Key Insights

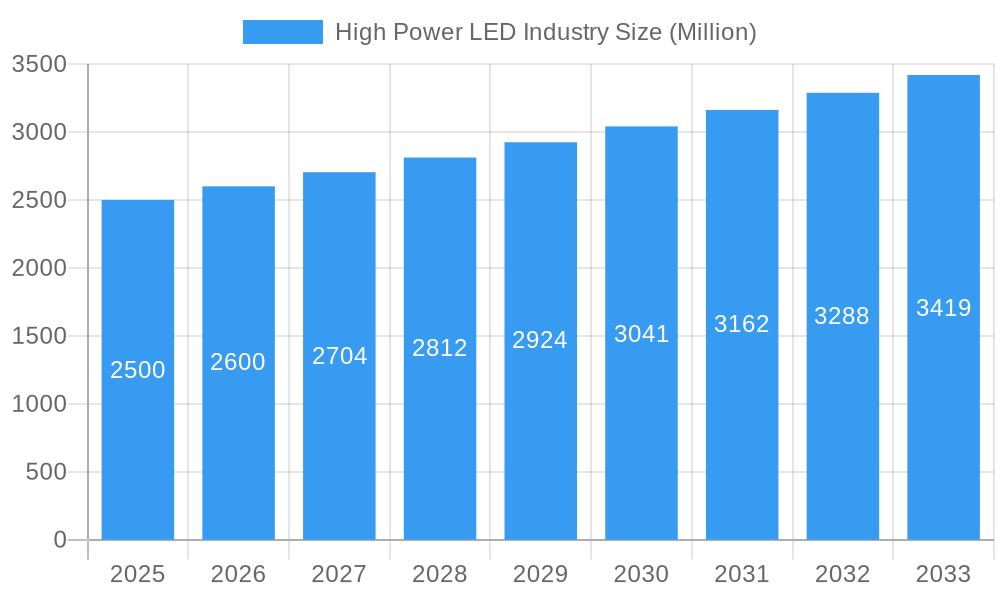

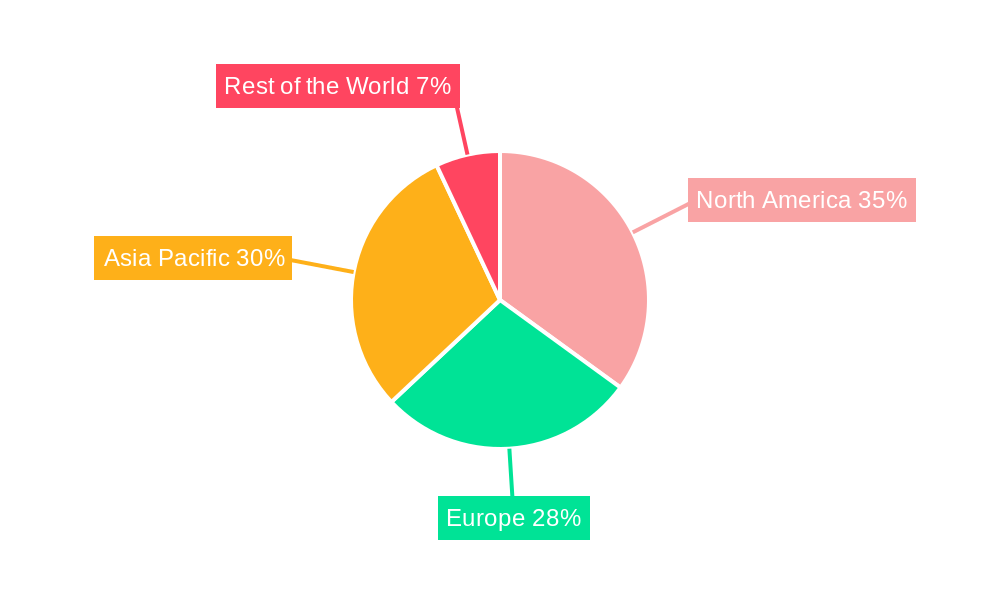

The high-power LED (light-emitting diode) industry is experiencing robust growth, driven by increasing demand across diverse applications. The market, currently valued at approximately $XX million in 2025 (assuming a logical estimation based on the provided CAGR and market size data), is projected to exhibit a compound annual growth rate (CAGR) of 4.00% from 2025 to 2033. This growth is fueled by several key factors. Firstly, the automotive lighting sector is a significant driver, with the ongoing transition towards LED headlamps and taillights due to their superior energy efficiency, longer lifespan, and design flexibility. Secondly, the general lighting segment continues to adopt high-power LEDs, spurred by government initiatives promoting energy conservation and the increasing affordability of LED-based lighting solutions. The backlighting segment also contributes significantly, with high-power LEDs powering displays in various consumer electronics and commercial applications. Technological advancements leading to improved lumen output, enhanced color rendering, and reduced costs further propel market expansion. However, challenges such as intense competition among manufacturers and the potential for price fluctuations in raw materials could pose restraints to growth. Regional variations exist, with North America and Asia Pacific anticipated to be key contributors to market expansion due to high adoption rates in the automotive and electronics industries.

High Power LED Industry Market Size (In Billion)

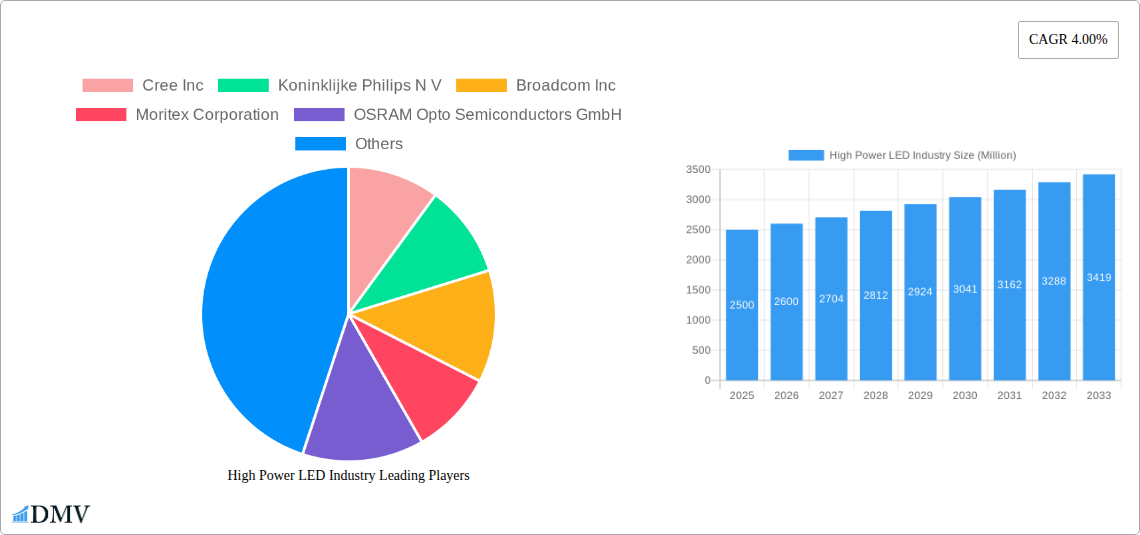

The competitive landscape is marked by a mix of established players like Cree Inc., Philips, and Osram, alongside emerging companies vying for market share. The industry's future trajectory hinges on ongoing innovation in LED technology, including advancements in materials science and packaging techniques to enhance efficiency and performance. Furthermore, the integration of smart lighting systems and Internet of Things (IoT) capabilities is expected to create new market opportunities and drive further growth. The market segmentation by application (automotive, general lighting, backlighting, other applications) will likely continue to evolve, with the automotive lighting sector potentially overtaking others in the coming years, given the global shift towards electric vehicles and enhanced safety features. Effective strategies for managing supply chain complexities and addressing potential environmental concerns related to LED manufacturing and disposal will be crucial for sustained, responsible growth within the high-power LED industry.

High Power LED Industry Company Market Share

High Power LED Industry Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the High Power LED industry, projecting a market value exceeding $XX Million by 2033. The study covers the period from 2019 to 2033, with 2025 serving as the base and estimated year. This report is essential for stakeholders seeking to understand market dynamics, identify growth opportunities, and make strategic decisions in this rapidly evolving sector.

High Power LED Industry Market Composition & Trends

This section delves into the competitive landscape of the High Power LED market, examining market concentration, innovation drivers, regulatory impacts, substitute products, end-user profiles, and merger & acquisition (M&A) activities. The report analyzes the market share distribution among key players, including Cree Inc, Koninklijke Philips N V, Broadcom Inc, Moritex Corporation, OSRAM Opto Semiconductors GmbH, Samsung Electronics Co Ltd, Seoul Semiconductor Co Ltd, LG Innotek Co Ltd, Plessey Semiconductors Ltd, Everlight Electronics Co Ltd, and Lumileds Holding B V (list not exhaustive). M&A activity is evaluated through the lens of deal values and their influence on market consolidation. The report assesses the impact of technological advancements, such as advancements in materials science and packaging technologies, on market competition and product differentiation. Furthermore, it explores the evolving regulatory landscape and its implications for industry participants. Finally, the report explores the role of substitute technologies and their potential to disrupt the market.

- Market Concentration: The market exhibits a [Insert level of concentration, e.g., moderately concentrated] structure with the top 5 players holding an estimated [Insert percentage]% market share in 2025.

- Innovation Catalysts: R&D investments exceeding $XX Million annually are driving advancements in LED efficiency, lifespan, and color rendering.

- Regulatory Landscape: [Describe key regulations and their impact, e.g., Stringent energy efficiency standards in various regions are driving adoption of high-power LEDs.]

- Substitute Products: Competition from alternative lighting technologies, such as OLEDs, is analyzed with respect to market share projections.

- End-User Profiles: Detailed analysis of end-user segments (automotive, general lighting, etc.) and their influence on market demand.

- M&A Activities: Analysis of significant M&A transactions in the period 2019-2024 with deal values totaling an estimated $XX Million.

High Power LED Industry Industry Evolution

This section provides a comprehensive analysis of the High Power LED industry's evolution, examining market growth trajectories, technological advancements, and shifting consumer demands over the study period (2019-2033). The analysis incorporates detailed data points on growth rates, adoption metrics, and market size projections across different segments. The impact of technological innovations, such as advancements in chip design, packaging technologies, and driver circuitry, is evaluated in terms of their influence on product performance, efficiency, and cost. Furthermore, the report examines changes in consumer preferences and their influence on market demand for different types of high-power LEDs, such as those optimized for specific applications or features.

Leading Regions, Countries, or Segments in High Power LED Industry

This section pinpoints the dominant regions, countries, and application segments within the High Power LED industry. A detailed analysis is conducted on the factors driving the dominance of each leading segment (Automotive Lighting, General Lighting, Backlighting, Other Applications).

- Automotive Lighting: Key drivers include stringent regulations on vehicle lighting, the increasing demand for advanced driver-assistance systems (ADAS), and the adoption of LED headlights.

- General Lighting: Growth is spurred by energy efficiency mandates, declining LED prices, and increased consumer awareness of energy savings.

- Backlighting: This segment’s growth is tied to the expanding display market and technological advancements in screen resolution and size.

- Other Applications: This section examines other significant applications, such as horticultural lighting and industrial lighting, and analyzes their market share and growth trajectories. [Provide in-depth analysis for the dominant segment, with details on market size, growth rate, and key players.]

High Power LED Industry Product Innovations

This section details recent product innovations in high-power LEDs, emphasizing their applications and performance metrics. Key advancements in chip design, materials, and packaging are highlighted, along with their unique selling propositions and impact on the market. The report examines the improvements in luminous efficacy, color rendering index (CRI), and lifespan achieved through these innovations.

Propelling Factors for High Power LED Industry Growth

Several key factors drive the growth of the High Power LED industry. These include technological advancements leading to higher efficiency and longer lifespan, government incentives promoting energy-efficient lighting solutions, and the increasing adoption of LEDs in various applications. Cost reductions due to economies of scale further fuel market expansion.

Obstacles in the High Power LED Industry Market

The High Power LED industry faces challenges such as supply chain disruptions, intense competition among manufacturers, and the emergence of alternative lighting technologies. Regulatory hurdles and the high initial investment costs associated with LED adoption also present significant barriers. These obstacles are quantitatively assessed in terms of their potential impact on market growth.

Future Opportunities in High Power LED Industry

Future opportunities lie in emerging applications like smart lighting, UV-C LEDs for disinfection, and micro-LED displays. The development of advanced materials and packaging technologies will further enhance LED performance and create new market niches. Expansion into developing economies offers significant growth potential.

Major Players in the High Power LED Industry Ecosystem

- Cree Inc

- Koninklijke Philips N V

- Broadcom Inc

- Moritex Corporation

- OSRAM Opto Semiconductors GmbH

- Samsung Electronics Co Ltd

- Seoul Semiconductor Co Ltd

- LG Innotek Co Ltd

- Plessey Semiconductors Ltd

- Everlight Electronics Co Ltd

- Lumileds Holding B V

Key Developments in High Power LED Industry Industry

- [Insert key developments with year/month and impact on market dynamics. Example: January 2023 - Cree Inc. launched a new high-efficiency LED chip, significantly impacting market competition.]

Strategic High Power LED Industry Market Forecast

The High Power LED industry is poised for continued growth driven by technological innovation, increasing demand across diverse applications, and supportive government policies. Market expansion is expected across all major segments, with particularly strong growth in automotive lighting and emerging applications. The long-term outlook remains positive, promising significant market potential in the coming years.

High Power LED Industry Segmentation

-

1. Application

- 1.1. Automotive Lighting

- 1.2. General Lighting

- 1.3. Backlighting

- 1.4. Other Applications

High Power LED Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

-

2. Europe

- 2.1. United Kingdom

- 2.2. Germany

- 2.3. France

- 2.4. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. South Korea

- 3.4. Rest of Asia Pacific

-

4. Rest of the World

- 4.1. Latin America

- 4.2. Middle East

High Power LED Industry Regional Market Share

Geographic Coverage of High Power LED Industry

High Power LED Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.00% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Growing Awareness Regarding Implementation of Energy-Efficient Systems; Increasing Applications of High Power LED's

- 3.3. Market Restrains

- 3.3.1. ; High Initial Cost

- 3.4. Market Trends

- 3.4.1. Increasing Adoption of High Power LED in Automotive Lighting Boosting the Market's Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global High Power LED Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Automotive Lighting

- 5.1.2. General Lighting

- 5.1.3. Backlighting

- 5.1.4. Other Applications

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. Europe

- 5.2.3. Asia Pacific

- 5.2.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America High Power LED Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Automotive Lighting

- 6.1.2. General Lighting

- 6.1.3. Backlighting

- 6.1.4. Other Applications

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. Europe High Power LED Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Automotive Lighting

- 7.1.2. General Lighting

- 7.1.3. Backlighting

- 7.1.4. Other Applications

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Asia Pacific High Power LED Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Automotive Lighting

- 8.1.2. General Lighting

- 8.1.3. Backlighting

- 8.1.4. Other Applications

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Rest of the World High Power LED Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Automotive Lighting

- 9.1.2. General Lighting

- 9.1.3. Backlighting

- 9.1.4. Other Applications

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Cree Inc

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Koninklijke Philips N V

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Broadcom Inc

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Moritex Corporation

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 OSRAM Opto Semiconductors GmbH

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Samsung Electronics Co Ltd

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Seoul Semiconductor Co Ltd

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 LG Innotek Co Ltd

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Plessey Semiconductors Ltd *List Not Exhaustive

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Everlight Electronics Co Ltd

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 Lumileds Holding B V

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.1 Cree Inc

List of Figures

- Figure 1: Global High Power LED Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America High Power LED Industry Revenue (Million), by Application 2025 & 2033

- Figure 3: North America High Power LED Industry Revenue Share (%), by Application 2025 & 2033

- Figure 4: North America High Power LED Industry Revenue (Million), by Country 2025 & 2033

- Figure 5: North America High Power LED Industry Revenue Share (%), by Country 2025 & 2033

- Figure 6: Europe High Power LED Industry Revenue (Million), by Application 2025 & 2033

- Figure 7: Europe High Power LED Industry Revenue Share (%), by Application 2025 & 2033

- Figure 8: Europe High Power LED Industry Revenue (Million), by Country 2025 & 2033

- Figure 9: Europe High Power LED Industry Revenue Share (%), by Country 2025 & 2033

- Figure 10: Asia Pacific High Power LED Industry Revenue (Million), by Application 2025 & 2033

- Figure 11: Asia Pacific High Power LED Industry Revenue Share (%), by Application 2025 & 2033

- Figure 12: Asia Pacific High Power LED Industry Revenue (Million), by Country 2025 & 2033

- Figure 13: Asia Pacific High Power LED Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Rest of the World High Power LED Industry Revenue (Million), by Application 2025 & 2033

- Figure 15: Rest of the World High Power LED Industry Revenue Share (%), by Application 2025 & 2033

- Figure 16: Rest of the World High Power LED Industry Revenue (Million), by Country 2025 & 2033

- Figure 17: Rest of the World High Power LED Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global High Power LED Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 2: Global High Power LED Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 3: Global High Power LED Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 4: Global High Power LED Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 5: United States High Power LED Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 6: Canada High Power LED Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 7: Global High Power LED Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 8: Global High Power LED Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 9: United Kingdom High Power LED Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Germany High Power LED Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: France High Power LED Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Rest of Europe High Power LED Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Global High Power LED Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 14: Global High Power LED Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 15: China High Power LED Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Japan High Power LED Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: South Korea High Power LED Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Rest of Asia Pacific High Power LED Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Global High Power LED Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 20: Global High Power LED Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 21: Latin America High Power LED Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Middle East High Power LED Industry Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the High Power LED Industry?

The projected CAGR is approximately 4.00%.

2. Which companies are prominent players in the High Power LED Industry?

Key companies in the market include Cree Inc, Koninklijke Philips N V, Broadcom Inc, Moritex Corporation, OSRAM Opto Semiconductors GmbH, Samsung Electronics Co Ltd, Seoul Semiconductor Co Ltd, LG Innotek Co Ltd, Plessey Semiconductors Ltd *List Not Exhaustive, Everlight Electronics Co Ltd, Lumileds Holding B V.

3. What are the main segments of the High Power LED Industry?

The market segments include Application.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

; Growing Awareness Regarding Implementation of Energy-Efficient Systems; Increasing Applications of High Power LED's.

6. What are the notable trends driving market growth?

Increasing Adoption of High Power LED in Automotive Lighting Boosting the Market's Growth.

7. Are there any restraints impacting market growth?

; High Initial Cost.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "High Power LED Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the High Power LED Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the High Power LED Industry?

To stay informed about further developments, trends, and reports in the High Power LED Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence