Key Insights

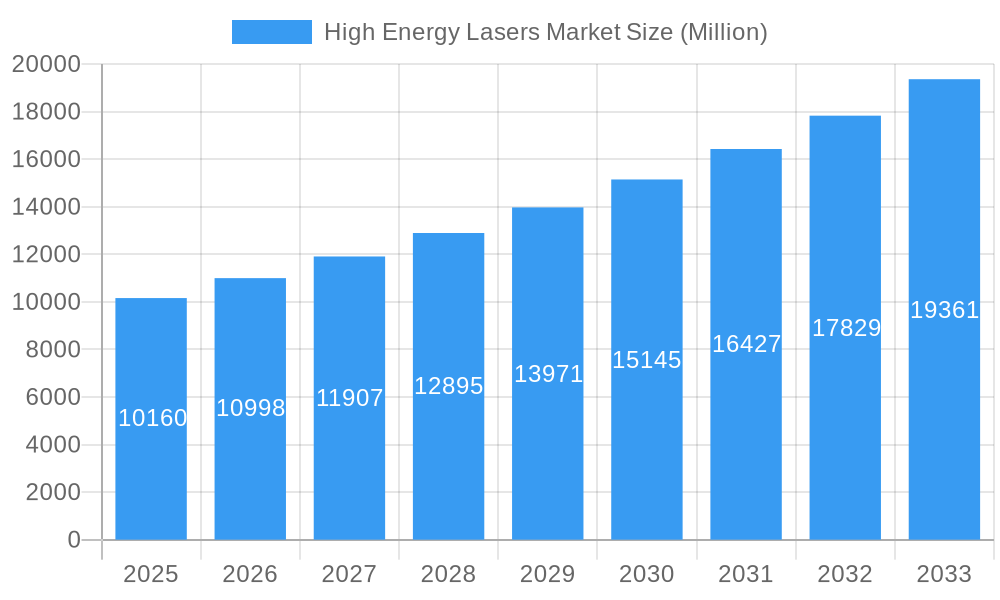

The High Energy Lasers market is experiencing robust growth, projected to reach $10.16 billion in 2025 and maintain a Compound Annual Growth Rate (CAGR) of 8.09% from 2025 to 2033. This expansion is driven by several key factors. Firstly, increasing military and defense spending globally fuels demand for high-energy lasers in directed energy weapons systems, enhancing capabilities in target acquisition, and missile defense. Secondly, advancements in laser technology, particularly in areas like fiber lasers and solid-state lasers, are leading to more efficient, compact, and powerful systems with improved performance and cost-effectiveness. The growing adoption of high-energy lasers in industrial applications, such as cutting, welding, and drilling, further contributes to market growth. Precision and speed offered by lasers are transforming manufacturing processes across various sectors. Finally, emerging applications in communications, particularly for free-space optical communication, are opening new avenues for market expansion. However, challenges remain, including the high initial investment cost of high-energy laser systems and potential safety concerns related to their operation. Nevertheless, ongoing technological advancements and increasing demand from diverse sectors are expected to outweigh these restraints, ensuring continued market expansion throughout the forecast period.

High Energy Lasers Market Market Size (In Billion)

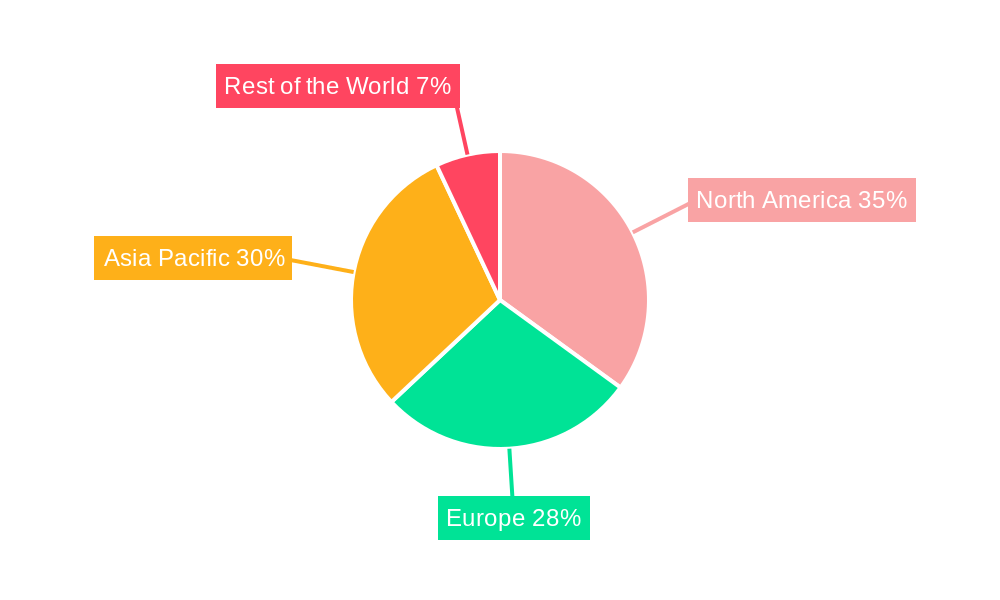

The market segmentation reveals significant opportunities within specific application areas. The military and defense segment currently holds a dominant position, fueled by government investments and strategic priorities. The industrial applications segment (cutting, welding, and drilling) is also witnessing substantial growth, driven by adoption across diverse industries seeking enhanced efficiency and precision. The communications sector's contribution, although currently smaller, is poised for rapid growth as free-space optical communication technologies mature. Major players like Coherent Inc., IPG Photonics, and Raytheon Company are driving innovation and competition, shaping the market landscape through their technological advancements and strategic partnerships. Geographic analysis indicates a strong presence across North America, Europe, and Asia-Pacific, with Asia-Pacific potentially exhibiting higher growth rates in the coming years due to rising industrialization and government initiatives promoting advanced technologies. The continuous development of more powerful, efficient, and cost-effective high-energy lasers will be crucial in unlocking further market expansion and realizing the full potential of this technology across various applications.

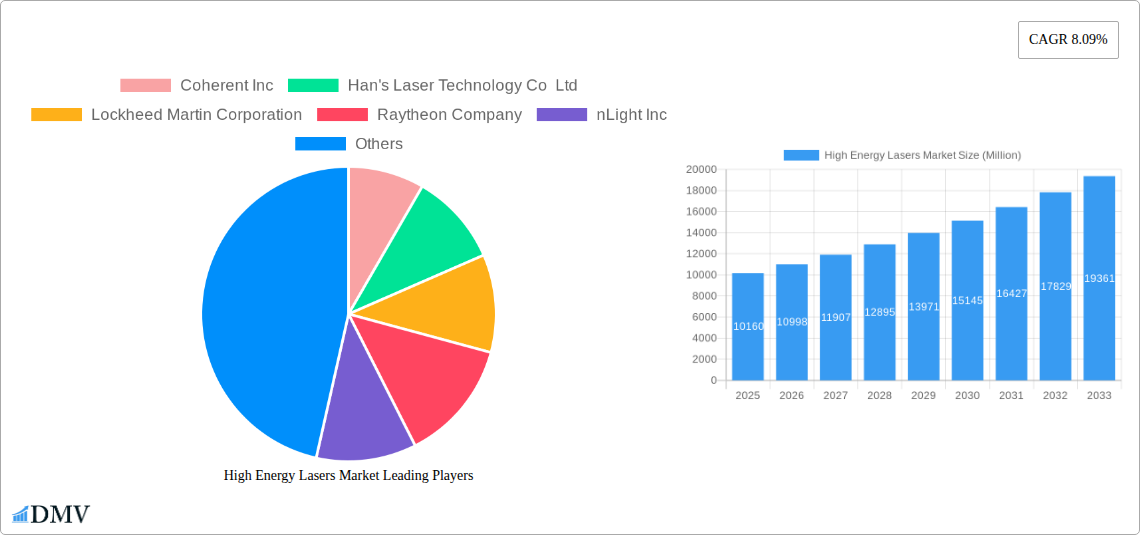

High Energy Lasers Market Company Market Share

High Energy Lasers Market: A Comprehensive Report (2019-2033)

This insightful report provides a detailed analysis of the High Energy Lasers Market, projecting a market value of xx Million by 2033. It delves into market dynamics, technological advancements, and key players shaping the industry's future. The study period covers 2019-2033, with 2025 serving as the base and estimated year. The forecast period spans 2025-2033, while the historical period encompasses 2019-2024. This report is essential for stakeholders seeking to understand and capitalize on the growth opportunities within this rapidly evolving market.

High Energy Lasers Market Composition & Trends

The High Energy Lasers Market exhibits a moderately concentrated landscape, with key players like Coherent Inc, Han's Laser Technology Co Ltd, and IPG Photonics holding significant market share. Market concentration is estimated at xx%, with the top five players accounting for approximately xx% of the total revenue in 2024. Innovation is driven by advancements in fiber laser technology, improved beam quality, and enhanced automation capabilities. Stringent safety regulations and increasing environmental concerns are shaping the regulatory landscape, while the market faces competition from alternative technologies like ultrasound and electron beam processing. End-users span diverse sectors, including manufacturing, military & defense, and telecommunications. M&A activity has been moderate, with deal values totaling approximately xx Million in the last five years. Notable examples include [mention specific M&A activity with deal values, if available, otherwise use "xx Million" for undisclosed values].

- Market Share Distribution (2024): Top 5 players: xx%, Others: xx%

- M&A Deal Values (2019-2024): Approximately xx Million

High Energy Lasers Market Industry Evolution

The High Energy Lasers Market has witnessed robust growth, driven by increasing automation in manufacturing, expanding military and defense applications, and growing demand for high-speed data transmission. The market's Compound Annual Growth Rate (CAGR) during the historical period (2019-2024) was approximately xx%, primarily fueled by the adoption of fiber lasers due to their superior efficiency and cost-effectiveness compared to other laser technologies. Technological advancements like the development of ultra-short pulse lasers and increased power levels are further accelerating growth. Shifting consumer demands towards higher precision, faster processing speeds, and improved energy efficiency are reshaping the market landscape. We project a CAGR of xx% during the forecast period (2025-2033), reaching an estimated market size of xx Million by 2033. The adoption rate of high-energy lasers in key sectors is also on the rise, with the manufacturing sector leading the way, followed by the military and defense sector.

Leading Regions, Countries, or Segments in High Energy Lasers Market

The High Energy Lasers Market is geographically diverse, with North America and Asia-Pacific emerging as dominant regions. Within applications, Cutting, Welding & Drilling holds the largest market share, followed by Military and Defense.

Key Drivers:

- Cutting, Welding & Drilling: High demand from automotive, aerospace, and electronics industries; government incentives for automation in manufacturing.

- Military and Defense: Growing investments in defense modernization and technological advancements in laser-guided weapons systems.

- Communications: Expansion of fiber optic networks and increasing data transmission demands.

Dominance Factors: North America's dominance stems from strong R&D investments and a well-established industrial base. The Asia-Pacific region's rapid growth is attributed to rising manufacturing activity and government support for technological advancements. The substantial market share of Cutting, Welding, and Drilling reflects its wide adoption across numerous industries for efficient material processing.

High Energy Lasers Market Product Innovations

Recent innovations focus on enhancing power output, beam quality, and processing speed while reducing costs. High-power fiber lasers, ultra-fast lasers, and advanced laser processing systems are gaining prominence. These advancements enable improved precision, versatility, and efficiency in various applications, offering unique selling propositions such as reduced processing time, enhanced material compatibility, and minimized heat-affected zones. Performance metrics like cutting speed, weld depth, and surface finish are continuously improving, driven by ongoing research and development.

Propelling Factors for High Energy Lasers Market Growth

The High Energy Lasers Market is propelled by several factors. Technological advancements, such as increased laser power and efficiency, are leading to wider adoption in diverse industries. Economic factors, including reduced production costs and increased automation benefits, are encouraging investments. Favorable regulatory policies promoting technological innovation and stringent safety standards contribute to market growth. The rising demand for high-precision applications in diverse sectors further stimulates market expansion. Specific examples include the growing adoption of fiber lasers in manufacturing and the increasing use of high-energy lasers in military applications.

Obstacles in the High Energy Lasers Market

Several factors hinder the High Energy Lasers Market's growth. Strict regulatory compliance regarding laser safety presents a significant challenge. Supply chain disruptions affecting component availability can impact production and lead times. Intense competition from established players and emerging entrants creates pricing pressures. These factors collectively impact market growth, with estimated revenue losses of approximately xx Million annually due to supply chain disruptions in the past two years.

Future Opportunities in High Energy Lasers Market

Emerging opportunities abound. The expansion into new markets, such as medical applications and 3D printing, presents significant potential. Advanced laser technologies, such as ultrafast lasers and adaptive optics, will further enhance market prospects. Consumer demand for increased efficiency and improved product quality will drive further innovations. The rising adoption of Industry 4.0 and the digital transformation of manufacturing will create further demand for high-energy lasers.

Major Players in the High Energy Lasers Market Ecosystem

- Coherent Inc

- Han's Laser Technology Co Ltd

- Lockheed Martin Corporation

- Raytheon Company

- nLight Inc

- Bae Systems Plc

- TRUMPF Pvt Ltd

- Lumentum Holdings

- Wuhan Raycus Fiber Laser Technologies Co Ltd

- Applied Companies Inc

- Alltec Gmbh

- Bystronic Laser AG

- Northrop Grumman Corporation

- The Boeing Company

- IPG Photonics

Key Developments in High Energy Lasers Market Industry

- September 2022: Trumpf Inc. launched significant advancements in automated arc welding, 3D laser welding, 3D laser marking, and additive manufacturing technologies, including the TruArc Weld 1000 and TruLaser Station 7000 fiber. This enhanced 3D processing capabilities and high-performance 3D laser marking.

- May 2021: BIZ Engineering invested in Trumpf Pvt. Ltd.'s 3kW TruLaser 1030 fiber laser cutter to increase production capacity and replace older CO2 technology. This adoption highlighted the shift towards fiber laser technology due to improved efficiency and cutting speed.

Strategic High Energy Lasers Market Forecast

The High Energy Lasers Market is poised for continued growth, driven by technological innovations, increasing automation across industries, and rising demand in key sectors such as manufacturing and defense. Future opportunities lie in exploring new applications, developing advanced laser systems, and expanding into emerging markets. The market's growth trajectory is expected to remain strong, with substantial potential for value creation in the years to come. This presents significant investment opportunities for stakeholders across the value chain.

High Energy Lasers Market Segmentation

-

1. Application

- 1.1. Cutting, Welding & Drilling

- 1.2. Military and Defense

- 1.3. Communications

- 1.4. Other Applications

High Energy Lasers Market Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Rest of the World

High Energy Lasers Market Regional Market Share

Geographic Coverage of High Energy Lasers Market

High Energy Lasers Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.09% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Demand for Laser Weapons Systems in Navy & Growth for Non-lethal Deterrents

- 3.3. Market Restrains

- 3.3.1. Regulatory Compliance & High Cost

- 3.4. Market Trends

- 3.4.1. Rising Demand for Laser Weapons Systems in Navy and Growth for Non-lethal Deterrents

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global High Energy Lasers Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Cutting, Welding & Drilling

- 5.1.2. Military and Defense

- 5.1.3. Communications

- 5.1.4. Other Applications

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. Europe

- 5.2.3. Asia Pacific

- 5.2.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America High Energy Lasers Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Cutting, Welding & Drilling

- 6.1.2. Military and Defense

- 6.1.3. Communications

- 6.1.4. Other Applications

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. Europe High Energy Lasers Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Cutting, Welding & Drilling

- 7.1.2. Military and Defense

- 7.1.3. Communications

- 7.1.4. Other Applications

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Asia Pacific High Energy Lasers Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Cutting, Welding & Drilling

- 8.1.2. Military and Defense

- 8.1.3. Communications

- 8.1.4. Other Applications

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Rest of the World High Energy Lasers Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Cutting, Welding & Drilling

- 9.1.2. Military and Defense

- 9.1.3. Communications

- 9.1.4. Other Applications

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Coherent Inc

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Han's Laser Technology Co Ltd

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Lockheed Martin Corporation

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Raytheon Company

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 nLight Inc

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Bae Systems Plc

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 TRUMPF Pvt Ltd

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Lumentum Holdings

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Wuhan Raycus Fiber Laser Technologies Co Ltd

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Applied Companies Inc

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 Alltec Gmbh

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.12 Bystronic Laser AG

- 10.2.12.1. Overview

- 10.2.12.2. Products

- 10.2.12.3. SWOT Analysis

- 10.2.12.4. Recent Developments

- 10.2.12.5. Financials (Based on Availability)

- 10.2.13 Northrop Grumman Corporation

- 10.2.13.1. Overview

- 10.2.13.2. Products

- 10.2.13.3. SWOT Analysis

- 10.2.13.4. Recent Developments

- 10.2.13.5. Financials (Based on Availability)

- 10.2.14 The Boeing Company

- 10.2.14.1. Overview

- 10.2.14.2. Products

- 10.2.14.3. SWOT Analysis

- 10.2.14.4. Recent Developments

- 10.2.14.5. Financials (Based on Availability)

- 10.2.15 IPG Photonics

- 10.2.15.1. Overview

- 10.2.15.2. Products

- 10.2.15.3. SWOT Analysis

- 10.2.15.4. Recent Developments

- 10.2.15.5. Financials (Based on Availability)

- 10.2.1 Coherent Inc

List of Figures

- Figure 1: Global High Energy Lasers Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America High Energy Lasers Market Revenue (Million), by Application 2025 & 2033

- Figure 3: North America High Energy Lasers Market Revenue Share (%), by Application 2025 & 2033

- Figure 4: North America High Energy Lasers Market Revenue (Million), by Country 2025 & 2033

- Figure 5: North America High Energy Lasers Market Revenue Share (%), by Country 2025 & 2033

- Figure 6: Europe High Energy Lasers Market Revenue (Million), by Application 2025 & 2033

- Figure 7: Europe High Energy Lasers Market Revenue Share (%), by Application 2025 & 2033

- Figure 8: Europe High Energy Lasers Market Revenue (Million), by Country 2025 & 2033

- Figure 9: Europe High Energy Lasers Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: Asia Pacific High Energy Lasers Market Revenue (Million), by Application 2025 & 2033

- Figure 11: Asia Pacific High Energy Lasers Market Revenue Share (%), by Application 2025 & 2033

- Figure 12: Asia Pacific High Energy Lasers Market Revenue (Million), by Country 2025 & 2033

- Figure 13: Asia Pacific High Energy Lasers Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Rest of the World High Energy Lasers Market Revenue (Million), by Application 2025 & 2033

- Figure 15: Rest of the World High Energy Lasers Market Revenue Share (%), by Application 2025 & 2033

- Figure 16: Rest of the World High Energy Lasers Market Revenue (Million), by Country 2025 & 2033

- Figure 17: Rest of the World High Energy Lasers Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global High Energy Lasers Market Revenue Million Forecast, by Application 2020 & 2033

- Table 2: Global High Energy Lasers Market Revenue Million Forecast, by Region 2020 & 2033

- Table 3: Global High Energy Lasers Market Revenue Million Forecast, by Application 2020 & 2033

- Table 4: Global High Energy Lasers Market Revenue Million Forecast, by Country 2020 & 2033

- Table 5: Global High Energy Lasers Market Revenue Million Forecast, by Application 2020 & 2033

- Table 6: Global High Energy Lasers Market Revenue Million Forecast, by Country 2020 & 2033

- Table 7: Global High Energy Lasers Market Revenue Million Forecast, by Application 2020 & 2033

- Table 8: Global High Energy Lasers Market Revenue Million Forecast, by Country 2020 & 2033

- Table 9: Global High Energy Lasers Market Revenue Million Forecast, by Application 2020 & 2033

- Table 10: Global High Energy Lasers Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the High Energy Lasers Market?

The projected CAGR is approximately 8.09%.

2. Which companies are prominent players in the High Energy Lasers Market?

Key companies in the market include Coherent Inc, Han's Laser Technology Co Ltd, Lockheed Martin Corporation, Raytheon Company, nLight Inc, Bae Systems Plc, TRUMPF Pvt Ltd, Lumentum Holdings, Wuhan Raycus Fiber Laser Technologies Co Ltd, Applied Companies Inc, Alltec Gmbh, Bystronic Laser AG, Northrop Grumman Corporation, The Boeing Company, IPG Photonics.

3. What are the main segments of the High Energy Lasers Market?

The market segments include Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 10.16 Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Demand for Laser Weapons Systems in Navy & Growth for Non-lethal Deterrents.

6. What are the notable trends driving market growth?

Rising Demand for Laser Weapons Systems in Navy and Growth for Non-lethal Deterrents.

7. Are there any restraints impacting market growth?

Regulatory Compliance & High Cost.

8. Can you provide examples of recent developments in the market?

September 2022 - Trumpf Inc. launched the most advancements in automated arc welding, 3D laser welding, 3D laser marking, and additive manufacturing technology. Trumpf emphasizes the TruArc Weld 1000, an automated arc welding system with its laser technology for 3D processing, which includes the TruLaser Station 7000 fiber. It also includes a TruMarkStation 7000 with a TruMark 6030 laser marking system for high-performance 3D laser marking.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "High Energy Lasers Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the High Energy Lasers Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the High Energy Lasers Market?

To stay informed about further developments, trends, and reports in the High Energy Lasers Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence