Key Insights

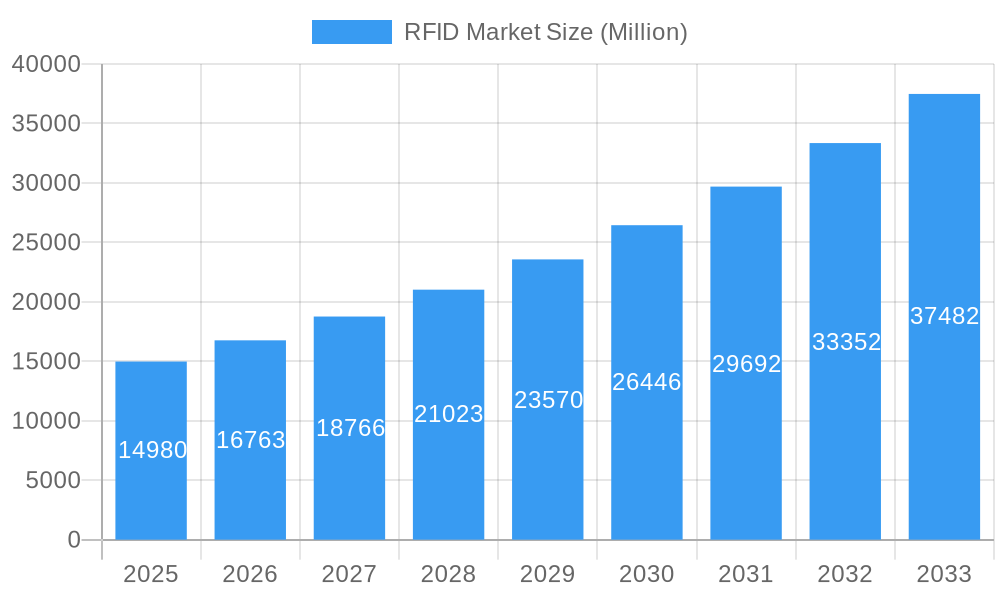

The global Radio-Frequency Identification (RFID) market is experiencing robust growth, projected to reach a market size of $14.98 billion in 2025, exhibiting a Compound Annual Growth Rate (CAGR) of 11.68% from 2025 to 2033. This expansion is fueled by several key factors. The increasing demand for efficient supply chain management and inventory tracking across diverse sectors like retail, healthcare, and manufacturing is a primary driver. Automation needs and the rise of Industry 4.0 are significantly contributing to the adoption of RFID technology for real-time asset tracking and process optimization. Furthermore, advancements in RFID technology, such as the development of more durable, cost-effective tags and improved reader capabilities, are broadening the applications and appeal of this technology. The emergence of active RFID and Real-Time Locating Systems (RTLS) is particularly noteworthy, providing highly precise location tracking with enhanced capabilities for asset management and security applications.

RFID Market Market Size (In Billion)

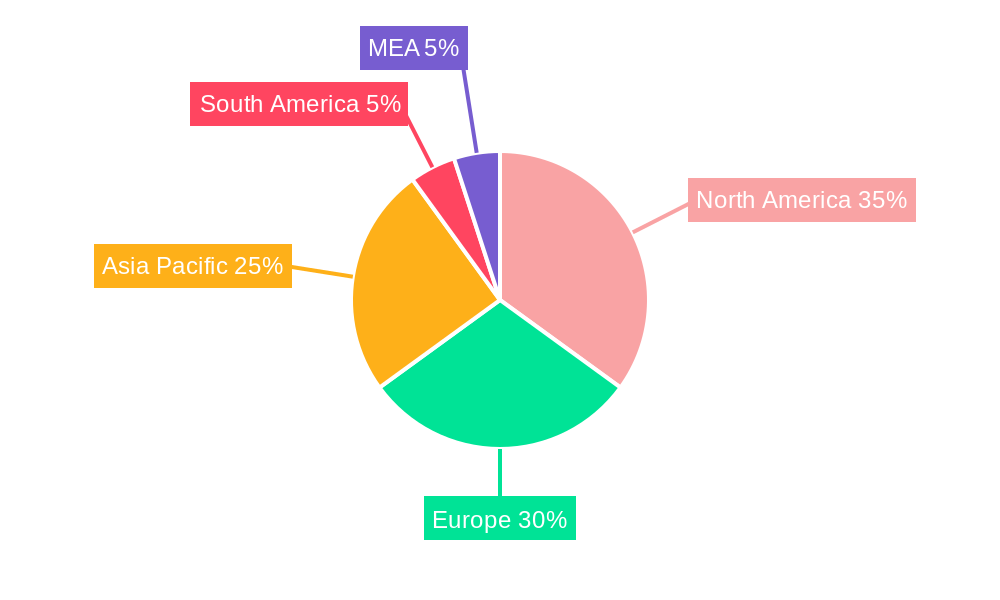

The market segmentation reveals significant opportunities across various technologies and applications. While passive RFID tags continue to dominate, the active RFID/RTLS segment is witnessing rapid growth due to its superior performance in demanding environments. In terms of application, the retail sector remains a major consumer, driven by the need for efficient inventory control and loss prevention. However, the healthcare and medical sectors are exhibiting strong growth potential as RFID is increasingly used for patient tracking, medication management, and asset monitoring. The manufacturing sector is also a key adopter, leveraging RFID for improved production tracking and quality control. Geographic distribution shows a strong concentration in North America and Europe, but the Asia-Pacific region is demonstrating rapid expansion, propelled by economic growth and increasing industrialization in countries like China and India. Despite these positive trends, challenges such as the relatively high initial investment costs for RFID implementation and concerns about data security could potentially impede market growth to some degree.

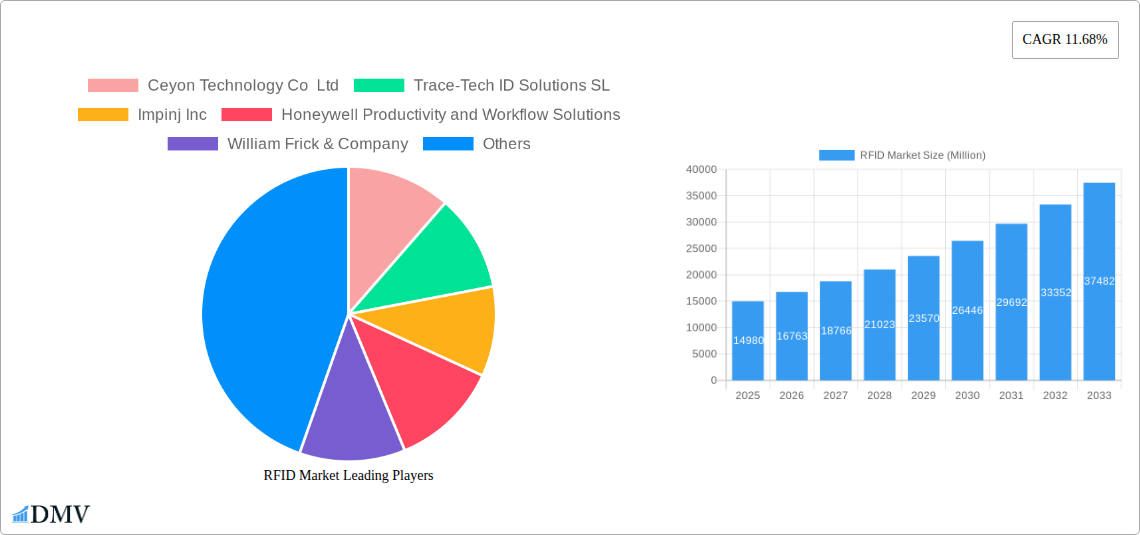

RFID Market Company Market Share

RFID Market: A Comprehensive Report (2019-2033)

This insightful report provides a comprehensive analysis of the RFID market, encompassing market size, growth trajectories, technological advancements, and competitive dynamics from 2019 to 2033. The study offers a detailed segmentation by technology (RFID Tags, RFID Interrogators, RFID Software/Services, Active RFID/RTLS) and application (Retail, Healthcare and Medical, Passenger Transport/Automotive, Manufacturing, Consumer Products, Other Applications), providing stakeholders with actionable insights for strategic decision-making. The report's base year is 2025, with an estimated year of 2025 and a forecast period spanning 2025-2033, leveraging historical data from 2019-2024. The global RFID market is projected to reach xx Million by 2033.

RFID Market Composition & Trends

This section delves into the intricate composition of the RFID market, examining market concentration, innovation drivers, regulatory landscapes, substitute products, end-user profiles, and mergers & acquisitions (M&A) activities. The report analyzes the market share distribution amongst key players, revealing the competitive intensity and dominance within specific segments. Analysis of M&A deals provides insights into strategic partnerships and market consolidation trends. For instance, the report will quantify the total value of M&A deals in the RFID market from 2019-2024 at approximately xx Million.

- Market Concentration: Analysis of the Herfindahl-Hirschman Index (HHI) to determine market concentration levels.

- Innovation Catalysts: Examination of technological advancements driving market innovation, such as advancements in low-power RFID tags and improved reader sensitivity.

- Regulatory Landscape: Assessment of regional and global regulations impacting RFID adoption and implementation.

- Substitute Products: Evaluation of alternative technologies (e.g., barcode systems) and their competitive impact on RFID market growth.

- End-User Profiles: Detailed profiling of key end-users across various application segments, including their specific needs and preferences.

- M&A Activities: Comprehensive analysis of significant M&A activities within the RFID industry, including deal values and strategic implications.

RFID Market Industry Evolution

This section meticulously traces the evolutionary path of the RFID market, charting its growth trajectory, pinpointing technological leaps, and examining evolving consumer demands. The report analyzes historical growth rates (2019-2024) and forecasts future growth (2025-2033) for different segments, incorporating market size and volume data. The adoption rate of RFID technology across different industries is also evaluated. For example, the retail segment is projected to witness a CAGR of xx% from 2025 to 2033, driven by increasing demand for efficient inventory management and loss prevention systems.

Leading Regions, Countries, or Segments in RFID Market

This section identifies the dominant regions, countries, and segments within the RFID market, providing a detailed breakdown of market share distribution and growth potential.

By Technology:

- RFID Tags: This segment holds a significant market share owing to the high demand for various types of RFID tags across diverse applications. Key drivers include the continuous miniaturization of tags, enhancing their integration capabilities into products.

- RFID Interrogators: Growth in this segment is influenced by advancements in reader technology, focusing on longer read ranges, increased processing speed and enhanced data security.

- RFID Software/Services: This segment's growth is primarily fueled by the increasing need for robust software solutions to manage and analyze data collected from RFID systems, improving operational efficiency.

- Active RFID/RTLS: This niche segment shows substantial growth potential driven by the expanding application in real-time location tracking, particularly in healthcare and logistics.

By Application:

- Retail: The retail sector dominates the RFID market due to the widespread adoption of RFID for inventory management, loss prevention, and enhanced customer experience. Key drivers include increasing investment in retail technology and consumer preference for seamless shopping experiences.

- Healthcare and Medical: The healthcare sector is a rapidly growing segment, driven by the need for effective asset tracking, patient monitoring, and improved supply chain management.

- Passenger Transport/Automotive: This segment is experiencing moderate growth driven by the implementation of RFID for vehicle identification, toll collection, and access control systems.

- Manufacturing: The manufacturing industry employs RFID for tracking components, managing inventory, and ensuring supply chain visibility.

- Consumer Products: The use of RFID in consumer products is growing slowly driven by the integration of RFID technology into everyday items.

RFID Market Product Innovations

Recent advancements in RFID technology include the development of smaller, more energy-efficient tags, along with improved reader sensitivity and range. The AD Pure line launched in September 2023, featuring AD Belt U9 Pure inlays and tags, demonstrates a focus on improving performance on challenging materials. These innovations are expanding the applications of RFID technology into new markets and improving the overall efficiency and performance of RFID systems.

Propelling Factors for RFID Market Growth

The RFID market is propelled by several key factors: the increasing need for efficient inventory management and supply chain visibility across various industries, continuous technological advancements driving down costs and improving performance, and supportive government regulations promoting the adoption of RFID technology. For example, the growing demand for real-time location tracking (RTLS) in healthcare and logistics is driving adoption of Active RFID systems.

Obstacles in the RFID Market

Despite significant growth potential, the RFID market faces certain challenges: high initial investment costs associated with implementing RFID systems can be a barrier for some businesses, concerns about data security and privacy, and competition from alternative technologies. Supply chain disruptions and fluctuations in raw material prices pose further obstacles.

Future Opportunities in RFID Market

The RFID market is poised for growth due to several emerging opportunities: expansion into new applications, especially in smart cities, agriculture and environmental monitoring, adoption of new technologies, such as sensor integration with RFID tags to enhance data collection, and the development of more sophisticated software solutions to analyze and interpret RFID data for better decision-making.

Major Players in the RFID Market Ecosystem

- Ceyon Technology Co Ltd

- Trace-Tech ID Solutions SL

- Impinj Inc

- Honeywell Productivity and Workflow Solutions

- William Frick & Company

- CCL Industries Inc

- Alien Technology Corporation

- Avery Dennison Corporation

- Nedap NV

- Zebra Technologies Corporation

- JADAK Technologies Inc

- Hangzhou Century Co Ltd

- SML Group Limited

- CHILITAG Technology Ltd

- Invengo Technology Pte Ltd

Key Developments in RFID Market Industry

- September 2023: Launch of the AD Pure line, including AD Belt U9 Pure inlays and tags, significantly enhancing RFID tag performance on challenging materials. This innovation expands the applicability of RFID technology in apparel, retail, and supply chain applications.

- March 2023: Invengo showcased new-generation RFID products and applications at EuroShop, highlighting advancements in UHF readers, tags, security gates, antennas, and handheld readers. This demonstrated the company’s commitment to innovation and expansion within the RFID market.

Strategic RFID Market Forecast

The RFID market is expected to witness robust growth over the forecast period, driven by technological advancements, increasing adoption across various industries, and favorable regulatory environments. The integration of RFID with other technologies, such as IoT and AI, will further enhance its capabilities and expand its applications. New markets and innovative applications will contribute significantly to market expansion, leading to considerable market potential in the coming years.

RFID Market Segmentation

-

1. Technology

- 1.1. RFID Tags

- 1.2. RFID Interrogators

- 1.3. RFID Software/Services

- 1.4. Active RFID/RTLS

-

2. Application

- 2.1. Retail

- 2.2. Healthcare and Medical

- 2.3. Passenger Transport/Automotive

- 2.4. Manufacturing

- 2.5. Consumer Products

- 2.6. Other Applications

RFID Market Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Latin America

- 5. Middle East and Africa

RFID Market Regional Market Share

Geographic Coverage of RFID Market

RFID Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 11.68% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Government Policies Favoring Digital Development; Increasing Installation of RFID in Manufacturing Units for Productivity Improvement and Security and Access Control Applications

- 3.3. Market Restrains

- 3.3.1. High Cost Associated with Software and Equipment Integration

- 3.4. Market Trends

- 3.4.1. Retail Segment is Expected to Hold a Major Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global RFID Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Technology

- 5.1.1. RFID Tags

- 5.1.2. RFID Interrogators

- 5.1.3. RFID Software/Services

- 5.1.4. Active RFID/RTLS

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Retail

- 5.2.2. Healthcare and Medical

- 5.2.3. Passenger Transport/Automotive

- 5.2.4. Manufacturing

- 5.2.5. Consumer Products

- 5.2.6. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Latin America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Technology

- 6. North America RFID Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Technology

- 6.1.1. RFID Tags

- 6.1.2. RFID Interrogators

- 6.1.3. RFID Software/Services

- 6.1.4. Active RFID/RTLS

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Retail

- 6.2.2. Healthcare and Medical

- 6.2.3. Passenger Transport/Automotive

- 6.2.4. Manufacturing

- 6.2.5. Consumer Products

- 6.2.6. Other Applications

- 6.1. Market Analysis, Insights and Forecast - by Technology

- 7. Europe RFID Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Technology

- 7.1.1. RFID Tags

- 7.1.2. RFID Interrogators

- 7.1.3. RFID Software/Services

- 7.1.4. Active RFID/RTLS

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Retail

- 7.2.2. Healthcare and Medical

- 7.2.3. Passenger Transport/Automotive

- 7.2.4. Manufacturing

- 7.2.5. Consumer Products

- 7.2.6. Other Applications

- 7.1. Market Analysis, Insights and Forecast - by Technology

- 8. Asia Pacific RFID Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Technology

- 8.1.1. RFID Tags

- 8.1.2. RFID Interrogators

- 8.1.3. RFID Software/Services

- 8.1.4. Active RFID/RTLS

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Retail

- 8.2.2. Healthcare and Medical

- 8.2.3. Passenger Transport/Automotive

- 8.2.4. Manufacturing

- 8.2.5. Consumer Products

- 8.2.6. Other Applications

- 8.1. Market Analysis, Insights and Forecast - by Technology

- 9. Latin America RFID Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Technology

- 9.1.1. RFID Tags

- 9.1.2. RFID Interrogators

- 9.1.3. RFID Software/Services

- 9.1.4. Active RFID/RTLS

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Retail

- 9.2.2. Healthcare and Medical

- 9.2.3. Passenger Transport/Automotive

- 9.2.4. Manufacturing

- 9.2.5. Consumer Products

- 9.2.6. Other Applications

- 9.1. Market Analysis, Insights and Forecast - by Technology

- 10. Middle East and Africa RFID Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Technology

- 10.1.1. RFID Tags

- 10.1.2. RFID Interrogators

- 10.1.3. RFID Software/Services

- 10.1.4. Active RFID/RTLS

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Retail

- 10.2.2. Healthcare and Medical

- 10.2.3. Passenger Transport/Automotive

- 10.2.4. Manufacturing

- 10.2.5. Consumer Products

- 10.2.6. Other Applications

- 10.1. Market Analysis, Insights and Forecast - by Technology

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Ceyon Technology Co Ltd

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Trace-Tech ID Solutions SL

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Impinj Inc

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Honeywell Productivity and Workflow Solutions

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 William Frick & Company

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 CCL Industries Inc

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Alien Technology Corporation

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Avery Dennison Corporation

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Nedap NV

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Zebra Technologies Corporation

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 JADAK Technologies Inc

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Hangzhou Century Co Ltd

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 SML Group Limited

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 CHILITAG Technology Ltd

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 Invengo Technology Pte Ltd

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.1 Ceyon Technology Co Ltd

List of Figures

- Figure 1: Global RFID Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: Global RFID Market Volume Breakdown (K Unit, %) by Region 2025 & 2033

- Figure 3: North America RFID Market Revenue (Million), by Technology 2025 & 2033

- Figure 4: North America RFID Market Volume (K Unit), by Technology 2025 & 2033

- Figure 5: North America RFID Market Revenue Share (%), by Technology 2025 & 2033

- Figure 6: North America RFID Market Volume Share (%), by Technology 2025 & 2033

- Figure 7: North America RFID Market Revenue (Million), by Application 2025 & 2033

- Figure 8: North America RFID Market Volume (K Unit), by Application 2025 & 2033

- Figure 9: North America RFID Market Revenue Share (%), by Application 2025 & 2033

- Figure 10: North America RFID Market Volume Share (%), by Application 2025 & 2033

- Figure 11: North America RFID Market Revenue (Million), by Country 2025 & 2033

- Figure 12: North America RFID Market Volume (K Unit), by Country 2025 & 2033

- Figure 13: North America RFID Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: North America RFID Market Volume Share (%), by Country 2025 & 2033

- Figure 15: Europe RFID Market Revenue (Million), by Technology 2025 & 2033

- Figure 16: Europe RFID Market Volume (K Unit), by Technology 2025 & 2033

- Figure 17: Europe RFID Market Revenue Share (%), by Technology 2025 & 2033

- Figure 18: Europe RFID Market Volume Share (%), by Technology 2025 & 2033

- Figure 19: Europe RFID Market Revenue (Million), by Application 2025 & 2033

- Figure 20: Europe RFID Market Volume (K Unit), by Application 2025 & 2033

- Figure 21: Europe RFID Market Revenue Share (%), by Application 2025 & 2033

- Figure 22: Europe RFID Market Volume Share (%), by Application 2025 & 2033

- Figure 23: Europe RFID Market Revenue (Million), by Country 2025 & 2033

- Figure 24: Europe RFID Market Volume (K Unit), by Country 2025 & 2033

- Figure 25: Europe RFID Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Europe RFID Market Volume Share (%), by Country 2025 & 2033

- Figure 27: Asia Pacific RFID Market Revenue (Million), by Technology 2025 & 2033

- Figure 28: Asia Pacific RFID Market Volume (K Unit), by Technology 2025 & 2033

- Figure 29: Asia Pacific RFID Market Revenue Share (%), by Technology 2025 & 2033

- Figure 30: Asia Pacific RFID Market Volume Share (%), by Technology 2025 & 2033

- Figure 31: Asia Pacific RFID Market Revenue (Million), by Application 2025 & 2033

- Figure 32: Asia Pacific RFID Market Volume (K Unit), by Application 2025 & 2033

- Figure 33: Asia Pacific RFID Market Revenue Share (%), by Application 2025 & 2033

- Figure 34: Asia Pacific RFID Market Volume Share (%), by Application 2025 & 2033

- Figure 35: Asia Pacific RFID Market Revenue (Million), by Country 2025 & 2033

- Figure 36: Asia Pacific RFID Market Volume (K Unit), by Country 2025 & 2033

- Figure 37: Asia Pacific RFID Market Revenue Share (%), by Country 2025 & 2033

- Figure 38: Asia Pacific RFID Market Volume Share (%), by Country 2025 & 2033

- Figure 39: Latin America RFID Market Revenue (Million), by Technology 2025 & 2033

- Figure 40: Latin America RFID Market Volume (K Unit), by Technology 2025 & 2033

- Figure 41: Latin America RFID Market Revenue Share (%), by Technology 2025 & 2033

- Figure 42: Latin America RFID Market Volume Share (%), by Technology 2025 & 2033

- Figure 43: Latin America RFID Market Revenue (Million), by Application 2025 & 2033

- Figure 44: Latin America RFID Market Volume (K Unit), by Application 2025 & 2033

- Figure 45: Latin America RFID Market Revenue Share (%), by Application 2025 & 2033

- Figure 46: Latin America RFID Market Volume Share (%), by Application 2025 & 2033

- Figure 47: Latin America RFID Market Revenue (Million), by Country 2025 & 2033

- Figure 48: Latin America RFID Market Volume (K Unit), by Country 2025 & 2033

- Figure 49: Latin America RFID Market Revenue Share (%), by Country 2025 & 2033

- Figure 50: Latin America RFID Market Volume Share (%), by Country 2025 & 2033

- Figure 51: Middle East and Africa RFID Market Revenue (Million), by Technology 2025 & 2033

- Figure 52: Middle East and Africa RFID Market Volume (K Unit), by Technology 2025 & 2033

- Figure 53: Middle East and Africa RFID Market Revenue Share (%), by Technology 2025 & 2033

- Figure 54: Middle East and Africa RFID Market Volume Share (%), by Technology 2025 & 2033

- Figure 55: Middle East and Africa RFID Market Revenue (Million), by Application 2025 & 2033

- Figure 56: Middle East and Africa RFID Market Volume (K Unit), by Application 2025 & 2033

- Figure 57: Middle East and Africa RFID Market Revenue Share (%), by Application 2025 & 2033

- Figure 58: Middle East and Africa RFID Market Volume Share (%), by Application 2025 & 2033

- Figure 59: Middle East and Africa RFID Market Revenue (Million), by Country 2025 & 2033

- Figure 60: Middle East and Africa RFID Market Volume (K Unit), by Country 2025 & 2033

- Figure 61: Middle East and Africa RFID Market Revenue Share (%), by Country 2025 & 2033

- Figure 62: Middle East and Africa RFID Market Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global RFID Market Revenue Million Forecast, by Technology 2020 & 2033

- Table 2: Global RFID Market Volume K Unit Forecast, by Technology 2020 & 2033

- Table 3: Global RFID Market Revenue Million Forecast, by Application 2020 & 2033

- Table 4: Global RFID Market Volume K Unit Forecast, by Application 2020 & 2033

- Table 5: Global RFID Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Global RFID Market Volume K Unit Forecast, by Region 2020 & 2033

- Table 7: Global RFID Market Revenue Million Forecast, by Technology 2020 & 2033

- Table 8: Global RFID Market Volume K Unit Forecast, by Technology 2020 & 2033

- Table 9: Global RFID Market Revenue Million Forecast, by Application 2020 & 2033

- Table 10: Global RFID Market Volume K Unit Forecast, by Application 2020 & 2033

- Table 11: Global RFID Market Revenue Million Forecast, by Country 2020 & 2033

- Table 12: Global RFID Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 13: Global RFID Market Revenue Million Forecast, by Technology 2020 & 2033

- Table 14: Global RFID Market Volume K Unit Forecast, by Technology 2020 & 2033

- Table 15: Global RFID Market Revenue Million Forecast, by Application 2020 & 2033

- Table 16: Global RFID Market Volume K Unit Forecast, by Application 2020 & 2033

- Table 17: Global RFID Market Revenue Million Forecast, by Country 2020 & 2033

- Table 18: Global RFID Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 19: Global RFID Market Revenue Million Forecast, by Technology 2020 & 2033

- Table 20: Global RFID Market Volume K Unit Forecast, by Technology 2020 & 2033

- Table 21: Global RFID Market Revenue Million Forecast, by Application 2020 & 2033

- Table 22: Global RFID Market Volume K Unit Forecast, by Application 2020 & 2033

- Table 23: Global RFID Market Revenue Million Forecast, by Country 2020 & 2033

- Table 24: Global RFID Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 25: Global RFID Market Revenue Million Forecast, by Technology 2020 & 2033

- Table 26: Global RFID Market Volume K Unit Forecast, by Technology 2020 & 2033

- Table 27: Global RFID Market Revenue Million Forecast, by Application 2020 & 2033

- Table 28: Global RFID Market Volume K Unit Forecast, by Application 2020 & 2033

- Table 29: Global RFID Market Revenue Million Forecast, by Country 2020 & 2033

- Table 30: Global RFID Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 31: Global RFID Market Revenue Million Forecast, by Technology 2020 & 2033

- Table 32: Global RFID Market Volume K Unit Forecast, by Technology 2020 & 2033

- Table 33: Global RFID Market Revenue Million Forecast, by Application 2020 & 2033

- Table 34: Global RFID Market Volume K Unit Forecast, by Application 2020 & 2033

- Table 35: Global RFID Market Revenue Million Forecast, by Country 2020 & 2033

- Table 36: Global RFID Market Volume K Unit Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the RFID Market?

The projected CAGR is approximately 11.68%.

2. Which companies are prominent players in the RFID Market?

Key companies in the market include Ceyon Technology Co Ltd, Trace-Tech ID Solutions SL, Impinj Inc, Honeywell Productivity and Workflow Solutions, William Frick & Company, CCL Industries Inc, Alien Technology Corporation, Avery Dennison Corporation, Nedap NV, Zebra Technologies Corporation, JADAK Technologies Inc , Hangzhou Century Co Ltd, SML Group Limited, CHILITAG Technology Ltd, Invengo Technology Pte Ltd.

3. What are the main segments of the RFID Market?

The market segments include Technology, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 14.98 Million as of 2022.

5. What are some drivers contributing to market growth?

Government Policies Favoring Digital Development; Increasing Installation of RFID in Manufacturing Units for Productivity Improvement and Security and Access Control Applications.

6. What are the notable trends driving market growth?

Retail Segment is Expected to Hold a Major Market Share.

7. Are there any restraints impacting market growth?

High Cost Associated with Software and Equipment Integration.

8. Can you provide examples of recent developments in the market?

September 2023 - The AD Pure line launches with, AD Belt U9 Pure inlays and tags which are ideally suited for global apparel, retail, industry and supply-chain applications. They are compact in size and offer excellent performance on difficult-to-tag or low-detuning materials such as cardboard and plastic.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "RFID Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the RFID Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the RFID Market?

To stay informed about further developments, trends, and reports in the RFID Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence