Key Insights

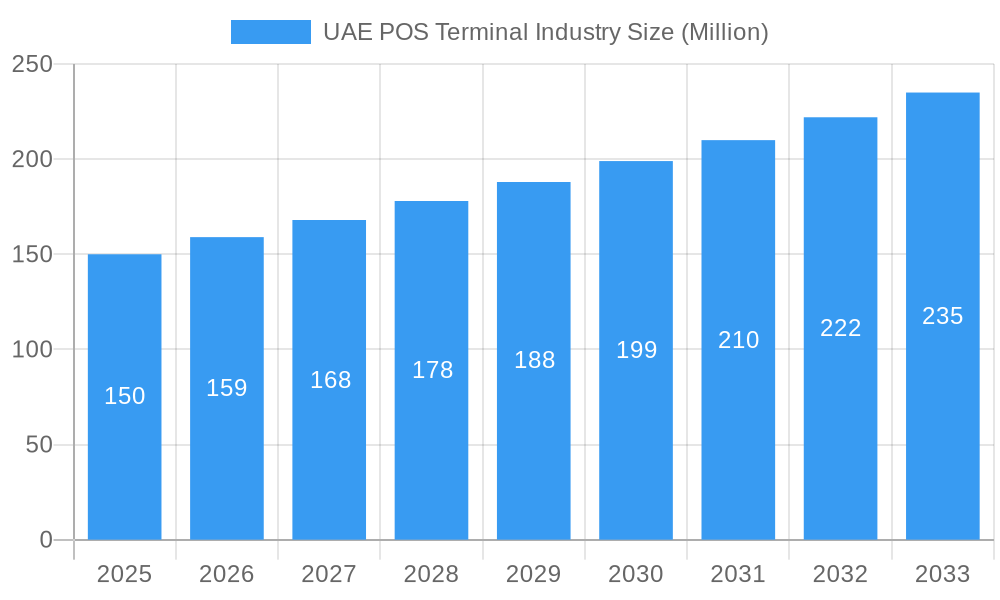

The United Arab Emirates (UAE) Point of Sale (POS) terminal market, estimated at $3.38 billion in 2025, is poised for substantial expansion. Projected to grow at a Compound Annual Growth Rate (CAGR) of 7.2% from 2025 to 2033, this robust growth is attributed to several key market drivers. The burgeoning UAE retail sector, increasingly adopting e-commerce and omnichannel strategies, demands advanced POS systems for optimized inventory, sales, and customer relationship management. Concurrently, the thriving hospitality industry, including hotels, restaurants, and cafes, is investing in technology to enhance operational efficiency and customer experiences. Government-led digitalization and cashless transaction initiatives further stimulate market growth. The escalating adoption of flexible and mobile POS solutions also significantly accelerates market expansion.

UAE POS Terminal Industry Market Size (In Billion)

While cybersecurity concerns and initial implementation costs present potential challenges, the UAE's dynamic economy and ongoing technological advancements ensure a positive market outlook. Segment analysis reveals that fixed POS systems currently lead the market due to their widespread adoption in large retail environments. However, mobile and portable POS systems are anticipated to experience accelerated growth, driven by their appeal to small and medium-sized enterprises (SMEs) and their inherent convenience. The retail sector remains the dominant end-user industry, followed by hospitality and healthcare. Prominent market players, including Ingenico SA, Toshiba Corporation, and VeriFone Systems Inc., are engaged in intense competition and continuous innovation to address evolving market demands. The UAE's strategic geographical position and its status as a regional business hub enhance the market's appeal to global enterprises.

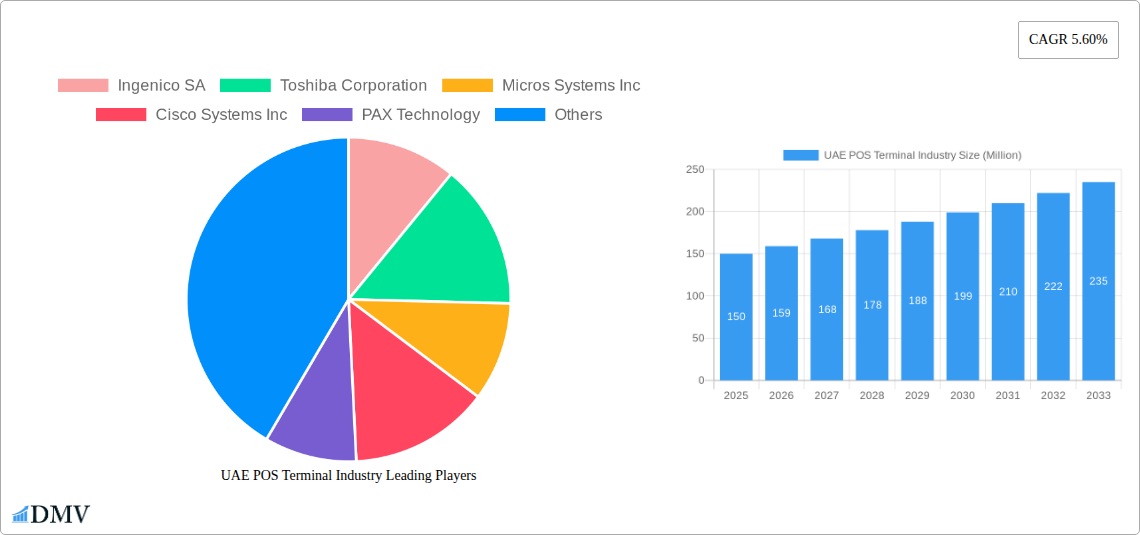

UAE POS Terminal Industry Company Market Share

UAE POS Terminal Industry Market Report: 2019-2033

This comprehensive report provides a detailed analysis of the UAE POS terminal market, covering the period from 2019 to 2033. With a base year of 2025 and an estimated year of 2025, this in-depth study forecasts market trends until 2033, offering invaluable insights for stakeholders across the industry. The report leverages extensive data from the historical period (2019-2024) to provide a robust foundation for future projections. The market is valued at xx Million in 2025 and is projected to reach xx Million by 2033.

UAE POS Terminal Industry Market Composition & Trends

The UAE POS terminal market exhibits a dynamic interplay of factors shaping its current and future trajectory. Market concentration is relatively high, with key players like Ingenico SA, PAX Technology, and VeriFone Systems Inc. holding significant market share. However, the entry of new players and technological innovations are driving increased competition. The regulatory landscape, characterized by initiatives promoting digital payments and financial inclusion, is a significant catalyst for growth. Substitute products, such as mobile payment apps, present a competitive challenge, though the demand for secure and reliable hardware POS terminals remains strong. The end-user profile is diverse, spanning retail, hospitality, healthcare, and other sectors, each exhibiting unique demand patterns. Furthermore, M&A activities have played a significant role in consolidating market share. Deal values have ranged from xx Million to xx Million in recent years, indicative of strong investor interest.

- Market Share Distribution (2025 Estimate): Ingenico SA (xx%), PAX Technology (xx%), VeriFone Systems Inc (xx%), Others (xx%)

- Recent M&A Activity: Deal value in 2024 estimated at xx Million.

- Key Regulatory Influences: UAE Central Bank initiatives promoting cashless transactions.

UAE POS Terminal Industry Industry Evolution

The UAE POS terminal market has witnessed robust growth from 2019 to 2024, driven by factors such as increasing digitalization, government initiatives promoting cashless transactions, and the expansion of e-commerce. The market experienced a Compound Annual Growth Rate (CAGR) of xx% during this period. Technological advancements, notably the rise of contactless payments, mobile POS systems, and integrated payment solutions, have significantly reshaped the industry. Consumer demand for seamless, secure, and convenient payment experiences is a key driver of innovation. The shift towards cloud-based POS systems and the integration of advanced analytics capabilities further propel market evolution. We project a CAGR of xx% from 2025-2033, with the market experiencing accelerated growth in the later years of the forecast period due to sustained technological innovation and increased adoption by SMEs. The adoption rate of mobile POS systems, in particular, is expected to increase significantly, reaching xx% by 2033.

Leading Regions, Countries, or Segments in UAE POS Terminal Industry

The retail sector dominates the UAE POS terminal market, accounting for approximately xx% of total market value in 2025. This dominance stems from the high concentration of retail establishments across the UAE and the increasing adoption of POS systems for efficient transaction processing and inventory management. The hospitality sector follows closely, with a significant share driven by the burgeoning tourism sector and the need for efficient payment solutions in hotels, restaurants, and other hospitality venues. Mobile/Portable POS systems are also gaining traction, fueled by the increasing preference for on-the-go payment solutions.

- Key Drivers for Retail Dominance: High retail density, government support for digital payments, strong e-commerce growth.

- Key Drivers for Hospitality Sector Growth: Tourism boom, increasing demand for contactless payments in restaurants and hotels.

- Key Drivers for Mobile POS Growth: Increased mobility, convenience, and cost-effectiveness for businesses.

UAE POS Terminal Industry Product Innovations

Recent innovations focus on enhancing security, improving user experience, and integrating advanced functionalities. Contactless payment technologies, such as NFC and tap-to-phone solutions, are becoming increasingly prevalent. Cloud-based POS systems offer scalability, remote management capabilities, and robust data analytics. Integration with loyalty programs and customer relationship management (CRM) systems is enhancing customer engagement. The introduction of crypto POS systems represents a significant leap towards the adoption of digital currencies in the UAE.

Propelling Factors for UAE POS Terminal Industry Growth

The UAE POS terminal market is propelled by several key factors. The government's strong push towards a cashless economy and the widespread adoption of digital payment methods are significant drivers. The flourishing tourism sector and increasing consumer spending fuel demand for efficient and reliable POS systems. Technological advancements, such as the introduction of contactless payment technologies and mobile POS solutions, are creating new opportunities for growth. Furthermore, the increasing penetration of smartphones and internet connectivity significantly supports market expansion.

Obstacles in the UAE POS Terminal Industry Market

Despite the positive outlook, the market faces certain challenges. The relatively high initial investment cost for some POS systems can be a barrier for smaller businesses. Concerns about data security and the potential for fraud remain significant. Competition from alternative payment methods, such as mobile wallets, also presents a challenge. Supply chain disruptions, while less severe than in previous years, still present a risk.

Future Opportunities in UAE POS Terminal Industry

Future opportunities lie in the expansion of contactless payments, the adoption of advanced analytics capabilities, and the integration of AI and IoT technologies into POS systems. The growth of e-commerce and the increasing demand for omnichannel payment solutions will further drive market growth. The adoption of cryptocurrencies and blockchain technology presents a promising avenue for future expansion. The expansion into underserved markets and segments also presents significant potential.

Major Players in the UAE POS Terminal Industry Ecosystem

- Ingenico Group Ingenico SA

- Toshiba Corporation Toshiba Corporation

- Micros Systems Inc (Now part of Oracle)

- Cisco Systems Inc Cisco Systems Inc

- PAX Technology PAX Technology

- Samsung Electronics Co., Ltd Samsung Electronics Inc

- NEC Corporation NEC Corporation

- VeriFone Systems Inc (Now part of FIS)

- Panasonic Corporation Panasonic Corporation

- Hewlett Packard Enterprises Hewlett Packard Enterprises

Key Developments in UAE POS Terminal Industry Industry

- April 2022: Visa and Magnati launch Tap to Phone, enabling contactless payments via smartphones.

- June 2022: Businesses begin accepting cryptocurrency payments via the Pallapay Crypto POS Machine System.

Strategic UAE POS Terminal Industry Market Forecast

The UAE POS terminal market is poised for continued growth, driven by ongoing digital transformation, government initiatives, and increasing consumer adoption of digital payments. The focus on innovation, particularly in contactless and mobile POS solutions, will further fuel market expansion. The emergence of new technologies, such as AI and IoT integration, will create exciting opportunities for market players and reshape the industry landscape. The market is expected to witness significant growth in the coming years, driven by the factors mentioned above, leading to substantial revenue generation and market expansion.

UAE POS Terminal Industry Segmentation

-

1. Type

- 1.1. Fixed Point-of-sale Systems

- 1.2. Mobile/Portable Point-of-sale Systems

-

2. End-user Industries

- 2.1. Retail

- 2.2. Hospitality

- 2.3. Healthcare

- 2.4. Others

UAE POS Terminal Industry Segmentation By Geography

-

1. Middle East & Africa

- 1.1. UAE

- 1.2. South Africa

- 1.3. Saudi Arabia

- 1.4. Rest Of MEA

UAE POS Terminal Industry Regional Market Share

Geographic Coverage of UAE POS Terminal Industry

UAE POS Terminal Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.2% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Low Total Cost of Ownership Compared to Other Channels of Payments; Significant Rise in the Demand for Contactless and Mobile POS Terminals

- 3.3. Market Restrains

- 3.3.1. High Investment is Required during Initial Setup; Synchronization and Compatibility Issue with the Existing System

- 3.4. Market Trends

- 3.4.1. Retail Expected to Witness Significant Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. UAE POS Terminal Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Fixed Point-of-sale Systems

- 5.1.2. Mobile/Portable Point-of-sale Systems

- 5.2. Market Analysis, Insights and Forecast - by End-user Industries

- 5.2.1. Retail

- 5.2.2. Hospitality

- 5.2.3. Healthcare

- 5.2.4. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Middle East & Africa

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Ingenico SA

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Toshiba Corporation

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Micros Systems Inc

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Cisco Systems Inc

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 PAX Technology

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Samsung Electronics Inc

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 NEC Corporation

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 VeriFone System Inc

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Panasonic Corporation

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Hewlett Packard Enterprises

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Ingenico SA

List of Figures

- Figure 1: UAE POS Terminal Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: UAE POS Terminal Industry Share (%) by Company 2025

List of Tables

- Table 1: UAE POS Terminal Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 2: UAE POS Terminal Industry Revenue billion Forecast, by End-user Industries 2020 & 2033

- Table 3: UAE POS Terminal Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 4: UAE POS Terminal Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 5: UAE POS Terminal Industry Revenue billion Forecast, by End-user Industries 2020 & 2033

- Table 6: UAE POS Terminal Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 7: UAE UAE POS Terminal Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: South Africa UAE POS Terminal Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 9: Saudi Arabia UAE POS Terminal Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Rest Of MEA UAE POS Terminal Industry Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the UAE POS Terminal Industry?

The projected CAGR is approximately 7.2%.

2. Which companies are prominent players in the UAE POS Terminal Industry?

Key companies in the market include Ingenico SA, Toshiba Corporation, Micros Systems Inc, Cisco Systems Inc, PAX Technology, Samsung Electronics Inc, NEC Corporation, VeriFone System Inc, Panasonic Corporation, Hewlett Packard Enterprises.

3. What are the main segments of the UAE POS Terminal Industry?

The market segments include Type, End-user Industries.

4. Can you provide details about the market size?

The market size is estimated to be USD 3.38 billion as of 2022.

5. What are some drivers contributing to market growth?

Low Total Cost of Ownership Compared to Other Channels of Payments; Significant Rise in the Demand for Contactless and Mobile POS Terminals.

6. What are the notable trends driving market growth?

Retail Expected to Witness Significant Market Share.

7. Are there any restraints impacting market growth?

High Investment is Required during Initial Setup; Synchronization and Compatibility Issue with the Existing System.

8. Can you provide examples of recent developments in the market?

June 2022 - Businesses in the UAE announced to accept cryptocurrency with the Pallapay Crypto POS Machine System and receive fiat in their bank accounts. Pallapay is in charge and accepts bitcoin and receives fiat payments in AED, USD, EUR, and GBP into one's bank account.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "UAE POS Terminal Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the UAE POS Terminal Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the UAE POS Terminal Industry?

To stay informed about further developments, trends, and reports in the UAE POS Terminal Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence