Key Insights

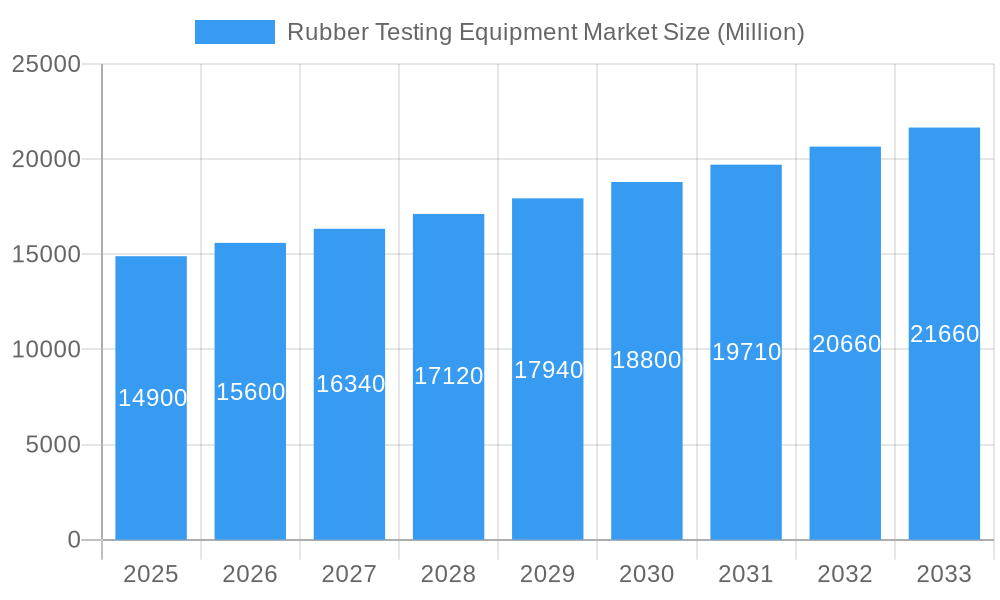

The global rubber testing equipment market, valued at $14.90 billion in 2025, is projected to experience robust growth, driven by a compound annual growth rate (CAGR) of 4.70% from 2025 to 2033. This expansion is fueled by several key factors. Firstly, the increasing demand for high-quality rubber products across diverse industries, including automotive (tires), construction, and manufacturing, necessitates rigorous quality control measures. This, in turn, drives the demand for sophisticated testing equipment. Secondly, stringent government regulations and industry standards regarding product safety and performance are pushing manufacturers to adopt advanced testing methodologies and equipment. Technological advancements in rubber testing equipment, such as the integration of automation and improved data analysis capabilities, are also contributing to market growth. The rising adoption of automated and non-destructive testing methods is further boosting market expansion. Finally, the growth of emerging economies, particularly in Asia-Pacific, presents significant opportunities for rubber testing equipment manufacturers due to increased industrialization and infrastructure development in these regions.

Rubber Testing Equipment Market Market Size (In Billion)

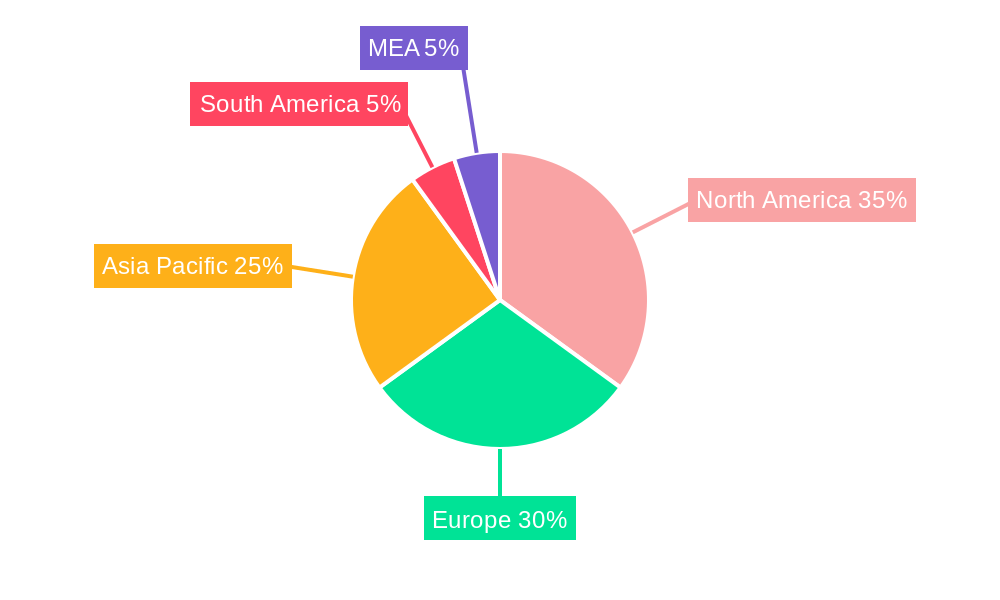

Segment-wise, the tire industry currently dominates the end-user application segment, followed by general rubber goods and industrial rubber products. Within the type of testing, density, viscosity, and hardness testing equipment hold the largest market shares due to their crucial role in ensuring product quality and consistency. However, the demand for more specialized testing equipment like flex testing and other advanced methods is expected to increase, owing to the evolving needs of the industry and the introduction of novel rubber materials. Geographically, North America and Europe are currently leading the market, driven by established industrial bases and a high level of regulatory compliance. However, the Asia-Pacific region is anticipated to witness the fastest growth rate due to its rapidly expanding manufacturing sector and rising investment in infrastructure projects. Competitive landscape analysis reveals a mix of established players and emerging companies, leading to innovations and price competition within the market.

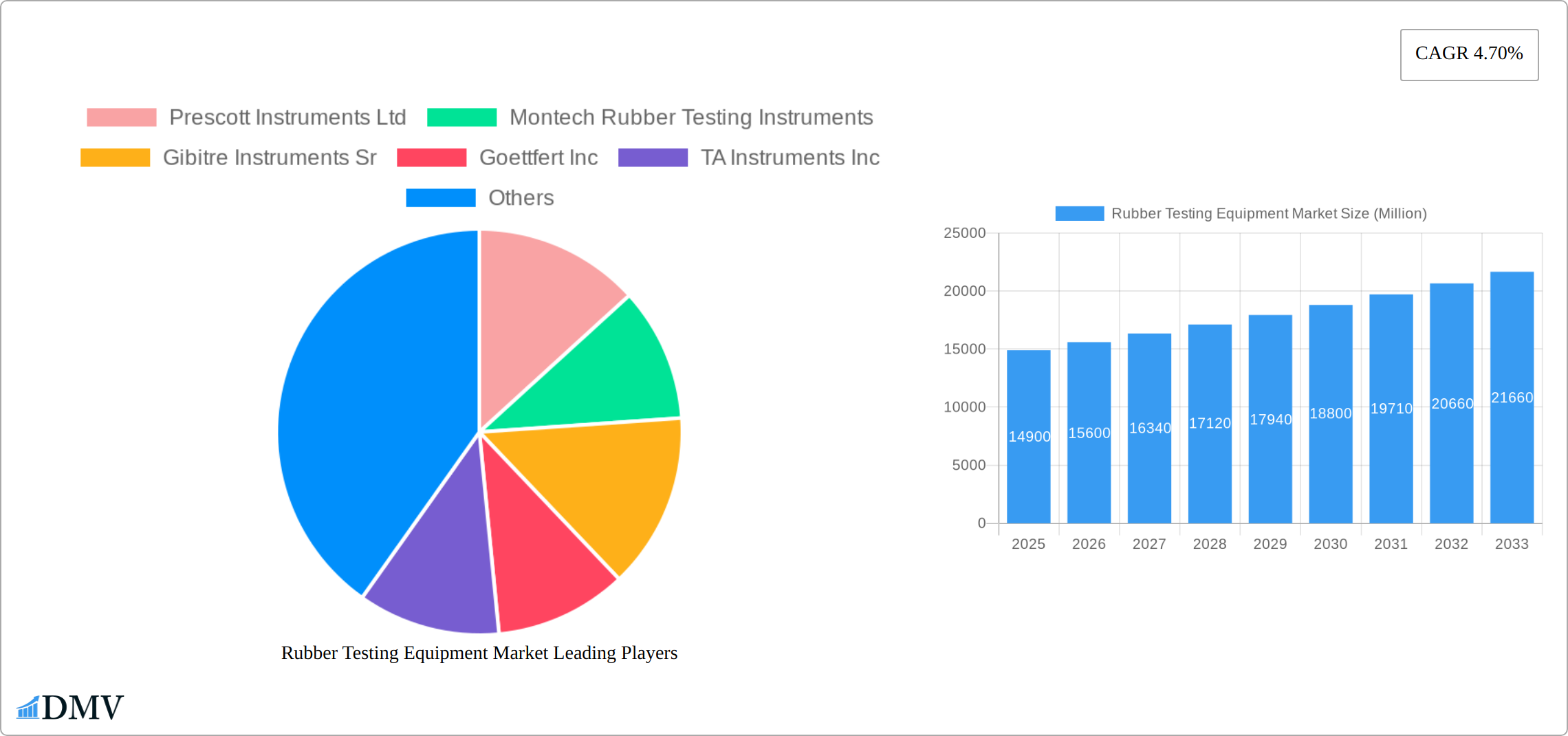

Rubber Testing Equipment Market Company Market Share

Rubber Testing Equipment Market: A Comprehensive Market Analysis (2019-2033)

This insightful report provides a comprehensive analysis of the global Rubber Testing Equipment market, offering a detailed examination of market trends, growth drivers, challenges, and future opportunities from 2019 to 2033. The study covers key segments by type of testing (density, viscosity, hardness, flex, and others) and end-user application (tires, general rubber goods, industrial rubber products, general polymers, and compounds). Valuations are expressed in Millions. The report offers a crucial resource for stakeholders, including manufacturers, distributors, researchers, and investors seeking to understand this dynamic market.

Rubber Testing Equipment Market Market Composition & Trends

This section delves into the competitive landscape of the Rubber Testing Equipment market, analyzing market concentration, innovation drivers, regulatory influences, substitute products, end-user profiles, and merger & acquisition (M&A) activities. We examine the market share distribution among key players such as Prescott Instruments Ltd, Montech Rubber Testing Instruments, Gibitre Instruments Sr, Goettfert Inc, TA Instruments Inc, Alpha Technologies, U-Can Dynatex Inc, Norka Instruments Sanghai Ltd, Ektron Tek Co Ltd, and Gotech Testing Machines. The report explores the impact of recent M&A activities, estimating their total value at approximately XX Million during the historical period (2019-2024), with a projected increase to YY Million during the forecast period (2025-2033).

- Market Concentration: The market exhibits a [Describe Concentration: e.g., moderately concentrated structure] with the top five players holding approximately XX% of the market share in 2024.

- Innovation Catalysts: Ongoing advancements in material science and increasing demand for high-performance rubber products are driving innovation in testing equipment.

- Regulatory Landscape: Stringent quality control regulations across various industries are propelling the adoption of advanced rubber testing equipment.

- Substitute Products: Limited readily available substitutes exist, strengthening market demand.

- End-User Profiles: The report profiles key end-users, analyzing their testing requirements and preferences.

- M&A Activities: Consolidation is expected to continue, driven by the need for expanded product portfolios and geographic reach.

Rubber Testing Equipment Market Industry Evolution

This section meticulously analyzes the evolution of the Rubber Testing Equipment market from 2019 to 2033. We examine market growth trajectories, technological advancements, and shifting consumer demands. The market witnessed a Compound Annual Growth Rate (CAGR) of XX% during the historical period (2019-2024) and is projected to grow at a CAGR of YY% during the forecast period (2025-2033), reaching a market value of ZZ Million by 2033. This growth is attributed to factors including increasing demand for improved rubber product quality, stringent industry regulations, and the adoption of advanced testing techniques. Technological advancements, such as automation and digitalization, are further contributing to market expansion. The adoption rate of automated testing systems increased by XX% between 2019 and 2024, reflecting the industry’s shift towards enhanced efficiency and precision.

Leading Regions, Countries, or Segments in Rubber Testing Equipment Market

The Rubber Testing Equipment market is experiencing significant growth, with advancements in technology and increasing demand for high-quality rubber products driving its expansion. The report identifies **[Please replace with the actual dominant region/country/segment from your report, e.g., Asia Pacific]** as the leading region in the Rubber Testing Equipment market. This dominance is attributed to a confluence of factors including robust industrial expansion, the implementation of stringent quality control mandates across various sectors, and substantial investments in research and development to foster innovation. The market is further segmented and analyzed based on key differentiators:

By Type of Testing:

- Hardness Testing: This segment is characterized by a consistently high demand, primarily driven by the extensive requirements of the tire manufacturing and general rubber goods industries, where precise hardness characterization is paramount for product performance and safety.

- Density Testing: Essential for maintaining consistent quality control, density testing is a critical component in a wide array of rubber applications, ensuring uniformity and adherence to specifications.

- Viscosity Testing: Crucial in the intricate processes of polymer and compound manufacturing, viscosity testing plays a vital role in optimizing material flow properties and ensuring consistent batch quality.

- Flex Testing: This segment is indispensable for thoroughly assessing the durability, resilience, and long-term performance of rubber products, particularly under dynamic stress conditions.

- Other Types of Testing: This category is witnessing growth fueled by the evolving and specialized testing needs arising from niche applications and the development of novel rubber formulations. This includes advanced rheological tests, abrasion resistance tests, and fatigue testing, among others.

By End-user Application:

- Tire Industry: This remains the largest and most influential segment, propelled by the sheer volume of global tire production and the exceptionally stringent quality and safety standards demanded by regulatory bodies and consumers alike.

- General Rubber Goods: Experiencing steady and consistent demand, this segment is supported by the diverse range of applications for rubber products across various industries, including footwear, consumer goods, and sporting equipment.

- Industrial Rubber Products: This segment shows significant growth potential, closely linked to the expansion and modernization of key industrial sectors such as automotive, aerospace, and manufacturing, where specialized rubber components are critical.

- General Polymer & Compound: Demonstrating strong growth momentum, this segment is significantly fueled by the increasing adoption and development of advanced polymers and sophisticated rubber compounds in a multitude of innovative applications, from medical devices to advanced composites.

The foundational drivers for the dominance of the leading region include substantial investments in industrial infrastructure, supportive government policies that foster manufacturing and technological advancement, and the established presence of a robust ecosystem of major manufacturers and research institutions within the region.

Rubber Testing Equipment Market Product Innovations

The landscape of rubber testing equipment is continuously being reshaped by a wave of innovative advancements designed to elevate precision, streamline operations through automation, and empower users with sophisticated data analysis capabilities. Emerging products are incorporating cutting-edge sensor technologies, refined software algorithms for enhanced accuracy and predictive insights, and intuitive, user-friendly interfaces that simplify complex testing procedures. These improvements translate directly into significantly faster testing cycles, more reliable and precise results, and a marked reduction in overall operational expenditures. The unique selling propositions of these advanced systems often include seamlessly integrated data management solutions for efficient record-keeping and traceability, remote monitoring and control functionalities for increased operational flexibility, and highly customizable advanced reporting features that provide deep analytical insights into material performance.

Propelling Factors for Rubber Testing Equipment Market Growth

The Rubber Testing Equipment market's growth is fueled by several key factors: the increasing demand for high-quality rubber products across various industries, stringent regulatory requirements for product safety and performance, advancements in testing technologies that offer improved accuracy and efficiency, and growing investments in research and development activities by key players.

Obstacles in the Rubber Testing Equipment Market Market

Despite its promising trajectory, the Rubber Testing Equipment market encounters several significant hurdles that can influence its growth trajectory. A primary challenge is the substantial initial investment cost associated with acquiring state-of-the-art, highly sophisticated testing equipment, which can be a barrier for smaller enterprises. Furthermore, the market is characterized by intense competition among established global players, leading to price pressures and a constant need for differentiation. Potential supply chain disruptions, particularly concerning the availability of specialized components and raw materials, can also impact production timelines and costs. The dynamic and ever-evolving regulatory landscapes across different geographies necessitate continuous adaptation and compliance, requiring ongoing investment in equipment upgrades and process modifications.

Future Opportunities in Rubber Testing Equipment Market

The future outlook for the Rubber Testing Equipment market is bright, with several promising avenues for growth and development. Key opportunities lie in the expansion of emerging economies that are undergoing rapid industrialization, creating a burgeoning demand for reliable testing solutions. The ongoing development of more sophisticated testing methodologies specifically tailored for advanced rubber materials, such as nanocomposites and bio-based elastomers, presents a significant growth area. The integration of automation and artificial intelligence (AI) technologies within testing equipment offers substantial potential for enhancing efficiency, predictive maintenance, and data interpretation. Additionally, the expansion of value-added services, including equipment maintenance, calibration, and specialized training, represents a lucrative opportunity for market participants to deepen customer relationships and create recurring revenue streams.

Major Players in the Rubber Testing Equipment Market Ecosystem

- Prescott Instruments Ltd

- Montech Rubber Testing Instruments

- Gibitre Instruments Sr

- Goettfert Inc

- TA Instruments Inc

- Alpha Technologies

- U-Can Dynatex Inc

- Norka Instruments Sanghai Ltd

- Ektron Tek Co Ltd

- Gotech Testing Machines

Key Developments in Rubber Testing Equipment Market Industry

- [Month, Year]: [Company Name] unveiled its groundbreaking automated hardness testing system, designed to significantly improve throughput and accuracy for tire manufacturers.

- [Month, Year]: [Company Name] announced the strategic acquisition of [Company Name], a move that is expected to significantly expand its product portfolio in specialized rheological testing solutions.

- [Month, Year]: New stringent regulations concerning the environmental impact and performance standards for rubber products were implemented in [Region], necessitating updated testing protocols and equipment.

- [Month, Year]: [Company Name] launched a cloud-based data analytics platform for its range of rheometers, enabling real-time performance monitoring and predictive maintenance for end-users.

- [Month, Year]: A leading automotive manufacturer mandated enhanced fatigue testing procedures for all critical rubber components, leading to increased demand for advanced flex testing equipment.

- (Add more bullet points with specific dates and detailed descriptions of key developments to provide a comprehensive overview)

Strategic Rubber Testing Equipment Market Market Forecast

The Rubber Testing Equipment market is poised for sustained growth, driven by technological advancements, increasing demand for high-quality rubber products, and stricter regulatory standards. Future opportunities are vast, with potential for significant expansion in emerging markets and the development of innovative testing solutions. The market is expected to witness considerable growth in the coming years, making it an attractive investment opportunity.

Rubber Testing Equipment Market Segmentation

-

1. Type of Testing

- 1.1. Density Testing

- 1.2. Viscocity Testing

- 1.3. Hardness Testing

- 1.4. Flex Testing

- 1.5. Other Types of Testing

-

2. End-user Application

- 2.1. Tire

- 2.2. General Rubber Goods

- 2.3. Industrial Rubber Products

- 2.4. General Polymer

- 2.5. Compound

Rubber Testing Equipment Market Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia

- 4. Australia and New Zealand

- 5. Latin America

- 6. Middle East and Africa

Rubber Testing Equipment Market Regional Market Share

Geographic Coverage of Rubber Testing Equipment Market

Rubber Testing Equipment Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.70% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Demand for Durable Goods; Technological Advancements in Rubber Testing

- 3.3. Market Restrains

- 3.3.1. High Cost of Ownership

- 3.4. Market Trends

- 3.4.1. The Rising Demand for Tires to Drive the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Rubber Testing Equipment Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type of Testing

- 5.1.1. Density Testing

- 5.1.2. Viscocity Testing

- 5.1.3. Hardness Testing

- 5.1.4. Flex Testing

- 5.1.5. Other Types of Testing

- 5.2. Market Analysis, Insights and Forecast - by End-user Application

- 5.2.1. Tire

- 5.2.2. General Rubber Goods

- 5.2.3. Industrial Rubber Products

- 5.2.4. General Polymer

- 5.2.5. Compound

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia

- 5.3.4. Australia and New Zealand

- 5.3.5. Latin America

- 5.3.6. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Type of Testing

- 6. North America Rubber Testing Equipment Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type of Testing

- 6.1.1. Density Testing

- 6.1.2. Viscocity Testing

- 6.1.3. Hardness Testing

- 6.1.4. Flex Testing

- 6.1.5. Other Types of Testing

- 6.2. Market Analysis, Insights and Forecast - by End-user Application

- 6.2.1. Tire

- 6.2.2. General Rubber Goods

- 6.2.3. Industrial Rubber Products

- 6.2.4. General Polymer

- 6.2.5. Compound

- 6.1. Market Analysis, Insights and Forecast - by Type of Testing

- 7. Europe Rubber Testing Equipment Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type of Testing

- 7.1.1. Density Testing

- 7.1.2. Viscocity Testing

- 7.1.3. Hardness Testing

- 7.1.4. Flex Testing

- 7.1.5. Other Types of Testing

- 7.2. Market Analysis, Insights and Forecast - by End-user Application

- 7.2.1. Tire

- 7.2.2. General Rubber Goods

- 7.2.3. Industrial Rubber Products

- 7.2.4. General Polymer

- 7.2.5. Compound

- 7.1. Market Analysis, Insights and Forecast - by Type of Testing

- 8. Asia Rubber Testing Equipment Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type of Testing

- 8.1.1. Density Testing

- 8.1.2. Viscocity Testing

- 8.1.3. Hardness Testing

- 8.1.4. Flex Testing

- 8.1.5. Other Types of Testing

- 8.2. Market Analysis, Insights and Forecast - by End-user Application

- 8.2.1. Tire

- 8.2.2. General Rubber Goods

- 8.2.3. Industrial Rubber Products

- 8.2.4. General Polymer

- 8.2.5. Compound

- 8.1. Market Analysis, Insights and Forecast - by Type of Testing

- 9. Australia and New Zealand Rubber Testing Equipment Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type of Testing

- 9.1.1. Density Testing

- 9.1.2. Viscocity Testing

- 9.1.3. Hardness Testing

- 9.1.4. Flex Testing

- 9.1.5. Other Types of Testing

- 9.2. Market Analysis, Insights and Forecast - by End-user Application

- 9.2.1. Tire

- 9.2.2. General Rubber Goods

- 9.2.3. Industrial Rubber Products

- 9.2.4. General Polymer

- 9.2.5. Compound

- 9.1. Market Analysis, Insights and Forecast - by Type of Testing

- 10. Latin America Rubber Testing Equipment Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type of Testing

- 10.1.1. Density Testing

- 10.1.2. Viscocity Testing

- 10.1.3. Hardness Testing

- 10.1.4. Flex Testing

- 10.1.5. Other Types of Testing

- 10.2. Market Analysis, Insights and Forecast - by End-user Application

- 10.2.1. Tire

- 10.2.2. General Rubber Goods

- 10.2.3. Industrial Rubber Products

- 10.2.4. General Polymer

- 10.2.5. Compound

- 10.1. Market Analysis, Insights and Forecast - by Type of Testing

- 11. Middle East and Africa Rubber Testing Equipment Market Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Type of Testing

- 11.1.1. Density Testing

- 11.1.2. Viscocity Testing

- 11.1.3. Hardness Testing

- 11.1.4. Flex Testing

- 11.1.5. Other Types of Testing

- 11.2. Market Analysis, Insights and Forecast - by End-user Application

- 11.2.1. Tire

- 11.2.2. General Rubber Goods

- 11.2.3. Industrial Rubber Products

- 11.2.4. General Polymer

- 11.2.5. Compound

- 11.1. Market Analysis, Insights and Forecast - by Type of Testing

- 12. Competitive Analysis

- 12.1. Global Market Share Analysis 2025

- 12.2. Company Profiles

- 12.2.1 Prescott Instruments Ltd

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Montech Rubber Testing Instruments

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Gibitre Instruments Sr

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Goettfert Inc

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 TA Instruments Inc

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 Alpha Technologies

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 U-Can Dynatex Inc

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 Norka Instruments Sanghai Ltd

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 Ektron Tek Co Ltd

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 Gotech Testing Machines

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.1 Prescott Instruments Ltd

List of Figures

- Figure 1: Global Rubber Testing Equipment Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: Global Rubber Testing Equipment Market Volume Breakdown (K Unit, %) by Region 2025 & 2033

- Figure 3: North America Rubber Testing Equipment Market Revenue (Million), by Type of Testing 2025 & 2033

- Figure 4: North America Rubber Testing Equipment Market Volume (K Unit), by Type of Testing 2025 & 2033

- Figure 5: North America Rubber Testing Equipment Market Revenue Share (%), by Type of Testing 2025 & 2033

- Figure 6: North America Rubber Testing Equipment Market Volume Share (%), by Type of Testing 2025 & 2033

- Figure 7: North America Rubber Testing Equipment Market Revenue (Million), by End-user Application 2025 & 2033

- Figure 8: North America Rubber Testing Equipment Market Volume (K Unit), by End-user Application 2025 & 2033

- Figure 9: North America Rubber Testing Equipment Market Revenue Share (%), by End-user Application 2025 & 2033

- Figure 10: North America Rubber Testing Equipment Market Volume Share (%), by End-user Application 2025 & 2033

- Figure 11: North America Rubber Testing Equipment Market Revenue (Million), by Country 2025 & 2033

- Figure 12: North America Rubber Testing Equipment Market Volume (K Unit), by Country 2025 & 2033

- Figure 13: North America Rubber Testing Equipment Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: North America Rubber Testing Equipment Market Volume Share (%), by Country 2025 & 2033

- Figure 15: Europe Rubber Testing Equipment Market Revenue (Million), by Type of Testing 2025 & 2033

- Figure 16: Europe Rubber Testing Equipment Market Volume (K Unit), by Type of Testing 2025 & 2033

- Figure 17: Europe Rubber Testing Equipment Market Revenue Share (%), by Type of Testing 2025 & 2033

- Figure 18: Europe Rubber Testing Equipment Market Volume Share (%), by Type of Testing 2025 & 2033

- Figure 19: Europe Rubber Testing Equipment Market Revenue (Million), by End-user Application 2025 & 2033

- Figure 20: Europe Rubber Testing Equipment Market Volume (K Unit), by End-user Application 2025 & 2033

- Figure 21: Europe Rubber Testing Equipment Market Revenue Share (%), by End-user Application 2025 & 2033

- Figure 22: Europe Rubber Testing Equipment Market Volume Share (%), by End-user Application 2025 & 2033

- Figure 23: Europe Rubber Testing Equipment Market Revenue (Million), by Country 2025 & 2033

- Figure 24: Europe Rubber Testing Equipment Market Volume (K Unit), by Country 2025 & 2033

- Figure 25: Europe Rubber Testing Equipment Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Europe Rubber Testing Equipment Market Volume Share (%), by Country 2025 & 2033

- Figure 27: Asia Rubber Testing Equipment Market Revenue (Million), by Type of Testing 2025 & 2033

- Figure 28: Asia Rubber Testing Equipment Market Volume (K Unit), by Type of Testing 2025 & 2033

- Figure 29: Asia Rubber Testing Equipment Market Revenue Share (%), by Type of Testing 2025 & 2033

- Figure 30: Asia Rubber Testing Equipment Market Volume Share (%), by Type of Testing 2025 & 2033

- Figure 31: Asia Rubber Testing Equipment Market Revenue (Million), by End-user Application 2025 & 2033

- Figure 32: Asia Rubber Testing Equipment Market Volume (K Unit), by End-user Application 2025 & 2033

- Figure 33: Asia Rubber Testing Equipment Market Revenue Share (%), by End-user Application 2025 & 2033

- Figure 34: Asia Rubber Testing Equipment Market Volume Share (%), by End-user Application 2025 & 2033

- Figure 35: Asia Rubber Testing Equipment Market Revenue (Million), by Country 2025 & 2033

- Figure 36: Asia Rubber Testing Equipment Market Volume (K Unit), by Country 2025 & 2033

- Figure 37: Asia Rubber Testing Equipment Market Revenue Share (%), by Country 2025 & 2033

- Figure 38: Asia Rubber Testing Equipment Market Volume Share (%), by Country 2025 & 2033

- Figure 39: Australia and New Zealand Rubber Testing Equipment Market Revenue (Million), by Type of Testing 2025 & 2033

- Figure 40: Australia and New Zealand Rubber Testing Equipment Market Volume (K Unit), by Type of Testing 2025 & 2033

- Figure 41: Australia and New Zealand Rubber Testing Equipment Market Revenue Share (%), by Type of Testing 2025 & 2033

- Figure 42: Australia and New Zealand Rubber Testing Equipment Market Volume Share (%), by Type of Testing 2025 & 2033

- Figure 43: Australia and New Zealand Rubber Testing Equipment Market Revenue (Million), by End-user Application 2025 & 2033

- Figure 44: Australia and New Zealand Rubber Testing Equipment Market Volume (K Unit), by End-user Application 2025 & 2033

- Figure 45: Australia and New Zealand Rubber Testing Equipment Market Revenue Share (%), by End-user Application 2025 & 2033

- Figure 46: Australia and New Zealand Rubber Testing Equipment Market Volume Share (%), by End-user Application 2025 & 2033

- Figure 47: Australia and New Zealand Rubber Testing Equipment Market Revenue (Million), by Country 2025 & 2033

- Figure 48: Australia and New Zealand Rubber Testing Equipment Market Volume (K Unit), by Country 2025 & 2033

- Figure 49: Australia and New Zealand Rubber Testing Equipment Market Revenue Share (%), by Country 2025 & 2033

- Figure 50: Australia and New Zealand Rubber Testing Equipment Market Volume Share (%), by Country 2025 & 2033

- Figure 51: Latin America Rubber Testing Equipment Market Revenue (Million), by Type of Testing 2025 & 2033

- Figure 52: Latin America Rubber Testing Equipment Market Volume (K Unit), by Type of Testing 2025 & 2033

- Figure 53: Latin America Rubber Testing Equipment Market Revenue Share (%), by Type of Testing 2025 & 2033

- Figure 54: Latin America Rubber Testing Equipment Market Volume Share (%), by Type of Testing 2025 & 2033

- Figure 55: Latin America Rubber Testing Equipment Market Revenue (Million), by End-user Application 2025 & 2033

- Figure 56: Latin America Rubber Testing Equipment Market Volume (K Unit), by End-user Application 2025 & 2033

- Figure 57: Latin America Rubber Testing Equipment Market Revenue Share (%), by End-user Application 2025 & 2033

- Figure 58: Latin America Rubber Testing Equipment Market Volume Share (%), by End-user Application 2025 & 2033

- Figure 59: Latin America Rubber Testing Equipment Market Revenue (Million), by Country 2025 & 2033

- Figure 60: Latin America Rubber Testing Equipment Market Volume (K Unit), by Country 2025 & 2033

- Figure 61: Latin America Rubber Testing Equipment Market Revenue Share (%), by Country 2025 & 2033

- Figure 62: Latin America Rubber Testing Equipment Market Volume Share (%), by Country 2025 & 2033

- Figure 63: Middle East and Africa Rubber Testing Equipment Market Revenue (Million), by Type of Testing 2025 & 2033

- Figure 64: Middle East and Africa Rubber Testing Equipment Market Volume (K Unit), by Type of Testing 2025 & 2033

- Figure 65: Middle East and Africa Rubber Testing Equipment Market Revenue Share (%), by Type of Testing 2025 & 2033

- Figure 66: Middle East and Africa Rubber Testing Equipment Market Volume Share (%), by Type of Testing 2025 & 2033

- Figure 67: Middle East and Africa Rubber Testing Equipment Market Revenue (Million), by End-user Application 2025 & 2033

- Figure 68: Middle East and Africa Rubber Testing Equipment Market Volume (K Unit), by End-user Application 2025 & 2033

- Figure 69: Middle East and Africa Rubber Testing Equipment Market Revenue Share (%), by End-user Application 2025 & 2033

- Figure 70: Middle East and Africa Rubber Testing Equipment Market Volume Share (%), by End-user Application 2025 & 2033

- Figure 71: Middle East and Africa Rubber Testing Equipment Market Revenue (Million), by Country 2025 & 2033

- Figure 72: Middle East and Africa Rubber Testing Equipment Market Volume (K Unit), by Country 2025 & 2033

- Figure 73: Middle East and Africa Rubber Testing Equipment Market Revenue Share (%), by Country 2025 & 2033

- Figure 74: Middle East and Africa Rubber Testing Equipment Market Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Rubber Testing Equipment Market Revenue Million Forecast, by Type of Testing 2020 & 2033

- Table 2: Global Rubber Testing Equipment Market Volume K Unit Forecast, by Type of Testing 2020 & 2033

- Table 3: Global Rubber Testing Equipment Market Revenue Million Forecast, by End-user Application 2020 & 2033

- Table 4: Global Rubber Testing Equipment Market Volume K Unit Forecast, by End-user Application 2020 & 2033

- Table 5: Global Rubber Testing Equipment Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Global Rubber Testing Equipment Market Volume K Unit Forecast, by Region 2020 & 2033

- Table 7: Global Rubber Testing Equipment Market Revenue Million Forecast, by Type of Testing 2020 & 2033

- Table 8: Global Rubber Testing Equipment Market Volume K Unit Forecast, by Type of Testing 2020 & 2033

- Table 9: Global Rubber Testing Equipment Market Revenue Million Forecast, by End-user Application 2020 & 2033

- Table 10: Global Rubber Testing Equipment Market Volume K Unit Forecast, by End-user Application 2020 & 2033

- Table 11: Global Rubber Testing Equipment Market Revenue Million Forecast, by Country 2020 & 2033

- Table 12: Global Rubber Testing Equipment Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 13: Global Rubber Testing Equipment Market Revenue Million Forecast, by Type of Testing 2020 & 2033

- Table 14: Global Rubber Testing Equipment Market Volume K Unit Forecast, by Type of Testing 2020 & 2033

- Table 15: Global Rubber Testing Equipment Market Revenue Million Forecast, by End-user Application 2020 & 2033

- Table 16: Global Rubber Testing Equipment Market Volume K Unit Forecast, by End-user Application 2020 & 2033

- Table 17: Global Rubber Testing Equipment Market Revenue Million Forecast, by Country 2020 & 2033

- Table 18: Global Rubber Testing Equipment Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 19: Global Rubber Testing Equipment Market Revenue Million Forecast, by Type of Testing 2020 & 2033

- Table 20: Global Rubber Testing Equipment Market Volume K Unit Forecast, by Type of Testing 2020 & 2033

- Table 21: Global Rubber Testing Equipment Market Revenue Million Forecast, by End-user Application 2020 & 2033

- Table 22: Global Rubber Testing Equipment Market Volume K Unit Forecast, by End-user Application 2020 & 2033

- Table 23: Global Rubber Testing Equipment Market Revenue Million Forecast, by Country 2020 & 2033

- Table 24: Global Rubber Testing Equipment Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 25: Global Rubber Testing Equipment Market Revenue Million Forecast, by Type of Testing 2020 & 2033

- Table 26: Global Rubber Testing Equipment Market Volume K Unit Forecast, by Type of Testing 2020 & 2033

- Table 27: Global Rubber Testing Equipment Market Revenue Million Forecast, by End-user Application 2020 & 2033

- Table 28: Global Rubber Testing Equipment Market Volume K Unit Forecast, by End-user Application 2020 & 2033

- Table 29: Global Rubber Testing Equipment Market Revenue Million Forecast, by Country 2020 & 2033

- Table 30: Global Rubber Testing Equipment Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 31: Global Rubber Testing Equipment Market Revenue Million Forecast, by Type of Testing 2020 & 2033

- Table 32: Global Rubber Testing Equipment Market Volume K Unit Forecast, by Type of Testing 2020 & 2033

- Table 33: Global Rubber Testing Equipment Market Revenue Million Forecast, by End-user Application 2020 & 2033

- Table 34: Global Rubber Testing Equipment Market Volume K Unit Forecast, by End-user Application 2020 & 2033

- Table 35: Global Rubber Testing Equipment Market Revenue Million Forecast, by Country 2020 & 2033

- Table 36: Global Rubber Testing Equipment Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 37: Global Rubber Testing Equipment Market Revenue Million Forecast, by Type of Testing 2020 & 2033

- Table 38: Global Rubber Testing Equipment Market Volume K Unit Forecast, by Type of Testing 2020 & 2033

- Table 39: Global Rubber Testing Equipment Market Revenue Million Forecast, by End-user Application 2020 & 2033

- Table 40: Global Rubber Testing Equipment Market Volume K Unit Forecast, by End-user Application 2020 & 2033

- Table 41: Global Rubber Testing Equipment Market Revenue Million Forecast, by Country 2020 & 2033

- Table 42: Global Rubber Testing Equipment Market Volume K Unit Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Rubber Testing Equipment Market?

The projected CAGR is approximately 4.70%.

2. Which companies are prominent players in the Rubber Testing Equipment Market?

Key companies in the market include Prescott Instruments Ltd, Montech Rubber Testing Instruments, Gibitre Instruments Sr, Goettfert Inc, TA Instruments Inc, Alpha Technologies, U-Can Dynatex Inc, Norka Instruments Sanghai Ltd, Ektron Tek Co Ltd, Gotech Testing Machines.

3. What are the main segments of the Rubber Testing Equipment Market?

The market segments include Type of Testing, End-user Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 14.90 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Demand for Durable Goods; Technological Advancements in Rubber Testing.

6. What are the notable trends driving market growth?

The Rising Demand for Tires to Drive the Market.

7. Are there any restraints impacting market growth?

High Cost of Ownership.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Rubber Testing Equipment Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Rubber Testing Equipment Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Rubber Testing Equipment Market?

To stay informed about further developments, trends, and reports in the Rubber Testing Equipment Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence