Key Insights

The Latin American Energy Management Systems (EMS) market is poised for substantial expansion, projected to reach $3.68 billion by 2025, exhibiting a CAGR of 12.99% from the base year 2025. This growth is fueled by escalating energy demands, a strategic emphasis on enhancing energy efficiency across diverse industries, and the widespread adoption of advanced smart grid technologies. Key catalysts include supportive government policies championing renewable energy integration and conservation, alongside the increasing deployment of smart building solutions in prominent Latin American urban centers such as Brazil, Mexico, and Argentina. Market analysis indicates robust demand across all EMS segments—hardware, software, and services—with a particular emphasis on Building Energy Management Systems (BEMS) and Industrial Energy Management Systems (IEMS) within the manufacturing and power & energy sectors. Significant investments from leading entities like IBM, Siemens, and Schneider Electric further validate the market's strong appeal. Nevertheless, challenges such as substantial upfront implementation costs, the necessity for a skilled workforce, and disparities in technological infrastructure across the region persist.

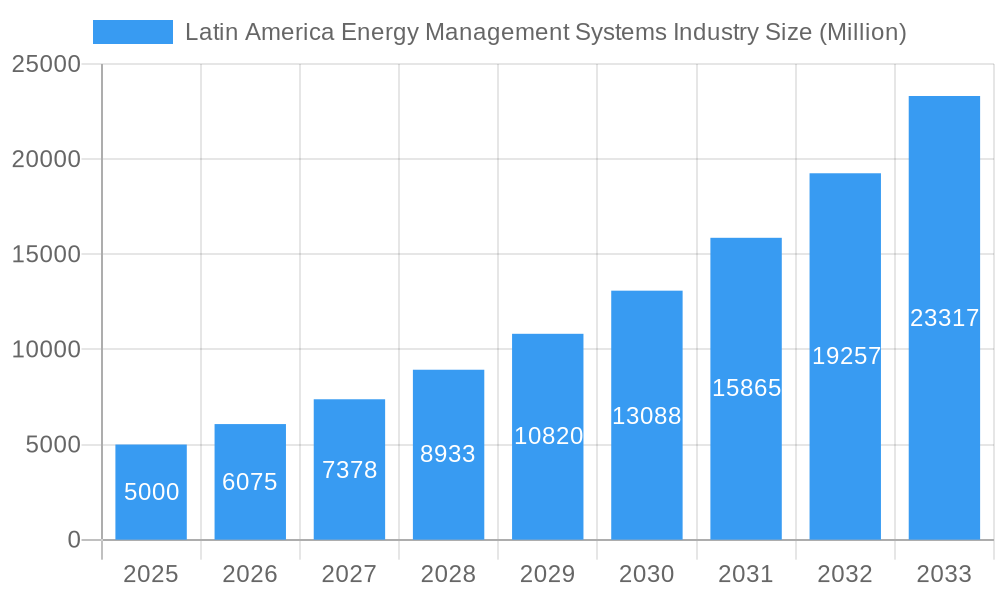

Latin America Energy Management Systems Industry Market Size (In Billion)

Notwithstanding these constraints, the long-term market outlook remains exceptionally positive. Ongoing urbanization and industrialization, coupled with heightened awareness of sustainability and the accelerating adoption of smart city initiatives, are expected to drive further market expansion. The increasing accessibility of reliable and affordable internet connectivity will significantly facilitate the deployment and scalability of cloud-based EMS solutions. To fully capitalize on the Latin American EMS market's potential, a strategic focus on developing tailored solutions for specific industry and regional requirements, complemented by targeted government support programs, will be critical. The market's impressive growth trajectory, propelled by technological innovation and favorable policy landscapes, presents compelling investment opportunities.

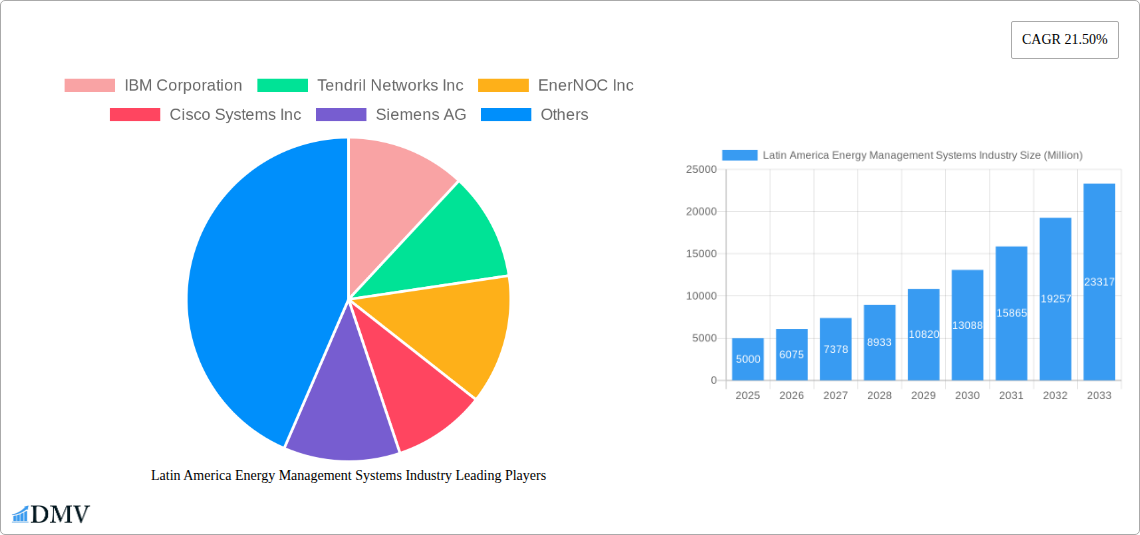

Latin America Energy Management Systems Industry Company Market Share

Latin America Energy Management Systems (EMS) Industry: A Comprehensive Market Report (2019-2033)

This insightful report provides a detailed analysis of the Latin America Energy Management Systems industry, offering crucial data and forecasts for stakeholders seeking to navigate this dynamic market. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report offers invaluable insights into market size, growth trajectories, and key trends impacting the industry's evolution. The total market value in 2025 is estimated at $XX Million.

Latin America Energy Management Systems Industry Market Composition & Trends

This section delves into the competitive landscape of the Latin American EMS market, examining market concentration, innovation drivers, regulatory influences, substitute products, end-user profiles, and mergers & acquisitions (M&A) activity. The market is characterized by a moderately concentrated structure, with key players such as IBM Corporation, Schneider Electric SE, and General Electric Co holding significant market share. However, several smaller, specialized players also contribute significantly. The estimated market share distribution in 2025 is as follows: IBM (15%), Schneider Electric (12%), GE (10%), others (63%). M&A activity has been relatively moderate in recent years, with total deal values averaging approximately $XX Million annually during the historical period (2019-2024).

- Market Concentration: Moderately concentrated, with a few major players dominating.

- Innovation Catalysts: Growing adoption of renewable energy sources, increasing energy costs, and government regulations promoting energy efficiency.

- Regulatory Landscape: Varying regulations across Latin American countries, creating both opportunities and challenges.

- Substitute Products: Limited direct substitutes, but energy conservation strategies and alternative technologies present indirect competition.

- End-User Profiles: Manufacturing, Power and Energy, IT and Telecommunication, Healthcare, and Other End-Users represent key segments.

- M&A Activity: Relatively moderate, with an average annual deal value of approximately $XX Million (2019-2024).

Latin America Energy Management Systems Industry Evolution

This section meticulously examines the historical and projected growth trajectories of the Latin American EMS market. The market experienced a Compound Annual Growth Rate (CAGR) of XX% during the historical period (2019-2024) driven by increasing demand for improved energy efficiency and the integration of renewable energy sources. Technological advancements, particularly in the areas of IoT, AI, and cloud computing, are significantly reshaping the industry. The growing adoption of smart grids, coupled with supportive government policies and rising consumer awareness about sustainability, fuels this growth. The forecast period (2025-2033) anticipates a CAGR of XX%, reaching a projected market value of $XX Million by 2033. The increasing adoption of Building Energy Management Systems (BEMS) and Home Energy Management Systems (HEMS) among diverse end-users is a key driver.

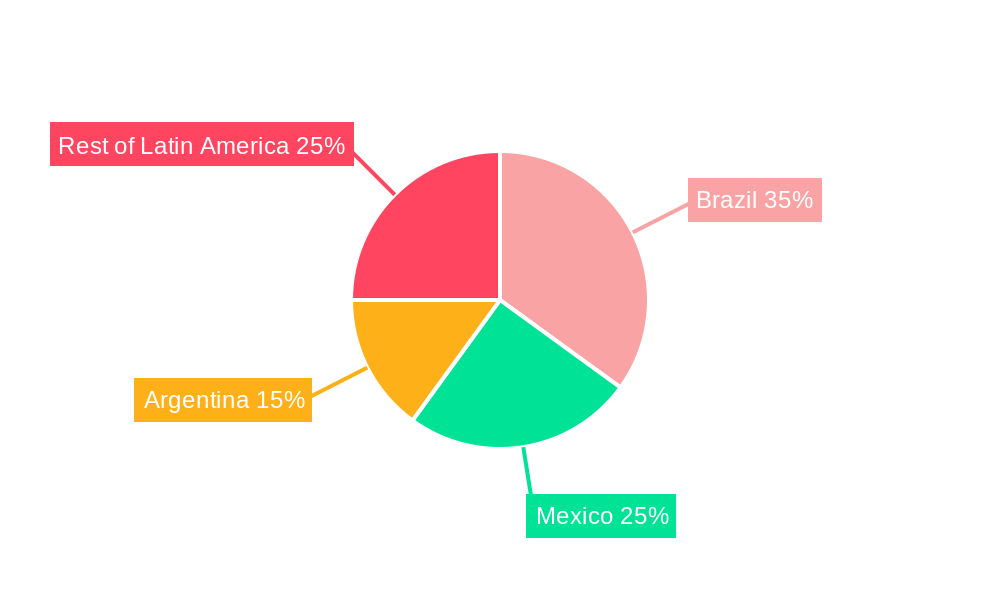

Leading Regions, Countries, or Segments in Latin America Energy Management Systems Industry

Brazil and Mexico currently dominate the Latin American EMS market, driven by robust economic growth, substantial investments in infrastructure development, and supportive government policies promoting energy efficiency. The Hardware segment holds the largest market share within the component category, followed by Software and Services. Within system types, Building Energy Management Systems (BEMS) and Industrial Energy Management Systems (IEMS) are leading the way, owing to high energy consumption in the industrial and commercial sectors.

- Key Drivers (Brazil & Mexico): Significant investments in renewable energy infrastructure, robust industrial growth, and government incentives for energy efficiency.

- Dominance Factors: Large market size, high energy consumption rates, and proactive governmental support for energy management technologies.

- Segment Breakdown: Hardware (largest market share), Software, and Services. BEMS and IEMS leading in system types.

Latin America Energy Management Systems Industry Product Innovations

Recent innovations in the EMS sector include advanced analytics capabilities, predictive maintenance features, and improved integration with renewable energy sources. These advancements deliver enhanced energy efficiency, cost savings, and reduced environmental impact. Unique selling propositions often focus on providing intuitive user interfaces, seamless data integration, and robust cybersecurity features. The incorporation of AI and machine learning is transforming EMS solutions, enabling predictive analytics and autonomous energy optimization.

Propelling Factors for Latin America Energy Management Systems Industry Growth

The Latin American EMS market is propelled by several key factors. The growing adoption of renewable energy sources necessitates efficient energy management. Stringent government regulations promoting energy efficiency are driving demand for EMS solutions. Furthermore, rising energy costs and increasing awareness of sustainability issues are incentivizing businesses and consumers to adopt energy-saving technologies.

Obstacles in the Latin America Energy Management Systems Industry Market

The industry faces challenges such as inconsistent regulatory frameworks across Latin American countries, creating implementation complexities. Supply chain disruptions can hinder the availability of crucial components, particularly during economic uncertainties. Furthermore, intense competition from both established and emerging players poses a challenge to market share and profitability.

Future Opportunities in Latin America Energy Management Systems Industry

Significant growth opportunities exist in untapped markets within Latin America, particularly in smaller countries with burgeoning economies. The integration of cutting-edge technologies such as AI, IoT, and blockchain presents substantial potential for innovation and service enhancement. The increasing demand for sustainable solutions will further drive the adoption of EMS within various sectors.

Major Players in the Latin America Energy Management Systems Industry Ecosystem

- IBM Corporation

- Tendril Networks Inc

- EnerNOC Inc

- Cisco Systems Inc

- Siemens AG

- General Electric Co

- Schneider Electric SE

- Elster Group GmbH

- Rockwell Automation Inc

- SAP SE

- Honeywell International Inc

- Eaton Corporation

Key Developments in Latin America Energy Management Systems Industry

- March 2021: Eaton launched "Buildings as a Grid," a hardware, software, and service offering enabling buildings to leverage on-site renewable energy.

- February 2021: Schneider Electric launched its Wholesale Building Management Distributor Program to enhance partner capabilities and market reach.

Strategic Latin America Energy Management Systems Industry Market Forecast

The Latin American EMS market is poised for robust growth, fueled by increasing investments in renewable energy, stricter environmental regulations, and the rising adoption of smart technologies. The market's future potential is significant, with substantial opportunities for both established and emerging players to capitalize on the region's growing demand for efficient and sustainable energy management solutions. The forecast indicates a strong upward trajectory, driven by ongoing technological innovation and supportive government policies.

Latin America Energy Management Systems Industry Segmentation

-

1. Component

- 1.1. Hardware

- 1.2. Software

- 1.3. Services

-

2. Type

- 2.1. HEMS

- 2.2. BEMS

- 2.3. IEMS

-

3. End User

- 3.1. Manufacturing

- 3.2. Power and Energy

- 3.3. IT and Telecommunication

- 3.4. Healthcare

- 3.5. Other End Users

-

4. Geography

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Rest of Latin America

Latin America Energy Management Systems Industry Segmentation By Geography

- 1. Brazil

- 2. Argentina

- 3. Rest of Latin America

Latin America Energy Management Systems Industry Regional Market Share

Geographic Coverage of Latin America Energy Management Systems Industry

Latin America Energy Management Systems Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 12.99% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Usage of Smart Grids and Smart Meters; Rising Investments in Energy Efficiency

- 3.3. Market Restrains

- 3.3.1. High Initial Installation Costs Coupled with Maintenance Costs

- 3.4. Market Trends

- 3.4.1. Brazil to Hold a Major Share in the EMS Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Latin America Energy Management Systems Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Component

- 5.1.1. Hardware

- 5.1.2. Software

- 5.1.3. Services

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. HEMS

- 5.2.2. BEMS

- 5.2.3. IEMS

- 5.3. Market Analysis, Insights and Forecast - by End User

- 5.3.1. Manufacturing

- 5.3.2. Power and Energy

- 5.3.3. IT and Telecommunication

- 5.3.4. Healthcare

- 5.3.5. Other End Users

- 5.4. Market Analysis, Insights and Forecast - by Geography

- 5.4.1. Brazil

- 5.4.2. Argentina

- 5.4.3. Rest of Latin America

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. Brazil

- 5.5.2. Argentina

- 5.5.3. Rest of Latin America

- 5.1. Market Analysis, Insights and Forecast - by Component

- 6. Brazil Latin America Energy Management Systems Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Component

- 6.1.1. Hardware

- 6.1.2. Software

- 6.1.3. Services

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1. HEMS

- 6.2.2. BEMS

- 6.2.3. IEMS

- 6.3. Market Analysis, Insights and Forecast - by End User

- 6.3.1. Manufacturing

- 6.3.2. Power and Energy

- 6.3.3. IT and Telecommunication

- 6.3.4. Healthcare

- 6.3.5. Other End Users

- 6.4. Market Analysis, Insights and Forecast - by Geography

- 6.4.1. Brazil

- 6.4.2. Argentina

- 6.4.3. Rest of Latin America

- 6.1. Market Analysis, Insights and Forecast - by Component

- 7. Argentina Latin America Energy Management Systems Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Component

- 7.1.1. Hardware

- 7.1.2. Software

- 7.1.3. Services

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1. HEMS

- 7.2.2. BEMS

- 7.2.3. IEMS

- 7.3. Market Analysis, Insights and Forecast - by End User

- 7.3.1. Manufacturing

- 7.3.2. Power and Energy

- 7.3.3. IT and Telecommunication

- 7.3.4. Healthcare

- 7.3.5. Other End Users

- 7.4. Market Analysis, Insights and Forecast - by Geography

- 7.4.1. Brazil

- 7.4.2. Argentina

- 7.4.3. Rest of Latin America

- 7.1. Market Analysis, Insights and Forecast - by Component

- 8. Rest of Latin America Latin America Energy Management Systems Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Component

- 8.1.1. Hardware

- 8.1.2. Software

- 8.1.3. Services

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1. HEMS

- 8.2.2. BEMS

- 8.2.3. IEMS

- 8.3. Market Analysis, Insights and Forecast - by End User

- 8.3.1. Manufacturing

- 8.3.2. Power and Energy

- 8.3.3. IT and Telecommunication

- 8.3.4. Healthcare

- 8.3.5. Other End Users

- 8.4. Market Analysis, Insights and Forecast - by Geography

- 8.4.1. Brazil

- 8.4.2. Argentina

- 8.4.3. Rest of Latin America

- 8.1. Market Analysis, Insights and Forecast - by Component

- 9. Competitive Analysis

- 9.1. Market Share Analysis 2025

- 9.2. Company Profiles

- 9.2.1 IBM Corporation

- 9.2.1.1. Overview

- 9.2.1.2. Products

- 9.2.1.3. SWOT Analysis

- 9.2.1.4. Recent Developments

- 9.2.1.5. Financials (Based on Availability)

- 9.2.2 Tendril Networks Inc

- 9.2.2.1. Overview

- 9.2.2.2. Products

- 9.2.2.3. SWOT Analysis

- 9.2.2.4. Recent Developments

- 9.2.2.5. Financials (Based on Availability)

- 9.2.3 EnerNOC Inc

- 9.2.3.1. Overview

- 9.2.3.2. Products

- 9.2.3.3. SWOT Analysis

- 9.2.3.4. Recent Developments

- 9.2.3.5. Financials (Based on Availability)

- 9.2.4 Cisco Systems Inc

- 9.2.4.1. Overview

- 9.2.4.2. Products

- 9.2.4.3. SWOT Analysis

- 9.2.4.4. Recent Developments

- 9.2.4.5. Financials (Based on Availability)

- 9.2.5 Siemens AG

- 9.2.5.1. Overview

- 9.2.5.2. Products

- 9.2.5.3. SWOT Analysis

- 9.2.5.4. Recent Developments

- 9.2.5.5. Financials (Based on Availability)

- 9.2.6 General Electric Co

- 9.2.6.1. Overview

- 9.2.6.2. Products

- 9.2.6.3. SWOT Analysis

- 9.2.6.4. Recent Developments

- 9.2.6.5. Financials (Based on Availability)

- 9.2.7 Schneider Electric SE

- 9.2.7.1. Overview

- 9.2.7.2. Products

- 9.2.7.3. SWOT Analysis

- 9.2.7.4. Recent Developments

- 9.2.7.5. Financials (Based on Availability)

- 9.2.8 Elster Group GmbH

- 9.2.8.1. Overview

- 9.2.8.2. Products

- 9.2.8.3. SWOT Analysis

- 9.2.8.4. Recent Developments

- 9.2.8.5. Financials (Based on Availability)

- 9.2.9 Rockwell Automation Inc

- 9.2.9.1. Overview

- 9.2.9.2. Products

- 9.2.9.3. SWOT Analysis

- 9.2.9.4. Recent Developments

- 9.2.9.5. Financials (Based on Availability)

- 9.2.10 SAP SE

- 9.2.10.1. Overview

- 9.2.10.2. Products

- 9.2.10.3. SWOT Analysis

- 9.2.10.4. Recent Developments

- 9.2.10.5. Financials (Based on Availability)

- 9.2.11 Honeywell International Inc *List Not Exhaustive

- 9.2.11.1. Overview

- 9.2.11.2. Products

- 9.2.11.3. SWOT Analysis

- 9.2.11.4. Recent Developments

- 9.2.11.5. Financials (Based on Availability)

- 9.2.12 Eaton Corporation

- 9.2.12.1. Overview

- 9.2.12.2. Products

- 9.2.12.3. SWOT Analysis

- 9.2.12.4. Recent Developments

- 9.2.12.5. Financials (Based on Availability)

- 9.2.1 IBM Corporation

List of Figures

- Figure 1: Latin America Energy Management Systems Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Latin America Energy Management Systems Industry Share (%) by Company 2025

List of Tables

- Table 1: Latin America Energy Management Systems Industry Revenue billion Forecast, by Component 2020 & 2033

- Table 2: Latin America Energy Management Systems Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 3: Latin America Energy Management Systems Industry Revenue billion Forecast, by End User 2020 & 2033

- Table 4: Latin America Energy Management Systems Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 5: Latin America Energy Management Systems Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 6: Latin America Energy Management Systems Industry Revenue billion Forecast, by Component 2020 & 2033

- Table 7: Latin America Energy Management Systems Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 8: Latin America Energy Management Systems Industry Revenue billion Forecast, by End User 2020 & 2033

- Table 9: Latin America Energy Management Systems Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 10: Latin America Energy Management Systems Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 11: Latin America Energy Management Systems Industry Revenue billion Forecast, by Component 2020 & 2033

- Table 12: Latin America Energy Management Systems Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 13: Latin America Energy Management Systems Industry Revenue billion Forecast, by End User 2020 & 2033

- Table 14: Latin America Energy Management Systems Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 15: Latin America Energy Management Systems Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 16: Latin America Energy Management Systems Industry Revenue billion Forecast, by Component 2020 & 2033

- Table 17: Latin America Energy Management Systems Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 18: Latin America Energy Management Systems Industry Revenue billion Forecast, by End User 2020 & 2033

- Table 19: Latin America Energy Management Systems Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 20: Latin America Energy Management Systems Industry Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Latin America Energy Management Systems Industry?

The projected CAGR is approximately 12.99%.

2. Which companies are prominent players in the Latin America Energy Management Systems Industry?

Key companies in the market include IBM Corporation, Tendril Networks Inc, EnerNOC Inc, Cisco Systems Inc, Siemens AG, General Electric Co, Schneider Electric SE, Elster Group GmbH, Rockwell Automation Inc, SAP SE, Honeywell International Inc *List Not Exhaustive, Eaton Corporation.

3. What are the main segments of the Latin America Energy Management Systems Industry?

The market segments include Component, Type, End User, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 3.68 billion as of 2022.

5. What are some drivers contributing to market growth?

Increasing Usage of Smart Grids and Smart Meters; Rising Investments in Energy Efficiency.

6. What are the notable trends driving market growth?

Brazil to Hold a Major Share in the EMS Market.

7. Are there any restraints impacting market growth?

High Initial Installation Costs Coupled with Maintenance Costs.

8. Can you provide examples of recent developments in the market?

In March 2021, Eaton, a power management business, released a set of hardware, software, and services that can turn buildings into energy hubs that get the most out of on-site renewable energy. Its strategy for energy transition and electric car charging is known as "Buildings as a Grid."

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Latin America Energy Management Systems Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Latin America Energy Management Systems Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Latin America Energy Management Systems Industry?

To stay informed about further developments, trends, and reports in the Latin America Energy Management Systems Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence