Key Insights

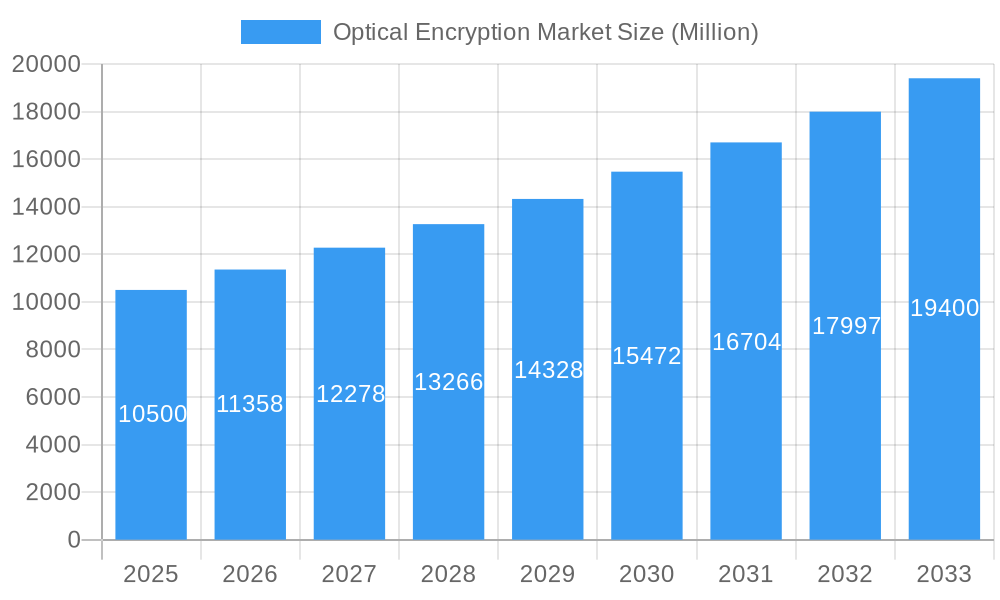

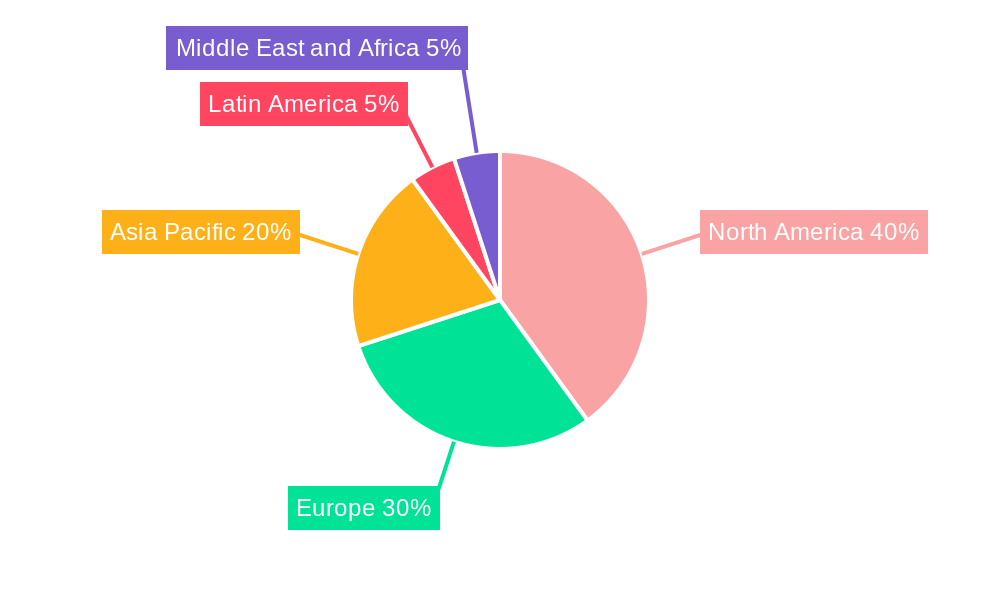

The optical encryption market is experiencing robust growth, driven by the increasing demand for secure data transmission across various sectors. The market's Compound Annual Growth Rate (CAGR) of 8.10% from 2019 to 2024 suggests a significant expansion, projected to continue through 2033. Key drivers include the rising adoption of cloud computing and data centers, the need for secure financial transactions in the BFSI sector, and stringent data security regulations across government and defense, healthcare, and other industries. The increasing reliance on high-speed data networks fuels the demand for higher data rate encryption solutions (10G-40G and above), while the layered encryption approach (Layer 1, Layer 2, and Layer 3) enhances security and meets diverse application needs. North America and Europe currently hold a significant market share, but the Asia-Pacific region is expected to witness substantial growth due to rapid digital transformation and infrastructure development. Competition is intense, with major players such as Cisco, Juniper, and Huawei vying for market dominance through technological innovations and strategic partnerships. The market segmentation, encompassing various end-user verticals and encryption layers, provides opportunities for specialized vendors catering to specific industry requirements. While restraints could include the high initial investment costs and complexities associated with implementing optical encryption, the escalating cyber security threats and the growing adoption of advanced encryption techniques are likely to outweigh these challenges, further fueling market expansion.

Optical Encryption Market Market Size (In Billion)

The forecast period (2025-2033) anticipates continued market expansion. Estimating the 2025 market size requires consideration of the historical data and CAGR. Assuming a 2024 market size of approximately $10 billion (a reasonable estimate given the provided 8.10% CAGR and the significant players involved), a projection for 2025 and beyond would naturally demonstrate continued growth, with the market size consistently increasing year-on-year at a rate slightly above the CAGR. This growth is fueled by continuous technological advancements in encryption methodologies and increasing adoption across diverse industry verticals. The ongoing need for secure data transmission in a hyper-connected world ensures the optical encryption market will remain a dynamic and lucrative sector with a promising future outlook.

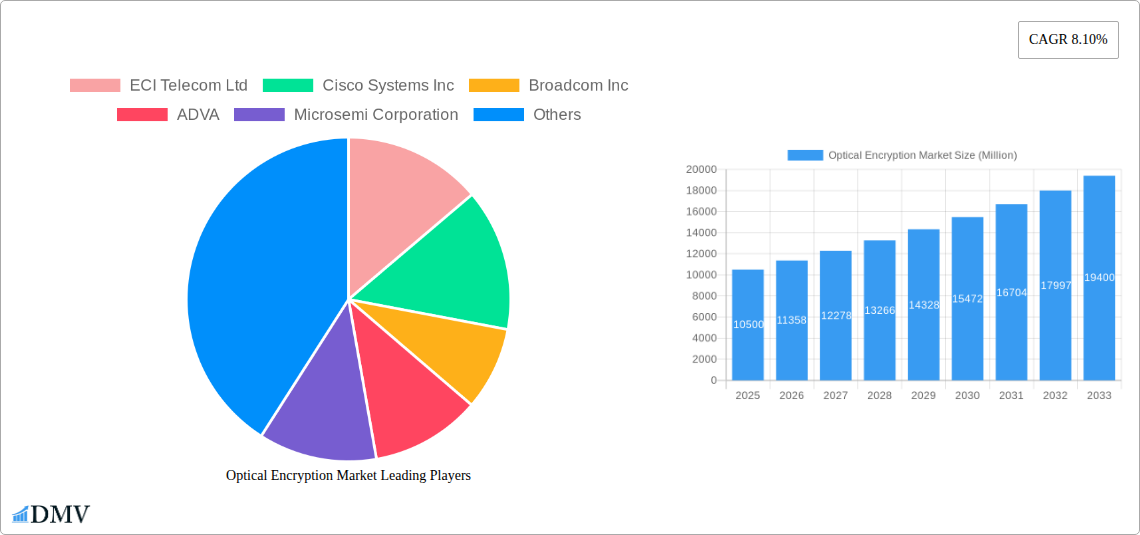

Optical Encryption Market Company Market Share

Optical Encryption Market: A Comprehensive Market Report (2019-2033)

This insightful report provides a comprehensive analysis of the Optical Encryption Market, offering a detailed understanding of its current state, future trajectory, and key players. The study period covers 2019-2033, with 2025 as the base and estimated year, and a forecast period of 2025-2033. The report is essential for stakeholders seeking to navigate the complexities of this rapidly evolving market, valued at xx Million in 2025 and projected to reach xx Million by 2033.

Optical Encryption Market Market Composition & Trends

The Optical Encryption Market is characterized by moderate concentration, with key players like ECI Telecom Ltd, Cisco Systems Inc, Broadcom Inc, ADVA, Microsemi Corporation, Arista Networks, Juniper Networks Inc, Thales E-Security, Huawei Technologies Co Ltd, Nokia Corporation, Acacia Communications, and Ciena Corporation holding significant market share. However, the market exhibits a dynamic landscape with ongoing mergers and acquisitions (M&A) activities. Recent M&A deals, totaling approximately xx Million in 2024, have reshaped competitive dynamics. Innovation in areas like quantum-resistant cryptography and advancements in silicon photonics are driving significant growth. Stringent data privacy regulations across various sectors, including BFSI (Banking, Financial Services, and Insurance) and Government & Defence, are further fueling market expansion. Substitute technologies, such as software-defined networking (SDN) with encryption, pose some competitive pressure, but the inherent security advantages of optical encryption continue to maintain its dominance in high-bandwidth applications.

- Market Share Distribution (2024): Top 5 players account for approximately xx% of the market.

- M&A Deal Value (2024): Approximately xx Million.

- Key Innovation Catalysts: Quantum-resistant cryptography, silicon photonics.

- Regulatory Landscape: Stringent data privacy regulations (GDPR, CCPA).

- End-User Profile: Primarily Datacenter and Cloud, BFSI, and Government and Defence.

Optical Encryption Market Industry Evolution

The Optical Encryption Market has experienced significant growth from 2019 to 2024, with a Compound Annual Growth Rate (CAGR) of approximately xx%. This growth is largely attributed to the increasing demand for secure high-speed data transmission across various sectors. Technological advancements, such as the development of high-capacity optical fibers and improved encryption algorithms, have played a crucial role in market expansion. Furthermore, the rising adoption of cloud computing and the growth of data centers have created a substantial demand for secure optical communication solutions. Consumer demand is shifting towards more secure and reliable data transmission solutions, driving the need for robust optical encryption technologies. The market is expected to maintain its growth trajectory during the forecast period (2025-2033), with projected CAGR of xx%, driven by factors such as the increasing deployment of 5G networks and the growing adoption of IoT devices.

Leading Regions, Countries, or Segments in Optical Encryption Market

The Datacenter and Cloud segment currently dominates the Optical Encryption Market, accounting for approximately xx% of the total market revenue in 2024. This is followed by the BFSI and Government & Defence segments. Geographically, North America and Europe are leading regions.

- Key Drivers:

- Datacenter and Cloud: Rapid growth of cloud computing, increasing data center interconnectivity.

- BFSI: Stringent regulatory compliance requirements, rising cyber threats.

- Government and Defence: Critical infrastructure protection, classified data transmission.

- Dominance Factors: High data transmission needs, stringent security requirements, significant investments in infrastructure.

- High Growth Segments: 10 G-40 G and 40 G-100 G data rate segments are experiencing rapid growth due to increasing adoption of high-speed networks.

Optical Encryption Market Product Innovations

Recent innovations focus on enhancing encryption speed, security, and integration with existing network infrastructure. Products incorporating advanced algorithms and hardware-based acceleration are gaining traction. Furthermore, the development of compact and cost-effective optical encryption modules is streamlining implementation across various applications. Unique selling propositions include improved key management systems, enhanced interoperability, and reduced latency.

Propelling Factors for Optical Encryption Market Growth

The Optical Encryption Market is fueled by several factors: the increasing adoption of cloud computing and big data analytics necessitates robust security measures; growing concerns about data breaches and cyberattacks are driving demand for advanced encryption technologies; and supportive government regulations, such as data privacy laws, are incentivizing the adoption of secure optical communication solutions. Furthermore, technological advancements in silicon photonics and quantum-resistant cryptography are enhancing the capabilities and security of optical encryption systems.

Obstacles in the Optical Encryption Market Market

High initial investment costs can deter smaller organizations from adopting optical encryption solutions. Supply chain disruptions, particularly concerning specialized components, can impact market growth. Moreover, intense competition among established players and emerging technology providers create pricing pressures. These challenges, alongside regulatory complexities in certain regions, can hinder broader market penetration.

Future Opportunities in Optical Encryption Market

Emerging opportunities lie in the integration of optical encryption with 5G and IoT networks, as well as the development of quantum-resistant optical encryption solutions. Expanding into new markets, particularly in developing economies with growing infrastructure investment, presents substantial potential. Furthermore, the development of more efficient and cost-effective optical encryption technologies will open new application avenues.

Major Players in the Optical Encryption Market Ecosystem

- ECI Telecom Ltd

- Cisco Systems Inc

- Broadcom Inc

- ADVA

- Microsemi Corporation

- Arista Networks

- Juniper Networks Inc

- Thales E-Security

- Huawei Technologies Co Ltd

- Nokia Corporation

- Acacia Communications

- Ciena Corporation

Key Developments in Optical Encryption Market Industry

- Q4 2024: Launch of new high-speed optical encryption module by Ciena Corporation.

- Q2 2024: Acquisition of a smaller optical encryption company by Cisco Systems Inc.

- Q1 2024: Release of upgraded encryption algorithm by ADVA.

Strategic Optical Encryption Market Market Forecast

The Optical Encryption Market is poised for continued growth, driven by technological advancements, increasing data security concerns, and supportive regulatory frameworks. The market's potential is immense, particularly in high-growth sectors such as cloud computing, IoT, and 5G. The projected growth trajectory underscores the significant opportunities for market participants, making strategic investments and innovation crucial for success.

Optical Encryption Market Segmentation

-

1. Encryption

- 1.1. Layer1

- 1.2. Layer 2

- 1.3. Layer 3

-

2. Data Rate

- 2.1. Less 10 G

- 2.2. 10 G-40 G

- 2.3. 40 G-100 G

- 2.4. Greater than 10 G

-

3. End-user Vertical

- 3.1. Datacenter and Cloud

- 3.2. BFSI

- 3.3. Government and Defence

- 3.4. Healthcare

- 3.5. Energy and Utilities

- 3.6. Retail and E-commerce

- 3.7. Other End-user Verticals

Optical Encryption Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Rest of Europe

-

3. Asia Pacific

- 3.1. India

- 3.2. China

- 3.3. Japan

- 3.4. Rest of Asia Pacific

-

4. Latin America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Rest of Latin America

-

5. Middle East and Africa

- 5.1. United Arab Eminates

- 5.2. Saudi Arabia

- 5.3. Rest of Middle East and Africa

Optical Encryption Market Regional Market Share

Geographic Coverage of Optical Encryption Market

Optical Encryption Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.8% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Internet Penetration with Demand for High-speed Internet; Technological Innovations by OTN Solution Providers

- 3.3. Market Restrains

- 3.3.1. Dearth of Skillful Workforce to Add New Solutions in Existing Network

- 3.4. Market Trends

- 3.4.1. Layer 1 Encryption is Expected to Witness High Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Optical Encryption Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Encryption

- 5.1.1. Layer1

- 5.1.2. Layer 2

- 5.1.3. Layer 3

- 5.2. Market Analysis, Insights and Forecast - by Data Rate

- 5.2.1. Less 10 G

- 5.2.2. 10 G-40 G

- 5.2.3. 40 G-100 G

- 5.2.4. Greater than 10 G

- 5.3. Market Analysis, Insights and Forecast - by End-user Vertical

- 5.3.1. Datacenter and Cloud

- 5.3.2. BFSI

- 5.3.3. Government and Defence

- 5.3.4. Healthcare

- 5.3.5. Energy and Utilities

- 5.3.6. Retail and E-commerce

- 5.3.7. Other End-user Verticals

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. Latin America

- 5.4.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Encryption

- 6. North America Optical Encryption Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Encryption

- 6.1.1. Layer1

- 6.1.2. Layer 2

- 6.1.3. Layer 3

- 6.2. Market Analysis, Insights and Forecast - by Data Rate

- 6.2.1. Less 10 G

- 6.2.2. 10 G-40 G

- 6.2.3. 40 G-100 G

- 6.2.4. Greater than 10 G

- 6.3. Market Analysis, Insights and Forecast - by End-user Vertical

- 6.3.1. Datacenter and Cloud

- 6.3.2. BFSI

- 6.3.3. Government and Defence

- 6.3.4. Healthcare

- 6.3.5. Energy and Utilities

- 6.3.6. Retail and E-commerce

- 6.3.7. Other End-user Verticals

- 6.1. Market Analysis, Insights and Forecast - by Encryption

- 7. Europe Optical Encryption Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Encryption

- 7.1.1. Layer1

- 7.1.2. Layer 2

- 7.1.3. Layer 3

- 7.2. Market Analysis, Insights and Forecast - by Data Rate

- 7.2.1. Less 10 G

- 7.2.2. 10 G-40 G

- 7.2.3. 40 G-100 G

- 7.2.4. Greater than 10 G

- 7.3. Market Analysis, Insights and Forecast - by End-user Vertical

- 7.3.1. Datacenter and Cloud

- 7.3.2. BFSI

- 7.3.3. Government and Defence

- 7.3.4. Healthcare

- 7.3.5. Energy and Utilities

- 7.3.6. Retail and E-commerce

- 7.3.7. Other End-user Verticals

- 7.1. Market Analysis, Insights and Forecast - by Encryption

- 8. Asia Pacific Optical Encryption Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Encryption

- 8.1.1. Layer1

- 8.1.2. Layer 2

- 8.1.3. Layer 3

- 8.2. Market Analysis, Insights and Forecast - by Data Rate

- 8.2.1. Less 10 G

- 8.2.2. 10 G-40 G

- 8.2.3. 40 G-100 G

- 8.2.4. Greater than 10 G

- 8.3. Market Analysis, Insights and Forecast - by End-user Vertical

- 8.3.1. Datacenter and Cloud

- 8.3.2. BFSI

- 8.3.3. Government and Defence

- 8.3.4. Healthcare

- 8.3.5. Energy and Utilities

- 8.3.6. Retail and E-commerce

- 8.3.7. Other End-user Verticals

- 8.1. Market Analysis, Insights and Forecast - by Encryption

- 9. Latin America Optical Encryption Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Encryption

- 9.1.1. Layer1

- 9.1.2. Layer 2

- 9.1.3. Layer 3

- 9.2. Market Analysis, Insights and Forecast - by Data Rate

- 9.2.1. Less 10 G

- 9.2.2. 10 G-40 G

- 9.2.3. 40 G-100 G

- 9.2.4. Greater than 10 G

- 9.3. Market Analysis, Insights and Forecast - by End-user Vertical

- 9.3.1. Datacenter and Cloud

- 9.3.2. BFSI

- 9.3.3. Government and Defence

- 9.3.4. Healthcare

- 9.3.5. Energy and Utilities

- 9.3.6. Retail and E-commerce

- 9.3.7. Other End-user Verticals

- 9.1. Market Analysis, Insights and Forecast - by Encryption

- 10. Middle East and Africa Optical Encryption Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Encryption

- 10.1.1. Layer1

- 10.1.2. Layer 2

- 10.1.3. Layer 3

- 10.2. Market Analysis, Insights and Forecast - by Data Rate

- 10.2.1. Less 10 G

- 10.2.2. 10 G-40 G

- 10.2.3. 40 G-100 G

- 10.2.4. Greater than 10 G

- 10.3. Market Analysis, Insights and Forecast - by End-user Vertical

- 10.3.1. Datacenter and Cloud

- 10.3.2. BFSI

- 10.3.3. Government and Defence

- 10.3.4. Healthcare

- 10.3.5. Energy and Utilities

- 10.3.6. Retail and E-commerce

- 10.3.7. Other End-user Verticals

- 10.1. Market Analysis, Insights and Forecast - by Encryption

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 ECI Telecom Ltd

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Cisco Systems Inc

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Broadcom Inc

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 ADVA

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Microsemi Corporation

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Arista Networks

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Juniper Networks Inc

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Thales E-Security*List Not Exhaustive 6 2 Investment Analysi

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Huawei Technologies Co Ltd

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Nokia Corporation

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Acacia Communications

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Ciena Corporation

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.1 ECI Telecom Ltd

List of Figures

- Figure 1: Global Optical Encryption Market Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: North America Optical Encryption Market Revenue (undefined), by Encryption 2025 & 2033

- Figure 3: North America Optical Encryption Market Revenue Share (%), by Encryption 2025 & 2033

- Figure 4: North America Optical Encryption Market Revenue (undefined), by Data Rate 2025 & 2033

- Figure 5: North America Optical Encryption Market Revenue Share (%), by Data Rate 2025 & 2033

- Figure 6: North America Optical Encryption Market Revenue (undefined), by End-user Vertical 2025 & 2033

- Figure 7: North America Optical Encryption Market Revenue Share (%), by End-user Vertical 2025 & 2033

- Figure 8: North America Optical Encryption Market Revenue (undefined), by Country 2025 & 2033

- Figure 9: North America Optical Encryption Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe Optical Encryption Market Revenue (undefined), by Encryption 2025 & 2033

- Figure 11: Europe Optical Encryption Market Revenue Share (%), by Encryption 2025 & 2033

- Figure 12: Europe Optical Encryption Market Revenue (undefined), by Data Rate 2025 & 2033

- Figure 13: Europe Optical Encryption Market Revenue Share (%), by Data Rate 2025 & 2033

- Figure 14: Europe Optical Encryption Market Revenue (undefined), by End-user Vertical 2025 & 2033

- Figure 15: Europe Optical Encryption Market Revenue Share (%), by End-user Vertical 2025 & 2033

- Figure 16: Europe Optical Encryption Market Revenue (undefined), by Country 2025 & 2033

- Figure 17: Europe Optical Encryption Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific Optical Encryption Market Revenue (undefined), by Encryption 2025 & 2033

- Figure 19: Asia Pacific Optical Encryption Market Revenue Share (%), by Encryption 2025 & 2033

- Figure 20: Asia Pacific Optical Encryption Market Revenue (undefined), by Data Rate 2025 & 2033

- Figure 21: Asia Pacific Optical Encryption Market Revenue Share (%), by Data Rate 2025 & 2033

- Figure 22: Asia Pacific Optical Encryption Market Revenue (undefined), by End-user Vertical 2025 & 2033

- Figure 23: Asia Pacific Optical Encryption Market Revenue Share (%), by End-user Vertical 2025 & 2033

- Figure 24: Asia Pacific Optical Encryption Market Revenue (undefined), by Country 2025 & 2033

- Figure 25: Asia Pacific Optical Encryption Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Latin America Optical Encryption Market Revenue (undefined), by Encryption 2025 & 2033

- Figure 27: Latin America Optical Encryption Market Revenue Share (%), by Encryption 2025 & 2033

- Figure 28: Latin America Optical Encryption Market Revenue (undefined), by Data Rate 2025 & 2033

- Figure 29: Latin America Optical Encryption Market Revenue Share (%), by Data Rate 2025 & 2033

- Figure 30: Latin America Optical Encryption Market Revenue (undefined), by End-user Vertical 2025 & 2033

- Figure 31: Latin America Optical Encryption Market Revenue Share (%), by End-user Vertical 2025 & 2033

- Figure 32: Latin America Optical Encryption Market Revenue (undefined), by Country 2025 & 2033

- Figure 33: Latin America Optical Encryption Market Revenue Share (%), by Country 2025 & 2033

- Figure 34: Middle East and Africa Optical Encryption Market Revenue (undefined), by Encryption 2025 & 2033

- Figure 35: Middle East and Africa Optical Encryption Market Revenue Share (%), by Encryption 2025 & 2033

- Figure 36: Middle East and Africa Optical Encryption Market Revenue (undefined), by Data Rate 2025 & 2033

- Figure 37: Middle East and Africa Optical Encryption Market Revenue Share (%), by Data Rate 2025 & 2033

- Figure 38: Middle East and Africa Optical Encryption Market Revenue (undefined), by End-user Vertical 2025 & 2033

- Figure 39: Middle East and Africa Optical Encryption Market Revenue Share (%), by End-user Vertical 2025 & 2033

- Figure 40: Middle East and Africa Optical Encryption Market Revenue (undefined), by Country 2025 & 2033

- Figure 41: Middle East and Africa Optical Encryption Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Optical Encryption Market Revenue undefined Forecast, by Encryption 2020 & 2033

- Table 2: Global Optical Encryption Market Revenue undefined Forecast, by Data Rate 2020 & 2033

- Table 3: Global Optical Encryption Market Revenue undefined Forecast, by End-user Vertical 2020 & 2033

- Table 4: Global Optical Encryption Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 5: Global Optical Encryption Market Revenue undefined Forecast, by Encryption 2020 & 2033

- Table 6: Global Optical Encryption Market Revenue undefined Forecast, by Data Rate 2020 & 2033

- Table 7: Global Optical Encryption Market Revenue undefined Forecast, by End-user Vertical 2020 & 2033

- Table 8: Global Optical Encryption Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 9: United States Optical Encryption Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 10: Canada Optical Encryption Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 11: Global Optical Encryption Market Revenue undefined Forecast, by Encryption 2020 & 2033

- Table 12: Global Optical Encryption Market Revenue undefined Forecast, by Data Rate 2020 & 2033

- Table 13: Global Optical Encryption Market Revenue undefined Forecast, by End-user Vertical 2020 & 2033

- Table 14: Global Optical Encryption Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 15: Germany Optical Encryption Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 16: United Kingdom Optical Encryption Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 17: France Optical Encryption Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 18: Rest of Europe Optical Encryption Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 19: Global Optical Encryption Market Revenue undefined Forecast, by Encryption 2020 & 2033

- Table 20: Global Optical Encryption Market Revenue undefined Forecast, by Data Rate 2020 & 2033

- Table 21: Global Optical Encryption Market Revenue undefined Forecast, by End-user Vertical 2020 & 2033

- Table 22: Global Optical Encryption Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 23: India Optical Encryption Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 24: China Optical Encryption Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 25: Japan Optical Encryption Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 26: Rest of Asia Pacific Optical Encryption Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 27: Global Optical Encryption Market Revenue undefined Forecast, by Encryption 2020 & 2033

- Table 28: Global Optical Encryption Market Revenue undefined Forecast, by Data Rate 2020 & 2033

- Table 29: Global Optical Encryption Market Revenue undefined Forecast, by End-user Vertical 2020 & 2033

- Table 30: Global Optical Encryption Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 31: Brazil Optical Encryption Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 32: Argentina Optical Encryption Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 33: Rest of Latin America Optical Encryption Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 34: Global Optical Encryption Market Revenue undefined Forecast, by Encryption 2020 & 2033

- Table 35: Global Optical Encryption Market Revenue undefined Forecast, by Data Rate 2020 & 2033

- Table 36: Global Optical Encryption Market Revenue undefined Forecast, by End-user Vertical 2020 & 2033

- Table 37: Global Optical Encryption Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 38: United Arab Eminates Optical Encryption Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 39: Saudi Arabia Optical Encryption Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 40: Rest of Middle East and Africa Optical Encryption Market Revenue (undefined) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Optical Encryption Market?

The projected CAGR is approximately 6.8%.

2. Which companies are prominent players in the Optical Encryption Market?

Key companies in the market include ECI Telecom Ltd, Cisco Systems Inc, Broadcom Inc, ADVA, Microsemi Corporation, Arista Networks, Juniper Networks Inc, Thales E-Security*List Not Exhaustive 6 2 Investment Analysi, Huawei Technologies Co Ltd, Nokia Corporation, Acacia Communications, Ciena Corporation.

3. What are the main segments of the Optical Encryption Market?

The market segments include Encryption, Data Rate, End-user Vertical.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Increasing Internet Penetration with Demand for High-speed Internet; Technological Innovations by OTN Solution Providers.

6. What are the notable trends driving market growth?

Layer 1 Encryption is Expected to Witness High Growth.

7. Are there any restraints impacting market growth?

Dearth of Skillful Workforce to Add New Solutions in Existing Network.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Optical Encryption Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Optical Encryption Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Optical Encryption Market?

To stay informed about further developments, trends, and reports in the Optical Encryption Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence