Key Insights

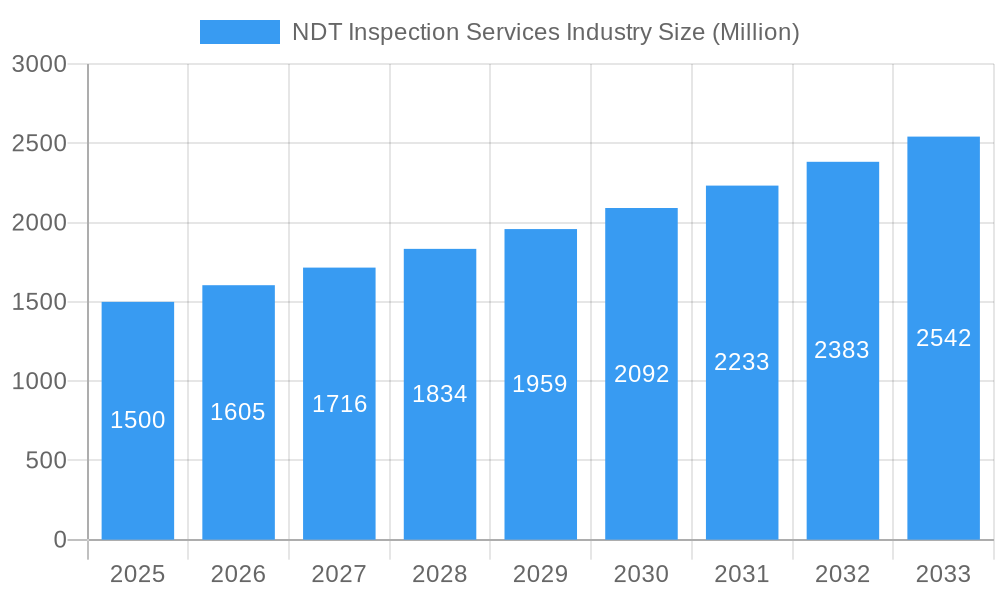

The Non-Destructive Testing (NDT) inspection services market is experiencing robust growth, driven by increasing demand for infrastructure development, stringent safety regulations across various industries, and the rising adoption of advanced NDT technologies. The market, estimated at $XX million in 2025, is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.70% from 2025 to 2033. This expansion is fueled by several key factors. Firstly, the oil and gas, aerospace and defense, and power and energy sectors are significant consumers of NDT services, consistently requiring rigorous inspections for asset integrity management and risk mitigation. Secondly, the automotive and transportation industries are witnessing a surge in demand due to stricter quality control measures and the increasing complexity of vehicle designs. The adoption of advanced technologies like radiography, ultrasonic testing, and magnetic particle inspection is further propelling market growth, as these methods offer improved accuracy, efficiency, and data analysis capabilities. Finally, growing government regulations emphasizing safety and preventative maintenance across industries are creating a mandatory need for regular NDT inspections, bolstering market demand.

NDT Inspection Services Industry Market Size (In Billion)

However, certain restraints exist. The high cost of advanced NDT equipment and the need for skilled technicians can hinder market penetration, particularly in developing economies. Furthermore, the market's susceptibility to economic downturns – a decrease in capital expenditure during economic slowdowns naturally impacting inspection frequency – presents a challenge. Nevertheless, the long-term outlook remains positive, driven by the continuous need for asset integrity management across critical infrastructure and industries. The market segmentation reveals significant opportunities within specific end-user industries and testing technologies. For instance, the aerospace and defense sectors are expected to show particularly strong growth due to the high safety standards involved and the need for rigorous quality checks throughout the manufacturing and maintenance cycles. Similarly, the increasing complexity of power generation and transmission infrastructure is bolstering demand for advanced NDT inspection services in the energy sector. The continued innovation in NDT technology, encompassing improved data analysis and automation, will further shape the market's evolution, leading to more efficient and cost-effective inspection procedures.

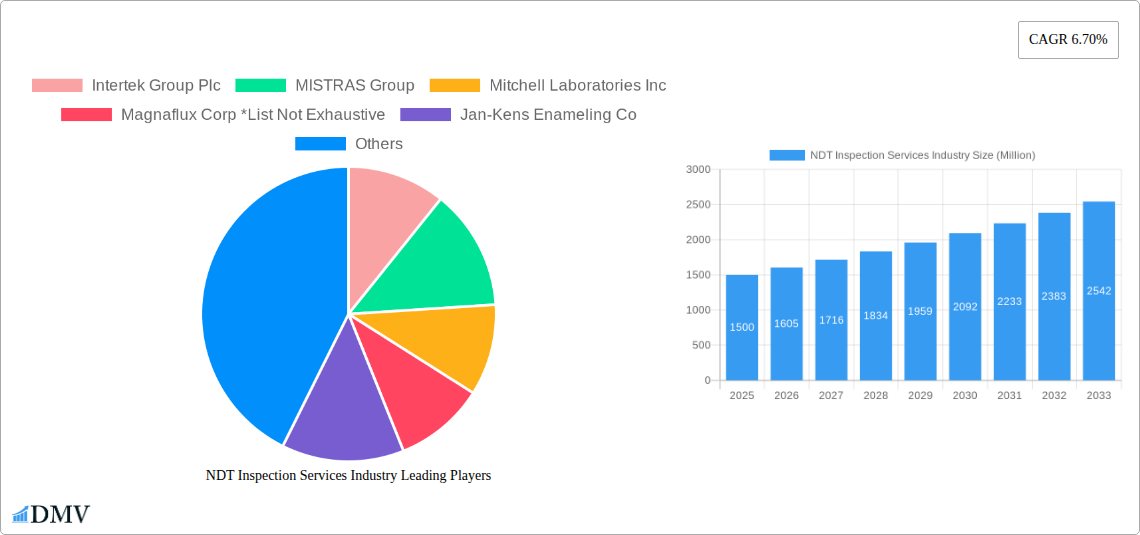

NDT Inspection Services Industry Company Market Share

NDT Inspection Services Industry Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the Non-Destructive Testing (NDT) inspection services market, offering invaluable insights for stakeholders across the value chain. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report leverages rigorous research to illuminate market trends, growth drivers, and future opportunities. The market is expected to reach xx Million by 2033, representing a substantial growth opportunity.

NDT Inspection Services Industry Market Composition & Trends

The NDT inspection services market is characterized by a moderately concentrated landscape, with key players such as Intertek Group Plc, MISTRAS Group, Mitchell Laboratories Inc., and Magnaflux Corp. holding significant market share. However, the presence of numerous smaller, specialized firms fosters competition. Market share distribution in 2025 is estimated as follows: Intertek Group Plc (xx%), MISTRAS Group (xx%), Mitchell Laboratories Inc. (xx%), Magnaflux Corp. (xx%), Others (xx%). Innovation is driven by advancements in testing technologies like phased array ultrasonic testing and digital radiography, improving accuracy and efficiency. Stringent regulatory frameworks, particularly within sectors like aerospace and oil & gas, mandate NDT inspections, shaping market demand. Substitute technologies are limited due to the critical nature of NDT in ensuring safety and structural integrity. The market witnesses considerable M&A activity, with deal values exceeding xx Million in the last five years, reflecting consolidation efforts and expansion strategies among leading players. End-user profiles are diverse, encompassing various industries with distinct inspection requirements.

- Market Concentration: Moderately concentrated with several major players and numerous smaller firms.

- Innovation Catalysts: Advancements in testing technologies (e.g., phased array ultrasonics, digital radiography).

- Regulatory Landscape: Stringent regulations in sectors like aerospace and oil & gas drive demand.

- Substitute Products: Limited viable substitutes due to the critical nature of NDT.

- M&A Activity: Significant M&A activity with deal values exceeding xx Million in recent years.

- End-user Profiles: Diverse, encompassing various industries with specific inspection needs.

NDT Inspection Services Industry Evolution

The NDT inspection services market has witnessed robust growth throughout the historical period (2019-2024), driven by factors such as increasing infrastructure development, stricter safety regulations, and the growing adoption of advanced NDT technologies. The market experienced a Compound Annual Growth Rate (CAGR) of xx% during 2019-2024, reaching a market value of xx Million in 2024. This growth trajectory is projected to continue during the forecast period (2025-2033), albeit at a slightly moderated pace, reflecting a CAGR of xx%. Technological advancements, particularly in automated and remote inspection systems, are streamlining processes and improving inspection efficiency. Furthermore, the increasing demand for quality assurance and safety across various industries is fueling market expansion. Shifting consumer demands are increasingly focused on faster turnaround times, cost-effectiveness, and data-driven insights from NDT inspections. The adoption rate of advanced NDT technologies like phased array ultrasonics is growing at xx% annually.

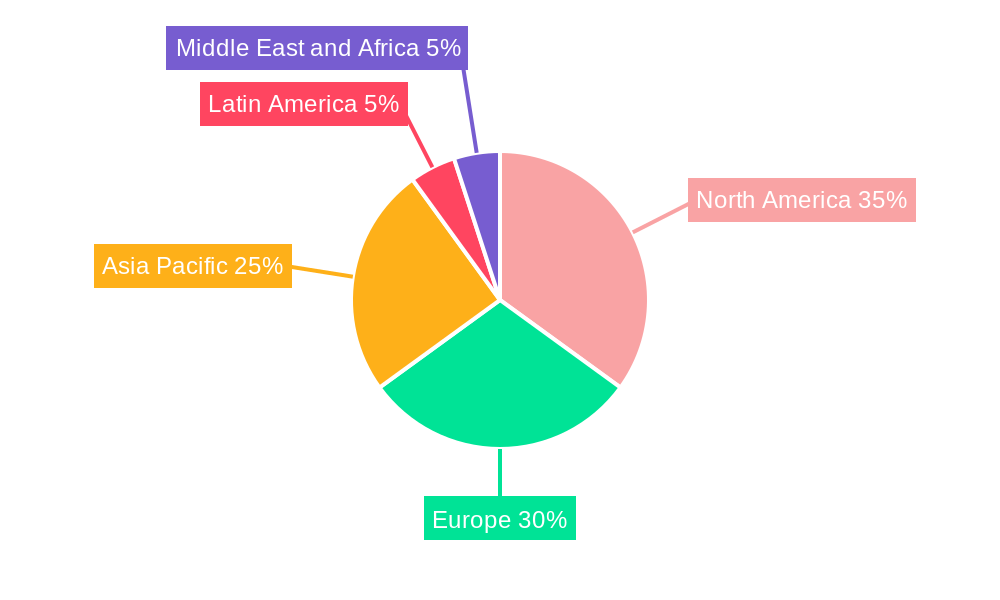

Leading Regions, Countries, or Segments in NDT Inspection Services Industry

The North American region currently holds the largest market share in the NDT inspection services market, driven by robust industrial activity and stringent regulatory environments in sectors such as oil & gas and aerospace. The Asia-Pacific region is projected to experience the fastest growth rate during the forecast period, fueled by substantial infrastructure investments and rapid industrialization. Within testing technologies, Ultrasonic and Radiography testing currently dominate the market, accounting for over xx% of the total market share. In end-user industries, the Oil and Gas and Aerospace & Defense sectors are the largest consumers of NDT inspection services.

- North America: Strong industrial activity, stringent regulations, high adoption of advanced technologies.

- Asia-Pacific: Rapid industrialization, significant infrastructure investments, high growth potential.

- Ultrasonic & Radiography Testing: Dominant testing technologies due to versatility and reliability.

- Oil & Gas & Aerospace & Defense: Largest end-user segments due to critical safety and quality requirements.

NDT Inspection Services Industry Product Innovations

Recent innovations include the development of automated inspection systems, advanced data analytics for improved defect detection, and the integration of robotics for enhanced accessibility in challenging environments. These advancements offer enhanced speed, precision, and data-driven insights, leading to improved efficiency and reduced operational costs. Unique selling propositions focus on minimizing downtime, improving accuracy, and providing comprehensive data analysis capabilities.

Propelling Factors for NDT Inspection Services Industry Growth

The growth of the NDT inspection services market is propelled by several key factors. Stringent safety regulations across various industries mandate regular inspections, driving demand. The increasing complexity of infrastructure projects necessitates advanced NDT techniques to ensure structural integrity. Technological advancements, such as automated systems and improved imaging techniques, are enhancing inspection efficiency and accuracy. The growing focus on predictive maintenance, using NDT to identify potential failures before they occur, further stimulates market growth. Economic growth in developing economies also contributes to the increased demand for NDT services in infrastructure and industrial projects.

Obstacles in the NDT Inspection Services Industry Market

The NDT inspection services market faces several challenges. The high initial investment cost for advanced equipment can be a barrier for smaller firms. Supply chain disruptions can impact the availability of specialized equipment and skilled personnel. Intense competition among established and emerging players can put pressure on pricing and profitability. Furthermore, regulatory changes and evolving industry standards require continuous adaptation and investment in training and technology upgrades.

Future Opportunities in NDT Inspection Services Industry

Emerging opportunities lie in the development and adoption of advanced technologies like artificial intelligence (AI) and machine learning (ML) for automated defect recognition and predictive maintenance. The expansion into new markets, particularly in developing economies with increasing infrastructure development, presents significant growth potential. The increasing demand for data-driven insights and the integration of NDT data with other enterprise systems offer avenues for value creation.

Major Players in the NDT Inspection Services Industry Ecosystem

- Intertek Group Plc

- MISTRAS Group

- Mitchell Laboratories Inc

- Magnaflux Corp

- Jan-Kens Enameling Co

- GE Measurement and Control Company (Baker & Hughes Company)

- LynX Inspection Inc

- Olympus Corporation

- Acuren Inspection Inc

- Applus Services S.A

Key Developments in NDT Inspection Services Industry Industry

- 2022 Q4: Magnaflux Corp. launched a new line of advanced ultrasonic testing equipment.

- 2023 Q1: Intertek Group Plc acquired a smaller NDT services provider in the European market.

- 2023 Q2: New regulations on NDT procedures were implemented in the aerospace industry.

- 2024 Q3: MISTRAS Group invested heavily in R&D for automated inspection systems. (Further details on specific developments would be included in the full report.)

Strategic NDT Inspection Services Industry Market Forecast

The NDT inspection services market is poised for sustained growth, driven by technological advancements, increasing regulatory requirements, and expanding industrial activity across diverse sectors. The integration of AI and advanced data analytics will be instrumental in enhancing inspection efficiency and accuracy. The focus on predictive maintenance and the exploration of new markets will further drive market expansion. The market is expected to experience a CAGR of xx% during the forecast period, reaching a market size of xx Million by 2033. This presents significant opportunities for established players and new entrants alike.

NDT Inspection Services Industry Segmentation

-

1. Testing Technology

- 1.1. Radiography

- 1.2. Ultrasonic

- 1.3. Magnetic Particle

- 1.4. Liquid Penetrant

- 1.5. Visual Inspection

-

2. End-user Industry

- 2.1. Oil and Gas

- 2.2. Aerospace and Defense

- 2.3. Power and Energy

- 2.4. Construction

- 2.5. Automotive and Transportation

- 2.6. Other End-user Industries

NDT Inspection Services Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

-

2. Europe

- 2.1. United Kingdom

- 2.2. Germany

- 2.3. France

- 2.4. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Rest of Asia Pacific

- 4. Latin America

- 5. Middle East and Africa

NDT Inspection Services Industry Regional Market Share

Geographic Coverage of NDT Inspection Services Industry

NDT Inspection Services Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.70% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Stringent Regulations Mandating Safety Standards; Innovation and Advancement in NDT Inspection Technology; Lack of Skilled Personnel and Training Facilities

- 3.3. Market Restrains

- 3.3.1. ; Reluctance to Adopt NDT Techniques

- 3.4. Market Trends

- 3.4.1. Aerospace Industry is Expected to Account for a Major Share of the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global NDT Inspection Services Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Testing Technology

- 5.1.1. Radiography

- 5.1.2. Ultrasonic

- 5.1.3. Magnetic Particle

- 5.1.4. Liquid Penetrant

- 5.1.5. Visual Inspection

- 5.2. Market Analysis, Insights and Forecast - by End-user Industry

- 5.2.1. Oil and Gas

- 5.2.2. Aerospace and Defense

- 5.2.3. Power and Energy

- 5.2.4. Construction

- 5.2.5. Automotive and Transportation

- 5.2.6. Other End-user Industries

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Latin America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Testing Technology

- 6. North America NDT Inspection Services Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Testing Technology

- 6.1.1. Radiography

- 6.1.2. Ultrasonic

- 6.1.3. Magnetic Particle

- 6.1.4. Liquid Penetrant

- 6.1.5. Visual Inspection

- 6.2. Market Analysis, Insights and Forecast - by End-user Industry

- 6.2.1. Oil and Gas

- 6.2.2. Aerospace and Defense

- 6.2.3. Power and Energy

- 6.2.4. Construction

- 6.2.5. Automotive and Transportation

- 6.2.6. Other End-user Industries

- 6.1. Market Analysis, Insights and Forecast - by Testing Technology

- 7. Europe NDT Inspection Services Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Testing Technology

- 7.1.1. Radiography

- 7.1.2. Ultrasonic

- 7.1.3. Magnetic Particle

- 7.1.4. Liquid Penetrant

- 7.1.5. Visual Inspection

- 7.2. Market Analysis, Insights and Forecast - by End-user Industry

- 7.2.1. Oil and Gas

- 7.2.2. Aerospace and Defense

- 7.2.3. Power and Energy

- 7.2.4. Construction

- 7.2.5. Automotive and Transportation

- 7.2.6. Other End-user Industries

- 7.1. Market Analysis, Insights and Forecast - by Testing Technology

- 8. Asia Pacific NDT Inspection Services Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Testing Technology

- 8.1.1. Radiography

- 8.1.2. Ultrasonic

- 8.1.3. Magnetic Particle

- 8.1.4. Liquid Penetrant

- 8.1.5. Visual Inspection

- 8.2. Market Analysis, Insights and Forecast - by End-user Industry

- 8.2.1. Oil and Gas

- 8.2.2. Aerospace and Defense

- 8.2.3. Power and Energy

- 8.2.4. Construction

- 8.2.5. Automotive and Transportation

- 8.2.6. Other End-user Industries

- 8.1. Market Analysis, Insights and Forecast - by Testing Technology

- 9. Latin America NDT Inspection Services Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Testing Technology

- 9.1.1. Radiography

- 9.1.2. Ultrasonic

- 9.1.3. Magnetic Particle

- 9.1.4. Liquid Penetrant

- 9.1.5. Visual Inspection

- 9.2. Market Analysis, Insights and Forecast - by End-user Industry

- 9.2.1. Oil and Gas

- 9.2.2. Aerospace and Defense

- 9.2.3. Power and Energy

- 9.2.4. Construction

- 9.2.5. Automotive and Transportation

- 9.2.6. Other End-user Industries

- 9.1. Market Analysis, Insights and Forecast - by Testing Technology

- 10. Middle East and Africa NDT Inspection Services Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Testing Technology

- 10.1.1. Radiography

- 10.1.2. Ultrasonic

- 10.1.3. Magnetic Particle

- 10.1.4. Liquid Penetrant

- 10.1.5. Visual Inspection

- 10.2. Market Analysis, Insights and Forecast - by End-user Industry

- 10.2.1. Oil and Gas

- 10.2.2. Aerospace and Defense

- 10.2.3. Power and Energy

- 10.2.4. Construction

- 10.2.5. Automotive and Transportation

- 10.2.6. Other End-user Industries

- 10.1. Market Analysis, Insights and Forecast - by Testing Technology

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Intertek Group Plc

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 MISTRAS Group

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Mitchell Laboratories Inc

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Magnaflux Corp *List Not Exhaustive

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Jan-Kens Enameling Co

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 GE Measurement and Control Company (Baker & Hughes Company)

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 LynX Inspection Inc

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Olympus Corporation

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Acuren Inspection Inc

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Applus Services S A

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Intertek Group Plc

List of Figures

- Figure 1: Global NDT Inspection Services Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America NDT Inspection Services Industry Revenue (Million), by Testing Technology 2025 & 2033

- Figure 3: North America NDT Inspection Services Industry Revenue Share (%), by Testing Technology 2025 & 2033

- Figure 4: North America NDT Inspection Services Industry Revenue (Million), by End-user Industry 2025 & 2033

- Figure 5: North America NDT Inspection Services Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 6: North America NDT Inspection Services Industry Revenue (Million), by Country 2025 & 2033

- Figure 7: North America NDT Inspection Services Industry Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe NDT Inspection Services Industry Revenue (Million), by Testing Technology 2025 & 2033

- Figure 9: Europe NDT Inspection Services Industry Revenue Share (%), by Testing Technology 2025 & 2033

- Figure 10: Europe NDT Inspection Services Industry Revenue (Million), by End-user Industry 2025 & 2033

- Figure 11: Europe NDT Inspection Services Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 12: Europe NDT Inspection Services Industry Revenue (Million), by Country 2025 & 2033

- Figure 13: Europe NDT Inspection Services Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific NDT Inspection Services Industry Revenue (Million), by Testing Technology 2025 & 2033

- Figure 15: Asia Pacific NDT Inspection Services Industry Revenue Share (%), by Testing Technology 2025 & 2033

- Figure 16: Asia Pacific NDT Inspection Services Industry Revenue (Million), by End-user Industry 2025 & 2033

- Figure 17: Asia Pacific NDT Inspection Services Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 18: Asia Pacific NDT Inspection Services Industry Revenue (Million), by Country 2025 & 2033

- Figure 19: Asia Pacific NDT Inspection Services Industry Revenue Share (%), by Country 2025 & 2033

- Figure 20: Latin America NDT Inspection Services Industry Revenue (Million), by Testing Technology 2025 & 2033

- Figure 21: Latin America NDT Inspection Services Industry Revenue Share (%), by Testing Technology 2025 & 2033

- Figure 22: Latin America NDT Inspection Services Industry Revenue (Million), by End-user Industry 2025 & 2033

- Figure 23: Latin America NDT Inspection Services Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 24: Latin America NDT Inspection Services Industry Revenue (Million), by Country 2025 & 2033

- Figure 25: Latin America NDT Inspection Services Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East and Africa NDT Inspection Services Industry Revenue (Million), by Testing Technology 2025 & 2033

- Figure 27: Middle East and Africa NDT Inspection Services Industry Revenue Share (%), by Testing Technology 2025 & 2033

- Figure 28: Middle East and Africa NDT Inspection Services Industry Revenue (Million), by End-user Industry 2025 & 2033

- Figure 29: Middle East and Africa NDT Inspection Services Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 30: Middle East and Africa NDT Inspection Services Industry Revenue (Million), by Country 2025 & 2033

- Figure 31: Middle East and Africa NDT Inspection Services Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global NDT Inspection Services Industry Revenue Million Forecast, by Testing Technology 2020 & 2033

- Table 2: Global NDT Inspection Services Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 3: Global NDT Inspection Services Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global NDT Inspection Services Industry Revenue Million Forecast, by Testing Technology 2020 & 2033

- Table 5: Global NDT Inspection Services Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 6: Global NDT Inspection Services Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 7: United States NDT Inspection Services Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Canada NDT Inspection Services Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Global NDT Inspection Services Industry Revenue Million Forecast, by Testing Technology 2020 & 2033

- Table 10: Global NDT Inspection Services Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 11: Global NDT Inspection Services Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 12: United Kingdom NDT Inspection Services Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Germany NDT Inspection Services Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: France NDT Inspection Services Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Rest of Europe NDT Inspection Services Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Global NDT Inspection Services Industry Revenue Million Forecast, by Testing Technology 2020 & 2033

- Table 17: Global NDT Inspection Services Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 18: Global NDT Inspection Services Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 19: China NDT Inspection Services Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Japan NDT Inspection Services Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: India NDT Inspection Services Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Rest of Asia Pacific NDT Inspection Services Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: Global NDT Inspection Services Industry Revenue Million Forecast, by Testing Technology 2020 & 2033

- Table 24: Global NDT Inspection Services Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 25: Global NDT Inspection Services Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 26: Global NDT Inspection Services Industry Revenue Million Forecast, by Testing Technology 2020 & 2033

- Table 27: Global NDT Inspection Services Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 28: Global NDT Inspection Services Industry Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the NDT Inspection Services Industry?

The projected CAGR is approximately 6.70%.

2. Which companies are prominent players in the NDT Inspection Services Industry?

Key companies in the market include Intertek Group Plc, MISTRAS Group, Mitchell Laboratories Inc, Magnaflux Corp *List Not Exhaustive, Jan-Kens Enameling Co, GE Measurement and Control Company (Baker & Hughes Company), LynX Inspection Inc, Olympus Corporation, Acuren Inspection Inc, Applus Services S A.

3. What are the main segments of the NDT Inspection Services Industry?

The market segments include Testing Technology, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

; Stringent Regulations Mandating Safety Standards; Innovation and Advancement in NDT Inspection Technology; Lack of Skilled Personnel and Training Facilities.

6. What are the notable trends driving market growth?

Aerospace Industry is Expected to Account for a Major Share of the Market.

7. Are there any restraints impacting market growth?

; Reluctance to Adopt NDT Techniques.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "NDT Inspection Services Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the NDT Inspection Services Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the NDT Inspection Services Industry?

To stay informed about further developments, trends, and reports in the NDT Inspection Services Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence