Key Insights

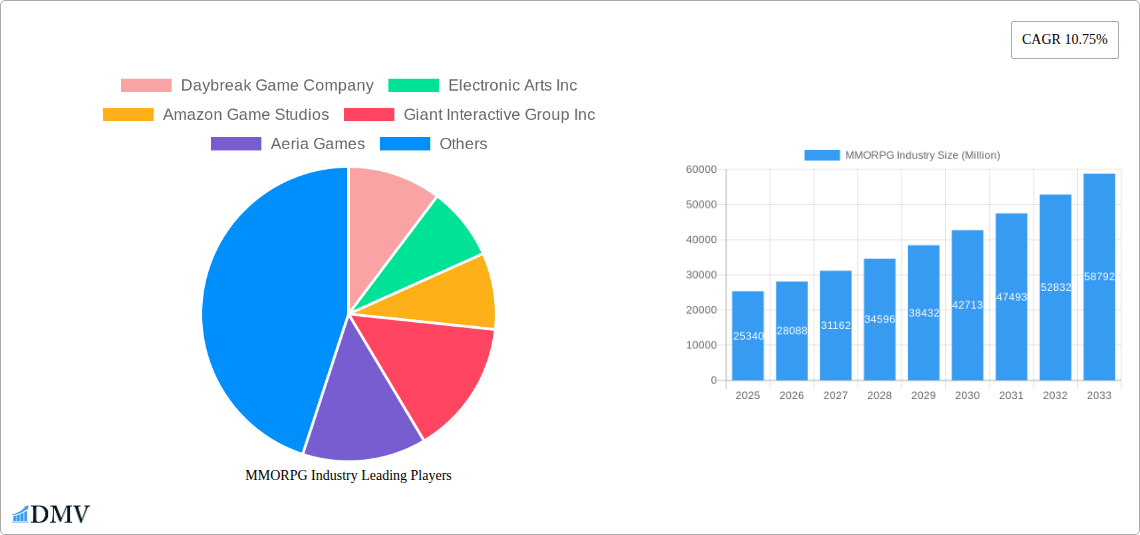

The MMORPG (Massively Multiplayer Online Role-Playing Game) industry, currently valued at $25.34 billion in 2025, is experiencing robust growth, projected to maintain a Compound Annual Growth Rate (CAGR) of 10.75% from 2025 to 2033. This expansion is driven by several key factors. The increasing accessibility of high-speed internet, coupled with the proliferation of mobile gaming and improved graphics capabilities across platforms (mobile, tablet, PC, and gaming consoles), has broadened the player base significantly. Furthermore, the evolving nature of MMORPGs, incorporating elements like esports integration, enhanced social features, and continuous content updates, keeps players engaged and attracts new audiences. The industry also benefits from a diverse range of monetization strategies, including in-app purchases, subscriptions, and expansions, fueling its financial success. Competition among established giants like Tencent Holdings Limited, Activision Blizzard Inc., and Electronic Arts Inc., alongside the emergence of innovative independent studios, fosters innovation and enhances the overall gaming experience. Geographic expansion, particularly in rapidly developing Asian markets, also contributes to the overall market growth.

MMORPG Industry Market Size (In Billion)

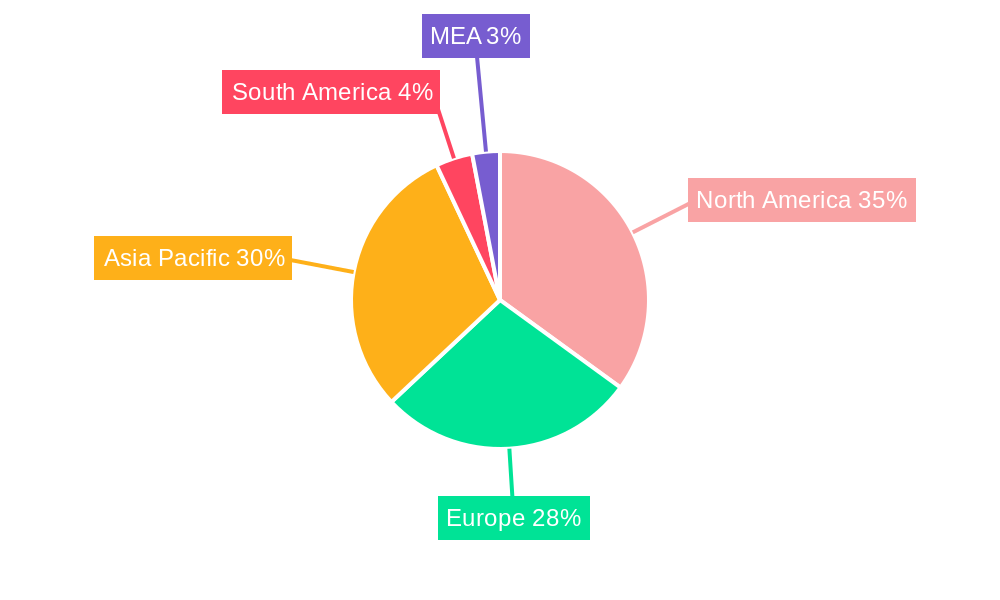

However, the market faces certain challenges. The increasing development costs associated with creating high-quality, immersive MMORPGs can present significant financial hurdles for smaller studios. Furthermore, maintaining player engagement over extended periods requires consistent content updates and addressing player feedback effectively. Competition for player attention from other gaming genres and entertainment forms is another factor that needs careful management. Successfully navigating these challenges requires a focus on innovative game design, robust community building, and strategic monetization, allowing the industry to sustain its high growth trajectory. The diverse regional landscape – with strong growth anticipated in Asia Pacific driven by markets like China and Japan, and continued strength in North America and Europe – highlights opportunities for targeted marketing and localization strategies.

MMORPG Industry Company Market Share

MMORPG Industry Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the Massively Multiplayer Online Role-Playing Game (MMORPG) industry, offering valuable insights for stakeholders seeking to understand market trends, competitive dynamics, and future growth opportunities. The report covers the period from 2019 to 2033, with a focus on the 2025-2033 forecast period. The estimated market size in 2025 is projected to be $XX Million.

MMORPG Industry Market Composition & Trends

The MMORPG market is characterized by a moderate level of concentration, with a few dominant players and a larger number of smaller, niche developers. Market share distribution shows a concentration of approximately 60% among the top 5 companies, with the remaining 40% spread across numerous smaller players. Innovation is driven by technological advancements in graphics, game mechanics, and monetization strategies, including the rise of web3 gaming. The regulatory landscape varies significantly across different regions, impacting market access and operation costs. Substitute products, such as other online gaming genres, exert some competitive pressure, but the unique immersive experience of MMORPGs retains significant market appeal. End-user profiles encompass a broad range of demographics, with significant appeal across age groups and geographical locations. Mergers and Acquisitions (M&A) activity has been moderate, with deal values ranging from $XX Million to $XX Million in recent years.

- Market Share Distribution (2024): Top 5 players - 60%; Remaining players - 40%

- Average M&A Deal Value (2019-2024): $XX Million

- Key Innovation Catalysts: Web3 integration, enhanced graphics, improved cross-platform compatibility.

MMORPG Industry Industry Evolution

The MMORPG industry has witnessed significant evolution since 2019, marked by substantial growth and notable technological advancements. The market experienced a Compound Annual Growth Rate (CAGR) of XX% during the historical period (2019-2024), fueled by rising internet penetration, improved mobile technology, and the growing popularity of esports. Technological advancements, including improved graphics engines, cloud computing capabilities, and virtual reality (VR) integration, have significantly enhanced the gaming experience. Shifting consumer demands have led to a focus on more immersive storylines, engaging social features, and diversified monetization models, with subscription services becoming increasingly popular alongside free-to-play models with in-app purchases. We project a CAGR of XX% for the forecast period (2025-2033). Adoption metrics indicate a steady increase in active players and average revenue per user (ARPU).

Leading Regions, Countries, or Segments in MMORPG Industry

The Mobile segment currently dominates the MMORPG market. Its accessibility and portability have significantly increased player reach and engagement.

- Key Drivers for Mobile Dominance:

- High Smartphone Penetration

- Ease of Access and Portability

- Lower Barriers to Entry for Developers

- Strong Mobile Gaming Culture in Key Markets (e.g., Asia)

Asia remains the leading region, followed by North America and Europe. The dominance of the mobile segment is attributed to factors including:

- High Smartphone Penetration

- Ease of Access and Portability

- Strong Mobile Gaming Culture in Key Markets (e.g., Asia)

- Lower Barriers to Entry for Developers

Other segments such as PC, Console, and Tablet contribute to the market but hold smaller market shares compared to the mobile segment. Growth in these segments is projected but at a slower pace than mobile, largely due to the higher initial investment required from consumers and the need for dedicated hardware.

MMORPG Industry Product Innovations

Recent innovations in the MMORPG sector include the integration of web3 technologies, allowing for player-owned assets and decentralized gameplay. This is evident with the launch of Animera on ImmutableX. Further advancements include enhanced graphics fidelity, cross-platform compatibility (as seen in Ragnarok V: Returns), and sophisticated AI-powered NPCs. These improvements aim to enhance immersion, accessibility, and the overall gaming experience, making these titles uniquely engaging.

Propelling Factors for MMORPG Industry Growth

Several factors contribute to the continued growth of the MMORPG industry. Technological advancements, such as improved graphics, VR/AR integration, and cloud-based gaming, constantly enhance the gaming experience. Economic factors, including rising disposable incomes and increasing spending on entertainment, contribute significantly. Favorable regulatory environments in certain regions also support market expansion. For example, the growing acceptance of online gaming in many Asian countries has led to a surge in MMORPG popularity.

Obstacles in the MMORPG Industry Market

The MMORPG market faces challenges including regulatory hurdles in specific markets regarding loot boxes and in-game purchases, impacting revenue generation. Supply chain disruptions can affect game development timelines and release schedules. Intense competition amongst established studios and independent developers necessitates constant innovation to maintain market share. The competition is intense, resulting in a need for constant innovation to survive.

Future Opportunities in MMORPG Industry

Emerging opportunities lie in the expansion into new markets, particularly in developing countries with growing internet penetration and smartphone adoption. The integration of cutting-edge technologies like metaverse integration, blockchain technology, and artificial intelligence (AI) will unlock new levels of immersion and interactivity, attracting a wider audience and driving sustained growth. Furthermore, the potential of cloud gaming for broader market access presents a significant opportunity for expansion.

Major Players in the MMORPG Industry Ecosystem

- Daybreak Game Company

- Electronic Arts Inc

- Amazon Game Studios

- Giant Interactive Group Inc

- Aeria Games

- CCP games UK Ltd

- NCSOFT Corporation

- Activision Blizzard Inc

- Neteasegames Inc

- Tencent Holdings Limited

- Bright Star Studios

- Ubisoft Entertainment SA

- Jagex Limited

- Gravity Corporatio

- Nexon Co Ltd

Key Developments in MMORPG Industry Industry

- May 2022: Gravity Co Ltd launched 'Ragnarok V: Returns,' a cross-platform 3D MMORPG, expanding its reach across iOS, Android, and PC platforms in the Oceanic region, leveraging its established brand recognition.

- June 2022: Clockwork Labs secured USD 22 Million in funding for BitCraft, a community-focused MMORPG, signifying investor confidence in the genre’s potential.

- September 2022: The global release of Dekaron G, a mobile MMORPG, by ThumbAge expanded the reach of the Dekaron franchise into new markets in Southeast Asia, North America, and Europe.

- January 2023: The launch of Search for Animera, a web3-native MMORPG on ImmutableX, demonstrates the emerging integration of blockchain technology into the MMORPG sector, enhancing user engagement and ownership.

Strategic MMORPG Industry Market Forecast

The MMORPG market is poised for continued growth, driven by technological advancements, expanding market penetration in new regions, and the incorporation of innovative monetization strategies. Emerging technologies like Web3 integration and the metaverse offer significant opportunities to enhance gameplay, user engagement, and revenue streams. This will lead to further market expansion and diversification across various platforms and regions, ensuring a dynamic and competitive landscape for the foreseeable future.

MMORPG Industry Segmentation

-

1. Gaming Platform

- 1.1. Mobile

- 1.2. Tablet

- 1.3. Gaming Console

- 1.4. PC

MMORPG Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

-

2. Europe

- 2.1. United Kingdom

- 2.2. Germany

- 2.3. France

- 2.4. Italy

- 2.5. Russia

-

3. Asia

- 3.1. China

- 3.2. India

- 3.3. Japan

- 3.4. South Korea

- 4. Australia and New Zealand

-

5. Latin America

- 5.1. Brazil

- 5.2. Mexico

- 5.3. Argentina

-

6. Middle East and Africa

- 6.1. United Arab Emirates

- 6.2. Saudi Arabia

- 6.3. South Africa

MMORPG Industry Regional Market Share

Geographic Coverage of MMORPG Industry

MMORPG Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 10.75% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Rising Smartphone Penetration and Increasing Penetration of Internet among Developing Economies; Technological Advancement such as IoT

- 3.2.2 AR

- 3.2.3 and VR; Emergence of Gamification

- 3.3. Market Restrains

- 3.3.1 Costs

- 3.3.2 Interoperability

- 3.3.3 and Security Concerns

- 3.4. Market Trends

- 3.4.1. Rising Smartphone Penetration and Increasing Penetration of Internet among Developing Economies may Drive the Market Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global MMORPG Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Gaming Platform

- 5.1.1. Mobile

- 5.1.2. Tablet

- 5.1.3. Gaming Console

- 5.1.4. PC

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. Europe

- 5.2.3. Asia

- 5.2.4. Australia and New Zealand

- 5.2.5. Latin America

- 5.2.6. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Gaming Platform

- 6. North America MMORPG Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Gaming Platform

- 6.1.1. Mobile

- 6.1.2. Tablet

- 6.1.3. Gaming Console

- 6.1.4. PC

- 6.1. Market Analysis, Insights and Forecast - by Gaming Platform

- 7. Europe MMORPG Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Gaming Platform

- 7.1.1. Mobile

- 7.1.2. Tablet

- 7.1.3. Gaming Console

- 7.1.4. PC

- 7.1. Market Analysis, Insights and Forecast - by Gaming Platform

- 8. Asia MMORPG Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Gaming Platform

- 8.1.1. Mobile

- 8.1.2. Tablet

- 8.1.3. Gaming Console

- 8.1.4. PC

- 8.1. Market Analysis, Insights and Forecast - by Gaming Platform

- 9. Australia and New Zealand MMORPG Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Gaming Platform

- 9.1.1. Mobile

- 9.1.2. Tablet

- 9.1.3. Gaming Console

- 9.1.4. PC

- 9.1. Market Analysis, Insights and Forecast - by Gaming Platform

- 10. Latin America MMORPG Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Gaming Platform

- 10.1.1. Mobile

- 10.1.2. Tablet

- 10.1.3. Gaming Console

- 10.1.4. PC

- 10.1. Market Analysis, Insights and Forecast - by Gaming Platform

- 11. Middle East and Africa MMORPG Industry Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Gaming Platform

- 11.1.1. Mobile

- 11.1.2. Tablet

- 11.1.3. Gaming Console

- 11.1.4. PC

- 11.1. Market Analysis, Insights and Forecast - by Gaming Platform

- 12. Competitive Analysis

- 12.1. Global Market Share Analysis 2025

- 12.2. Company Profiles

- 12.2.1 Daybreak Game Company

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Electronic Arts Inc

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Amazon Game Studios

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Giant Interactive Group Inc

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Aeria Games

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 CCP games UK Ltd

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 NCSOFT Corporation

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 Activision Blizzard Inc

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 Neteasegames Inc

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 Tencent Holdings Limited

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.11 Bright Star Studios

- 12.2.11.1. Overview

- 12.2.11.2. Products

- 12.2.11.3. SWOT Analysis

- 12.2.11.4. Recent Developments

- 12.2.11.5. Financials (Based on Availability)

- 12.2.12 Ubisoft Entertainment SA

- 12.2.12.1. Overview

- 12.2.12.2. Products

- 12.2.12.3. SWOT Analysis

- 12.2.12.4. Recent Developments

- 12.2.12.5. Financials (Based on Availability)

- 12.2.13 Jagex Limited

- 12.2.13.1. Overview

- 12.2.13.2. Products

- 12.2.13.3. SWOT Analysis

- 12.2.13.4. Recent Developments

- 12.2.13.5. Financials (Based on Availability)

- 12.2.14 Gravity Corporatio

- 12.2.14.1. Overview

- 12.2.14.2. Products

- 12.2.14.3. SWOT Analysis

- 12.2.14.4. Recent Developments

- 12.2.14.5. Financials (Based on Availability)

- 12.2.15 Nexon Co Ltd

- 12.2.15.1. Overview

- 12.2.15.2. Products

- 12.2.15.3. SWOT Analysis

- 12.2.15.4. Recent Developments

- 12.2.15.5. Financials (Based on Availability)

- 12.2.1 Daybreak Game Company

List of Figures

- Figure 1: Global MMORPG Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America MMORPG Industry Revenue (Million), by Gaming Platform 2025 & 2033

- Figure 3: North America MMORPG Industry Revenue Share (%), by Gaming Platform 2025 & 2033

- Figure 4: North America MMORPG Industry Revenue (Million), by Country 2025 & 2033

- Figure 5: North America MMORPG Industry Revenue Share (%), by Country 2025 & 2033

- Figure 6: Europe MMORPG Industry Revenue (Million), by Gaming Platform 2025 & 2033

- Figure 7: Europe MMORPG Industry Revenue Share (%), by Gaming Platform 2025 & 2033

- Figure 8: Europe MMORPG Industry Revenue (Million), by Country 2025 & 2033

- Figure 9: Europe MMORPG Industry Revenue Share (%), by Country 2025 & 2033

- Figure 10: Asia MMORPG Industry Revenue (Million), by Gaming Platform 2025 & 2033

- Figure 11: Asia MMORPG Industry Revenue Share (%), by Gaming Platform 2025 & 2033

- Figure 12: Asia MMORPG Industry Revenue (Million), by Country 2025 & 2033

- Figure 13: Asia MMORPG Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Australia and New Zealand MMORPG Industry Revenue (Million), by Gaming Platform 2025 & 2033

- Figure 15: Australia and New Zealand MMORPG Industry Revenue Share (%), by Gaming Platform 2025 & 2033

- Figure 16: Australia and New Zealand MMORPG Industry Revenue (Million), by Country 2025 & 2033

- Figure 17: Australia and New Zealand MMORPG Industry Revenue Share (%), by Country 2025 & 2033

- Figure 18: Latin America MMORPG Industry Revenue (Million), by Gaming Platform 2025 & 2033

- Figure 19: Latin America MMORPG Industry Revenue Share (%), by Gaming Platform 2025 & 2033

- Figure 20: Latin America MMORPG Industry Revenue (Million), by Country 2025 & 2033

- Figure 21: Latin America MMORPG Industry Revenue Share (%), by Country 2025 & 2033

- Figure 22: Middle East and Africa MMORPG Industry Revenue (Million), by Gaming Platform 2025 & 2033

- Figure 23: Middle East and Africa MMORPG Industry Revenue Share (%), by Gaming Platform 2025 & 2033

- Figure 24: Middle East and Africa MMORPG Industry Revenue (Million), by Country 2025 & 2033

- Figure 25: Middle East and Africa MMORPG Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global MMORPG Industry Revenue Million Forecast, by Gaming Platform 2020 & 2033

- Table 2: Global MMORPG Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 3: Global MMORPG Industry Revenue Million Forecast, by Gaming Platform 2020 & 2033

- Table 4: Global MMORPG Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 5: United States MMORPG Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 6: Canada MMORPG Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 7: Global MMORPG Industry Revenue Million Forecast, by Gaming Platform 2020 & 2033

- Table 8: Global MMORPG Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 9: United Kingdom MMORPG Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Germany MMORPG Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: France MMORPG Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Italy MMORPG Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Russia MMORPG Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Global MMORPG Industry Revenue Million Forecast, by Gaming Platform 2020 & 2033

- Table 15: Global MMORPG Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 16: China MMORPG Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: India MMORPG Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Japan MMORPG Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: South Korea MMORPG Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Global MMORPG Industry Revenue Million Forecast, by Gaming Platform 2020 & 2033

- Table 21: Global MMORPG Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 22: Global MMORPG Industry Revenue Million Forecast, by Gaming Platform 2020 & 2033

- Table 23: Global MMORPG Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 24: Brazil MMORPG Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: Mexico MMORPG Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Argentina MMORPG Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: Global MMORPG Industry Revenue Million Forecast, by Gaming Platform 2020 & 2033

- Table 28: Global MMORPG Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 29: United Arab Emirates MMORPG Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Saudi Arabia MMORPG Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 31: South Africa MMORPG Industry Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the MMORPG Industry?

The projected CAGR is approximately 10.75%.

2. Which companies are prominent players in the MMORPG Industry?

Key companies in the market include Daybreak Game Company, Electronic Arts Inc, Amazon Game Studios, Giant Interactive Group Inc, Aeria Games, CCP games UK Ltd, NCSOFT Corporation, Activision Blizzard Inc, Neteasegames Inc, Tencent Holdings Limited, Bright Star Studios, Ubisoft Entertainment SA, Jagex Limited, Gravity Corporatio, Nexon Co Ltd.

3. What are the main segments of the MMORPG Industry?

The market segments include Gaming Platform.

4. Can you provide details about the market size?

The market size is estimated to be USD 25.34 Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Smartphone Penetration and Increasing Penetration of Internet among Developing Economies; Technological Advancement such as IoT. AR. and VR; Emergence of Gamification.

6. What are the notable trends driving market growth?

Rising Smartphone Penetration and Increasing Penetration of Internet among Developing Economies may Drive the Market Growth.

7. Are there any restraints impacting market growth?

Costs. Interoperability. and Security Concerns.

8. Can you provide examples of recent developments in the market?

January 2023: The development team behind Search for Animera, a web3-native massively multiplayer online role-playing game (MMORPG), announced the game's launch on ImmutableX, the go-to Ethereum platform for creating and scaling web3 games. By partnering with ImmutableX and utilizing its platform for the project's infrastructure, the developers of Animera can make sure that users may benefit from the simplicity of quick transactions, free mining, and trade, as well as the strength of Ethereum's built-in security.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "MMORPG Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the MMORPG Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the MMORPG Industry?

To stay informed about further developments, trends, and reports in the MMORPG Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence