Key Insights

The global Testing, Inspection, and Certification (TIC) market for the transportation industry is projected for substantial growth, propelled by stringent safety standards, escalating demand for quality assurance, and the expanding transportation sector. The market is valued at $251.62 million, with an anticipated Compound Annual Growth Rate (CAGR) of 4.68% from 2025 to 2033. Key growth drivers include the increasing adoption of advanced materials and technologies in vehicle manufacturing, a strong emphasis on environmental compliance, and the growing complexity of transportation systems. The automotive, aerospace, and rail segments are significant revenue contributors, with rail experiencing robust expansion due to global infrastructure upgrades and development projects. The outsourcing of TIC services remains a prominent trend, driven by cost efficiencies and access to specialized expertise, though some organizations retain in-house capabilities for critical quality control and intellectual property protection. North America and Europe currently lead the market due to mature infrastructure and regulatory frameworks, while the Asia-Pacific region is poised for considerable growth driven by rapid industrialization and infrastructure development.

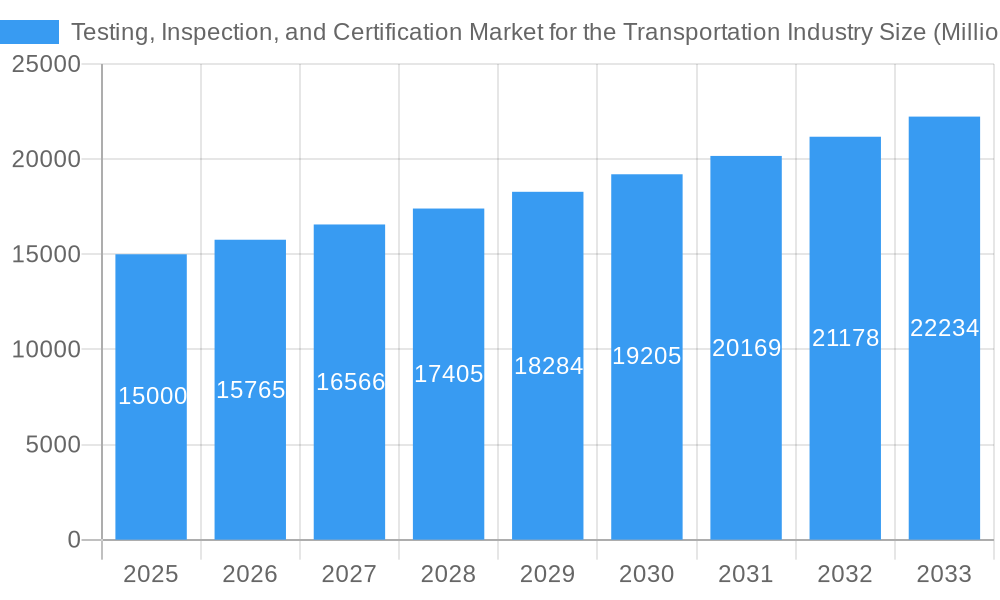

Testing, Inspection, and Certification Market for the Transportation Industry Market Size (In Million)

The TIC market is subject to certain constraints, including the high investment required for advanced testing technologies, the demand for skilled professionals, and potential regional regulatory variations. Intense competition exists among established entities and specialized emerging firms. The ongoing evolution of transportation technologies, such as autonomous and electric vehicles, presents both opportunities and challenges, necessitating continuous adaptation and investment in specialized TIC capabilities. Strategic navigation of these trends is vital for market players to sustain their positions and leverage future growth prospects. Market segmentation by service type (testing, inspection, certification), sourcing model (outsourced, in-house), and end-user industry (automotive, aerospace, rail) offers critical insights into this dynamic sector.

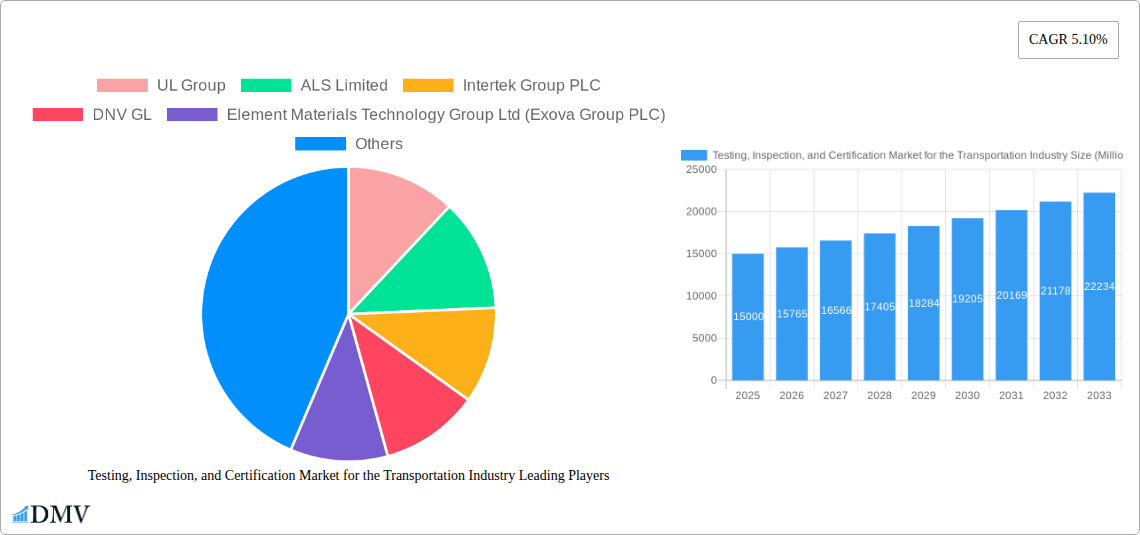

Testing, Inspection, and Certification Market for the Transportation Industry Company Market Share

Testing, Inspection, and Certification Market for the Transportation Industry: A Comprehensive Report (2019-2033)

This insightful report provides a comprehensive analysis of the Testing, Inspection, and Certification (TIC) market for the transportation industry, covering the period from 2019 to 2033. It delves into market dynamics, growth drivers, challenges, and future opportunities, offering valuable insights for stakeholders across the industry. With a focus on key players like UL Group, ALS Limited, Intertek Group PLC, and DNV GL, this report provides a detailed understanding of this rapidly evolving market, valued at xx Million in 2025 and projected to reach xx Million by 2033.

Testing, Inspection, and Certification Market for the Transportation Industry Market Composition & Trends

The global Testing, Inspection, and Certification market for the transportation industry is characterized by a moderately consolidated landscape, with several multinational corporations holding significant market share. The market is witnessing a surge in innovation driven by stringent safety regulations, increasing demand for automation, and the rise of new materials and technologies in aerospace and rail. Regulatory landscapes vary significantly across different regions, influencing testing requirements and market access. Substitute products are limited, given the specialized nature of TIC services, while M&A activities are frequent, reflecting the consolidation trend in the industry. Recent deals, such as the May 2021 acquisition of IMA Materialforschung und Anwendungstechnik GmbH by Applus Laboratories, demonstrate a strategic focus on expanding expertise in key sectors like rail and aerospace.

- Market Share Distribution (2025): UL Group (xx%), Intertek Group PLC (xx%), SGS SA (xx%), Bureau Veritas SA (xx%), Others (xx%). These figures are estimates based on publicly available data and market analysis.

- M&A Deal Values (2019-2024): Total deal value estimated at xx Million, with an average deal size of xx Million. Data is based on reported transactions and market estimations.

- Innovation Catalysts: Stringent safety regulations, automation in testing procedures, advancements in materials science.

- End-user Profiles: Primarily OEMs, Tier-1 suppliers, and regulatory bodies.

Testing, Inspection, and Certification Market for the Transportation Industry Industry Evolution

The transportation TIC market has exhibited consistent growth over the historical period (2019-2024), driven by increasing global transportation volumes, heightened safety concerns, and evolving regulatory frameworks. Technological advancements, particularly in automation and data analytics, are transforming testing and inspection processes, leading to increased efficiency and accuracy. The demand for specialized services catering to new materials and propulsion technologies (e.g., electric vehicles, hydrogen-powered aircraft) is also fueling growth. Growth rates have been estimated at xx% CAGR during the historical period, with projections of xx% CAGR for the forecast period (2025-2033). Adoption of advanced technologies, such as AI-powered inspection systems and predictive maintenance tools, is increasing steadily, although penetration remains relatively low, showing significant future potential. Consumer demand for safer, more reliable transportation is a key driver, leading to stricter regulatory compliance requirements and a corresponding increase in testing and certification activities.

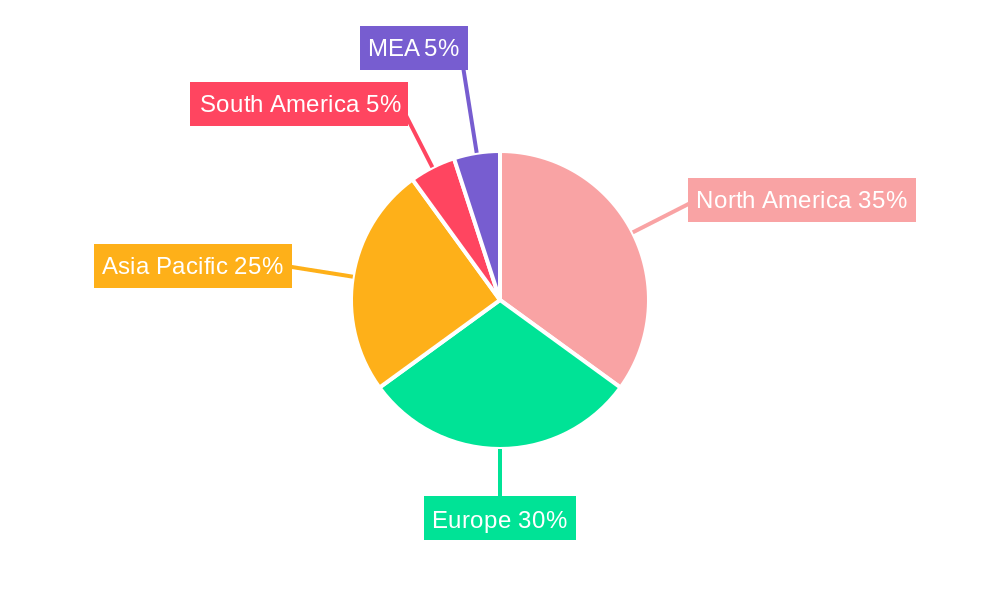

Leading Regions, Countries, or Segments in Testing, Inspection, and Certification Market for the Transportation Industry

Dominant Region: North America and Europe currently hold the largest market share due to established regulatory frameworks, strong manufacturing bases, and high adoption rates of advanced technologies. Asia-Pacific is witnessing strong growth, propelled by increasing infrastructure investments and stringent regulatory reforms.

Dominant Segment (By Service Type): Testing and Inspection services currently dominate the market due to broader applications across the value chain. Certification services are projected to experience faster growth driven by increased demand for compliance certifications.

Dominant Segment (By Sourcing Type): Outsourced services are prevalent due to cost-effectiveness and access to specialized expertise. However, in-house capabilities are increasingly adopted by larger players for improved control and data integration.

Dominant Segment (By End-user Industry): Aerospace and rail demonstrate the highest demand for TIC services given the stringent safety requirements and complex regulatory frameworks.

Key Drivers:

- North America & Europe: Stringent safety regulations, robust aerospace and rail industries, high investments in research and development.

- Asia-Pacific: Rapid infrastructure development, increasing investments in transportation networks, stringent regulatory developments.

Testing, Inspection, and Certification Market for the Transportation Industry Product Innovations

Recent product innovations focus on automation, data analytics, and the integration of advanced technologies such as AI and machine learning. This enables faster, more accurate, and cost-effective testing and inspection processes. New testing protocols are being developed to address the unique challenges posed by emerging transportation technologies, such as electric and autonomous vehicles. Unique selling propositions include improved accuracy, reduced downtime, and enhanced data management capabilities. The development of remote inspection technologies and digital twins is also significantly shaping the industry.

Propelling Factors for Testing, Inspection, and Certification Market for the Transportation Industry Growth

Several factors propel market growth, including:

- Technological Advancements: Automation, AI, and big data analytics significantly improve testing efficiency and accuracy. The development of non-destructive testing methods further enhances safety and reliability.

- Economic Growth: Growing global transportation sector and infrastructure development initiatives drive increased demand for TIC services.

- Stringent Regulations: Government regulations focused on safety and environmental compliance mandate rigorous testing and certification procedures. The South Korean government's initiative to replace imported rail inspection technology is a clear example of this trend.

Obstacles in the Testing, Inspection, and Certification Market for the Transportation Industry Market

The market faces challenges such as:

- Regulatory Complexity: Varying regulations across regions create complexities and compliance costs.

- Supply Chain Disruptions: Global supply chain issues can impact the availability of testing equipment and skilled personnel.

- Intense Competition: The presence of numerous established players creates competitive pressure and price sensitivity. These challenges contribute to an estimated xx% reduction in market growth during specific periods.

Future Opportunities in Testing, Inspection, and Certification Market for the Transportation Industry

Future opportunities include:

- Expansion into Emerging Markets: Growing transportation infrastructure in developing economies presents significant growth potential.

- Development of New Testing Technologies: Advancements in areas like non-destructive testing and predictive maintenance will create demand for innovative services.

- Increased Adoption of Digitalization: The integration of digital technologies will improve data management, analysis, and decision-making.

Major Players in the Testing, Inspection, and Certification Market for the Transportation Industry Ecosystem

Key Developments in Testing, Inspection, and Certification Market for the Transportation Industry Industry

- June 2022: South Korea developed automated rail inspection technology, boosting efficiency and safety while reducing reliance on imports.

- May 2021: Applus Laboratories acquired IMA Materialforschung und Anwendungstechnik GmbH, expanding its expertise in rail, aerospace, and other sectors.

Strategic Testing, Inspection, and Certification Market for the Transportation Industry Market Forecast

The Testing, Inspection, and Certification market for the transportation industry is poised for robust growth, driven by technological innovations, expanding transportation infrastructure, and increasingly stringent safety regulations. The emergence of new transportation technologies, such as electric vehicles and autonomous systems, will further fuel demand for specialized testing and certification services. The market's growth trajectory will be significantly shaped by the ongoing adoption of digital technologies and the consolidation trend among key players. The forecast period (2025-2033) anticipates a substantial increase in market size, driven primarily by the factors mentioned above, creating opportunities for companies that can adapt to changing technological landscapes and regulatory requirements.

Testing, Inspection, and Certification Market for the Transportation Industry Segmentation

-

1. Service Type

- 1.1. Testing and Inspection Service

- 1.2. Certification Service

-

2. Sourcing Type

- 2.1. Outsourced

- 2.2. In-house

-

3. End-user Industry

- 3.1. Rail

- 3.2. Aerospace

Testing, Inspection, and Certification Market for the Transportation Industry Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Latin America

- 5. Middle East and Africa

Testing, Inspection, and Certification Market for the Transportation Industry Regional Market Share

Geographic Coverage of Testing, Inspection, and Certification Market for the Transportation Industry

Testing, Inspection, and Certification Market for the Transportation Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.68% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increase in Strict Regulations Imposed by the Government; Need for High Reliability and Compliance

- 3.3. Market Restrains

- 3.3.1. High Initial Cost of the Equipment

- 3.4. Market Trends

- 3.4.1. Testing and Inspection Service to Hold a Significant Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Testing, Inspection, and Certification Market for the Transportation Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Service Type

- 5.1.1. Testing and Inspection Service

- 5.1.2. Certification Service

- 5.2. Market Analysis, Insights and Forecast - by Sourcing Type

- 5.2.1. Outsourced

- 5.2.2. In-house

- 5.3. Market Analysis, Insights and Forecast - by End-user Industry

- 5.3.1. Rail

- 5.3.2. Aerospace

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. Latin America

- 5.4.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Service Type

- 6. North America Testing, Inspection, and Certification Market for the Transportation Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Service Type

- 6.1.1. Testing and Inspection Service

- 6.1.2. Certification Service

- 6.2. Market Analysis, Insights and Forecast - by Sourcing Type

- 6.2.1. Outsourced

- 6.2.2. In-house

- 6.3. Market Analysis, Insights and Forecast - by End-user Industry

- 6.3.1. Rail

- 6.3.2. Aerospace

- 6.1. Market Analysis, Insights and Forecast - by Service Type

- 7. Europe Testing, Inspection, and Certification Market for the Transportation Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Service Type

- 7.1.1. Testing and Inspection Service

- 7.1.2. Certification Service

- 7.2. Market Analysis, Insights and Forecast - by Sourcing Type

- 7.2.1. Outsourced

- 7.2.2. In-house

- 7.3. Market Analysis, Insights and Forecast - by End-user Industry

- 7.3.1. Rail

- 7.3.2. Aerospace

- 7.1. Market Analysis, Insights and Forecast - by Service Type

- 8. Asia Pacific Testing, Inspection, and Certification Market for the Transportation Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Service Type

- 8.1.1. Testing and Inspection Service

- 8.1.2. Certification Service

- 8.2. Market Analysis, Insights and Forecast - by Sourcing Type

- 8.2.1. Outsourced

- 8.2.2. In-house

- 8.3. Market Analysis, Insights and Forecast - by End-user Industry

- 8.3.1. Rail

- 8.3.2. Aerospace

- 8.1. Market Analysis, Insights and Forecast - by Service Type

- 9. Latin America Testing, Inspection, and Certification Market for the Transportation Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Service Type

- 9.1.1. Testing and Inspection Service

- 9.1.2. Certification Service

- 9.2. Market Analysis, Insights and Forecast - by Sourcing Type

- 9.2.1. Outsourced

- 9.2.2. In-house

- 9.3. Market Analysis, Insights and Forecast - by End-user Industry

- 9.3.1. Rail

- 9.3.2. Aerospace

- 9.1. Market Analysis, Insights and Forecast - by Service Type

- 10. Middle East and Africa Testing, Inspection, and Certification Market for the Transportation Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Service Type

- 10.1.1. Testing and Inspection Service

- 10.1.2. Certification Service

- 10.2. Market Analysis, Insights and Forecast - by Sourcing Type

- 10.2.1. Outsourced

- 10.2.2. In-house

- 10.3. Market Analysis, Insights and Forecast - by End-user Industry

- 10.3.1. Rail

- 10.3.2. Aerospace

- 10.1. Market Analysis, Insights and Forecast - by Service Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 UL Group

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 ALS Limited

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Intertek Group PLC

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 DNV GL

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Element Materials Technology Group Ltd (Exova Group PLC)

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 MISTRAS Group Inc

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 SAI Global Limited

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 SGS SA

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 TUV SUD Limited

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Bureau Veritas SA

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Dekra certification Gmbh (DEKRA SE)

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.1 UL Group

List of Figures

- Figure 1: Global Testing, Inspection, and Certification Market for the Transportation Industry Revenue Breakdown (million, %) by Region 2025 & 2033

- Figure 2: Global Testing, Inspection, and Certification Market for the Transportation Industry Volume Breakdown (K Unit, %) by Region 2025 & 2033

- Figure 3: North America Testing, Inspection, and Certification Market for the Transportation Industry Revenue (million), by Service Type 2025 & 2033

- Figure 4: North America Testing, Inspection, and Certification Market for the Transportation Industry Volume (K Unit), by Service Type 2025 & 2033

- Figure 5: North America Testing, Inspection, and Certification Market for the Transportation Industry Revenue Share (%), by Service Type 2025 & 2033

- Figure 6: North America Testing, Inspection, and Certification Market for the Transportation Industry Volume Share (%), by Service Type 2025 & 2033

- Figure 7: North America Testing, Inspection, and Certification Market for the Transportation Industry Revenue (million), by Sourcing Type 2025 & 2033

- Figure 8: North America Testing, Inspection, and Certification Market for the Transportation Industry Volume (K Unit), by Sourcing Type 2025 & 2033

- Figure 9: North America Testing, Inspection, and Certification Market for the Transportation Industry Revenue Share (%), by Sourcing Type 2025 & 2033

- Figure 10: North America Testing, Inspection, and Certification Market for the Transportation Industry Volume Share (%), by Sourcing Type 2025 & 2033

- Figure 11: North America Testing, Inspection, and Certification Market for the Transportation Industry Revenue (million), by End-user Industry 2025 & 2033

- Figure 12: North America Testing, Inspection, and Certification Market for the Transportation Industry Volume (K Unit), by End-user Industry 2025 & 2033

- Figure 13: North America Testing, Inspection, and Certification Market for the Transportation Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 14: North America Testing, Inspection, and Certification Market for the Transportation Industry Volume Share (%), by End-user Industry 2025 & 2033

- Figure 15: North America Testing, Inspection, and Certification Market for the Transportation Industry Revenue (million), by Country 2025 & 2033

- Figure 16: North America Testing, Inspection, and Certification Market for the Transportation Industry Volume (K Unit), by Country 2025 & 2033

- Figure 17: North America Testing, Inspection, and Certification Market for the Transportation Industry Revenue Share (%), by Country 2025 & 2033

- Figure 18: North America Testing, Inspection, and Certification Market for the Transportation Industry Volume Share (%), by Country 2025 & 2033

- Figure 19: Europe Testing, Inspection, and Certification Market for the Transportation Industry Revenue (million), by Service Type 2025 & 2033

- Figure 20: Europe Testing, Inspection, and Certification Market for the Transportation Industry Volume (K Unit), by Service Type 2025 & 2033

- Figure 21: Europe Testing, Inspection, and Certification Market for the Transportation Industry Revenue Share (%), by Service Type 2025 & 2033

- Figure 22: Europe Testing, Inspection, and Certification Market for the Transportation Industry Volume Share (%), by Service Type 2025 & 2033

- Figure 23: Europe Testing, Inspection, and Certification Market for the Transportation Industry Revenue (million), by Sourcing Type 2025 & 2033

- Figure 24: Europe Testing, Inspection, and Certification Market for the Transportation Industry Volume (K Unit), by Sourcing Type 2025 & 2033

- Figure 25: Europe Testing, Inspection, and Certification Market for the Transportation Industry Revenue Share (%), by Sourcing Type 2025 & 2033

- Figure 26: Europe Testing, Inspection, and Certification Market for the Transportation Industry Volume Share (%), by Sourcing Type 2025 & 2033

- Figure 27: Europe Testing, Inspection, and Certification Market for the Transportation Industry Revenue (million), by End-user Industry 2025 & 2033

- Figure 28: Europe Testing, Inspection, and Certification Market for the Transportation Industry Volume (K Unit), by End-user Industry 2025 & 2033

- Figure 29: Europe Testing, Inspection, and Certification Market for the Transportation Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 30: Europe Testing, Inspection, and Certification Market for the Transportation Industry Volume Share (%), by End-user Industry 2025 & 2033

- Figure 31: Europe Testing, Inspection, and Certification Market for the Transportation Industry Revenue (million), by Country 2025 & 2033

- Figure 32: Europe Testing, Inspection, and Certification Market for the Transportation Industry Volume (K Unit), by Country 2025 & 2033

- Figure 33: Europe Testing, Inspection, and Certification Market for the Transportation Industry Revenue Share (%), by Country 2025 & 2033

- Figure 34: Europe Testing, Inspection, and Certification Market for the Transportation Industry Volume Share (%), by Country 2025 & 2033

- Figure 35: Asia Pacific Testing, Inspection, and Certification Market for the Transportation Industry Revenue (million), by Service Type 2025 & 2033

- Figure 36: Asia Pacific Testing, Inspection, and Certification Market for the Transportation Industry Volume (K Unit), by Service Type 2025 & 2033

- Figure 37: Asia Pacific Testing, Inspection, and Certification Market for the Transportation Industry Revenue Share (%), by Service Type 2025 & 2033

- Figure 38: Asia Pacific Testing, Inspection, and Certification Market for the Transportation Industry Volume Share (%), by Service Type 2025 & 2033

- Figure 39: Asia Pacific Testing, Inspection, and Certification Market for the Transportation Industry Revenue (million), by Sourcing Type 2025 & 2033

- Figure 40: Asia Pacific Testing, Inspection, and Certification Market for the Transportation Industry Volume (K Unit), by Sourcing Type 2025 & 2033

- Figure 41: Asia Pacific Testing, Inspection, and Certification Market for the Transportation Industry Revenue Share (%), by Sourcing Type 2025 & 2033

- Figure 42: Asia Pacific Testing, Inspection, and Certification Market for the Transportation Industry Volume Share (%), by Sourcing Type 2025 & 2033

- Figure 43: Asia Pacific Testing, Inspection, and Certification Market for the Transportation Industry Revenue (million), by End-user Industry 2025 & 2033

- Figure 44: Asia Pacific Testing, Inspection, and Certification Market for the Transportation Industry Volume (K Unit), by End-user Industry 2025 & 2033

- Figure 45: Asia Pacific Testing, Inspection, and Certification Market for the Transportation Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 46: Asia Pacific Testing, Inspection, and Certification Market for the Transportation Industry Volume Share (%), by End-user Industry 2025 & 2033

- Figure 47: Asia Pacific Testing, Inspection, and Certification Market for the Transportation Industry Revenue (million), by Country 2025 & 2033

- Figure 48: Asia Pacific Testing, Inspection, and Certification Market for the Transportation Industry Volume (K Unit), by Country 2025 & 2033

- Figure 49: Asia Pacific Testing, Inspection, and Certification Market for the Transportation Industry Revenue Share (%), by Country 2025 & 2033

- Figure 50: Asia Pacific Testing, Inspection, and Certification Market for the Transportation Industry Volume Share (%), by Country 2025 & 2033

- Figure 51: Latin America Testing, Inspection, and Certification Market for the Transportation Industry Revenue (million), by Service Type 2025 & 2033

- Figure 52: Latin America Testing, Inspection, and Certification Market for the Transportation Industry Volume (K Unit), by Service Type 2025 & 2033

- Figure 53: Latin America Testing, Inspection, and Certification Market for the Transportation Industry Revenue Share (%), by Service Type 2025 & 2033

- Figure 54: Latin America Testing, Inspection, and Certification Market for the Transportation Industry Volume Share (%), by Service Type 2025 & 2033

- Figure 55: Latin America Testing, Inspection, and Certification Market for the Transportation Industry Revenue (million), by Sourcing Type 2025 & 2033

- Figure 56: Latin America Testing, Inspection, and Certification Market for the Transportation Industry Volume (K Unit), by Sourcing Type 2025 & 2033

- Figure 57: Latin America Testing, Inspection, and Certification Market for the Transportation Industry Revenue Share (%), by Sourcing Type 2025 & 2033

- Figure 58: Latin America Testing, Inspection, and Certification Market for the Transportation Industry Volume Share (%), by Sourcing Type 2025 & 2033

- Figure 59: Latin America Testing, Inspection, and Certification Market for the Transportation Industry Revenue (million), by End-user Industry 2025 & 2033

- Figure 60: Latin America Testing, Inspection, and Certification Market for the Transportation Industry Volume (K Unit), by End-user Industry 2025 & 2033

- Figure 61: Latin America Testing, Inspection, and Certification Market for the Transportation Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 62: Latin America Testing, Inspection, and Certification Market for the Transportation Industry Volume Share (%), by End-user Industry 2025 & 2033

- Figure 63: Latin America Testing, Inspection, and Certification Market for the Transportation Industry Revenue (million), by Country 2025 & 2033

- Figure 64: Latin America Testing, Inspection, and Certification Market for the Transportation Industry Volume (K Unit), by Country 2025 & 2033

- Figure 65: Latin America Testing, Inspection, and Certification Market for the Transportation Industry Revenue Share (%), by Country 2025 & 2033

- Figure 66: Latin America Testing, Inspection, and Certification Market for the Transportation Industry Volume Share (%), by Country 2025 & 2033

- Figure 67: Middle East and Africa Testing, Inspection, and Certification Market for the Transportation Industry Revenue (million), by Service Type 2025 & 2033

- Figure 68: Middle East and Africa Testing, Inspection, and Certification Market for the Transportation Industry Volume (K Unit), by Service Type 2025 & 2033

- Figure 69: Middle East and Africa Testing, Inspection, and Certification Market for the Transportation Industry Revenue Share (%), by Service Type 2025 & 2033

- Figure 70: Middle East and Africa Testing, Inspection, and Certification Market for the Transportation Industry Volume Share (%), by Service Type 2025 & 2033

- Figure 71: Middle East and Africa Testing, Inspection, and Certification Market for the Transportation Industry Revenue (million), by Sourcing Type 2025 & 2033

- Figure 72: Middle East and Africa Testing, Inspection, and Certification Market for the Transportation Industry Volume (K Unit), by Sourcing Type 2025 & 2033

- Figure 73: Middle East and Africa Testing, Inspection, and Certification Market for the Transportation Industry Revenue Share (%), by Sourcing Type 2025 & 2033

- Figure 74: Middle East and Africa Testing, Inspection, and Certification Market for the Transportation Industry Volume Share (%), by Sourcing Type 2025 & 2033

- Figure 75: Middle East and Africa Testing, Inspection, and Certification Market for the Transportation Industry Revenue (million), by End-user Industry 2025 & 2033

- Figure 76: Middle East and Africa Testing, Inspection, and Certification Market for the Transportation Industry Volume (K Unit), by End-user Industry 2025 & 2033

- Figure 77: Middle East and Africa Testing, Inspection, and Certification Market for the Transportation Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 78: Middle East and Africa Testing, Inspection, and Certification Market for the Transportation Industry Volume Share (%), by End-user Industry 2025 & 2033

- Figure 79: Middle East and Africa Testing, Inspection, and Certification Market for the Transportation Industry Revenue (million), by Country 2025 & 2033

- Figure 80: Middle East and Africa Testing, Inspection, and Certification Market for the Transportation Industry Volume (K Unit), by Country 2025 & 2033

- Figure 81: Middle East and Africa Testing, Inspection, and Certification Market for the Transportation Industry Revenue Share (%), by Country 2025 & 2033

- Figure 82: Middle East and Africa Testing, Inspection, and Certification Market for the Transportation Industry Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Testing, Inspection, and Certification Market for the Transportation Industry Revenue million Forecast, by Service Type 2020 & 2033

- Table 2: Global Testing, Inspection, and Certification Market for the Transportation Industry Volume K Unit Forecast, by Service Type 2020 & 2033

- Table 3: Global Testing, Inspection, and Certification Market for the Transportation Industry Revenue million Forecast, by Sourcing Type 2020 & 2033

- Table 4: Global Testing, Inspection, and Certification Market for the Transportation Industry Volume K Unit Forecast, by Sourcing Type 2020 & 2033

- Table 5: Global Testing, Inspection, and Certification Market for the Transportation Industry Revenue million Forecast, by End-user Industry 2020 & 2033

- Table 6: Global Testing, Inspection, and Certification Market for the Transportation Industry Volume K Unit Forecast, by End-user Industry 2020 & 2033

- Table 7: Global Testing, Inspection, and Certification Market for the Transportation Industry Revenue million Forecast, by Region 2020 & 2033

- Table 8: Global Testing, Inspection, and Certification Market for the Transportation Industry Volume K Unit Forecast, by Region 2020 & 2033

- Table 9: Global Testing, Inspection, and Certification Market for the Transportation Industry Revenue million Forecast, by Service Type 2020 & 2033

- Table 10: Global Testing, Inspection, and Certification Market for the Transportation Industry Volume K Unit Forecast, by Service Type 2020 & 2033

- Table 11: Global Testing, Inspection, and Certification Market for the Transportation Industry Revenue million Forecast, by Sourcing Type 2020 & 2033

- Table 12: Global Testing, Inspection, and Certification Market for the Transportation Industry Volume K Unit Forecast, by Sourcing Type 2020 & 2033

- Table 13: Global Testing, Inspection, and Certification Market for the Transportation Industry Revenue million Forecast, by End-user Industry 2020 & 2033

- Table 14: Global Testing, Inspection, and Certification Market for the Transportation Industry Volume K Unit Forecast, by End-user Industry 2020 & 2033

- Table 15: Global Testing, Inspection, and Certification Market for the Transportation Industry Revenue million Forecast, by Country 2020 & 2033

- Table 16: Global Testing, Inspection, and Certification Market for the Transportation Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 17: Global Testing, Inspection, and Certification Market for the Transportation Industry Revenue million Forecast, by Service Type 2020 & 2033

- Table 18: Global Testing, Inspection, and Certification Market for the Transportation Industry Volume K Unit Forecast, by Service Type 2020 & 2033

- Table 19: Global Testing, Inspection, and Certification Market for the Transportation Industry Revenue million Forecast, by Sourcing Type 2020 & 2033

- Table 20: Global Testing, Inspection, and Certification Market for the Transportation Industry Volume K Unit Forecast, by Sourcing Type 2020 & 2033

- Table 21: Global Testing, Inspection, and Certification Market for the Transportation Industry Revenue million Forecast, by End-user Industry 2020 & 2033

- Table 22: Global Testing, Inspection, and Certification Market for the Transportation Industry Volume K Unit Forecast, by End-user Industry 2020 & 2033

- Table 23: Global Testing, Inspection, and Certification Market for the Transportation Industry Revenue million Forecast, by Country 2020 & 2033

- Table 24: Global Testing, Inspection, and Certification Market for the Transportation Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 25: Global Testing, Inspection, and Certification Market for the Transportation Industry Revenue million Forecast, by Service Type 2020 & 2033

- Table 26: Global Testing, Inspection, and Certification Market for the Transportation Industry Volume K Unit Forecast, by Service Type 2020 & 2033

- Table 27: Global Testing, Inspection, and Certification Market for the Transportation Industry Revenue million Forecast, by Sourcing Type 2020 & 2033

- Table 28: Global Testing, Inspection, and Certification Market for the Transportation Industry Volume K Unit Forecast, by Sourcing Type 2020 & 2033

- Table 29: Global Testing, Inspection, and Certification Market for the Transportation Industry Revenue million Forecast, by End-user Industry 2020 & 2033

- Table 30: Global Testing, Inspection, and Certification Market for the Transportation Industry Volume K Unit Forecast, by End-user Industry 2020 & 2033

- Table 31: Global Testing, Inspection, and Certification Market for the Transportation Industry Revenue million Forecast, by Country 2020 & 2033

- Table 32: Global Testing, Inspection, and Certification Market for the Transportation Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 33: Global Testing, Inspection, and Certification Market for the Transportation Industry Revenue million Forecast, by Service Type 2020 & 2033

- Table 34: Global Testing, Inspection, and Certification Market for the Transportation Industry Volume K Unit Forecast, by Service Type 2020 & 2033

- Table 35: Global Testing, Inspection, and Certification Market for the Transportation Industry Revenue million Forecast, by Sourcing Type 2020 & 2033

- Table 36: Global Testing, Inspection, and Certification Market for the Transportation Industry Volume K Unit Forecast, by Sourcing Type 2020 & 2033

- Table 37: Global Testing, Inspection, and Certification Market for the Transportation Industry Revenue million Forecast, by End-user Industry 2020 & 2033

- Table 38: Global Testing, Inspection, and Certification Market for the Transportation Industry Volume K Unit Forecast, by End-user Industry 2020 & 2033

- Table 39: Global Testing, Inspection, and Certification Market for the Transportation Industry Revenue million Forecast, by Country 2020 & 2033

- Table 40: Global Testing, Inspection, and Certification Market for the Transportation Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 41: Global Testing, Inspection, and Certification Market for the Transportation Industry Revenue million Forecast, by Service Type 2020 & 2033

- Table 42: Global Testing, Inspection, and Certification Market for the Transportation Industry Volume K Unit Forecast, by Service Type 2020 & 2033

- Table 43: Global Testing, Inspection, and Certification Market for the Transportation Industry Revenue million Forecast, by Sourcing Type 2020 & 2033

- Table 44: Global Testing, Inspection, and Certification Market for the Transportation Industry Volume K Unit Forecast, by Sourcing Type 2020 & 2033

- Table 45: Global Testing, Inspection, and Certification Market for the Transportation Industry Revenue million Forecast, by End-user Industry 2020 & 2033

- Table 46: Global Testing, Inspection, and Certification Market for the Transportation Industry Volume K Unit Forecast, by End-user Industry 2020 & 2033

- Table 47: Global Testing, Inspection, and Certification Market for the Transportation Industry Revenue million Forecast, by Country 2020 & 2033

- Table 48: Global Testing, Inspection, and Certification Market for the Transportation Industry Volume K Unit Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Testing, Inspection, and Certification Market for the Transportation Industry?

The projected CAGR is approximately 4.68%.

2. Which companies are prominent players in the Testing, Inspection, and Certification Market for the Transportation Industry?

Key companies in the market include UL Group, ALS Limited, Intertek Group PLC, DNV GL, Element Materials Technology Group Ltd (Exova Group PLC), MISTRAS Group Inc, SAI Global Limited, SGS SA, TUV SUD Limited, Bureau Veritas SA, Dekra certification Gmbh (DEKRA SE).

3. What are the main segments of the Testing, Inspection, and Certification Market for the Transportation Industry?

The market segments include Service Type, Sourcing Type, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 251.62 million as of 2022.

5. What are some drivers contributing to market growth?

Increase in Strict Regulations Imposed by the Government; Need for High Reliability and Compliance.

6. What are the notable trends driving market growth?

Testing and Inspection Service to Hold a Significant Share.

7. Are there any restraints impacting market growth?

High Initial Cost of the Equipment.

8. Can you provide examples of recent developments in the market?

June 2022 - South Korea developed a technology for inspecting the condition of rail-supporting facilities for electric trains to replace imports. As per the Ministry of Land, Infrastructure, and Transport, automated inspection technology will increase the efficiency and accuracy of inspection and reduce the risk of railway accidents.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Testing, Inspection, and Certification Market for the Transportation Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Testing, Inspection, and Certification Market for the Transportation Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Testing, Inspection, and Certification Market for the Transportation Industry?

To stay informed about further developments, trends, and reports in the Testing, Inspection, and Certification Market for the Transportation Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence