Key Insights

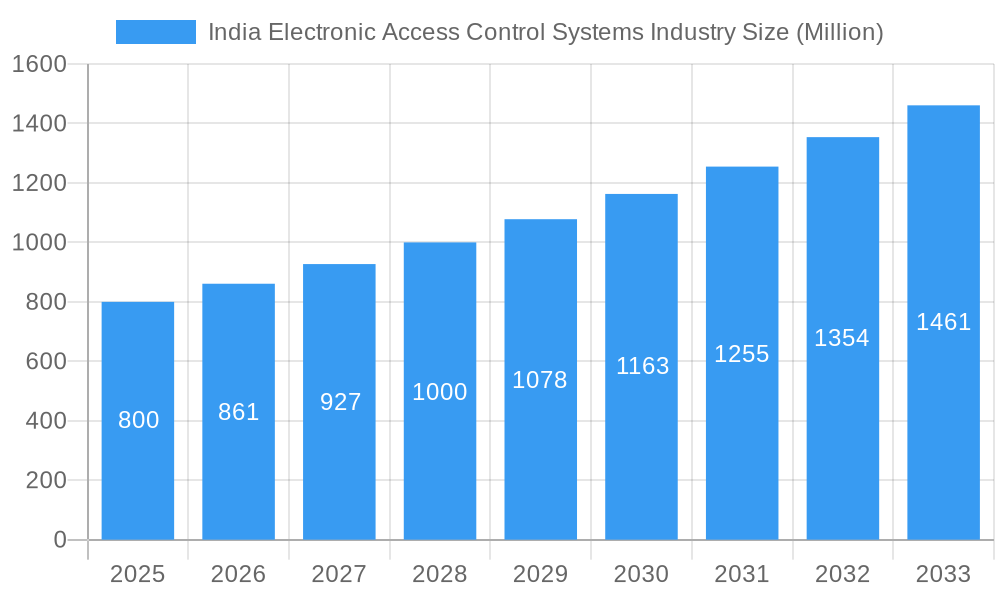

India's electronic access control systems market is poised for significant expansion, driven by escalating security imperatives across sectors and the integration of cutting-edge technologies. The market, estimated at $0.61 billion in the base year 2025, is projected to grow at a Compound Annual Growth Rate (CAGR) of 12.13% from 2025 to 2033. Key growth catalysts include the robust expansion of the IT & Telecom, BFSI, and manufacturing industries, which demand advanced access control solutions for safeguarding critical data and assets. Government-backed smart city initiatives and a focus on bolstering national security infrastructure further stimulate market development. The increasing prevalence of biometric and card readers, coupled with a discernible shift from traditional mechanical locks to electronic alternatives, is reshaping the market's trajectory. Despite considerations regarding initial investment for advanced systems and the requirement for specialized installation and maintenance expertise, the market outlook remains exceptionally promising.

India Electronic Access Control Systems Industry Market Size (In Million)

Market segmentation highlights substantial opportunities within diverse industrial verticals and product categories. The IT & Telecom sector, particularly vulnerable to data breaches, is expected to spearhead demand for sophisticated electronic access control solutions. The BFSI sector's commitment to protecting financial assets and confidential customer information also drives substantial technology investment. Biometric readers are experiencing accelerated adoption due to their superior security and user-friendly authentication, while card readers and electronic locks continue to command significant market share, recognized for their economic viability and dependability. Regional market penetration varies, with accelerated growth anticipated in urbanizing areas and developing infrastructure hubs. Leading companies such as Honeywell and Siemens are strategically enhancing their product offerings and distribution channels to meet dynamic market needs, thereby fostering a competitive landscape rich in technological innovation.

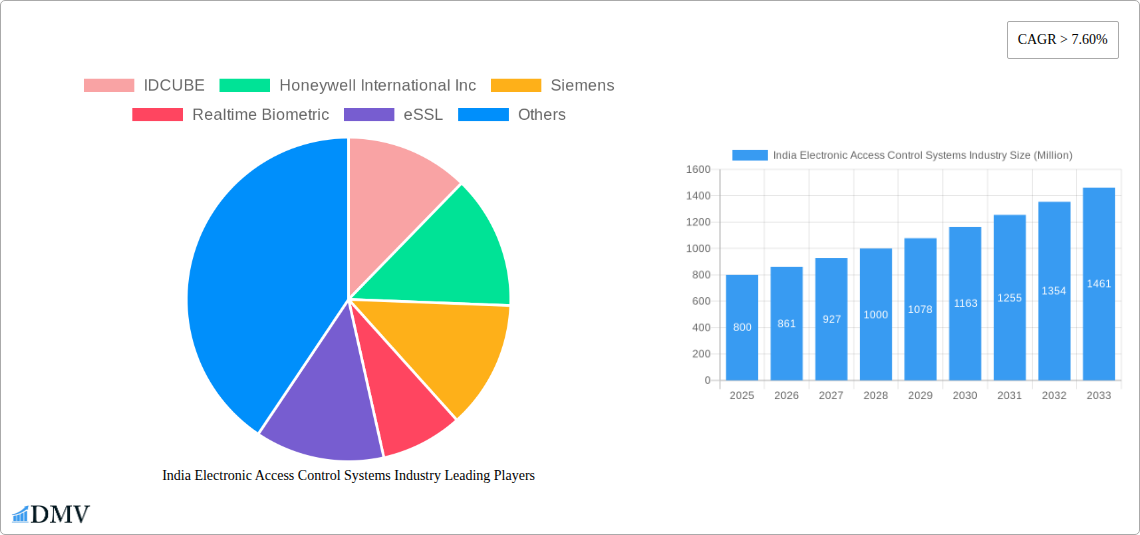

India Electronic Access Control Systems Industry Company Market Share

India Electronic Access Control Systems Industry Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the burgeoning India Electronic Access Control Systems market, offering valuable insights for stakeholders seeking to navigate this dynamic landscape. The study covers the period 2019-2033, with a base year of 2025 and a forecast period of 2025-2033. The market is poised for significant growth, driven by technological advancements and increasing security concerns across diverse sectors. This report provides a detailed breakdown of market size, segmentation, leading players, and future growth projections, enabling informed decision-making and strategic planning. The market value in 2025 is estimated at XX Million USD and is projected to reach XX Million USD by 2033.

India Electronic Access Control Systems Industry Market Composition & Trends

The Indian Electronic Access Control Systems market exhibits a moderately consolidated structure, with key players like Honeywell International Inc, Siemens, and Johnson Controls holding significant market share. However, the market also accommodates several smaller, specialized players catering to niche segments. Innovation is driven by the integration of advanced technologies such as biometric authentication, cloud-based access management, and AI-powered surveillance. Government regulations regarding data security and privacy are increasingly shaping market dynamics. Substitute products, primarily traditional mechanical locking systems, are gradually losing ground due to the enhanced security and convenience offered by electronic access control systems. The end-user profile is diverse, spanning various industrial verticals. M&A activity remains moderate, with deal values primarily ranging from XX Million USD to XX Million USD, driven by consolidation strategies and technology acquisition.

- Market Share Distribution (2025): Honeywell International Inc (XX%), Siemens (XX%), Johnson Controls (XX%), Others (XX%).

- Significant M&A Activities (2019-2024): [List notable mergers and acquisitions with deal values, if available; otherwise, state "Data unavailable"].

India Electronic Access Control Systems Industry Industry Evolution

The Indian Electronic Access Control Systems market has witnessed a steady growth trajectory since 2019, fueled by rising security concerns across various sectors. Technological advancements, particularly in biometric authentication and cloud-based access management, have significantly enhanced the capabilities and appeal of these systems. Consumer demand is shifting towards more sophisticated, integrated solutions offering enhanced security, remote management capabilities, and seamless user experience. The market experienced a Compound Annual Growth Rate (CAGR) of XX% during the historical period (2019-2024) and is projected to maintain a CAGR of XX% during the forecast period (2025-2033). Adoption rates are particularly high in sectors such as BFSI and IT & Telecom, driven by the need to protect sensitive data and infrastructure. The increasing adoption of smart buildings and smart cities initiatives also contributes significantly to market growth. The market is expected to witness further consolidation as larger players acquire smaller companies to expand their product portfolio and market reach.

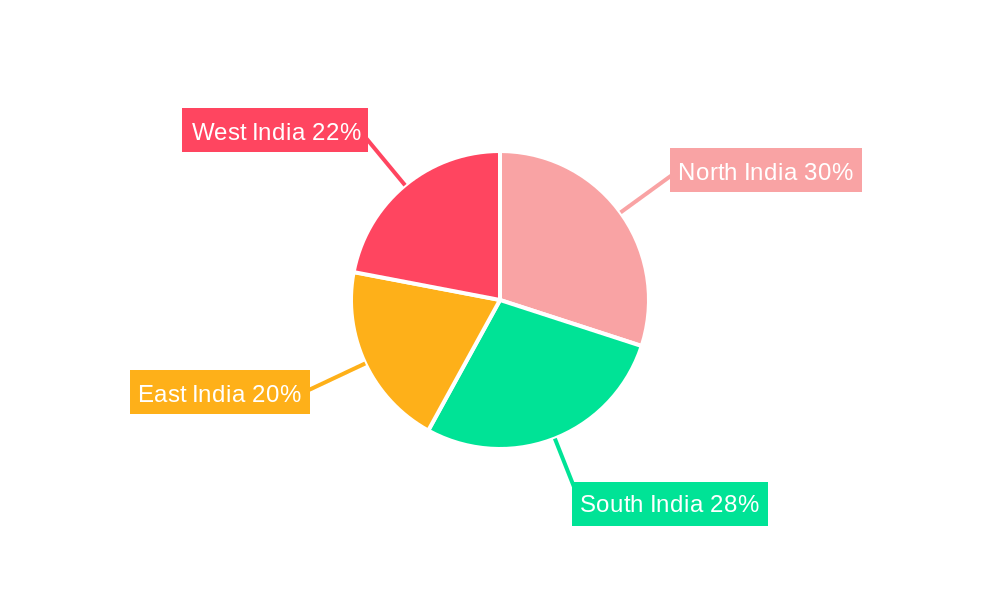

Leading Regions, Countries, or Segments in India Electronic Access Control Systems Industry

The metropolitan areas of major Indian cities, including Mumbai, Delhi, Bangalore, and Hyderabad, represent the dominant regions for Electronic Access Control Systems. Within industrial verticals, the BFSI (Banking, Financial Services, and Insurance) and IT & Telecom sectors demonstrate the highest adoption rates due to stringent security regulations and the sensitive nature of the data they handle. Among product types, biometric readers are gaining popularity due to their enhanced security features and ease of use.

- Key Drivers in BFSI: Stringent regulatory compliance, high value assets protection, and the need for robust fraud prevention mechanisms.

- Key Drivers in IT & Telecom: Protection of critical infrastructure and sensitive data, and compliance with data privacy regulations.

- Key Drivers in Biometric Readers: Enhanced security, improved user experience, and reduced reliance on physical cards.

India Electronic Access Control Systems Industry Product Innovations

Recent innovations include the integration of AI and machine learning for improved threat detection and risk assessment, the development of more robust and user-friendly biometric authentication systems, and the introduction of cloud-based access control platforms that facilitate remote management and monitoring. These advancements enhance the overall security, efficiency, and convenience of electronic access control systems, thus expanding their appeal across diverse applications.

Propelling Factors for India Electronic Access Control Systems Industry Growth

Several factors are propelling the growth of the India Electronic Access Control Systems market. Firstly, increasing security concerns across various sectors, including government, healthcare, and manufacturing, are driving demand for advanced security solutions. Secondly, technological advancements, including the development of more sophisticated biometric authentication systems and cloud-based access control platforms, are enhancing the capabilities and appeal of these systems. Thirdly, government initiatives promoting smart cities and smart buildings are creating new opportunities for the adoption of electronic access control systems. Finally, favorable economic conditions and increasing investments in infrastructure projects are further boosting market growth.

Obstacles in the India Electronic Access Control Systems Industry Market

The market faces challenges such as the high initial investment cost for implementation, concerns regarding data privacy and security, and the potential for integration issues with existing security infrastructure. Supply chain disruptions can also impact market growth, especially during periods of global uncertainty. Furthermore, intense competition among established players and emerging technology providers presents a considerable challenge.

Future Opportunities in India Electronic Access Control Systems Industry

Future opportunities lie in the integration of advanced technologies such as AI and IoT, the expansion into new markets such as smart homes and small businesses, and the development of more customized solutions to cater to specific industry requirements. The growing demand for secure access control in remote areas and the increasing adoption of cloud-based solutions present further avenues for growth.

Major Players in the India Electronic Access Control Systems Industry Ecosystem

- IDCUBE

- Honeywell International Inc

- Siemens

- Realtime Biometric

- eSSL

- Johnson Controls

- Gallagher Security

- HID Global Corporation

- Tyco Security Products

- Mantra Softech India Private Limited

- Robert Bosch GmbH

- Gemalto (3M Cogent)

- Dahua Technology Co Ltd

- IDEMIA

- Paxton Access Ltd

Key Developments in India Electronic Access Control Systems Industry Industry

- 2021: Honeywell implemented facial recognition in the Bengaluru Safe City project. Honeywell India won a contract worth about USD 66 Million to execute this project.

- [Add other key developments with year/month if available]

Strategic India Electronic Access Control Systems Industry Market Forecast

The India Electronic Access Control Systems market is projected to experience robust growth over the forecast period, driven by technological advancements, increasing security concerns, and government initiatives. The expanding adoption of smart city projects and the rising demand for secure access control solutions across diverse sectors will fuel market expansion. The integration of AI, IoT, and cloud technologies is expected to further enhance the capabilities of these systems, driving their adoption across various applications and creating new opportunities for growth.

India Electronic Access Control Systems Industry Segmentation

-

1. Industrial Verticals

- 1.1. IT and Telecom

- 1.2. BFSI

- 1.3. Defense and Aerospace

- 1.4. Manufacturing

- 1.5. Healthcare

- 1.6. Transportation and Logistics

- 1.7. Government

- 1.8. Others

-

2. Type

- 2.1. Card Reader and Access Control Devices

- 2.2. Biometric Readers

- 2.3. Electronic Locks

- 2.4. Other Types

India Electronic Access Control Systems Industry Segmentation By Geography

- 1. India

India Electronic Access Control Systems Industry Regional Market Share

Geographic Coverage of India Electronic Access Control Systems Industry

India Electronic Access Control Systems Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 12.13% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing adoption of access control system to manage terrorist attacks and organized crimes; Growing demand for implementation of mobile-based access control

- 3.3. Market Restrains

- 3.3.1. Intense Competition in the Market

- 3.4. Market Trends

- 3.4.1. Biometric readers expected to have the highest growth rate in future

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India Electronic Access Control Systems Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Industrial Verticals

- 5.1.1. IT and Telecom

- 5.1.2. BFSI

- 5.1.3. Defense and Aerospace

- 5.1.4. Manufacturing

- 5.1.5. Healthcare

- 5.1.6. Transportation and Logistics

- 5.1.7. Government

- 5.1.8. Others

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Card Reader and Access Control Devices

- 5.2.2. Biometric Readers

- 5.2.3. Electronic Locks

- 5.2.4. Other Types

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. India

- 5.1. Market Analysis, Insights and Forecast - by Industrial Verticals

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 IDCUBE

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Honeywell International Inc

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Siemens

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Realtime Biometric

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 eSSL

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Johnson Controls

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Gallagher Security

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 HID Global Corporation

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Tyco Security Products

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Mantra Softech India Private Limited

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Robert Bosch GmbH

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Gemalto (3M Cogent)

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 Dahua Technology Co Ltd*List Not Exhaustive

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.14 IDEMIA

- 6.2.14.1. Overview

- 6.2.14.2. Products

- 6.2.14.3. SWOT Analysis

- 6.2.14.4. Recent Developments

- 6.2.14.5. Financials (Based on Availability)

- 6.2.15 Paxton Access Ltd

- 6.2.15.1. Overview

- 6.2.15.2. Products

- 6.2.15.3. SWOT Analysis

- 6.2.15.4. Recent Developments

- 6.2.15.5. Financials (Based on Availability)

- 6.2.1 IDCUBE

List of Figures

- Figure 1: India Electronic Access Control Systems Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: India Electronic Access Control Systems Industry Share (%) by Company 2025

List of Tables

- Table 1: India Electronic Access Control Systems Industry Revenue billion Forecast, by Industrial Verticals 2020 & 2033

- Table 2: India Electronic Access Control Systems Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 3: India Electronic Access Control Systems Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 4: India Electronic Access Control Systems Industry Revenue billion Forecast, by Industrial Verticals 2020 & 2033

- Table 5: India Electronic Access Control Systems Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 6: India Electronic Access Control Systems Industry Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India Electronic Access Control Systems Industry?

The projected CAGR is approximately 12.13%.

2. Which companies are prominent players in the India Electronic Access Control Systems Industry?

Key companies in the market include IDCUBE, Honeywell International Inc, Siemens, Realtime Biometric, eSSL, Johnson Controls, Gallagher Security, HID Global Corporation, Tyco Security Products, Mantra Softech India Private Limited, Robert Bosch GmbH, Gemalto (3M Cogent), Dahua Technology Co Ltd*List Not Exhaustive, IDEMIA, Paxton Access Ltd.

3. What are the main segments of the India Electronic Access Control Systems Industry?

The market segments include Industrial Verticals , Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 0.61 billion as of 2022.

5. What are some drivers contributing to market growth?

Increasing adoption of access control system to manage terrorist attacks and organized crimes; Growing demand for implementation of mobile-based access control.

6. What are the notable trends driving market growth?

Biometric readers expected to have the highest growth rate in future.

7. Are there any restraints impacting market growth?

Intense Competition in the Market.

8. Can you provide examples of recent developments in the market?

In 2021, Honeywell implemented facial recognition in the Bengaluru Safe City project. Honeywell India has won a contract worth about USD 66 million to execute a Safe City project, including facial recognition in Bengaluru, the capital of India's Karnataka state.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India Electronic Access Control Systems Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India Electronic Access Control Systems Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India Electronic Access Control Systems Industry?

To stay informed about further developments, trends, and reports in the India Electronic Access Control Systems Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence