Key Insights

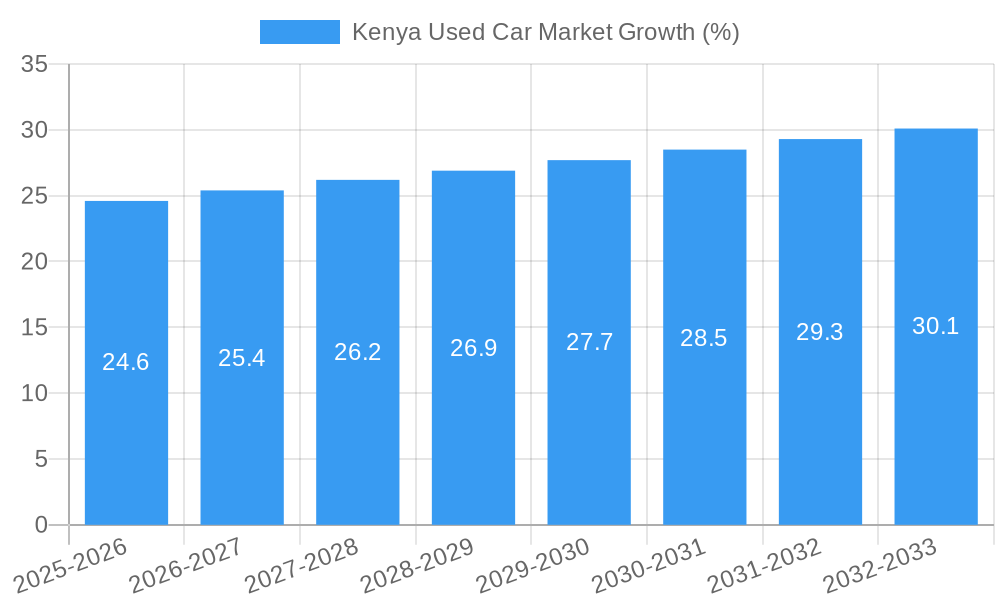

The Kenyan used car market, valued at $1.23 billion in 2025, exhibits robust growth potential, projected to expand at a compound annual growth rate (CAGR) exceeding 2.00% from 2025 to 2033. This growth is fueled by several key factors. Rising disposable incomes among the burgeoning middle class are driving increased demand for personal vehicles, particularly in urban areas. The preference for affordable transportation options, coupled with a relatively lower cost of used cars compared to new vehicles, further boosts market expansion. The growth of e-commerce platforms dedicated to used car sales, like Cheki, CarMax, and others, streamlines the buying process and improves market transparency, attracting a broader customer base. However, the market faces challenges. Fluctuations in fuel prices and the overall economic climate can impact affordability and purchasing decisions. Furthermore, concerns surrounding vehicle quality and maintenance costs may restrain market growth, especially amongst less informed buyers. The market is segmented by vehicle type (hatchbacks, sedans, SUVs, MPVs) and vendor type (organized and unorganized dealerships), reflecting diverse consumer preferences and sales channels. Leading players include UsedCars.co.ke, Automark, Car Soko Ltd, PigiaMe, Jiji, Autochek Africa, Gigi Motors Ltd, Cars45 Kenya, Peach Cars, and Toyota Kenya Ltd, competing across various segments. The historical period (2019-2024) likely witnessed a similar growth trajectory, although specific data is unavailable, suggesting that the market's current momentum is built on a foundation of steady expansion.

The competitive landscape is characterized by a mix of established players and emerging online platforms. Organized vendors, often offering greater transparency and warranties, compete with unorganized players, typically offering lower prices but with potentially higher risks for buyers. Future growth will depend on addressing the challenges related to vehicle quality assurance and financing options. The increasing adoption of digital technologies, including online marketplaces and mobile payment systems, is likely to reshape the market dynamics and facilitate further growth in the coming years. Government policies on vehicle imports and taxation will also play a crucial role in shaping the market's future trajectory. Overall, while the market is subject to macroeconomic influences, its strong fundamentals, driven by increasing affordability and expanding digitalization, signal a promising outlook for the Kenyan used car market over the forecast period.

Kenya Used Car Market: A Comprehensive Market Report (2019-2033)

This insightful report provides a detailed analysis of the dynamic Kenya used car market, offering crucial insights for stakeholders, investors, and industry players. Covering the period from 2019 to 2033, with a focus on 2025, this report unveils the market's composition, evolution, leading segments, and future potential. The market is projected to reach xx Million by 2033, growing at a CAGR of xx% during the forecast period (2025-2033). This comprehensive study delves into key players like UsedCars.co.ke, Automark, Car Soko Ltd, PigiaMe, Jiji, Autochek Africa, Gigi Motors Ltd, Cars45 Kenya, Peach Cars, and Toyota Kenya Ltd, analyzing their strategies and market share within the diverse landscape of hatchbacks, sedans, SUVs, and MPVs.

Kenya Used Car Market Composition & Trends

The Kenyan used car market exhibits a fragmented landscape with a mix of organized and unorganized vendors. While organized players like UsedCars.co.ke and Automark are gaining traction, a significant portion of the market remains unorganized, posing challenges for data accuracy and market regulation. Innovation is driven by online marketplaces, offering wider reach and improved customer experience. The regulatory landscape is evolving, with ongoing efforts to improve vehicle inspection and registration processes. Substitute products include public transport and newer, cheaper vehicle options. The primary end-users are individuals and small businesses, with a growing demand for affordable and reliable transportation. Mergers and acquisitions (M&A) activity has been moderate, with deal values ranging from xx Million to xx Million in recent years.

- Market Share Distribution (2024): Organized sector: xx%; Unorganized sector: xx%

- Key M&A Activities (2019-2024): Deal values totaling approximately xx Million across xx transactions.

- Innovation Catalysts: Online marketplaces, mobile payment integration, improved vehicle inspection services.

Kenya Used Car Market Industry Evolution

The Kenyan used car market has witnessed significant growth since 2019, driven by increasing urbanization, rising disposable incomes, and a growing demand for personal transportation. The historical period (2019-2024) saw an average annual growth rate of xx%, largely driven by the expansion of online platforms and increased affordability of used vehicles. Technological advancements, such as online vehicle listing platforms and digital payment systems, have streamlined the buying and selling process, increasing market efficiency. Consumer demand is shifting towards fuel-efficient vehicles and those with better safety features. The market has also experienced increased participation from established automotive dealerships, like Caetano Kenya's entry in April 2022, signaling a maturing market structure. This trend is expected to continue with an increased focus on quality assurance and customer service. The forecast period (2025-2033) is projected to maintain a growth trajectory, albeit at a potentially slower pace as the market approaches maturity, reaching an estimated value of xx Million by 2033.

Leading Regions, Countries, or Segments in Kenya Used Car Market

The Kenyan used car market is geographically diverse, with Nairobi and Mombasa leading in terms of transaction volume. However, growth is also observed in other urban centers as demand increases. Within vehicle types, SUVs and MPVs are experiencing the most significant growth, driven by their practicality and suitability for varied terrains.

By Vehicle Type:

- SUVs and MPVs: Dominance driven by family needs and suitability for Kenyan roads. Increased affordability is a key growth driver.

- Sedans and Hatchbacks: Continue to hold significant market share, catering to a broader range of budget-conscious consumers.

By Vendor:

- Organized Sector: Growth fueled by investments in technology and improved customer service, leading to increased trust and transparency.

- Unorganized Sector: While significant in volume, this sector faces challenges regarding quality control, pricing transparency, and regulatory compliance. Government initiatives to formalize the sector are key to future growth and market stability.

The organized sector is expected to gain market share over the forecast period due to increased consumer preference for transparency and reliable service.

Kenya Used Car Market Product Innovations

Recent innovations include the integration of online platforms with digital payment systems, enhancing transaction security and convenience. Improved vehicle inspection services, offered by some organized players, bolster consumer confidence by providing verified vehicle history reports. The introduction of warranty programs by some dealerships further increases buyer confidence and reduces risk. These innovations are key differentiators in the market, improving customer experience and driving competition.

Propelling Factors for Kenya Used Car Market Growth

Several factors drive the growth of Kenya's used car market. Firstly, increasing urbanization and the need for personal transportation fuel significant demand. Secondly, the affordability of used vehicles compared to new cars makes them accessible to a wider segment of the population. Finally, the emergence of online platforms significantly improves market accessibility and efficiency. Government initiatives to improve vehicle inspection standards are expected to positively influence growth by promoting consumer trust.

Obstacles in the Kenya Used Car Market Market

The market faces challenges, primarily from the large unorganized sector, leading to inconsistent quality and pricing. Supply chain disruptions, particularly related to import restrictions and global chip shortages, impact the availability of used vehicles. Furthermore, regulatory inconsistencies and challenges in enforcing standards create an uneven playing field and impact consumer protection.

Future Opportunities in Kenya Used Car Market

Significant opportunities exist within expanding into secondary cities and rural areas. Investments in technology, especially in vehicle history verification and online auction platforms, could significantly enhance transparency and efficiency. Increased financial inclusion through micro-loans tailored to used vehicle purchases can unlock market potential and further drive growth.

Major Players in the Kenya Used Car Market Ecosystem

- UsedCars.co.ke

- Automark

- Car Soko Ltd

- PigiaMe

- Jiji

- Autochek Africa

- Gigi Motors Ltd

- Cars45 Kenya

- Peach Cars

- Toyota Kenya Ltd

Key Developments in Kenya Used Car Market Industry

- December 2022: TRADE X enters the Kenyan market, establishing a new trading corridor for used cars. This expansion is expected to increase competition and improve efficiency within the B2B sector.

- April 2022: Caetano Kenya, a leading dealership, enters the pre-owned vehicle market, bringing established brand credibility and a wider selection of vehicles to the used car market. This significantly boosts consumer trust in the organized sector.

Strategic Kenya Used Car Market Market Forecast

The Kenyan used car market is poised for continued growth, driven by increasing demand, technological advancements, and improvements in the regulatory environment. While challenges remain, the opportunities presented by the expanding middle class, improved digital infrastructure, and increased participation from established players suggest robust market expansion in the coming years. The market's evolution toward greater formalization and enhanced transparency will further solidify its position as a significant sector in the Kenyan economy.

Kenya Used Car Market Segmentation

-

1. Vehicle Type

- 1.1. Hatchbacks

- 1.2. Sedan

- 1.3. Sports Utility Vehicles and Multi-Purpose Vehicles

-

2. Vendor

- 2.1. Organized

- 2.2. Unorganized

Kenya Used Car Market Segmentation By Geography

- 1. Kenya

Kenya Used Car Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 2.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. High Cost Associated With the New Cars and Affordability Concerns Drive the Market; Others

- 3.3. Market Restrains

- 3.3.1. Stringent Governmental Regulations and Import Taxes Restrict the Market Growth

- 3.4. Market Trends

- 3.4.1. Governmental Importation Taxes on Used Cars is Likely to Boost Local Automobile Market-

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Kenya Used Car Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.1.1. Hatchbacks

- 5.1.2. Sedan

- 5.1.3. Sports Utility Vehicles and Multi-Purpose Vehicles

- 5.2. Market Analysis, Insights and Forecast - by Vendor

- 5.2.1. Organized

- 5.2.2. Unorganized

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Kenya

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 UsedCars co ke

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Automark

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Car Soko Lt

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 PigiaMe

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Jiji

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Autochek Africa

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Gigi Motors Ltd

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Cars45 Kenya

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Peach Cars

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Toyota Kenya Ltd

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 UsedCars co ke

List of Figures

- Figure 1: Kenya Used Car Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Kenya Used Car Market Share (%) by Company 2024

List of Tables

- Table 1: Kenya Used Car Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Kenya Used Car Market Revenue Million Forecast, by Vehicle Type 2019 & 2032

- Table 3: Kenya Used Car Market Revenue Million Forecast, by Vendor 2019 & 2032

- Table 4: Kenya Used Car Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Kenya Used Car Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Kenya Used Car Market Revenue Million Forecast, by Vehicle Type 2019 & 2032

- Table 7: Kenya Used Car Market Revenue Million Forecast, by Vendor 2019 & 2032

- Table 8: Kenya Used Car Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Kenya Used Car Market?

The projected CAGR is approximately > 2.00%.

2. Which companies are prominent players in the Kenya Used Car Market?

Key companies in the market include UsedCars co ke, Automark, Car Soko Lt, PigiaMe, Jiji, Autochek Africa, Gigi Motors Ltd, Cars45 Kenya, Peach Cars, Toyota Kenya Ltd.

3. What are the main segments of the Kenya Used Car Market?

The market segments include Vehicle Type, Vendor.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.23 Million as of 2022.

5. What are some drivers contributing to market growth?

High Cost Associated With the New Cars and Affordability Concerns Drive the Market; Others.

6. What are the notable trends driving market growth?

Governmental Importation Taxes on Used Cars is Likely to Boost Local Automobile Market-.

7. Are there any restraints impacting market growth?

Stringent Governmental Regulations and Import Taxes Restrict the Market Growth.

8. Can you provide examples of recent developments in the market?

December 2022: TRADE X, the global automotive trading platform, made a significant move into the Kenyan market, catering to automotive dealers across key East African nations. This expansion, led by TRADE X, a B2B cross-border automotive trading platform headquartered in Ontario, Canada, involved the establishment of a new trading corridor in Kenya, specifically targeting the used car trading sector.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Kenya Used Car Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Kenya Used Car Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Kenya Used Car Market?

To stay informed about further developments, trends, and reports in the Kenya Used Car Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence