Key Insights

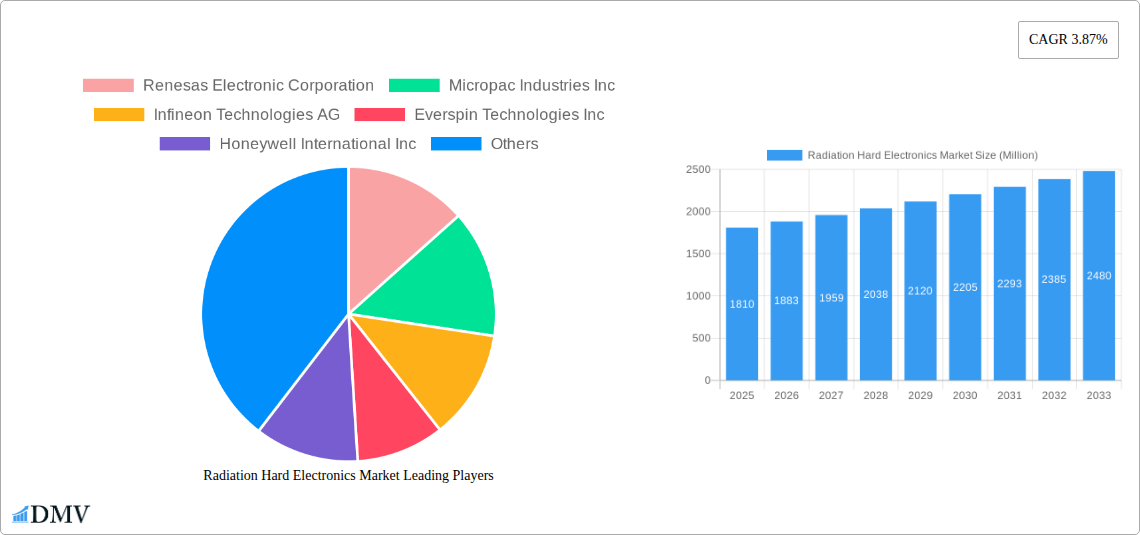

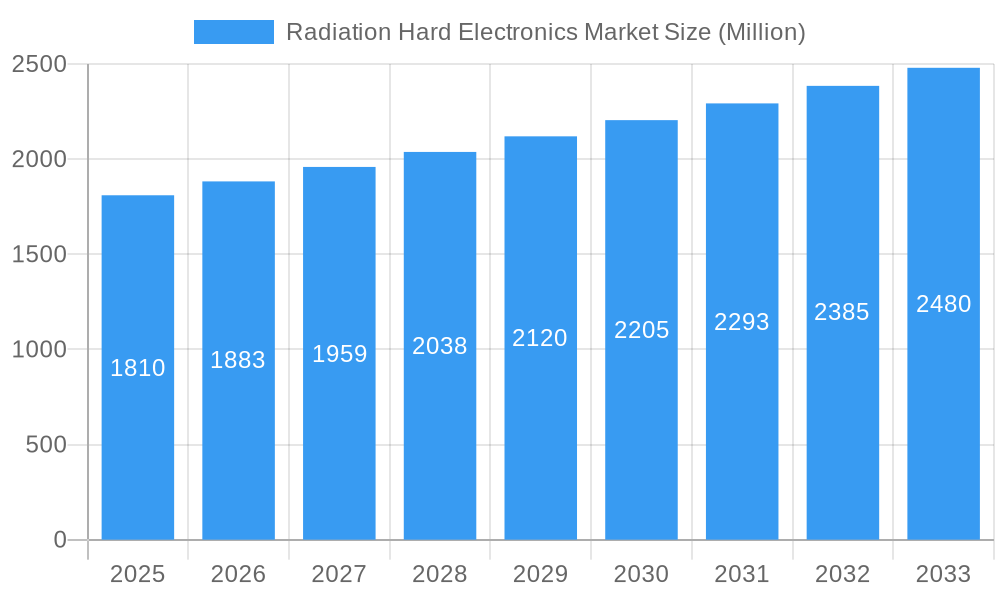

The Radiation Hard Electronics Market, valued at $1.81 billion in 2025, is projected to experience robust growth, driven by increasing demand from critical infrastructure sectors like aerospace and defense, and nuclear power plants. The market's Compound Annual Growth Rate (CAGR) of 3.87% from 2025 to 2033 reflects a steady expansion fueled by technological advancements in radiation-hardened components. The demand for reliable and resilient electronics in space exploration, military applications, and nuclear facilities is a major growth catalyst. Furthermore, the rising adoption of integrated circuits and microcontrollers in these demanding environments contributes significantly to market expansion. Specific growth segments include advanced sensors and memory technologies designed to withstand high radiation levels. While the market faces challenges in terms of high manufacturing costs and the complexity of designing and testing radiation-hardened components, the strategic importance of reliable operation in extreme environments outweighs these restraints, ensuring sustained market growth.

Radiation Hard Electronics Market Market Size (In Billion)

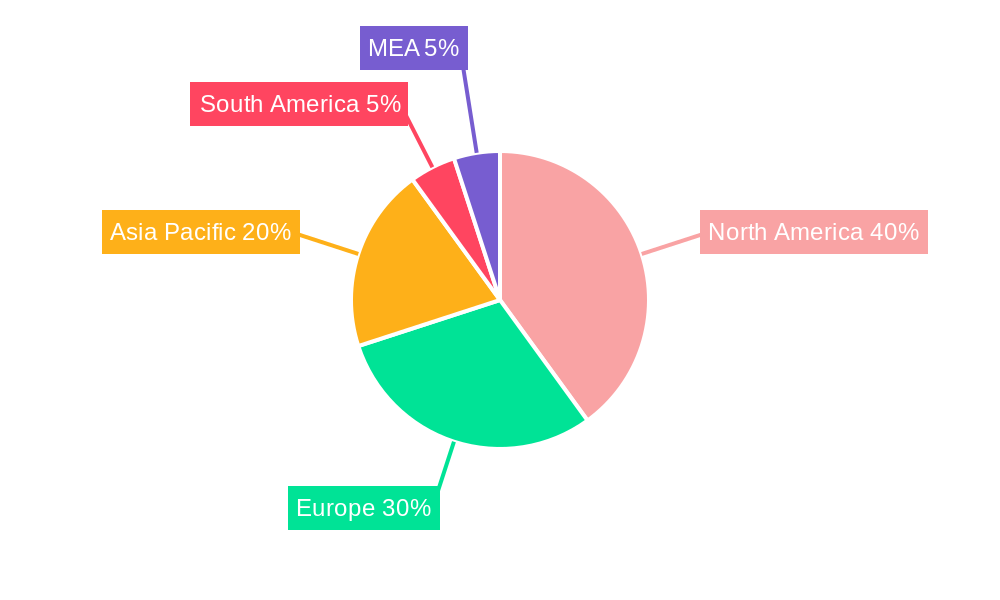

The competitive landscape is marked by a mix of established players and emerging companies. Key market participants, including Renesas Electronics, Infineon Technologies, Microchip Technology, and Texas Instruments, are actively investing in research and development to enhance the performance and reliability of their radiation-hardened products. Geographic expansion is a key strategy, with North America and Europe currently holding significant market share due to the concentration of aerospace and defense activities. However, the Asia-Pacific region is expected to witness considerable growth owing to increasing investments in space technology and nuclear power infrastructure. The market segmentation by component (discrete, sensors, integrated circuits, microcontrollers/microprocessors, memory) further highlights the diversified nature of the industry, showcasing strong demand across all component types, particularly for integrated solutions that offer enhanced performance and reliability. The ongoing trend towards miniaturization and improved power efficiency in radiation-hardened electronics will further drive market expansion in the coming years.

Radiation Hard Electronics Market Company Market Share

Radiation Hard Electronics Market: A Comprehensive Report (2019-2033)

This insightful report provides a detailed analysis of the Radiation Hard Electronics Market, offering a comprehensive overview of market dynamics, technological advancements, and future growth prospects. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report is an invaluable resource for stakeholders seeking to understand and capitalize on the opportunities within this crucial market. The market is projected to reach USD xx Million by 2033, exhibiting a CAGR of xx% during the forecast period.

Radiation Hard Electronics Market Composition & Trends

This section delves into the competitive landscape of the radiation-hard electronics market, analyzing market concentration, innovation drivers, regulatory frameworks, substitute products, end-user profiles, and mergers and acquisitions (M&A) activities. The market exhibits a moderately concentrated structure, with key players such as Renesas Electronic Corporation, Infineon Technologies AG, and Texas Instruments holding significant market share. However, the presence of several smaller, specialized companies indicates a dynamic competitive environment.

- Market Share Distribution (2024): Renesas: xx%; Infineon: xx%; Texas Instruments: xx%; Others: xx%

- Innovation Catalysts: Government funding for space exploration and defense initiatives, advancements in semiconductor technology (e.g., SiC, GaN), and increasing demand for reliable electronics in harsh environments are key drivers of innovation.

- Regulatory Landscape: Stringent safety and reliability standards for aerospace and defense applications significantly influence market dynamics. Compliance necessitates robust testing and certification processes, adding to the cost of product development.

- Substitute Products: While limited, alternative technologies like radiation-tolerant electronics are emerging, posing a potential threat to the radiation-hardened electronics market in specific niche applications.

- End-User Profiles: The aerospace and defense sector remains the dominant end-user, followed by nuclear power plants and increasingly, the medical and industrial sectors.

- M&A Activities (2019-2024): A total of xx M&A deals were recorded, with a combined value of approximately USD xx Million. These transactions primarily focused on consolidating technological capabilities and expanding market reach.

Radiation Hard Electronics Market Industry Evolution

This section examines the historical and projected growth trajectories of the radiation-hard electronics market, analyzing the impact of technological advancements and evolving consumer demands. The market witnessed substantial growth during the historical period (2019-2024), driven primarily by increased government spending on defense and space exploration. Technological advancements, such as the development of more radiation-tolerant materials and improved design techniques, have significantly enhanced the performance and reliability of radiation-hardened electronics, leading to broader adoption across various industries. The forecast period (2025-2033) is expected to witness continued growth, fueled by the rising demand for radiation-hardened electronics in emerging applications like space-based internet infrastructure and advanced medical devices. Growth rates are anticipated to be xx% between 2025-2030 and xx% between 2030-2033, driven primarily by technological advancements and growing demand in several end-user industries.

Leading Regions, Countries, or Segments in Radiation Hard Electronics Market

The North American region, particularly the United States, holds the leading position in the radiation-hard electronics market, driven by robust government spending on defense and space exploration, a well-established semiconductor industry, and a strong focus on research and development. Europe follows closely behind, fueled by strong aerospace and defense sectors. Asia-Pacific exhibits significant growth potential, particularly in space-related applications.

- Key Drivers for North America:

- High government spending on defense and aerospace.

- Strong presence of major market players like Honeywell International Inc and Texas Instruments.

- Advanced research and development in semiconductor technology.

- Key Drivers for Europe:

- Strong aerospace and defense industries within the region.

- Growing adoption of radiation-hardened electronics in various applications.

- Active participation in space exploration initiatives.

- Key Drivers for Asia-Pacific:

- Increasing investment in space exploration and satellite technology.

- Development of advanced semiconductor manufacturing capabilities.

- Strong growth in the industrial and medical sectors.

By End-User: The Aerospace and Defense segment accounts for the largest market share, followed by the Space segment and Nuclear Power Plants.

By Component: Integrated Circuits dominate the market, followed by Microcontrollers and Microprocessors, with Memory and Sensors exhibiting strong growth potential.

Radiation Hard Electronics Market Product Innovations

Recent product innovations include the development of advanced radiation-hardened integrated circuits with improved performance and reduced power consumption, coupled with miniaturization leading to smaller form factors. Advancements in materials science and design techniques have significantly improved the radiation tolerance of these components, expanding their applications in diverse fields. This leads to unique selling propositions like higher reliability, longer lifespans, and enhanced performance under extreme conditions, broadening the scope of applications for radiation-hardened electronics.

Propelling Factors for Radiation Hard Electronics Market Growth

The market's growth is propelled by several factors, including increasing demand for reliable electronics in harsh environments, technological advancements in semiconductor technology, and substantial government funding for space exploration and defense programs. The development of more radiation-tolerant materials, such as silicon carbide and gallium nitride, has broadened applications. Furthermore, stringent regulatory requirements for safety and reliability in critical applications are further driving market growth.

Obstacles in the Radiation Hard Electronics Market

The radiation-hard electronics market faces challenges, including high manufacturing costs, a complex supply chain susceptible to disruptions, and intense competition from other technologies. Stringent regulatory compliance requirements increase development time and expenses, while supply chain vulnerabilities can lead to production delays. Competition from less expensive, albeit less radiation-hardened, alternatives also affects market growth.

Future Opportunities in Radiation Hard Electronics Market

Future growth opportunities lie in expanding applications into new sectors like medical devices and industrial automation, with a focus on developing smaller, more energy-efficient, and cost-effective radiation-hardened components. Further advancements in semiconductor technology and new materials will play a critical role in driving future market expansion. The rising adoption of space-based technologies and increasing demand for reliable electronics in critical infrastructure also present substantial market opportunities.

Major Players in the Radiation Hard Electronics Market Ecosystem

- Renesas Electronic Corporation

- Micropac Industries Inc

- Infineon Technologies AG

- Everspin Technologies Inc

- Honeywell International Inc

- Microchip Technology Inc

- Texas Instruments

- Data Device Corporation

- Frontgrade Technologies

- BAE Systems PLC

- Vorago Technologie

- Solid State Devices Inc

- Advanced Micro Devices Inc

- STMicroelectronics International NV

Key Developments in Radiation Hard Electronics Market Industry

- October 2023: An Indian University secured USD 111 Million to advance its leadership in microelectronics and nanotechnology, allocating USD 10 Million to establish a Center for Reliable and Trusted Electronics focused on radiation-hardened technologies, signaling a significant boost to research and development.

- June 2023: Texas Instruments' expansion of its manufacturing operations in Malaysia enhances its cost advantage and strengthens its supply chain, contributing to increased production capacity and potentially lower prices.

Strategic Radiation Hard Electronics Market Forecast

The radiation-hard electronics market is poised for significant growth driven by continuous technological advancements, rising demand from various end-user sectors, and substantial government investment in space exploration and defense. New materials and designs, along with emerging applications in critical infrastructure and medical technologies, will further stimulate market expansion. The market exhibits immense growth potential across various regions, particularly in North America and Asia-Pacific, offering lucrative opportunities for market players.

Radiation Hard Electronics Market Segmentation

-

1. End-user

- 1.1. Space

- 1.2. Aerospace and Defense

- 1.3. Nuclear Power Plants

-

2. Component

- 2.1. Discrete

- 2.2. Sensors

- 2.3. Integrated Circuit

- 2.4. Microcontrollers and Microprocessors

- 2.5. Memory

Radiation Hard Electronics Market Segmentation By Geography

- 1. Americas

- 2. Europe

- 3. Asia

- 4. Australia and New Zealand

- 5. Latin America

- 6. Middle East and Africa

Radiation Hard Electronics Market Regional Market Share

Geographic Coverage of Radiation Hard Electronics Market

Radiation Hard Electronics Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.87% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Instances of Satellite Launches and Space Exploration Activities; Growing Adoption of Radiation Hardened Electronics in Power Management and Nuclear Environment

- 3.3. Market Restrains

- 3.3.1. High Designing and Development Cost

- 3.4. Market Trends

- 3.4.1. Nuclear Power Plants to Witness Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Radiation Hard Electronics Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by End-user

- 5.1.1. Space

- 5.1.2. Aerospace and Defense

- 5.1.3. Nuclear Power Plants

- 5.2. Market Analysis, Insights and Forecast - by Component

- 5.2.1. Discrete

- 5.2.2. Sensors

- 5.2.3. Integrated Circuit

- 5.2.4. Microcontrollers and Microprocessors

- 5.2.5. Memory

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Americas

- 5.3.2. Europe

- 5.3.3. Asia

- 5.3.4. Australia and New Zealand

- 5.3.5. Latin America

- 5.3.6. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by End-user

- 6. Americas Radiation Hard Electronics Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by End-user

- 6.1.1. Space

- 6.1.2. Aerospace and Defense

- 6.1.3. Nuclear Power Plants

- 6.2. Market Analysis, Insights and Forecast - by Component

- 6.2.1. Discrete

- 6.2.2. Sensors

- 6.2.3. Integrated Circuit

- 6.2.4. Microcontrollers and Microprocessors

- 6.2.5. Memory

- 6.1. Market Analysis, Insights and Forecast - by End-user

- 7. Europe Radiation Hard Electronics Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by End-user

- 7.1.1. Space

- 7.1.2. Aerospace and Defense

- 7.1.3. Nuclear Power Plants

- 7.2. Market Analysis, Insights and Forecast - by Component

- 7.2.1. Discrete

- 7.2.2. Sensors

- 7.2.3. Integrated Circuit

- 7.2.4. Microcontrollers and Microprocessors

- 7.2.5. Memory

- 7.1. Market Analysis, Insights and Forecast - by End-user

- 8. Asia Radiation Hard Electronics Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by End-user

- 8.1.1. Space

- 8.1.2. Aerospace and Defense

- 8.1.3. Nuclear Power Plants

- 8.2. Market Analysis, Insights and Forecast - by Component

- 8.2.1. Discrete

- 8.2.2. Sensors

- 8.2.3. Integrated Circuit

- 8.2.4. Microcontrollers and Microprocessors

- 8.2.5. Memory

- 8.1. Market Analysis, Insights and Forecast - by End-user

- 9. Australia and New Zealand Radiation Hard Electronics Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by End-user

- 9.1.1. Space

- 9.1.2. Aerospace and Defense

- 9.1.3. Nuclear Power Plants

- 9.2. Market Analysis, Insights and Forecast - by Component

- 9.2.1. Discrete

- 9.2.2. Sensors

- 9.2.3. Integrated Circuit

- 9.2.4. Microcontrollers and Microprocessors

- 9.2.5. Memory

- 9.1. Market Analysis, Insights and Forecast - by End-user

- 10. Latin America Radiation Hard Electronics Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by End-user

- 10.1.1. Space

- 10.1.2. Aerospace and Defense

- 10.1.3. Nuclear Power Plants

- 10.2. Market Analysis, Insights and Forecast - by Component

- 10.2.1. Discrete

- 10.2.2. Sensors

- 10.2.3. Integrated Circuit

- 10.2.4. Microcontrollers and Microprocessors

- 10.2.5. Memory

- 10.1. Market Analysis, Insights and Forecast - by End-user

- 11. Middle East and Africa Radiation Hard Electronics Market Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by End-user

- 11.1.1. Space

- 11.1.2. Aerospace and Defense

- 11.1.3. Nuclear Power Plants

- 11.2. Market Analysis, Insights and Forecast - by Component

- 11.2.1. Discrete

- 11.2.2. Sensors

- 11.2.3. Integrated Circuit

- 11.2.4. Microcontrollers and Microprocessors

- 11.2.5. Memory

- 11.1. Market Analysis, Insights and Forecast - by End-user

- 12. Competitive Analysis

- 12.1. Global Market Share Analysis 2025

- 12.2. Company Profiles

- 12.2.1 Renesas Electronic Corporation

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Micropac Industries Inc

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Infineon Technologies AG

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Everspin Technologies Inc

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Honeywell International Inc

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 Microchip Technology Inc

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 Texas Instruments

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 Data Device Corporation

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 Frontgrade Technologies

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 BAE Systems PLC

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.11 Vorago Technologie

- 12.2.11.1. Overview

- 12.2.11.2. Products

- 12.2.11.3. SWOT Analysis

- 12.2.11.4. Recent Developments

- 12.2.11.5. Financials (Based on Availability)

- 12.2.12 Solid State Devices Inc

- 12.2.12.1. Overview

- 12.2.12.2. Products

- 12.2.12.3. SWOT Analysis

- 12.2.12.4. Recent Developments

- 12.2.12.5. Financials (Based on Availability)

- 12.2.13 Advanced Micro Devices Inc

- 12.2.13.1. Overview

- 12.2.13.2. Products

- 12.2.13.3. SWOT Analysis

- 12.2.13.4. Recent Developments

- 12.2.13.5. Financials (Based on Availability)

- 12.2.14 STMicroelectronics International NV

- 12.2.14.1. Overview

- 12.2.14.2. Products

- 12.2.14.3. SWOT Analysis

- 12.2.14.4. Recent Developments

- 12.2.14.5. Financials (Based on Availability)

- 12.2.1 Renesas Electronic Corporation

List of Figures

- Figure 1: Global Radiation Hard Electronics Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: Americas Radiation Hard Electronics Market Revenue (Million), by End-user 2025 & 2033

- Figure 3: Americas Radiation Hard Electronics Market Revenue Share (%), by End-user 2025 & 2033

- Figure 4: Americas Radiation Hard Electronics Market Revenue (Million), by Component 2025 & 2033

- Figure 5: Americas Radiation Hard Electronics Market Revenue Share (%), by Component 2025 & 2033

- Figure 6: Americas Radiation Hard Electronics Market Revenue (Million), by Country 2025 & 2033

- Figure 7: Americas Radiation Hard Electronics Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Radiation Hard Electronics Market Revenue (Million), by End-user 2025 & 2033

- Figure 9: Europe Radiation Hard Electronics Market Revenue Share (%), by End-user 2025 & 2033

- Figure 10: Europe Radiation Hard Electronics Market Revenue (Million), by Component 2025 & 2033

- Figure 11: Europe Radiation Hard Electronics Market Revenue Share (%), by Component 2025 & 2033

- Figure 12: Europe Radiation Hard Electronics Market Revenue (Million), by Country 2025 & 2033

- Figure 13: Europe Radiation Hard Electronics Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Radiation Hard Electronics Market Revenue (Million), by End-user 2025 & 2033

- Figure 15: Asia Radiation Hard Electronics Market Revenue Share (%), by End-user 2025 & 2033

- Figure 16: Asia Radiation Hard Electronics Market Revenue (Million), by Component 2025 & 2033

- Figure 17: Asia Radiation Hard Electronics Market Revenue Share (%), by Component 2025 & 2033

- Figure 18: Asia Radiation Hard Electronics Market Revenue (Million), by Country 2025 & 2033

- Figure 19: Asia Radiation Hard Electronics Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: Australia and New Zealand Radiation Hard Electronics Market Revenue (Million), by End-user 2025 & 2033

- Figure 21: Australia and New Zealand Radiation Hard Electronics Market Revenue Share (%), by End-user 2025 & 2033

- Figure 22: Australia and New Zealand Radiation Hard Electronics Market Revenue (Million), by Component 2025 & 2033

- Figure 23: Australia and New Zealand Radiation Hard Electronics Market Revenue Share (%), by Component 2025 & 2033

- Figure 24: Australia and New Zealand Radiation Hard Electronics Market Revenue (Million), by Country 2025 & 2033

- Figure 25: Australia and New Zealand Radiation Hard Electronics Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Latin America Radiation Hard Electronics Market Revenue (Million), by End-user 2025 & 2033

- Figure 27: Latin America Radiation Hard Electronics Market Revenue Share (%), by End-user 2025 & 2033

- Figure 28: Latin America Radiation Hard Electronics Market Revenue (Million), by Component 2025 & 2033

- Figure 29: Latin America Radiation Hard Electronics Market Revenue Share (%), by Component 2025 & 2033

- Figure 30: Latin America Radiation Hard Electronics Market Revenue (Million), by Country 2025 & 2033

- Figure 31: Latin America Radiation Hard Electronics Market Revenue Share (%), by Country 2025 & 2033

- Figure 32: Middle East and Africa Radiation Hard Electronics Market Revenue (Million), by End-user 2025 & 2033

- Figure 33: Middle East and Africa Radiation Hard Electronics Market Revenue Share (%), by End-user 2025 & 2033

- Figure 34: Middle East and Africa Radiation Hard Electronics Market Revenue (Million), by Component 2025 & 2033

- Figure 35: Middle East and Africa Radiation Hard Electronics Market Revenue Share (%), by Component 2025 & 2033

- Figure 36: Middle East and Africa Radiation Hard Electronics Market Revenue (Million), by Country 2025 & 2033

- Figure 37: Middle East and Africa Radiation Hard Electronics Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Radiation Hard Electronics Market Revenue Million Forecast, by End-user 2020 & 2033

- Table 2: Global Radiation Hard Electronics Market Revenue Million Forecast, by Component 2020 & 2033

- Table 3: Global Radiation Hard Electronics Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global Radiation Hard Electronics Market Revenue Million Forecast, by End-user 2020 & 2033

- Table 5: Global Radiation Hard Electronics Market Revenue Million Forecast, by Component 2020 & 2033

- Table 6: Global Radiation Hard Electronics Market Revenue Million Forecast, by Country 2020 & 2033

- Table 7: Global Radiation Hard Electronics Market Revenue Million Forecast, by End-user 2020 & 2033

- Table 8: Global Radiation Hard Electronics Market Revenue Million Forecast, by Component 2020 & 2033

- Table 9: Global Radiation Hard Electronics Market Revenue Million Forecast, by Country 2020 & 2033

- Table 10: Global Radiation Hard Electronics Market Revenue Million Forecast, by End-user 2020 & 2033

- Table 11: Global Radiation Hard Electronics Market Revenue Million Forecast, by Component 2020 & 2033

- Table 12: Global Radiation Hard Electronics Market Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Global Radiation Hard Electronics Market Revenue Million Forecast, by End-user 2020 & 2033

- Table 14: Global Radiation Hard Electronics Market Revenue Million Forecast, by Component 2020 & 2033

- Table 15: Global Radiation Hard Electronics Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Global Radiation Hard Electronics Market Revenue Million Forecast, by End-user 2020 & 2033

- Table 17: Global Radiation Hard Electronics Market Revenue Million Forecast, by Component 2020 & 2033

- Table 18: Global Radiation Hard Electronics Market Revenue Million Forecast, by Country 2020 & 2033

- Table 19: Global Radiation Hard Electronics Market Revenue Million Forecast, by End-user 2020 & 2033

- Table 20: Global Radiation Hard Electronics Market Revenue Million Forecast, by Component 2020 & 2033

- Table 21: Global Radiation Hard Electronics Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Radiation Hard Electronics Market?

The projected CAGR is approximately 3.87%.

2. Which companies are prominent players in the Radiation Hard Electronics Market?

Key companies in the market include Renesas Electronic Corporation, Micropac Industries Inc, Infineon Technologies AG, Everspin Technologies Inc, Honeywell International Inc, Microchip Technology Inc, Texas Instruments, Data Device Corporation, Frontgrade Technologies, BAE Systems PLC, Vorago Technologie, Solid State Devices Inc, Advanced Micro Devices Inc, STMicroelectronics International NV.

3. What are the main segments of the Radiation Hard Electronics Market?

The market segments include End-user, Component.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.81 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Instances of Satellite Launches and Space Exploration Activities; Growing Adoption of Radiation Hardened Electronics in Power Management and Nuclear Environment.

6. What are the notable trends driving market growth?

Nuclear Power Plants to Witness Significant Growth.

7. Are there any restraints impacting market growth?

High Designing and Development Cost.

8. Can you provide examples of recent developments in the market?

October 2023: Indian University (IU) announced that it had secured and would invest about USD 111 million over the next few years to advance its leadership in microelectronics and nanotechnology. The university has also made a provision of USD 10 million to launch the new Center for Reliable and Trusted Electronics, which aims to take forward research activities focused primarily on the modeling and simulation of radiation effects and the design of radiation-hardened technologies.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Radiation Hard Electronics Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Radiation Hard Electronics Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Radiation Hard Electronics Market?

To stay informed about further developments, trends, and reports in the Radiation Hard Electronics Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence