. Islamic Insurance 'Takaful'

- 9.1.3. Islamic Bonds 'Sukuk'

- 9.1.4. Other Fi

- 9.1. Market Analysis, Insights and Forecast - by Financial Sector

- 10. Asia Pacific UK Islamic Finance Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Financial Sector

- 10.1.1. Islamic Banking

- 10.1.2. Islamic Insurance 'Takaful'

- 10.1.3. Islamic Bonds 'Sukuk'

- 10.1.4. Other Fi

- 10.1. Market Analysis, Insights and Forecast - by Financial Sector

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 GateHouse Bank

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 AI Rayan Bank

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Abu Dhabi Islamic Bank

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 QIB UK

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Bank of London and The Middle East

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 ABC International Bank

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Ahli United Bank

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Bank of Ireland

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Barclays

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 BNP Paribas

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Bristol & West

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Citi Group

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 IBJ International London

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 J Aron & Co**List Not Exhaustive

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.1 GateHouse Bank

List of Figures

- Figure 1: Global UK Islamic Finance Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: Global UK Islamic Finance Market Volume Breakdown (Billion, %) by Region 2025 & 2033

- Figure 3: North America UK Islamic Finance Market Revenue (Million), by Financial Sector 2025 & 2033

- Figure 4: North America UK Islamic Finance Market Volume (Billion), by Financial Sector 2025 & 2033

- Figure 5: North America UK Islamic Finance Market Revenue Share (%), by Financial Sector 2025 & 2033

- Figure 6: North America UK Islamic Finance Market Volume Share (%), by Financial Sector 2025 & 2033

- Figure 7: North America UK Islamic Finance Market Revenue (Million), by Country 2025 & 2033

- Figure 8: North America UK Islamic Finance Market Volume (Billion), by Country 2025 & 2033

- Figure 9: North America UK Islamic Finance Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: North America UK Islamic Finance Market Volume Share (%), by Country 2025 & 2033

- Figure 11: South America UK Islamic Finance Market Revenue (Million), by Financial Sector 2025 & 2033

- Figure 12: South America UK Islamic Finance Market Volume (Billion), by Financial Sector 2025 & 2033

- Figure 13: South America UK Islamic Finance Market Revenue Share (%), by Financial Sector 2025 & 2033

- Figure 14: South America UK Islamic Finance Market Volume Share (%), by Financial Sector 2025 & 2033

- Figure 15: South America UK Islamic Finance Market Revenue (Million), by Country 2025 & 2033

- Figure 16: South America UK Islamic Finance Market Volume (Billion), by Country 2025 & 2033

- Figure 17: South America UK Islamic Finance Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: South America UK Islamic Finance Market Volume Share (%), by Country 2025 & 2033

- Figure 19: Europe UK Islamic Finance Market Revenue (Million), by Financial Sector 2025 & 2033

- Figure 20: Europe UK Islamic Finance Market Volume (Billion), by Financial Sector 2025 & 2033

- Figure 21: Europe UK Islamic Finance Market Revenue Share (%), by Financial Sector 2025 & 2033

- Figure 22: Europe UK Islamic Finance Market Volume Share (%), by Financial Sector 2025 & 2033

- Figure 23: Europe UK Islamic Finance Market Revenue (Million), by Country 2025 & 2033

- Figure 24: Europe UK Islamic Finance Market Volume (Billion), by Country 2025 & 2033

- Figure 25: Europe UK Islamic Finance Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Europe UK Islamic Finance Market Volume Share (%), by Country 2025 & 2033

- Figure 27: Middle East & Africa UK Islamic Finance Market Revenue (Million), by Financial Sector 2025 & 2033

- Figure 28: Middle East & Africa UK Islamic Finance Market Volume (Billion), by Financial Sector 2025 & 2033

- Figure 29: Middle East & Africa UK Islamic Finance Market Revenue Share (%), by Financial Sector 2025 & 2033

- Figure 30: Middle East & Africa UK Islamic Finance Market Volume Share (%), by Financial Sector 2025 & 2033

- Figure 31: Middle East & Africa UK Islamic Finance Market Revenue (Million), by Country 2025 & 2033

- Figure 32: Middle East & Africa UK Islamic Finance Market Volume (Billion), by Country 2025 & 2033

- Figure 33: Middle East & Africa UK Islamic Finance Market Revenue Share (%), by Country 2025 & 2033

- Figure 34: Middle East & Africa UK Islamic Finance Market Volume Share (%), by Country 2025 & 2033

- Figure 35: Asia Pacific UK Islamic Finance Market Revenue (Million), by Financial Sector 2025 & 2033

- Figure 36: Asia Pacific UK Islamic Finance Market Volume (Billion), by Financial Sector 2025 & 2033

- Figure 37: Asia Pacific UK Islamic Finance Market Revenue Share (%), by Financial Sector 2025 & 2033

- Figure 38: Asia Pacific UK Islamic Finance Market Volume Share (%), by Financial Sector 2025 & 2033

- Figure 39: Asia Pacific UK Islamic Finance Market Revenue (Million), by Country 2025 & 2033

- Figure 40: Asia Pacific UK Islamic Finance Market Volume (Billion), by Country 2025 & 2033

- Figure 41: Asia Pacific UK Islamic Finance Market Revenue Share (%), by Country 2025 & 2033

- Figure 42: Asia Pacific UK Islamic Finance Market Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global UK Islamic Finance Market Revenue Million Forecast, by Financial Sector 2020 & 2033

- Table 2: Global UK Islamic Finance Market Volume Billion Forecast, by Financial Sector 2020 & 2033

- Table 3: Global UK Islamic Finance Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global UK Islamic Finance Market Volume Billion Forecast, by Region 2020 & 2033

- Table 5: Global UK Islamic Finance Market Revenue Million Forecast, by Financial Sector 2020 & 2033

- Table 6: Global UK Islamic Finance Market Volume Billion Forecast, by Financial Sector 2020 & 2033

- Table 7: Global UK Islamic Finance Market Revenue Million Forecast, by Country 2020 & 2033

- Table 8: Global UK Islamic Finance Market Volume Billion Forecast, by Country 2020 & 2033

- Table 9: United States UK Islamic Finance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: United States UK Islamic Finance Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 11: Canada UK Islamic Finance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Canada UK Islamic Finance Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 13: Mexico UK Islamic Finance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Mexico UK Islamic Finance Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 15: Global UK Islamic Finance Market Revenue Million Forecast, by Financial Sector 2020 & 2033

- Table 16: Global UK Islamic Finance Market Volume Billion Forecast, by Financial Sector 2020 & 2033

- Table 17: Global UK Islamic Finance Market Revenue Million Forecast, by Country 2020 & 2033

- Table 18: Global UK Islamic Finance Market Volume Billion Forecast, by Country 2020 & 2033

- Table 19: Brazil UK Islamic Finance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Brazil UK Islamic Finance Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 21: Argentina UK Islamic Finance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Argentina UK Islamic Finance Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 23: Rest of South America UK Islamic Finance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Rest of South America UK Islamic Finance Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 25: Global UK Islamic Finance Market Revenue Million Forecast, by Financial Sector 2020 & 2033

- Table 26: Global UK Islamic Finance Market Volume Billion Forecast, by Financial Sector 2020 & 2033

- Table 27: Global UK Islamic Finance Market Revenue Million Forecast, by Country 2020 & 2033

- Table 28: Global UK Islamic Finance Market Volume Billion Forecast, by Country 2020 & 2033

- Table 29: United Kingdom UK Islamic Finance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: United Kingdom UK Islamic Finance Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 31: Germany UK Islamic Finance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Germany UK Islamic Finance Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 33: France UK Islamic Finance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: France UK Islamic Finance Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 35: Italy UK Islamic Finance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: Italy UK Islamic Finance Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 37: Spain UK Islamic Finance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 38: Spain UK Islamic Finance Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 39: Russia UK Islamic Finance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 40: Russia UK Islamic Finance Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 41: Benelux UK Islamic Finance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 42: Benelux UK Islamic Finance Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 43: Nordics UK Islamic Finance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 44: Nordics UK Islamic Finance Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 45: Rest of Europe UK Islamic Finance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 46: Rest of Europe UK Islamic Finance Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 47: Global UK Islamic Finance Market Revenue Million Forecast, by Financial Sector 2020 & 2033

- Table 48: Global UK Islamic Finance Market Volume Billion Forecast, by Financial Sector 2020 & 2033

- Table 49: Global UK Islamic Finance Market Revenue Million Forecast, by Country 2020 & 2033

- Table 50: Global UK Islamic Finance Market Volume Billion Forecast, by Country 2020 & 2033

- Table 51: Turkey UK Islamic Finance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 52: Turkey UK Islamic Finance Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 53: Israel UK Islamic Finance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 54: Israel UK Islamic Finance Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 55: GCC UK Islamic Finance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 56: GCC UK Islamic Finance Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 57: North Africa UK Islamic Finance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 58: North Africa UK Islamic Finance Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 59: South Africa UK Islamic Finance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 60: South Africa UK Islamic Finance Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 61: Rest of Middle East & Africa UK Islamic Finance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 62: Rest of Middle East & Africa UK Islamic Finance Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 63: Global UK Islamic Finance Market Revenue Million Forecast, by Financial Sector 2020 & 2033

- Table 64: Global UK Islamic Finance Market Volume Billion Forecast, by Financial Sector 2020 & 2033

- Table 65: Global UK Islamic Finance Market Revenue Million Forecast, by Country 2020 & 2033

- Table 66: Global UK Islamic Finance Market Volume Billion Forecast, by Country 2020 & 2033

- Table 67: China UK Islamic Finance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 68: China UK Islamic Finance Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 69: India UK Islamic Finance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 70: India UK Islamic Finance Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 71: Japan UK Islamic Finance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 72: Japan UK Islamic Finance Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 73: South Korea UK Islamic Finance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 74: South Korea UK Islamic Finance Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 75: ASEAN UK Islamic Finance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 76: ASEAN UK Islamic Finance Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 77: Oceania UK Islamic Finance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 78: Oceania UK Islamic Finance Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 79: Rest of Asia Pacific UK Islamic Finance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 80: Rest of Asia Pacific UK Islamic Finance Market Volume (Billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the UK Islamic Finance Market?

The projected CAGR is approximately 3.12%.

2. Which companies are prominent players in the UK Islamic Finance Market?

Key companies in the market include GateHouse Bank, AI Rayan Bank, Abu Dhabi Islamic Bank, QIB UK, Bank of London and The Middle East, ABC International Bank, Ahli United Bank, Bank of Ireland, Barclays, BNP Paribas, Bristol & West, Citi Group, IBJ International London, J Aron & Co**List Not Exhaustive.

3. What are the main segments of the UK Islamic Finance Market?

The market segments include Financial Sector.

4. Can you provide details about the market size?

The market size is estimated to be USD 7.5 Million as of 2022.

5. What are some drivers contributing to market growth?

Increase in International Business and Trade; Increase in Muslim Population.

6. What are the notable trends driving market growth?

Digital Disruption of the Financial Services.

7. Are there any restraints impacting market growth?

Increase in International Business and Trade; Increase in Muslim Population.

8. Can you provide examples of recent developments in the market?

April 2023: London-based Nomo Bank has announced an innovative new partnership with Abu Dhabi-based banks ADCB and Al Hilal Bank to bring digital UK banking to UAE nationals and residents.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "UK Islamic Finance Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the UK Islamic Finance Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the UK Islamic Finance Market?

To stay informed about further developments, trends, and reports in the UK Islamic Finance Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence